GCC Retail Industry | May 22, 2017 Page | 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Majid Al Futtaim Signs with Yellow Door Energy to Supply Solar Power to Carrefour Stores in Jordan

Majid Al Futtaim Signs with Yellow Door Energy to Supply Solar Power to Carrefour Stores in Jordan Dubai, UAE, May 19, 2019: Majid Al Futtaim, the leading shopping mall, communities, retail and leisure pioneer across the Middle East, Africa and Asia, has signed with UAE-based Yellow Door Energy, the leading regional commercial solar developer, to bring solar power to Carrefour stores in Jordan. The 17-megawatt build-own-operate-transfer (BOOT) wheeling agreement will provide Carrefour stores located in Amman, Zarqa, Madaba and Al-Salt with 29 gigawatt-hours of clean energy in the first year of operation, meeting 100% of the retailer’s electricity needs in those areas. Alain Enjalbert, Country Manager for Carrefour Jordan at Majid Al Futaim Retail said: “Sustainability plays an important role in our business as illustrated by our Net Positive strategy, which aims to over compensate our water consumption and carbon emissions resulting in a positive corporate footprint by 2040. The BOOT solar agreement will prove not only integral to helping us achieve our goals but also halving our energy costs, allowing us to pass the savings on to our loyal customers across Jordan.” BOOT is defined as a form of project financing, wherein a private entity receives a concession from the private or public sector to finance, design, construct, own, and operate a facility stated in the contract1. As the BOOT solar provider, Yellow Door Energy will invest in, design, construct, commission, operate and maintain the solar park. Located east of Amman, the solar park will span an area of 366,000 square meters and will comprise of 300,000 solar panels. -

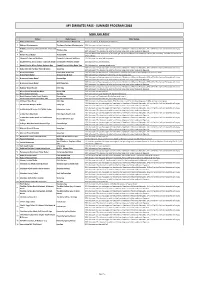

My Emirates Pass - Summer Program 2018

MY EMIRATES PASS - SUMMER PROGRAM 2018 MIND AND BODY Partner Outlet name Offer Details 1 Address Boulevard The Spa at Address Boulevard 2 for 1 on all Spa & Hammam treatments. 2 Address Montgomerie The Spa at Address Montgomerie 30% discount on Spa treatments Al Maha, a luxury collection desert resort and 20% discount on Spa massages and treatments. Members of Marriott Rewards, SPG or The Ritz-Carlton Rewards will enjoy 3 Timeless Spa spa 30% discount. The discount is valid for the boarding pass holder and up to 9 guests Buy one 80-minute treatment of choice & get the second 80-minute treatment free on the same day . Includes full access to 4 Armani Hotel Dubai Armani/SPA SPA facilities. 5 Cleopatra's Spa and Wellness Cleopatra's Spa and Wellness 50% discount on selected treatments. 6 DoubleTree by Hilton Dubai - Jumeirah Beach Breakwater Wellness Centre 20% discount on all treatments. 7 DoubleTree by Hilton Dubai, Business Bay DoubleTree by Hilton Dubai Spa 20% discount on massage treatments. 20% discount on Spa massages and treatments. Members of Marriott Rewards, SPG or The Ritz-Carlton Rewards will enjoy 8 Dubai Marriott Harbour Hotel & Suites Saray Spa 30% discount. The discount is valid for the boarding pass holder and up to 9 guests 9 Dusit Thani Dubai Dusit Thani Dubai Spa 20% discount on the total bill. The discount is valid for the boarding pass holder and up to 3 guests. 10 Grand Hyatt Dubai Ahasees Spa & Club 25% discount on individual treatments and day access pass. 20% discount on Spa massages and treatments. -

