Sustainability with Everything We Do

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Coin Cart Schedule (From 2014 to 2020) Service Hours: 10 A.M

Coin Cart Schedule (From 2014 to 2020) Service hours: 10 a.m. to 7 p.m. (* denotes LCSD mobile library service locations) Date Coin Cart No. 1 Coin Cart No. 2 2014 6 Oct (Mon) to Kwun Tong District Kwun Tong District 12 Oct (Sun) Upper Ngau Tau Kok Estate Piazza Upper Ngau Tau Kok Estate Piazza 13 Oct (Mon) to Yuen Long District Tuen Mun District 19 Oct (Sun) Ching Yuet House, Tin Ching Estate, Tin Yin Tai House, Fu Tai Estate Shui Wai * 20 Oct (Mon) to North District Tai Po District 26 Oct (Sun) Wah Min House, Wah Sum Estate, Kwong Yau House, Kwong Fuk Estate * Fanling * (Service suspended on Tuesday 21 October) 27 Oct (Mon) to Wong Tai Sin District Sham Shui Po District 2 Nov (Sun) Ngan Fung House, Fung Tak Estate, Fu Wong House, Fu Cheong Estate * Diamond Hill * (Service suspended on Friday 31 October) (Service suspended on Saturday 1 November) 3 Nov (Mon) to Eastern District Wan Chai District 9 Nov (Sun) Oi Yuk House, Oi Tung Estate, Shau Kei Lay-by outside Causeway Centre, Harbour Wan * Drive (Service suspended on Thursday 6 (opposite to Sun Hung Kai Centre) November) 10 Nov (Mon) to Kwai Tsing District Islands District 16 Nov (Sun) Ching Wai House, Cheung Ching Estate, Ying Yat House, Yat Tung Estate, Tung Tsing Yi * Chung * (Service suspended on Monday 10 November and Wednesday 12 November) 17 Nov (Mon) to Kwun Tong District Sai Kung District 23 Nov (Sun) Tsui Ying House, Tak Chak House, Tsui Ping (South) Estate * Hau Tak Estate, Tseung Kwan O * (Service suspended on Tuesday 18 November) 24 Nov (Mon) to Sha Tin District Tsuen Wan -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

Hong Kong Public Opinion Program of Hong Kong Public Opinion Research Institute

Hong Kong Public Opinion Program of Hong Kong Public Opinion Research Institute PopPanel Research Report No. 21 cum Community Democracy Project Research Report No. 18 cum Community Health Project Research Report No. 14 Survey Date: 7 May to 12 May 2020 Release Date: 13 May 2020 Copyright of this report was generated by the Hong Kong Public Opinion Program (HKPOP) and opened to the world. HKPOP proactively promotes open data, open technology and the free flow of ideas, knowledge and information. The predecessor of HKPOP was the Public Opinion Programme at The University of Hong Kong (HKUPOP). “POP” in this publication may refer to HKPOP or HKUPOP as the case may be. 1 HKPOP Community Health Project Report No. 14 Research Background Initiated by the Hong Kong Public Opinion Research Institute (HKPORI), the “Community Integration through Cooperation and Democracy, CICD” Project (or the “Community Democracy Project”) aims to provide a means for Hongkongers to re-integrate ourselves through mutual respect, rational deliberations, civilized discussions, personal empathy, social integration, and when needed, resolution of conflicts through democratic means. It is the rebuilding of our Hong Kong society starting from the community level following the spirit of science and democracy. For details, please visit: https://www.pori.hk/cicd. The surveys of Community Democracy (CD) Project officially started on 3 January 2020, targeting members of “HKPOP Panel” established by HKPORI in July 2019, including “Hong Kong People Representative Panel” (Probability-based Panel) and “Hong Kong People Volunteer Panel” (Non-probability-based Panel). This report also represents Report No. 21 under HKPOP Panel survey series, as well as Report No. -

L.N. 121 of 2003 Declaration of Constituencies (District Councils) Order 2003 (Made by the Chief Executive in Council Under Sect

