The Outsourcing Handbook a Guide to Outsourcing

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Preventing Deglobalization: an Economic and Security Argument for Free Trade and Investment in ICT Sponsors

Preventing Deglobalization: An Economic and Security Argument for Free Trade and Investment in ICT Sponsors U.S. CHAMBER OF COMMERCE FOUNDATION U.S. CHAMBER OF COMMERCE CENTER FOR ADVANCED TECHNOLOGY & INNOVATION Contributing Authors The U.S. Chamber of Commerce is the world’s largest business federation representing the interests of more than 3 million businesses of all sizes, sectors, and regions, as well as state and local chambers and industry associations. Copyright © 2016 by the United States Chamber of Commerce. All rights reserved. No part of this publication may be reproduced or transmitted in any form—print, electronic, or otherwise—without the express written permission of the publisher. Table of Contents Executive Summary ............................................................................................................. 6 Part I: Risks of Balkanizing the ICT Industry Through Law and Regulation ........................................................................................ 11 A. Introduction ................................................................................................. 11 B. China ........................................................................................................... 14 1. Chinese Industrial Policy and the ICT Sector .................................. 14 a) “Informatizing” China’s Economy and Society: Early Efforts ...... 15 b) Bolstering Domestic ICT Capabilities in the 12th Five-Year Period and Beyond ................................................. 16 (1) 12th Five-Year -

Selecting Import Products and Suppliers 409

Chapter 17 SelectingSelecting Import Import Products andProducts Suppliers and Suppliers TYPES OF PRODUCTS FOR IMPORTATION One of the most important import decisions is the selection of the proper product that serves the market need. In the absence of the latter, one is left with a warehouse full of merchandise with no one interested in buying it. Nevertheless, importing can become a successful and profitable venture so long as sufficient effort and time is invested in selecting the right product for the target market. How does one find the right product to import? The following are differ- ent types of products to consider. Unique Products Products that are unique and different can be appealing to customers be- cause they are a welcome change from the standardized and identical prod- ucts sold in the domestic market. The fact that a product is imported and different is in itself sufficient for many people to purchase the item. However, some studies indicate product uniqueness in terms of cultural appeal to be a relatively less important variable in the purchasing decision of import man- agers (Ghymn, 1983). Less Expensive Products It is quite common to find imports that perform identically to the competi- tor’s product but can be sold at a much lower price. As customers quickly switch allegiance to buy the imported item, it is quite possible to capture a substantial share of the domestic market. Export-Import Theory, Practices, and Procedures, Second Edition 407 408 EXPORT-IMPORT THEORY, PRACTICES, AND PROCEDURES For firms selling in mature markets where there is little or no product dif- ferentiation, cost reduction provides a competitive advantage (Shippen, 1999). -

Service Offshoring and Productivity

Service Offshoring and Productivity: Evidence from the US∗ Mary Amiti Federal Reserve Bank of New York and CEPR Shang-Jin Wei International Monetary Fund, CEPR and NBER Abstract The practice of sourcing service inputs from overseas suppliers has been growing in response to new technologies that have made it possible to trade in some business and computing services that were previously considered non-tradable. This paper estimates the effects of offshoring on productivity in US manufacturing industries between 1992 and 2000. It finds that service offshoring has a significant positive effect on productivity in the US, accounting for around 10 percent of labor productivity growth during this period. Offshoring material inputs also has a positive effect on productivity, but the magnitude is smaller accounting for approximately 5 percent of productivity growth. Keywords: offshoring, outsourcing, services, productivity JEL Classification: F1 F2 ∗International Research, Federal Reserve Bank of New York, 33 Liberty Street, New York, NY 10045, email [email protected]; [email protected]. We would like to thank John Romalis, Caroline Freund, Gordon Hanson, Simon Johnson, Jozef Konings, Aart Kraay, Anna Maria Mayda, Christopher Pissarides, Raghu Rajan, Tony Venables, and seminar participants at the IMF, Georgetown University, the US International Trade Commission and the EIIE conference in Lubljana, Slovenia 2005, for helpful comments. We thank Yuanyuan Chen, Jungjin Lee and Evelina Mengova for excellent research assistance. The views expressed in this Working Paper are those of the authors and do not necessarily represent those of Federal Reserve Bank of New York, the Federal Reserve System or the IMF. 1. -

