Portfolio Holdings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

STOXX EMERGING MARKETS 800 LO Selection List

STOXX EMERGING MARKETS 800 LO Last Updated: 20200901 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 295.1 1 1 KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 195.5 2 2 INE002A01018 6099626 RELI.BO IN0027 Reliance Industries Ltd IN INR Y 77.8 3 3 INE040A01034 BK1N461 HDBK.BO IN00CH HDFC Bank Ltd IN INR Y 58.5 4 7 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORPCN H HKD Y 57.8 5 4 ZAE000015889 6622691 NPNJn.J ZA004D Naspers Ltd ZA ZAR Y 57.3 6 5 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 51.5 7 6 INE009A01021 6205122 INFY.BO IN006B Infosys Ltd IN INR Y 41.6 8 8 RU0009024277 B59SNS8 LKOH.MM EV020 LUKOIL RU RUB Y 38.9 9 9 KR7035420009 6560393 035420.KS KR00NY NAVER CORP KR KRW Y 37.4 10 12 BRVALEACNOR0 2196286 VALE3.SA BR0024 Vale SA BR BRL Y 34.3 11 10 INE001A01036 6171900 HDFC.BO IN00EJ Housing Development Finance Co IN INR Y 34.1 12 13 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 33.2 13 11 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 32.6 14 15 KR7000660001 6450267 000660.KS KR00EP SK HYNIX INC KR KRW Y 30.8 15 14 INE467B01029 B01NPJ1 TCS.BO IN005A Tata Consultancy Services Ltd IN INR Y 26.9 16 18 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 26.4 17 17 INE090A01021 BSZ2BY7 ICBK.BO IN00BG ICICI Bank Ltd IN INR Y 26.3 18 22 RU0009029540 4767981 SBER.MM EV023 SBERBANK RU RUB Y 26.1 19 19 TW0002454006 6372480 -

Marketing Holdings Report

Driehaus Emerging Markets Opportunities Fund (Unaudited) Security Portfolio for 12/31/2020 Quantity ID Security Description Market Value ARGENTINA 779,514.10 1,188 GLOB GLOBANT SA 258,520.68 311 MELI MERCADOLIBRE INC 520,993.42 BRAZIL 3,469,892.11 9,387 AZUL AZUL SA 214,211.34 1,500,000 ZP2084801 BNTNF 10 01/01/31 350,434.62 200,000 105756CA6 BRAZIL 4 1/2 05/30/29 222,524.00 500,000 105756BZ2 BRAZIL 4 5/8 01/13/28 560,005.00 79,977 GGB GERDAU SA -SPON ADR 373,492.59 108,578 LOGG3 BZ LOG COMMERCIAL PROPERTIES E 719,349.78 40 MGLU3 BZ MAGAZINE LUIZA SA 191.81 6,724 PAGS PAGSEGURO DIGITAL LTD-CL A 382,461.12 103,212 PETZ3 BZ PET CENTER COMERCIO E PARTIC 378,668.12 18,388 WEGE3 BZ WEG SA 268,553.73 CANADA 635,019.44 11,626 BLDP BALLARD POWER SYSTEMS INC 272,048.40 8,696 WPM WHEATON PRECIOUS METALS CORP 362,971.04 CAYMAN ISLANDS 693,582.54 300,000 BK4590505 BANORT 8 3/8 PERP 358,128.00 5,451 BEKE KE HOLDINGS INC 335,454.54 CHINA 11,943,072.89 28,500 9988 HK ALIBABA GROUP HOLDING LTD 855,097.41 2,174 BABA ALIBABA GROUP HOLDING-SP ADR 505,955.02 3,315 BILI BILIBILI INC-SPONSORED ADR 284,161.80 7,000,000 BJ4697907 CGB 2.68 05/21/30 1,027,243.95 1,200,000 AM7831903 CGB 3.2 03/16/24 185,149.41 2,500,000 AT9654381 CGB 3.54 08/16/28 395,132.53 193,600 3908 HK CHINA INTERNATIONAL CAPITA-H 524,427.76 37,700 3968 HK CHINA MERCHANTS BANK-H 238,285.96 4,937 601888 C1 China Tourism Group Duty Free 213,226.04 9,195 300750 C2 CONTEMPORARY AMPEREX TECHN-A 493,662.87 108,354 300059 C2 EAST MONEY INFORMATION CO-A 513,620.29 35,200 002074 C2 GOTION HIGH-TECH -

China Resources Pharmaceutical Group Limited 華潤醫藥集團有限公司 (Incorporated in Hong Kong with Limited Liability)

