Schedule of Investments S&P Midcap 400® Pure Value Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY U.S

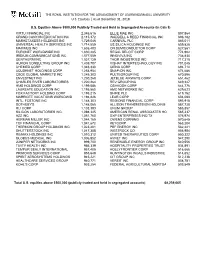

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY U.S. Equities │ As at December 31, 2018 U.S. Equities Above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) VIRTU FINANCIAL INC 2,345,616 ELLIE MAE INC 897,864 GRAND CANYON EDUCATION INC 2,115,372 WADDELL & REED FINANCIAL INC 896,182 MARKETAXESS HOLDINGS INC 1,729,046 CARNIVAL PLC 865,011 UNIVERSAL HEALTH SERVICES INC 1,714,559 US SILICA HOLDINGS INC 859,828 MAXIMUS INC 1,635,403 ON SEMICONDUCTOR CORP 827,561 EURONET WORLDWIDE INC 1,630,285 REGAL BELOIT CORP 774,962 IRIDIUM COMMUNICATIONS INC 1,577,559 INNOVIVA INC 738,830 GENTHERM INC 1,527,129 THOR INDUSTRIES INC 717,318 HURON CONSULTING GROUP INC 1,439,707 VISHAY INTERTECHNOLOGY INC 701,045 CHEMED CORP 1,343,330 CIENA CORP 694,714 ACUSHNET HOLDINGS CORP 1,258,954 SNAP-ON INC 674,686 CBOE GLOBAL MARKETS INC 1,245,303 PULTEGROUP INC 670,896 ENVESTNET INC 1,230,268 JETBLUE AIRWAYS CORP 651,462 CHARLES RIVER LABORATORIES 1,220,264 REV GROUP INC 649,247 HMS HOLDINGS CORP 1,199,586 OSHKOSH CORP 644,776 LAUREATE EDUCATION INC 1,195,560 AMC NETWORKS INC 629,623 FOX FACTORY HOLDING CORP 1,195,215 SHIRE PLC 619,182 MARRIOTT VACATIONS WORLDWID 1,194,826 LEAR CORP 604,088 INTL. FCSTONE INC 1,148,303 REGIONS FINANCIAL CORP 593,918 SOTHEBY'S 1,148,065 ALLISON TRANSMISSION HOLDING 587,728 RLI CORP 1,103,393 UNUM GROUP 585,857 SILICON LABORATORIES INC 1,098,345 AMERICAN RENAL ASSOCIATES HO 585,337 AZZ INC 1,051,760 DXP ENTERPRISES INC/TX 576,974 HERMAN MILLER INC 1,044,165 OWENS CORNING 570,645 TCF FINANCIAL -

S P O T L I G H T Pa R T I C I Pa N

SPOTLIGHT PARTICIPANTS 12 Copyright © 2019 Mercer (US) Inc. All rights reserved. ORGANIZATION LISTING 3M (Minnesota Mining & Manufacturing) Atlas Energy Group LLC City of Overland Park, KS Cleveland Indians Baseball Co. A&E Television Networks Auburn University City of Winston-Salem, NC CliftonLarsonAllen, LLP A.O. Smith Corporation Automatic Data Processing California Health Care Foundation CMA CGM (America) LLC American Automobile Association, Inc., The Automobile Club of Southern California Cabot Oil & Gas Corporation CNH Industrial America LLC Accenture LLP AXA XL Cactus Feeders, Inc. CNO Financial Group Accudyne Industries, LLC Badger Meter, Inc. Cadmus Holding Company CNOOC Petroleum U.S.A. Inc. Advance Auto Parts Baltimore Orioles California Endowment, The CNX Resources ADVICS North America, Inc. Bank of the Ozarks, Inc. California ISO Colorado Rockies Baseball Club AECOM Building & Construction Bank of New York Mellon California Wellness Foundation Cobb Electric Membership Corporation AECOM Enterprise Baptist Health - FL Cambia Health Solutions (Regence Group) Coca-Cola Company, Inc., The AECOM Management Services Crestline Hotels & Resorts, LLC Canadian Imperial Bank of Commerce COG Operating, LLC Aera Energy Services Company Barnes & Noble, Inc. Canadian National Cognizant Technology Solutions Corporation Affinity Federal Credit Union BASF Corporation Canadian Pacific Railway CohnReznick LLP AgReserves Inc. Basin Electric Power Co-op Canadian Solar, Inc. Colby College Agri Beef Company Bates College Capital Group Companies, Inc., The Colonial Group, Inc. American International Group, Inc. (AIG) Battelle Memorial Institute Capital One Financial Corporation Columbia Sportswear Company Aimbridge Hospitality Baylor College of Medicine CarMax Auto Superstores, Inc. Columbia University American Institutes for Research BB&T Corporation Carilion Clinic Columbus McKinnon Corporation Air Liquide USA Blue Cross Blue Shield of Kansas Carrix, Inc. -

