CHICAGO PARK DISTRICT $8,000,000* Generalobligation B

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Economic Impact of Parks and Recreation Chicago, Illinois July 30 - 31, 2015

The Economic Impact of Parks and Recreation Chicago, Illinois July 30 - 31, 2015 www.nrpa.org/Innovation-Labs Welcome and Introductions Mike Kelly Superintendent and CEO Chicago Park District Kevin O’Hara NRPA Vice President of Urban and Government Affairs www.nrpa.org/Innovation-labs Economic Impact of Parks The Chicago Story Antonio Benecchi Principal, Civic Consulting Alliance Chad Coffman President, Global Economics Group www.nrpa.org/Innovation-labs Impact of the Chicago Park District on Chicago’s Economy NRPA Innovation Lab 30 July 2015 The charge: is there a way to measure the impact of the Park Districts assets? . One of the largest municipal park managers in the country . Financed through taxes and proceeds from licenses, rents etc. Controls over 600 assets, including Parks, beaches, harbors . 11 museums are located on CPD properties . The largest events in the City are hosted by CPD parks 5 Approach summary Relative improvement on Revenues generated by value of properties in parks' events and special assets proximity . Hotel stays, event attendance, . Best indicator of value museum visits, etc. by regarding benefits tourists capture additional associated with Parks' benefit . Proxy for other qualitative . Direct spending by locals factors such as quality of life indicates economic . Higher value of properties in significance driven by the parks' proximity can be parks considered net present . Revenues generated are value of benefit estimated on a yearly basis Property values: tangible benefit for Chicago residents Hypothesis: . Positive benefit of parks should be reflected by value of properties in their proximity . It incorporates other non- tangible aspects like quality of life, etc. -

Wasson Way Trail Design a Place-Based Approach to Building World-Class Infrastructure

WASSON WAY TRAIL DESIGN A PLACE-BASED APPROACH TO BUILDING WORLD-CLASS INFRASTRUCTURE PREPARED FOR THE CITY OF CINCINNATI & THE WASSON WAY ORGANIZATION Darren Meyer • Overall Project Lead & Point of Responsibility Building Community Through • Lead Designer: Character, Experience & Function Vibrant Public Space • Public Engagement & Public Process Lead Clete Benken • MKSK Team Leader • Project Manager & Client Point of Contact • Team Supervisor & Project Quality Control Joe Nickol • MKSK Urban Design • Urban Development Strategies International Forerunner in Michael King • Public Engagement & Public Processes People-First Transportation Planning • Transportation Design Steven Smith • Burgess & Niple Project Manager • Civil & Transportation Engineering Unparalleled Experience in • Technical & Regulatory Engineering Lead Engineering Complex Infrastructure Steven Anslinger • Transportation Lead • Bridge Engineering INTRODUCTIONS SAFETY EFFICIENCY MOBILITY SINGLE USE A TO B COMMUNITY EVENTS DINING & SOCIAL LIFE 18 HR VIBRANCY & AMBIENCE NEIGHBORHOOD SHOPPING ART & PLACEMAKING MADISONVILLE MADISON ROAD D A MIAMI ROAD O 71 R ERIE AVENUE Y A K W AN ARK MONTGOMERY ROAD B P COLUMBIA PLAINVILLE ROAD RY RED TO TOWNSHIP VIC OAKLEY SQUARE NORWOOD XAVIER UNIVERSITY INDIAN HILL MURRAY PATH OAKLEY COLUMBIA TOWNSHIP ROOKWOOD COMMONS & HYDE PARK GOLF AND COUNTRY CLUB EVANSTON DANA AVE PAVILION BUSINESS HYDE PARK DISTRICT PLAZA MARIEMONT WASSON ROAD MARBURG AVENUE SQUARE WITHROW HIGH SCHOOL DOGWOOD EVANSTON EAST HYDE FAIRFAX PARK WALNUT HILLS MARIEMONT PARK -

Pdfs/2000874-Equitable-Development- Environmentalists and EJ Advocates (See Sandler & Pezzullo, 2007)

