2014 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aqualis ASA (A Public Limited Liability Company Organised Under the Laws of Norway) Org.No

Aqualis ASA (A public limited liability company organised under the laws of Norway) Org.no. 913 757 424 The information in this prospectus (the "Prospectus") relates to (i) a underwritten rights issue (the “Rights Issue”) by Aqualis ASA (“Aqualis” or the “Company”, and when taken together with its consolidated subsidiaries, the “Group” or the “Aqualis Group”) and the listing on Oslo Børs of up to 8,882,575 new shares in the Company with a par value of NOK 0.1 each (the “Rights Issue Shares”), issued for a subscription price of NOK 3.96 per share (the “Subscription Price”), (ii) listing of 4,375,000 new shares in Aqualis, each with a par value of NOK 0.1 each (the “Private Placement Shares”) and (iii) listing of 14,865,621 new shares in Aqualis, each with a par value of NOK 0.1 each (the “Consideration Shares”, and together with the Rights Issue shares and the Private Placement Shares the “New Shares”). Subscription Period for the Rights Issue: From 24 June 09:00 (CET) to 8 July 16:30 (CET) Trading in Subscription Rights: From 24 09:00 (CET) 4 July 16:30 (CET) The shareholders of the Company as at 11 June 2019 (and being registered as such in the Norwegian Central Securities Depository (the "VPS") on 13 June 2019 pursuant to the two days' settlement procedure (the "Record Date")) (the "Existing Shareholders"), will be granted subscription rights in the Rights Issue that, subject to applicable law, provide preferential rights to subscribe for and be allocated Rights Issue Shares at the Subscription Price (the "Subscription Rights"). -

Aqualis Offshore Holding ASA (A Public Limited Liability Company Organised Under the Laws of Norway) Org.No

Aqualis Offshore Holding ASA (A public limited liability company organised under the laws of Norway) Org.no. 913 757 424 Listing of 43,190,544 shares in Aqualis Offshore Holding ASA (the “Shares”) on the Oslo Stock Exchange (the “Listing”) The first day of listing of Aqualis Offshore Holding ASA (“New Aqualis” or the “Company”, together with its subsidiaries the “New Aqualis Group” or the “Group”) on the Oslo Stock Exchange is expected to be 13 August 2014 and trading in the shares will commence on the date of listing, under the trading symbol AQUA. Investing in the Shares involves a high degree of risk. See section 2 “Risk Factors” beginning on page 15. THIS PROSPECTUS SERVES AS A LISTING PROSPECTUS ONLY, AS REQUIRED BY NORWEGIAN LAW AND REGULATION. THIS PROSPECTUS DOES NOT CONSTITUE AN OFFER TO BUY, SUBSCRIBE OR SELL ANY OF THE SECURITIES DESCRIBED HEREIN, AND NO SECURITIES ARE BEING OFFERED OR SOLD PURSUANT TO IT. Manager: 12 August 2014 AQUALIS OFFSHORE HOLDING ASA IMPORTANT INFORMATION For the definitions of terms used throughout this Prospectus, see section 17 "Definitions and glossary of terms" of this Prospectus. This prospectus (the “Prospectus”) has been prepared to comply with the Norwegian Securities Trading Act of 29 June 2007 no. 75 (the “Norwegian Securities Trading Act”) and related secondary legislation, including the Commission Regulation (EC) no. 809/2004 implementing Directive 2003/71/EC of the European Parliament and of the Council of 4 November 2003 regarding information contained in prospectuses (the “Prospectus Directive”) as well as the format, incorporation by reference and publication of such prospectuses and dissemination of advertisements (hereafter “EC Regulation 809/2004”). -