Capped Buffered Return Enhanced Insight Notes Linked to the J.P

The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to completion dated June 2, 2021 June , 2021 Registration Statement Nos. 333-236659 and 333-236659-01; Rule 424(b)(2) JPMorgan Chase Financial Company LLC Structured Investments Capped Buffered Return Enhanced Insight Notes Linked to the J.P. Morgan Basket of Reference Stocks with Potential Exposure to Inflation (June 2021) due July 6, 2023 Fully and Unconditionally Guaranteed by JPMorgan Chase & Co. The notes are designed for investors who seek a return of 1.50 times any appreciation of the J.P. Morgan Basket of Reference Stocks with Potential Exposure to Inflation (June 2021) of 45 unequally weighted Reference Stocks, which we refer to as the Basket, up to a maximum return of at least 21.00%, at maturity. The Reference Stocks in the Basket represent the common stocks / common shares / ordinary shares of 45 U.S.-listed companies with potential exposure to inflation in the United States. Investors should be willing to forgo interest and dividend payments and be willing to lose up to 90.00% of their principal amount at maturity. The notes are unsecured and unsubordinated obligations of JPMorgan Chase Financial Company LLC, which we refer to as JPMorgan Financial, the payment on which is fully and unconditionally guaranteed by JPMorgan Chase & Co. Any payment on the notes is subject to the credit risk of JPMorgan Financial, as issuer of the notes, and the credit risk of JPMorgan Chase & Co., as guarantor of the notes. -

SCHEDULE of INVESTMENTS MID-CAP 1.5X STRATEGY FUND

SCHEDULE OF INVESTMENTS December 31, 2020 MID-CAP 1.5x STRATEGY FUND SHARES VALUE SHARES VALUE COMMON STOCKS† - 39.5% United Bankshares, Inc. 118 $ 3,823 Kinsale Capital Group, Inc. 19 3,802 FINANCIAL - 9.3% Highwoods Properties, Inc. REIT 95 3,765 Medical Properties Trust, Inc. REIT 489 $ 10,655 RLI Corp. 36 3,749 Brown & Brown, Inc. 215 10,193 Park Hotels & Resorts, Inc. REIT 215 3,687 Camden Property Trust REIT 89 8,893 Selective Insurance Group, Inc. 55 3,684 CyrusOne, Inc. REIT 110 8,047 Rayonier, Inc. REIT 125 3,673 Alleghany Corp. 13 7,848 Healthcare Realty Trust, Inc. REIT 124 3,670 RenaissanceRe Holdings Ltd. 46 7,628 Valley National Bancorp 369 3,598 Omega Healthcare Investors, Inc. REIT 207 7,518 Webster Financial Corp. 82 3,456 STORE Capital Corp. REIT 216 7,340 Bank OZK 110 3,440 Reinsurance Group of Physicians Realty Trust REIT 190 3,382 America, Inc. — Class A 62 7,186 PROG Holdings, Inc. 62 3,340 Eaton Vance Corp. 104 7,065 Hudson Pacific Properties, Inc. REIT 139 3,339 Jones Lang LaSalle, Inc.* 47 6,973 Sabra Health Care REIT, Inc. 189 3,283 Signature Bank 49 6,629 Alliance Data Systems Corp. 44 3,260 Lamar Advertising Co. — Class A REIT 79 6,574 Wintrust Financial Corp. 53 3,238 East West Bancorp, Inc. 129 6,541 CIT Group, Inc. 90 3,231 National Retail Properties, Inc. REIT 159 6,506 JBG SMITH Properties REIT 102 3,190 First Horizon National Corp. 507 6,469 Sterling Bancorp 177 3,183 SEI Investments Co. -

