Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

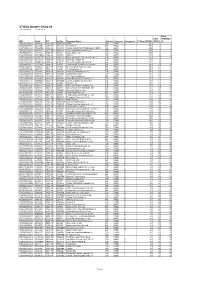

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Chapter 4 About Cosco Shipping Ports

10 COSCO SHIPPING PORTS LIMITED Sustainability Report 2020 CHAPTER 4 ABOUT COSCO SHIPPING PORTS CHAPTER 4 ABOUT COSCO SHIPPING PORTS 11 COSCO SHIPPING PORTS LIMITED Sustainability Report 2020 12 COSCO SHIPPING PORTS LIMITED Sustainability Report 2020 CORPORATE OVERVIEW COSCO SHIPPING Ports is a leading ports operator in the world, with a portfolio covering the five main port regions in Mainland China, Southeast Asia, the Middle East, Europe, South America and the Mediterranean. As of 31 December 2020, COSCO SHIPPING Ports operated and managed 357 berths at 36 ports worldwide, of which 210 were for containers, with a total annual handling capacity of approximately 118 million TEU. The Company upholds its mission of “The Ports for ALL” and strives to build a global terminal network with controlling stake that offers linkage effect on costs, services and synergies, creating mutual benefits across the shipping industry chain, connecting global shipping services and becoming truly “the ports for all people”. COSCO SHIPPING Ports’ intermediate holding company is COSCO SHIPPING Holdings Co., Limited (stock code: 1919 (H Share), 601919 (A Share)) whose ultimate holding company, China COSCO SHIPPING Corporation Limited, is the largest integrated shipping enterprise in the world. As at 31 December 2020, COSCO SHIPPING holds 46.22% share in COSCO SHIPPING Holdings, which in turn holds 50.23% share in COSCO SHIPPING Ports. KEY ECONOMIC PERFORMANCE IN THE LAST FIVE YEARS: Revenue Total Asset (US$ million) (US$ million) 11,224 1,028 10,477 1,000 1,001 8,954 9,046 6,787 635 556 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Total Throughput (million TEU) 123.78 123.82 117.37 100.20 95.07 2016 2017 2018 2019 2020 For detailed economic performance, please refer to the 2020 Annual Report of COSCO SHIPPING Ports. -

March 2, 2020 I Vol - 131

NEWS March 2, 2020 I Vol - 131 Hamriyah Free Zone woos exporters from Kerala to UAE India: JNPT walks back direct terminal handling fees Federation of Indian Export Organisations, Kerala Indian regulatory measures to address nagging shipper concerns about “arbitrary” terminal pricing have begun to yield Chapter jointly with Hamriyah Free Zone Authority has positive results, at least on a limited scale, according to shippers and customs brokers operating in the country. Effective organised a seminar on the opportunities available in Monday, terminal operators at Jawaharlal Nehru Port (JNPT) have agreed to lift the additional direct port delivery (DPD) cargo UAE for exporters. Speaking on the occasion, Ali Al shifting charges they had previously sought to impose beyond the port’s base fee. DPD handling gives importers the option to Jarwan, Deputy Executive Director, Hamriyah Free Zone, clear cargo directly from the wharf within 48 hours of landing. “JNPT will charge only one shifting charge and applicable dwell said India has emerged the third largest trading partner time charges for DPD containers moved to CFSs [container freight stations] after 48 hours,” the Brihanmumbai Custom Brokers of UAE after China and the US and the trade between Association (BCBA) said of the move. That cost revision is significant, as a good portion of DPD cargo is shifted off-site, after two countries has touched $60 billion today compared being declared out-of-charge by customs, as cargo owners generally prefer to store goods at port-side yards longer because of to $180 million in the 70s. Moreover, UAE is the second limited warehousing capacity in and around their production sites. -

