Odfjell Drilling Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Uk / Norway Cross-Border Business to Business Mentoring

UK / NORWAY CROSS-BORDER BUSINESS TO BUSINESS MENTORING PROGRAMME 2012-2013 Conducted for DECC/INTSOK By Iain Morrison Final A12DEC048A June 2013 SENERGY (GB) LIMITED 15 BON ACCORD CRESCENT ABERDEEN AB11 6DE United Kingdom T: +44 1224 213440 F: +44 1224 213453 E: [email protected] REGISTERED IN SCOTLAND SC 125513 Senergy (GB) Limited is also registered to OHSAS 18001 w w w . s e n e r g y w o r l d . c o m Uk / Norway Cross-Border Business To Business Mentoring Programme 2012-2013 Contents 1 Introduction ................................................................................................................. 4 2 Participants ................................................................................................................. 4 2.1 Selection ............................................................................................................ 4 2.2 Pairings .............................................................................................................. 4 3 Events ......................................................................................................................... 5 3.1 Aberdeen ........................................................................................................... 5 3.2 Trondheim .......................................................................................................... 6 3.3 London ............................................................................................................... 6 3.4 Stavanger ......................................................................................................... -

Odfjell Drilling Ltd

Odfjell Drilling Ltd. Report for the 1st quarter of 2020 This interim report is unaudited and has been prepared in accordance with IAS 34 “Interim Financial Reporting”. Key figures for the Group All figures in USD million Key figures Odfjell Drilling Ltd. Group Q1 20 Q1 19 FY 19 Operating revenue…………………………………..………… 197 201 823 EBITDA………………………………………………………...…… 82 73 332 EBIT……………………………………….…………………...……… 33 31 147 Net profit (loss)………………………………………………… 23 10 41 EBITDA margin…………………………………………...……… 42% 36% 40 % Total assets……………………………………………………… 2,654 2,674 2,686 Net interest bearing debt………………………………... 1,216 1,251 1,221 Equity………………………………………………………………. 1,048 1,035 1,062 Equity ratio……………………………………………………… 40% 39% 40 % Highlights Q1 2020 Odfjell Drilling Ltd. Group • Operating revenue of USD 197 million compared to USD 201 million in Q1 2019. • EBITDA of USD 82 million compared to USD 73 million in Q1 2019. • EBITDA margin of 42% compared to an EBITDA margin of 36% in Q1 2019. • The Group’s contract backlog is USD 2.2 billion, whereof USD 1.2 billion is firm backlog. The comparable figure at the end of Q1 2019 was USD 2.3 billion, whereof USD 1.3 billion was firm backlog. Mobile Offshore Drilling Units segment (MODU) • Operating revenue of USD 142 million compared to USD 152 million in Q1 2019. • EBITDA of USD 70 million compared to USD 67 million in Q1 2019. • EBITDA margin of 49% compared to an EBITDA margin of 44% in Q1 2019. Drilling & Technology segment (D&T) • Operating revenue of USD 36 million compared to USD 34 million in Q1 2019. • EBITDA of USD 3 million compared to USD 2 million in Q1 2019. -

