IAGL 4E and Annual Report (6.44

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fire & General Insurance Providers

FIRE & GENERAL INSURANCE PROVIDERS COMPANY FINANCIAL STRENGTH RATING RATING AGENCY AIG Asia Pacific Insurance Pte Ltd A A M Best A+ Standard & Poor’s AIG Insurance NZ Ltd A Standard & Poor’s Allianz Australia Insurance Limited AA- [*] Standard & Poor’s Ando (UK) Insurance Group Limited Refer Lloyd’s Ando Insurance Group Limited A- [*] A M Best (underwritten by Hollard Insurance Company Pty Ltd) AWP Services New Zealand Limited A- [*] A M Best trading as Allianz Partners (underwritten by Hollard Insurance Company Pty Ltd) Berkshire Hathaway Speciality Insurance A ++ A M Best (incl. BHSI Facilities) AA+ Standard & Poor’s Chubb Insurance New Zealand Ltd AA- Standard & Poor’s Classic Cover (underwritten by Lumley a Refer NZI a division of IAG New business division of IAG New Zealand Ltd) Zealand Ltd Cover-more (NZ) Ltd Refer Zurich New Zealand Dealersblock Insurance (Bus) Refer NZI a division of IAG New Zealand Ltd Delta Insurance NZ Ltd Refer Lloyd’s Delta Property Insurance Limited Refer Lloyd’s Dual New Zealand Ltd Refer Lloyd’s Ed Brokering LLP Refer Lloyd’s GT Insurance Refer Allianz Australia Insurance Limited HDI Global SE, Australia A+ [*] Standard & Poor’s Insurance Wholesale Limited Refer Lloyd’s International Underwriting Agencies Ltd Refer Lloyd’s, NZI a division of IAG New Zealand Ltd:-as advised Lumley, a business division of IAG New Refer NZI a division of IAG New Zealand Ltd Zealand Ltd NZI a division of IAG New Zealand Ltd AA- Standard & Poor’s (Incl. NZI Standard) NZI and Vero Insurance Refer NZI a division of IAG New Zealand -

Nzhc 2956 Between Gregory Peter Young and Mall

IN THE HIGH COURT OF NEW ZEALAND CHRISTCHURCH REGISTRY CIV-2015-409-000222 [2016] NZHC 2956 BETWEEN GREGORY PETER YOUNG AND MALLEY & CO TRUSTEES LIMITED AS TRUSTEES OF THE MCARA YOUNG TRUST Plaintiffs AND TOWER INSURANCE LIMITED Defendant Hearing: 29 August-2 September, 5-9 September & 14 October 2016 Appearances: P F Whiteside QC and H T Shaw for Plaintiffs M C Harris and ATB Joseph for Defendant Judgment: 7 December 2016 JUDGMENT OF GENDALL J YOUNG v TOWER INSURANCE LIMITED [2016] NZHC 2956 [7 December 2016] Table of Contents Para No Introduction [1] Factual background [4] Mr Sinclair instructed [31] The Policy [41] Approach to interpreting the policy [43] The plaintiffs’ claims [47] The defendant’s response [48] Issues [50] What is the extent of earthquake caused damage? [50] Is Tower’s repair strategy commonly used at the time of loss or damage? [54] (a) What is the repair method/strategy proposed by the defendant? [55] (b) Is the repair strategy proposed a construction method commonly used [68] at the time of the earthquakes? In the alternative, if the repair strategy is one commonly used, is the [82] damage economically repairable? (a) Will the proposed repair strategy work and return the house to an as [83] new condition? (b) The economic viability of the repair strategy? [100] Has Tower made an election to cash settle the plaintiffs’ claim? [122] Rebuild cost? [129] General and exemplary damages claim [145] Exemplary damages [147] General damages [151] Relief sought [178] Result [186] Costs [190] Introduction [1] This is a claim brought by the plaintiffs who have a residential property on the Christchurch hills insured through Tower Insurance Limited, the defendant company, which was significantly damaged as a result of the Canterbury earthquake sequence in 2010 and 2011. -

