Selected Info State Banks

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2008 Handbook on Client Trust Accounting for California Attorneys

Handbook on Client Trust Accounting for California Attorneys Publication of The State Bar of California 2009* This Handbook on Client Trust Accounting for California Attorneys is issued by the State Bar's Office of Professional Competence, Planning and Development. It has not been adopted or endorsed by the State Bar's Board of Governors, and does not constitute the official position or policy of the State Bar of California. It is advisory only and is not binding upon the California Supreme Court, the State Bar Court, or any office or person charged with responsibility for attorney discipline or regulation. The Handbook contains legal information, not legal advice. Nothing contained in this Handbook is intended to address any specific legal inquiry, nor is it a substitute for independent legal research to original sources or for obtaining the advice of legal counsel with respect to legal problems. The workbook may not be reproduced or copied in any manner without the express, written permission of the State Bar of California. For information or a copy of this workbook, contact the Office of Professional Competence, Planning and Development, State Bar of California, 180 Howard Street, San Francisco, California 94105 (415) 538-2112. © Copyright 1992, 2003, 2006, 2008, 2009 by The State Bar of California All rights reserved. Acknowledgments he State Bar of California gratefully acknowledges that the idea for this Handbook arose out of the exhaustive book on client trust T accounting prepared by David Johnson, Jr., the Director of Attorney Ethics of the Supreme Court of New Jersey. Although the client trust accounting rules in New Jersey differ from those in California, the same basic principles of accounting apply. -

Summary of Pending Applications As of Dec 2001

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2001 APPLICATION TYPE PAGE NO. BANK APPLICATIONS NEW BANKS 1 CONVERSION TO STATE CHARTER 3 MERGERS 3 ACQUISITION OF BRANCH OFFICE 4 ACQUISITION OF TRUST BUSINESS 4 APPLICATION FOR TRUST POWERS 4 TRANSFORMATION OF TRUST COMPANY TO COMMERCIAL BANK WITH TRUST POWERS 4 NEW BRANCHES 5 NEW PLACES OF BUSINESS 10 EXTENSION OF BANKING OFFICE 12 HEAD OFFICE RELOCATIONS 12 BRANCH OFFICE RELOCATIONS 12 PLACE OF BUSINESS RELOCATIONS 14 DISCONTINUANCE OF BRANCH OFFICES 14 DISCONTINUANCE OF PLACES OF BUSINESS 16 CHANGE OF NAME 16 APPLICATION PURSUANT TO SECTION 772 17 INDUSTRIAL BANK APPLICATIONS NEW PLACES OF BUSINESS 17 DISCONTINUANCE OF BRANCH OFFICES 17 INDUSTRIAL LOAN COMPANY APPLICATIONS NEW INDUSTRIAL LOAN COMPANY 18 CHANGE OF NAME 18 FOREIGN (OTHER NATION) BANK APPLICATIONS NEW OFFICES 19 RELOCATIONS 19 DISCONTINUANCE OF OFFICES 20 FOREIGN (OTHER STATE) BANK APPLICATIONS NEW FACILITY 20 CREDIT UNION APPLICATIONS CONVERSIONS TO STATE CHARTER 21 MERGERS 22 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 24 CHANGE OF NAME 24 TRANSMITTERS OF MONEY ABROAD APPLICATIONS NEW TRANSMITTERS 24 BUSINESS AND INDUSTRIAL DEVELOPMENT CORPORATION HEAD OFFICE RELOCATION 25 1 BANK APPLICATIONS NEW BANKS Filed: 4 Approved: 3 Opened: 1 AMERICAN PREMIER BANK Proposed Location: in the vicinity of East Huntington Drive between Baldwin and Fifth Avenue, Arcadia, Los Angeles County Correspondent: Henry M. Fields Morrison & Foerster, LLP, 555 West Fifth Street, Los Angeles, CA 90013-1024 Phone: (213) 892-5200 Filed: 1/31/01 Approved: 6/21/01 GB INTERIM BANK 800 West Sixth Street, Los Angeles, Los Angeles County Correspondent: T. -

