Impact of the Econimic Downturn on the Development of the Canadian

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appendix 4-I: Descriptions of the Life Stages and Habitat Requirements For

APPENDIX 4-I DESCRIPTIONS OF THE LIFE STAGES AND HABITAT REQUIREMENTS FOR FISH AND FISH HABITAT KEY INDICATOR RESOURCES MEG Energy Corp. - i - Fish and Fish Habitat KIRs Christina Lake Regional Project – Phase 3 Appendix 4-I April 2008 TABLE OF CONTENTS SECTION PAGE 1 INTRODUCTION.......................................................................................................1 1.1 ARCTIC GRAYLING........................................................................................................2 1.2 NORTHERN PIKE ...........................................................................................................3 1.3 WALLEYE........................................................................................................................4 1.4 WHITE SUCKER .............................................................................................................6 1.5 BROOK STICKLEBACK..................................................................................................7 1.6 BENTHIC INVERTEBRATES..........................................................................................7 2 REFERENCES..........................................................................................................9 2.1 PERSONAL COMMUNICATIONS ................................................................................11 LIST OF TABLES Table 1 Fish Life Cycle Stages and Habitat Components............................................................1 Volume 4 MEG Energy Corp. - 1 - Fish and Fish Habitat KIRs Christina -

NB4 - Rivers, Creeks and Streams Waterbody Waterbody Detail Season Bait WALL NRPK YLPR LKWH BURB GOLD MNWH L = Bait Allowed Athabasca River Mainstem OPEN APR

Legend: As examples, ‘3 over 63 cm’ indicates a possession and size limit of ‘3 fish each over 63 cm’ or ‘10 fish’ indicates a possession limit of 10 for that species of any size. An empty cell indicates the species is not likely present at that waterbody; however, if caught the default regulations for the Watershed Unit apply. SHL=Special Harvest Licence, BKTR = Brook Trout, BNTR=Brown Trout, BURB = Burbot, CISC = Cisco, CTTR = Cutthroat Trout, DLVR = Dolly Varden, GOLD = Goldeye, LKTR = Lake Trout, LKWH = Lake Whitefish, MNWH = Mountain Whitefish, NRPK = Northern Pike, RNTR = Rainbow Trout, SAUG = Sauger, TGTR = Tiger Trout, WALL = Walleye, YLPR = Yellow Perch. Regulation changes are highlighted blue. Waterbodies closed to angling are highlighted grey. NB4 - Rivers, Creeks and Streams Waterbody Waterbody Detail Season Bait WALL NRPK YLPR LKWH BURB GOLD MNWH l = Bait allowed Athabasca River Mainstem OPEN APR. 1 to MAY 31 l 0 fish 3 over 63 cm 10 fish 10 fish 5 over 30 cm Mainstem OPEN JUNE 1 to MAR. 31 l 3 over 3 over 63 cm 10 fish 10 fish 5 over 43 cm 30 cm Tributaries except Clearwater and Hangingstone rivers OPEN JUNE 1 to OCT. 31 l 3 over 3 over 63 cm 10 fish 10 fish 10 fish 5 over 43 cm 30 cm Birch Creek Beyond 10 km of Christina Lake OPEN JUNE 1 to OCT. 31 l 0 fish 3 over 63 cm Christina Lake Tributaries and Includes all tributaries and outflows within 10km of OPEN JUNE 1 to OCT. 31 l 0 fish 0 fish 15 fish 10 fish 10 fish Outflows Christina Lake including Jackfish River, Birch, Sunday and Monday Creeks Clearwater River Snye Channel OPEN JUNE 1 to OCT. -