RTF Template

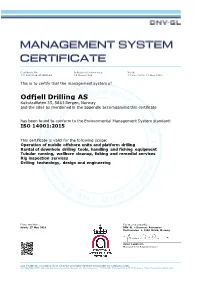

C ertificate No: Initial certification date: V alid: 1 5 1 949-2014-AE-NOR-NA 28 March 2014 21 May 2019 - 21 May 2022 This is to certify that the management system of Odfjell Drilling AS Kokstadflaten 35, 5863 Bergen, Norway and the sites as mentioned in the appendix accompanying this certificate has been found to conform to the Environmental Management System standard: ISO 14001:2015 This certificate is valid for the following scope: Operation of mobile offshore units and platform drilling Rental of downhole drilling tools, handling and fishing equipment Tubular running, wellbore cleanup, fishing and remedial services Rig inspection services Drilling technology, design and engineering Place and date: For the issuing office: Høvik, 27 May 2019 DNV GL – Business Assurance Veritasveien 1, 1363 Høvik, Norway Jøran Laukholm Management Representative Lack of fulfilment of conditions as set out in the Certification Agreement may render this Certificate invalid. ACCREDITED UNIT: DNV GL Business Assurance Norway AS, Veritasveien 1, 1363 Høvik, Norway. TEL:+47 67 57 99 00. http://assurance.dnvgl.com C ertificate No: 151949-2014-AE-NOR-NA P lac e and date: Høvik, 27 May 2 019 Appendix to Certificate Odfjell Drilling AS Locations included in the certification are as follows: Site Name Site Address Site Scope Odfjell Drilling (UK) Ltd. Odfjell Bergen House, Crawpeel Road, Operation of mobile drilling units and Well Services (UK) Ltd. Aberdeen Altens, Aberdeen, Scotland, AB12 platform drilling; 3LG, United Kingdom Rental of downhole drilling tools, handling and fishing equipment; Tubular running, wellbore cleanup, fishing and remedial services; Rig inspection services Odfjell Drilling AS Stjørdal Strandvegen 4, 7500 Stjørdal, Platform drilling. -

Chosen for Experience and Expertise

Chosen for experience and expertise www.odfjelldrilling.com Chosen for experience and expertise Odfjell Drilling is a leading international drilling company with 40 years of industry experience. Odfjell Drilling is an established and respect- services and engineering) combine to create ed drilling company, founded in 1973, with a the optimum results, and value, while our moti- proven track record of outstanding perfor- vated and highly qualified staff are committed mance in the harsh environment and ultra to delivering first class standards for all our deepwater oil extraction markets. customers, right across the world. We’ve been at home in some of the most oper- We are now present in 20 countries, employ ationally hostile environments on the planet, more than 3000 skilled team members and such as the North Sea, for the past 40 years. have the most technologically advanced fleet of In that time the company has gained huge drilling assets in the industry. experience and honed its industry expertise, emerging as a preferred partner for a host of We are proud of our achievements, proud of our leading global energy businesses. customers’ successes, and proud to be chosen for our experience and expertise. Odfjell Drilling can now offer its valued custom- ers a portfolio of integrated services that is cus- tom-made to help them achieve their business objectives. Our range of services (drilling, well 3 Chosen for experience and expertise 4 Introduction by Simen Lieungh, CEO 6 A zero fault culture 8 Mobile Offshore Drilling Units 10 The fleet 12 Drilling & Technology 16 Odfjell ellW Services 18 The human factor 2 3 Odfjell Drilling has a history of rising to the most demanding challenges… and a future rich with the potential of reaching new horizons. -

Research & Development

RESEARCH & DEVELOPMENT, AN INTERNATIONAL NETWORK TOTAL RESEARCH CENTRE – STAVANGER R&D IN FIGURES HOUSTON RIO DE JANEIRO CSTJF PERL ABERDEEN STAVANGER DOHA R&D, (United States) (Brazil) (France) (France) (United Kingdom) (Norway) (Qatar) THE WORLD IS OUR LABORATORY Our research organization spans the globe. Basing our specialized Research Centres and teams strategically near the regional hubs of the oil & gas industry gives us access to these regions and projects our image of R&D excellence around the world. In full synergy with the nerve centre of Total E&P’s R&D at the Centre Scientifique et Technique Jean-Féger (CSTJF) in southwest France, these researchers are part of a multi-disciplinary network of teams working on strategic R&D programs and themes, crucial for Total’s competitiveness. Our international network and the close ties we have forged with leading-edge public and private research bodies enable us to tap into the academic and industrial expertise available 300 25 in each region. This open innovation strategy helps us RESEARCHERS NATIONALITIES access the most promising scientific and technological NEARLY 340 PATENT FAMILIES advances that we can leverage to deliver tomorrow’s REPRESENTING SOME breakthrough technologies a step ahead of our peers. 1,700 Our Research Centre in Stavanger, Norway, has enjoyed rapid PATENTS FILED growth, fostering highly efficient partnerships with industrial ALL AROUND 10 THE WORLD DISRUPTIVE consortiums and universities in some of the world’s most 2 9,000 m TECHNOLOGIES crucial R&D programs, that will keep Total ahead in our OF LABORATORY FIELD-TESTED EACH YEAR commitment to produce better energy. -

