TAA (Vic) Current and Future Hotel Developments November 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CBD News Editions 38 – December 2017 / January 2018

FOR THE MONTHS OF DECEMBER 2017 & JANUARY 2018 ISSUE 38 WWW.CBDNEWS.COM.AU 㿱 25 亥 FREE ON THE OTHER SIDE YEAR OF THE DOG IS COMING CAPITOL THEATRE APPEAL FLINDERS ST REVEALED - page 2 - - page 5 - - page 6 - - page 11 - City Square cash deal By Shane Scanlan said. “But, one way or another, we’ll have the cash to buy back the public space.” Fears have been allayed that Cr Wood said the council decided the sale and repurchase of the square was the City of Melbourne may not the cleanest way to deal with the matter have the cash to buy back the because it was not known what condition or remaining parts of the square would City Square when the Metro be available when the rail project was Tunnel project is complete. completed. “We don’t know at this stage exactly how Th e council earlier this year sold the square much of the square will be used for Metro to the State Government for around $67 Tunnel,” Cr Wood said. million and it was feared the money would “We know there will be less public open be spent on the Queen Victoria Market space, but not the absolute fi nal design. (QVM) renewal project. However, the City of Melbourne is working In April 2014, the council resolved to with Metro throughout the entire process establish a fund to pay for the QVM. to ensure the fi nal design is mutually benefi cial for everyone, most importantly It also resolved: “Commencing from 1 the residents, workers and visitors to the July 2014, all profi t proceeds from the sale city.” of any other surplus or redundant City of “Th e cleanest way is to sell the lot and Melbourne land holdings will be deposited negotiate the repurchase when the time into the fund.” comes at the mutually agreed value, But Deputy Lord Mayor and fi nance chair providing it is in line with the approved Arron Wood says funds received from masterplan.” the sale of the City Square will be held in “It was impossible to negotiate a binding trust to an agreed amount currently under agreement when there was so many negotiation with the Valuer-General. -

Glass Reinforced Concrete (GRC)

SYDNEY • LONDON • DUBAI 1 SKYE BY CROWN GROUP North Sydney NSW Contents About 3 Memorable Projects 5 Services 10 Featured Work 20 GRC 59 CharlesMSc, CEng, FIStruct.E, FIE (AUST),Rickard MIPENZ PRINCIPAL An industry leader and well-respected professional within his field. Charles Rickard graduated from Surrey University, UK with a Master of Science (Distinction) in Structural Engineering in 1975, having completed a Bachelor of Science in Civil Engineering the previous year. Charles undertook his initial three years of engineering training with Taylor Woodrow, the international engineering group. By 1982, after an 18 month stay with Alan Baxter & Associates, he had achieved the position of London Associate with White Young Consulting Group (now known as White Young Green). His major responsibility with them was the engineering design and site supervision of construction for the $100 million (1980 value) Phase 2 Basildon town Charles Rickard is one of centre development in the UK. Charles also did a three month stint in Australia’s most sought-after Qatar, where he designed a new palace for the Emir. engineers who has built a solid In 1984, Charles moved to Australia and set up Rickard and reputation through delivering Partners Pty Ltd, subsequently known as Bonacci Rickard, then quality, trust and innovation Rickard Hails Moretti Pty Ltd. Over a period of 20 years, the within his field. company offered civil, structural, façade and building diagnostic consultancy services in two divisions, while utilising the very latest in design and drafting computer technology. The new company eventually enjoyed an annual fee income turnover in excess of $3 million, with clients covering the public and private sector and project values ranging up to $200 million. -