The Stock Exchange of Hong Kong Limited and the Securities and Futures Commission take no responsibility for the contents of this Application Proof, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Application Proof. Application Proof of China Resources Pharmaceutical Group Limited 華潤醫藥集團有限公司 (Incorporated in Hong Kong with limited liability) WARNING The publication of this Application Proof is required by The Stock Exchange of Hong Kong Limited (the “Exchange”)/ the Securities and Futures Commission (the “Commission”) solely for the purpose of providing information to the public in Hong Kong. This Application Proof is in draft form. The information contained in it is incomplete and is subject to change which can be material. By viewing this document, you acknowledge, accept and agree with the Company, its sponsor, advisers or member of the underwriting syndicate that: (a) this document is only for the purpose of providing information about the Company to the public in Hong Kong and not for any other purposes. No investment decision should be based on the information contained in this document; (b) the publication of this document or supplemental, revised or replacement pages on the Exchange’s website does not give rise to any obligation of the Company, its sponsor, advisers or members of the underwriting syndicate to proceed with an offering in Hong Kong or any other jurisdiction. -

Stock Select Monthly

Stock Select Monthly March 2016 Risk Factor Top 40 up 0.75% this year Small Cap in focus In this edition: Steinhoff International Invest in one of our portfolios NV Do not have the time to actively manage your portfolio? – Let us do it for you. We have been managing wealth for our clients JSE Winners & Losers (page 3) since 1969. We have well qualified and experienced portfolio managers and analysts to Top 40 Recap (page 3) select the right shares for you. By paying a small management fee you can sit Small Cap Focus (page 16) back and relax and see your money grow. Contact us on 011-3751000 or mail us on [email protected] to find out more. Please refer to the disclaimer at the end of this document 1 Stock Select Monthly – March 2016 Table of Contents Executive Summary JSE Winners and Losers 3 Welcome to the March 2016 edition of Stock Select Monthly, a monthly publication produced by Thebe Stockbroking for our private clients. Top 40 Key Events and Results 3 The JSE All Share Index closed 5.74% higher in March supported by strong JSE Indices Performance 5 performances in platinum and financial shares. Platinum shares were the best performers during March, rising as a group by 24.98% followed by Top 40 Focus 6 banking shares that gained 13.43%. Platinum shares benefitted from increased demand for the metal - the platinum price rose by more than 4% Top 40 Stock Pick Performances 6 during the month - while banking and financial shares benefitted from an increase in the repo rate. -

Voting Disclosure

Notices: LGPS Central Limited is committed to disclosing its voting record on a vote-by-vote basis, including where practicable the provision of a rationale for votes cast against management. The data presented here relate to voting decisions for securities held in portfolios held within the company’s Authorised Contractual Scheme (ACS). Meeting Company Name Meeting Type Voting Action Agenda Item Numbers Voting Explanation 20/01/2021 Guotai Junan International Holdings Limited Special All For 04/02/2021 Lenovo Group Limited Special All For 04/03/2021 MMG Ltd. Special Against 1 Apparent failure to link pay and appropriate performance 05/03/2021 CSPC Pharmaceutical Group Ltd. Special Against 11.1 Concerns related to board gender diversity 12 Concerns related to shareholder rights 29/03/2021 China Resources Beer (Holdings) Co. Ltd. Special Against 2 Concerns related to board gender diversity 28/01/2021 Kobe Bussan Co., Ltd. Annual All For 28/01/2021 Park24 Co., Ltd. Annual Against 1.6,1.7 Concerns about overall board structure 19/02/2021 Kansai Mirai Financial Group, Inc. Special All For 20/02/2021 OSG Corp. (6136) Annual Against 2.1 Concerns related to approach to board diversity 25/02/2021 Kewpie Corp. Annual All For 26/02/2021 Hitachi Capital Corp. Special Against 1 Concerns to protect shareholder value 26/02/2021 Mitsubishi HC Capital, Inc. Special All For 09/03/2021 Nippon Building Fund, Inc. Special All For 18/03/2021 Toshiba Corp. Special Against 1 SH: For shareholder resolution, against management recommendation / Shareholder proposal promotes transparency 19/03/2021 Kubota Corp. -