Evolving Frontiers Change Is Coming, and Statoil Wants to Be an Implementor, Not a Follower

E UROP E AN D RILLING O UTLOOK “The challenges we face at Statoil are changing. On one end we have mature fields that continue to get more technically complex. On the other end, we have HPHT field developments that require cutting-edge technologies,” said Statoil vice president Per Haaland. Shown here, Kvitebjørn is one such project that demands the industry’s best technologies. Statoil photo 20 July/August 2007 DRILLIN G CONTRACTOR E UROP E AN D RILLING O UTLOOK Statoil photo Rune Johansen, Statoil photo Øyvind Hagen, Statoil photo Evolving frontiers Change is coming, and Statoil wants to be an implementor, not a follower By Linda Hsieh, associate editor WITH 22 DRILLING operations and seven well Bergen will commence operations in the Halten area operations in Norway alone, Statoil is running near in mid-2008. Two newbuilds — Odfjell’s Deepsea full capacity these days. Furthermore, it has plans Atlantic and Aker Drilling’s Aker I — will be deliv- to amp up activities even more in the next couple of ered in late 2008 and early 2009, respectively. The years, according to Per Haaland, Statoil vice presi- Deepsea Atlantic will go to the North Sea, and the dent. Aker I will work in the Halten area. The company is currently working with 10 floaters “Contracting these two newbuilds is one way and 13 platforms on the drilling side, and with coiled we’re implementing new drilling technologies,” Mr tubing and wireline on well operations. Over the Haaland said. “We’re saying that we want to be a next couple of years, three additional rigs will arrive part of the fleet renewal, and we’re doing it through to work for the company. -

Listing of the Drilling Company of 1972 A/S’ Shares a Public Limited Company to Be Incorporated in Denmark in Connection with the Demerger of A.P

Listing of The Drilling Company of 1972 A/S’ shares a public limited company to be incorporated in Denmark in connection with the demerger of A.P. Møller—Mærsk A/S registered under CVR no. 22 75 62 14 This document (the “Listing Document”) relates to a tax-exempt, partial demerger under Danish law (the “Demerger”) of A.P. Møller—Mærsk A/S (“Maersk”) by contribution of Maersk’s holding of shares in Maersk Drilling Holding A/S (“MDH”) including its direct and indirect subsidiaries as well as certain other assets and liabilities (together, the “Maersk Drilling Group”) to a newly incorporated Danish limited liability company to be named The Drilling Company of 1972 A/S (“ListCo”) and admission for trading and official listing (“Listing”) of the shares of ListCo (the “Shares”) on Nasdaq Copenhagen A/S (“Nasdaq Copenhagen”). The Maersk Drilling Group will at completion of the Demerger also include ListCo. Upon completion of the Demerger, the Shares will be distributed proportionally 1:2 to the holders of Maersk shares of a nominal value of DKK 1,000 and proportionally 1:1 to the holders of Maersk shares of a nominal value of DKK 500 (together, the “Receiving Shareholders”) that are registered as shareholders of Maersk in VP Securities A/S (“VP Securities”) at 5:59 p.m. CEST on 5 April 2019 (the “Demerger Record Date”). Accordingly, the holding of shares in Maersk as of the Demerger Record Date will allow the Receiving Shareholders as follows: (i) one (1) A share of nominal value DKK 1,000 in Maersk will entitle the Receiving Shareholder to receive two (2) Shares in ListCo, (ii) one (1) B share of nominal value DKK 1,000 in Maersk will entitle the Receiving Shareholder to receive two (2) Shares in ListCo, (iii) one (1) A share of nominal value DKK 500 in Maersk will entitle the Receiving Shareholder to receive one (1) Share in ListCo, and (iv) one (1) B share of nominal value DKK 500 in Maersk will entitle the Receiving Shareholder to receive one (1) Share in ListCo. -