L.N. 121 of 2003 Declaration of Constituencies (District Councils) Order 2003 (Made by the Chief Executive in Council under section 6 of the District Councils Ordinance (Cap. 547)) 1. Commencement This Order shall--- (a) come into operation on 10 July 2003 for the purpose only of enabling arrangements to be made for the holding of the District Council ordinary election in 2003; and (b) in so far as it has not come into operation under paragraph (a), come into operation on 1 January 2004. 2. Interpretation In this Order--- "approved map" (獲批准㆞圖), in relation to any District, means the map or any of the maps of that District--- (a) submitted together with the report referred to in section 18(1)(b) of the Electoral Affairs Commission Ordinance (Cap. 541) by the Electoral Affairs Commission to the Chief Executive on 22 April 2003; (b) specified in column 3 of the Schedule; (c) identified by reference to a plan number (Plan No.) prefixed "DCCA"; (d) approved by the Chief Executive in Council on 13 May 2003; and (e) copies of which are deposited in the respective offices of the Electoral Registration Officer and the Designated Officer; "constituency boundary" (選區分界), in relation to an area declared to be a constituency in this Order, means--- (a) the boundary represented in the relevant approved map by the unbroken edging coloured red delineating, or partially delineating, that area and described as "Constituency Boundary" in the legend of that map; or (b) where any part of a district boundary joins or abuts any boundary partially delineating that area as mentioned in paragraph (a), or circumscribes or otherwise partially delineates that area--- (i) that part of that district boundary; and (ii) that boundary partially delineating that area as so mentioned; "district boundary" (㆞方行政區分界), in relation to any District, means the boundary of the District area delineated as mentioned in section 3(1) of the Ordinance which is represented in the relevant approved map by the broken edging coloured red and described as "District Boundary" in the legend of that map. -

Egn201014152134.Ps, Page 29 @ Preflight ( MA-15-6363.Indd )

G.N. 2134 ELECTORAL AFFAIRS COMMISSION (ELECTORAL PROCEDURE) (LEGISLATIVE COUNCIL) REGULATION (Section 28 of the Regulation) LEGISLATIVE COUNCIL BY-ELECTION NOTICE OF DESIGNATION OF POLLING STATIONS AND COUNTING STATIONS Date of By-election: 16 May 2010 Notice is hereby given that the following places are designated to be used as polling stations and counting stations for the Legislative Council By-election to be held on 16 May 2010 for conducting a poll and counting the votes cast in respect of the geographical constituencies named below: Code and Name of Polling Station Geographical Place designated as Polling Station and Counting Station Code Constituency LC1 A0101 Joint Professional Centre Hong Kong Island Unit 1, G/F., The Center, 99 Queen's Road Central, Hong Kong A0102 Hong Kong Park Sports Centre 29 Cotton Tree Drive, Central, Hong Kong A0201 Raimondi College 2 Robinson Road, Mid Levels, Hong Kong A0301 Ying Wa Girls' School 76 Robinson Road, Mid Levels, Hong Kong A0401 St. Joseph's College 7 Kennedy Road, Central, Hong Kong A0402 German Swiss International School 11 Guildford Road, The Peak, Hong Kong A0601 HKYWCA Western District Integrated Social Service Centre Flat A, 1/F, Block 1, Centenary Mansion, 9-15 Victoria Road, Western District, Hong Kong A0701 Smithfield Sports Centre 4/F, Smithfield Municipal Services Building, 12K Smithfield, Kennedy Town, Hong Kong Code and Name of Polling Station Geographical Place designated as Polling Station and Counting Station Code Constituency A0801 Kennedy Town Community Complex (Multi-purpose -

Tuenmun 20191018 E.Pdf

NOMINATIONS FOR THE 2019 DISTRICT COUNCIL ORDINARY ELECTION (NOMINATION PERIOD: 4 - 17 OCTOBER 2019) TUEN MUN DISTRICT As at 5pm, 17 October 2019 (Thursday) Constituency Constituency Name of Nominees Alias Gender Occupation Political Affiliation Date of Nomination Remarks Code (Surname First) L01 Tuen Mun Town Centre LAI Chun-wing Alfred M Legislative Councillor Assistant The Democratic Party 4/10/2019 L01 Tuen Mun Town Centre AU Chi-yuen M Civil Engineer 17/10/2019 L02 Siu Chi LAM Chung-hoi M Full Time District Councillor The Democratic Party 4/10/2019 L02 Siu Chi WONG Ka-leung M 14/10/2019 L03 On Ting FUNG Pui-yin M Community Officer FTU, DAB 4/10/2019 L03 On Ting KONG Fung-yi F ADPL 15/10/2019 L04 Siu Tsui YIP Man-pan M Member of Tuen Mun District Council DAB 4/10/2019 L04 Siu Tsui YAN Pui-lam M Illustrator Power for Democracy, Team Chu Hoi Dick of NTW 8/10/2019 L05 Yau Oi South LAM Kin-cheung M Community Organizer Labour Party 8/10/2019 L05 Yau Oi South TSANG Hin-hong M RSW, Full Time District Council Member DAB 9/10/2019 L06 Yau Oi North IP Chun-yuen M Solicitor DAB 4/10/2019 L06 Yau Oi North LAM Ming-yan M Community Organizer Labour Party 8/10/2019 L07 Tsui Hing POON Chi-kin M Community Officer Tuen Mun Community Network 4/10/2019 L07 Tsui Hing CHU Yiu-wah M District Councilor Roundtable 10/10/2019 L08 Shan King WONG Tan-ching M Registered Social Worker Tuen Mun Community Network 4/10/2019 L08 Shan King NG Dip-pui F Community Worker Independent Candidate 9/10/2019 L09 King Hing LAW Cheuk-yung M Social Worker Tuen Mun Community Network -