Cities xxx (xxxx) xxx–xxx Contents lists available at ScienceDirect Cities journal homepage: www.elsevier.com/locate/cities “We're not in the business of housing:” Environmental gentrification and the nonprofitization of green infrastructure projects ⁎ Alessandro Rigolona, , Jeremy Némethb a Department of Recreation, Sport and Tourism, University of Illinois at Urbana-Champaign, USA b Department of Urban and Regional Planning, University of Colorado Denver, USA ARTICLE INFO ABSTRACT Keywords: Environmental gentrification, or the influx of wealthy residents to historically disenfranchised neighborhoods Environmental gentrification due to new green spaces, is an increasingly common phenomenon around the globe. In particular, investments in Environmental justice large green infrastructure projects (LGIPs) such as New York's High Line have contributed to displacing long- Urban green space term low-income residents. Many consider environmental gentrification to be an important environmental Park nonprofits justice issue, but most of this research has focused on distributional justice; that is, quantifying whether LGIPs Sustainability have indeed contributed to gentrifying neighborhoods around them. Limited work has focused on procedural justice in the context of environmental gentrification, or how planning processes can shape project outcomes. This is a particularly critical oversight because many LGIP planning processes are led by nonprofits, a govern- ance model that has already raised important equity concerns in the context of planning and maintenance of smaller neighborhood parks. Yet less is known about the impacts of park nonprofits leading LGIPs. To address these gaps, we study the planning process of the 606, a rails-to-trails project located in Chicago, U.S. that contributed to environmental gentrification. -

Table Version Website 031621.Xlsx

CHICAGO PARK DISTRICT PARK CAPITAL PROJECTS 2011-2021* As of March 1, 2021 PARK YEAR PARK NAME NO PROG** SUB PROGRAM PROJECT DESCRIPTION STATUS COMPLETE $ ABBOTT (ROBERT) 259 FR Swimming Pool Pool Retrofit - compliance COMPLETE 2012 ABBOTT (ROBERT) 259 SI Playground Chicago Plays! - new equipment COMPLETE 2013 ABBOTT (ROBERT) 259 FR Minor Rehab Misc. pool stairs COMPLETE 2015 ABBOTT (ROBERT) 259 FR Swimming Pool Pool - rehab COMPLETE 2016 ABBOTT (ROBERT) 259 SI Paving 2016 DW Paving COMPLETE 2017 ABBOTT (ROBERT) 259 SI Landscape Tree planting COMPLETE 2018 ABBOTT (ROBERT) 259 SI Site Improvement Park improvements COMPLETE 2018 ABBOTT (ROBERT) 259 FR Concrete Masonry Structural Field house - masonry PRE-DESIGN ADA (SAWYER GARRETT) 45 FR Swimming Pool Pool Retrofit - compliance COMPLETE 2012 ADA (SAWYER GARRETT) 45 FR Minor Rehab Entrance and washrooms COMPLETE 2012 ADA (SAWYER GARRETT) 45 FR HVAC and Energy Efficiency HVAC energy management COMPLETE 2012 ADA (SAWYER GARRETT) 45 SI Paving Paving - playground COMPLETE 2012 ADA (SAWYER GARRETT) 45 SI Lighting Lighting - parking lot COMPLETE 2012 ADA (SAWYER GARRETT) 45 SI Playground Chicago Plays! - new playground equipment COMPLETE 2013 ADA (SAWYER GARRETT) 45 SI Courts Slam Dunk Basketball Court - rehab with lighting COMPLETE 2013 ADA (SAWYER GARRETT) 45 FR Swimming Pool Misc. rehab COMPLETE 2015 ADA (SAWYER GARRETT) 45 FR Concrete Masonry Structural Field house - masonry and tuckpointing COMPLETE 2017 ADA (SAWYER GARRETT) 45 SI Athletic Field Athletic field - rehab COMPLETE 2018 * ADA (SAWYER -

Cities Alive: Towards a Walking World Foreword Gregory Hodkinson | Chairman, Arup Group

Towards a walking world Towards a walking world 50 DRIVERS OF CHANGE 50 BENEFITS 40 ACTIONS 80 CASE STUDIES This report is the product of collaboration between Arup’s Foresight + Research + Innovation, Transport Consulting and Urban Design teams as well as other specialist planners, designers and engineers from across our global offices. We are also grateful for the expert contributions from a range of external commentators. Contacts Susan Claris Chris Luebkeman Associate Director Arup Fellow and Director Transport Consulting Global Foresight + Research + Innovation [email protected] [email protected] Demetrio Scopelliti Josef Hargrave Architect Associate Masterplanning and Urban Design Foresight + Research + Innovation [email protected] [email protected] Local Contact Stefano Recalcati Associate Masterplanning and Urban Design [email protected] Released June 2016 #walkingworld 13 Fitzroy Street London W1T 4BQ arup.com driversofchange.com © Arup 2016 Contents Foreword 7 Executive summary 9 Introduction 14 Benefits 28 Envisioning walkable cities 98 Achieving walkable cities 110 Next steps 153 References 154 Acknowledgements 165 5 higher experience parking walk neighbourhoods community route increasing culture places strategies improving travel change research policies air needs road work study temporary services route digital cycling efcient physical local time potential order accessible transport improve attractive context investment city risk towards space walkable use people world live urban data -