Press Release

Press Release COSCO SHIPPING Ports Signs Investment Agreement of COSCO SHIPPING Ports Supply Chain Project with Guangzhou Nansha Economic and Technology Development Zone Commercial Bureau Take Advantage of Scarce Logistics Resources near the Port to Develop High-end Warehousing Business Further Enhance Profitability Hong Kong – 3 April 2019 – COSCO SHIPPING Ports Limited (”COSCO SHIPPING Ports” or “CSP” or “Company”, HKEX stock code:1199), a leading ports operator in the world, today announced that the Company signed investment agreement of COSCO SHIPPING Ports Supply Chain Project with Guangzhou Nansha Economic and Technology Development Zone Commercial Bureau (广州南沙经 济技术开发区商务局). The Company plans to develop phase I of terminal extended business in the land near Nansha Stevedoring Corporation Limited of Port of Guangzhou and Guangzhou South China Oceangate Container Terminal Company Limited, in order to develop port supply chain plat- form, develop high-end warehousing business and extend the upstream and downstream industries. Leveraging on Nansha Free Trade Zone’s policy and favourable geographical position, the Company plans to establish supply chain platform to develop various business, including cross-border e-com- merce, auto parts and accessories distribution, fresh food and pharmaceutical products cold chain and supply chain finance, as the extension of port supply chain. Phase I of the project covers a con- struction area of about 254,000 ㎡ and consists of warehousing, comprehensive service areas and supporting facilities. Relying on the resource advantages of COSCO Shipping Group in shipping, ports, trade, logistics and finance, the Company will build a high-standard port supply chain base integrat- ing logistics, warehousing and business support services. -

Press Release (For Immediate Release)

Press Release (For immediate release) COSCO SHIPPING Holdings Achieved Net Profit of RMB 687million for 1Q 2019 Representing a Substantial Increase of 280% Year-on-Year (26 April 2019, Shanghai) - COSCO SHIPPING Holdings Co., Ltd ("COSCO SHIPPING Holdings" or "the Company") (SSE: 601919; HKEx: 1919) today announced its financial results for the first quarter of 2019. In the first quarter of 2019, the international container shipping market continued to recover. The freight rates of Transpacific and Asia-Europe routes were higher than the same period of last year. The average China Containerized Freight Index (CCFI) reached 852 points, representing a year-on-year increase of 4.5%. COSCO SHIPPING Holdings actively seized market opportunities, made efforts to improve the quality of development and maintained its growth momentum. In the first quarter of 2019, the revenue reached RMB35.08 billion, representing a year-on-year increase of 60%. The company realized a net profit attributable to equity holders of the company of RMB687 million, surged 280% from RMB181 million in the same period of last year. The revenue of container shipping business reached RMB33.45 billion, representing a year-on-year growth of 62.4%, and the gross profit was RMB3.22 billion, representing a year-on-year increase of 159%, with gross profit margin increased by 3.6 percent points to 9.6%. In view of major operating data, the core businesses of the Company continued to maintain sound growth momentum. In the first quarter of 2019, the container shipping business of the Company handled a shipping volume of 5.88 million TEUs, representing a year-on-year increase of 42.6%; of which COSCO SHIPPING Lines handled a shipping volume of 4.28 million TEUs, representing a year-on-year increase of 3.7% and OOCL handled a shipping volume of 1.61 million TEUs. -