Elan by Majid Al Futtaim Brochure

1 Tilal Al Ghaf Community Living 2 Tilal Al Ghaf *Artist impression A forward-thinking city deserves a forward-thinking Community living community. A neighbourhood that puts mind, body, soul and the human connection at its heart, while crafted around you. enriching lives through a deep sense of belonging. A community that will grow with Dubai and is built on a tradition which understands that life, work, and play have one thing in common: you. Welcome to Tilal Al Ghaf. 3 Tilal Al Ghaf Dubai International Airport Burj Khalifa Kings School Dubai Repton School GEMS WellingtonSchool The Dubai Al Ain Road Dubai Hills Mall perfect Kings School Al Barsha Sheikh Zayed Road spot Emirates Road Al Fay Road Drive time: Hessa Road NMC Hospital Mall of the Emirates 15 Minutes 5Km 10Km 15Km > Al Maktoum Airport 25 Minutes AcademicRoad City > Cedars Jebel Ali International Hospital > Dubai International Airport 37 Minutes > Downtown 20 Minutes > Emirates Golf Club 25 Minutes Al Maktoum > Dubai Autodrome 11 Minutes International Airport Jebel Ali - Lehbab Road > Polo Equestrian Club 17 Minutes > Global Village 20 Minutes Dubai Miracle Garden 13 Minutes Al Khail Road > > Jebel Ali Racecourse 23 Minutes > Al Barsha Pond Park 20 Minutes > City Centre Me’aisem 9 Minutes > Dubai Mall 27 Minutes > Kings School – Al Barsha 14 Minutes > GEMS – Dubai American Academy 18 Minutes 4 Tilal Al Ghaf Lagoon Al Ghaf Catering to every mood The lagoon is more than a picturesque escape; it’s a place for residents and visitors to gather to exercise both mind and body. Everybody will have a lot to look forward to once arriving at the heart of the community. -

Download Brochure

Resort living reinvented by Majid Al Futtaim *Artist impression of private beach at The Club Beachside Residences B1 Beachside Residences B2 Beachside Residences B5 The Club Beachside Residences B6 Beachside Residences B3 Beachside Residences B4 The Park Restaurants and Convenience Retail Private Beach Beach *Artist impression of an aerial view of Beachside Residences Imagine living on the shores of a recreational lagoon with white sandy beaches. Waking up every day to beautiful views. Living in a vibrant community focused on Rediscover life nurturing mind, body and soul. Wonderfully placed in Tilal Al Ghaf’s most exciting mixed-use destination, Beachside Residences brings resort living home. N Dubai International Airport Part of a growth Dubai Festival City Downtown Dubai corridor in Dubai 9 The Palm Jumeirah Burj Al Arab SCHOOLS GOLF CLUBS HOSPITALS CRICKET STADIUM Within 5 km Beyond 5 km 1 Victory Heights Primary School 1 Cedars Jebel Ali 5 Kings School Al Barsha 6 Minutes International Hospital 10 Minutes 18 Minutes 2 Gems Metropole School 6 American School Dubai Hills Mall 4 Minutes 2 Aster DM Healthcare 12 Minutes 7 15 Minutes 3 Jebel Ali School 7 Emirates School 8 11 Minutes 3 Mediclinic Parkview Hospital 18 Minutes 12 Minutes 7 5 Dubai - Al Ain4 RoadRanches Primary School 8 GEMS World Academy 11 Minutes 4 Emirates Hospital 9 Minutes 6 Day Surgery & Medical Center 6 10 7 Minutes 9 Dubai International Victory Heights The Els Club School Emirates Road 1 20 Minutes 6 7 Minutes 5 Conceive Gynaecology & Fertility Hospital JLT 4 5 2 Jumeirah -

Iventure Card Valid Until 31 October 2020

IVENTURE CARD VALID UNTIL 31 OCTOBER 2020 The Dubai Pass combines the best attractions, tours and experiences into one pre-paid attractions pass to save you time and money. You choose what you want to do and when you want to do it, simply present your pass on arrival for cash-free entry – simple! There are 3 different ticket options 1. Dubai Select Pass 2. Dubai Flexi Attractions Pass 3. Dubai Unlimited Attractions Pass Clients can collect the iVenture Card in Dubai at the following points: 1. Mall of the Emirates, Gate number 4 Opening: 9:00 - 19:00 Closed: 9am - 7pm Phone: 0564183475 2. Dubai Mall, Grand Entrance Opening: 9am - 7pm Phone: 0564183482 3. JBR, Before Sofitel Hotel Opening: 9am - 7pm Phone: 0543095931 4. Atlantis The Palm, Next to Avenues and Restaurant Entrance Opening: 9am - 7pm Phone: 0564182971 DUBAI SELECT PASS USD116 per person Your choice of three Dubai experiences of your choice. Take your pick from 48 fantastic things to do across Dubai - simply pick one attraction from each of the three pools. Ticket is valid for 7 days from first use. ATTRACTION POOL 1 ATTRACTION POOL 2 ATTRACTION POOL 3 The Lost Chambers Aquarium & Wild Wadi Waterpark At the Top, Burj Khalifa Ambassador Lagoon Dubai Aquarium & Underwater Desert Safari with Dinner Dubai Dolphinarium Zoon (tunnel and zoo) Dubai Aquarium & Underwater Palm Island Inner Circle Cruise Ski Dubai Zoo. Explorer Experience (60 minutes) IMG Worlds of Adventure Marina Dhow Dinner Cruise The Dubai Fountain Boardwalk City Sightseeing Dubai MOTION GATE Dubai Dubai Frame (hop -