TAA (Vic) Current and Future Hotel Developments August 2019

TAA (Vic) Current and Future Hotel Developments August 2019 Hotel Market Outlook 2 Supply and Demand 3 Australian Key International Visitor Trends 7 Australian Key Domestic Visitor Trends 9 Demand Drivers 11 Major Stakeholders 13 New Projects Announced 14 Development Summary Melbourne (including inner suburbs, city and surrounds) o New hotel openings 17 o Under Construction 18 o Approved 19 o Proposed 22 Suburban developments 24 Regional developments 25 Hotel openings over the past 12 years (Melbourne) 27 Tourism Accommodation Australia (Victoria) 1 Market outlook remains broadly positive Prevailing economic conditions “Slowing global growth and a pick up in the pace of housing price losses weighed on consumer spending and household construction over the second half of 2018.” - “Looking forward, a restrained household sector will continue to weigh on growth, but will somewhat be offset by increased government spending and exports growth.” - “Continued falls in the value of their largest asset have prompted households to be more cautious with their wallets, while also causing developers to think twice before beginning new construction projects.1” - Combined, the slowdown in household consumption growth and retreat in dwelling investment were responsible for about half the decline in economic growth (the economy grew at an annualised rate of 3.8 per cent over the first six months of 2018, falling to 0.9 per cent, post a significant slowdown over the balance of the year) (Ibid). - Spending on infrastructure projects by state governments across Australia’s fastest growing cities, the continued rollout of the National Disability Insurance Scheme and tax cuts announced in the Federal Budget will assist to offset future declines in economic activity (Ibid). -

Download Brochure

WHERE ELEGANCE COMES NATURALLY Public gardens and central laneway | Artist’s impression As the final chapter of West Side Place, The Park Release celebrates the beautiful public gardens that connect this new CBD precinct, along with the striking views across the evergreen Flagstaff Gardens. P. 02 WEST SIDE PLACE The Precinct Situated in the heart of Melbourne, this world-class development’s four towers offer luxury residences, hotel accommodation, personalised amenities, access to public leisure space and endless retail options, with encompassing views across the bay and cityscape. Striking a balance between opulence and the beauty of nature, the West Side Place precinct is bound to become a go-to destination in its own right. South view across Flagstaff Gardens to West Side Place (aerial taken April 2018) | Artist’s impression P. 05 The towers of West Side Place have been designed by renowned architects Cottee Parker to capture breathtaking views of the inner-city precinct’s surrounding landscape. A striking, angled glass facade weaves throughout the tower exterior using a folding and terracing effect for a sophisticated, contemporary look. Meanwhile, soft honey tones highlight key architectural features and accent breaks. Each tower is composed of a six-sided floor plate, allowing for maximum solar exposure and superior view lines. The three-dimensional and sculptural nature of the project invites engagement from multiple facets for residents. Aerial view of central laneway and public gardens | Artist’s impression P. 06 THE WORLD’S MOST PRESTIGIOUS HOTEL MEETS A NEW HEIGHT OF LUXURY LIVE WHERE THE WORLD’S ELITE COME TO STAY West Side Place will be anchored by The Ritz-Carlton, the top luxury hotel brand in the world. -

Double Whammy for CBD Traders Along the Eastern Edge of the CBD

FOR THE MONTH OF SEPTEMBER, 2015 ISSUE 13 WWW.CBDNEWS.COM.AU FREE FOOD / EVENTS / NIGHTLIFE / LUNCH TIME / AFTER WORK / THE WEEKEND pages 12-15 COUNCIL IS ROLLING IN CASH TRAM STOP PLAN REVEALED DUCKBOARD BOOK LAUNCH STATE ACTS ON SMOKING - page 3 - - page 4 - - page 7 - - page 9 - Independence celebrations Indian Independence Day was celebrated in style last month. Federation Square was the focus of the day on August 15, which saw a fl ag-raising, dancing and celebrity heart-throbs. Th e Indian Film Festival of Melbourne also kicked off during the weekend. A Bollywood dance competition was popular with 31 teams of dancers selected from around Australia, New Zealand and Fiji participating. Among the judges were actress Kangana Ranaut, heart-throb Imran Khan and director Nikhil Advani. Double whammy for CBD traders along the eastern edge of the CBD. this year’s parade to assess whether the in that context. We will work closely with the money it contributes continues to activate AFL to ensure that city businesses continue Th e previously joyous thoughts Th is year’s parade starts at the Old Treasury CBD businesses. to benefi t from the AFL Grand Final Parade Building, travels south down Spring St before of another AFL grand fi nal in future years.” have turned to despair for turning left into Wellington Pde and making Th e council’s marketing chair, Cr Beverley its way to the MCG. Pinder-Mortimer, said she was disappointed Collins Street Precinct president Mary city retailers who are about to that the parade had been re-routed. -