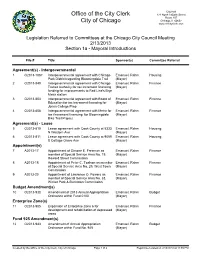

Referred Matters Report

City Hall Office of the City Clerk 121 North LaSalle Street Room 107 City of Chicago Chicago, IL 60602 www.chicityclerk.com Legislation Referred to Committees at the Chicago City Council Meeting 2/13/2013 Section 1a - Mayoral Introductions File # Title Sponsor(s) Committee Referral Agreement(s) - Intergovernmental 1 O2013-1087 Intergovernmental agreement with Chicago Emanuel, Rahm Housing Park District regarding Bloomingdale Trail (Mayor) 2 O2013-848 Intergovernmental agreement with Chicago Emanuel, Rahm Finance Transit Authority for tax increment financing (Mayor) funding for improvements to Red Line's Bryn Mawr station 3 O2013-853 Intergovernmental agreement with Board of Emanuel, Rahm Finance Education for tax increment financing for (Mayor) Jones College Prep 4 O2013-858 Intergovernmental agreement with Metra for Emanuel, Rahm Finance tax iIncrement financing for Bloomingdale (Mayor) Bike Trail Project Agreement(s) - Lease 5 O2013-810 Lease agreement with Cook County at 5333 Emanuel, Rahm Housing N Western Ave (Mayor) 6 O2013-811 Lease agreement with Cook County at 9059 Emanuel, Rahm Housing S Cottage Grove Ave (Mayor) Appointment(s) 7 A2013-17 Appointment of Simone E. Freeman as Emanuel, Rahm Finance member of Special Service Area No. 19, (Mayor) Howard Street Commission 8 A2013-18 Appointment of Peter C. Toalson as member Emanuel, Rahm Finance of Special Service Area No. 29, West Town (Mayor) Commission 9 A2013-20 Appointment of Lawrence O. Powers as Emanuel, Rahm Finance member of Special Service Area No. 33, (Mayor) Wicker Park & Bucktown Commission Budget Amendment(s) 10 O2013-938 Amendment of 2013 Annual Appropriation Emanuel, Rahm Budget Ordinance within Fund 0100 (Mayor) Enterprise Zone(s) 11 O2013-905 Expansion of Enterprise Zone 6 for Emanuel, Rahm Finance development and rehabilitation of depressed (Mayor) areas Fund 925 Amendment(s) 12 O2013-943 Amendment of Annual Appropriation Emanuel, Rahm Budget Ordinance within Fund No. -

Comparing Three Elevated Parks—The High Line, 606, and High Bridge

sustainability Article What Park Visitors Survey Tells Us: Comparing Three Elevated Parks—The High Line, 606, and High Bridge Jisoo Sim 1,* , Cermetrius Lynell Bohannon 1 and Patrick Miller 1 Department of Landscape Architecture, College of Architecture and Urban Studies, Virginia Tech., Blacksburg, VA 24061, USA; [email protected] (C.L.B.); [email protected] (P.M.) * Correspondence: [email protected]; Tel.: +1-540-449-5143 Received: 3 November 2019; Accepted: 10 December 2019; Published: 22 December 2019 Abstract: Many cities have replaced abandoned transportation infrastructure with an elevated park to gain increased economic benefits by developing old fabric. By following this trend, most studies to this point have only focused on the economic rewards from the replacement rather than its uses in the real world. This study aims to understand how park visitors use elevated parks through a park visitors’ survey. The authors selected three representative elevated parks—the High Line in New York City, the 606 in Chicago, and the High Bridge in Farmville—for the study and asked visitors about their activities, perceived benefits, and satisfaction. Results indicate that the 606, a mixed-use elevated park, allows visitors to engage in high-intensity activity, the High Line as an elevated urban park provides visitors public arts and gardens, and the High Bridge as an elevated green park provided visitors with a connection to unique natural scenery. This study, as the first to compare three different elevated parks, contributes to an understanding of who uses elevated parks and how they use elevated parks. Keywords: elevated park; park visitor survey; High Line; 606; Bloomingdale Trail; High Bridge 1. -

