Ontario Wholesale Electricity Market Price Forecast

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Generation Capacity and Production

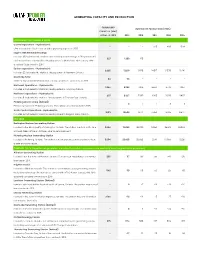

GENERATION CAPACITY AND PRODUCTION NET GENERATION NET GENERATION (GWh) HYDROELECTRIC CAPACITY (MW) 2017 2016 2015 2014 2013 Central Operations 124 668 493 564 692 645 Includes 26 stations, headquarters in North Bay. Eastern Operations 2,571 14,517 12,535 12,241 13,281 12,774 Includes 10 stations, headquarters in Renfrew. Niagara Operations 2,278 11,250 12,015 12,547 12,267 12,372 Includes 5 stations, headquarters in Niagara area. Northeast Operations 1,809 3,584 3,779 4,057 3,802 3,359 Includes 14 stations, headquarters in Timmins. Northwest Operations 687 3,065 3,089 3,497 3,448 3,583 Includes 11 stations, headquarters in Thunder Bay. NET GENERATION NET GENERATION (GWh) NUCLEAR CAPACITY (MW) 2017 2016 2015 2014 2013 Darlington Nuclear Generating Station Located on Lake Ontario in the Municipality of Clarington. The 2,634 19,250 25,619 23,293 27,960 25,051 station has four units. One unit was taken offline in October 2016 for refurbishment. Pickering Nuclear Generating Station Located on Lake Ontario in Pickering. The station has six 3,094 21,411 19,958 21,231 20,045 19,642 operating units and two units in a safe shutdown state. NET GENERATION NET GENERATION (GWh) (1) THERMAL CAPACITY (MW) 2017 2016 2015 2014 2013 Atikokan Generating Station Located near the town of Atikokan in northwestern Ontario. The 205 138 149 109 10 -18 station has one biomass unit. The station stopped using coal in 2012. Brighton Beach (2) Located in Windsor. The station is a combined cycle generating 280 60 123 115 100 Not reported station fuelled by natural gas. -

Power Workers Union

October 20, 2020 Independent Electricity System Operator 1600-120 Adelaide Street West Toronto, ON M5H 1T1 Via email to [email protected] Re: Resource Adequacy Engagement CANADIAN UNION OF PUBLIC EMPLOYEES, The Power Workers’ Union (“PWU”) represents a large portion of the employees LOCAL 1000, C.L.C. working in Ontario’s electricity industry. Attached please find a list of PWU employers. 244 EGLINTON AVE. E. TORONTO, ONTARIO The PWU appreciates the opportunity to provide input on the Resource Adequacy M4P 1K2 Engagement. The PWU is a strong supporter and advocate for the prudent and TEL.: (416) 481-4491 rational reform of Ontario’s electricity sector and recognizes the importance of low- FAX: (416) 481-7115 cost, low-carbon energy to the competitiveness of Ontario’s economic sectors. PRESIDENT Jeff Parnell The PWU believes that IESO processes and initiatives should deliver energy at the lowest reasonable cost while stimulating job creation and growing the province’s gross VICE PRESIDENTS Andrew Clunis domestic product (GDP). We are respectfully submitting our detailed observations Mike Hambly and recommendations. Tom Chessell We hope you will find the PWU’s comments useful. Yours very truly, Jeff Parnell President Printed on recycled and recyclable paper List of PWU Employers Abraflex (2004) Ltd. Alectra Utilities Algoma Power Aptum Atlantic Power Corporation - Calstock Power Plant Atlantic Power Corporation - Kapuskasing Power Plant Atlantic Power Corporation - Nipigon Power Plant Atura - Halton Hills Generating Station Atura - Napanee Generating Station Atura - Portlands Energy Centre Atura – Brighton Beach Generating Station Bracebridge Generation Brookfield Power Wind Operations Brookfield Renewable Power - Mississagi Power Trust Bruce Power Inc. -

A Clean Path to Ozone Annex Compliance: Phasing out Ontario’S Coal-Fired Power Plants