Schedule of Investments: 1.31.21 Holdings

Schedule of Investments January 31, 2021 (Unaudited) Schedule of Investments LSV Small Cap Value Fund LSV Small Cap Value Fund Shares Value (000) Shares Value (000) Automotive (2.5%) Common Stock (99.1%) American Axle & Aerospace & Defense (1.4%) Manufacturing Holdings* 146,500 $ 1,291 1,213 Curtiss-Wright 12,100 $ 1,256 Cooper Tire & Rubber 33,000 2,958 Moog, Cl A 32,500 2,401 Dana 152,800 1,277 Vectrus* 18,000 925 Modine Manufacturing* 101,800 4,582 Winnebago Industries 19,200 1,326 8,065 Agricultural Products (0.9%) Automotive Retail (1.9%) Ingredion 36,900 2,785 Camping World Holdings, Cl A 33,700 1,151 Air Freight & Logistics (0.9%) 2,518 Atlas Air Worldwide Group 1 Automotive 18,300 1,101 Holdings* 43,500 2,254 Penske Automotive Group 18,400 1,298 Park-Ohio Holdings 16,500 465 Sonic Automotive, Cl A 31,700 2,719 6,068 Aircraft (1.2%) Banks (16.2%) 3,102 Hawaiian Holdings 47,000 920 Associated Banc-Corp 172,900 1,271 Bank of NT Butterfield & JetBlue Airways* 88,600 1,384 1,489 Son 45,500 SkyWest 38,200 2,346 3,680 BankUnited 67,700 Berkshire Hills Bancorp 49,800 826 1,243 Apparel Retail (1.7%) Camden National 33,100 1,491 1,608 Cathay General Bancorp 44,100 Foot Locker 36,700 Dime Community 1,739 Genesco* 44,800 Bancshares 45,300 720 Guess? 13,900 323 Federal Agricultural Shoe Carnival 37,700 1,771 Mortgage, Cl C 18,700 1,421 5,441 Financial Institutions 43,990 1,007 First Busey 28,400 587 Apparel, Accessories & Luxury Goods (0.5%) First Commonwealth G-III Apparel Group* 60,400 1,633 Financial 148,900 1,747 First Horizon National -

COMPANY INDEX WEIGHT ACI Worldwide Inc 0.22% AECOM 0.40% AGCO Corp 0.23% AMC Networks Inc.-A 0.09% ASGN Incorporated 0.19% Aaron's Inc

COMPANY INDEX WEIGHT ACI Worldwide Inc 0.22% AECOM 0.40% AGCO Corp 0.23% AMC Networks Inc.-A 0.09% ASGN Incorporated 0.19% Aaron's Inc. 0.21% Acadia Healthcare Company Inc 0.16% Acuity Brands Inc 0.25% Adient Inc. 0.13% Adtalem Global Education Inc 0.10% Affiliated Managers Grp 0.22% Alleghany Corp (NY) 0.63% Allegheny Technologies Inc 0.14% Allete Inc 0.23% Allscript Healthcare Solutions Inc 0.08% Amedisys Inc 0.35% American Campus Communities Inc 0.35% American Eagle Outfitters 0.13% American Financial Group 0.46% Antero Midstream Corp 0.08% Apergy Corp 0.11% AptarGroup Inc 0.39% Arrow Electronics Inc 0.35% Arrowhead Pharmaceuticals, Inc 0.23% Ashland Global Holdings Inc 0.26% Associated Banc-Corp (IL) 0.18% AutoNation Inc 0.15% Avanos Medical, Inc 0.08% Avis Budget Group Inc 0.13% Avnet Inc 0.20% Axon Enterprise Inc 0.28% BANK OZK 0.18% BJ's Wholesale Club Holdings 0.14% BancorpSouth Inc (MS) 0.15% Bank of Hawaii Corp 0.20% Bed Bath & Beyond Inc 0.08% Belden Inc 0.11% Bio-Rad Laboratories Inc A 0.44% Bio-Techne Corp 0.42% Black Hills Corp 0.28% Blackbaud Inc 0.21% Boston Beer Inc A 0.20% Boyd Gaming Corp 0.14% Brighthouse Financial Inc 0.27% Brinker Intl Inc 0.09% Brixmor Property Group Inc 0.33% Brown & Brown Inc 0.59% Brunswick Corp 0.29% CACI International Inc 0.37% CDK Global Inc 0.34% CIENA Corp 0.36% CIT Group Inc 0.24% CNO Financial Group Inc 0.16% CNX Resources Corp. -

