Hybrid Technology Decision

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ministry Nod for Three Free Trade Zones

ISO 9001:2008 CERTIFIED NEWSPAPER Thursday 29 May 2014 30 Rajab 1435 - Volume 19 Number 6080 Price: QR2 LNG supply to face competition Business | 17 1 4 DAYS TO GO www.thepeninsulaqatar.com [email protected] | [email protected] Editorial: 4455 7741 | Advertising: 4455 7837 / 4455 7780 Father Emir, Sheikha Moza attend graduation Al Sisi heads Ministry nod for big win in early count CAIRO: Former Egyptian for three free army chief Abdel Fattah Al Sisi was on course for a sweeping vic- tory in the country’s presidential election yesterday, according to early provisional results. Sisi’s trade zones campaign said their man had captured 93.4 percent with 2,000 polling stations counted, while Plan for new livestock market judicial sources said he had 89 percent with 3,000 polling sta- DOHA: The Ministry of Municipality and Urban Planning, tions counted. His only rival, Municipality and Urban Noora Al Suwaidi. veteran leftist Hamdeen Sabahi, Planning has eventually She told in a presenta- was on 2.9 percent according to approved plans to establish the tion at the Central Municipal the Sisi campaign, while the judi- three free trade zones (FTZs) Council (CMC) on Qatar’s urban cial sources put Sabahi on 5 per- that are being talked about for a Masterplan, that the FTZ plans cent, with the rest of the ballots long time. However, a new loca- had been approved by the minis- deemed void. tion is being discussed for one of try. Two massive industrial zones Turnout was 44.4 percent of the FTZs which was originally were being planned for setting up Egypt’s 54 million voters, accord- planned to be set up south of warehousing facilities. -

Modern Moparmopar ER CAR SL C Y L R U H B

HRYSLE R C O C A F R S C O L U U T B H A U A STR ALI Modern Mopar ER CAR SL C Y L R U H B C O F A I S L O A GHFHPEHURPDUFKR U R TH AUST President Iain Carlin General monthly meetings are held on the FIRST Tuesday of every month at: Vice President Hugh Mortimer The West Adelaide Football Club, 57 Milner Rd, Richmond. Secretary Di Hastwell Treasurer Greg Helbig Events Coordinator Damian Tripodi ACF Coordinator Jason Rowley Regular - $40.00 per year (& quarterly magazine) Events Organisers John Leach Historic Registration - $50 per year (& quarterly magazine) Chris Taylor Historic Registrar Stuart Croser Inspectors North John Eckermann Jason Rowley South Chris Hastwell Charles Lee Central Rob McBride Dave Hocking Sponsorship & Marketing Evan Lloyd Club Library Iain Carlin Editorial / Design Dave Heinrich Webmasters Iain Carlin Dave Heinrich Photography Mary Heath Iain Carlin Lesley Little Ingrid Matschke Damian Tripodi Paris Charles John Antinow Charles Lee Mandy Walsh Contributors Iain Carlin Hugh Mortimer Lesley Little Rick Saxon John Antinow Guy Oakes Stuart Croser Damian Tripodi Source Wikipedia Allpar Hot Rod Car Advice Car & Driver FourWheeler.com DISCLAIMER CarWeekly.co.uk Chrysler, Jeep®, Dodge and Mopar are registered trademarks of FCA LLC and are used with permission by the Chrysler Car Club of South Australia. Enquiries Torqueback is not a commercial publication and is only published in good faith as a newsletter for a not-for-proÀt organisation. Club Mobile The mention of companies, products or services, and the inclusion of advertisements in this magazine does not immediately 0412 426 360 imply any automatic endorsement by the Chrysler Car Club of South Australia or its editorial team. -

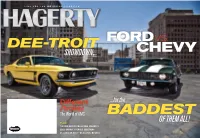

Showdown ... of Them All!