CRH (Beer) Limited

THIS PROSPECTUS IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in doubt as to any aspect of this Prospectus or as to the action to be taken, you should consult a licensed securities dealer, bank manager, solicitor, professional accountant or other professional advisers. If you have sold or transferred all your securities in China Resources Beer (Holdings) Company Limited (the “Company”), you should at once hand the Rights Issue Documents (as defined herein) to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or the transferee. The Rights Issue Documents should not, however, be distributed, forwarded to or transmitted to, into or from any jurisdiction where to do so might constitute a violation of local securities laws or regulations including but not limited to the United States or the other Specified Territories. A copy of each of the Rights Issue Documents, together with the documents specified in the paragraph headed “Documents delivered to the Registrar of Companies” in Appendix III to this Prospectus, has been registered with the Registrar of Companies in Hong Kong pursuant to Section 38D of the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Chapter 32 of the Laws of Hong Kong). The Securities and Futures Commission of Hong Kong and the Registrar of Companies in Hong Kong take no responsibility for the contents of any of the Rights Issue Documents. Dealings in the securities of the Company and the Rights Shares (as defined herein) in their nil-paid form and fully-paid form may be settled through CCASS and you should consult a licensed securities dealer, bank manager, solicitor, professional accountant or other professional advisers for details of the settlement arrangements and how such arrangements may affect your rights and interests. -

Corporates Carlsberg Breweries

Corporates Food, Beverage & Tobacco / Denmark Carlsberg Breweries A/S Rating Type Rating Outlook Last Rating Action Long-Term IDR BBB+ Stable Affirmed 16 May 2019 Short-Term IDR F1 Upgrade 16 May 2019 Click here for full list of ratings Financial Summary (DKKm) Dec 2016 Dec 2017 Dec 2018 Dec 2019F Dec 2020F Dec 2021F Revenue 62,614 60,655 62,503 64,598 68,303 69,637 Operating EBITDAR 13,265 13,618 13,688 14,143 14,631 15,039 Operating EBITDAR Margin (%) 21.2 22.5 21.9 21.9 21.4 21.6 Free Cash Flow Margin (%) 6.4 9.8 8.1 3.3 4.0 3.2 FFO Adjusted Net Leverage (x) 3.4 2.1 2.0 2.3 2.4 2.4 Source: Fitch Ratings, Fitch Solutions The ratings reflect Carlsberg Breweries A/S’s strong business profile as the third-largest international brewer globally and Fitch Ratings’ expectation that the company will be able to maintain the improved credit metrics it achieved after deleveraging in 2016-2018. This expectation is underpinned by the company’s conservative financial policy and clear capital allocation principles. The rating continues to incorporate some room for bolt-on M&A as we believe the group will continue to pursue growth opportunities in Asia. Based on our assessment of Carlsberg’s financial flexibility, we assigned the higher of the two short-term options (F1) for the current rating profile in May 2019. Any material weakening in financial flexibility, financial structure or operating environment conditions could lead to the assignment of the lower of the two short-term rating options for the current long- term profile. -

Hållbara Investeringar

Hållbara investeringar Exkluderingar enligt våra utökade hållbarhetskriterier per Q1 2019 För ett antal fonder har vi, utöver exkluderingar enligt Storebrandstandarden, även utökade hållbarhetskriterier. För mer information om vår policy och vår metod, se www.sppfonder.se. Följande företag är exkluderade: Bergen Group ASA CHUGOKU ELECTRIC DONG ENERGY A/S 1. Fossila bränslen Berkshire Hathaway POWER CO DTE ENERGY COMPANY Cia Energetica de Minas Gerais A.P. Moller - Maersk A/S Class A Berkshire Hathaway Finance DUKE ENERGY CORP Corp. CIA PARANAENSE DE ENER- E.ON International Finance BV Aboitiz Equity Ventures, Inc. GI-PFB Berkshire Hathaway Inc-Cl A E.ON SE ABOITIZ POWER CORP CIMAREX ENERGY CO BHARAT PETROLEUM CORP LTD Ecopetrol SA ADARO ENERGY TBK PT CITIC Ltd. BHP Group LIMITED EDF ADS CRUDE CARRIERS AS CK Hutchison Holdings Ltd. BHP Group PLC EDISON INTERNATIONAL AES CORP CK Infrastructure Holdings Ltd BlackPearl Resources Inc. EDP Finance BV AGL ENERGY LTD Swedish DR Clariant AG Reg Air Water Inc. EDP-ENERGIAS DE Bolloré SA CLP HOLDINGS LTD PORTUGAL SA Akastor ASA Bonheur ASA CMS ENERGY CORP Eidesvik Offshore ASA Aker ASA Borr Drilling Limited CNOOC LTD ELECTRIC POWER AKER BP ASA BP Capital Markets Plc COAL INDIA LTD DEVELOPMENT C Aker Solutions ASA BP PLC COLBUN SA ELECTRICITY GENERATING PCL AKR Corporindo Tbk PT BRASKEM SA Colruyt SA Electromagnetic Geoservices Alimentation Couche-Tard, Inc. BW LPG LTD CONCHO RESOURCES INC ASA ALLIANT ENERGY CORP BW Offshore Ltd. Concordia Maritime AB Eletrobras SA ALTAGAS LTD CABOT OIL & GAS CORP CONOCOPHILLIPS EMERA INC Aluminum Corporation of California Resources Corp. CONSOLIDATED EDISON INC EMPRESAS COPEC SA China Ltd-H CALTEX AUSTRALIA LTD CONTACT ENERGY LTD ENAGAS SA Amcor Ltd CAMECO CORP CONTINENTAL RESOURCES INC/ ENBRIDGE INC AMEREN CORPORATION CANADIAN NATURAL RESOUR- OK ENCANA CORP AMERICAN ELECTRIC POWER CES CORE LABORATORIES N.V. -