Northwest Territories Territoires Du Nord-Ouest British Columbia

122° 121° 120° 119° 118° 117° 116° 115° 114° 113° 112° 111° 110° 109° n a Northwest Territories i d i Cr r eighton L. T e 126 erritoires du Nord-Oues Th t M urston L. h t n r a i u d o i Bea F tty L. r Hi l l s e on n 60° M 12 6 a r Bistcho Lake e i 12 h Thabach 4 d a Tsu Tue 196G t m a i 126 x r K'I Tue 196D i C Nare 196A e S )*+,-35 125 Charles M s Andre 123 e w Lake 225 e k Jack h Li Deze 196C f k is a Lake h Point 214 t 125 L a f r i L d e s v F Thebathi 196 n i 1 e B 24 l istcho R a l r 2 y e a a Tthe Jere Gh L Lake 2 2 aili 196B h 13 H . 124 1 C Tsu K'Adhe L s t Snake L. t Tue 196F o St.Agnes L. P 1 121 2 Tultue Lake Hokedhe Tue 196E 3 Conibear L. Collin Cornwall L 0 ll Lake 223 2 Lake 224 a 122 1 w n r o C 119 Robertson L. Colin Lake 121 59° 120 30th Mountains r Bas Caribou e e L 118 v ine i 120 R e v Burstall L. a 119 l Mer S 117 ryweather L. 119 Wood A 118 Buffalo Na Wylie L. m tional b e 116 Up P 118 r per Hay R ark of R iver 212 Canada iv e r Meander 117 5 River Amber Rive 1 Peace r 211 1 Point 222 117 M Wentzel L. -

In Situ Report Card

Drilling DEEPERTHE IN SITU OIL SANDS REPORT CARD JEREMY MOORHOUSE • MARC HUOT • SIMON DYER March 2010 Oil SANDSFever SERIES Drilling Deeper The In Situ Oil Sands Report Card Jeremy Moorhouse Marc Huot Simon Dyer March 2010 The In Situ Oil Sands Report Card About the Pembina Institute The Pembina Institute The Pembina Institute is a national The Pembina Institute provides policy Box 7558 non-profit think tank that advances research leadership and education on Drayton Valley, Alberta, T7A 1S7 sustainable energy solutions through climate change, energy issues, green Phone: 780-542-6272 research, education, consulting and economics, energy efficiency and advocacy. It promotes environmental, conservation, renewable energy, and E-mail: [email protected] social and economic sustainability in environmental governance. For more the public interest by developing information about the Pembina practical solutions for communities, Institute, visit www.pembina.org or individuals, governments and businesses. contact info @pembina.org. Acknowledgements The Pembina Institute thanks the graciously reviewed and commented William and Flora Hewlett Foundation on the data the Pembina Institute for its support of this work. The had collected for this analysis. Their Pembina Institute would also like to comments and insights improved acknowledge the support of Cenovus, the quality of this report and the Shell and Husky for participating in this Pembina Institute’s understanding process. Each of these companies of in situ operations. ii DRILLING DEEPER: THE IN SITU OIL SANDS REPORT CARD The Pembina Institute The In Situ Oil Sands Report Card About the Authors Jeremy Moorhouse of Alberta, and a Master of Arts in Technical Analyst natural sciences Jeremy is a Technical Analyst with the from Cambridge Pembina Institute’s Corporate University. -

. . Expanding the Mission . . . Facilitating the Future PETROLEUM TECHNOLOGY ALLIANCE CANADA

PETROLEUM TECHNOLOGY ALLIANCE CANADA ANNUAL REPOR T 2007 . expanding the mission . facilitating the future PETROLEUM TECHNOLOGY ALLIANCE CANADA Mission PTAC facilitates innovation, collaborative research and technology development, demonstration and deployment for a responsible Canadian hydrocarbon energy industry. Technical Areas Enhanced Environmental Management Emission Reduction / Eco-Efficiency Energy Efficiency Resource Access Air Ecological Soil and Groundwater Water Improved Oil and Gas Recovery Conventional Oil and Gas Recovery CO2 Enhanced Hydrocarbon Recovery Coalbed Methane/Unconventional Gas Oil Sands Heavy Oil Reservoir Engineering Geosciences Cost Reductions/Operations Alternative Energy Production Engineering Facility Design Drilling and Well Completion Inactive Wells Instrumentation / Measurement E-Business Fundamental Research Health and Safety Innovation R&D Funding Security Telecommunications Upgrading, Refining, Petrochemical Technologies, and Transportation Hydrocarbon Upgrading Refining Petrochemicals Hydrogen Gasification Pipelines Integration Transportation ANNUAL REPOR T 2 0 0 7 . expanding oppor tunities . 2007 Key Accomplishments Message from the Board of Directors Established a new vision: to help Canada The hydrocarbon energy sector in Canada has experienced significant become a global hydrocarbon energy changes since PTAC was first established, and in 2007 our commitment to our technology leader. This vision is supported members led us to examine our organization and the role we play in the indus- by a broadened -

