Cme® Equity Index Futures and Options

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gauging Your Investments with Performance Benchmarks

Gauging Your Investments with Performance Benchmarks One way to evaluate your investments objectively is to use industry-standard performance benchmarks. A benchmark is a market index or average that allows you to compare the performance of your stocks, bonds, or mutual funds against similar investments. Here are some of the most well-known and widely used investment benchmarks: Stock Benchmarks Dow Jones Industrial Average (DJIA). The oldest and most widely quoted market indicator. It reflects the price-weighted average of 30 actively traded blue chip stocks, mostly industrials, that generally represent 15% to 20% of the New York Stock Exchange (NYSE) total market value. (In a price- weighted index, higher priced stocks carry more weight than lower priced issues.) The mix of individual stocks changes occasionally. Standard and Poor’s 500 Index (S&P 500). A market value-weighted index that reflects changes in the aggregate market value of 500 stocks compared to the base period of 19411943. The S&P 500 consists mainly of New York Stock Exchange industrials, although it also includes transportation, utility, and financial stocks traded on the American Stock Exchange (AMEX), as well as over-the-counter (OTC). National Association of Securities Dealers Automated Quotation (NASDAQ) Composite Index. A broader measure of market activity than the DJIA or the S&P 500, this market value-weighted index tracks the prices of all securities traded on the NASDAQ Stock Market. The NASDAQ specializes in emerging companies, such as technology, telecommunications, and even electronic commerce. Market values are computed by multiplying the most recent sale price of the stock with the total number of outstanding shares. -

Margin Requirements Across Equity-Related Instruments: How Level Is the Playing Field?

Fortune pgs 31-50 1/6/04 8:21 PM Page 31 Margin Requirements Across Equity-Related Instruments: How Level Is the Playing Field? hen interest rates rose sharply in 1994, a number of derivatives- related failures occurred, prominent among them the bankrupt- cy of Orange County, California, which had invested heavily in W 1 structured notes called “inverse floaters.” These events led to vigorous public discussion about the links between derivative securities and finan- cial stability, as well as about the potential role of new regulation. In an effort to clarify the issues, the Federal Reserve Bank of Boston sponsored an educational forum in which the risks and risk management of deriva- tive securities were discussed by a range of interested parties: academics; lawmakers and regulators; experts from nonfinancial corporations, investment and commercial banks, and pension funds; and issuers of securities. The Bank published a summary of the presentations in Minehan and Simons (1995). In the keynote address, Harvard Business School Professor Jay Light noted that there are at least 11 ways that investors can participate in the returns on the Standard and Poor’s 500 composite index (see Box 1). Professor Light pointed out that these alternatives exist because they dif- Peter Fortune fer in a variety of important respects: Some carry higher transaction costs; others might have higher margin requirements; still others might differ in tax treatment or in regulatory restraints. The author is Senior Economist and The purpose of the present study is to assess one dimension of those Advisor to the Director of Research at differences—margin requirements. -