Odfjell Drilling Annual Report 2019

Odfjell Drilling Annual Report 2019 ANNUAL REPORT 19 ANNUAL REPORT 19 Content Section 01 Section 09 Introduction 03 Board of Directors Report 51 – CEO Letter 04 – Business & Market Overview 52 – Focus Areas 56 Section 02 – Segment Overview 58 Our Business 06 – Outlook 59 Section 03 – Financial Review 60 Milestones 13 – Risk Review 63 – Going Concern Statement 64 Section 04 – Subsequent Events 64 Executive Management Team 15 Section 10 Section 05 Group Financial Statements 65 QHSE 18 Section 11 Section 06 Parent Financial Statements 143 Corporate Governance Report 25 Section 12 Section 07 Responsibility Statement 160 Sustainability Report 33 Section 13 – Environment 35 Auditors Report 162 – Social Responsibility 41 – Governance 45 Appendix 1 Definitions of Alternative Section 08 Performance Measures 169 Board of Directors 49 01 Introduction Section 01 Introduction Section 01 Introduction The outbreak of the Coronavirus and the collapse of the the Mariner drilling facilities from the project where OPEC+/Russia cooperation has, however, dramatically drilling is due to commence early in 2020. Platform changed the global economy and the world’s prospects Drilling has in 2019 continued production drilling and CEO Letter for 2020. drilling maintenance for Wintershall on Brage, on the Heidrun and Johan Sverdrup installations for Equinor The spread of the coronavirus is having a profound and for Taqa and Serica Energy in the UK. With our and serious impact on the global economy, how much contracts on Johan Sverdrup, Mariner and Clair Ridge, and for how long is still to be seen. We are obviously we are positioned on the three most digitally advanced not immune to this correction in the world economic field installations in the North Sea. -

Oil & Oil Services

Equity Research - 13 January 2020 06:56 CET Oil & Oil Services Q4’19 reports likely to be mixed Big differences from company to company 2020 is likely to be another stock picking year We highlight 5 large caps and 3 small caps Akastor, Aker ASA, Aker BP, Aker Solutions, Archer, Borr Drilling, Equinor, KOG, DRLCO, Gradual, but small improvements in fundamentals Noreco, Ocean Yield, Odfjell Drilling, PGS, We expect the Brent oil price to trade near the USD 65/bbl level in 2020 Polarcus, Seabird, Subsea 7, TGS Nopec and offshore exploration and production (E&P) to grow 5%. In other words, we forecast only modest improvements in fundamentals, similar to the situation experienced in 2019. Company-specific news likely to drive share prices in 2020 BW Offshore, DNO, EMGS, Kvaerner, Huge differences in share price performance were prevalent among and Lundin Petroleum, Magseis, NODL, oil service shares in 2019. Given our view on 2020 (only modest general Prosafe, Seadrill improvements in fundamentals), we think company specifics again will be the key drivers for share prices. In general, our top picks have the following characteristics: strong balance sheets, strong market positions, ABGSC estimates are above consensus, improving company specific and positive free cash flow. Our best ideas The following companies are our top picks, all rated BUY ‒ Aker BP (with Reporting dates: Q4'19 JS, 2020 will be year of de-risking and FCF focus, ~8% 2021 dividend PGS 30/01/2020 yield is likely too high); Aker ASA (its industrial holdings like AKERBP, Lundin -

Prospectus Northern Drilling Ltd

PROSPECTUS NORTHERN DRILLING LTD. (a limited liability company incorporated under the laws of Bermuda) Listing of 29,805,883 Shares, issued in a Private Placement and transfer of listing from Oslo Axess to Oslo Børs __________ The information contained in this prospectus (the “Prospectus”) relates to the transfer of listing from Oslo Axess to Oslo Børs of 77,750,100 shares in Northern Drilling Ltd. (the “Company”, taken together with its consolidated subsidiaries the “Group”), each with a par value of USD 1.00 (the “Existing Shares”), together with a listing on Oslo Børs of 29,805,883 new shares (the “Private Placement Shares” and together with the Existing Shares, the “Shares”) issued in a private placement directed towards certain institutional investors for gross proceeds of NOK 2,026,800,000, or approximately USD 250 million (the “Private Placement”). The Company’s Shares have been approved for listing on Oslo Børs on 29 June 2018. It is expected that the first day of listing on Oslo Børs will be on or about 3 July 2018. The Shares will be listed on the Oslo Børs under the Company’s current ticket code “NODL”. __________ For the definitions of capitalised terms used throughout this Prospectus, see Section 20 “Definitions”. Investing in the Shares involves risks; see Section 2 "Risk Factors" beginning on page 8. __________ Managers: DNB Markets, part of DNB Bank ASA ABN Amro Bank N.V. Arctic Securities AS Fearnley Securities AS Pareto Securities AS The date of this Prospectus is 29 June 2018. IMPORTANT INFORMATION This Prospectus has been prepared in order to provide information about the Company and its business in relation to the transfer of listing from Oslo Axess to Oslo Børs of the Existing Shares, the listing of the Private Placement Shares and to comply with the Norwegian Securities Trading Act of 29 June 2007 no. -