Annual Information Form 2014 March 9, 2015

ANNUAL INFORMATION FORM 2014 MARCH 9, 2015 TABLE OF CONTENTS Page SELECTED TERMS ..................................................................................................................................................... 1 ABBREVIATIONS ....................................................................................................................................................... 4 CONVERSIONS ........................................................................................................................................................... 4 CONVENTIONS ........................................................................................................................................................... 5 SPECIAL NOTES TO READER .................................................................................................................................. 5 BAYTEX ENERGY CORP. ......................................................................................................................................... 9 GENERAL DEVELOPMENT OF OUR BUSINESS ................................................................................................. 10 RISK FACTORS ......................................................................................................................................................... 11 DESCRIPTION OF OUR BUSINESS AND OPERATIONS ..................................................................................... 11 DIRECTORS AND OFFICERS ................................................................................................................................. -

Big Oil's Oily Grasp

Big Oil’s Oily Grasp The making of Canada as a Petro-State and how oil money is corrupting Canadian politics Daniel Cayley-Daoust and Richard Girard Polaris Institute December 2012 The Polaris Institute is a public interest research organization based in Canada. Since 1997 Polaris has been dedicated to developing tools and strategies to take action on major public policy issues, including the corporate power that lies behind public policy making, on issues of energy security, water rights, climate change, green economy and global trade. Polaris Institute 180 Metcalfe Street, Suite 500 Ottawa, ON K2P 1P5 Phone: 613-237-1717 Fax: 613-237-3359 Email: [email protected] www.polarisinstitute.org Cover image by Malkolm Boothroyd Table of Contents Introduction 1 1. Corporations and Industry Associations 3 2. Lobby Firms and Consultant Lobbyists 7 3. Transparency 9 4. Conclusion 11 Appendices Appendix A, Companies ranked by Revenue 13 Appendix B, Companies ranked by # of Communications 15 Appendix C, Industry Associations ranked by # of Communications 16 Appendix D, Consultant lobby firms and companies represented 17 Appendix E, List of individual petroleum industry consultant Lobbyists 18 Appendix F, Recurring topics from communications reports 21 References 22 ii Glossary of Acronyms AANDC Aboriginal Affairs and Northern Development Canada CAN Climate Action Network CAPP Canadian Association of Petroleum Producers CEAA Canadian Environmental Assessment Act CEPA Canadian Energy Pipelines Association CGA Canadian Gas Association DPOH -

Impacts and Mitigations of in Situ Bitumen Production from Alberta Oil Sands

Impacts and Mitigations of In Situ Bitumen Production from Alberta Oil Sands Neil Edmunds, P.Eng. V.P. Enhanced Oil Recovery Laricina Energy Ltd. Calgary, Alberta Submission to the XXIst World Energy Congress Montréal 2010 - 1 - Introduction: In Situ is the Future of Oil Sands The currently recognized recoverable resource in Alberta’s oil sands is 174 billion barrels, second largest in the world. Of this, about 150 billion bbls, or 85%, is too deep to mine and must be recovered by in situ methods, i.e. from drill holes. This estimate does not include any contributions from the Grosmont carbonate platform, or other reservoirs that are now at the early stages of development. Considering these additions, together with foreseeable technological advances, the ultimate resource potential is probably some 50% higher, perhaps 315 billion bbls. Commercial in situ bitumen recovery was made possible in the 1980's and '90s by the development in Alberta, of the Steam Assisted Gravity Drainage (SAGD) process. SAGD employs surface facilities very similar to steamflooding technology developed in California in the ’50’s and 60’s, but differs significantly in terms of the well count, geometry and reservoir flow. Conventional steamflooding employs vertical wells and is based on the idea of pushing the oil from one well to another. SAGD uses closely spaced pairs of horizontal wells, and effectively creates a melt cavity in the reservoir, from which mobilized bitumen can be collected at the bottom well. Figure 1. Schematic of a SAGD Well Pair (courtesy Cenovus) Economically and environmentally, SAGD is a major advance compared to California-style steam processes: it uses about 30% less steam (hence water and emissions) for the same oil recovery; it recovers more of the oil in place; and its surface impact is modest. -