Market Preview Domestic Indices Market

24-AUG-2021 Domestic Indices Market wrap up Domestic indices The domestic equity benchmarks managed to close with decent index Close Prv close %Chg gains after a volatile session on Monday. The Nifty closed just NIFTY 50 16,496.5 16,450.5 0.28 NIFTY SMALLCAP 50 4820.55 4928.35 -2.19 shy of the 16,500 mark. IT stocks climbed while auto and metal NIFTY MIDCAP 50 7,186.8 7,238.4 -0.71 shares tumbled.The barometer index, the S&P BSE Sensex, NIFTY SMALLCAP 250 8350.15 8518.7 -1.98 advanced 226.47 points or 0.41% to 55,555.79. The Nifty 50 NIFTY BANK 35,124.4 35,033.9 0.26 index gained 45.95 points or 0.28% to 16,496.45.Bajaj Finserv , NIFTY NEXT 50 39220.15 39381.85 -0.41 NIFTY METAL 5,291.3 5,336.0 -0.84 Nestle India , Bharti Airtel, Bajaj Finance and Reliance Industries INDIA VIX 13.69 14.02 -2.35 supported the indices.Mahindra & Mahindra , Bajaj Auto , Global indices UltraTech Cement and ITC were major drags. In th broader market, the BSE Mid-Cap index fell 0.90% index Close Prv close %Chg Global Market NASDAQ 13,192.0 13,119.0 0.56% Wall Street rallied on Monday, and the Nasdaq reached an all- DOW 28,323.4 28,391.4 -0.24% time closing high as sentiment was boosted by full FDA approval CAC 40 5,769.0 5,765.0 1.16% DAX 13,884.0 13,786.0 0.71% of a COVID-19 vaccine and market participants looked ahead to NIKKEI 29,452.0 28,966.0 2.41% the Jackson Hole Symposium expected to convene later this HANG SENG 26,016.2 25,709.2 1.18% week.The Dow Jones Industrial Average rose 215.63 points, or NYSE 2,072.2 2,077.2 -0.24% 0.61%, to 35,335.71, the S&P 500 gained 37.86 points, or 0.85%, FTSE 6,553.0 6,483.0 1.07% to 4,479.53 and the Nasdaq Composite added 227.99 points, or As on 8.00 IST 1.55%, to 14,942.65.Shares in Asia-Pacific largely rose in NiftyMarket Watch Snapshot Tuesday morning trade . -

Invest in Your Retirement—And Yourself—Today, with Help from Comcast Corporation Retirement-Investment Plan and Fidelity

Comcast Corporation Retirement-Investment Plan Invest in your retirement—and yourself—today, with help from Comcast Corporation Retirement-Investment Plan and Fidelity. YOUR GUIDE TO GETTING STARTED Invest some of what you earn today for what you plan to accomplish tomorrow. Dear Comcaster: It is our pleasure to offer you the opportunity to participate in the Comcast Corporation Retirement- Investment Plan (the ’Comcast Plan’). Your retirement savings plan offers a convenient, tax-deferred way to save for retirement. As an eligible employee of Comcast Corporation, you will be automatically enrolled in the Plan at a contribution rate of 3% of your pretax eligible earnings. Benefit from: Matching contributions. Comcast helps your contributions grow by matching your 401(k) contributions. Convenience. Your contributions are automatically deducted regularly from your paycheck. Tax-deferred savings opportunities. You pay no taxes on any earnings until you withdraw them from your account, enabling you to keep more of your money working for you now. Tax savings now. Your pretax contributions are deducted from your pay before income taxes are taken out. This means that you can actually lower the amount of current income taxes withheld each period. It could mean more money in your take-home pay versus saving money in a taxable account. Portability. You can roll over eligible savings from a previous employer into this Plan. You can also take your vested account balance with you if you leave the company. Automatic annual increases. Save a little more each year, the easy way — the Annual Increase Program automatically increases your contribution rate by 1% each year up to 10% of your pretax eligible earnings. -

Morning Briefing Global Economic Trading Calendar

A Eurex publication focused on European financial markets, produced by MNl Morning Briefing March 12h 2015 Thursday sees a full day of data, with Council Member KlaasKnot speaks and be up 0.4%also excluding the German and French final inflation in Amsterdam. gasoline station sales. numbers the early feature. EMU data at 1000GMT sees the The US January business At 0700GMT, the German final January industrial output numbers inventories data will cross the wires February harmonised inflation data cross the wires. at 1400GMT. will be published. to be followed by the French numbers at 0745GMT Across the Atlantic, the calendar gets The value of business inventories is and the Spanish data at 0800GMT. underway at 1230GMT, with the expected to fall 0.2% in January after release of the February retail sales, small gains in recent months. ECB Executive Board Member February import/export index and the Benoit Coeure will deliver a speech jobless claims data for the March 7 Late data sees the US February on the future of euro area week. Treasury Statement set for release at investment, quantitative easing, and 1800GMT and Greek debt, in Paris, starting The level of initial jobless claims is at0745GMT. expected to fall by 12,000 to 308,000 the M2 money supply data for the in the March 7 week after rising by Mar 2 week at 2030GMT. Then, at 0915GMT, ECB Governing 7,000 in the previous week. The four- Council Member Jens Weidmann will week moving average rose by The U.S. Treasury is expected to hold a press conference, in 10,250 to 304,750 in the February 28 post a $188.5 billion budget deficit Frankfurt. -

