Business Online & Mobile Banking Alerts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nokia Lumia 521 User Manual

www.nokia.com Product and safety information Copyright © 2013 Nokia. All rights reserved. Nokia and Nokia Connecting People are trademarks or registered trademarks of Nokia Corporation. Other product and company names mentioned herein may be trademarks or trade names of their respective owners. The phone supplied in the sales package may differ from that shown. Specifications subject to change without notice. Printed in China. 9260765 Ver. 1.0 03/13 Quick Guide Psst... Nokia Lumia 521 This guide isn't all there is... For the online user guide, even more info, user Contents guides in another language, and Safety 3 troubleshooting help, go to www.nokia.com/ support. Keys and parts 4 Check out the videos at www.youtube.com/ Get started 5 NokiaSupportVideos. Get the basics 9 For info on Nokia Service terms and Privacy policy, go to www.nokia.com/privacy. Try out the touch screen 10 First start-up Take your friends with you 15 Your new phone comes with great features that will be installed when you start your phone Messages 17 for the first time. Allow some minutes for your Mail 21 phone to be ready. Take photos and share 25 HERE Maps 27 Browse the web 29 Feature-specific instructions 36 Product and safety information 38 2 Stop using the device until the glass is replaced by Safety qualified service personnel. Read these simple guidelines. Not following them may be dangerous or illegal. For further info, read the PROTECT YOUR HEARING complete user guide. To prevent possible hearing damage, do not listen at high volume levels for long periods. -

RADA Sense Mobile Application End-User Licence Agreement

RADA Sense Mobile Application End-User Licence Agreement PLEASE READ THESE LICENCE TERMS CAREFULLY BY CONTINUING TO USE THIS APP YOU AGREE TO THESE TERMS WHICH WILL BIND YOU. IF YOU DO NOT AGREE TO THESE TERMS, PLEASE IMMEDIATELY DISCONTINUE USING THIS APP. WHO WE ARE AND WHAT THIS AGREEMENT DOES We Kohler Mira Limited of Cromwell Road, Cheltenham, GL52 5EP license you to use: • Rada Sense mobile application software, the data supplied with the software, (App) and any updates or supplements to it. • The service you connect to via the App and the content we provide to you through it (Service). as permitted in these terms. YOUR PRIVACY Under data protection legislation, we are required to provide you with certain information about who we are, how we process your personal data and for what purposes and your rights in relation to your personal data and how to exercise them. This information is provided in https://www.radacontrols.com/en/privacy/ and it is important that you read that information. Please be aware that internet transmissions are never completely private or secure and that any message or information you send using the App or any Service may be read or intercepted by others, even if there is a special notice that a particular transmission is encrypted. APPLE APP STORE’S TERMS ALSO APPLY The ways in which you can use the App and Documentation may also be controlled by the Apple App Store’s rules and policies https://www.apple.com/uk/legal/internet-services/itunes/uk/terms.html and Apple App Store’s rules and policies will apply instead of these terms where there are differences between the two. -

Your Business Is Covered

FREE Samsung & Cellairis Bundle for Business Your business is covered. Get the latest Galaxy phones for your Phone Case and Screen Protector business, and protect them for free.1 • Cellairis Rapture® case • Cellairis Shell Shock® screen protector Business hates surprises, especially when it comes in the form of unexpected costs associated with suddenly Never Pay Guarantee inoperable devices. • 3 years of free Samsung phone repairs The Samsung & Cellairis Bundle for Business comes • Includes the screen and components such free with the latest unlocked Samsung Galaxy devices, as microphones, buttons, cameras, charge 2 for a limited time only.1 It’ll save you money, time, ports, speakers and headphone jacks productivity and stress so you can keep your business moving forward. Dedicated Repair Services • Convenient repair drop-off locations and ship-in service options Contact Us: samsung.com/cellairis FREE Samsung & Cellairis Bundle for Business The Samsung & Cellairis Bundle for Business. It’s the protection bundle with a back-up plan, and comes FREE with every unlocked Samsung Galaxy S9, S8 or Note8 device purchased. That’s a $700 value per device, or $14,000 of free coverage for every 20 phones purchased.3 Qualifying Devices • Galaxy S8 | S8+ (Unlocked) • Galaxy Note8 Enterprise Edition • Galaxy S9 | S9+ (Unlocked) • Galaxy S9 Enterprise Edition The Samsung & Cellairis Bundle offers complete protection and peace of mind. Offer available July 1, 2018-September 30, 2018. For more information visit samsung.com/cellairis, contact a mobility sales expert: 1-877-800-7894 or contact your local reseller. Learn more samsung.com/business insights.samsung.com Product Support 1-866-SAM4BIZ 1-877-800-7894 Follow Us youtube.com/samsungbizusa @SamsungBizUSA ©2018 Samsung Electronics America, Inc. -