68560 Bankers Conseco Life Insurance Company

STATEMENT AS OF MARCH 31, 2019 OF THE BANKERS CONSECO LIFE INSURANCE COMPANY ASSETS Current Statement Date 4 1 2 3 December 31 Net Admitted Assets Prior Year Net Assets Nonadmitted Assets (Cols. 1 - 2) Admitted Assets 1. Bonds 448,414,680 448,414,680 441,499,686 2. Stocks: 2.1 Preferred stocks 4,465,600 4,465,600 8,530,271 2.2 Common stocks 315,120 315,120 262,276 3. Mortgage loans on real estate: 3.1 First liens 5,137,566 5,137,566 5,137,566 3.2 Other than first liens 4. Real estate: 4.1 Properties occupied by the company (less $ encumbrances) 4.2 Properties held for the production of income (less $ encumbrances) 4.3 Properties held for sale (less $ encumbrances) 5. Cash ($ 100,661 ), cash equivalents ($ 10,450,000 ) and short-term investments ($ ) 10,550,661 10,550,661 14,369,346 6. Contract loans (including $ premium notes) 5,575,700 20,233 5,555,467 5,445,886 7. Derivatives 8. Other invested assets 4,524,761 4,524,761 2,485,072 9. Receivables for securities 10. Securities lending reinvested collateral assets 11. Aggregate write-ins for invested assets 12. Subtotals, cash and invested assets (Lines 1 to 11) 478,984,088 20,233 478,963,855 477,730,103 13. Title plants less $ charged off (for Title insurers only) 14. Investment income due and accrued 5,324,855 5,324,855 4,950,468 15. Premiums and considerations: 15.1 Uncollected premiums and agents' balances in the course of collection 205,892 1,595 204,297 235,707 15.2 Deferred premiums, agents' balances and installments booked but deferred and not yet due (including $ earned but unbilled premiums) 7,685,519 7,685,519 7,161,985 15.3 Accrued retrospective premiums ($ ) and contracts subject to redetermination ($ ) 16. -

The CEO Action for Diversity & Inclusion™ Aims to Rally The

The CEO Action for Diversity & Inclusion™ aims to rally the business community to advance diversity & inclusion within the workplace by working collectively across organizations and sectors. It outlines a specific set of actions the undersigned companies will take to cultivate a trusting environment where all ideas are welcomed and employees feel comfortable and empowered to discuss diversity & inclusion. All the signatories serve as leaders of their companies and have committed to implementing the following pledge within their workplaces. Where companies have already implemented one or several of the commitments, the undersigned commit to support other companies in doing the same. The persistent inequities across our country underscore our urgent, national need to address and alleviate racial, ethnic and other tensions and to promote diversity within our communities. As leaders of some of America’s largest corporations, we manage thousands of employees and play a critical role in ensuring that inclusion is core to our workplace culture and that our businesses are representative of the communities we serve. Moreover, we know that diversity is good for the economy; it improves corporate performance, drives growth and enhances employee engagement. Simply put, organizations with diverse teams perform better. We recognize that diversity & inclusion are multifaceted issues and that we need to tackle these subjects holistically to better engage and support all underrepresented groups within business. To do this, we believe we also need to address honestly and head-on the concerns and needs of our diverse employees and increase equity for all, including Blacks, Latinos, Asians, Native Americans, LGBTQ, disabled, veterans and women. -

