Capital Markets Day

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Simply the Best Buses in Britain

Issue 100 | November 2013 Y A R N A N I S V R E E R V S I A N R N Y A onThe newsletter stage of Stagecoach Group CELEBRATING THE 100th EDITION OF STAGECOACH GROUP’S STAFF MAGAZINE Continental Simply the best coaches go further MEGABUS.COM has buses in Britain expanded its network of budget services to Stagecoach earns host of awards at UK Bus event include new European destinations, running STAGECOACH officially runs the best services in Germany buses in Britain. for the first time thanks Stagecoach Manchester won the City Operator of to a new link between the Year Award at the recent 2013 UK Bus Awards, London and Cologne. and was recalled to the winner’s podium when it was In addition, megabus.com named UK Bus Operator of the Year. now also serves Lille, Ghent, Speaking after the ceremony, which brought a Rotterdam and Antwerp for number of awards for Stagecoach teams and individuals, the first time, providing even Stagecoach UK Bus Managing Director Robert more choice for customers Montgomery said: “Once again our companies and travelling to Europe. employees have done us proud. megabus.com has also “We are delighted that their efforts in delivering recently introduced a fleet top-class, good-value bus services have been recognised of 10 left-hand-drive 72-seat with these awards.” The Stagecoach Manchester team receiving the City Van Hool coaches to operate Manchester driver John Ward received the Road Operator award. Pictured, from left, are: Operations Director on its network in Europe. -

Firstgroup Vies with Virgin in West Coast Rail Bidding War | Business | Guardian.Co.Uk Page 1 of 2

FirstGroup vies with Virgin in west coast rail bidding war | Business | guardian.co.uk Page 1 of 2 Printing sponsored by: FirstGroup vies with Virgin in west coast rail bidding war Aberdeen-based group is frontrunner, along with incumbent, in battle to secure 14-year franchise contract Dan Milmo, industrial editor guardian.co.uk, Sunday 15 July 2012 14.13 BST Virgin, the current holders of the west coast franchise, pay an annual premium of £150m to the government. Photograph: Christopher Thomond for the Guardian FirstGroup has emerged as a frontrunner for the multibillion-pound west coast rail franchise alongside incumbent Virgin Trains, with the contest now a two-horse race between the experienced operators. Aberdeen-based FirstGroup is vying with Virgin despite announcing last year that it is handing back its Great Western rail contract three years ahead of schedule, avoiding more than £800m in payments to the government. The Department for Transport is expected to bank a considerable windfall from the new 14-year west coast contract, with Virgin currently paying an annual premium of about £150m to the state. Both bidders are expected to promise an even bigger number over the life of the new franchise. The winner is expected to be announced next month. It is understood that FirstGroup and Virgin are still in talks with the DfT, but two foreign-owned bidders on the four-strong shortlist are no longer considered likely contenders. They are a joint venture between public transport operator Keolis and SNCF, the French state rail group, and a bid from Abellio, which is controlled by the Dutch national rail operator. -

London and the South East of England: 15 July 2016

OFFICE OF THE TRAFFIC COMMISSIONER (LONDON AND THE SOUTH EAST OF ENGLAND) NOTICES AND PROCEEDINGS PUBLICATION NUMBER: 2359 PUBLICATION DATE: 15 July 2016 OBJECTION DEADLINE DATE: 05 August 2016 Correspondence should be addressed to: Office of the Traffic Commissioner (London and the South East of England) Hillcrest House 386 Harehills Lane Leeds LS9 6NF Telephone: 0300 123 9000 Fax: 0113 249 8142 Website: www.gov.uk/traffic-commissioners The public counter at the above office is open from 9.30am to 4pm Monday to Friday The next edition of Notices and Proceedings will be published on: 29/07/2016 Publication Price £3.50 (post free) This publication can be viewed by visiting our website at the above address. It is also available, free of charge, via e-mail. To use this service please send an e-mail with your details to: [email protected] Remember to keep your bus registrations up to date - check yours on https://www.gov.uk/manage-commercial-vehicle-operator-licence-online NOTICES AND PROCEEDINGS Important Information All correspondence relating to public inquiries should be sent to: Office of the Traffic Commissioner (London and the South East of England) Ivy House 3 Ivy Terrace Eastbourne BN21 4QT The public counter at the Eastbourne office is open for the receipt of documents between 9.30am and 4pm Monday Friday. There is no facility to make payments of any sort at the counter. General Notes Layout and presentation – Entries in each section (other than in section 5) are listed in alphabetical order. Each entry is prefaced by a reference number, which should be quoted in all correspondence or enquiries. -

