26021466 (PCCW)4Th Proof 11:15 P

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SUNDAY Communications Limited (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 0866)

The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this announcement, makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUNDAY Communications Limited (Incorporated in the Cayman Islands with limited liability) (Stock Code: 0866) ANNOUNCEMENT (1) VERY SUBSTANTIAL DISPOSAL AND CONNECTED TRANSACTION (2) VOLUNTARY WITHDRAWAL OF LISTING AND PROPOSED DISTRIBUTION Offer to purchase substantially all the businesses and assets of the SUNDAY Group The Directors announce that on 25 September 2006, the Company received from PCCW, its controlling shareholder, an offer letter offering to purchase the entire issued share capital of SUNDAY Holdings, a wholly owned subsidiary of the Company. It is a condition precedent to completion of the sale and purchase of SUNDAY Holdings contemplated by the Offer Letter that an internal group reorganisation first be implemented. On completion of the internal group reorganisation, SUNDAY Holdings would be the holding company of: (a) Mandarin and SUNDAY 3G, which are the SUNDAY Group’s operating subsidiaries respectively providing 2G and 3G telecommunications services; (b) SUNDAY IP, which holds all of the intellectual property rights required by Mandarin and SUNDAY 3G for those businesses; and (c) SUNDAY China, which is the holding company for the SUNDAY Group’s back office operations located in the PRC, which are carried on by SUNDAY Communications Services (Shenzhen) Limited. Accordingly, the sale and purchase contemplated by the Offer Letter is a sale of substantially all the operating businesses and assets of the SUNDAY Group. -

PCCW Limited

PCCW Limited (Incorporated in Hong Kong with limited liability) (Stock Code: 0008) INTERIM RESULTS ANNOUNCEMENT FOR THE SIX MONTHS ENDED JUNE 30, 2006 The directors (“Directors”) of PCCW Limited (“PCCW” or the “Company”) announce the unaudited consolidated results of the Company and its subsidiaries (collectively the “Group”) for the six months ended June 30, 2006. These interim financial statements have not been audited, but have been reviewed by the Company’s Audit Committee and, in accordance with the Statement of Auditing Standards 700 “Engagements to review interim financial reports” issued by the Hong Kong Institute of Certified Public Accountants, by the Company’s independent auditors, PricewaterhouseCoopers. ● Continued recovery of core telecommunications business ● Significant growth of now TV ● Consolidated revenue increased 21% to HK$14,124 million ● Consolidated EBITDA increased 13% to HK$3,652 million ● Basic earnings per share 11.83 HK cents ● Declared interim dividend of 6.5 HK cents per share MANAGEMENT REVIEW In the first half of 2006, PCCW’s core telecommunications business continued to recover in a steadily improving business environment. Consolidated revenue for the six months ended June 30, 2006 increased 21% to HK$14,124 million and consolidated EBITDA increased 13% to HK$3,652 million. This was largely due to the higher Bel-Air sales recognized upon completion of construction, and the consolidation of SUNDAY Communications Limited (“SUNDAY”) results in the first half of 2006. Excluding the Group’s property business, Pacific Century Premium Developments Limited (“PCPD”), and its mobile business, SUNDAY, the financial performance of PCCW’s telecommunications business was relatively stable. -