2012 CNO Investor Day

2012 CNO Investor Day December 13, 2012 Agenda Time Topic Speaker 12:15 Introductions Erik Helding – SVP Investor Relations & Treasury 12:20 CNO Strategy Ed Bonach – CEO 12:50 Segment Growth Strategy Scott Perry – CBO 1:05 Target Market & Distribution Scott Perry – CBO & President, Bankers Life Mike Buckley – SVP Sales, Bankers Life Steve Stecher – President, Washington National Gerardo Monroy – President, Colonial Penn 1:50 Break 2:00 Investments Eric Johnson – CIO, President, 40|86 2:30 Financial Overview Fred Crawford – CFO 3:00 Q&A 3:25 Concluding Remarks Ed Bonach - CEO CNO Financial Group | Investor Day | December 13, 2012 2 CNO Financial Group | Investor Day | December 13, 2012 3 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our Quarterly Reports on Form 10-Q, our 2011 Annual Report on Form 10-K and other filings we make with the Securities and EhExchange Comm iiission. We assume no o blititbligation to up dtthidate this presentation, which speaks as of today’s date. CNO Financial Group | Investor Day | December 13, 2012 4 Non-GAAP Measures This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between those non-GAAP measures an d the compara ble GAAP measures are inc lu de d in the AdiAppendix. -

L'institution Royale Pour L'avancement

L’INSTITUTION ROYALE POUR L’AVANCEMENT DES SCIENCES / UNIVERSITÉ McGILL ACTIONS AMÉRICAINES │ au 31 mars 2019 Actions américaines d’une valeur supérieure à 500 000 $ cotées en bourse et détenues dans des comptes distincts (en $ CAN) GRAND CANYON EDUCATION INC 2 464 502 WADDELL & REED FINANCIAL INC 838 294 VIRTU FINANCIAL INC 2 098 163 DXP ENTERPRISES INC/TX 829 531 EURONET WORLDWIDE INC 2 075 232 OSHKOSH CORP 772 848 IRIDIUM COMMUNICATIONS INC 2 021 967 CIENA CORP 748 266 MARKETAXESS HOLDINGS INC 1 969 545 SNAP‐ON INC 710 950 UNIVERSAL HEALTH SERVICES INC 1 924 707 PULTEGROUP INC 705 975 MAXIMUS INC 1 697 760 VISHAY INTERTECHNOLOGY INC 703 237 ENVESTNET INC 1 539 593 UNUM GROUP 659 850 CHARLES RIVER LABORATORIES INT 1 531 805 LEAR CORP 652 686 CHEMED CORP 1 484 619 JETBLUE AIRWAYS CORP 649 127 MARRIOTT VACATIONS WORLDWIDE C 1 442 976 AVNET INC 643 136 US SILICA HOLDINGS INC 1 434 222 AMC NETWORKS INC 636 960 ACUSHNET HOLDINGS CORP 1 352 421 HUNTINGTON INGALLS INDUSTRIES 636 660 GENTHERM INC 1 321 685 WESTROCK CO 635 298 LAUREATE EDUCATION INC 1 308 706 CIT GROUP INC 628 038 FOX FACTORY HOLDING CORP 1 274 121 DOMTAR CORP 623 501 HURON CONSULTING GROUP INC 1 242 872 REGIONS FINANCIAL CORP 614 370 INTL. FCSTONE INC 1 242 806 ARBOR REALTY TRUST INC 608 950 RE/MAX HOLDINGS INC 1 238 584 QUEST DIAGNOSTICS INC 600 643 TEMPUR SEALY INTERNATIONAL INC 1 225 928 OWENS CORNING 598 025 GLOBUS MEDICAL INC 1 212 789 GLOBAL BRASS & COPPER HOLDINGS 593 531 THERMON GROUP HOLDINGS INC 1 209 830 FEDERAL AGRICULTURAL MORTGAGE 590 253 SHUTTERSTOCK INC 1 202 -