CHSA HP2010.Pdf

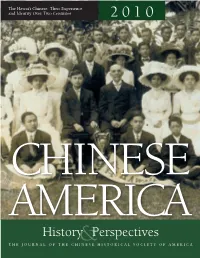

The Hawai‘i Chinese: Their Experience and Identity Over Two Centuries 2 0 1 0 CHINESE AMERICA History&Perspectives thej O u r n a l O f T HE C H I n E s E H I s T O r I C a l s OCIET y O f a m E r I C a Chinese America History and PersPectives the Journal of the chinese Historical society of america 2010 Special issUe The hawai‘i Chinese Chinese Historical society of america with UCLA asian american studies center Chinese America: History & Perspectives – The Journal of the Chinese Historical Society of America The Hawai‘i Chinese chinese Historical society of america museum & learning center 965 clay street san francisco, california 94108 chsa.org copyright © 2010 chinese Historical society of america. all rights reserved. copyright of individual articles remains with the author(s). design by side By side studios, san francisco. Permission is granted for reproducing up to fifty copies of any one article for educa- tional Use as defined by thed igital millennium copyright act. to order additional copies or inquire about large-order discounts, see order form at back or email [email protected]. articles appearing in this journal are indexed in Historical Abstracts and America: History and Life. about the cover image: Hawai‘i chinese student alliance. courtesy of douglas d. l. chong. Contents Preface v Franklin Ng introdUction 1 the Hawai‘i chinese: their experience and identity over two centuries David Y. H. Wu and Harry J. Lamley Hawai‘i’s nam long 13 their Background and identity as a Zhongshan subgroup Douglas D. -

Department of Financial Institutions Summary of Pending Applications As of December 2010

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2010 Assembly Bill 1301 (Gaines) Changes Procedures for Banking Office Applications AB 1301 (Gaines) became law on January 1, 2009. Among the changes made by the new law were to: Reclassify banking offices as head office, branch office and facility; Eliminate the place of business and extension of banking office categories; Eliminate the requirement that banks give advance notice to DFI before opening or relocating a banking office, or redesignating a head office and branch office. Consequently, notice of banking offices that open, relocate or are redesignated on or after January 1, 2009 will only be published after the fact. Eliminate the Miscellaneous Powers and Provisions chapter of the Financial Code that required banks receive approval to engage in certain activities, e.g., FC 752, FC 772, etc. APPLICATION TYPE PAGE NO. BANK APPLICATION CONVERSION TO STATE CHARTER 1 MERGER 1 ACQUISITION OF CONTROL 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE REDESIGNATION 3 BRANCH OFFICE RELOCATION 4 DISCONTINUANCE OF BRANCH OFFICE 4 DISCONTINUANCE OF FACILITY 6 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 7 DISCONTINUANCE OF BRANCH 7 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 7 VOLUNTARY SURRENDER OF LICENSE 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 9 DISCONTINUANCE 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 9 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 10 ACQUISITION -

Weiss Research's Recent White Paper

Dangerous Unintended Consequences: How Banking Bailouts, Buyouts and Nationalization Can Only Prolong America’s Second Great Depression and Weaken Any Subsequent Recovery Presented by Martin D. Weiss, Ph.D. Weiss Research, Inc. National Press Club Washington, DC March 19, 2009 Copyright © 2009 by Weiss Research 15430 Endeavour Drive Jupiter, FL 33478 Media Contacts Joy Howell Phone: 202.828.7838 Email: [email protected] Elizabeth Kelley Grace Phone: 561.989.9855 Email: [email protected] Pam Reimer (Broadcast) Phone: 608.727.2600 Email: [email protected] Martin D. Weiss, Ph.D., president of Weiss Research, Inc., is one of the nation’s leading advocates for investors and savers, helping hundreds of thousands find safety even in the worst of times. Issuing warnings of future failures without ambiguity and with months of advance lead time, Weiss predicted the demise of Bear Stearns 102 days prior to its failure, Lehman Brothers (182 days prior), Fannie Mae (eight years prior), and Citigroup (110 days prior). Similarly, the U.S. Government Accountability Office (GAO) reported that, in the 1990s, Weiss greatly outperformed Moody’s, Standard & Poor’s, A.M. Best and D&P (now Fitch) in warning of future insurance company failures. Dr. Weiss holds a Ph.D. from Columbia University, and has testified many times before Congress, providing constructive proposals for reform in the financial industry. Weiss Research, Inc. is an independent investment research firm founded in 1971, providing information and tools to help investors and savers make sound financial decisions through its free daily e‐letter, Money and Markets, its monthly Safe Money Report, and other investor publications. -

