QAD CLOUD IMPERIAL TOBACCO ROI: 72% Payback: 4.8 Months

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ethics Agreement in Order to Avoid Any Financial Conflict

Date: 7 .-e-•15 Iett..% 1--4 17 MEMORANDUM FOR THE RECORD SUBJECT: Ethics Agreement In order to avoid any financial conflict of interest in violation of 18 U.S.C. § 208(a) or the appearance of a financial conflict of interest as defined in the Standards of Ethical Conduct for Employees of the Executive Branch, 5 C.F.R. § 2635.502, and to adhere to the Ethics Pledge instituted by Executive Order 13770 issued on January 28, 2017, and entitled "Ethics Commitments by Executive Branch Appointees" (the Ethics Pledge), I am issuing the following statement. I understand that as an appointee I must sign the Ethics Pledge and that I will be bound by the requirements and restrictions therein even if not specifically mentioned in this or any other ethics agreement. Before beginning my covered Federal position, I resigned from my non-Federal positions with the Association of State and Territorial Health Officials (ASTHO) and the State of Georgia on July 6, 2017. Pursuant to the Ethics Pledge, I will not, for a period of two years from the date of my appointment to my covered Federal position, participate in an official capacity in any particular matter involving specific parties that is directly and substantially related to ASTHO, unless an exception applies or I am granted a waiver. I understand that this provision in the Ethics Pledge does not apply to state government entities, including the State of Georgia. Even when the two-year restriction of the Ethics Pledge does not apply, under 5 C.F.R. § 2635.502, I will not, for a period of one year from the date of my resignation from ASTHO and the State of Georgia, participate in any particular matter involving specific parties in which ASTHO or the State of Georgia is a party or represents a party, unless I am first authorized to participate, pursuant to 5 C.F.R. -

Actor Vince Vaughn

internet only CigarJUNE 2, 2015 n VOL. 20,Insider NO. 11 n FROM THE PUBLISHER OF CIGAR AFICIONADO MAGAZINE CLICK HERE TO SUBSCRIBE IN THIS ISSUE: FEATURED CIGAR TASTING REPORT: MY FATHER LE BIJOU 1922 PREVIEWS FROM THE AUGUST 2015 BOX PRESS TORPEDO 93 ISSUE OF CIGAR AFICIONADO: NICARAGUA n PRICE: $11.40 n BODY: MEDIUM TO FULL POINTS n My Father Le Bijou 1922 Box Press Torpedo [page 2] For a full tasting, see page two. n Padrón Serie 1926 80 Years Maduro [page 2] n Trinidad Vigía [page 2] n Don Pepin Garcia Cuban Classic 1979 [page 2] BEST CIGARS THIS ISSUE n Por Larrañaga Picadores [page 3] n Fuente Fuente OpusX Angel’s Share Reserva d’Chateau [page 3] My Father Le Bijou 1922 Box Press Torpedo Nicaragua 93 n Partagás Serie D No. 6 [page 3] Padrón Serie 1926 80 Years Maduro Nicaragua 93 n H. Upmann Connossieur A [page 3] VERTICAL BRAND TASTINGS: Trinidad Vigía Cuba 93 n Romeo Añejo by Romeo y Julieta [page 4] Don Pepin Garcia Cuban Classic 1979 Nicaragua 92 NEW SIZES: Por Larrañaga Picadores Cuba 92 n Hoyo de Monterrey Edición de Cumpleaños 150 [page 4] Fuente Fuente OpusX Angel’s Share n Matilde Renacer Lancero [page 4] Reserva d’Chateau Dom. Rep. 92 CIGAR NEWS n The Avo Syncro Nicaragua [page 5] n El Centurion Wrapped in Connecticut [page 5] n Montecristo With a Vintage Wrapper [page 6] n Keystone State Looks to Tax Cigars [page 6] ACTOR VINCE VAUGHN n Quesada Cigars Distributes La Matilde [page 6] HE MIGHT BE KNOWN FOR COMEDY, but Vince Vaughn has a serious side, along with a n Nick Melillo Starts up Foundation [page 7] penchant for cigars. -