Commerce Act 1986: Business Acquisition

Commerce Act 1986: Business Acquisition Section 66: Notice Seeking Clearance for proposed acquisition of Lumley General Insurance (N.Z.) Limited by IAG (NZ) Holdings Limited Date: 19 December 2013 To: The Registrar Market Structure Team Commerce Commission PO Box 2351 Wellington By email: [email protected] Pursuant to section 66(1) of the Commerce Act 1986 notice is hereby given seeking clearance of a proposed business acquisition. PUBLIC VERSION All confidential information included in [square brackets]. 64008029.1 1 Contents Summary1 Part 1 Transaction Details 3 Part 2 The Industry 7 Part 3 Market Definition 14 Part 4 Counterfactual 21 Part 5 Competition Analysis 22 Part 6 Further Information and Supporting Documentation 55 Part 7 Confidentiality 61 Annexure 1 – IAG structure chart 63 Annexure 2 – Lumley structure chart 64 Annexure 3 – Sale and Purchase Agreement [Confidential Annexure] 65 Annexure 4 – Mutual Transitional Services Agreement [Confidential Annexure] 66 Annexure 5 – Google search trends 67 Annexure 6 – Market share estimates [Confidential Annexure] 69 Annexure 7 – Autoglass market shares [Confidential Annexure] 70 Annexure 8 – Collision repair market shares [Confidential Annexure] 71 Annexure 9 – Schedule of confidential information [Confidential Annexure] 72 64008029.1 1 Summary This is a notice seeking clearance for a proposed acquisition that will result in the personal and commercial insurance businesses IAG New Zealand Limited, AMI Insurance Limited (together, IAG) and Lumley General Insurance (N.Z.) Limited (Lumley) coming under common ownership of IAG (NZ) Holdings Limited (the Applicant). At its broadest, this is a transaction in one aspect of the financial services industry and, like many aspects of that industry, a number of large, often global, competitors are involved to a greater or lesser extent and at many levels. -

2019 Annual Report Limited Group Australia Insurance ABN 60 090 739 923 the Numbers The

Insurance Australia Group Limited Limited Group Australia Insurance Annual Report 2019 Annual Report The numbers Annual Report 2019 Insurance Australia Group Limited ABN 60 090 739 923 Contents Directors’ report 1 Remuneration report 19 Lead auditor’s independence declaration 43 Consolidated financial statements contents 44 Consolidated statement of comprehensive income 45 About this report The 2019 annual report of Insurance Australia Group Limited (IAG, Consolidated balance sheet 47 or the Group) includes IAG’s full statutory accounts, along with the Consolidated statement of changes in equity 48 Directors’ and remuneration reports for the financial year ended 30 June 2019. This year’s corporate governance report is available Consolidated cash flow statement 49 in the About Us area of our website (www.iag.com.au). Notes to the financial statements 50 The financial statements are structured to provide prominence Directors’ declaration 98 to the disclosures that are considered most relevant to the user’s understanding of the operations, results and financial position Independent auditor’s report 99 of the Group. Shareholder information 104 IAG is a “dual listed issuer” that is listed on both the ASX and Corporate directory 107 the NZX Debt Market. As such, IAG is subject to some, but not all, of the NZX Main Board/Debt Market Listing Rules (“NZX Listing Five-year financial summary 108 Rules”). In particular, the rules set out in Appendix 17 to the NZX Listing Rules do not apply to IAG. All figures are in Australian dollars unless otherwise stated. 2019 annual review and safer communities report This report should be read with the 2019 annual review and safer communities report, which provides a summary of IAG’s operating performance, including the Chairman’s, CEO’s and CFO’s reviews. -

Insurance Law and the Principle of Indemnity in Light of Ridgecrest Nz Ltd V Iag New Zealand Ltd

73 INSURANCE LAW AND THE PRINCIPLE OF INDEMNITY IN LIGHT OF RIDGECREST NZ LTD V IAG NEW ZEALAND LTD Kasia Ginders* When the Supreme Court discussed the principle of indemnity in Ridgecrest NZ Ltd v IAG New Zealand Ltd, it was referred to as "awkward" in the context of a replacement policy. The application of the indemnity principle in the case raises further questions about the nature of the principle in insurance contracts. It is submitted that the indemnity principle is currently enforceable not as a legal test nor as a policy-based presumption; rather, it is applicable mostly because it is presumed the parties intended it to apply. This conclusion draws on both consideration of the rationales and rules of, exceptions to, and law reform concerning the principle. It also draws on analysis of the principle in light of Ridgecrest and two other recent cases following the Christchurch earthquakes that deal with the principle of indemnity. I INTRODUCTION The principle of indemnity in insurance law holds that an insured is entitled to receive a full indemnity for his or her loss, no more and no less. However, Ridgecrest NZ Ltd v IAG New Zealand Ltd (Ridgecrest), a 2014 case in the New Zealand Supreme Court, has brought the nature of the principle into question. When an insured building owned by Ridgecrest NZ Ltd (Ridgecrest) sustained damage in successive Canterbury earthquakes, the Supreme Court held that Ridgecrest could claim up to the full amount of the sum insured per happening, despite being underinsured and not having repaired the damage from the earlier quakes when the insured building became a total loss. -