2009 Annual Report | Conseco, Inc

2009 Annual Report | Conseco, Inc. Table of Contents 3 Letter to Shareholders 6 Our New Brand 9 Committed to Customer Service 10 Sound Advice to Meet Our Customers’ Needs 13 Financial Protection for the Unexpected 14 Conseco in the Community 17 Annual Report on Form 10-K 57 Market for Registrant’s Common Equity Related Stockholder Matters and Issuer Purchases of Equity Securities 60 Selected Consolidated Financial Data 61 Management’s Discussion and Analysis of Consolidated Financial Condition and Results of Operations 132 Consolidated Financial Statements and Supplementary Data 222 Exhibits and Financial Statement Schedules 231 Directors of Conseco, Inc. 233 Investor Information CNO Financial Group I 1 Our new brand exemplifies our commitment to our customers and reflects our improved financial position, our more clearly-defined business strategy and the positive opportunities for growth in the years ahead. C. James Prieur Chief Executive Officer To Our Shareholders: What an extraordinary year 2009 was for Conseco. investors and each of our three distribution channels is Following the economic downturn and turmoil in the consistent with our goal to focus even more clearly on U.S. and worldwide capital markets the previous year, our customers. Conseco made significant progress at both the holding company and the operating businesses. The culmination Our company has been streamlined and simplified over of those efforts and the strategic initiatives carried out in the past three years to concentrate on those businesses recent years has substantially transformed our company. where we are best positioned to meet the needs of a fast- growing but underserved marketplace that we understand This widespread transformation included recapitalizing well. -

ACVR NT High Income

American Century Investments® Quarterly Portfolio Holdings NT High Income Fund June 30, 2021 NT High Income - Schedule of Investments JUNE 30, 2021 (UNAUDITED) Shares/ Principal Amount ($) Value ($) CORPORATE BONDS — 94.0% Aerospace and Defense — 1.9% Bombardier, Inc., 6.00%, 10/15/22(1) 1,287,000 1,291,240 Bombardier, Inc., 7.50%, 12/1/24(1) 1,450,000 1,517,070 Bombardier, Inc., 7.50%, 3/15/25(1) 676,000 696,702 Bombardier, Inc., 7.875%, 4/15/27(1) 1,100,000 1,142,636 BWX Technologies, Inc., 4.125%, 4/15/29(1) 525,000 535,521 F-Brasile SpA / F-Brasile US LLC, 7.375%, 8/15/26(1) 600,000 620,250 Howmet Aerospace, Inc., 5.125%, 10/1/24 1,925,000 2,129,493 Howmet Aerospace, Inc., 5.90%, 2/1/27 125,000 146,349 Howmet Aerospace, Inc., 5.95%, 2/1/37 1,975,000 2,392,574 Rolls-Royce plc, 5.75%, 10/15/27(1) 600,000 661,668 Spirit AeroSystems, Inc., 5.50%, 1/15/25(1) 400,000 426,220 Spirit AeroSystems, Inc., 7.50%, 4/15/25(1) 875,000 936,587 Spirit AeroSystems, Inc., 4.60%, 6/15/28 600,000 589,515 TransDigm, Inc., 7.50%, 3/15/27 675,000 718,942 TransDigm, Inc., 5.50%, 11/15/27 6,000,000 6,262,500 TransDigm, Inc., 4.625%, 1/15/29(1) 1,275,000 1,279,195 TransDigm, Inc., 4.875%, 5/1/29(1) 1,425,000 1,440,319 Triumph Group, Inc., 8.875%, 6/1/24(1) 315,000 350,833 Triumph Group, Inc., 6.25%, 9/15/24(1) 275,000 280,159 Triumph Group, Inc., 7.75%, 8/15/25 375,000 386,250 23,804,023 Air Freight and Logistics — 0.3% Cargo Aircraft Management, Inc., 4.75%, 2/1/28(1) 850,000 869,584 Western Global Airlines LLC, 10.375%, 8/15/25(1) 875,000 1,003,520 XPO Logistics, Inc., 6.125%, 9/1/23(1) 1,100,000 1,111,820 XPO Logistics, Inc., 6.75%, 8/15/24(1) 475,000 494,000 3,478,924 Airlines — 1.1% American Airlines Group, Inc., 5.00%, 6/1/22(1) 750,000 751,890 American Airlines, Inc., 11.75%, 7/15/25(1) 2,475,000 3,109,219 American Airlines, Inc.