Media Release

MEDIA RELEASE EMBARGOED THURSDAY 4TH APRIL 2019, 5:00PM MELBOURNE CBD’S TALLEST BUILDING, AURORA MELBOURNE CENTRAL, TOPS OUT • UEM Sunrise and Probuild celebrate the structural topping out of Aurora Melbourne Central in Melbourne • At 289m AHD, the mixed-use tower comprising of residential, serviced apartment, retail and commercial space is the tallest in the CBD • The project is creating more than 500 new ongoing employment opportunities and over 3000 jobs during construction Melbourne, Australia: Leading Malaysian property developer, UEM Sunrise, and Australian Tier 1 contractor Probuild are proud to announce that Melbourne CBD’s new tallest and most significant tower, Aurora Melbourne Central, has officially reached its highest point. Topping out at a staggering 289m AHD, Aurora Melbourne Central is an 88-storey mixed-use development comprising 959 residential apartments, 252 serviced apartments, office suites and premium retail space. Having now reached its structural peak, it towers over the CBD’s current tallest tower, The Rialto, which is at 270m AHD. UEM Sunrise Managing Director and CEO, Anwar Syahrin Abdul Ajib, said that this is not only a major milestone for UEM Sunrise, being the company’s second project to top out in Australia in the past 12 months, but also a testament to the growth of Melbourne’s prospering CBD. “Aurora Melbourne Central is UEM Sunrise’s flagship development in Australia, so it is a very important moment for us to see it structurally reach its peak. It is a testament to the work of all parties involved in the project, including our construction partner Probuild, that it has been so successful thus far, and it’s fantastic that we are able to celebrate this milestone together. -

Information Only

Annual General Meeting - 2018 Adam Lamond Managing Director Slide 1 Veris is a national professional services business offering surveying, professional and advisory and geospatial services Slide 2 FY2018 Financial Dashboard Revenue EBITDA1 NPATBA2 $106.8m $11.2m $11.2 $5.3m $5.3m 45%45% 96%96% 92% 92% Cash Dividend Per Share Net Debt $106.8m $11.2 $5.3m $5.6m 0.5 cents $8.0m 45% 96% 92% 1. EBITDA is a non-IFRS measure 2. Underlying NPATBA Slide 3 Note: % increase from prior period represents the movement from continuing operations FY18 Results Overview $m FY18 FY17 Revenue 106.8 73.5 EBITDA 11.2 96% 5.7 Depreciation (3.6) (3.7) Acquisition related costs (1.6) (1.2) Restructuring costs1 (1.8) (0.9) Share-based payments (1.0) (0.3) EBITA 3.2 900% (0.4) Amortisation (4.1) (4.2) EBIT (0.9) 80% (4.6) Net interest expense (1.0) (0.6) Profit before tax (1.9) (5.2) Income tax benefit/(expense) 0.9 3.8 NPAT (1.0) (1.4) Amortisation net of tax 2.8 2.9 NPATBA 1.8 20% 1.5 Note 1: FY18: includes costs associated with the restructuring and integration activities for the surveying business Note 2: FY17 restated for continuing operations Slide 4 FY18 Balance Sheet $m FY18 FY17 Cash 5.6 14.6 Elton Purchase Consideration $000 Receivables 30.9 16.0 Net Assets acquired 1,853 Work in progress 10.5 4.6 Brand 293 Other current assets 1.7 1.1 Customer relationships 3,496 Plant and equipment 15.2 11.0 Goodwill 12,251 Intangibles 58.6 40.5 Total Purchase consideration 17,893 Deferred tax asset 6.3 7.6 TOTAL ASSETS 128.8 95.4 Payables 17.5 7.3 LANDdata Purchase -