Candidates Nominated to the Board of Directors in Gjensidige Forsikring ASA

Office translation for information purpose only Appendix 18 Candidates nominated to the Board of Directors in Gjensidige Forsikring ASA Per Andersen Born in 1947, lives in Oslo Occupation/position: Managing Director, Det norske myntverket AS Education/background: Chartered engineer and Master of Science in Business and Economics, officer’s training school, Director of Marketing and Sales and other positions with IBM, CEO of Gjensidige, CEO of Posten Norge and Managing Director of ErgoGroup, senior consultant to the CEO of Posten Norge, CEO of Lindorff. Trond Vegard Andersen Born in 1960, lives in Fredrikstad Occupation/position: Managing Director of Fredrikstad Energi AS Education/background: Certified public accountant and Master of Science in Business and Economics from the Norwegian School of Business Economics and Administration (NHH) Offices for Gjensidige: Member of owner committee in East Norway Organisational experience: Chairman of the Board for all FEAS subsidiaries, board member for Værste AS (regional development in Fredrikstad) Hans-Erik Folke Andersson Born in 1950, Swedish, lives in Djursholm Occupation/position: Consultant, former Managing Director of insurance company Skandia, Nordic Director for Marsh & McLennan and Executive Director of Mercantile & General Re Education/background: Statistics, economy, business law and administration from Stockholm University Offices for Gjensidige: Board member since 2008 Organisational experience: Chairman of the Board of Semcon AB, Erik Penser Bankaktiebolag and Canvisa AB and a board member of Cision AB. Per Engebreth Askildsrud Born in 1950, lives in Jevnaker Occupation/position: Lawyer, own practice Education/background: Law Offices for Gjensidige: Chairman of the owner committee Laila S. Dahlen Born in 1968, lives in Oslo Occupation/position: Currently at home on maternity leave. -

Mr. Thorleif Enger Elected New Telenor Chairman

Mr. Thorleif Enger elected new Telenor Chairman The Corporate Assembly of Telenor ASA has elected Mr. Thorleif Enger (59) as new Chairman of the Board. Mr. Enger has been a member of the Board since October 2001. Thorleif Enger has a PhD in Structural Engineering from the University of Colorado, USA and today holds position as Executive Vice President and member of Norsk Hydro Corporate Management, in charge of Hydro Agri, the world's largest fertilizer company. Mr. Enger has been with Norsk Hydro since 1973 and has, among other things, been Project Director for the development of the Oseberg Field in the North Sea and has been responsible for Norsk Hydro's domestic and foreign oil and gas acitivities. From 1970 to 1973 he was employed by Shell Development Company in Houston, Texas. Mr. Thorleif Enger succeeds Mr. Tom Vidar Rygh, who resigned as Chairman in December 2002 when he accepted the position as head of the investment bank Enskilda Securities AB in Sweden. The Board of Telenor ASA after this consist of: Thorleif Enger, Chairman à shild Bendiktsen, Deputy Chairman Hanne de Mora Jørgen Lindegaard Bjørg Ven Einar Førde Per Gunnar Salomonsen (employee representative) Irma Ruth Tystad (employee representative) Harald Stavn (employee representative) A high resolution picture of Mr. Thorleif Enger is available at: http://www.telenor.no/pressesenter/_gfx/trykk_tenger.jpg Telenor Group is one of the world's major mobile operators. We keep our customers connected in our markets across Scandinavia and Asia. Our more than 30,000 employees are committed to responsible business conduct and being our customers' favourite partner in digital life. -

The Supervisory Board of Gjensidige Forsikring ASA

The Supervisory Board of Gjensidige Forsikring ASA Name Office Born Address Occupation/position Education/background Organisational experience Bjørn Iversen Member 1948 Reinsvoll Farmer Agricultural economics, Agricultural Head of Oppland county branch of the Norwegian University of Norway in 1972. Landbrukets Farmers' Union 1986-1989, head of the Norwegian sentralforbund 1972-1974, Norges Kjøtt- og Farmers' Union 1991-1997, chair of the supervisory Fleskesentral 1974-1981, state secretary in board of Hed-Opp 1985-89, chair/member of the board the Ministry of Agriculture 1989-1990 of several companies. Chair of the Supervisory Board and Chair of the Nomination Committee of Gjensidige Forsikring ASA. Hilde Myrberg Member 1957 Oslo Senior Vice President MBA Insead, law degree. Chair of the board of Orkla Asia Holding AS, deputy Corporate Governance, chair of the board of Petoro AS, member of the board of Orkla ASA Renewable Energy Corporation ASA, deputy board member of Stålhammar Pro Logo AS, deputy chair of the board of Chr. Salvesen & Chr Thams's Communications Aktieselskap, member of the boards of Industriinvesteringer AS and CGGVeritas SA. Randi Dille Member 1962 Namsos Self-employed, and Economies subjects. Case officer/executive Chair of the boards of Namsskogan Familiepark, Nesset general manager of officer in the agricultural department of the fiskemottak and Namdal Skogselskap, member of the Namdal Bomveiselskap, County Governor of Nord-Trøndelag, boards of several other companies. Sits on Nord- Namsos national recruitment project manager for Trøndelag County Council and the municipal Industribyggeselskap and the Norwegian Fur Breeders' Association, council/municipal executive board of Namsos Nordisk Reinskinn own company NTN AS from 1999. -