“IOLTA-Eligible” L

All of the financial institutions identified below are eligible to hold IOLTA. If your financial institution is not identified on the list below but would like to become eligible to hold an IOLTA, please call the Legal Services Trust Fund Program at the State Bar of California to determine how to become eligible. “IOLTA–Eligible” Financial Institutions 5.7.08 1st Centennial Bank City National Bank Gilmore Bank Premier Commercial Bank 1st Century Bank Coast National Bank Gold Country Bank Premier Service Bank 1st Enterprise Bank Comerica Bank Golden State Business Bank Premier Valley Bank 1st Pacific Bank of California Commerce Bank of Folsom Golden Valley Bank Premier West Bank Affinity Bank Commerce Bank of Temecula Granite Community Bank Presidio Bank Alliance Bank Valley Greater Bay Bank Private Bank of the Peninsula Alta Alliance Bank Commerce National Bank Guaranty Bank Professional Business Bank America California Bank Commerce West Bank Hanmi Bank Promerica Bank American Business Bank Commercial Bank of California Heritage Bank of Commerce Provident Bank American Continental Bank Commonwealth Business Heritage Oaks Bank Rabobank, N.A. American Premier Bank Bank HSBC Bank Redding Bank of Commerce American Principle Bank Community Bank Imperial Capital Bank Redwood Capital Bank American River Bank Community Bank of San Inland Community Bank Regents Bank American Riviera Bank Joaquin Innovative Bank River City Bank American Security Bank Community Bank of Santa International City Bank River Valley Community Bank Americas United Bank -

The Banking Industry

2010 STATE OF THE INDUSTRY REPORT ON THE CONDITION OF CALIFORNIA COMMERCIAL BANKING California Bankers Association Carpenter & Company 1303 J Street, Suite 600 Five Park Plaza, Suite 950 Sacramento, California 95814 Irvine, California 92614 916-441-7377 949-261-8888 Richard P. Smith, Chairperson Edward J. Carpenter, Chairman Rodney K. Brown, President John D. Flemming, President 200404 2010 TABLE OF CONTENTS INTRODUCTION ........................................................................................................... 1 THE ECONOMY United States ................................................................................................... 3 California Trends ........................................................................................... 15 THE BANKING INDUSTRY National Trends ............................................................................................. 23 California Trends ........................................................................................... 31 THE CHANGING ENVIRONMENT Banking Failures ............................................................................................. 39 Commercial Real Estate ................................................................................ 49 INDUSTRY VALUATIONS Mergers and Acquisition Activity ................................................................ 55 National Stock Prices .................................................................................... 57 California Stock Prices ................................................................................. -

The Los Angeles Business Journal Digital Edition

2-Page Spread Single Page View Thumbnails | LABJ User Guide | Front Page | Table of Content Previous Page Zoom In Zoom Out Next Page labusinessjournal.com LOS ANGELES BUSINESS JOURNALL TM DIGITAL EDITION THE COMMUNITY OF BUSINESS www.labusinessjournal.com/digital WELCOME TO THE LOS ANGELES BUSINESS JOURNAL DIGITAL EDITION To read your copy of the Digital Edition INSTRUCTION Please select a reading preference FOR PC/MAC How to read LABJ Digital Edition on iPad in iBooks: 1 TAP CENTER 2 TAP ‘OPEN WITH’ 3 TAP ‘iBOOKS’ Wait for gray bar with Wait for scroll down menu menu buttons to appear on and tap the iBooks icon. top of the PDF. Wait for PDF to load in iBOOKS. 2-Page Spread Single Page View Thumbnails | LABJ User Guide | Front Page | Table of Content Previous Page Zoom In Zoom Out Next Page labusinessjournal.com LOS ANGELES BUSINESS JOURNAL Volume 33, Number 25 THE COMMUNITY OF BUSINESSTM June 20 - 26, 2011 • $3.00 Up SPECIAL REPORT BANKING AND FINANCE Painful Breakup Front In Development REAL ESTATE: Will partners’ split cost Casden properties? By ALFRED LEE Staff Reporter A dispute with a longtime partner has brought bil- lionaire residential developer Alan Casden to the brink Local firm cap- of foreclosure on six properties, including his prized tured time on a Palazzo mixed-used complex in Westwood Village. bottle with its Lenders led by Comerica Bank say that Casden has caps that say been missing payments since November and have filed when to take foreclosure lawsuits on the six properties, including your pill. PAGE 3 development sites in Los Angeles and Ventura counties. -