STRS Ohio Smarttalk Newsletter

Quarterly investment newsletter for STRS Ohio members participating in the Defined Contribution and Combined Plans SUMMER 2021 STRS Ohio’s Fiscal 2022 Investment Plan calls for returns near expected policy return of 6.84% in the year ahead STRS Ohio Investment staff presented its Investment The Retirement Board’s investment consultants, Callan LLC Plan for the 2022 fiscal year at the June Retirement Board and Cliffwater LLC, reviewed and expressed support for meeting. The plan details staff’s investment strategy for the Investment Plan. The plan is available on the STRS Ohio each asset class in the system’s total fund. Fiscal year 2022 website at www.strsoh.org. STRS Ohio’s plan and forecast began on July 1 and runs through June 30, 2022. The fiscal is designed for a large institutional investor and may 2022 Investment Plan projects a combined overall return not be appropriate to an individual investor’s portfolio among all asset classes to be near STRS Ohio’s expected allocation, time horizon or risk tolerance. Like all economic policy return of 6.84% (assuming the total fund’s current forecasts, it should not be relied upon as an indicator of allocation). The plan forecast calls for a growing U.S. future results. For more personalized assistance, you can economy and for inflation to remain within a tolerable reach a Nationwide Retirement Solutions (NRS) Retirement range during the fiscal year. Specialist toll-free at 866-332-3342. Review your asset allocation Investment Style Asset Classes (allocation) ■ Cash 30% following strong equity market returns ■ Bonds 40% Domestic and international equity returns have been exceptionally CONSERVATIVE ■ Large-cap stocks 16% ■ Mid-cap stocks 4% strong for over a year now. -

A Primer on U.S. Stock Price Indices

A Primer on U.S. Stock Price Indices he measurement of the “average” price of common stocks is a matter of widespread interest. Investors want to know how “the Tmarket” is doing, and to be able to compare their returns with a meaningful benchmark. Money managers often have their compensation tied to performance, typically measured by comparing their results to a benchmark portfolio, so they and their clients are interested in the benchmark portfolio’s returns. And policymakers want to judge the potential for sudden adjustments in stock prices when differences from “fundamental value” emerge. The most widely quoted stock price index, the Dow Jones Industrial Average, has been supplemented by other popular indices that are constructed in a different way and pose fewer problems as a measure of stock prices. At present, a number of stock price indices are reported by the few companies that we will consider in this paper. Each of these indices is intended to be a benchmark portfolio for a different segment of the universe of common stocks. This paper discusses some of the issues in constructing and interpreting stock price indices. It focuses on the most widely used indices: the Dow Jones Industrial Average, the Stan- dard & Poor’s 500, the Russell 2000, the NASDAQ Composite, and the Wilshire 5000. The first section of this study addresses issues of construction and interpretation of stock price indices. The second section compares the movements of the five indices in the last two decades and investigates the Peter Fortune relationship between the returns on the reported indices and the return on “the market.” Our results suggest that the Dow Jones Industrial Average (Dow 30) The author is a Senior Economist and has inherent problems in its construction. -