A Clean Path to Ozone Annex Compliance: Phasing Out Ontario’s Coal-Fired Power Plants Prepared by: Cliff Chen, Bruce Biewald, and David White Synapse Energy Economics 22 Pearl Street, Cambridge, MA 02139 www.synapse-energy.com 617-661-3248 Prepared for: The OntAIRio Campaign March 21, 2003 THE OntAIRio CAMPAIGN The production of this report was made possible though the generous financial support of the Salamander Foundation and the Walter and Duncan Gordon Foundation. We would also like to express our appreciation for the support of the Climate Action Network of Canada (CANet). For additional copies of this report, please contact: Sierra Club of Canada 24 Mercer Street, Suite 102 Toronto, ON M5V 1H3 (416) 960-9606 [email protected] Table of Contents 1. Introduction................................................................................................................. 1 2. Ontario’s Aging Coal Fleet .......................................................................................... 3 3. A Clean Alternative ...................................................................................................... 6 4. Coal Phase Out Scenario............................................................................................ 10 5. Conclusion ...................................................................................................................15 References........................................................................................................................ 17 Appendix A: Explanation -

Developing North America's Energy Future

DEVELOPING NORTH AMERICA’S ENERGY FUTURE 12 2012 Annual Report TransCanada Corporation 2012 Financial Highlights Net Income Attributable to Common Shares | $1.30 billion or $1.84 per share Comparable Earnings £® | $1.33 billion or $1.89 per share «>À>LiÊ >À}ÃÊLivÀiÊÌiÀiÃÌ]Ê/>ÝiÃ]Ê i«ÀiV>ÌÊ>`ÊÀÌâ>ÌÊ£® | $4.2 billion Funds Generated from Operations £® | $3.3 billion >«Ì>Ê Ý«i`ÌÕÀiÃ]Ê µÕÌÞÊÛiÃÌiÌÃÊ>`ÊVµÕÃÌÃÊ NÊ $3.5 billion Ê- >ÀiÊ Û`i`ÃÊ iV>Ài`Ê NÊ $1.76 per share Net Income Attributable Comparable Earnings(1) Comparable EBITDA(1) Funds Generated from Capital Expenditures, Equity to Common Shares (millions of dollars) (millions of dollars) Operations(1) (millions of dollars) Investments and Acquisitions (millions of dollars) (millions of dollars) 2,000 2,000 5,000 5,000 8,000 4,544 4,245 1,526 1,559 1,600 1,600 4,000 3,686 4,000 6,400 1,357 3,451 1,299 1,330 3,284 1,233 3,161 4,973 1,200 1,200 3,000 3,000 4,800 3,146 3,461 800 800 2,000 2,000 3,200 400 400 1,000 1,000 1,600 0 0 0 0 0 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 Net Income per Share Comparable Earnings Dividends Declared Common Shares Market Price – Close (1) – Basic (dollars) per Share (dollars) per Share (dollars) Outstanding – Average Toronto Stock Exchange (millions of shares) (dollars) 3 3 3 1,000 50 47.02 44.53 2.22 37.99 2.17 800 40 691 702 705 1.96 1.89 2 1.84 2 2 1.77 1.76 1.68 1.60 600 30 400 20 1 1 1 200 10 0 0 0 0 0 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 2010 2011 2012 (1) Non-GAAP measure that does not have any standardized meaning prescribed by generally accepted accounting principles (GAAP). -

Meeting Toronto's Electricity Supply Needs

ONTARIO CLEAN AIR QUALITY ISSUES FACT SHEET #19 AIR ALLIANCE A comparison of the Meeting Toronto’s ▼ Portlands Energy www.cleanairalliance.org Electricity Supply Centre and the Needs: Toronto Waterfront Clean Energy Centre Toronto is one of the largest cities in North America that has no significant electricity generation capacity within its own vicinity — the city generates just 1.2% of the power used within its boundaries while using close to 20% of the power produced in Ontario. Currently, the central city south of Eglinton (between Hwy. 427 and Victoria Park) receives almost its entire electricity supply via two Hydro One transmission corridors. This leaves the city highly reliant on large centralized supply sources outside of the city, such as the Pickering and Darlington nuclear stations and the giant Nanticoke coal-fired station on Lake Erie. It has been widely recognized that this current power structure leaves the city highly vulnerable to power disrup- tions while also creating serious system inefficiencies. To address this imbalance, efforts are underway to locate new generation capacity within the city, while also improving overall energy efficiency (Toronto Hydro, for exam- ple, has set a goal of reducing peak demand in Toronto by 5% by 2007). This, in turn, has led to two proposals to build new generation facilities on the eastern waterfront: • The Portlands Energy Centre (PEC) is a joint venture of Ontario Power Generation and TransCanada that is proposing to build a 550 megawatt (MW) combined-cycle* natural gas power plant near the site of the mothballed Hearn Generating Station. The PEC plan has undergone a complete environmental assess- ment. -