CSL Acquisition FCF Accretive: Prefer HKT Among HK Telcos

March 11, 2014 Hong Kong: Telecom Services Equity Research CSL acquisition FCF accretive: Prefer HKT among HK telcos HKT’s pending acquisition of CSL signals industry consolidation The HK mobile industry stands to benefit from HKT’s proposed US$2.4bn HONG KONG TELECOM VALUATION COMPS acquisition of CSL in the longer term, in our view, as it would reduce 12-Mo. Market Up/Down Total Name Ticker Rating Tgt Px Price Side Return competitive intensity in Asia’s highest penetrated mobile market. The deal PCCW 0008.HK Neutral 3.60 3.75 -4% 2% HKT Trust 6823.HK Neutral 8.90 8.25 8% 14% is pending regulatory approval after receiving PCCW and HKT HTHK 0215.HK Neutral 2.60 2.61 0% 4% SmarTone 0315.HK Neutral 10.00 9.20 9% 12% shareholders’ approval (99.98%) at the EGM on Feb 28. The acquisition P/E EV/EBITDA Div Yld could also potentially remove the overhang of the upcoming spectrum re- Name 2014E 2015E 2014E 2015E 2014E 2015E PCCW 13.0x 11.5x 5.6x 5.2x 6.0% 6.8% auction, which we would see as an industry-wide positive. HKT HKT Trust 22.7x 16.5x 8.9x 8.5x 5.9% 6.0% HTHK 15.6x 15.6x 6.4x 6.3x 4.8% 4.8% management estimates 10%-15% opex synergy on the combined mobile SmarTone 15.8x 16.3x 4.5x 4.5x 3.8% 3.7% business after full integration, or US$596mn-934mn in savings by our ROE ROIC CROCI Name 2014E 2015E 2014E 2015E 2014E 2015E estimate, which we believe is achievable for an in-market consolidation. -

Report on the Competition Impact of the Acquisition of Shares in SUNDAY by PCCW

CDN0196 OFFICE OF THE TELECOMMUNICATIONS AUTHORITY Report on the competition impact of the acquisition of shares in SUNDAY by PCCW 1. SUMMARY 1.1 OFTA has now completed its assessment of whether the Transaction whereby PCCW will acquire a controlling shareholding in SUNDAY, warrants investigation under section 7P of the Ordinance. 1.2 This report concludes that no substantial lessening of competition in any relevant telecommunications market is likely to result from the Transaction. Based on this assessment and with specific reference to section 7P(2) of the Ordinance, which allows the Authority two weeks to commence a full competition investigation following a change in relation to a carrier licensee, the Authority has decided not to undertake an investigation into the Transaction under section 7P(1)(a). 2. GLOSSARY “Authority” means the Telecommunications Authority; “BWA” means broadband wireless access; “CSL” means Hong Kong CSL Limited; “Distacom” means Distacom Hong Kong Limited; “Huawei” means Huawei Technologies Investment Co. Ltd; 1 “Mandarin” means Mandarin Communications Limited; “M&A Guidelines” means the Telecommunications Authority Guidelines on Mergers and Acquisitions in Hong Kong Telecommunications Markets, 3 May 2004 “MNO” means mobile network operator; “MVNO” means mobile virtual network operator; “OFTA” means the Office of the Telecommunications Authority; “Ordinance” means the Telecommunications Ordinance, Cap.106; “PCCW” means PCCW Limited; “Stock Exchange” means The Stock Exchange of Hong Kong Limited; “SUNDAY” means SUNDAY Communications Limited; “SUNDAY 3G” means SUNDAY 3G (Hong Kong) Limited; “Takeovers Code” means the Hong Kong Code on Takeovers and Mergers in force from time to time; “Telstra” means Telstra Corporation Limited; “The Distacom Shareholding” means Distacom’s 46.15% shareholding in SUNDAY; “The Townhill Shareholding” means Townhill’s 13.72% shareholding in SUNDAY; “Transaction” means the transaction referred to in section 3 of this report; “Townhill” means Townhill Enterprises Limited. -