0 STATOIL Den Norske Stats Oljeselskap A.S - Statoil - Was Founded in 1972

DEN NORSKE STATS O L J ESE [S K A P A.S ANNUAL REPORT AND ACCOUNTS NINETEEN HUNDRED AND NINETY-FIVE 0 STATOIL Den norske stats oljeselskap a.s - Statoil - was founded in 1972. All its shares are owned by the Norwegian state. The company’s object is, either by itself or through participation in or together with other companies, to car,y out exploration, production, trans portation, refining and marketing of petroleum and petroleum-derived products, as well as other business. Net operating revenue for the group in 1995 totalled NOK 87 billion. At 3’l December, it had some 14 000 employees. Statoil is the leading player on the Norwegian continental shelfand the biggest petrol retail er in Scandinavia. It also ranks as one of the world’s largest net sellers ofcrude oil and is a substantial supplier II of natural gas to continental Europe. The group has pur sued a gradual expansion outside Scandinavia in recent years. Statoil is responsible for managing the govern I ment’s directfinancial interest in partnerships engaged in exploration for as well as development, production and fransport ofpefroleum on the Norwegian continental shelf ‘p. Statoil operates in the following countries: Norway • Sweden • Denmark • Germany • Poland • Estonia Latvia • Lithuania • UK • Ireland • Belgium • Russia • Thailand Vietnam • Malaysia • Singapore • Azerbaijan • Kazakhstan Angola • Namibia • Nigeria • USA • Venezuela • China ______L 1995 Statoil made the biggest oil discovery off Denmark for 18 years as operator on the Sin structure, which is estimated to hold 145 million barrels of commercially-recoverable oil. Statoil took over as production operator on the Heidrun field, which has a daily output of 220 000 barrels of oil. -

Download Bios of Tone H Bachke and Jørgen C. Arentz Rostrup

Tone H. Bachke Tone H. Bachke, born 1972, has more than 20 years of business experience in an international context. In Telenor, she has held the position as SVP and Head of Group Treasury upon joining the company in September 2018. She has a broad range of management positions in several companies and across industries, including CEO of Implenia Norge AS, CFO of Kistefos AS, as well as various management positions in Aker Solutions, including SVP and CFO of Aker Process Systems. She also serves on the Board of Directors for Veidekke ASA. Education: Bachke holds a degree in economics and business administration from Norwegian School of Economics (NHH). Jørgen C. Arentz Rostrup Jørgen Rostrup, born 1966, has more than 20 years’ business experience in an international context. For the past years as CFO for Telenor Group, Jørgen has been instrumental in setting a solid course for the company of growth and modernisation. Through Telenor’s operational excellence measures, a sharper focus on what creates value, and a dedication to uncovering efficiencies over time, the company is today one of the best-positioned global telcos. Prior to joining Telenor Group in 2016 as CFO, he served as President of Yara North America, Inc. Rostrup has held a broad range of management positions in two of Norway’s leading companies, including Country Manager for Yara Ghana Ltd., CFO in Norsk Hydro AS, Executive Vice President Energy in Hydro and CFO for Hydro’s Norwegian oil and gas activity. Rostrup has also served on several boards, including positions within the private equity and investment banking area. -