Tuen Mun 明愛屯門綜合家庭服務中心caritas

Caritas Integrated Family Service 明愛屯門綜合家庭服務中心 Centre – Tuen Mun Caritas – Hong Kong 香港明愛 Tuen Mun District 屯門區 Enquiries: 2466 8622 查詢電話:2466 8622 Fax: 2462 6032 傳真:2462 6032 Email: [email protected] 電郵:[email protected] Geographical Service Boundary 服務地域範圍 Eastern Boundary 東面分界線 - Starts from junction of Ming Kum - 由鳴琴路與震寰路交界開始 Road and Tsun Wen Road - Moving along Tsun Wen Road, Shek - 沿震寰路、石排頭路及鳴琴路 Pai Tau Road and Ming Kum Road - Ends at junction of Ming Kum Road - 至鳴琴路與楊景路交界止 and Yeung King Road Southern Boundary 南面分界線 - Starts from junction of Ming Kum - 由鳴琴路與楊景路交界開始 Road and Yeung King Road - Ends at hillside of Shan King Estate - 至山景邨山邊止 Western Boundary 西面分界線 - Starts from hillside of Siu Lung Court - 由兆隆苑山邊開始 - Ends at hillside of Shan King Estate - 至山景邨山邊止 Northern Boundary 北面分界線 - Starts from junction of Ming Kum - 由鳴琴路與震寰路交界開始 Road and Tsun Wen Road - Along Ming Kum Road and Tin King - 沿鳴琴路及田景路 Road - Ends at hillside of Siu Lung Court - 至兆隆苑山邊止 1 Details of Geographical Service Boundary 服務地域範圍詳情 District Council Constituency 區議會選區# Code Name Part 部分 / Whole 全部 * 代號 名稱 L08 Shan King 山景 Part 部分☐ Whole 全部 L09 King Hing 景興 Part 部分☐ Whole 全部 L10 Hing Tsak 興澤 Part 部分 Whole 全部☐ L21 San King 新景 Part 部分☐ Whole 全部 L22 Leung King 良景 Part 部分☐ Whole 全部 L23 Tin King 田景 Part 部分☐ Whole 全部 L25 Kin Sang 建生 Part 部分☐ Whole 全部 # According to 2015 District Council Election Constituency Boundaries 根據 2015 年區議會選舉選區分界 Public Housing Estate 公營屋邨 K: Kin Sang Estate 建生邨 L: Leung King Estate 良景邨 S: Shan King Estate 山景邨 T: Tai Hing Estate -