Weakest Banks and Thrifts and Weakest Insurers

Weiss “X” List 1st Centennial Bk Bank of North Georgia CNLBank 1st United Bk Bank of the Carolinas Cole Taylor Bk Acacia FSB Bank of the Cascades College Svgs Bk Advantage Bk Bank of the Orient Colonial Bank Affinity Bk Bank of the Pacific Colorado East B&T Alliance Bank Bank Trust Columbia River Bk Alliance Bk BankAtlantic Columbia St Bk Alliance Bk Corp WeakestBankUnited Banks FSB and ThriftsCommunity B&T Allstate Bk Banner Bk Community B&TC Amboy Bank Baraboo NBand Community B&TC Amcore Bk NA Barclays Bank Delaware Community Banks of CO American Bk WeakestBarnes Bkg Co Insurers Community Bk of Nevada American Bk Baylake Bk Community Central BK American Bk North Beach Community Bk Community South Bk American Bk of Commerce Beach First NB Community St Bk NA American Founders Bk Inc BPD Bk Community West Bk Americanwest Bk Bridgeview Bk Group Communityone Bank, NA Ameriprise Bank, FSB Broadway Bk Compass Bank Amtrust Bank Buckhead Community Bk Conestoga Bank Anchor MSB Builders Bk Cooperative Bk Anchorbank FSB Business Bk of St Louis Corus Bk NA Appalachian Community Bk Butte Cmnty Bk Countrywide Bank, FSB Archer Bk California NB County Bk Armed Forces Bk NA Cape Bank Cowlitz Bk Artisans Bk Capital City Bk Crescent B&T Atlantic Central Bankers Bk Capitalbank Crescent B&TC Atlantic Coast Bank CapitalSouth Bank Darby B&TC Atlantic Southern Bank Carolina First Bk Delaware County B&TC Avidia Bank Carver FSB Desert Hills Bk Banco Bilbao Vizcaya CB&T Bk of Middle Georgia Doral Bank Puerto Rico Argenta Central Co-Op Bk E*Trade Bank Banco Popular -

Sojourners and Settlers, Chinese Migrants in Hawaii

Sojourners and Settlers CHINESE MIGRANTS IN HAWAII Sojourners and Settlers CHINESE MIGRANTS IN HAWAII Clarence E. Glick HAWAII CHINESE HISTORY CENTER AND THE UNIVERSITY PRESS OF HAWAII Honolulu COPYRIGHT © 1980 BY THE UNIVERSITY PRESS OF HAWAII All rights reserved Manufactured in the United States of America Library of Congress Cataloging in Publication Data Glick, Clarence Elmer, 1906– Sojourners and settlers: Chinese migrants in Hawaii. Includes bibliographical references and index. 1. Chinese Americans—Hawaii—History. 2. Hawaii—Foreign population. 1. Title. DU624.7.C5C46 996.9 004951 80-13799 ISBN 0–8248–0707–3 The jacket photo of a Honolulu Chinese family, circa 1912, is reproduced courtesy of Helen Kam Fong and the Hawaii Multi-Cultural Center. Contents Title Page iii Copyright 4 Tables vi Maps vii Preface viii Acknowledgments xii 1. The Cycle of Migration 1 2. On the Sugar Plantations 20 3. On the Rural Frontier 40 4. On the Urban Frontier 60 5. Settlement, Investment, Entrenchment 92 6. Urbanization 118 7. The Migrants’ Chinatown 127 8. Migrant Families 149 9. Group Identity and Early Migrant Organizations 170 10. Migrant Organizations and Community Crises 191 11. Differentiation and Integration 215 12. From Familism to Nationalism 242 13. Personal Prestige 278 14. Group Status 294 Appendix: Population of the Hawaiian Islands by Racial and Ethnic Groups: 1853–1970 319 Glossary 367 Index 378 Authors Cited in Notes 392 Plates 395 v Tables 1. Arrivals of Chinese in Hawaii: 1852–1899 2. Chinese Men Engaged in Rural Occupations in Hawaii: 1884–1930 3. Percentage Distribution of Chinese Men Employed in Hawaii by Occupational Class: 1890–1970 4. -