Step 1(To Be Performed on Your Google Pixel 2 XL)

For a connection between your mobile phone and your Mercedes-Benz hands-free system to be successful, Bluetooth® must be turned on in your mobile phone. Please make sure to also read the operating and pairing instructions of the mobile phone. Please follow the steps below to connect your mobile phone Google Pixel 2 XL with the mobile phone application of your Mercedes-Benz hands-free system using Bluetooth®. Step 1(to be performed on your Google Pixel 2 XL) Step 2 To get to the telephone screen of your Mercedes-Benz hands-free system press the Phone icon on the homescreen. Step 3 Select the Phone icon in the lower right corner. Step 4 Select the “Connect a New Device” application. Page 1 of 3 Step 5 Select the “Start Search Function” Step 6 The system will now search for any Bluetooth compatible phones. This may take some time depending on how many devices are found by the system. Step 7 Once the system completes searching select your mobile phone (example "My phone") from the list. Step 8 The pairing process will generate a 6-digit passcode and display it on the screen. Verify that the same 6 digits are shown on the display of your phone. Step 9 (to be performed on your Google Pixel 2 XL) There will be a pop-up "Bluetooth Request: 'MB Bluetooth' would like to pair with your phone. Confirm that the code '### ###' is shown on 'MB Bluetooth'. " Select "Pair" on your phone if the codes match. Page 2 of 3 Step 10 After the passcode is verified on both the mobile and the COMAND, the phone will begin to be authorized. -

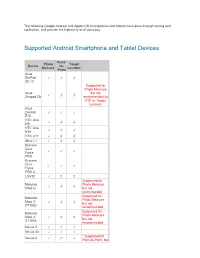

Supported Android Smartphone and Tablet Devices

The following Google Android and Apple iOS smartphones and tablets have gone through testing and calibration, and provide the highest level of accuracy: Supported Android Smartphone and Tablet Devices Point- Photo Target Device to- Measure Location Point Asus ZenPad ✓ ✗ ✗ 3S 10 Supported for Photo Measure Asus but not ✓ ✗ ✗ Zenpad Z8 recommended for P2P or Target Location Asus Zenpad ✓ ✓ ✓ Z10 HTC One ✓ ✗ ✗ M8 HTC One ✓ ✗ ✗ Mini HTC U11 ✓ ✗ ✗ iNew L1 ✓ ✗ ✗ Kyocera Dura ✓ ✓ ✓ Force PRO Kyocera Dura ✓ ✓ ✓ Force PRO 2 LGV20 ✓ ✗ ✗ Supported for Motorola Photo Measure ✓ ✗ ✗ Moto G but not recommended Supported for Motorola Photo Measure Moto X ✓ ✗ ✗ but not XT1052 recommended Supported for Motorola Photo Measure Moto X ✓ ✗ ✗ but not XT1053 recommended Nexus 5 ✓ ✓ ✓ Nexus 5X ✓ ✓ ✓ * Supported for Nexus 6 ✓ ✓* ✓ Point-to-Point, but cannot guarantee +/-3% accuracy * Supported for Point-to-Point, but Nexus 6P ✓ ✓* ✓ cannot guarantee +/-3% accuracy * Supported for Point-to-Point, but Nexus 7 ✓ ✓* ✓ cannot guarantee +/-3% accuracy Samsung Galaxy ✓ ✓ ✓ A20 Samsung Galaxy J7 ✓ ✗ ✓ Prime * Supported for Samsung Point-to-Point, but GALAXY ✓ ✓* ✓ cannot guarantee Note3 +/-3% accuracy Samsung GALAXY ✓ ✓ ✓ Note 4 * Supported for Samsung Point-to-Point, but GALAXY ✓ ✓* ✓ cannot guarantee Note 5 +/-3% accuracy Samsung GALAXY ✓ ✓ ✓ Note 8 Samsung GALAXY ✓ ✓ ✓ Note 9 Samsung GALAXY ✓ ✓ ✓ Note 10 Samsung GALAXY ✓ ✓ ✓ Note 10+ Samsung GALAXY ✓ ✓ ✓ Note 10+ 5G Supported for Samsung Photo Measure GALAXY ✓ ✗ ✗ but not Tab 4 (old) recommended Samsung Supported for -