Key to Maps for Details in Central London See Overleaf

S 1 N B C 712.724 M S 2 O 9 Maldon Manor Station, The Manor Drive, Worcester Park, Dorchester Road, North Cheam, London Road, Windsor Avenue, H A C 242.C1.C2 M H 310.311 W1† 614 S 298 308.312 610 66.103.175 D 9 757 to D NE R R 2 E Cuffley 381 3 R E R A A 8 N LEY 4 1 A 5 .39 FF H U . 364 5.248 . A L N 12 A CU IL D 1 T A E P C1.C3.C4 6 621 N 615 A 3 A 380.880 L 191 W8 W10 247.294.296 O 8 - * Luton Airport E Cranborne Road . L T H 8 Stayton Road, Sutton, Cedar Road, Langley Park Road, Lind Road, Westmead Road, Carshalton, Carshalton Beeches, D R 2 9 O 1 R Breach Barns A R D Colney D * L T N 2 84 N C1 K B81 Y . O 2 648.N15 4 N S3 R 6 TI 242 I 8 E . E 0 84.302 A 365.375.575 S . A 797 D *T C T 2 S S C1 W9 O O L M B 298 B Industrial 3 RD C 382 9 . E N 7 6 G Y R . 8 CH 880 G * S S 1 T I U Street E . R R 242 211.212† 6 4 8 602 A U O R C Belmont, Royal Marsden Hospital, Sutton Hospital (Mon-Sat except evenings). Quality Line M O O O 4 398 H R 169 R T H S Shenleybury B 0 E 242 F . -

How We Support Britain's Economy and Communities

How we support Britain’s economy and communities stagecoach.com We carry We employ almost 24,000 people around 2.5 Welcome million customers a day Our transport services play a vital role in keeping Britain moving We operate 8,300 buses, coaches and trams For four decades, Stagecoach transport services have The new research carried out by Cebr has now also revealed transported billions of people, helped to build strong local the wider transport benefits associated with Stagecoach, which economies and provided a greener way to travel. As the demonstrate how we contribute towards making the nation more UK’s biggest bus and coach operator, our operations serve active, delivering cleaner air, reducing congestion on our roads communities in major cities including London, Manchester, and making our communities safer. Liverpool, Newcastle, Hull, Sheffield, Oxford and Cambridge * as well as inter-urban and rural locations, such as Cumbria Stagecoach internal data and Lincolnshire. We connect people with jobs, skills and training, bring customers to our high streets and draw families, friends For over 25 years Cebr has supplied We create vital and communities together, supporting the country’s independent economic forecasting and Jobs economic growth and reducing social deprivation. analysis to hundreds of private firms Our economic impact employment and public organisations. Cebr was This new report published by Stagecoach and the commissioned by Stagecoach Group Centre for Economics and Business Research (Cebr) to assess the economic and social contribution of its We pay our way …that’s analyses the significant impact that Stagecoach makes, not transport services to the UK economy. -

Doing Transport Differently

Doing Transport Differently How to access public transport – a guide for everyone with lived experience of disabilty or health conditions Doing Transport Differently How to access public transport – a guide for everyone with lived experience of disabilty or health conditions Doing Transport Differently How to access public transport – a guide for everyone with lived experience of disabilty or health conditions How to use this guide Where should I start? This guide is aimed at people with If you’re not yet using public transport lived experience of disability or health for whatever reason and want to know conditions and at those advising or what’s possible, go to section two. working with them. Using a question For an overview of the law as it relates and answer approach to enable different to transport, go to section two. people with different travel needs to dip To begin planning a journey, short or into it in different ways, it will show you long, go to section three. how far access to public transport has For information and advice on using improved and how to make use of it. buses or coaches, go to section four. For information and advice on using trains, go to section five. For information and advice on underground trains, go to section six. For information and advice on light rail and tramways, ferries and other forms of transport, go to section seven. The resources section includes both useful websites and useful phone numbers to keep with you when you travel. 2 Contents Contents Foreword – Genevieve Barr 6 Foreword – Sir Bert Massie -