Iag New Zealand Limited

23 April 2013 ABN 60 090 739 923 IAG IN FOCUS NEW ZEALAND IMPORTANT INFORMATION This presentation contains general information in summary form which is current as at 23 April 2013. It presents financial information on both a statutory basis (which has been prepared in accordance with Australian accounting standards, which comply with International Financial Reporting Standards (IFRS)) and non-IFRS basis. This presentation is not a recommendation or advice in relation to Insurance Australia Group Limited (“IAG”) or any product or service offered by IAG’s subsidiaries. It is not intended to be relied upon as advice to investors or potential investors, and does not contain all information relevant or necessary for an investment decision. It should be read in conjunction with IAG’s other periodic and continuous disclosure announcements filed with the Australian Securities Exchange which are also available at www.iag.com.au. No representation or warranty, express or implied, is made as to the accuracy, adequacy or reliability of any statements, estimates or opinions or other information contained in this presentation. To the maximum extent permitted by law, IAG, its subsidiaries and their respective directors, officers, employees and agents disclaim all liability and responsibility for any direct or indirect loss or damage which may be suffered by any recipient through use of or reliance on anything contained in or omitted from this presentation. No recommendation is made as to how investors should make an investment decision. Investors must rely on their own examination of IAG, including the merits and risks involved. Investors should consult with their own professional advisors in connection with any acquisition of securities. -

The Numbers The

Insurance Australia Group Limited Limited Group Australia Insurance Annual Report 2020 Annual Report The numbers Annual Report 2020 Insurance Australia Group Limited ABN 60 090 739 923 ANNUAL REPORT 2020 Contents Directors’ report 1 About this report Remuneration report 24 The 2020 annual report of Insurance Australia Group Limited Lead auditor’s independence (IAG, or the Group) includes IAG’s full statutory accounts, along with declaration 47 the Directors’ and remuneration reports for the financial year ended 30 June 2020. This year’s corporate governance report is available in Consolidated financial the About Us area of our website (www.iag.com.au). statements contents 48 The financial statements are structured to provide prominence Consolidated statement of to the disclosures that are considered most relevant to the user’s comprehensive income 49 understanding of the operations, results and financial position Consolidated balance sheet 51 of the Group. Consolidated statement IAG is a “dual listed issuer” that is listed on both the ASX and of changes in equity 52 the NZX Debt Market. As such, IAG is subject to some, but not all of the NZX Main Board/Debt Market Listing Rules (“NZX Listing Rules”). Consolidated cash flow statement 53 In particular, the rules set out in Appendix 17 to the NZX Listing Rules do not apply to IAG. Notes to the financial statements 54 All figures are in Australian dollars unless otherwise stated. Directors’ declaration 102 Independent auditor’s report 103 2020 annual review and Shareholder information 108 safer communities report Corporate directory 111 This report should be read with the 2020 annual review and Five-year financial summary 112 safer communities report, which provides a summary of IAG’s operating performance, including the Chairman’s, CEO’s and Deputy CEO’s reviews. -