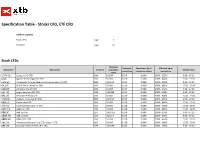

Specification Table - Stocks CFD, ETF CFD

Specification Table - Stocks CFD, ETF CFD Table of contents Stock CFDs page 1 ETF CFDs page 61 Stock CFDs Minimum Minimum Commission (% of XTB mark-up on Instrument Description Currency transaction Trading Hours commission transaction value) commission value 1COV.DE Covestro AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 A.US Agilent Technologies Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 A3M.ES Atresmedia Corp de Medios de Comunicacion SA CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AA.US* CLOSE ONLY / Alcoa Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAD.DE Amadeus Fire AG CFD EUR 50 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAL.UK Anglo American PLC CFD GBP 100 GBP 8 EUR 0.08% 100% - 200% 9:00 - 17:30 AAL.US American Airlines CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AALB.NL Aalberts Industries NV CFD EUR 100 EUR 8 EUR 0.08% 100% - 250% 9:00 - 17:30 AAN.US Aaron's Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAP.US Advance Auto Parts Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 AAPL.US Apple Inc CFD USD 50 USD 8 USD 0.08% 100% - 480% 15:30 - 22:00 ABB.SE ABB Ltd CFD SEK 1000 SEK 8 EUR 0.08% 100% - 430% 9:00 - 17:25 ABBN.CH ABB Ltd CFD CHF 150 CHF 8 EUR 0.08% 100% - 375% 9:00 - 17:20 ABBV.US Abbvie Inc. -

Hydro's Approach to Sustainability

Copyrighted material. Reproduction or distribution without written permission of the presenter is prohibited. HYDRO’S APPROACH TO SUSTAINABILITY Hans Erik Vatne CTO, Norsk Hydro 1 About the Presenter • Hans Erik Vatne, PhD – Senior Vice President and Chief Technology Officer – Head of Corporate Technology Office, Norsk Hydro – BoD, NTNU Faculty of Natural Sciences – BoD, Research Council of Norway Portfolio Board • [email protected] • Twitter: @HansErikVatne 2 Contents • Introduction: • Hydro’s approach to sustainability – Hydro in brief – Bauxite and alumina – Global sentiment – Primary aluminium – Hydro’s sustainability targets – Casthouse area and recycling – Product development 3 4 Building industries that matter A leading industrial company with basis in renewable energy and aluminium • Global provider of aluminium raw materials, products and solutions and of renewable energy • First-class operations within renewable energy, raw materials, primary aluminium metal, rolled products, extruded solutions and recycling • 34,000 employees at 140 locations in 40 countries • Market cap ~USD 9 billion (as per January ‘21) • Annual revenues ~USD 15 billion (2020) • Included in Dow Jones Sustainability Indices, Global Compact 100, FTSE4Good 4 Introduction Strong increase in sustainability, environment and climate awareness Action and improvement needed on waste, recycling and emissions (CO2) to defend aluminium’s position 5 Sustainability challenges and opportunities in the aluminium value chain 6 Hydro’s 2030 sustainability targets -

Package Leaflet: Information for the User Trampalgin 37.5 Mg/325 Mg

Package leaflet: Information for the user Trampalgin 37.5 mg/325 mg tablets tramadol hydrochloride/paracetamol Read all of this leaflet carefully before you start taking this medicine because it contains important information for you. • Keep this leaflet. You may need to read it again. • If you have any further questions, ask your doctor or pharmacist or nurse. • This medicine has been prescribed for you only. Do not pass it on to others. It may harm them, even if their signs of illness are the same as yours. • If you get any side effects, talk to your doctor or pharmacist or nurse. This includes any possible side effects not listed in this leaflet. See section 4. What is in this leaflet: 1. What Trampalgin is and what it is used for 2. What you need to know before you take Trampalgin 3. How to take Trampalgin 4. Possible side effects 5. How to store Trampalgin 6. Contents of the pack and other information 1. What Trampalgin is and what it is used for Trampalgin is composed of two pain relieving active substances, tramadol and paracetamol. Trampalgin is used to treat moderate to severe pain when your doctor recommends that a combination of tramadol and paracetamol is needed. Trampalgin is intended for adults, adolescents and children over 12 years of age. 2. What you need to know before you take Trampalgin Do not take Trampalgin • if you are allergic (hypersensitive) to the active substances tramadol and paracetamol or any of the other ingredients of Trampalgin • in cases of acute poisoning with alcohol, sleeping pills, pain relievers or psychotropic drugs (that affect mood, emotions and state of mind). -