DELIVERING HONG KONG's FIRST QUADRUPLE-PLAY EXPERIENCE

PCCW annual report 2006 9 BUSINESS OVERVIEW DELIVERING HONG KONG’s FIRST QUADRUPLE-PLAY EXPERIENCE Year 2006 saw PCCW become Hong Kong’s first “quadruple- A whole new vista of opportunity then materialized as PCCW play” operator, changing the face of the local set out to discover more imaginative ways of applying our telecommunications industry. quadruple-play capability to produce a succession of innovative-yet-affordable services. Customers are now able to tailor their own digital lifestyles at home, at work and on the move, thanks to PCCW’s newfound Synergies between formerly disparate units soon began to power to provide innovative services across four platforms – emerge, giving rise to new lines of business and the fixed line, broadband Internet access, TV and mobile. transformation of the Company from access provider – as a traditional telecoms operator – to new breed of ICT/media- A prime example was the world’s first screening of real-time delivery player, bringing a whole new meaning to the PCCW television on 3G handsets using Cell Multimedia Broadcast brand. technology to take programming from our now TV platform to mobile phones. In addition, our award-winning innovation at home in the public and private sectors is now in demand overseas, opening up more revenue opportunities and positioning the Company as an industry role model on the world stage. 10 PCCW annual report 2006 BUSINESS OVERVIEW Telecommunications Services (TSS) Services (TSS) ENRICHING OUR FIXED-LINE OFFERING PCCW annual report 2006 11 LOCAL TELEPHONY The Company’s Commercial Group scored a number of Yet more innovative services and functionality from PCCW lucrative contract wins last year, especially in Macau’s continued to enrich Hong Hong’s fixed-line experience in booming hospitality and gaming market, which resulted in 2006, helping the Company to enjoy more net line gain and some HK$200 million in new income generated by telecoms stability, and focus on increasing average revenue per user. -

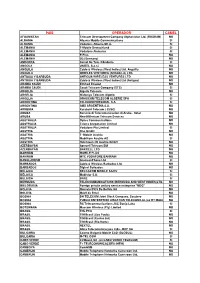

Operadores Camel 23.06.09

PAÍS OPERADOR CAMEL AFGANISTAN Telecom Development Company Afghanistan Ltd. (ROSHAN) NO ALBANIA Albania Mobile Communications SI ALBANIA Vodafone Albania SH.A. SI ALEMANIA T-Mobile Deutschland SI ALEMANIA Vodafone Alemania SI ALEMANIA E-Plus NO ALEMANIA O2 (Germany) NO ANDORRA Servei De Tele. DAndorra SI ANGOLA UNITEL S.a.r.l. NO ANGUILA Cable & Wireless (West Indies) Ltd. Anguilla NO ANGUILA WIRELES VENTURES (ANGUILLA) LTD. NO ANTIGUA Y BARBUDA ANTIGUA WIRELESS VENTURES LTD NO ANTIGUA Y BARBUDA Cable & Wireless (West Indies) Ltd (Antigua) NO ARABIA SAUDI Ethihad Etisalat NO ARABIA SAUDI Saudi Telecom Company (STC) SI ARGELIA Algerie Telecom NO ARGELIA Wataniya Telecom Algerie SI ARGELIA ORASCOM TELECOM ALGERIE SPA SI ARGENTINA TELECOM PERSONAL S.A. SI ARGENTINA AMX ARGENTINA S.A. NO ARMENIA Karabaht Telecom ( CJSC) NO ARUBA Servicio di Telecomunicacion di Aruba - Setar NO ARUBA New Millenium Telecom Services NO AUSTRALIA Optus Communications NO AUSTRALIA Telstra Corporation Limited NO AUSTRALIA Vodafone Pty Limited SI AUSTRIA One GmbH NO AUSTRIA T -Mobile Austria NO AUSTRIA Mobilkom Austria AG SI AUSTRIA Hutchison 3G Austria GmbH NO AZERBAYÁN Azercell Telecom BM NO AZERBAYÁN BAKCELL LTD NO BAHREIN MOBILE PLUS NO BAHREIN MTC VODAFONE BAHRAIN NO BANGLADESH GrameenPhone Ltd SI BARBADOS Cable & Wireless Barbados Ltd. NO BARBADOS Digicel Barbados NO BÉLGICA BELGACOM MOBILE SA/NV SI BÉLGICA Mobistar S.A. SI BÉLGICA BASE SI BERMUDA TELECOMMUNICATIONS (BERMUDA AND WEST INDIES)LTD. NO BIELORUSIA Foreign private unitary service enterprise "MDC" NO BOLIVIA Nuevatel PCS De Bolivia SA NO BOLIVIA Móvil de Entel NO BOSNIA BH TELECOM Joint Stock Company, Sarajevo NO BOSNIA PUBLIC ENTERPRISE CROATIAN TELECOM Ltd. -