FUEL FOR THE MOTORING LIFESTYLE Dee-troit Ford vs. showdown ... CHevy Fall 2011 $4.95 U.S.a. | Canada Different ... for the Strokes The World of AMC baddest Plus: of them all! THE ODD ART OF COLLECTING CONCEPTS COOL GARAGE STORAGE SOLUTIONS ST. LOUIS OR BUST—IN A LOTUS, NO LESS a word from mckeel FordFord vs.vs. Chevy Chevy in the Driver’s seat editoriAl stAFF Executive Publisher McKEEL Hagerty Publisher RoB SASS Associate Publisher Jonathan A. Stein Senior Publishing Advisor Greg Stropes Executive Editor JERRy Burton Managing Editor nAdInE SCodELLARo Art director/designer Todd Kraemer Copy Editor SHEILA WALSH dETTLoFF Art Production Manager JoE FERRARo Although McKeel Creative director LAURA RoGERS hagerty spends as Editorial director dAn GRAnTHAM much time as possible in the driver’s seat, he Publishing stAFF director of Publishing Angelo ACoRd found time to sit on a Publication Manager Danielle PoissanT panel of notable auto Production Manager Lynn Sarosik MAGES editors and writers y I Ad Sales Coordinator KIM PoWERS to make his picks in ETT our Ford vs. Chevy Contributors Carl Bomstead, BoB Butz, WAynE on, G showdown. rt CarinI, KEn GRoss, DavE KInnEy, Stefan Lombard, jeff peek, JoHn L. Stein n Mo TEPHE Advertising stAFF S director of Ad Sales East Coast Sales office ToM Krempel, 586-558-4502 [email protected] Central/West Coast Sales office Lisa Kollander, 952-974-3880 Fun with cars [email protected] Anyone who’s read at least one issue of Hagerty magazine realizes that we subscribe to the notion that the old car hobby is supposed to be fun — fun in the sense that we enjoy using our cars from time to time and that we have a good time poking fun both at ourselves and the foibles of our beloved old cars. -

A Work Project, Presented As Part of the Requirements for the Award of a Master’S Degree In

A Work Project, presented as part of the requirements for the Award of a Master’s Degree in Management from Faculdade de Economia da Universidade Nova de Lisboa (Nova School of Business and Economics) HOW CAN PREMIUM AUTOMOTIVE BRANDS MAINTAIN THEIR STATUS, WHILE SHARING TECHNOLOGY WITH THEIR RESPECTIVE AUTO GROUPS? The case of Audi and the Volkswagen Automotive Group Tiago Filipe Correia Lourenço Fonseca Student number 29242 A Project carried out on the International Master’s in Management degree, with the supervision of: Professor Catherine da Silveira 04-01-2021 Abstract Automotive groups with large portfolios face growing branding challenges in the premium market. Currently, premium brands need to pursue digital innovation to maintain their status, but technology by itself does not lead to a higher positioning: other attributes like comfort, safety, material quality, and design are still valued. Based on the study of Audi and the Volkswagen Automotive Group, this Work Project demonstrates that autonomous driving, integrated smartphone connectivity, and media consumption applications are likely to increasingly act as differentiators in the future. Also, the identity of premium brands needs to remain strong to justify the consumers’ personal brand preferences. With the guidance of: Johan Van Langendonck. Henrique Monteiro Wadsworth. Thank you to all the interviewees who participated in the qualitative research used in this Work Project. Keywords: Premium Automotive Brands; Digital Innovation and Technology; Premium Status Attributes; Automotive Market Segmentation. This work used infrastructure and resources funded by Fundação para a Ciência e a Tecnologia (UID/ECO/00124/2013, UID/ECO/00124/2019 and Social Sciences DataLab, Project 22209), POR Lisboa (LISBOA-01-0145-FEDER-007722 and Social Sciences DataLab, Project 22209) and POR Norte (Social Sciences DataLab, Project 22209). -

The Future Depends on Improving Returns on Capital 2017 Automotive Industry Trends

2017 Automotive Industry Trends The future depends on improving returns on capital Contacts Beirut Cleveland Florham Park, N.J. London Fadi Majdalani Akshay Singh Barry Jaruzelski Mark Couttie Partner, PwC Middle East Director, PwC US Principal, PwC US Partner, PwC UK +961-1-985-655 +1-216-925-4068 +1-973-236-7738 +44-20-7212-5032 [email protected] [email protected] [email protected] [email protected] Chicago Detroit Frankfurt Rich Parkin Partner, PwC UK Evan Hirsh John Jullens Dr. Richard Viereckl +44-20-7212-5615 Principal, PwC US Principal, PwC US Managing Director, PwC [email protected] +1-216-287-3723 +1-313-394-3622 Strategy& Germany [email protected] [email protected] +49-69-97167-418 Tokyo richard.viereckl Reid Wilk @strategyand.de.pwc.com Shoji Shiraishi Principal, PwC US Partner, PwC Japan +1-248-872-6792 +81-3-6250-1200 [email protected] [email protected] 2 Strategy& About the authors Rich Parkin is a leading practitioner for Strategy&, PwC’s strategy consulting business. Based in London, he is a partner with PwC UK. He specializes in automotive and industrial products covering the value chain, and has more than 25 years of experience in the U.S., the Middle East, and Europe. Reid Wilk is an advisor to executives of automotive and industrials companies for Strategy&. He is a principal with PwC US, based in Detroit. He focuses on business and portfolio strategy and strategic sourcing transformations, and has more than 25 years of industry and consulting experience. -