Barrier Free Conditions of Mass Rapid Transit Stations in Hong Kong

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by Muroran-IT Academic Resource Archive Barrier Free Conditions of Mass Rapid Transit Stations in Hong Kong 著者 OSAKAYA Yoshiyuki, AOYAMA Takeshi, RATANAMART Suphawadee journal or Proceedings of TRANSED 2010 publication title volume 2010 number A078 page range 1-10 year 2010-06-02 URL http://hdl.handle.net/10258/1148 Barrier Free Conditions of Mass Rapid Transit Stations in Hong Kong 著者 OSAKAYA Yoshiyuki, AOYAMA Takeshi, RATANAMART Suphawadee journal or Proceedings of TRANSED 2010 publication title volume 2010 number A078 page range 1-10 year 2010-06-02 URL http://hdl.handle.net/10258/1148 BARRIER FREE CONDITIONS OF MASS RAPID TRANSIT STATIONS IN HONG K ONG Osakaya Yoshiyuki ,Muroran Institute of Technology Muroran ,Japan ,E-mail : osakaya@mmm .muroran-i t. ac .jp Aoyama Takeshi ,Muroran City Council Muroran ,Japan ,E-mail : t-aoyama@beige .plala .or .jp Ratanamart Suphawadee , King Mongkut Institute of Technology Ladkrabang Bangkok ,Thailand ,E-mail : nuibooks@yahoo .com SUMMARY In In Hong Kong ,it is estimated that aging will be rapidly going on after 2010 Increase Increase of the elderly means increase of the disabled . In Hong Kong , there are 3 KCR lines (East Li ne ,West Li ne and Ma On Shan Li ne) and 7 MTR lines (Kwun Tong Li ne ,Tsuen Wan Li ne , Island Li ne ,Tsueng Wan 0 Li ne ,Tung Chung Li ne , Airport Airport Li ne and Disneyland Li ne) in 2006 This This study firstly made the actual conditions of barrier free at all 81 stations clear It It secondly made problems clear . -

SAP Crystal Reports

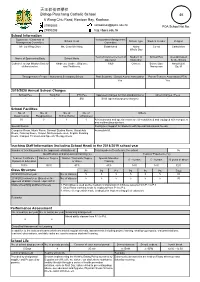

天主教柏德學校 Bishop Paschang Catholic School 46 6 Wang Chiu Road, Kowloon Bay, Kowloon 27993003 [email protected] POA School Net No. 27990208 http://bpcs.edu.hk School Information Supervisor / Chairman of Incorporated Management School Head School Type Student Gender Religion Management Committee Committee Mr. Lai Wing Chun Ms. Chan Mei Hing Established Aided Co-ed Catholicism Whole Day Year of Commencement of Medium of School Bus Area Occupied Name of Sponsoring Body School Motto Operation Instruction by the School Catholic Foreign Mission Society Kindness, Justice, Diligence 1969 Chinese School Bus; About 6600 of America Inc. and Thriftiness. Nanny van Sq. M Through-train / Feeder / Nominated Secondary School Past Students' / School Alumni Association Parent-Teacher Association (PTA) - Yes Yes 2019/2020 Annual School Charges School Fee Tong Fai PTA Fee Approved Charges for Non-standard Items Other Charges / Fees - - $50 $200 (special purposes charges) - School Facilities No. of No. of No. of No. of Others Classroom(s) Playground(s) School Hall(s) Library(ies) 30 3 1 1 All classrooms and special rooms are air-conditioned and equipped with computers and multimedia projectors. Special Rooms Facility(ies) Support for Students with Special Educational Needs Computer Room, Music Room, General Studies Room, Visual Arts Accessible lift. Room, Dancing Room, Chapel, Multi-purpose area, English Reading Room, Campus TV Room and Speech Therapy Room. Teaching Staff Information (including School Head) in the 2018/2019 school year Number of teaching posts in the approved establishment 56 Total number of teachers in the school 56 Qualifications and professional training (%) Years of Experience (%) Teacher Certificate / Bachelor Degree Master / Doctorate Degree Special Education 0 - 4 years 5 - 9 years 10 years or above Diploma in Education or above Training 100% 100% 41% 43% 14% 14% 72% Class Structure P1 P2 P3 P4 P5 P6 Total 2018/2019 school year No. -

Electoral Affairs Commission Report

i ABBREVIATIONS Amendment Regulation to Electoral Affairs Commission (Electoral Procedure) Cap 541F (District Councils) (Amendment) Regulation 2007 Amendment Regulation to Particulars Relating to Candidates on Ballot Papers Cap 541M (Legislative Council) (Amendment) Regulation 2007 Amendment Regulation to Electoral Affairs Commission (Financial Assistance for Cap 541N Legislative Council Elections) (Application and Payment Procedure) (Amendment) Regulation 2007 APIs announcements in public interest APRO, APROs Assistant Presiding Officer, Assistant Presiding Officers ARO, AROs Assistant Returning Officer, Assistant Returning Officers Cap, Caps Chapter of the Laws of Hong Kong, Chapters of the Laws of Hong Kong CAS Civil Aid Service CC Complaints Centre CCC Central Command Centre CCm Complaints Committee CE Chief Executive CEO Chief Electoral Officer CMAB Constitutional and Mainland Affairs Bureau (the former Constitutional and Affairs Bureau) D of J Department of Justice DC, DCs District Council, District Councils DCCA, DCCAs DC constituency area, DC constituency areas DCO District Councils Ordinance (Cap 547) ii DO, DOs District Officer, District Officers DPRO, DPROs Deputy Presiding Officer, Deputy Presiding Officers EAC or the Commission Electoral Affairs Commission EAC (EP) (DC) Reg Electoral Affairs Commission (Electoral Procedure) (District Councils) Regulation (Cap 541F) EAC (FA) (APP) Reg Electoral Affairs Commission (Financial Assistance for Legislative Council Elections and District Council Elections) (Application and Payment -