PGAV Destinations: #71 • Volume 14, Issue 1 • 2018 the Power of “We” and Creative Collaboration

PGAV Destinations: #71 • volume 14, issue 1 • 2018 www.inparkmagazine.com The power of “We” and creative collaboration The Dubai Double Thea mania Laser focus The Middle East’s playground is Special section on 2018 Christie’s passion, quality and gearing up for Expo 2020 Thea award recipients consultative approach 2 inparkmagazine.com Annual recognition The Dubai Double Martin Palicki, Judith Rubin, IPM publisher IPM editor his issue is full of doubles! In addition to being The elcome to the first print issue of InPark for year TDubai Double (see Judy’s editorial), we are presenting a W2018! special collection of articles highlighting the TEA Summit and Thea Awards. They are two action-packed events This edition you are now reading is the first part of the taking place April 5-7 at the Disneyland Resort in Anaheim, “Dubai Double” – InPark print issues #71 and #72. Both California. are getting into the hands of your industry colleagues – perhaps your next client or team member - at trade events The Theas and Summit also do double duty. In addition in Dubai: the DEAL show, (April 9-11) and the Theme to providing a forum for professional growth and Parks & Development Forum (May 7-9). development, the events also provide a critical opportunity to network with industry colleagues, both vendors and We do our best to share information and be a point of operators. connection for you: in multiple sectors of the attractions industry: theme parks and waterparks, museums, science This issue, with its highlight on Thea projects and info on centers, world’s fairs, zoos & aquariums, planetariums, the Summit, will be distributed to every attendee at the corporate branding centers, multimedia spectacle, specialty Summit. -

Majid Al Futtaim Lists World's First Benchmark Corporate Green Sukuk

Majid Al Futtaim lists world’s first benchmark corporate Green Sukuk on Nasdaq Dubai ● Region’s first corporate Green Sukuk and valued at USD 600 million ● Investment to be used for financing existing and future green projects ● Issuance is a key milestone towards the retail conglomerate’s 2040 Net Positive goals Dubai, UAE, May 15, 2019: Majid Al Futtaim, the leading shopping mall, communities, retail and leisure pioneer across the Middle East, Africa and Asia today rang the market-opening bell at Nasdaq Dubai to mark the listing of the world’s first benchmark corporate Green Sukuk and the first Green Sukuk issued by a corporate in the region. Valued at USD 600 million and with a tenor of ten years, the Green Sukuk is testament to Majid Al Futtaim’s long term commitment to support the transition to a low carbon economy. The investment will be used to finance and refinance Majid Al Futtaim’s existing and future green projects, including green buildings, renewable energy, sustainable water management, and energy efficiency. To mark the occasion, Alain Bejjani, Chief Executive Officer at Majid Al Futtaim - Holding, rang the market-opening bell in the presence of His Excellency Essa Kazim, Governor of Dubai International Financial Centre (DIFC) and Chairman of Dubai Islamic Economy Development Centre (DIEDC), Hamed Ali, Chief Executive of Nasdaq Dubai and members of Majid Al Futtaim’s leadership team. Alain Bejjani, Chief Executive Officer at Majid Al Futtaim - Holding, said: “This issuance will enable Majid Al Futtaim to deliver more sustainable experiences for our customers and to address the implications of climate change. -