Outsourcing Tariff Evasion: a New Explanation for Entrepot Trade

NBER WORKING PAPER SERIES OUTSOURCING TARIFF EVASION: A NEW EXPLANATION FOR ENTREPOT TRADE Raymond Fisman Peter Moustakerski Shang-Jin Wei Working Paper 12818 http://www.nber.org/papers/w12818 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 January 2007 * Associate Professor, 823 Uris Hall, Graduate School of Business, Columbia University, New York, NY 10027, phone: (212) 854-9157; fax: (212) 854-9895; email:[email protected]. **Senior Associate, Booz Allen Hamilton, 101 Park Avenue, New York, NY 10178, phone: (212) 551-6798, fax: (212) 551-6732, email: [email protected] *** Assistant Director and Chief of the Trade and Investment Division, Research Department, IMF, 700 19th Street NW, Washington, DC 20431, and Research Associate and Director of the Working Group on the Chinese Economy, National Bureau of Economic Research, phone: 202/797-6023, fax: 202/797-6181, [email protected]. www.nber.org/~wei. We thank Jahangir Aziz, Lee Branstetter, Mihir Desai, Martin Feldstein, Wensheng Peng, John Romalis, and participants at NBER and CEPR conferences and a World Bank-IMF joint seminar for helpful comments and Yuanyuan Chen for able research assistance. The views expressed herein are those of the author(s) and do not necessarily reflect the views of the National Bureau of Economic Research. © 2007 by Raymond Fisman, Peter Moustakerski, and Shang-Jin Wei. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Outsourcing Tariff Evasion: A New Explanation for Entrepot Trade Raymond Fisman, Peter Moustakerski, and Shang-Jin Wei NBER Working Paper No. -

Outsourcing Tariff Evasion: a New Explanation for Entrepôt Trade

WP/05/102 Revised: 6/3/05 Outsourcing Tariff Evasion: A New Explanation for Entrepôt Trade Raymond Fisman, Peter Moustakerski, and Shang-Jin Wei © 2005 International Monetary Fund WP/05/102 Revised: 6/3/05 IMF Working Paper Research Department Outsourcing Tariff Evasion: A New Explanation for Entrepôt Trade Prepared by Raymond Fisman, Peter Moustakerski, and Shang-Jin Wei1 May 2005 Abstract This Working Paper should not be reported as representing the views of the IMF. The views expressed in this Working Paper are those of the author(s) and do not necessarily represent those of the IMF or IMF policy. Working Papers describe research in progress by the author(s) and are published to elicit comments and to further debate. Traditional explanations for indirect trade carried out through an entrepôt have focused on savings in transport costs and on the role of specialized agents in processing and distribution. We provide an alternative perspective based on the possibility that entrepôts may facilitate tariff evasion. Using data on direct exports to mainland China and indirect exports to it via Hong Kong SAR, we find that the indirect export rate rises with the Chinese tariff rate, even though there is no legal tax advantage to sending goods via Hong Kong SAR. We undertake a number of extensions to rule out plausible alternative hypotheses. JEL Classification Numbers: H2, F1 Keywords: Tax Evasion, Indirect Trade, Corruption Author(s) E-Mail Address: [email protected]; [email protected]; [email protected] 1 The authors would like to thank Jahangir Aziz, John Romalis, Lee Branstetter, and participants in a National Bureau of Economic Research (NBER) conference and a World Bank-IMF joint seminar for helpful comments and Yuanyuan Chen for able research assistance. -

Customs Compliance Procedures

Since 2014, Irish Traders are required to provide customs CUSTOMS COMPLIANCE authorities with information, by way of an Electronic Manifest Declaration, of all vessels/aircraft PROCEDURES carrying goods into and out of Ireland, both Community and non- Community. The Union Customs Code is in place from May 2016. Penalties have been introduced in the 2011 Finance Act which focuses attention on the administration responsibilities for correct submission of SAD returns. Failure to make correct declarations also brings closer the possibility of a Customs audit. Authorised Economic Operator (AEO) certifications have achieved substantial take up across Europe. Mutual Recognition has been agreed between AEO and CTPAT in the USA. However Ireland AEO certification is lagging far behind other EU countries. Lack of AEO certification may encounter delays in clearance by Customs. Course Objectives Feedback from This two day course provides the Exporting, Importing and our participants Logistics companies with a has been valuable update to International Trade excellent in Documentation, Customs, VIES 11 Merrion Square - & INTRASTAT Procedures. Dublin 2 - Ireland assisting them with their Target Audience [email protected] This course is a must for Brexit issues. those management and operational personnel needing +353 (1) 676 6894 to become familiar with Austin Rutledge Customs developments. www.export-edge.com CEO / Educational Course Benefit Director Assurance A detailed review of your customs and trade issues will take place with a pre-course -

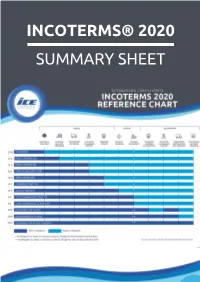

INCOTERMS® 2020 SUMMARY SHEET Note That Clause a Still Excludes Coverage in a Range of Circumstances, Such As War and Strikes