Odfjell Drilling Ltd

Odfjell Drilling Ltd. Report for the 3rd quarter of 2020 This interim report is unaudited and has been prepared in accordance with IAS 34 “Interim Financial Reporting”. Key figures for the Group All figures in USD million Key figures Odfjell Drilling Ltd. Group Q3 20 Q3 19 YTD 20 YTD 19 FY 19 Operating revenue…………………………………..………… 210 215 574 602 823 EBITDA………………………………………………………...…… 87 94 250 239 332 EBIT……………………………………….…………………...……… 38 47 90 105 147 Net profit (loss)………………………………………………… 19 20 36 30 41 EBITDA margin…………………………………………...……… 41% 44% 43% 40% 40% Total assets……………………………………………………… 2,609 2,650 2,686 Net interest bearing debt………………………………... 1,130 1,278 1,221 Equity………………………………………………………………. 1,073 1,040 1,062 Equity ratio……………………………………………………… 41% 39% 40% Highlights Q3 2020 Odfjell Drilling Ltd. Group • Operating revenue of USD 210 million compared to USD 215 million in Q3 2019. • EBITDA of USD 87 million compared to USD 94 million in Q3 2019. • EBITDA margin of 41% compared to an EBITDA margin of 44% in Q3 2019. • The Group’s contract backlog is USD 2.6 billion, whereof USD 1.4 billion is firm backlog. The comparable figure at the end of Q3 2019 was USD 2.1 billion, whereof USD 1.1 billion was firm backlog. Mobile Offshore Drilling Units segment (MODU) • Operating revenue of USD 151 million compared to USD 155 million in Q3 2019. • EBITDA of USD 76 million compared to USD 81 million in Q3 2019. • EBITDA margin of 50% compared to an EBITDA margin of 52% in Q3 2019. Energy segment (Energy) • Operating revenue of USD 42 million compared to USD 38 million in Q3 2019. -

RIG RATE FORMATIONS in the NORTH SEA Axel Roshauw Tidemann 93406 Henrik Borgen Nordby 93629

RIG RATE FORMATIONS IN THE NORTH SEA Axel Roshauw Tidemann 93406 Henrik Borgen Nordby 93629 Characters: 236,949 | Pages: 119 | Supervisor: Tim Mondorf | May 15, 2019 MSc - Applied Economics and Finance | Master Thesis Master Thesis Copenhagen Business School May 15th 2019 ABSTRACT This paper seeks to understand the offshore drilling market and specifically the formation of the contracted day rates on drilling operations. An industry analysis and a strategic analysis form the basis for an econometric model explaining day rates. The model is used to build forecasts on the day rates, which are used in a valuation of Odfjell Drilling, in order to illustrate a potential use case of the research. Drilling Rig Supply and Demand The supply of rigs is found to be fixed in the short-term but is adjusted in the medium- to long-term with drilling companies stack, scrap, and build rigs in order to meet the expected demand of the exploration and production (E&P) companies. We also see that rigs are principally purpose-built, where geo-specific regions demand different needs, mainly for water depths and the need for harsh weatherproofing. These geo-specific needs also create sub-markets where drilling rates vary with the technical specifications and capabilities of the rigs. The drilling demand comes from the exploration and production companies. Their need for drilling rigs fluctuates with their profitability, where the price of oil dictates their wish for exploratory spending. We also uncover a bargaining relationship between the drilling companies and the E&P companies. Here it seems that rig fleet availability dictates the pricing power of the drilling companies.