Exclusion List

Exclusion list ROBECO INSTITUTIONAL ASSET MANAGEMENT 1 Sustainability Inside Excluded companies: 61 Rimbunan Sawit Bhd 15 Bots Inc 62 Riverview Rubber Estates BHD 16 Bright Packaging Industry Bhd Controversial behavior 63 Salim Ivomas Pratama Tbk PT 17 Brilliant Circle Holdings International Ltd 1 G4S International Finance PLC 64 Sarawak Oil Palms Bhd 18 British American Tobacco Bangladesh Co Ltd 2 G4S PLC 65 Sarawak Plantation Bhd 19 British American Tobacco Chile Operaciones SA 3 Korea Electric Power Corp 66 Scope Industries Bhd 20 British American Tobacco Holdings The Netherlands BV 4 Oil & Natural Gas Corp Ltd1 67 Sin Heng Chan Malaya Bhd 21 British American Tobacco Kenya PLC 5 ONGC Nile Ganga BV 68 Sinar Mas Agro Resources & Technology Tbk PT 22 British American Tobacco Malaysia Bhd 6 ONGC Videsh Ltd 69 Socfin 23 British American Tobacco PLC 7 Vale Indonesia Tbk PT 70 Socfinasia SA 24 British American Tobacco Uganda Ltd 8 Vale SA2 71 Societe Camerounaise de Palmeraies 25 British American Tobacco Zambia PLC 72 Societe des Caoutchoucs de Grand-Bereby 26 British American Tobacco Zimbabwe Holdings Ltd Palm oil 73 SSMS Plantation Holdings Pte Ltd 27 Bulgartabac Holding AD 1 A Brown Co Inc 74 Sterling Plantations Ltd 28 Carreras Ltd/Jamaica 2 Agalawatte Plantations PLC 75 Subur Tiasa Holdings Bhd 29 Casey’s General Stores Inc 3 Anglo-Eastern Plantations PLC 76 Sungei Bagan Rubber Co Malaya Bhd 30 Cat Loi JSC 4 Astra Agro Lestari Tbk PT 77 Sunshine Holdings PLC 31 Ceylon Tobacco Co PLC 5 Astral Asia Bhd 78 Ta Ann Holdings Bhd 32 Champion -

Pwc's Growth Markets Centre

PwC’s Growth Markets Centre - Retail & Consumer Update Global Market Size (US$ trillion) Key global trends Regional / Country Updates APAC • Ultra convenience: Quick and CAGR convenient ‘push-button’ products and • Indonesia: JD.com opened JD.ID X-Mart, an AI-powered 5.8% services like Amazon Dash Buttons or via store, in Jakarta this August. It is the group’s first unmanned convenience store to be opened overseas. Since launching its 10.7 11.3 11.9 12.7 Siri or Alexa are rising in popularity. first AI-powered store in Beijing last October, JD has opened • Micro-shopping: Micro-shopping trips over 20 X-Mart stores in China. (< 5 minutes) are becoming increasingly • India: Swedish retailer IKEA enters the Indian market, 2016 2017 2018F 2019F common thanks to ‘click n collect ’grocery Source: Euromonitor launching its first store in Hyderabad in August. The retailer services. In the US, micro-shopping grew is also planning to enter the Latin American market by 2020. 8.7% at Whole Foods stores after Amazon Global Consumer Goods Output acquired the grocery chain in Aug 2017. • Southeast Asia: Retailers across the region are investing in (US$ trillion) digital engagement to get closer to consumers. Earlier in • Customized Environment: Customers 2018, Bata secured a partnership with a Singaporean CAGR today are yearning for a unique retail software company, Capillary Technologies, to strengthen 3.3% experience and are ready to reward their omni-channel customer relationship management 11.9 12.3 12.7 13.1 retailers which provide them. This will (CRM) strategies in Philippines and Vietnam. -