A Review of the 1.4 Μm Pixel Generation Ray Fontaine Technology Analysis Group Chipworks Inc

A Review of the 1.4 µm Pixel Generation Ray Fontaine Technology Analysis Group Chipworks Inc. 3685 Richmond Road, Suite 500 Ottawa, Ontario, Canada K2H 5B7 [email protected] Abstract – The first 1.4 µm pixel generation CMOS image sensors version of its internal reset control (IRC) pixels to reduce the (CIS) began appearing in consumer-grade downstream products number of interconnect lines in its FI pixels [9]. in early 2009 with the majority of small pixel CIS innovators mass producing 1.4 µm pixel devices by the end of 2010. As TABLE I. PIXEL ARCHITECTURE BY COMPANY 1.1 µm pixel generation devices have entered mass production in early 2011, it is worth reviewing the enabling technologies found 1.4 µm Pixel Device Pixel Architecture Application in real world examples of 1.4 µm pixel devices. Manufacturer Sharing Aptina 4-shared 1.75T effective, Mobile phone CIS developers faced a fundamental decision when scaling IRC down from the 1.75 µm pixel generation: whether to extend front-illuminated (FI) technology or to develop back-illuminated OmniVision/TSMC 2-shared 2T effective Mobile phone (BI, or BSI) sensors. In both cases, the trend for small pixel CIS (BIa) devices has been the use of more advanced silicon wafer foundries, and a remarkable increase in materials integration Panasonic 4-shared 1.5T effective DSC and packaging innovation. Samsung 2-shared 2.5T effective Mobile phone Chipworks, as a supplier of competitive intelligence to the Samsung (BIa) 2-shared 2.5T effective DVC semiconductor and electronics industries, monitors the evolution of image sensor technologies as they come into production. -

A Guide to Smartphone Astrophotography National Aeronautics and Space Administration

National Aeronautics and Space Administration A Guide to Smartphone Astrophotography National Aeronautics and Space Administration A Guide to Smartphone Astrophotography A Guide to Smartphone Astrophotography Dr. Sten Odenwald NASA Space Science Education Consortium Goddard Space Flight Center Greenbelt, Maryland Cover designs and editing by Abbey Interrante Cover illustrations Front: Aurora (Elizabeth Macdonald), moon (Spencer Collins), star trails (Donald Noor), Orion nebula (Christian Harris), solar eclipse (Christopher Jones), Milky Way (Shun-Chia Yang), satellite streaks (Stanislav Kaniansky),sunspot (Michael Seeboerger-Weichselbaum),sun dogs (Billy Heather). Back: Milky Way (Gabriel Clark) Two front cover designs are provided with this book. To conserve toner, begin document printing with the second cover. This product is supported by NASA under cooperative agreement number NNH15ZDA004C. [1] Table of Contents Introduction.................................................................................................................................................... 5 How to use this book ..................................................................................................................................... 9 1.0 Light Pollution ....................................................................................................................................... 12 2.0 Cameras ................................................................................................................................................ -