PCCW Limited

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in PCCW Limited, you should at once hand this circular, together with the enclosed form of proxy, to the purchaser or transferee or to the bank, the licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. PCCW Limited 電訊盈科有限公司 (Incorporated in Hong Kong with limited liability) (Stock Code: 0008) MAJOR TRANSACTION IN RELATION TO THE ACQUISITION OF THE ENTIRE ISSUED SHARE CAPITAL OF CSL NEW WORLD MOBILITY LIMITED BY HKT LIMITED Joint financial advisers to PCCW Limited A letter from the Board (as defined herein) is set out on pages 6 to 25 of this circular. A notice convening the EGM (as defined herein) of PCCW Limited to be held on Friday, 28 February 2014 at 11:00 a.m. in the Conference Room, 14th Floor, PCCW Tower, TaiKoo Place, 979 King’s Road, Quarry Bay, Hong Kong, is set out on pages 132 to 133 of this circular. -

Partnerzy Roamingowi

Partnerzy roamingowi Kraj Operator Aeroplanes AeroMobile AS (d. Telenor Mobile Aviation AS) Aeroplanes OnAir Switzerland Sarl Afghanistan Telecom Development Company Afghanistan Ltd. Afghanistan Afghan Wireless Communication Company Afghanistan Etisalat Afghanistan Albania Albanian Mobile Communications Albania Vodafone Albania Algeria Orascom Telecom Algerie Spa Algeria Wataniya Telecom Algerie Andorra Servei De Tele. DAndorra Angola Servei De Tele. DAndorra Anguilla under IRA with Mossel Limited T/A Digicel extended to it's affiliated network Digicel Anguilla Antigua & Barbuda under IRA with Mossel Limited T/A Digicel transferred from Cingular Wireless Argentina Nextel Communications, Inc. Argentina Telecom Personal Ltd. Argentina AMOV Argentina S.A. (d. AMX ARGENTINA S.A. , CTI Compania de Telefonos del Interior S.A.) Armenia ArmenTel Armenia K Telecom CJSC Aruba under IRA with Mossel Limited T/A Digicel extended to it's affiliated network New Millenium Telecom Services (NMTS) Australia Singtel Optus Limited Australia Telstra Corporation Ltd. Australia Vodafone Network Pty Ltd Austria Hutchison Drei Austria GmbH (d.Orange Austria Telecommunication GmbH (d. ONE GMBH / Connect Austria) Austria A1 Telekom Austria AG (d.Orange Austria Telecommunication GmbH (d. ONE GMBH / Connect Austria) Austria Hutchison Drei Austria GmbH (d.Hutchison 3G Austria GmbH Austria A1 Telekom Austria AG (d. Mobilkom Austria AG & Co KG) Austria Mobilkom Austria AG & Co KG Austria T-Mobile Austria GmbH (d. max.mobil Telekommunikation Service GmbH) Austria T-Mobile Austria GmbH (d. Tele.ring Telekom Service GmbH) Azerbaijan Azercell Telecom BM Azerbaijan Bakcell Ltd (d. J.V. Bakcell) Bahamas The Bahamas Telecommunications Company Ltd. Bahrain Bahrain Telecommunications Company Bahrain MTC VODAFONE (BAHRAIN) Bangladesh GrameenPhone Ltd Barbados under IRA with Mossel Limited T/A Digicel extended to it's affiliated network Digicel (Barbados) Limited Belarus FE VELCOM (d. -

PCCW Limited

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in PCCW Limited, you should at once hand this circular to the purchaser or transferee or to the bank, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. The Stock Exchange of Hong Kong Limited takes no responsibility for the contents of this circular, 14.64(1) 14.58(1) makes no representation as to its accuracy or completeness and expressly disclaims any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. PCCW Limited (Incorporated in Hong Kong with limited liability) (Stock Code: 0008) DISCLOSEABLE TRANSACTION RELATING TO (1) CONDITIONAL SALE AND PURCHASE AGREEMENTS RELATING TO 1,790,134,000 ORDINARY SHARES IN SUNDAY COMMUNICATIONS LIMITED AND (2) MANDATORY UNCONDITIONAL CASH OFFER BY CITIGROUP GLOBAL MARKETS ASIA LIMTIED FOR AND ON BEHALF OF THE OFFEROR FOR ALL THE ISSUED SHARE CAPITAL IN SUNDAY COMMUNICATIONS LIMITED OTHER THAN THOSE SHARES ALREADY OWNED OR AGREED TO BE ACQUIRED BY THE OFFEROR AND TO CANCEL ALL OUTSTANDING SHARE OPTIONS OF SUNDAY COMMUNICATIONS LIMITED A letter from the board of directors of PCCW Limited is set out on pages 5 to 16 of this circular. -