OFFICIAL RECORD of PROCEEDINGS Wednesday, 11

LEGISLATIVE COUNCIL ─ 11 February 2015 6007 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 11 February 2015 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. 6008 LEGISLATIVE COUNCIL ─ 11 February 2015 THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE RONNY TONG KA-WAH, S.C. THE HONOURABLE CYD HO SAU-LAN, J.P. THE HONOURABLE STARRY LEE WAI-KING, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. -

D5184 2008 年第46 期憲報第4 號特別副刊ss No. 4 to Gazette No. 46

D5184 2008 年第 46 期憲報第 4 號特別副刊 S. S. NO. 4 TO GAZETTE NO. 46/2008 註冊編號 姓名 註冊地址 資格性質 年份 Reg. No. Name Registered Address Nature of Qualification Year M14755 林麗娜 香港荷李活道208至214號太平大樓17樓 香港中文大學內外全科醫學士 LAM, LAI NA A 室 MB ChB CUHK 2004 FLAT A, 17/F, TAI PING MANSION, 208-214 HOLLYWOOD ROAD, HONG KONG M14284 林麗珊 新界天水圍慧景軒第2座23樓 C 室 香港大學內外全科醫學士 LAM, LAI SAN FLAT C, 23/F., BLOCK 2, VIANNI MB BS HK 2003 COVE, TIN SHUI WAI, N.T. M12116 林麗霜 新界馬鞍山沙安街9號翠擁華庭5座17樓 香港大學內外全科醫學士 LAM, LAI SHEUNG A 室 MB BS HK 1997 ROOM A, 17/F, BLOCK 5, MONTE VISTA, 9 SHA ON STREET, MA ON SHAN, N.T. M14940 林立寶 九龍藍田興田邨恩田樓2316室 香港大學內外全科醫學士 LAM, LAP PO ROOM 2316, YAN TIN HOUSE, MB BS HK 2006 HING TIN ESTATE, LAM TIN, KOWLOON M08993 林利樺 ( 前稱林梨 ) 新界沙田火炭駿景園6座3樓 C 室 香港醫務委員會執照 LAM, LEE WAH (formerly FLAT C, 3/F., BLK 6, ROYAL ASCOT, LMCHK 1993 known as LAM, LEE) FO TAN, N.T. M11708 林念 香港柴灣杏花邨23座1801室 香港大學內外全科醫學士 LAM, LIM SAM ROOM 1801, BLOCK 23, HENG FA MB BS HK 1996 CHUEN, CHAIWAN, HONG KONG M13353 林連美 香港北角天后廟道144-158號雲峰大廈C 香港醫務委員會執照 LAM, LIN MEI ALICE 座二樓2室 LMCHK 2002 FLAT 2, 2/F, BLOCK C, SUMMIT COURT, 144-158 TIN HAU TEMPLE ROAD, NORTH POINT, HONG KONG M05051 藍連德 香港薄扶林瑪麗醫院 A 座1樓內科部門 香港大學內外全科醫學士 LAM, LINDA DEPT OF MEDICINE, A1, QUEEN MB BS HK 1982 MARY HOSPITAL, POKFULAM, MRCP UK 1990 HONG KONG FRCP Glasg 2000 M04745 林露娟 香港鴨脷洲大街161號鴨脷洲診所3樓香 香港大學內外全科醫學士 LAM, LO KUEN CINDY 港大學家庭醫學部 MB BS HK 1981 FAMILY MEDICINE UNIT, THE MRCGP 1986 UNIVERSITY OF HONG KONG, 3/F, APLEICHAU CLINIC, 161 MAIN STREET, APLEICHAU, H.K.