UW LOGISTIEKE OPLOSSING? Waarom

DE LOGISTIEKE DIENSTVERLENER 6#0-'0 61.4'(70& 81'467+)5'48+%'5 10.+0'5'48+%'5 )QGFXQQT\KGPFQQTJGGN'WTQRC )TGP\GNQ\G\GMGTJGKFOGVFG&-8%#4& 4WKOCEEGRVCVKGRWPVGPFQQTJGGN'WTQRC$GUVGNPWWYHWGNGP UGTXKEGECTFFKGVQGICPIDKGFVVQVJGVITQQVUVGVQGNGXGTKPIUPGVYGTMKP FGVTCPURQTVUGEVQT&KVKUUNGEJVUÅÅPXCPQP\GXGNGFKGPUVGPYCCTOGGW QPFGTYGIPQQKVCCPFGMCPV\WNVDNKLXGPUVCCP 8TCCIXCPFCCIPQIWYQHHGTVGQROCCVCCP FMXGWTQUGTXKEGEQO NIEUWSBLAD TRANSPORT 12-18 APRIL 20177 De logistieke dienstverlener 3 VOORWOORDRD Omkoping, MELS DEES [email protected] maar geen fraude Logistiek dienstverlener HAVENSCHANDAAL Hoge Raad handhaaft vonnis Nu het woord ‘logistiek’ op bijna elke vrachtwagen prijkt en bijna elke onderneming zich ‘dienstverlener’ noemt, kan de redactie van Nieuwsblad Transport het thema ‘de logistieke dienstverlener’ nogal breed interpreteren. En dat doen we dan ook in deze editie. Veranderende business-modellen (die we tegenwoordig als ‘disruptive’ omschrijven) komen in meerdere artikelen terug. Zo beschouwt de topman van DHL alternatieven voor de pak- ketbezorging (pag. 11). Hebben drones de toekomst, of blijft het bij chauff eurs die aanbellen bij de besteller? Duurzaamheid was ook lange tijd een onderscheidende factor voor bedrijven – vooral in hun marketinguitingen. Dat veran- derde inmiddels. ‘Duurzaamheid is gewoon geworden, het zit in het DNA van veel bedrijven’, stelt Jurgen Hoppenbrouwers van Deloitte (pag. 15). Waarbij hij wel moet toegeven dat de lo- gistieke sector niet echt proactief is: bedrijven volgen de wen- sen van hun opdrachtgevers op het gebied van duurzaamheid. Dit, terwijl een meer duurzame houding tot kostenreducties leidt – en daar is uiteindelijk bijna elke logistieke dienstverle- ning naar op zoek. ‘Binnen twee jaar is 10 tot 15% reductie van het aantal gereden kilometers, brandstof en transportkosten mogelijk’. Schaalvergroting bij logistiek dienstverleners leidt, zo is de ervaring van Hoppenbrouwers, in de praktijk vaak tot een toenemend gebruik van schone modaliteiten, zoals spoor en binnenvaart. -

Corporate Sustainability Report 2016

COSCO SHIPPING Ports Limited Sustainability Report 2016 Publication Format This report is published in print and electronic versions in both Chinese and English. Electronic versions can be downloaded from website of the COSCO SHIPPING Ports. http://ports.coscoshipping.com Contents About This Report 1 Chairman’s Statement 3 Report by Vice Chairman 5 About Us 7 Our Approach to Sustainability 15 Corporate Governance 19 Commitment to Staff 21 Commitment to Customers 25 Commitment to the Environment 29 Commitment to Supply Chain 31 Commitment to the Community 33 The Way Forward in our Sustainability Journey 35 Data Tables 37 Contact Information 39 Report Survey Questionnaire 40 Appendices 41 1 About This Report This sustainability report is published by COSCO In-scoped companies for the Shareholdings SHIPPING Ports Limited (“COSCO SHIPPING report Ports”, “We” or “the Company”, together with our Headquarter subsidiaries, are collectively referred to “the Group”), summarising the performance and COSCO SHIPPING Ports progress of the Group for the period from Bohai Rim 1 January 2016 to 31 December 2016 pertaining 1 Qingdao Qianwan Terminal 20% to environmental, social and governance aspects. 2 Tianjin Five Continents Terminal 28% Basis of Preparation 3 Tianjin Euroasia Terminal 30% The preparation of this report was conducted 4 Yingkou New Century Terminal 40% mainly with reference to the core option of the 5 Dalian International Terminal 40% Global Reporting Initiative (GRI) “G4 Sustainability 6 Yingkou Terminal 50% Reporting Guidelines” and the “Environmental, 7 Dalian Port Terminal 20% Social and Governance Reporting Guide” set out 8 Jinzhou New Age Terminal in Appendix 27 of the Rules Governing the Listing 51% of Securities on The Stock Exchange of Hong Yangtze River Delta Kong Limited (“the Listing Rules”). -