Comparison: Android Vs IOS for Mediography

Comparison: Android vs IOS for mediography 2016.12 Pure Android Google phone iPhone 6s and later (Nexus 5x, Nexus 6, (iPhone 6s, iPhone 6s Plus, Nexus 6p, Pixel, Pixel XL) iPhone 7, iPhone 7 Plus) Works with Project Fi? 100%, Officially, no... (see my related article) including seamless switching Unofficially yes... between WiFi, US Cellular, but only as well as an iPhone Sprint and T-Mobile, can work solely with T-Mobile, including WiFi and including WiFi and T-Mobile’s coveted T-Mobile’s coveted 700 MHz band 700 MHz band. (It can’t use the US Cellular and Sprint networks —until if and when— Apple and Google make it official.) Over 130 countries Yes! Yes! with data roaming at no With Project Fi With Project Fi extra cost or T-Mobile (Simple Choice) or T-Mobile (Simple Choice) as your primary carrier. as your primary carrier. Allows 5GHz personal Yes! No! hotspot? (See this article) What’s up with that Apple? It has been four generations since you added 5 GHz to the original iPhone 5. It’s about time you make it available for the personal hotspot. Allows WiFi Analyzer Yes! No! or equivalent (See this article) Still photos Tie Tie Video with FiLMiC Pro, Tie Tie including 4K UHD at 100 megabits per second Mono direct native Recording quality is a tie. Recording quality is a tie. 48 kHz audio recording from a single digital Regarding Regarding microphone, using my confidence monitoring: confidence monitoring: recommended apps Unless the digital mic has its Latency for live audio monitoring own latency-free monitoring from latest iPhone models is feature (i.e. -

Nokia 7.2 Is Designed to Offer Fans Advanced Tools to Express Their Creativity with a Powerful 48MP Triple Camera Featuring ZEISS Optics

Key features Key specifications1 Nokia 7.2 is designed to offer fans advanced tools to express their creativity with a powerful 48MP triple camera featuring ZEISS Optics. The ITEM SPECIFICATION smartphone combines stunning PureDisplay screen technology with SKU 1 ROW: GSM: 850, 900, 1800, 1900; WCDMA: 1, 5, 8; LTE: 1, 3, 5, 7, 8, Nokia 7.2 20, 28, 38, 40, 41 (120MHz) timeless Nordic design, in a class-defining package. NETWORK SKU 2 LATAM+US: GSM: 850, 900, 1800, 1900; WCDMA: 1, 2, 4, 5, 8; LTE: 1, BANDS 2, 3, 4, 5, 7, 8, 12/17, 13, 28, 66 Get creative with ZEISS Optics and powerful AI SKU 3 INDIA: GSM 900, 1800; WCDMA: 1, 5, 8; LTE: 1, 3, 5, 8, 40, 41 48MP triple camera with ZEISS Create shareworthy memories with intricate detail in both well lit and dim (120MHz) NETWORK Optics combined with state-of-the- conditions with Nokia 7.2’s triple camera featuring a highly sensitive 48MP SKU 1 & 2 LTE CAT6, SKU 3 LTE CAT 4 art PureDisplay sensor with Quad Pixel technology and ZEISS Optics and powerful AI. SPEED OS Android 9 Pie Portrait mode with unique ZEISS bokeh styles - ZEISS Modern, ZEISS Swirl CPU Qualcomm SDM660 and ZEISS Smooth - that recreate the way legendary ZEISS lenses produce RAM 4/6GB LPPDDR4x high visual impact and signature blur. STORAGE ROM: 64/128GB2 e-MMC 5.1, uSD supports to 512GB. Google Drive SIM Dual SIM + SD card slots (3 in 3) AI powered Night mode with image fusion and exposure stacking can 6.3" FHD+ Waterdrop, PureDisplay, Brightness (typ.) 500nits, contrast ratio sense whether hand held or on a tripod, adjusting the number of DISPLAY 1:1500, NTSC ratio 96%, SDR to HDR, HDR10 support for Amazon, Corning® exposures accordingly. -