Annual Report and Accounts 2019

IMPERIAL BRANDS PLC BRANDS IMPERIAL ANNUAL REPORT AND ACCOUNTS 2019 ACCOUNTS AND REPORT ANNUAL ANNUAL REPORT AND ACCOUNTS 2019 OUR PURPOSE WE CAN I OWN Our purpose is to create something Everything See it, seize it, is possible, make it happen better for the world’s smokers with together we win our portfolio of high quality next generation and tobacco products. In doing so we are transforming WE SURPRISE I AM our business and strengthening New thinking, My contribution new actions, counts, think free, our sustainability and value creation. exceed what’s speak free, act possible with integrity OUR VALUES Our values express who we are and WE ENJOY I ENGAGE capture the behaviours we expect Thrive on Listen, challenge, share, make from everyone who works for us. make it fun connections The following table constitutes our Non-Financial Information Statement in compliance with Sections 414CA and 414CB of the Companies Act 2006. The information listed is incorporated by cross-reference. Additional Non-Financial Information is also available on our website www.imperialbrands.com. Policies and standards which Information necessary to understand our business Page Reporting requirement govern our approach1 and its impact, policy due diligence and outcomes reference Environmental matters • Occupational health, safety and Environmental targets 21 environmental policy and framework • Sustainable tobacco programme International management systems 21 Climate and energy 21 Reducing waste 19 Sustainable tobacco supply 20 Supporting wood sustainability -

Supplementary Table 10.7

Factory-made cigarettes and roll-your-own tobacco products available for sale in January 2019 at major Australian retailers1 Market Pack Number of Year Tobacco Company segment2 Brand size3 variants Variant name(s) Cigarette type introduced4 British American Super-value Rothmans5 20 3 Blue, Gold, Red Regular 2015 Tobacco Australia FMCs 23 2 Blue, Gold Regular 2018 25 5 Blue, Gold, Red, Silver, Menthol Green Regular 2014 30 3 Blue, Gold, Red Regular 2016 40 6 Blue, Gold, Red, Silver, Menthol Green, Black6 Regular 2014 50 5 Blue, Gold, Red, Silver, Menthol Green Regular 2016 Rothmans Cool Crush 20 3 Blue, Gold, Red Flavour capsule 2017 Rothmans Superkings 20 3 Blue, Red, Menthol Green Extra-long sticks 2015 ShuangXi7 20 2 Original Red, Blue8 Regular Pre-2012 Value FMCs Holiday 20 3 Blue, Gold, Red Regular 20189 22 5 Blue, Gold, Red, Grey, Sea Green Regular Pre-2012 50 5 Blue, Gold, Red, Grey, Sea Green Regular Pre-2012 Pall Mall 20 4 Rich Blue, Ultimate Purple, Black10, Amber Regular Pre-2012 40 3 Rich Blue, Ultimate Purple, Black11 Regular Pre-2012 Pall Mall Slims 23 5 Blue, Amber, Silver, Purple, Menthol Short, slim sticks Pre-2012 Mainstream Winfield 20 6 Blue, Gold, Sky Blue, Red, Grey, White Regular Pre-2012 FMCs 25 6 Blue, Gold, Sky Blue, Red, Grey, White Regular Pre-2012 30 5 Blue, Gold, Sky Blue, Red, Grey Regular 2014 40 3 Blue, Gold, Menthol Fresh Regular 2017 Winfield Jets 23 2 Blue, Gold Slim sticks 2014 Winfield Optimum 23 1 Wild Mist Charcoal filter 2018 25 3 Gold, Night, Sky Charcoal filter Pre-2012 Winfield Optimum Crush 20 -