Monthly Economic Update

In this month’s recap: Stocks moved higher as investors looked past accelerating inflation and the Fed’s pivot on monetary policy. Monthly Economic Update Presented by Ray Lazcano, July 2021 U.S. Markets Stocks moved higher last month as investors looked past accelerating inflation and the Fed’s pivot on monetary policy. The Dow Jones Industrial Average slipped 0.07 percent, but the Standard & Poor’s 500 Index rose 2.22 percent. The Nasdaq Composite led, gaining 5.49 percent.1 Inflation Report The May Consumer Price Index came in above expectations. Prices increased by 5 percent for the year-over-year period—the fastest rate in nearly 13 years. Despite the surprise, markets rallied on the news, sending the S&P 500 to a new record close and the technology-heavy Nasdaq Composite higher.2 Fed Pivot The Fed indicated that two interest rate hikes in 2023 were likely, despite signals as recently as March 2021 that rates would remain unchanged until 2024. The Fed also raised its inflation expectations to 3.4 percent, up from its March projection of 2.4 percent. This news unsettled 3 the markets, but the shock was short-lived. News-Driven Rally In the final full week of trading, stocks rallied on the news of an agreement regarding the $1 trillion infrastructure bill and reports that banks had passed the latest Federal Reserve stress tests. Sector Scorecard 07072021-WR-3766 Industry sector performance was mixed. Gains were realized in Communication Services (+2.96 percent), Consumer Discretionary (+3.22 percent), Energy (+1.92 percent), Health Care (+1.97 percent), Real Estate (+3.28 percent), and Technology (+6.81 percent). -

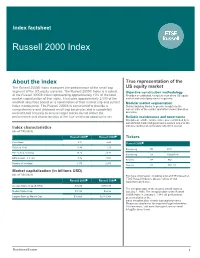

Russell 2000® Index Measures the Performance of the Small-Cap US Equity Market Segment of the US Equity Universe

Index factsheet Russell 2000 Index About the index True representation of the The Russell 2000® Index measures the performance of the small-cap US equity market segment of the US equity universe. The Russell 2000® Index is a subset Objective construction methodology of the Russell 3000® Index representing approximately 10% of the total Provides an unbiased, complete view of the US equity market capitalization of that index. It includes approximately 2,000 of the market and underlying market segments smallest securities based on a combination of their market cap and current Modular market segmentation index membership. The Russell 2000® is constructed to provide a Distinct building blocks to provide insight into the comprehensive and unbiased small-cap barometer and is completely current state of the market and inform asset allocation reconstituted annually to ensure larger stocks do not distort the decisions performance and characteristics of the true small-cap opportunity set. Reliable maintenance and governance Disciplined, reliable maintenance process backed by a well-defined, balanced governance system ensures the Index characteristics indexes continue to accurately reflect the market (As of 7/31/2021) Russell 2000® Russell 3000® Tickers Price/Book 2.71 4.46 Russell 2000® Dividend Yield 0.99 1.26 Bloomberg PR RTY P/E Ex-Neg Earnings 19.25 24.71 Bloomberg TR RU20INTR EPS Growth - 5 Years 9.76 17.01 Reuters PR .RUT Number of Holdings 1,975 2,997 Reuters TR .RUTTU Market capitalization (in billions USD) (As of 7/31/2021) For more information, including a list of ETFs based on FTSE Russell Indexes, please call us or visit Russell 2000® Russell 3000® www.ftserussell.com Average Market Cap ($-WTD) $3.274 $478.338 The inception date of the Russell 2000® Index is Median Market Cap $1.193 $2.636 January 1, 1984. -