بطاقة استكشاف the Ultimate أبرز الوجهات السياحية Attractions

iVenture Card combines the best تمنحك بطاقة آي فينتشر إمكانية اﻻستمتاع بأفضل attractions, tours, entertainment and dining وجهات الترفية والرحﻻت والمطاعم عبر استخدام experiences into one pre-paid pass, so you تذكرة مرور واحدة فقط تأخذك إلى عالم متكامل من .can see more for less المتعة والترفيه. .Barcelona. Cape Town. Dubai. Gold Coast برشلونة – كيب تاون – جولد كوست دبي – هونغ .Hong Kong. Honolulu. Madrid. Melbourne كونج – هونولولو – مدريد – ميلبورن – مكسيكو .Mexico City. London. San Francisco. Seoul سيتي – لندن – سان فرانسيسكو – سيؤول – .Singapore. Sydney. Tasmania سنغافورة – سيدني – تاسمانيا www.iventurecard.com www.iventurecard.com THE ULTIMATE Need help? We’re here for you لﻻستفسار بطاقة استكشاف ATTRACTIONS PASS 2952007 4 (0) 971+ 2952007 4 (0) 971+ أبرز الوجهات السياحية [email protected] [email protected] EXPERIENCE ALL اكتشف كلّ ما هو ممكن THAT’S POSSIBLE For terms and conditions, please the website www.dubaipass.ae للشروط واﻷحكام زوروا موقعنا www.dubaipass.ae يمكنك استخدام البطاقة بسهولة تامة! الفئة اﻷولى HOW IT WORKS ATTRACTION POOL 1 الخطوة اﻷولى: اختر ما يناسبك Step 1: Pick & Choose اختر من بين أكثر من 30 من أفضل الوجهات الترفيهية في دبي رحلة سفاري في الصحراء موشنجيت دبي ليغوﻻند دبي Choose from over 30 of Dubai’s best attractions WILD WADI WATER PARK™ MOTIONGATE™ DUBAI LEGOLAND® DUBAI • اختر وجهة واحدة من كل فئة مع “بطاقة الدخول المرنة” With Dubai Select, pick one attraction per pool • تتوفر خدمة النقل من وإلى الفندق أو إلى أي مكان آخر في دبي دبي باركس آند ريزورتس، شارع الشيخ زايد دبي باركس آند ريزورتس، شارع -

Hayyakom Welcom E

CITYGUIDE m o k e ya ay om h lc we 2019 EDITION TABLE OF CONTENTS Welcome The Loved-Up 05 A brief history 57 Couples The city of the future Couples’ bucket list Sights Dubai Maps Spas 11 Attractions Gastronomy Malls Transport The Art Lovers Districts 69 Art lovers’ bucket list Museums The Basics Heritage + Nature 21 Travel essentials Arts + Culture Top 10 Arabic phrases UAE traditions Stopover in Dubai Dubai Business 81 Events The Happy 31 Families Shop Talk Family bucket list 87 Leading malls Theme parks Souks Waterparks Community centres Nature Outdoor malls Play + Learn Discounts + Deals Family adventures Dubai Calendar The 99 January to March 45 Thrill-Seekers April to September Adventure bucket list October to December Sky high thrills Watersports Golf in Dubai Desert fun Sports + Fitness WELCOME With its unparalleled coastline, beautiful desert and magnificent cityscapes, memories are just waiting to be made in Dubai. Embark on the holiday of a lifetime as you delve into living history by the Creek, journey up the world’s tallest tower, relax on golden beaches, experience record-breaking theme parks and enjoy some of the most spectacular shopping and dining on the planet. Welcome to Dubai – the city that always surprises. visitdubai.com 5 Dubai World Trade 1979 Centre, the city’s first TIMELINE skyscraper, opens A brief history of Dubai The Al Maktoum Dubai’s flagship tribe establishes the 1833 airline, Emirates, is 1985 fishing settlement launched of Dubai Pearling and HH Sheikh Maktoum 1892 maritime trade 1990 bin Rashid Al begins -