Excerpt from the Proceedings of the Eighteenth Annual Acquisition Research Symposium

SYM-AM-21-066 Excerpt from the Proceedings of the Eighteenth Annual Acquisition Research Symposium Strategies for Addressing Uncertain Markets and Uncertain Technologies May 11–13, 2021 Published: May 10, 2021 Approved for public release; distribution is unlimited. Prepared for the Naval Postgraduate School, Monterey, CA 93943. Disclaimer: The views represented in this report are those of the author and do not reflect the official policy position of the Navy, the Department of Defense, or the federal government. Acquisition Research Program Graduate School of Defense Management Naval Postgraduate School The research presented in this report was supported by the Acquisition Research Program of the Graduate School of Defense Management at the Naval Postgraduate School. To request defense acquisition research, to become a research sponsor, or to print additional copies of reports, please contact any of the staff listed on the Acquisition Research Program website (www.acquisitionresearch.net). Acquisition Research Program Graduate School of Defense Management Naval Postgraduate School Strategies for Addressing Uncertain Markets and Uncertain Technologies William B. Rouse—Georgetown University [[email protected]] Dinesh Verma—Stevens Institute of Technology [[email protected]] D. Scott Lucero—Office of the Secretary of Defense (Ret.) [[email protected]] Edward S. Hanawalt—General Motors [[email protected]] Abstract Engineering involves designing solutions to meet the needs of markets or missions. Organizations would like to have the flexibility and agility to address both uncertain needs and uncertain technologies for meeting these needs. This article presents and illustrates a decision framework that enables flexibility and agility and provides guidance on when to pursue optimal, highly integrated solutions. -

Autos for Africa? Possibilities and Pitfalls for an Automotive Industry in Africa

Autos for Africa? Possibilities and Pitfalls for an Automotive Industry in Africa Thomas McLennan UniversitySupervisor: Professor of Cape Anthony BlackTown Dissertation Presented in Partial Fulfilment of the Degree of MASTER OF COMMERCE in the School of Economics UNIVERSITY OF CAPE TOWN January 2016 1 The copyright of this thesis vests in the author. No quotation from it or information derived from it is to be published without full acknowledgement of the source. The thesis is to be used for private study or non- commercial research purposes only. Published by the University of Cape Town (UCT) in terms of the non-exclusive license granted to UCT by the author. University of Cape Town Abstract Sub-Saharan Africa (SSA) has grown very rapidly over the last decade. Demand for light vehicles has rapidly increased in this period, albeit from a very low base. Growing demand is almost entirely supplied by the import of used vehicles from the developed world. This has led to an enormous automotive trade deficit in the region where, apart from South Africa, there is almost no domestic production. The dissertation establishes the trends and scale of automotive demand in SSA and then considers the question of whether and how the region can begin to meet this booming demand by developing its own industry. Despite limited industrialisation levels and relatively small domestic markets, some larger countries, such as Nigeria and Kenya, are putting policies in place to encourage domestic production. However, if countries follow individual national strategies it is unlikely that any will have sufficient market scale or investment levels to become sustainable automotive producers. -