HR Kompatibilitätsübersicht

HR-imotion Kompatibilität/Compatibility 2018 / 11 Gerätetyp Telefon 22410001 23010201 22110001 23010001 23010101 22010401 22010501 22010301 22010201 22110101 22010701 22011101 22010101 22210101 22210001 23510101 23010501 23010601 23010701 23510320 22610001 23510420 Smartphone Acer Liquid Zest Plus Smartphone AEG Voxtel M250 Smartphone Alcatel 1X Smartphone Alcatel 3 Smartphone Alcatel 3C Smartphone Alcatel 3V Smartphone Alcatel 3X Smartphone Alcatel 5 Smartphone Alcatel 5v Smartphone Alcatel 7 Smartphone Alcatel A3 Smartphone Alcatel A3 XL Smartphone Alcatel A5 LED Smartphone Alcatel Idol 4S Smartphone Alcatel U5 Smartphone Allview P8 Pro Smartphone Allview Soul X5 Pro Smartphone Allview V3 Viper Smartphone Allview X3 Soul Smartphone Allview X5 Soul Smartphone Apple iPhone Smartphone Apple iPhone 3G / 3GS Smartphone Apple iPhone 4 / 4S Smartphone Apple iPhone 5 / 5S Smartphone Apple iPhone 5C Smartphone Apple iPhone 6 / 6S Smartphone Apple iPhone 6 Plus / 6S Plus Smartphone Apple iPhone 7 Smartphone Apple iPhone 7 Plus Smartphone Apple iPhone 8 Smartphone Apple iPhone 8 Plus Smartphone Apple iPhone SE Smartphone Apple iPhone X Smartphone Apple iPhone XR Smartphone Apple iPhone Xs Smartphone Apple iPhone Xs Max Smartphone Archos 50 Saphir Smartphone Archos Diamond 2 Plus Smartphone Archos Saphir 50x Smartphone Asus ROG Phone Smartphone Asus ZenFone 3 Smartphone Asus ZenFone 3 Deluxe Smartphone Asus ZenFone 3 Zoom Smartphone Asus Zenfone 5 Lite ZC600KL Smartphone Asus Zenfone 5 ZE620KL Smartphone Asus Zenfone 5z ZS620KL Smartphone Asus -

These Phones Will Still Work on Our Network After We Phase out 3G in February 2022

Devices in this list are tested and approved for the AT&T network Use the exact models in this list to see if your device is supported See next page to determine how to find your device’s model number There are many versions of the same phone, and each version has its own model number even when the marketing name is the same. ➢EXAMPLE: ▪ Galaxy S20 models G981U and G981U1 will work on the AT&T network HOW TO ▪ Galaxy S20 models G981F, G981N and G981O will NOT work USE THIS LIST Software Update: If you have one of the devices needing a software upgrade (noted by a * and listed on the final page) check to make sure you have the latest device software. Update your phone or device software eSupport Article Last updated: Sept 3, 2021 How to determine your phone’s model Some manufacturers make it simple by putting the phone model on the outside of your phone, typically on the back. If your phone is not labeled, you can follow these instructions. For iPhones® For Androids® Other phones 1. Go to Settings. 1. Go to Settings. You may have to go into the System 1. Go to Settings. 2. Tap General. menu next. 2. Tap About Phone to view 3. Tap About to view the model name and number. 2. Tap About Phone or About Device to view the model the model name and name and number. number. OR 1. Remove the back cover. 2. Remove the battery. 3. Look for the model number on the inside of the phone, usually on a white label. -

ANALYSIS of AUDIO RECORDINGS MADE USING the VOICE RECORDER APPLICATION on ANDROID PHONES by GINA ANTOINETTE DEANGELIS A.A., Arap

ANALYSIS OF AUDIO RECORDINGS MADE USING THE VOICE RECORDER APPLICATION ON ANDROID PHONES by GINA ANTOINETTE DEANGELIS A.A., Arapahoe Community College, 1999 B.S., University of Colorado Denver, 2001 A thesis submitted to the Faculty of the Graduate School of the University of Colorado in partial fulfillment of the requirements for the degree of Master of Science Recording Arts Program 2020 © 2020 GINA ANTOINETTE DEANGELIS ALL RIGHTS RESERVED ii This thesis for the Master of Science degree by Gina Antoinette DeAngelis has been approved for the Recording Arts Program by Catalin Grigoras, Chair Jeff M. Smith Marcus Rogers Date: May 16, 2020 iii DeAngelis, Gina Antoinette (M.S., Recording Arts) Analysis of Audio Recordings Made Using the Voice Recorder Application on Android Phones Thesis directed by Associate Professor Catalin Grigoras ABSTRACT Android is one of the two main operating systems for mobile phones and includes an application for voice recording. Since extensive research has been completed on the "Voice Memos" application for iOS, there remains research to be completed on the default application for the Android OS. This thesis explores the user interface for four different Android phones with four different voice recording application versions. Features, limitations, editing capabilities, file formats and atom structure for each phone are discussed. A testing protocol was created and utilized for the creation of the test recordings. The analysis of those recordings explored authenticity, detected editing and discovered consistencies and inconsistencies between the recordings for each phone. The form and content of this abstract are approved. I recommend its publication. Approved: Catalin Grigoras iv DEDICATION This is dedicated to my parents and my boys who supported me every step of the way.