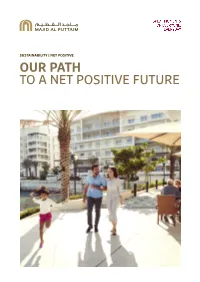

OUR PATH to a NET POSITIVE FUTURE Contents

SUSTAINABILITY | NET POSITIVE OUR PATH TO A NET POSITIVE FUTURE Contents About our company 3 A message from our Chief Executive Officer 4 A message from our Chief Sustainability Officer 5 Our sustainability strategy 6 What is Net Positive? 7 Our Net Positive journey 8 Our markets in 2016 10 Our portfolio in 2016 11 Majid Al Futtaim - Properties 12 Introduction 13 Carbon and water footprint breakdown 14 Targets and action plans 15 Majid Al Futtaim - Retail 16 Introduction 17 Carbon and water footprint breakdown 18 Targets and action plans 19 Majid Al Futtaim - Ventures 20 Introduction 21 Carbon and water footprint breakdown 22 Targets and action plans 23 A message from the Minister of Climate Change & Environment 25 Carbon and water footprint data 26 Sustainability glossary 27 2 ABOUT OUR COMPANY BUILT FROM A SINGLE VISION exclusive rights to the Carrefour franchise in 38 markets across the Founded in 1992, Majid Al Futtaim Middle East, Africa and Asia, and Majid Al Futtaim 2016 is the leading shopping mall, operates a portfolio of more than communities, retail and leisure 175 outlets in 14 countries. pioneer across the Middle East, Africa and Asia. Majid Al Futtaim operates 284 VOX Cinema screens and 24 Magic A remarkable business success Planet family entertainment story, Majid Al Futtaim started centres across the region, in from one man’s vision to addition to iconic leisure and transform the face of shopping, entertainment facilities such as entertainment and leisure to Ski Dubai and Orbi Dubai, among ‘create great moments for others. 560m everyone, every day’. It has since visitors annually grown into one of the United Arab The company is parent to the Emirates’ most respected and consumer finance company successful businesses spanning 16 ‘Najm’, a fashion retail business international markets, employing representing international brands more than 40,000 people, and such as Abercrombie & Fitch, obtaining the highest credit rating AllSaints, lululemon athletica, (BBB) among privately-held Crate & Barrel and Maison du corporates in the region. -

Download the Yearbook 2018/19

GLOBAL CITIZENSHIP GROWING BY LEARNING LEADING INNOVATION PURSUING EXCELLENCE �ساحب �ل�سمو �ل�سيخ خليفة بن ز�يد �آل نهيان �ساحب �ل�سمو )�لر�حل( �ل�سيخ ز�يد بن �سلطان �آل نهيان His Highness (Late) Sheikh Zayed Bin Sultan Al Nahyan His Highness Sheikh Khalifa Bin Zayed Al Nahyan رئي�س دولة الإمارات العربية املتحدة رئي�س دولة الإمارات العربية املتحدة )1966 - 2004( President of United Arab Emirates )1966 – 2004( President of United Arab Emirates �ساحب �ل�سمو �ل�سيخ حمد�ن بن حممد بن ر��سد �آل مكتوم �ساحب �ل�سمو �ل�سيخ حممد بن ر��سد �آل مكتوم His Highness Sheikh Mohammed Bin Rashid Al Maktoum His Highness Sheikh Hamdan Bin Mohammed Al Maktoum ويل عهد دبي نائب رئي�س الدولة، ورئي�س جمل�س الوزراء، وحاكم دبي Vice President and Prime Minister of the UAE and Ruler of Dubai Crown Prince of Dubai Founder’s Message GEMS Education continues to inspire generations of learners from across the globe, whose school successes give them the foundation to go on to achieve greatness and lead happy, fulfilling lives. The quality of our schools and the education they provide is a reflection of the individuals that lead and support them. These are passionate, dedicated educators 4 who help change and improve the lives of thousands of children across the globe, and we hold firm to our belief that all children have the right to a quality education. We strongly believe that every child has talents and abilities that are as unique as their personality. We take pride in our inclusive ethos and in our commitment to helping every family find the right school for their child. -

GCC Retail Industry | April 22, 2019 Page|1

GCC Retail Industry | April 22, 2019 Page|1 Table of Contents 1. EXECUTIVE SUMMARY ............................................................................ 7 1.1 Scope of the Report ........................................................................................ 7 1.2 Sector Outlook ............................................................................................... 7 1.3 Growth Drivers .............................................................................................. 7 1.4 Challenges .................................................................................................... 8 1.5 Trends .......................................................................................................... 8 2. THE GCC RETAIL INDUSTRY OVERVIEW ................................................. 9 2.1 Country-wise Retail Market Overview .............................................................. 11 2.2 GCC Supermarket/Hypermarket Overview ....................................................... 23 2.3 GCC Luxury Retail Market Overview................................................................ 25 2.4 GCC Airport Retail Market Overview................................................................ 27 2.5 The GCC E-Commerce Industry Overview ........................................................ 29 3. THE GCC RETAIL INDUSTRY OUTLOOK ................................................. 34 3.1 Forecasting Methodology ............................................................................... 34 3.2 Demand-side