Insurance Australia Group (IAG) - Master Privacy Policy

Last Update: 23 June 2021 Insurance Australia Group (IAG) - Master Privacy Policy Jump to the section you want by clicking on the image shortcuts below: Who are we? What personal information do How do we use your personal we collect? information? Who do we share your Significant data sharing Want to contact us? personal information with? arrangements Includes access requests, correcting your information and complaints. What is a master privacy policy? As with other large organisations, there are certain activities which we perform across Our Businesses (listed in Appendix A) and Our Companies (listed in Appendix B) (IAG Group Activities), in addition to the individual activities of each business (Business Specific Activities). In addition to the privacy policies that apply to Business Specific Activities, this Master Privacy Policy applies to: • any personal information we handle as part of the IAG Group Activities; and • any other personal information we handle that is not otherwise covered by the privacy policies for the Business Specific Activities. As such, if you are an individual whose personal information is handled by one of Our Businesses, or you otherwise interact with one of Our Businesses, this Master Privacy Policy should be read in conjunction with the privacy policy for the relevant Business Specific Activities. For example: if you are an NRMA Insurance customer, you should read the NRMA Insurance privacy policy first, as that will be most relevant to you, and then read this Master Privacy Policy. Whilst we’ve tried to ensure this doesn’t occur, if the information in this Master Privacy Policy conflicts with information in any of the privacy policies for any Business Specific Activities, the information in the relevant privacy policy for the Business Specific Activities will override this Master Privacy Policy. -

Statement of Services

STATEMENT OF SERVICES Hurford Parker Insurance Brokers Limited & Hurford Parker Financial Services Limited INTRODUCTION We are a leading insurance intermediary and risk management brokerage and offer advisory services for your insurance requirements. We are committed to acting in your best interests at all times in providing services to you. We are members of the NZbrokers Group, which is a collaborative group of New Zealand owned and operated professional insurance brokers. This document sets out the terms under which we provide services to you, as well as the co- operation and responsibilities required from you. These terms apply until they are varied by mutual agreement, or until our appointment is cancelled by you. We may vary the services we offer you from time to time by written notice to you. In this document “we”, “us” and “our” means Hurford Parker Insurance Brokers Limited and/or Hurford Parker Financial Services Limited. Hurford Parker Insurance Brokers Limited is an insurance intermediary registered to provide financial services advice in New Zealand by the Financial Markets Authority (FMA) Financial Services Provider Number FSP37162. A list of the services we provide to you in addition to other pertinent information are stated in Appendix A to F, attached to this document. By entering into a contract of insurance with us you confirm acceptance of the terms set out in this Statement of Services. Contents 1. INSURANCE BROKING .................................................................................................................... -

Financial Strength Ratings - Insurance Companies

January 2018 Financial Strength Ratings - Insurance Companies Insurers Licensed Under the Insurance (Prudential Supervision) Act 2010 Approved Rating Agencies Standard & Key General Insurers A.M.Best Fitch Poor's AA Insurance Ltd A+ (strong) AIG New Zealand Ltd A (strong) Aioi Nissay Dowa Insurance Company Ltd ( MS&AD Holdings) A+ Allianz New Zealand Insurance Limited AA- AMI Insurance Limited (Division of IAG) AA- Atradius Credit Insurance NV A A Berkshire Hathaway International Insurance Limited AA+ A++ CBL Insurance Ltd A- (Stable) Chubb Insurance Core Operating Insurance Companies AA (Stable) Chubb Insurance New Zealand AA-(Stable) Civic Assurance B+ FM Insurance Ltd A+ FMG Insurance Ltd A IAG New Zealand Ltd ( NZI, AMI and State) AA- Lloyd's of London A+ A AA- [Lumley/NZI] is a business division of IAG New Zealand Ltd (IAG). IAG has received a financial strength rating of AA- Maritime Mutual (Equifax) BBB (Sound) Mitsui Sumitomo Insurance Company Ltd A+(Stable) A+(Stable) Pacific International Insurance Ltd B++ QBE Insurance (International) Ltd (new Zealand Branch) A+ Sunderland Marine Mutual Insurance Company Ltd A (stable) The New India Assurance Co Ltd A- Tokio Marine & Nichido Fire Insurance Co. Lt global A+ A+ A++ Tower Insurance Limited A- Vero Insurance New Zealand Ltd A+ Vero Liability Insurance Ltd New Zealand A+ Zurich Australian Insurance Limited trading as Zurich New Zealand A+ January 2018 Rating Definitions The insurer financial strength rating table for Standard & Poor’s (Australia) Pty Ltd is: AAA (Extremely Strong) AA (Very Strong) A (Strong) BBB (Good) BB (Marginal) B (Weak) CCC (Very Weak) CC (Extremely Weak) SD (Selective Default) D (Default) R (Regulatory Supervision) NR (Not Rated) Notes: Ratings from “AA” to “CCC” may be modified be the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. -