Aj Fernandez

internet only CigarFEBRUARY 12, 2013 n VOL.Insider 18, NO. 3 n FROM THE PUBLISHER OF CIGAR AFICIONADO MAGAZINE CLICK HERE TO SUBSCRIBE IN THIS ISSUE: FEATURED CIGAR TASTING REPORT: VEGAS ROBAINA PETIT UNICO EXCLUSIVO SUIZA VERTICAL BRAND TASTINGS: 93 CUBA n PRICE: 19.00 Sw. Fr. n BODY: MED. TO FULL POINTS n Daniel Marshall DM2 Red Label [page 2] For a full tasting, see page three. n Gurkha 125th Anniversary Edition [page 2] n Cohiba Edición Diamante [page 3] BEST CIGARS THIS ISSUE NEW SIZES: n Hoyo de Monterrey Epicure De Luxe [page 3] Vegas Robaina Petit Unico Exclusivo Suiza Cuba 93 n Quesada Q d’Etat Daga [page 3] Gurkha 125th Anniversary Edition XO Dom. Rep. 92 n Vegas Robaina Petit Unico Exclusivo Suiza [page 3] Gurkha 125th Anniversary Edition Rothchild Dom. Rep. 91 Gurkha 125th Anniversary Edition Robusto Dom. Rep. 90 CIGAR NEWS Gurkha 125th Anniversary Edition Torpedo Dom. Rep. 90 n Swisher Eyes Premium Market [page 4] Hoyo de Monterrey Epicure De Luxe Cuba 90 n CRA Musters International Support [page 5] Two Tied At Various 89 n A Short, Thick Davidoff Puro d’Oro [page 5] n INSIDER EXCLUSIVE: Q&A With San Lotano Brand Owner A.J. Fernandez [page 6] n Cuba Releases Romeo y Julieta Reserva Churchill [page 6] COHIBA EDICIÓN DIAMANTE AN AGED CAMEROON WRAPPER covers the n Arango’s Exclusive Punch and Macanudo [page 8] new Cohiba Edición Diamante (which was released at last year’s IPCPR trade show in Orlando) and General Cigar n Rafael Gonzalez Perla of Spain Now Shipping says that it’s from a 1980 harvest. -

Imperial Tobacco Group Plc Annual Report and Accounts

IMPERIAL TOBACCO GROUP PLC ANNUAL REPORT AND ACCOUNTS 2003 02 FINANCIAL HIGHLIGHTS 03 PERFORMANCE 05 INTERNATIONAL 06 COST FOCUS 08 BRANDS 10 ACQUISITIONS 12 CHAIRMAN’S STATEMENT 15 CHIEF EXECUTIVE’S COMMITTEE 17 OPERATING AND FINANCIAL REVIEW 30 OPERATING ENVIRONMENT 34 BOARD OF DIRECTORS 36 SHAREHOLDER INFORMATION 37 REPORT OF THE DIRECTORS 39 CORPORATE GOVERNANCE 45 DIRECTORS’ REMUNERATION REPORT 57 INDEPENDENT AUDITORS’ REPORT TO THE MEMBERS OF IMPERIAL TOBACCO GROUP PLC 58 CONSOLIDATED PROFIT AND LOSS ACCOUNT 58 STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES 59 CONSOLIDATED BALANCE SHEET 60 CONSOLIDATED CASH FLOW STATEMENT 61 ACCOUNTING POLICIES 63 NOTES TO THE ACCOUNTS 96 IMPERIAL TOBACCO GROUP PLC BALANCE SHEET 97 NOTES TO THE IMPERIAL TOBACCO GROUP PLC BALANCE SHEET 99 PRINCIPAL SUBSIDIARIES Imperial Tobacco is the world’s fourth largest international tobacco company which manufactures, markets and sells a comprehensive range of cigarettes, tobaccos, rolling papers and cigars. ITG 01 The consistent application of our strategy has delivered compound annual growth in adjusted earnings per share of 18% and in dividends per share of 15% since 1997. FINANCIAL HIGHLIGHTS (In £’s million) 2003 2002 2001 2000 1999 Turnover 11,412 up 38% 8,296 5,918 5,220 4,494 Operating profit 881 up 46% 603 604 560 518 Adjusted operating profit 1 1,135 up 44% 789 619 568 518 Pre-tax profit 656 up 55% 423 494 450 400 Adjusted pre-tax profit 1 898 up 40% 642 509 458 400 Profit after tax 424 up 50% 283 355 323 287 Adjusted profit after tax 1 655 up 41% 465 370 331 287 (In pence) 2003 2002 2001 2000 1999 Basic earnings per share 58.1 up 42% 41.0 56.6 52.3 46.4 Adjusted earnings per share 1 90.0 up 32% 68.4 59.0 53.6 46.4 Diluted earnings per share 57.9 up 42% 40.8 56.2 52.0 46.1 Dividend per share 42.0 up 27% 33.0 28.8 26.4 23.0 1 Adjusted to exclude the effect of amortisation and exceptional items. -

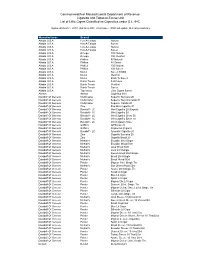

Commonwealth of Massachusetts Department of Revenue Cigarette and Tobacco Excise Unit List of Little Cigars Classified As Cigarettes Under G.L