Qingdao Port International Co Annual Report 12748B.Pdf

CONTENTS PAGE DEFINITIONS 2 CORPORATE INFORMATION 6 COMPANY PROFILE 8 2017 MAJOR EVENTS 12 FINANCIAL HIGHLIGHTS 17 CHAIRMAN’S STATEMENT 19 MANAGEMENT DISCUSSION AND ANALYSIS 22 DIRECTORS, SUPERVISORS AND SENIOR MANAGEMENT 44 DIRECTORS’ REPORT 51 SUPERVISORS’ REPORT 68 CORPORATE GOVERNANCE REPORT 71 AUDITOR’S REPORT 85 CONSOLIDATED AND COMPANY BALANCE SHEET 91 CONSOLIDATED AND COMPANY INCOME STATEMENT 95 CONSOLIDATED AND COMPANY CASH FLOW STATEMENT 98 CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY 102 COMPANY STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY 104 NOTES TO THE FINANCIAL STATEMENTS 106 DEFINITIONS Unless the context otherwise requires, the following expressions shall have the following meanings: “2017 AGM” the annual general meeting for the year 2017 of the Company to be held on 6 June 2018 “Articles of Association” the articles of association of the Company, as amended from time to time “Board” the board of directors of Qingdao Port International Co., Ltd. (青島港國際股份有限公司) “CFS” container freight station, of which, container freight station at loading ports refers to the location designated by carriers for the receiving of cargo to be loaded into containers by the carrier, while container freight station at discharge or destination ports refer to the location designated by carriers for de-vanning of containerized cargo “Company” Qingdao Port International Co., Ltd. (青島港國際股份有限公司), a joint stock company established in the PRC with limited liability on 15 November 2013 “Consolidated Group Companies” the Company (including -

Chapter 4 About Cosco Shipping Ports

12 13 COSCO SHIPPING PORTS LIMITED COSCO SHIPPING PORTS LIMITED Sustainability Report 2019 Sustainability Report 2019 CHAPTER 4 ABOUT COSCO SHIPPING PORTS Corporate Overview COSCO SHIPPING Ports is one of the world’s leading ports operators, with a portfolio covering the five major port regions in Mainland China, Southeast Asia, Middle East, Europe, South America and the Mediterranean. As of 31 December 2019, COSCO SHIPPING Ports operated and managed 290 berths at 36 ports worldwide, of which 197 were for containers, with a total designed annual handling capacity of approximately 113 million TEUs. With “The Ports for ALL” as its mission, the Company is committed to building a global terminal network with controlling stake that offers linkage effect on costs, services and synergies, creating a win-win platform that delivers maximum value across the shipping industry chain, connecting global routes and becoming truly “the ports for all people”. COSCO SHIPPING Ports’ intermediate holding company is COSCO SHIPPING Holdings Co., Ltd. (stock code: 1919) whose ultimate holding company, China COSCO SHIPPING Corporation Limited, is the largest integrated shipping enterprise in the world. 12 13 COSCO SHIPPING PORTS LIMITED COSCO SHIPPING PORTS LIMITED Sustainability Report 2019 Sustainability Report 2019 CHAPTER 4 ABOUT COSCO SHIPPING PORTS Corporate Overview COSCO SHIPPING Ports is one of the world’s leading ports operators, with a portfolio covering the five major port regions in Mainland China, Southeast Asia, Middle East, Europe, South America and the Mediterranean. As of 31 December 2019, COSCO SHIPPING Ports operated and managed 290 berths at 36 ports worldwide, of which 197 were for containers, with a total designed annual handling capacity of approximately 113 million TEUs. -

Annual Report 2019

2019 Important notice The Board of Directors (the “Board”), the Supervisory Committee (the “Supervisory Committee”), the directors (the “Directors”), the supervisors (the “Supervisors”) and senior management of COSCO SHIPPING Holdings Co., Ltd. (the “Company” or “COSCO SHIPPING Holdings”, together with its subsidiaries, the “Group”) declare that there are no false information, misleading statements or material omissions in this annual report, and collectively and individually accept full responsibility for the truthfulness, accuracy and completeness of the information contained herein. All Directors attended the Board meeting held on 30 March 2020. ShineWing Certified Public Accountants, LLP and PricewaterhouseCoopers have issued standard and unqualified auditor’s reports for the Company. The authorized person of the Company, Mr. Xu Lirong (chairman), Mr. Yang Zhijian (executive Director and general manager), Mr. Zhang Mingwen (person-in-charge of accounting) and Mr. Xu Hongwei (head of the accounting department), declare that they confirm the truthfulness, accuracy and completeness of the financial reports in this report. Proposals for profit distribution and reserves capitalization during the year ended 31 December 2019 (the “Reporting Period”) as considered by the Board: Pursuant to the audited financial statements of the Company for the year 2019, which were prepared in accordance with Hong Kong Financial Reporting Standards, the profit attributable to equity holders of the Company for 2019 was RMB6.690 billion. Since total net profit attributable to owners of the parent company of COSCO SHIPPING Holdings for the year was used to recover previous years’ losses, the aggregate undistributed profit was negative. According to the relevant requirements under the Company Law (the “Company Law”) of the People’s Republic of China (the “PRC”), no profit shall be distributed provided that the aggregate undistributed profit of a company is negative. -