2020 APPENDIX 4E (ASX Listing Rule 4.3A)

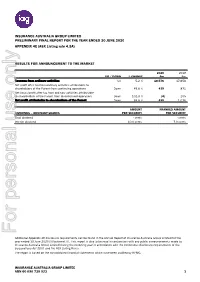

INSURANCE AUSTRALIA GROUP LIMITED PRELIMINARY FINAL REPORT FOR THE YEAR ENDED 30 JUNE 2020 APPENDIX 4E (ASX Listing rule 4.3A) RESULTS FOR ANNOUNCEMENT TO THE MARKET 2020 2019 UP / DOWN % CHANGE $m $m Revenue from ordinary activities Up 5.2 % 18,576 17,658 Net profit after tax from ordinary activities attributable to shareholders of the Parent from continuing operations Down 49.6 % 439 871 Net (loss)/profit after tax from ordinary activities attributable to shareholders of the Parent from discontinued operations Down 102.0 % (4) 205 Net profit attributable to shareholders of the Parent Down 59.6 % 435 1,076 AMOUNT FRANKED AMOUNT DIVIDENDS – ORDINARY SHARES PER SECURITY PER SECURITY Final dividend - cents - cents Interim dividend 10.0 cents 7.0 cents For personal use only Additional Appendix 4E disclosure requirements can be found in the Annual Report of Insurance Australia Group Limited for the year ended 30 June 2020 (Attachment A). This report is also to be read in conjunction with any public announcements made by Insurance Australia Group Limited during the reporting year in accordance with the continuous disclosure requirements of the Corporations Act 2001 and the ASX Listing Rules. The report is based on the consolidated financial statements which have been audited by KPMG. INSURANCE AUSTRALIA GROUP LIMITED ABN 60 090 739 923 1 ATTACHMENT A INSURANCE AUSTRALIA GROUP LIMITED AND SUBSIDIARIES ANNUAL REPORT 30 JUNE 2020 For personal use only INSURANCE AUSTRALIA GROUP LIMITED ABN 60 090 739 923 2 Insurance Australia Group Limited Limited Group Australia Insurance Annual Report 2020 Annual Report The numbers For personal use only Annual Report 2020 Insurance Australia Group Limited ABN 60 090 739 923 ANNUAL REPORT 2020 Contents Directors’ report 1 About this report Remuneration report 24 The 2020 annual report of Insurance Australia Group Limited Lead auditor’s independence (IAG, or the Group) includes IAG’s full statutory accounts, along with declaration 47 the Directors’ and remuneration reports for the financial year ended 30 June 2020. -

Vero Insurance New Zealand and Tower Limited – Clearance

Public Version NOTICE SEEKING CLEARANCE OF A BUSINESS ACQUISITION PURSUANT TO SECTION 66 OF THE COMMERCE ACT 1986 2 March 2017 The Registrar Business Acquisitions and Authorisations Commerce Commission PO Box 2351 WELLINGTON Pursuant to s66(1) of the Commerce Act 1986 notice is hereby given seeking clearance of a proposed business acquisition. Public Version ii EXECUTIVE SUMMARY 1.1 Vero Insurance New Zealand Limited (" Vero "), a member of the Suncorp New Zealand group (" Suncorp ") currently holds 13.2% of the ordinary shares in Tower Limited (" Tower "). Vero is seeking clearance to acquire up to 100% of the shares in Tower by way of a scheme of arrangement under Part 15 of the Companies Act 1993 (the "Transaction "). No substantial lessening of competition 1.2 Suncorp and Tower are complementary businesses, and the degree of market share aggregation that would arise from the Transaction is low and unlikely to materially change the competitive dynamic. 1.3 The Commission has analysed the relevant insurance markets in its recent decisions of IAG/AMI and IAG/Lumley .1 As the Commission found in those recent clearance decisions, it remains the case that there are a number of well-resourced and established insurance providers with trusted and respected brands. Just as the Commission found in IAG/Lumley 2, the level of existing competition means that the Transaction is unlikely to result in a substantial lessening of competition. Market share aggregation is low 1.4 Tower has approximately a 5% share of the general insurance market in New Zealand. It is estimated to have about a []% share in personal lines and []% in commercial lines.