Capital Space Ltd Land South of Coldharbour Road, Gravesend

Capital Space Ltd Land South of Coldharbour Road, Gravesend Transport Assessment July 2016 Gravesham Borough Council Contents 1 INTRODUCTION .................................................................................................. 1 2 SITE AND LOCAL AREA ........................................................................................ 2 Site Location ....................................................................................................... 2 Local Road Network ............................................................................................ 2 Public Transport .................................................................................................. 3 3 POLICY ................................................................................................................ 4 National Planning Policy Framework .................................................................. 4 Supplementary Planning Guidance SPG 4 Kent Vehicle Parking Standards (July 2006) ................................................................................................................... 4 Gravesham Local Plan Core Strategy (September 2014) ................................... 5 4 BASELINE CONDITIONS ..................................................................................... 6 Existing Traffic Conditions .................................................................................. 6 5 PROPOSED DEVELOPMENT ................................................................................. 7 Overview -

On Stage Issue

The newsletter of Stagecoach Group Issue 110 | July 2015 STAGE ON page 2 page 6 INSIDE Memorial award | Greener together megabus.com continues European expansion megabus.com has revealed record advance ticket sales on its new network of domestic coach services in Italy as well as launching two new international routes. More than 30,000 customers purchased tickets during the first week of sales in Italy – higher than the initial sales on any of the company’s other networks in Europe. megabus.com services now link 13 destinations across Italy and passengers have been snapping up bargain fares from just €1 (plus 50 cents booking fee). The major new network of inter-city coach services covers Rome, Milan, Florence, Venice, Naples, Turin, Bologna, Verona, Padua, Siena, Genoa, Sarzana (La Spezia) and Pisa. megabus.com has also created around 100 new jobs through the opening of new bases near Milan megabus.com vehicles at the launch of the new Italian domestic network in Florence and in Florence. In addition, megabus.com recently launched its first base in France, where it has created 35 jobs between London and Milan via Lille, Paris, Lyon from customers has been fantastic. at a depot located near Lyon, from which a new and Turin. “The new routes between London and Milan, and international route now operates between megabus.com Managing Director Edward between Barcelona and Cologne are great news Barcelona, Perpignan, Montpellier, Avignon, Lyon, Hodgson said: “These latest routes mark even for our customers who now have access to even Mulhouse, Freiburg, Karlsruhe, Heidelberg, more expansion of our services in Europe. -

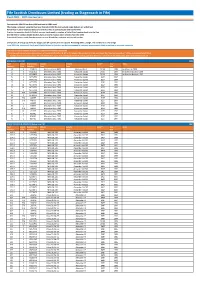

Historic Fleetlists.Xlsx

Fife Scottish Omnibuses Limited (trading as Stagecoach in Fife) Fleet 2001… 40th Anniversary Fleet strength 294 (25 less than 1996 and back to 1991 level) After being a constant since the fleet was formed in 1961 the last Leyland single deckers are withdrawn 30 low floor 'Loliner' branded buses are now in service at Cowdenbeath and Dunfermline A return to operating Scottish Citylink services has brought a number of toilet fitted coaches back into the fleet Over 50 former London double deckers have arrived to replace older vehicles from the 1970s Stagecoach Express coach fleet has grown to over 40 vehicles, including articulated coaches Livery notes; A new group livery for Stagecoach UK operations is introduced. Retaining white, orange, red and blue in a new design From 2000 Fife, Stagecoach Perth and Bluebird Buses in Aberdeen are being managed by common management albeit remaining as separate companies * LF next to a fleet number indicates it is low floor/wheelchair accessible ** Seating code shows a bus, dual purpose or coach (starts with a B, DP or C) followed by number of seats and then F (for front entranced) a 't' at the end means toilet fitted *** Double decker seating is shown 'H' followed by the upper deck seating/lower deck seating and then the door code (F for front entranced). Open top vehicles start 'O' MINIBUSES (Total 20) 2001 Fleet Depot Registration Chassis Vehicle Seats** Year Notes Number* Alloc Number Type Type New 16 K F234NLS Mercedes Benz 609D Mercedes Benz DP18F 1988 ex Alisons in 2000 17 K M317RSO Mercedes Benz -