POLITECNICO DI TORINO Competitive Landscape

POLITECNICO DI TORINO Department of Mechanical, Aerospace, Automotive and Production Engineering Master of Science in Automotive Engineering Thesis Competitive Landscape Strategic Passenger Vehicles Architectures Benchmark Supervisors Prof. Paolo Federico Ferrero Ing. Ph.D Franco Anzioso Candidate Giorgio Carlisi Academic Year 2017/2018 Index Index I 1 Abstract 1 2 Introduction 3 3 Brief history of the electric vehicle 5 4 Available electrification technologies 17 4.1 Micro Hybrid Electric Vehicles (µHEV) 20 4.2 Mild Hybrid Electric Vehicles (MHEV) 21 4.2.1 48V P0 (BSG) 22 4.2.2 48V P1 (ISG) 23 4.2.3 48V P2 (ISG) 23 4.2.4 48V P3 (ISG) 24 4.2.5 48V P4 (rear axle) 25 4.3 Hybrid Electric Vehicles (HEV) 25 4.4 Plug-in Hybrid Electric Vehicles (PHEV) 28 4.5 Range Extender Electric Vehicles (REEV) 29 4.6 Battery Electric Vehicles (BEV) 30 5 European market evolution 31 5.1 Current European market outlook 31 5.1.1 Germany 36 5.1.2 United Kingdom 36 5.1.3 France 37 5.1.4 Italy 37 5.1.5 Norway, Spain, Sweden and The Netherlands 38 5.2 Legislative evolution on carbon dioxide emissions 39 5.2.1 2015 targets 39 I 5.2.2 2021 targets 40 5.2.3 2025-2030 targets 44 5.3 Future European market projection 48 6 Platforms analysis 53 6.1 Vehicle architectures history 53 6.2 Vehicle architectures classification 61 6.2.1 Conventional platforms 61 6.2.2 Multi-energy platforms 64 6.2.3 Dedicated battery electric vehicle platforms 65 6.3 Platform strategy benchmark 67 6.3.1 BMW Group 67 6.3.2 PSA Groupe 73 6.3.3 Hyundai Motor Group 82 6.3.4 Renault Nissan Mitsubishi Alliance 88 6.3.5 Volkswagen Group 96 6.3.6 Daimler 109 7 Conclusions 116 8 Definitions and Glossary 121 9 Bibliography 126 II III 1 Abstract The topic examined in the present work has been developed at the department of Electrified Vehicles Product Planning of Fiat Chrysler Automobiles and deals with passenger vehicles architectures. -

The New Essential the Confluence of Technology and Human Ingenuity

The New Essential The confluence of technology and human ingenuity Annual Report 2021 Contents Corporate Overview Accelerated Growth – $10B & Beyond 4 Message from the Founder 6 Message from the Chairperson 8 Letter from the CEO 10 Board of Directors 13 Perspectives from the CFO 14 Perspectives from the CHRO 15 Financial Highlights 16 Leadership Team 18 A Broad Global Reach 20 A Landmark Year 24 Sustainability 26 Empathy and Collaboration 28 Resilience for a Better Future 30 Business Highlights Cloud Smart 37 HCL Ecosystems 38 IT & Business Services 40 Engineering and R&D Services 46 Products and Platforms 48 Management Discussion and Analysis (MDA) 50 Directors’ Report 98 Corporate Governance Report 154 CEO and CFO Certificates 188 Business Responsibility Report 189 Financial Performance Standalone Financial Statements 207 Consolidated Financial Statements 268 Statement under Section 129 339 1 240200282_HCL_ARA2021_AW_21_07_20_Front Section_IFC_23.indd 1 20/07/2021 18:35 We reflect on colleagues lost to COVID-19 2 If this page were a room, we would be standing silently together to honor the members of our HCL family who lost their lives to COVID-19. As we grieve their passing, our thoughts and prayers are with their families, colleagues, friends, and everyone they touched with their presence. Though gone, our former colleagues live on in the legacy they leave behind. The gap in our lives and our company cannot be filled. But their example of excellence and commitment will continue to inspire us. Each of them played a role in HCL’s success. The dedication they brought to work each day will motivate us. -