Your Next Big Idea Is Here

Your next big idea is here. harris.uchicago.edu Welcome to the University of Chicago Harris School of Public Policy. What sets the University of Chicago apart? We lead with a focus on inquiry and a commitment to impact. We empower individuals to challenge conventional thinking in pursuit of original ideas. UChicago research has led to revolutionary theories of economics and tools to effect social change. In all we do, we are driven to dig deeper, push further, and ask bigger questions—and to leverage our knowledge to enrich all human life. 92 140+ 100+ Nobel Laureates affiliated Interdisciplinary Research Programs, initiatives, with the University, including Centers and Institutes and partnerships in six Nobel Prize winners currently over 48 nations and on faculty at UChicago on every continent 1 1 The University of Chicago CHICAGO HIGHLIGHTS American Writers Museum The 606 / Bloomingdale Trail Center for Intuitive and Outsider Art Chicago is: The Windy City. Bahá’í Temple The City of Big Shoulders. The Plant vertical farm The City that Works. Design Museum of Chicago National Museum of Mexican Art Chicago is known by many names Garfield Park Conservatory but its spirit is singular. One of River cruise architecture tours The Second City comedy club the great American cities and the largest city in the Midwest, TO-DO LIST Chicago offers all the perks of an Cubs or White Sox game international metropolis. Lakefront beach barbecue Free music and movies in Millennium Park And the University of Chicago campus, with its dramatic mixture of Gothic and Postmodern Live jazz at the Green Mill architecture, its world-famous Frank Lloyd Wright Free contemporary art exhibitions home, quirky student-run cafés, and more Nobel at Hyde Park Art Center Prize winners than just about anywhere else in Talks and exhibitions at the DuSable the world, is the setting for your next big idea. -

A Look Back on Eight Years of Progress

MOVING CHICAGO FORWARD: A LOOK BACK ON EIGHT YEARS OF PROGRESS MAYOR RAHM EMANUEL MOVING CHICAGO FORWARD • A LOOK BACK ON EIGHT YEARS OF PROGRESS LETTER FROM THE MAYOR May 2, 2019 Dear Fellow Chicagoans, It has been the honor of my lifetime to serve the people of this great city as mayor for eight years. Together, we have addressed longstanding challenges, overcome old obstacles and confronted new headwinds. At the outset of my administration, Chicago was beset by fiscal, economic and academic crises. Many thought our best days were behind us, and that the ingenuity and ability to rise to meet great challenges that had defined our city for generations was part of our past, but not our future. In response, Chicagoans came together and showed the resolve and resilience that define the character of this great city. Today, Chicago’s fiscal health is stronger than it has been in many years, with a smaller structural deficit, a larger rainy day fund, true and honest accounting of city finances, and dedicated recurring revenues for all four city pension funds. Our economic landscape is dramatically improved, with historic lows in unemployment, the highest level of jobs per-capita in the city in over five decades, and a record amount of corporate relocations and foreign direct investment. Academically, Chicago’s students are raising the bar for success and making our city proud. Every year for the past seven, a new record number of Chicago’s students have graduated high school. More graduates than ever now go to college. Stanford University found CPS students are learning faster than 96 percent of students of all districts in the United States. -

Trends in Use of Chicago's Elevated Rail-Trail Greg Lindsey University of Minnesota, Minneapolis, MN, [email protected]