INCOTERMS® 2020 SUMMARY SHEET Note that Clause A still excludes coverage in a range of circumstances, such as war and strikes. Further, all cargo insurance generally excludes coverage for consequential loss (flow-on effects such as loss of profit or loss of opportunity as a result of lost or damaged goods, for example). Is it worth increasing costs with higher premiums for wider coverage? Or is better to expose your cargo to further risk at a more affordable premium? Consider which cargo insurance policy is more appropriate for your business goals. INCLUSION OF SECURITY REQUIREMENTS Incoterms® 2020 makes security obligations more prominent. Screening of containers in certain circumstances is now compulsory. New provisions in Incoterms® 2020 distribute security responsibilities between vendor and purchaser, so it is critical to review where each party is responsible and what measures must be introduced. MOVEMENT OF GOODS BY OWN TRANSPORTATION Incoterms® 2020 now enable that parties to use their own transport for carrying goods, rather than outsourcing transport to a third-party carrier (which had been assumed in Incoterms® 2010). The FCA, DAP, DPU and DDP have been updated to reflect this clarification. CHANGING THE WORDING OF THE INCOTERMS DOCUMENT Incoterms® 2020 have been reworded to make it more relevant and more easily understood. Now there are explanatory notes outlining the fundamental nature of each of the Incoterms®. Costs are better presented, creating an easy list of costs all in one place. FINAL CONSIDERATIONS It’s really important that both importers and exporters pay close attention their contract of sale. The Incoterm used needs to align with all the other terms used in the contract which deal with things like transportation and finance. -

The Benefits and Costs of Outsourcing Jobs

The Park Place Economist Volume 12 Issue 1 Article 10 March 2008 Opinion: The Benefits and Costs of Outsourcing Jobs George Coontz '04 Illinois Wesleyan University Follow this and additional works at: https://digitalcommons.iwu.edu/parkplace Recommended Citation Coontz '04, George (2004) "Opinion: The Benefits and Costs of Outsourcing Jobs," The Park Place Economist: Vol. 12 Available at: https://digitalcommons.iwu.edu/parkplace/vol12/iss1/10 This Article is protected by copyright and/or related rights. It has been brought to you by Digital Commons @ IWU with permission from the rights-holder(s). You are free to use this material in any way that is permitted by the copyright and related rights legislation that applies to your use. For other uses you need to obtain permission from the rights-holder(s) directly, unless additional rights are indicated by a Creative Commons license in the record and/ or on the work itself. This material has been accepted for inclusion by faculty at Illinois Wesleyan University. For more information, please contact [email protected]. ©Copyright is owned by the author of this document. Opinion: The Benefits and Costs of Outsourcing Jobs This article is available in The Park Place Economist: https://digitalcommons.iwu.edu/parkplace/vol12/iss1/10 Opinion: The Benefits and Costs of Outsourcing Jobs George Coontz With today’s consumer stretching the dollar try, then this country possesses the comparative ad- further and further, tremendous competitive pres- vantage. This country should elect to produce this sure has been put on U.S. companies trying to com- good or service, while the other country should pro- pete with foreign companies. -

Pre-Empting Protectionism in Services: the Gats and Outsourcing

3B2 Version 8.07i/W (Oct 12 2004) J:/3B2/Oxford University Press/Journals/JIEL/Vol 7-4/002Mattoo.3d Journal of International Economic Law 7(4), 765–800 pre-empting protectionism in services: the gats and outsourcing Aaditya Mattoo* and Sacha Wunsch-Vincent** abstract Cross-border trade in services is growing rapidly, with both developed and developing countries among the most dynamic exporters. Despite the substantial global benefits from such trade, the adjustment pressures created in importing countries could provoke a protectionist backlash – some signs of which are already visible in procurement and regulatory restrictions. The current negotiations under the Doha Development Agenda offer an opportunity to lock in current openness and pre-empt protectionism. This note describes how a bold initiative under the General Agreement on Trade in Services (GATS) can help secure openness. introduction Cross-border trade in business services, especially the so-called ‘IT-enabled services’, is today among the fastest growing areas of international trade.1 While the industrial countries are the largest exporters of such services, some of the most dynamic exporters are developing countries. Three factors are responsible for this phenomenon. First, advances in technology have made cross-border trade possible in a number of services that were previously only tradeable through the movement of providers. Second, substantial investment in education in a number of developing countries has created a relative abundance of skilled labor, and the absence of commensurate employment opportunities has ensured its availability at a relatively low wage. Finally, * Lead Economist, World Bank, 1818 H St NW, Washington, DC, USA; [email protected] ** Economist, OECD/Visiting Fellow Institute for International Economics, OECD – STI, Informa- tion, Computer and Communications Policy (ICCP), 2 rue Andre´ Pascal, F-75775 Paris Cedex 16; [email protected]. -