For Government Actions to Avert Large Bank Failures Is the Concern That

Dangerous Unintended Consequences: How Banking Bailouts, Buyouts and Nationalization Can Only Prolong America’s Second Great Depression and Weaken Any Subsequent Recovery Presented by Martin D. Weiss, Ph.D. Weiss Research, Inc. National Press Club Washington, DC March 19, 2009 Copyright © 2009 by Weiss Research 15430 Endeavour Drive Jupiter, FL 33478 Media Contacts Joy Howell Phone: 202.828.7838 Email: [email protected] Elizabeth Kelley Grace Phone: 561.989.9855 Email: [email protected] Pam Reimer (Broadcast) Phone: 608.727.2600 Email: [email protected] Martin D. Weiss, Ph.D., president of Weiss Research, Inc., is one of the nation’s leading advocates for investors and savers, helping hundreds of thousands find safety even in the worst of times. Issuing warnings of future failures without ambiguity and with months of advance lead time, Weiss predicted the demise of Bear Stearns 102 days prior to its failure, Lehman Brothers (182 days prior), Fannie Mae (eight years prior), and Citigroup (110 days prior). Similarly, the U.S. Government Accountability Office (GAO) reported that, in the 1990s, Weiss greatly outperformed Moody’s, Standard & Poor’s, A.M. Best and D&P (now Fitch) in warning of future insurance company failures. Dr. Weiss holds a Ph.D. from Columbia University, and has testified many times before Congress, providing constructive proposals for reform in the financial industry. Weiss Research, Inc. is an independent investment research firm founded in 1971, providing information and tools to help investors and savers make sound financial decisions through its free daily e‐letter, dMoney an Markets, its monthly Safe Money Report, and other investor publications. -

December 2005

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2005 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 6 MERGER 7 ACQUISITION OF CONTROL 7 FINAL ORDER (Financial Code Section 1913) 8 NEW BRANCH 8 NEW PLACE OF BUSINESS 16 NEW EXTENSION OFFICE 19 HEAD OFFICE RELOCATION 19 HEAD OFFICE RELOCATION WITH ESTABLISHMENT OF BRANCH OFFICE 20 HEAD OFFICE REDESIGNATION 20 BRANCH OFFICE RELOCATION 20 PLACE OF BUSINESS RELOCATION 22 DISCONTINUANCE OF BRANCH OFFICE 23 DISCONTINUANCE OF PLACE OF BUSINESS 23 DISCONTINUANCE OF EXTENSION OFFICE 24 CHANGE OF NAME 25 PURCHASE WHOLE BUSINESS UNIT 25 INDUSTRIAL BANK APPLICATION NEW BRANCH 25 NEW PLACE OF BUSINESS 26 HEAD OFFICE RELOCATION 26 BRANCH OFFICE RELOCATION 26 DISCONTINUANCE OF BRANCH OFFICE 26 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 27 HEAD OFFICE RELOCATION 28 ACQUISITION OF CONTROL 28 CHANGE OF NAME 28 TRUST COMPANY APPLICATION HEAD OFFICE RELOCATION 28 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 29 RELOCATION OF OFFICE 29 DISCONTINUANCE OF OFFICE 29 CHANGE OF NAME 29 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 29 RELOCATION 30 ii SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2005 APPLICATION TYPE PAGE NO. CREDIT UNION APPLICATION CONVERSION TO STATE CHARTER 31 MERGER 31 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 32 CHANGE OF NAME 32 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 32 ACQUISITION OF CONTROL 33 MERGER 34 FINAL ORDER (Financial Code Section 1818) 34 CHANGE OF NAME