Commonwealth of Massachusetts Department of Revenue Cigarette and Tobacco Excise Unit List of Little Cigars Classified as Cigarettes under G.L. 64C Updated March 1, 2010 This list is NOT all inclusive. DOR will update this list periodically. Manufacturer Brand Altadis U.S.A Hav-A-Tampa Natural Altadis U.S.A Hav-A-Tampa Sweet Altadis U.S.A Hav-A-Tampa Natural Altadis U.S.A Hav-A-Tampa Sweet Altadis U.S.A Omega 100 Natural Altadis U.S.A Omega 100 Menthol Altadis U.S.A Phillies 80 Natural Altadis U.S.A Phillies 80 Sweet Altadis U.S.A Phillies 100 Natural Altadis U.S.A Phillies 100 Sweet Altadis U.S.A Muriel Sweet 'N Mild Altadis U.S.A Muriel Menthol Altadis U.S.A Muriel Black 'N Sweet Altadis U.S.A Dutch Treats Full Flavor Altadis U.S.A Dutch Treats Menthol Altadis U.S.A Dutch Treats Sweet Altadis U.S.A Top Value Little Cigars Sweet Ashton Ashton Cigarillos Mini Davidoff Of Geneva Clubmaster Superior Sumatra 20 Davidoff Of Geneva Clubmaster Superior Sumatra Gold 20 Davidoff Of Geneva Clubmaster Superior Vanilla 20 Davidoff Of Geneva Zino Red Mini Cigarillo 20 Davidoff Of Geneva Davidoff - LC Mini Cigarillo 20 (Export) Davidoff Of Geneva Davidoff - LC Mini Cigarillo 50 Davidoff Of Geneva Davidoff - LC Mini Cigarillo Silver 50 Davidoff Of Geneva Davidoff - LC Mini Cigarillo Silver 20 Davidoff Of Geneva Davidoff - LC Mini Cigarelo Silver Davidoff Of Geneva Griffin's Griffionos 20 Davidoff Of Geneva Griffin's Cigarellos (Cigars) Davidoff Of Geneva Davidoff - LC Aromatic Cigarillo 20 Davidoff Of Geneva Zino Cigarillo Sumatra 20 Davidoff Of Geneva Zino Cigarillo Brasil 20 Davidoff Of Geneva Mehari's Ecuador 20ct Single Davidoff Of Geneva Mehari's Ecuador Wood 50ct Davidoff Of Geneva Mehari's Java Wood 50ct Davidoff Of Geneva Mehari's Java 20ct Single Davidoff Of Geneva Mehari's Sweet Orient 20ct Single Davidoff Of Geneva Mehari's Brasil 20ct Single Davidoff Of Geneva Mehari's Brasil Wood 50ct Davidoff Of Geneva Panter Mignon 10ct. -

Directory for Cigarettes and Roll-Your-Own Tobacco

DEPARTMENT OF THE ATTORNEY GENERAL STATE OF HAWAI‘I DIRECTORY FOR CIGARETTES AND ROLL-YOUR-OWN TOBACCO of (Available at: http://ag.hawaii.gov/cjd/tobacco-enforcement-unit/) Certified Tobacco Product Manufacturers Their Brands and Brand Families DEPARTMENT OF THE ATTORNEY GENERAL TOBACCO ENFORCEMENT UNIT 425 QUEEN STREET HONOLULU, HAWAI‘I 96813 (808) 586-1203 INDEX I. Directory: Cigarettes and Roll-Your-Own Tobacco Page 1. INTRODUCTION 3 2. DEFINITIONS 3 3. NOTICES 5 II. Update Summary For September 22, 2017 Posting III. Alphabetical Brand List IV. Compliant Participating Manufacturers List V. Compliant Non-Participating Manufacturers List Posted: September 22, 2017 2 1. INTRODUCTION Pursuant to Haw. Rev. Stat. §245-22.5(a), beginning December 1, 2003, it shall be unlawful for an entity (1) to affix a stamp to a package or other container of cigarettes belonging to a tobacco product manufacturer or brand family not included in this directory, or (2) to import, sell, offer, keep, store, acquire, transport, distribute, receive, or possess for sale or distribution cigarettes1 belonging to a tobacco product manufacturer or brand family not included in this directory. Pursuant to §245-22.5(b), any entity that knowingly violates subsection (a) shall be guilty of a class C felony. Pursuant to Haw. Rev. Stat. §§245-40 and 245-41, any cigarettes unlawfully possessed, kept, stored, acquired, transported, or sold in violation of Haw. Rev. Stat. §245-22.5 may be ordered forfeited pursuant to Haw. Rev. Stat., Chapter 712A. In addition, the attorney general may apply for a temporary or permanent injunction restraining any person from violating or continuing to violate Haw. -