MRP Report V4

GENERATING CHANGE: SUSTAINABLE ADAPTIVE REUSE OF URBAN POWER PLANTS IN-DEPTH CASE STUDIES AND PLANNING IMPLICATIONS FOR THE HEARN, TORONTO by Julia Smith MA, Maastricht University, 2011 BA, University of Toronto, 2009 A Major Research Paper presented to Ryerson University in partial fulfillment of the requirements for the degree of Master of Planning in Urban Development Toronto, Ontario, Canada, 2015 © Julia Smith 2015 Author’s Declaration for Electronic Submission of a MRP I hereby declare that I am the sole author of this MRP. This is a true copy of the MRP, including any required final revisions. I authorize Ryerson University to lend this MRP to other institutions or individuals for the purposes of scholarly research. I further authorize Ryerson University to reproduce this MRP by photocopying or by other means, in total or in part, at the request of other institutions or individuals for the purpose of scholarly research. I understand that my MRP may be made electronically available to the public. ii GENERATING CHANGE: SUSTAINABLE ADAPTIVE REUSE OF URBAN POWER PLANTS IN-DEPTH CASE STUDIES AND PLANNING IMPLICATIONS FOR THE HEARN, TORONTO © Julia Smith 2015 Master of Planning in Urban Development Ryerson University ABSTRACT Cities across the western world are making the transition away from coal energy, and towards greener methods of power generation; as a result, abandoned power plants, including Toronto’s Richard L. Hearn Power Generation Station, are now features of many post-industrial urban landscapes. Largely out of use since 1983, the Hearn has seen a variety of redevelopment concepts over the last 30 years, but recent initiatives to revitalize Toronto’s Waterfront and industrial Port Lands have spurred renewed interest in the site. -

Generating Capacity and Production

GENERATING CAPACITY AND PRODUCTION GENERATING ELECTRICITY PRODUCTION (GWh) CAPACITY (MW) at Dec. 31, 2019 2019 2018 2017 2016 2015 HYDROELECTRIC, SOLAR & WIND Central Operations − Hydroelectric − − − 668 493 564 OPG moved from five to four Ontario operating regions in 2018. Eagle Creek Renewable Energy Includes 85 hydroelectric stations and minority shareholdings in 13 hydroelectric 627 1,239 105 − − − stations and two solar facilities. Headquarters in Morristown, New Jersey. OPG acquired Eagle Creek in 2018. Eastern Operations − Hydroelectric 2,625 13,218 13,185 14,517 12,535 12,241 Includes 22 hydroelectric stations. Headquarters in Renfrew, Ontario. Nanticoke Solar 44 58 − − − − Solar facility located in Haldimand County, Ontario. In−service as of 2019. Northeast Operations − Hydroelectric 1,846 3,243 4,019 3,584 3,779 4,057 Includes 21 hydroelectric stations. Headquarters in Timmins, Ontario. Northwest Operations − Hydroelectric 687 3,367 2,892 3,065 3,089 3,497 Includes 11 hydroelectric stations. Headquarters in Thunder Bay, Ontario. Pickering Wind Turbine (Retired) − 0 2 2 3 3 Previously located in Pickering, Ontario. The turbine was dismantled in 2019. South Central Operations − Hydroelectric 2,319 12,534 12,174 11,250 12,015 12,547 Includes 12 hydroelectric stations. Headquarters in Niagara area, Ontario. NUCLEAR Darlington Nuclear Generating Station Located in the Municipality of Clarington, Ontario. The station has four units. One 2,634 19,860 20,029 19,250 25,619 23,293 unit was taken offline in October 2016 for refurbishment. Pickering Nuclear Generating Station Located in Pickering, Ontario. The station has six operating units and two units in 3,094 23,605 20,850 21,411 19,958 21,231 a safe shutdown state. -