Demolition Fears for Historic Drill Hall

FOR THE MONTH OF OCTOBER, 2014 ISSUE 03 FREE WWW.CBDNEWS.COM.AU Food Events Nightlife LUNCH TIME 14 AFTER WORK 16 THE WEEKEND 18 FAN-POWER TRIUMPH OVER-SHADOWING DEAL COMIC BOOK HEROES FAKE-MONK WARNING page 2 page 3 page 4 page 9 Demolition fears for historic drill hall Th e Royal Historical Society of Victoria (RHSV) fears it could be evicted from its premises and the historical building demolished after the state election. Th e Drill Hall at 239 A’Beckett St is owned by the State Government but is on a list of properties which could be sold. Th e society says it has been given a single- year’s extension on its lease until the end of the fi nancial year and has been told the building would not be sold as long as Matthew Guy remains planning minister. “We interpret this as meaning possible sale of the building after the election,” the society said in a letter to supporters. Th e hall was built in the 1930s in art deco style for the Australian Army’s medical corp. It was sold by the Federal Government to private interest and was later purchased by the Victorian Government. In 1988 it was added to the Victorian Register of Historic Buildings. Th e society has had a number of From left Kate Prinsley, Jodie Boyd, Alan Hall and Gerardine Horgan inside the art deco drill hall in A'Beckett St. short-term leases on the building since 2000. “Th e building is owned by the Victorian collection while it has no security of tenure. -

The Highest Residences in the Southern Hemisphere

THE HIGHEST RESIDENCES IN THE SOUTHERN HEMISPHERE 70 SOUTHBANK BOULEVARD ARTIST IMPRESSION Australia 108, luxury skyhomes in the heart of the world’s most liveable city. Melbourne, Australia. ARTIST IMPRESSION “Australia 108 is a highly sculptural residential by the Commonwealth Star on the Australian tower unlike any other in Australia. The starburst flag and is an obvious celebration of the sense which contains the resident facilities is inspired of community within the building.” MELBOURNE ARTIST IMPRESSION BESPOKE LUXURY THE BEAUTY INSIDE Australia 108 is designed by world “The interior design builds on the feminine renowned architects Fender Katsalidis. curves of the architecture. Envisioned Karl Fender and Nonda Katsalidis have as a ‘queen,’ the building shimmers produced some of the finest buildings in with an appropriately majestic colour Australia and around the world. palette – a luxurious hotel-style scheme The firm’s latest architectural masterpiece with an understated materiality of rich is a highly sculptural residential tower natural textures.” Carr Design Group has unlike any other in Australia. Its slender a fascination for putting all the design form is highlighted at the higher levels subtleties together to create beautiful by a golden starburst expression and then solutions that are very strong. ARTIST IMPRESSION morphs into a curvaceous profile against Led by the much lauded Sue Carr, Carr the sky. The starburst which contains Design Group is one of Australia’s most the resident facilities is inspired by the influential multidisciplinary design firms. Commonwealth Star on the Australian flag Their building designs are distinctive, often very sculptural in form. The Award-winning architect and new National For over 40 years, the group has maintained Australia. -

SYDNEY • LONDON • DUBAI 1 SKYE by CROWN GROUP North Sydney NSW Contents

SYDNEY • LONDON • DUBAI 1 SKYE BY CROWN GROUP North Sydney NSW Contents About 3 Memorable Projects 5 Services 10 Featured Work 20 GRC 59 CharlesMSc, CEng, FIStruct.E, FIE (AUST),Rickard MIPENZ PRINCIPAL An industry leader and well-respected professional within his field Charles Rickard graduated from Surrey University, UK with a Master of Science (Distinction) in Structural Engineering in 1975, having completed a Bachelor of Science in Civil Engineering the previous year. Charles undertook his initial three years of engineering training with Taylor Woodrow, the international engineering group. By 1982, after an 18 month stay with Alan Baxter & Associates, he had achieved the position of London Associate with White Young Consulting Group (now known as White Young Green). His major responsibility with them was the engineering design and site supervision of construction for the $100 million (1980 value) Phase 2 Basildon town Charles Rickard is one of centre development in the UK. Charles also did a three month stint in Australia’s most sought-after Qatar, where he designed a new palace for the Emir. engineers who has built a solid In 1984, Charles moved to Australia and set up Rickard and reputation through delivering Partners Pty Ltd, subsequently known as Bonacci Rickard, then quality, trust and innovation Rickard Hails Moretti Pty Ltd. Over a period of 20 years, the within his field. company offered civil, structural, façade and building diagnostic consultancy services in two divisions, while utilising the very latest in design and drafting computer technology. The new company eventually enjoyed an annual fee income turnover in excess of $3 million, with clients covering the public and private sector and project values ranging up to $200 million. -