Identifying Ticker Symbols and Interpreting Stock Quotes

Identifying Ticker Symbols and Interpreting Stock Quotes Lesson Summary Identifying Ticker Symbols and Interpreting Stock Quotes teaches students how to use stock ticker symbols to locate companies. Students will also learn how to read a stock quote. Lesson Objectives • Identify stocks by both newspaper and ticker symbol. • Determine how to look up a ticker symbol. • Enter purchase orders and/or make a trade on The Stock Market Game website. • Demonstrate the ability to use each of the following terms: share or stock, dividend, P/E ratio, volume or sales, change. NCTM Standards 1A - Understand numbers, ways of representing numbers, relationships among numbers, and number systems. 5A - Formulate questions that can be addressed with data and collect, organize, and display relevant data to answer them. 5B - Select and use appropriate statistical methods to analyze data. 5C - Develop and evaluate inferences and predictions that are based on data. 5D - Understand and apply basic concepts of probability. 6B - Solve problems that arise in mathematics and in other contexts. 6C - Apply and adapt a variety of appropriate strategies to solve problems. 8A - Organize and consolidate mathematical thinking through communication. 8B - Communicate mathematical thinking coherently and clearly to peers, teachers, and others. 9C - Recognize and apply mathematics in contexts outside of mathematics. 10A - Create and use representations to organize, record, and communicate mathematical ideas. Mathematical Strands Thinking Students practice calculating the value of stocks before Algebraically and after splits. Interpreting Students interpret graphs and make decisions based on Statistics the information presented. They are also asked to make choices about what types of investors might be more or less interested in certain graphs of the same information. -

Small Cap Is Active Management's Rightful Home

SMALL CAP IS ACTIVE MANAGEMENT’S RIGHTFUL HOME Recent trends show a growing willingness among investors to apply indexing’s logic farther down the market-cap ladder. But, when it comes to smaller companies, the indexing argument isn’t very convincing. Maintaining exposure to the small-cap “category” through an index-based product eliminates the chance to benefit in an area that, we contend, offers active managers with fundamentals-based strategies the most consistent and pronounced opportunity to generate excess return. PASSIVE INFLUX: FUNDS FORM THE FOUNDATION WHILE ETFS KEEP PILING ON… The Vanguard Group introduced the first index fund at the end of 1975 as a low-cost way for investors to gain exposure to the companies of the S&P 500 Index, which account for roughly 80 percent of the stock market’s total capitalization. The strategy initially attracted $11 million in assets under management. According to S&P Dow Jones Indices, more than $7.8 trillion is currently benchmarked to the S&P 500 Index, “with index assets comprising approximately $2.2 trillion of this total.” Other estimates put indexing’s reach at more than one out of every three shares outstanding among the index’s component companies. The emergence of exchange-traded funds (ETFs), the first of which was launched in 1993 to track the S&P 500 Index, only adds momentum to passive investing’s growing presence within the equity market. Since 2008, when the SEC broadened the scope of allowable ETF strategies, the number of ETFs more than doubled to 1,594 through the end of 2015. -

Why Switzerland?

Why Switzerland? Marwan Naja, AS Investment Management January, 2010 I. Executive Summary Swiss Equities Have Outperformed: Here is a fact you probably did not know: The Swiss equity market has arguably been the best performing developed world market over the past 20, 10, 5 and 2 years. The SPI Index, which incorporates over 200 Swiss stocks, is the best performing index in Swiss Franc (“CHF”), US Dollars (“USD”), Euro (“EUR”) and British Pounds (“GBP”) over the past 20 years1,10 years, 5 years, and 2 years when compared to similar broad-based total return indices in the United States (S&P 500 Total Return), the United Kingdom (FTSE 350 Total Return), Germany (CDAX), France (SBF 120 Total Return) and Japan (TOPIX Total Return)2. For most of these periods the magnitude of the outperformance is significant. Furthermore, the Swiss market has exhibited attractive risk characteristics including lower volatility than comparable markets. Figure 1: SPI 20 Year Performance (red) Compared to Major Developed Indices in CHF3 1 The 20 year comparable excludes the EUR which has not existed for that duration and the French SBF 120 TR which was established in 1990 and has underperformed the SPI over the 19 year period. 2 The Swiss market is the best performer in our local currency comparison (stripping out the foreign exchange effects) over 20 years and marginally trails the FTSE 350 for the 10 year, 5 year and 2 year comparisons. 3 Source of all graphs is Bloomberg unless otherwise indicated. Why Switzerland? AS Investment Management Contents I. Executive Summary ............................................................................................................ 1 Swiss Equities Have Outperformed ...................................................................................