Annual Report 2004 Corporate Profile

Annual Report 2004 Corporate Profile Ontario Power Generation Inc. is an Ontario-based electricity generation company whose principal business is the generation and sale of electricity in Ontario and to interconnected markets. Our focus is on the efficient production and sale of electricity from our generation assets, while operating in a safe, open and environmentally responsible manner. In 2004, OPG generated 105 terawatt hours (TWh) of electricity. OPG’s electricity generating portfolio, as of December 31, 2004, had a total in-service capacity of 22,790 megawatts (MW), which consisted of: • three nuclear stations with a capacity of 6,103 MW (excludes Pickering A, Units 2 and 3, which have a capacity of 1,030 MW and are currently laid up) and Pickering A, Unit 1, with a capacity of 515 MW, currently being returned to service; • six fossil-fuelled stations with a capacity of 9,718 MW; • 64 hydroelectric stations with a capacity of 6,962 MW; • three wind power stations (which includes OPG’s 50 per cent interest in the Huron Wind joint venture) with a capacity of 7 MW. OPG co-owns one gas-fired station with ATCO Power Canada Ltd. and ATCO Resources Ltd. In addition, OPG has leased two nuclear stations on a long-term basis to Bruce Power L.P. Contents 2 Message from the Chairman and the President 74 Board of Directors 10 Management’s Discussion and Analysis 74 Governance 44 Consolidated Financial Statements 76 Officers 48 Notes to the Consolidated Financial Statements Ontario Power Generation Facilities – see inside back cover Electricity Terms One megawatt (MW) is one million watts. -

Communication from Kevin Dick, General Manager, Portlands Energy Centre

PG23.6.6 PG23.6.6 Portlands Energy Centre 470 Unwin Ave, Toronto ON M4M 389 PH: 416.462.8670 www.portlandsenergycentre.com Planning and Growth Management Committee 10°1 Floor, West, City Hall October 11, 2017 100 Queen Street West Toronto, ON M5H2N2 To whom it may concern: Re: Draft Official Plan Amendment - The Port Lands I am writing you on behalf of Portlands Energy Center ("PEC") as a tenant of Ontario Power Generation Inc. ("OPG") in connection with its properties located at 470 Unwin Avenue (the Po1tlands Energy Centre) located in the Central Waterfront Secondaiy Plan Area. As OPG's tenant PEC has been copied on the correspondence to date that OPG has provided the City of Toronto regarding the Official Plan Amendment for the Pott Lands. Specifically, PEC was copied on the correspondence that occurred on April 12, 2017 and May 25, 201 7. However, PEC wished to advise you independently that we share some of the concerns with the proposed Official Plan Amendment. Kindly accept this letter, which details PEC's concerns regarding the proposed amendments to the Central Waterfront Secondary Plan ("CWS Plan") concerning lands located within the area known as the Pott Lands. In reviewing the draft Official Plan Amendment for the Pott Lands ("Draft OPA") there are a number of concerns that PEC identified and had previously discussed with the City of Toronto in their consultation in advance of the publication of the Draft OPA. Specifically, the Draft OPA does not recognize the existing land uses by PEC on OPG's lands which are leased by PEC. -