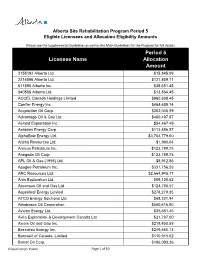

Alberta Site Rehabilitation Program Period 5 Eligible Licensees and Allocation Eligibility Amounts

Alberta Site Rehabilitation Program Period 5 Eligible Licensees and Allocation Eligibility Amounts Please see the Supplemental Guidelines as well as the Main Guidelines for the Program for full details Period 5 Licensee Name Allocation Amount 2155192 Alberta Ltd. $15,845.09 2214896 Alberta Ltd. $121,809.11 611890 Alberta Inc. $35,651.45 840586 Alberta Ltd. $13,864.45 ACCEL Canada Holdings Limited $960,608.45 Conifer Energy Inc. $464,459.14 Acquisition Oil Corp. $302,046.99 Advantage Oil & Gas Ltd. $460,497.87 Aeneid Exploration Inc. $54,467.49 Aeraden Energy Corp. $113,886.57 AlphaBow Energy Ltd. $3,704,779.60 Altima Resources Ltd. $1,980.64 Amicus Petroleum Inc. $123,789.75 Anegada Oil Corp. $123,789.75 APL Oil & Gas (1998) Ltd. $8,912.86 Apogee Petroleum Inc. $331,756.53 ARC Resources Ltd. $2,664,945.71 Artis Exploration Ltd. $89,128.62 Ascensun Oil and Gas Ltd. $124,780.07 Aspenleaf Energy Limited $278,279.35 ATCO Energy Solutions Ltd. $68,331.94 Athabasca Oil Corporation $550,616.80 Avalon Energy Ltd. $35,651.45 Avila Exploration & Development Canada Ltd $21,787.00 Axiom Oil and Gas Inc. $219,850.59 Baccalieu Energy Inc. $249,560.13 Barnwell of Canada, Limited $110,915.62 Barrel Oil Corp. $196,083.36 #Classification: Public Page 1 of 10 Alberta Site Rehabilitation Program Period 5 Eligible Licensees and Allocation Eligibility Amounts Please see the Supplemental Guidelines as well as the Main Guidelines for the Program for full details Period 5 Licensee Name Allocation Amount Battle River Energy Ltd. -

Public Notice Laricina Energy Ltd. Germain Project Expansion Proposed Terms of Reference for Environmental Impact Assessment

Public Notice Laricina Energy Ltd. Germain Project Expansion Proposed Terms of Reference for Environmental Impact Assessment Laricina is proposing the Germain Project Expansion to expand the Germain Project by 150,000 gross barrels per day (bbls/d) of bitumen production to 155,000 bbls/d. The primary zone of interest at Germain is the Grand Rapids Formation. Laricina has Grand Rapids oil sands rights in 63 (gross) sections which offer significant resource potential, containing an estimated 2.3 billion barrels of bitumen in place within the lease area. Current and future innovations of in situ technology will be utilized to develop Laricina’s oil sands assets at Germain. Laricina’s Energy’s total land base at Germain is 71 sections within Townships 83-85, Ranges 21-23 west of the 4th Meridian and is located within the west Athabasca Oil Sands region, approximately 46 km northeast of the community of Wabasca-Desmarais. The Director responsible for Environmental Assessment has directed that an Environmental Impact Assessment Report be prepared for the Germain Project Expansion. Laricina has prepared a proposed Terms of Reference for this Environmental Impact Assessment, and through this public notice, invites the public to review this document. Any comments filed concerning the proposed Terms of Reference will be accessible to the public. The proposed Terms of Reference and associated project information can be viewed at the following locations: Laricina Wabasca Office , 2155 Mistassiniy Road, Wabasca, Alberta T0G 2K0 Laricina Energy Ltd. Head Office, 4100, 150-6th Ave. SW, Calgary, Alberta T2P 3Y7 www.laricinaenergy.com Alberta Environment’s Register of Environmental Assessment, 111 Twin Atria Bldg., 4999 – 98 Avenue, Edmonton, Alberta, Attn: Melanie Daneluk; http://environment.alberta.ca/02313.html For further information on the Germain Project Expansion or copies of the proposed Terms of Reference and associated project information please contact: Laricina Energy Ltd Tel: 403-718-9300 4100, Suncor Energy Centre Fax: 403-263-0767 150-6th Ave. -