FTSE Publications

2 FTSE Russell Publications FTSE Developed Europe SMID Cap 19 August 2021 Tradable Plus Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.72 UNITED Bureau Veritas S.A. 0.42 FRANCE Gjensidige Forsikring ASA 0.17 NORWAY KINGDOM Campari 0.31 ITALY Gn Store Nordic 0.53 DENMARK AAK 0.18 SWEDEN Carl Zeiss Meditec 0.33 GERMANY Halma 0.66 UNITED Aalberts NV 0.24 NETHERLANDS Castellum 0.32 SWEDEN KINGDOM ABN AMRO Bank NV 0.23 NETHERLANDS Centrica 0.2 UNITED Hargreaves Lansdown 0.39 UNITED Acciona S.A. 0.16 SPAIN KINGDOM KINGDOM Accor 0.32 FRANCE Chr. Hansen Holding A/S 0.43 DENMARK Hays 0.16 UNITED ACS Actividades Cons y Serv 0.3 SPAIN Clariant 0.21 SWITZERLAND KINGDOM Adecco Group AG 0.49 SWITZERLAND Coca-Cola HBC AG 0.33 UNITED HeidelbergCement AG 0.6 GERMANY Adevinta 0.21 NORWAY KINGDOM HelloFresh SE 0.67 GERMANY Admiral Group 0.43 UNITED Cofinimmo 0.21 BELGIUM Helvetia Holding AG 0.18 SWITZERLAND KINGDOM Commerzbank 0.35 GERMANY Hikma Pharmaceuticals 0.27 UNITED Aedifica 0.22 BELGIUM ConvaTec Group 0.25 UNITED KINGDOM Aegon NV 0.34 NETHERLANDS KINGDOM Hiscox 0.18 UNITED KINGDOM Aeroports de Paris 0.17 FRANCE Countryside Properties 0.16 UNITED Holmen AB 0.2 SWEDEN Ageas 0.46 BELGIUM KINGDOM Homeserve 0.17 UNITED Aker BP ASA 0.16 NORWAY Covestro AG 0.54 GERMANY KINGDOM Alfa Laval 0.52 SWEDEN Covivio 0.2 FRANCE Howden Joinery Group 0.3 UNITED Alstom 0.7 FRANCE Croda International 0.64 UNITED KINGDOM KINGDOM Alten 0.18 -

Quarterly Report, Q1 2020

Q1 2020 Quarterly Report: WilderHill Clean Energy Index®, March 31, 2020 The Clean Energy Index® (ECO) began 1st Quarter 2020 around 70 and it ended Q1 near 56, down -20%; but there was more to this Q1. A remarkable, volatile, exhilarating, frightening, roller coaster Q1 first had gone up sharply +30%, over 90 in mid-February, then crashed latter Q1 to below 50. Intra-day moves were abrupt: in a few hours March 24, ECO sprang up +15%. Or seen longer since 2017, when the ECO Index® was 38, last 3 years it’s risen some +55%. An independent tracking fund at start of 2017 was about 18.5, start of 2018 was about 25.5, start of 2019 was about 21.5, start of 2020 around 34 and at end of Q1 fell to around 27. ECO passively captures an emerging highly volatile theme; it thusly can & does at times also ‘drop like a rock’ – as was amply proven for instance Q1 2020. Big gains have occurred here – as well too as bigger declines. Plus we offer a mere observation: it’s counter-intuitive perhaps yet ECO’s theme has now spiked up at times in Bush II & Trump Presidencies - though neither greatly promoted green energy. Meanwhile drops were seen 8 years of an Obama Presidency that favored this sector (yet 2008-2016 was a bit singular as China undertook to enter and gain major market share in clean energy, a goal that since came to fruition). Look back last 5 years at Benchmark ECO Index®, live since 2004 & 1st for climate solutions, and it’s near nil, negligibly up a few percent.