1 CO-OPERATION AGREEMENT Dated As of 27 September 2010

CO-OPERATION AGREEMENT dated as of 27 September 2010 among IMPERIAL TOBACCO LIMITED AND THE EUROPEAN UNION REPRESENTED BY THE EUROPEAN COMMISSION AND EACH MEMBER STATE LISTED ON THE SIGNATURE PAGES HERETO 1 ARTICLE 1 DEFINITIONS Section 1.1. Definitions........................................................................................... 7 ARTICLE 2 ITL’S SALES AND DISTRIBUTION COMPLIANCE PRACTICES Section 2.1. ITL Policies and Code of Conduct.................................................... 12 Section 2.2. Certification of Compliance.............................................................. 12 Section 2.3 Acquisition of Other Tobacco Companies and New Manufacturing Facilities. .......................................................................................... 14 Section 2.4 Subsequent changes to Affiliates of ITL............................................ 14 ARTICLE 3 ANTI-CONTRABAND AND ANTI-COUNTERFEIT INITIATIVES Section 3.1. Anti-Contraband and Anti-Counterfeit Initiatives............................ 14 Section 3.2. Support for Anti-Contraband and Anti-Counterfeit Initiatives......... 14 ARTICLE 4 PAYMENTS TO SUPPORT THE ANTI-CONTRABAND AND ANTI-COUNTERFEIT COOPERATION ARTICLE 5 NOTIFICATION AND INSPECTION OF CONTRABAND AND COUNTERFEIT SEIZURES Section 5.1. Notice of Seizure. .............................................................................. 15 Section 5.2. Inspection of Seizures. ...................................................................... 16 Section 5.3. Determination of Seizures................................................................ -

Current Research in Toxicology 1 (2020) 161–173

Current Research in Toxicology 1 (2020) 161–173 Contents lists available at ScienceDirect Current Research in Toxicology journal homepage: www.elsevier.com/locate/crtox The use of human induced pluripotent stem cells to screen for developmental toxicity potential indicates reduced potential for non-combusted products, when compared to cigarettes ⇑ Liam Simms a, , Kathryn Rudd a, Jessica Palmer c, Lukasz Czekala a, Fan Yu a, Fiona Chapman a, Edgar Trelles Sticken b, Roman Wieczorek b, Lisa Maria Bode b, Matthew Stevenson a, Tanvir Walele a a Imperial Brands PLC, 121 Winterstoke Road, Bristol BS3 2LL, UK b Reemtsma Cigarettenfabriken GmbH, An Imperial Brands PLC Company, Albert-EinsteinRing-7, D-22761 Hamburg, Germany c Stemina Biomarker Discovery Inc., 504 S. Rosa Rd., Madison, WI 53719, USA ARTICLE INFO ABSTRACT Keywords: devTOX quickPredict (devTOXqP) is a metabolomics biomarker‐based assay that utilises human induced E‐cigarettes pluripotent stem (iPS) cells to screen for potential early stage embryonic developmental toxicity in vitro. Developmental toxicity Developmental toxicity potential is assessed based on the assay endpoint of the alteration in the ratio of key Cigarettes unrelated biomarkers, ornithine and cystine (o/c). Nicotine This work aimed to compare the developmental toxicity potential of tobacco‐containing and tobacco‐free Human induced pluripotent stem cells non‐combustible nicotine products to cigarette smoke. Smoke and aerosol from test articles were produced In vitro reproduction assay using a Vitrocell VC10 smoke/aerosol exposure system and bubbled into phosphate buffered saline (bPBS). iPS cells were exposed to concentrations of up to 10% bPBS. Assay sensitivity was assessed through a spiking study with a known developmental toxicant, all‐trans‐retinoic acid (ATRA), in combination with cigarette smoke extract. -