The Liminal Fantasy of Sport Utility Vehicle Advertisements

The SUV Fantasy 1 Running Head: THE SUV FANTASY Living Above it All: The Liminal Fantasy of Sport Utility Vehicle Advertisements Richard K. Olsen, Jr., Ph.D. University of North Carolina at Wilmington 601 S. College Rd. Wilmington, NC 28403-5933 (910) 962-3710 Email: [email protected] Final Draft for inclusion in the edited volume Enviropop: Studies in Environmental Rhetoric and Popular Culture edited by Mark Meister and Phyllis Japp The SUV Fantasy 2 Living Above it All: The Liminal Fantasy of Sport Utility Vehicle Advertisements American popular culture offers a long history of celebrating modes of transportation. From the pony express through the various planes, trains and automobiles, each has captured the national imagination. Television and movies such as Route 66, Knight Rider and Smokey and the Bandit, among others, have made particular automobiles popular. This essay does not examine the popularity of a particular model of vehicle such as the Mustang, but rather an entire category of vehicles: The SUV. The sport utility vehicle has become a dominant vehicle on both the physical and cultural landscapes of America. The popularity of SUVs, and the way they have been portrayed in advertisements, reveals a cultural stance regarding the environment and speaks of what “wilderness” can mean in popular culture. In this chapter I briefly review the popularity of SUVs as well as some negative implications of that popularity. I then introduce the concepts of fantasy theme, dialectic and liminality, which will guide my analysis of SUV advertisements. Third, I offer analysis of the advertisements from the vantage point provided by these concepts to demonstrate that the fantasy operating in many SUV advertisements attempts to position the SUV as a purchasable and permanent resolution to the dialectics inherent in our relationship with the environment. -

Regimental Society Newsletter Fall 2014 Lord Strathcona’S Horse (Royal Canadians) Regimental Society, PO Box 10500 Station Forces Edmonton, AB T5J 4J5

trathcona’s Horse (Royal Lord S Canadians) Regimental Society Newsletter FALL 2014 Lord Strathcona’s Horse (Royal Canadians) Regimental Society, PO Box 10500 Station Forces Edmonton, AB T5J 4J5 In this Edition Colonel of the Regiment Commanding Officer “Tales From The Big Chair” Strathcona Regimental Association Update Lost Trails Perseverance is Worth it in Marriage Calgary Branch News Spring 2015 Edition Deadline A Strathcona Returns to Italy And We Flew Last Recondos Retire Diaries of a UN Soldier What's in a Name? Artifacts and Memorabilia Help Wanted-Apply Within News from the Ottawa Chapter of the Ontario Branch News from the Kingston Chapter of the Ontario Branch Remembering Major Danny McLeod MC, CD The Backbone of the Regiment at the Calgary Olympics Annual Family Golf Tournament Your Dispatches A Call for Afghanistan Stories and Anecdotes Last Trumpet Call Strathconas Newsletter Page 1 www.strathconas.ca Colonel of the Regiment By Major-General (Ret’d) Cam Ross For the last four years, the Strathconas have been directly involved in an extraordinary series of commemorative events recognizing our war dead and veterans. While those in Edmonton are aware of this initiative, many in our clan are not; hence this article. The initiative is called ‘No Stone Left Alone’. Started in 2010 by great friends of the Regiment, Maureen Bianchini- Purvis and her husband Randall, the aim of ‘No Stone Left Alone’ is to cause students to become aware of the actions and sacrifices of the members of the Canadian Armed Forces who have served and fought for Canada. By placing a poppy at the headstone of our war dead and veterans, it is hoped that the students will reflect on what these Canadians have done to serve Canada. -

LABOR LAW UPDATE Moderator: Michael B

Friday, December 7, 2018 ICLE: State Bar Series LABOR AND EMPLOYMENT LAW INSTITUTE 6 CLE Hours 1 Ethics Hour | 2 Trial Practice Hours Sponsored By: Institute of Continuing Legal Education Copyright © 2018 by the Institute of Continuing Legal Education of the State Bar of Georgia. All rights reserved. Printed in the United States of America. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form by any means, electronic, mechanical photocopying, recording, or otherwise, without the prior written permission of ICLE. The Institute of Continuing Legal Education’s publications are intended to provide current and accurate information on designated subject matter. They are offered as an aid to practicing attorneys to help them maintain professional competence with the understanding that the publisher is not rendering legal, accounting, or other professional advice. Attorneys should not rely solely on ICLE publications. Attorneys should research original and current sources of authority and take any other measures that are necessary and appropriate to ensure that they are in compliance with the pertinent rules of professional conduct for their jurisdiction. ICLE gratefully acknowledges the efforts of the faculty in the preparation of this publication and the presentation of information on their designated subjects at the seminar. The opinions expressed by the faculty in their papers and presentations are their own and do not necessarily reflect the opinions of the Institute of Continuing Legal Education, its officers, or employees. The faculty is not engaged in rendering legal or other professional advice and this publication is not a substitute for the advice of an attorney.