Council Set to Slam Road Project

FOR THE MONTH OF JULY, 2017 ISSUE 33 WWW.CBDNEWS.COM.AU 㾕 21 义 FREE SEEING THROUGH MAX'S EYES NOT JUST BOOKS AND THEATRE HONOUR FOR SHOE MAN COME AND SEE OUR MURALS - page 4 - - page 6 - - page 7 - - page 8 - Council set to slam road project Th e City of Melbourne looks set to launch a withering critique of the West Gate Tunnel project, which will dump thousands more vehicles per day into the north and west of the CBD. Speaking at a community session at the town hall on June 8, traffi c co-ordinator Richard Smithers said the council had serious concerns about the impact of the project. Th e government on May 29 released a Council traffi c co-ordinator Richard Smithers 10,000-page environmental eff ects statement addresses the session. (EES) on the impact of the privately-initiated toll road proposal. Submissions in response would be taken up for 14 hours per day. close on July 10. “Essentially, in both directions these Th e EES is predicting signifi cant reductions roads will be in peak conditions for up to of traffi c in King and Spencer streets in 14 hours a day,” he said. “Th at’s a concern 2031 if the project proceeds, with traffi c because council has spent a lot of time being diverted via Docklands. Apart from and energy changing how traffi c moves the western end of LaTrobe St (which is through this area.” predicted to carry 1000 more vehicles per day), no other Hoddle Grid streets were He said this extra east-west traffi c would included in the analysis. -

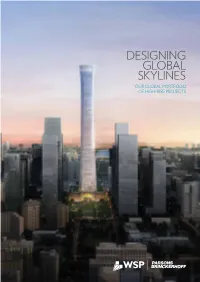

Designing Global Skylines Our Global Portfolio of High-Rise Projects Designing Global Skylines

DESIGNING GLOBAL SKYLINES OUR GLOBAL PORTFOLIO OF HIGH-RISE PROJECTS DESIGNING GLOBAL SKYLINES “ENGINEERING HIGH-RISE CONTENTS BUILDINGS IS HALF ART, HALF SCIENCE – AN ARTFUL DESIGNING GLOBAL SKYLINES 04 APPLICATION OF SCIENCE OUR PROJECTS 09 EMPOWERED BY EXPERIENCE.” THE ONLY WAY IS UP 10 NORTH AMERICA 12 AHMAD RAHIMIAN, DIRECTOR OF BUILDING STRUCTURES, USA EUROPE, MIDDLE EAST AND AFRICA 32 CHINA AND SOUTH EAST ASIA 52 AUSTRALIA 70 OUR SERVICES 78 ABOUT US 80 CONTACT DETAILS 82 Image of 111 West 57th Street courtesy of JDS 3 DESIGNING GLOBAL SKYLINES DESIGNING GLOBAL SKYLINES DESIGNING GLOBAL SKYLINES FOR MORE THAN A CENTURY WSP | PARSONS BRINCKERHOFF HAS BEEN HELPING TO SHAPE THE SKYLINE OF CITIES THROUGHOUT THE WORLD. WE’RE LEADERS IN THE DESIGN OF TALL BUILDINGS, PIONEERING THE TREND TO BUILD HIGHER AND SLIMMER TO OPTIMISE VALUABLE REAL ESTATE IN OUR DENSE URBAN ENVIRONMENTS. Our expertise makes it possible for architects BUILDING HIGHER AND SLIMMER to push the boundaries of their aesthetic THAN EVER BEFORE visions and for our clients to realise their goals. Our engineers are enabling a new generation We have a long history of innovation and a of landmark mega-towers and super-slender reputation for meeting engineering challenges buildings. with imaginative thinking coupled with common sense solutions. Buildings engineered Through our innovative design approach and use by WSP | Parsons Brinckerhoff stand the test of materials we ensure that the form and function of time and make a positive contribution to our of our mega-towers are perfectly adapted to the cities’ economies, society and the environment. different needs of the people who use them.