Analytical Model: Evaluating Incoterm Conversion

Analytical Model: Evaluating Incoterm Conversion By Name(s) Mark C. Brown, Pratik Yadav Topic Areas: Sourcing, Strategy, Risk Management Advisor: Dr. Bruce Arntzen Summary: This capstone project investigates the various material buying arrangements that a buying entity will take on. The research will focus on a select group of products from a select group of suppliers. The suppliers selected will have different characteristics such as origin, volume, price, supplier relationship, etc. Total logistics costs and risk are included per incoterm option to give an overview to business managers on how to approach buying decisions. The result is a matrix of selected scenarios which will allow the buyer to understand the risk associated with each incoterm under a set of conditions and the expected cost difference. Bio Bio Before coming to MIT, Mark Before coming to MIT, Pratik worked in product distribution worked in various areas of for several companies supply chain at companies like including U.S. Lumber, Maersk, DPDHL and lately Weyerhaeuser, and Georgia- ABB. He advised leading Pacific managing multiple companies on numerous departments including topics ranging from growth operations, transportation, strategy, supply chain procurement, and sales. He management, operations holds a BSci degree from the transformation to corporate University of Tennessee / restructuring. He holds an MSc Knoxville. from Cranfield and BEng degree from University of KEY INSIGHTS Rajasthan 1. Having an active inbound spend and choice of shipper. This often results in management operation is critical in poor shipment status visibility and less control of taking advantage of an incoterm carrier selection for the buyer. Our research conversion strategy. -

Technology and the Future of ASEAN Jobs

Technology and the future of ASEAN jobs Technology and the future of ASEAN jobs The impact of AI on workers in ASEAN’s six largest economies September 2018 © 2018© 2018 Cisco Cisco and/or and/or its affiliates.its affiliates. All rightsAll rights reserved. reserved. Technology and the future of ASEAN jobs Executive summary Over the next decade, innovations in digital technology will present vast opportunities to ASEAN economies to boost their productivity and prosperity. The more widespread adoption of existing technologies, coupled with advances in the use of artificial intelligence (AI) through software, hardware, and robotics, has the potential to transform business capabilities. As a youthful region (half the 630 million inhabitants are aged under 30) with an internationally competitive manufacturing sector and innovative enterprises, ASEAN is poised to take advantage. However, digital transformation will also mean that many of the region’s workers face considerable upheaval. To better understand these opportunities and challenges, Cisco has worked with Oxford Economics to explore what the next decade of technological change will 6.6 million mean for ASEAN workers. We assembled a multidisciplinary team of experts Number of jobs that will become redundant through more widespread from across the region to advise on the role technology will play in different adoption of technology by 2028 industries and occupations. We then leveraged data on 433 occupations across * Across the ASEAN-6 economies. 21 industries to model the impact of these technology adoption patterns on the 275 million full-time equivalent (FTE) workers employed in the six largest ASEAN economies (ASEAN-6) by 2028. -

Globalization in Transition: the Future of Trade and Value Chains

GLOBALIZATION IN TRANSITION: THE FUTURE OF TRADE AND VALUE CHAINS JANUARY 2019 AboutSince itsMGI founding in 1990, the McKinsey Global Institute (MGI) has sought to develop a deeper understanding of the evolving global economy. As the business and economics research arm of McKinsey & Company, MGI aims to provide leaders in the commercial, public, and social sectors with the facts and insights on which to base management and policy decisions. MGI research combines the disciplines of economics and management, employing the analytical tools of economics with the insights of business leaders. Our “micro-to-macro” methodology examines microeconomic industry trends to better understand the broad macroeconomic forces affecting business strategy and public policy. MGI’s in-depth reports have covered more than 20 countries and 30 industries. Current research focuses on six themes: productivity and growth, natural resources, labor markets, the evolution of global financial markets, the economic impact of technology and innovation, and urbanization. Recent reports have assessed the digital economy, the impact of AI and automation on employment, income inequality, the productivity puzzle, the economic benefits of tackling gender inequality, a new era of global competition, Chinese innovation, and digital and financial globalization. MGI is led by three McKinsey & Company senior partners: Jacques Bughin, Jonathan Woetzel, and James Manyika, who also serves as the chairman of MGI. Michael Chui, Susan Lund, Anu Madgavkar, Jan Mischke, Sree Ramaswamy, and Jaana Remes are MGI partners, and Mekala Krishnan and Jeongmin Seong are MGI senior fellows. Project teams are led by the MGI partners and a group of senior fellows, and include consultants from McKinsey offices around the world.