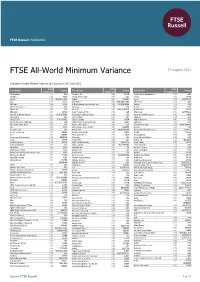

FTSE All-World Minimum Variance

2 FTSE Russell Publications 19 August 2021 FTSE All-World Minimum Variance Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 3M Company 0.1 USA Ajinomoto Co 0.05 JAPAN Annaly Capital Management 0.07 USA 3M India 0.02 INDIA Akamai Technologies 0.14 USA Anritsu 0.03 JAPAN a2 Milk 0.03 NEW ZEALAND Akbank 0.01 TURKEY Ansell 0.02 AUSTRALIA A2A 0.01 ITALY Akzo Nobel 0.02 NETHERLANDS ANSYS Inc 0.08 USA ABB India 0.04 INDIA Al Rajhi Banking & Investment Corp 0.04 SAUDI ARABIA Anthem 0.08 USA Abbott Laboratories 0.09 USA Albemarle 0.06 USA Aon plc 0.09 USA AbbVie Inc 0.11 USA Alcon AG 0.02 SWITZERLAND Aozora Bank 0.03 JAPAN ABC-Mart 0.03 JAPAN Aldar Properties PJSC 0.02 UAE APA Group 0.02 AUSTRALIA Abdullah Al Othaim Markets 0.04 SAUDI ARABIA Alexandria Real Estate Equity 0.09 USA Apollo Hospitals Enterprise 0.04 INDIA Abiomed Inc 0.11 USA Alexion Pharm 0.12 USA Apple Inc. 0.09 USA Aboitiz Power 0.02 PHILIPPINES Alfresa Holdings 0.02 JAPAN Applied Materials 0.06 USA Abu Dhabi Commercial Bank 0.02 UAE Alibaba Pictures Group (P Chip) 0.02 CHINA Aptiv PLC 0.04 USA Abu Dhabi Islamic Bank 0.03 UAE Align Technology Inc 0.05 USA Arab National Bank 0.03 SAUDI ARABIA ACC 0.04 INDIA Alimentation Couche-Tard B 0.02 CANADA Aramark 0.04 USA Accenture Cl A 0.09 USA Alinma Bank 0.04 SAUDI ARABIA Arca Continental SAB de CV 0.03 MEXICO Accton Technology 0.03 TAIWAN A-Living Services (H) 0.02 CHINA Arcelik 0.01 TURKEY Acer 0.04 TAIWAN Alkem Laboratories -

Peakstone Food and Beverage Index - Trading Statistics

www.peakstone.com Food and Beverage Industry M&A Update October 2016 Food and Beverage Industry M&A Update | October 2016 Food and Beverage Industry Update . For year-to-date 2016, total announced transactions of 281 deals are on pace with 2015 record levels. There were 351 transactions during 2015. For announced transactions, Food and Beverage (“F&B”) multiples saw a modest decrease from 13.4x Enterprise Value to EBITDA to 12.1x. Many F&B categories continue to outperform the S&P 500. Notable publicly announced recent M&A transactions: o ConAgra Foods acquired Frontera Foods including the Frontera, Red Fork and Salpica brands from the Frontera Hospitality Group for an undisclosed amount. o B&G Foods North America Inc. acquired ACH Food Companies, Inc., Spices and Seasonings Business for approximately $365 million. o Cott Corporation acquired S&D Coffee, Inc. for approximately $355 million. o UTZ Quality Foods, Inc. acquired Golden Enterprises Inc. for approximately $144 million. o Gores Holdings, Inc. acquired Hostess Brands, LLC for approximately $2.2 billion. o Dean Foods Company acquired Friendly's Ice Cream, LLC, Manufacturing and retail ice cream business for approximately $155 million. o Apollo Global Management, LLC entered into a definitive agreement to acquire The Fresh Market, Inc. for approximately $1.3 billion. o Peakstone advises PepperJax Grill on sale of company to TA Associates for an undisclosed amount. o Peakstone advises Clearbrook Farms on sale of company to Glencoe for an undisclosed amount. 1 Food and Beverage Industry M&A Update | October 2016 PepperJax Grill sold to TA Associates Peakstone served as exclusive M&A advisor to PepperJax Development Company (“PepperJax” or the “Company”) in connection with its sale to TA Associates.