Drivers'union

The train ASLEF drivers’ union >>> Rail Franchise Handbook 2019 ASLEF Introduction Welcome to our new Rail Franchise Handbook. I hope you will find it as interesting, and useful, as I do and a valuable tool for the political and industrial work you do for our union. We put this handbook together to give our reps and decision makers the inside track on who really runs Britain’s railways, how they run our railways, and what they take out from our railway industry every year. Because we believe the facts and figures revealed in these pages show, with crystal clarity, the utter folly of our privatised, and fragmented, franchise system. A structure – set up by John Major, 25 years ago, and continued by Conservative governments ever since – that separates the wheels and steel and is underwritten by an enormous public subsidy from every taxpayer in this country, and sky high passenger fares, while tens of millions of pounds haemorrhage from the system into the pockets of shareholders in the form of profits and dividends, or increasingly due inefficiencies. In fact whilst the system has never worked for passengers or taxpayers, there are now signs that it doesn’t work for operators either. The franchising system has been put on hold for a couple of years now due to a lack of bidders. This means direct awards have been handed out leading to even less competition. So we now have a system that exists to maintain the system itself, not our railway. It isn’t true to say that all the train and freight operating fill the pockets of shareholders; some TOCs and FOCs are owned by public, not private, operators where shareholders do not skim the cream off the top of the milk. -

Appendix A: List of Stakeholders That Responded to the ULEZ Consultation

Appendix B (2) Appendix A: List of stakeholders that responded to the ULEZ consultation Air Quality Brentford Coulsdon & Purley Road User Alliance of British Drivers Forum Arriva Cross River Partnership Balfour Beatty Disabled Motoring UK Bambos Charalambous MP Federation of British Historic Barking and Dagenham and Vehicle Clubs Havering Green Party Federation of Small Businesses Barnet Green Party Forest Hill Society Better Streets for Enfield Freight Transport Association Bloomsbury Air Friends of the Earth Brentford Chamber of Gipsy Hill Green Party Commerce Greenpeace Brentford Community Council Greenwich Conservatives Brewery Logistics Group Heart of London Business British Heart Foundation Alliance British Lung Foundation Herne Hill Green Party British Motorcyclists Federation Hertfordshire County Council British Vehicle Rental and Hounslow and Brentford Leasing Association (BVRLA) Friends of the Earth Builders Merchants Federation Islington Green Party Campaign for Better Transport Joanne McCartney AM Campaign for Better Transport John Lewis Partnership (London Group) Kingston Environment Forum Campaign to Protect Rural Lambeth for a Cool Planet England Lambeth Green Party Caroline Pidgeon AM LEVC Caroline Russell AM Lewisham Cyclists Chartered Institute of Lewisham Liberal Democrats Environmental Health Licensed Taxi Drivers' Chiswick Liberal Democrats Association (LTDA) Church of England (Diocese of Living Streets Chelmsford) London Assembly Environment City of London Committee -

Retail Market Review

Retail market review Emerging findings June 2015 Contents Executive Summary 5 Box 1: Summary of proposed remedies 12 1. Introduction 14 Summary 14 Purpose of the retail market review 14 Scope of the Review 15 Box 2: The Retail Market Review and wider interactions 17 Characteristics of the rail retail market 18 Our methodology 19 Purpose of this document 20 Next steps 20 Question for Chapter 1 21 2. Passengers’ experiences of the rail ticketing market 22 Summary 22 Introduction 22 Where passengers buy tickets 22 Box 3: Passengers’ appetite for having a wider range of retailers, including smaller retailers 27 How passengers buy tickets 28 Ticket formats 30 Passengers' choice of tickets 34 Box 4: Passengers’ take-up of inter-available and through fares 36 Passengers' opportunities to find different / cheaper fares 38 Questions for Chapter 2 38 3. The industry regime for TOCs and possible remedies to promote effective competition 39 Summary 39 Introduction 39 TOCs’ ability to offer new fares and products 40 TOCs’ ability to differentiate the ticket buying experience 44 TOCs’ ability to differentiate by sales channels 45 Questions for Chapter 3 47 4. The industry regime for third party retailers and possible remedies to promote effective competition 49 Summary 49 Introduction 49 Third party retailing in ticket selling 49 Incentives on potential third party retailers to enter and to expand in the market for ticket selling 52 Box 5: The level of third party retailers’ commission 57 Scope for third party retailers to compete 60 Box 6: ATOC’s trial to allow third party retailers sell Season tickets 61 Box 7: Retail rail prices in Sweden 64 Questions for Chapter 4 66 5.