Tobacco Directory Deletions by Manufacturer

Cigarettes and Tobacco Products Removed From The California Tobacco Directory by Manufacturer Brand Manufacturer Date Comments Removed Catmandu Alternative Brands, Inc. 2/3/2006 Savannah Anderson Tobacco Company, LLC 11/18/2005 Desperado - RYO Bailey Tobacco Corporation 5/4/2007 Peace - RYO Bailey Tobacco Corporation 5/4/2007 Revenge - RYO Bailey Tobacco Corporation 5/4/2007 The Brave Bekenton, S.A. 6/2/2006 Barclay Brown & Williamson * Became RJR July 5/2/2008 2004 Belair Brown & Williamson * Became RJR July 5/2/2008 2004 Private Stock Brown & Williamson * Became RJR July 5/2/2008 2004 Raleigh Brown & Williamson * Became RJR July 5/6/2005 2004 Viceroy Brown & Williamson * Became RJR July 5/3/2010 2004 Coronas Canary Islands Cigar Co. 5/5/2006 Palace Canary Islands Cigar Co. 5/5/2006 Record Canary Islands Cigar Co. 5/5/2006 VL Canary Islands Cigar Co. 5/5/2006 Freemont Caribbean-American Tobacco Corp. 5/2/2008 Kingsboro Carolina Tobacco Company 5/3/2010 Roger Carolina Tobacco Company 5/3/2010 Aura Cheyenne International, LLC 1/5/2018 Cheyenne Cheyenne International, LLC 1/5/2018 Cheyenne - RYO Cheyenne International, LLC 1/5/2018 Decade Cheyenne International, LLC 1/5/2018 Bridgeton CLP, Inc. 5/4/2007 DT Tobacco - RYO CLP, Inc. 7/13/2007 Railroad - RYO CLP, Inc. 5/30/2008 Smokers Palace - RYO CLP, Inc. 7/13/2007 Smokers Select - RYO CLP, Inc. 5/30/2008 Southern Harvest - RYO CLP, Inc. 7/13/2007 Davidoff Commonwealth Brands, Inc. 7/19/2016 Malibu Commonwealth Brands, Inc. 5/31/2017 McClintock - RYO Commonwealth Brands, Inc. -

Massmutual Short Duration Bond.Xlsx

Fund Holdings As of 6/30/2021 MassMutual Short-Duration Bond Fund Barings Prior to 5/1/2021, the Fund name was MassMutual Premier Short-Duration Bond Fund. Fund Position Market Security Name Weighting % Value Us 10yr Note (Cbt)sep21 Xcbt 20210921 23.43 44,652,500 USTREAS T-Bill Auction Ave 3 Mon 5.24 9,987,667 Avis Budget Rental Car Funding AESOP LLC 3.02% 2.80 5,340,681 Goldman Sachs Group, Inc. 4.25% 2.79 5,319,704 Fna VI LLC 1.35% 2.22 4,229,828 COLLEGE AVE STUDENT LOANS LLC 2.32% 1.79 3,409,152 Adani Ports & Special Economic Zone 3.38% 1.71 3,251,532 Tower Bersama Infrastructure Tbk Pt 4.25% 1.70 3,235,134 Citigroup Inc. 4.4% 1.64 3,128,408 Country Garden Holdings Company Limited 8% 1.62 3,080,136 STARWOOD MORTGAGE RESIDENTIAL TRUST 1.53% 1.61 3,073,822 SOFI CONSUMER LOAN PROGRAM TRUST 3.89% 1.60 3,054,751 Occidental Petroleum Corporation 5.5% 1.58 3,008,904 Li & Fung LTD 4.5% 1.55 2,952,486 Avis Budget Rental Car Funding AESOP LLC 3.15% 1.51 2,875,133 Nelnet Student Loan Trust 1.5% 1.46 2,773,573 BX COMMERCIAL MORTGAGE TRUST 2.07% 1.45 2,760,068 Petroleos Mexicanos 4.62% 1.44 2,750,387 Vale Overseas Limited 6.25% 1.41 2,691,164 CARVANA AUTO RECEIVABLES TRUST 1.5% 1.39 2,644,293 Kref 2018-FL1 Ltd / Kref 2018-FL1 LLC 1.43% 1.36 2,600,819 Bpce Sa 5.7% 1.34 2,562,527 Residential Asset Mortgage Products, Inc.