COSCO SHIPPING Holdings Co., Ltd. Sustainability Report 2019 About the Report Contents About the Report About the Report About the Report Contents

COSCO SHIPPING Holdings Co., Ltd. Sustainability Report 2019 About the report Contents About the report About the Report About the report Contents Overview Time frame: January 1, 2019 to December 31, 2019 Organization Name: COSCO SHIPPING Holdings Co., Ltd. About the report 2 Release cycle: The Social Responsibility Report is released annually. The previous version was issued in March 2019, and the Statement of Chairman 3 issue date of this Report is March 2020. Outline of report disclosure 7 Guidance: This report is in line with the Environmental, Social and Governance Reporting Guide of the Hong Kong Stock Exchange About COSCO SHIPPING Holdings 11 (released in July 2015) and is based on the Global Reporting Initiative (GRI) Sustainability Reporting Standards 2016 and prepared by referencing the Core option. :The entity disclosed in this report is carefully selected based on the selection criteria of “whether there is actual business Scope Sustainability governance operation” and the overall impact of the entity on COSCO’s environment, society and governance. The production units / companies Governance mechanism 17 with no actual business operation or with little or no impact despite actual operation are filtered out. According to our selection process, the report covers three first-tier subsidiaries (COSCO SHIPPING Lines, COSCO SHIPPING Ports and Orient Overseas (International) Stakeholders and material topics 18 Limited) as well as their affiliates in the financial statements. Should there be any exceptions, there will be description of specific sta- tistical methods and data dimensions in the corresponding chapters. For the list of specific companies, please refer to the report scope Economic topics in Appendix part. -

Stoxx® China Total Market Index

STOXX® CHINA TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CHINA CONSTRUCTION BANK CORP H Banks CN 9.86 ICBC H Banks CN 7.26 China Mobile Ltd. Telecommunications CN 7.16 PING AN INSUR GP CO. OF CN 'H' Insurance CN 6.57 BANK OF CHINA 'H' Banks CN 4.79 China Life Insurance Co 'H' Insurance CN 2.97 CNOOC Ltd. Oil & Gas CN 2.89 China Petroleum & Chemical 'H' Oil & Gas CN 2.33 BOC Hong Kong (Holdings) Ltd. Banks CN 2.33 China Merchants Bank Co Ltd'H' Banks CN 1.93 PetroChina Co Ltd 'H' Oil & Gas CN 1.89 AGRICULTURAL BANK OF CHINA 'H' Banks CN 1.71 China Overseas Land & Investme Real Estate CN 1.53 CHINA PAC.IN.(GROUP) 'H' Insurance CN 1.51 CITIC LTD. Industrial Goods & Services CN 1.15 CHINA SHENHUA EN. 'H' Basic Resources CN 1.08 PICC P&C 'H' Insurance CN 1.07 China Unicom (Hong Kong) Ltd. Telecommunications CN 1.05 China Resources Land Ltd. Real Estate CN 0.98 China Mengniu Dairy Co. Ltd. Food & Beverage CN 0.97 POSTAL SAVINGS BOC.'H' Banks CN 0.93 BRILLIANCE CHINA AUTV. HDG. Automobiles & Parts CN 0.91 China Telecom Corp Ltd 'H' Telecommunications CN 0.83 NEW CHINA LIFE INSURANCE 'H' Insurance CN 0.76 CHINA CITIC BANK 'H' Banks CN 0.76 BYD 'H' Automobiles & Parts CN 0.75 CHINA MINSHENG BANKING H Banks CN 0.73 Bank of Communications Co 'H' Banks CN 0.70 ANHUI CONCH CEMENT H Construction & Materials CN 0.69 China Taiping Insurance Holdin Insurance CN 0.68 CHINA RESOURCES BEER (HLDG) Industrial Goods & Services CN 0.67 CHINA VANKE 'H' Real Estate CN 0.63 China Communictn 'H' Construction & Materials CN 0.63 CHINA HUARONG ASTMGMT.