2010 Annual Report

2010 Annual Report MISSION Our mission is to facilitate innovation, collaborative research and technology development, demonstration and deployment for a responsible Canadian hydrocarbon energy industry. VISION Our vision is to help Canada become a global hydrocarbon energy technology leader. Contact Us For further information please contact: PTAC Petroleum Technology Alliance Canada Suite 400, Chevron Plaza, 500 Fifth Avenue SW, Calgary, Alberta, Canada T2P 3L5 MAIN: 403-218-7700 FAX: 403-920-0054 EMAIL: [email protected] WEB SITE: www.ptac.org PERSONNEL SOHEIL ASGARPOUR BRENDA BELLAND SUSIE DWYER LORIE FREI MARC GODIN President Manager, Knowledge Centre Innovation and Technology R&D Initiatives Assistant and Technical Advisor (403) 218-7701 (403) 218-7712 Development Web Site (403) 870-5402 [email protected] [email protected] Coordinator Administrator marc.godin@portfi re.com (403) 218-7708 (403) 218-7707 [email protected] [email protected] ARLENE MERLING TRUDY HIGH BOBBI SINGH LAURA SMITH TANNIS SUCH Director, Operations Administrative and Registration Accountant Controller Manager, Environmental (403) 218-7702 Coordinator (403) 218-7723 (403) 218-7701 Research [email protected] (403) 218-7711 [email protected] [email protected] Initiatives [email protected] (403) 218-7703 [email protected] PETROLEUM TECHNOLOGY ALLIANCE CANADA 2010 ANNUAL REPORT 3 Message from the Board A New Decade – A New Direction 2010 proved to be a turning point for PTAC as we redeined our role and PTAC Technology Areas set new strategies in motion. Over the past year PTAC has achieved goals in diverse areas of our organization: improving our inances, rebalancing our MANAGE ENVIRONMENTAL IMPACTS project portfolios to address a broad spectrum of needs, leveraging support • Emission Reduction / Eco-eficiency for ield implementations, and building a measurably more effective and • Energy Eficiency eficient organization. -

Emerging Oil Sands Producers

RBC Dominion Securities Inc. Emerging Oil Sands Producers Mark Friesen (Analyst) (403) 299-2389 Initiating Coverage: The Oil Sands Manifesto [email protected] Sam Roach (Associate) Investment Summary & Thesis (403) 299-5045 We initiate coverage of six emerging oil sands focused companies. We are bullish with [email protected] respect to the oil sands sector and selectively within this peer group of new players. We see decades of growth in the oil sands sector, much of which is in the control of the emerging companies. Our target prices are based on Net Asset Value (NAV), which are based on a long-term flat oil price assumption of US$85.00/bbl WTI. The primary support for our December 13, 2010 valuations and our recommendations is our view of each management team’s ability to execute projects. This report is priced as of market close December 9, 2010 ET. We believe that emerging oil sands companies are an attractive investment opportunity in the near, medium and longer term, but investors must selectively choose the All values are in Canadian dollars companies with the best assets and greatest likelihood of project execution. unless otherwise noted. For Required Non-U.S. Analyst and Investment Highlights Conflicts Disclosures, please see • page 198. MEG Energy is our favourite stock, which we have rated as Outperform, Above Average Risk. We have also assigned an Outperform rating to Ivanhoe Energy (Speculative Risk). • We have rated Athabasca Oil Sands and Connacher Oil & Gas both as Sector Perform, (Above Average Risk). We have also assigned a Sector Perform rating to SilverBirch Energy (Speculative Risk).