Proceedings of the Fábos Conference on Landscape and Greenway Planning Volume 6 Adapting to Expanding and Contracting Article 37 Cities 2019 The 606 ta Three: Trends in Use of Chicago's Elevated Rail-Trail Greg Lindsey University of Minnesota, Minneapolis, MN, [email protected] Yunlei Qi University of Minnesota, [email protected] Paul H. Gobster USDA Forest Service Northern Research Station, [email protected] Sonya Sachdeva USDA Forest Service, Evanston, IL, [email protected] Follow this and additional works at: https://scholarworks.umass.edu/fabos Part of the Environmental Design Commons, Geographic Information Sciences Commons, Historic Preservation and Conservation Commons, Landscape Architecture Commons, Nature and Society Relations Commons, Remote Sensing Commons, Urban, Community and Regional Planning Commons, and the Urban Studies and Planning Commons Recommended Citation Lindsey, Greg; Qi, Yunlei; Gobster, Paul H.; and Sachdeva, Sonya (2019) "The 606 ta Three: Trends in Use of Chicago's Elevated Rail- Trail," Proceedings of the Fábos Conference on Landscape and Greenway Planning: Vol. 6 , Article 37. Available at: https://scholarworks.umass.edu/fabos/vol6/iss1/37 This Article is brought to you for free and open access by ScholarWorks@UMass Amherst. It has been accepted for inclusion in Proceedings of the Fábos Conference on Landscape and Greenway Planning by an authorized editor of ScholarWorks@UMass Amherst. For more information, please contact [email protected]. Lindsey et al.: The 606 at Three: Trends in Use of Chicago's Elevated Rail-Trail The 606 at Three: Trends in Use of Chicago's Elevated Rail-Trail Greg Lindsey1, Yunlei Qi1, Paul H. -

Cityscapes: Bloomingdale Trail Close to Securing Major Federal Funding

Home News Business Sports Entertainment Travel Health Opinion Real Estate Cars Jobs Deals Cityscapes RSS >> About this blog Cityscapes >> About Blair Kamin A DAILY CHICAGO JOURNAL ABOUT THE BUILDINGS AND URBAN SPACES THAT SHAPE OUR LIVES BY BLAIR KAMIN | E-mail | About | RSS « A shout-out to the C.A.D.--read on to find out what that means | Main | Mr. Justice Breyer talks about judging architecture's top prize » October 05, 2011 Bloomingdale Trail close to securing major federal funding Like 20 likes. Sign Up to see what your friends like. Share | For years, park advocates have dreamed of turning a dormant railroad line on Chicago's Northwest Side into an elevated park that would stretch for nearly 3 miles and include a bike trail. VIDEO Now, that vision seems closer than ever to reality. City officials on Tuesday night said they are on the verge of securing millions of dollars in federal funding for the project, which is called the Bloomingdale Trail. When state and local matches are figured in, the total would top $46 million. "It's real money," said Janet Attarian, a project director for the Chicago Department of Transportation following a presentation of design alternatives for the project at the McCormick Tribune YMCA at 1834 N. Lawndale Avenue. "This is obviously a huge leap forward for the project." Indeed, after years of delays, planners think that construction on the project's first phase could begin in 2013 and be completed in late 2014. At a minimum, that phase would include a bike trail because the project would be made possible through the federal Congestion Mitigation and Air Quality Improvement program, or LAST 10 POSTS CMAQ, which supports efforts that lower pollution and provide relief from traffic • A lecture on Chicago's movable bridges congestion. -

Strategic Development of Petrodvorets District in Saint- Petersburg, Russia

Strategic Development of Petrodvorets District in Saint- Petersburg, Russia 1 Content: 1. Introduction 1. Description of the aim of diploma work 2. Ter ms 2. Diploma Project Analytical Part 1. The city of Saint Petersburg 2. Historic development of Saint Petersburg 3. Historic development of Petrodvorets district Petrodvorets district 4. Location of Petrodvorets district 5. Connections and transport network 6. Structure 7. Strelna 8. Peterhof 9. Lomonosov (Oranienbaum) 10. Land use structure Values of the territory 11. Connections 12. Park and Garden Complexes 13. Heritage 14. Connected railway network as a basis for development 15. Natural sanctuaries and bio diversity 16. Dachas 17. Structure of the waterfront Problems and issues of the territory 18. Industrialisation of the district 19. Priorities 20. Mass construction 21. Infrastructural gaps 22. Undeveloped territories 23. Connectivity 24. Waterfront accessibility 2 Redevelopment principles of the territory Lomonosov city 1. Compositional structure of the city 2. Functional structure of the city 3. Road structure of the city 4. Green structure of the city 5. Cultural heritage 6. Problems and opportunities 7. Vision of the city and principles of development 3. Selected concepts and relevant case studies Implementation strategies and concepts 1. Transit-Oriented Development 2. Pedestrian mobility environments Cases 1. Case: Delaware River, Philadelphia, USA 2. Case: The Bloomingdale Trail, Chicago, IL 3. Case: Brygge Island, Copenhagen, Denmark 4. Summary and conclusions 4. Diploma Project Design Part Regional development concept 1. Principles and strategies of regional development 2. Regional vision 3. Proposed urban structures 4. Identification of key intervention areas and projects Spatial development of Lomonosov city 5.