EB-2012-0451/EB-2012-0433/EB-2013-0074 Exhibit M.IESO.GEC.1 Page 1 of 1

EB-2012-0451/EB-2012-0433/EB-2013-0074 Exhibit M.IESO.GEC.1 Page 1 of 1 INDEPENDENT ELECTRICITY SYSTEM OPERATOR RESPONSE TO GREEN ENERGY COALITION INTERROGATORY #1 INTERROGATORY Issue A.1. Reference IESO Letter, June 28, 2013 Questions Please identify the witnesses who will sponsor the evidence, and explain their relationship to the documents in the Appendices to the letter (e.g., author, familiar with the development of the document, no relationship) RESPONSE The IESO witnesses are: Dan Rochester, Manager – Reliability Assessments. Mr. Rochester’s relationship with the documents in the Appendices to the letter is as follows: o Appendix 1 – limited review and limited familiarity with the content o Appendices 2 and 6 – no relationship o Appendices 3 to 5 - author David Robitaille, Manager – Operational Effectiveness. Mr. Robitaille’s relationship with the documents in the Appendices to the letter is as follows: o Appendix 1, 2 and 6 – no relationship o Appendices 3 to 5 – familiar with the content EB-2012-0451/EB-2012-0433/EB-2013-0074 Exhibit M.IESO.GEC.2 Page 1 of 1 INDEPENDENT ELECTRICITY SYSTEM OPERATOR RESPONSE TO GREEN ENERGY COALITION INTERROGATORY #2 INTERROGATORY Issue A.1. Reference IESO Letter, June 28, 2013 Questions Please provide the equivalent of Table 1 for “Capability at Winter Peak.” RESPONSE The Forecast Capability at 2013/2014 Winter Peak is included and provided in the last column of the table below: Total Forecast Change in Forecast Installed Capability at Number Installed Change in Capability at Fuel Type Capacity -

Greenhouse Gas Emissions Associated with Various Methods of Power Generation in Ontario

GREENHOUSE GAS EMISSIONS ASSOCIATED WITH VARIOUS METHODS OF POWER GENERATION IN ONTARIO October 2016 Prepared For: Ontario Power Generation Inc. 700 University Avenue Toronto, Ontario M5G 1Z5 6605 Hurontario Street , Suite 500, Mississauga, Ontario ▪ L5T 0A3 Tel: 905-364-7800 ▪ Fax: 905-364-7816 ▪ www.intrinsik.com DISCLAIMER Intrinsik Corp. (hereafter referred to as Intrinsik) provided this report to Ontario Power Generation Inc. (OPG) solely for the purpose stated in the report. Intrinsik does not accept any responsibility for the use of this report for any purpose other than as specifically intended by OPG. Intrinsik does not have, and does not accept, any responsibility or duty of care whether based in negligence or otherwise, in relation to the use of this report in whole or in part by any third party. Any alternate use, including that by a third party, or any reliance on or decision made based on this report, are the sole responsibility of the alternative user or third party. Intrinsik does not accept responsibility for damages, if any, suffered by any third party as a result of decisions made or actions based on this report. Intrinsik makes no representation, warranty or condition with respect to this report or the information contained herein other than that it has exercised reasonable skill, care and diligence in accordance with accepted practice and usual standards of thoroughness and competence for the profession of toxicology and environmental science to assess and evaluate information acquired during the preparation of this report. Any information or facts provided by others, and referred to or utilized in the preparation of this report, is believed to be accurate without any independent verification or confirmation by Intrinsik. -

3.05 Electricity Power System Planning

Chapter 3 Ministry of Energy Section 3.05 Electricity Power System Planning 1.0 Background 1.2 Key Players Involved The entities involved in power system planning in Ontario include the Ministry of Energy (Ministry), 1.1 What Is Electricity Power the Independent Electricity System Operator System Planning? (IESO), the Ontario Energy Board (OEB), Ontario Electricity power system planning involves man- Power Generation (OPG), Hydro One, a major aging the long-term demand for electricity and transmitter and distributor (see Section 3.06 of deciding how to meet that demand through vari- this year’s Annual Report for our audit of Hydro ous generation, conservation and transmission One’s Management of Electricity Transmission solutions: and Distribution Assets), four other small licenced Generation—Ontario has a diverse mix of transmitters and approximately 70 local distribu- Chapter 3 • VFM Section 3.05 • energy sources (called the “supply mix”) tion companies. Figure 1 shows the key roles and including nuclear, hydropower, natural gas, responsibilities of each. wind, solar and bioenergy. The Ministry and the IESO are the key players in • Conservation—Ontario encourages consum- power system planning at the provincial level. Their ers to reduce or shift consumption away from plans aim to ensure adequate supply, bulk transmis- peak times and to use energy more efficiently, sion planning and interaction with local distribu- with the intent to avoid the need for increased tion companies. Under the Electricity Act, 1998, the electricity generation and to avoid or defer the Minister has the authority to issue directives (which need for significant investment in new electri- require cabinet approval) on the supply mix, and city infrastructure.