AWCC) 21.6 Afghanistan Areeba (MTN

Country Network EUR/Data Afghanistan Afghanistan Wireless Communication (AWCC) 21.6 Afghanistan Areeba (MTN) 21.6 Afghanistan Etisalat 21.36 Afghanistan Telecom Development Company Afghanistan Ltd (TDCA) 12.58 Albania Albanian Mobile Communications (A M C MOBIL) 0.23 Albania Eagle Mobile 23.89 Albania Vodafone Albania 18.33 Algeria Mobilis 18 Algeria Orascom Telecom Algerie Spa (Djezzy) 0.34 Algeria Wataniya Telecom Algerie 18.57 Andorra S.T.A (Mobiland) 17.12 Angola Movicel 19.62 Anguilla Cable & Wireless (West Indies) Ltd. Anguilla 15.5 Antigua & Barbuda Cable & Wireless Caribbean Cellular (Antigua) Limited 14.54 Argentina Telecom Personal SA (Personal) 1.36 Argentina Telefonica Comunicaciones Personales SA (UNIFON/ Movistar) 19.46 Armenia ArmenTel 18 Armenia K-Telecom Vivacel 11.09 Australia Singtel Optus Limited (YES OPTUS) 0.13 Australia Telstra Corporation Limited (Telstra MobileNet) 35.46 Australia Vodafone Pacific Limited 27.48 Austria Mobilkom Austria AG & Co KG (A1) 0.09 Austria ONE GMBH 0.09 Austria T-Mobile + ex Telering 0.09 Azerbaijan, Republic of Azerfon 16.12 Azerbaijan, Republic of J.V.Bakcell (BAKCELL GSM 2000) 0.51 Bahamas The Bahamas Telecommunications Company Ltd 17.06 Bahrain Batelco (BHR MOBILE PLUS) 0.53 Bahrain Viva 0.66 Bahrain Zain BH (ex MTC Vodafone ) 21.11 Bangladesh Airtel 18 Bangladesh TM Int'l (Bangladesh) Ltd (AKTEL) 18 Barbados Cable and wireless 14.62 Belarus, Republic of Best Belarus 22.56 Belarus, Republic of JLLC Mobile TeleSystems (MTS) 23.22 Belarus, Republic of Mobile Digital Communications (VELCOM) 18 Belgium BASE NV/SA (KPN group belgium) 0.09 Belgium Belgacom Mobile (PROXIMUS) 0.09 Belgium Mobistar S.A. -

Coverage Countries & Networks – DGM SIM: Voice, SMS & DATA |A|B|C|D|E|F|G|H|I|J|K|L|M|N|O|P|Q|R

DUAL GLOBAL MOBILE – Coverage Countries & Networks – DGM SIM: Voice, SMS & DATA May 2014 www.dualglobalmobile.us | [email protected] Full list of Coverage Countries and Networks – including Roaming Networks and Networks the SIM can call and receive call as well. Please, see the coverage countries and networks worldwide for Voice [placing and receiving calls including SIM and Web Initiated Call and SMS [sending and receiving sms]. |A|B|C|D|E|F|G|H|I|J|K|L|M|N|O|P|Q|R|S|T|U|V|W|X|Y|Z| A AEROMOBILE [NORAM] AFGHANISTAN AFGHANISTAN AREEBA MOBILE (MTN) [AFGAR] AFGHANISTAN MOBILE (AWCC) [AFGAW] AFGHANISTAN ROSHAN MOBILE (TDCA) [AFGTD] AFGHANISTAN TELCOM MOBILE AFGHANTAN ETISALAT MOBILE [AFGEA] ALBANIA ALBANIA AMC ALBANIA OLO ALBANIA TIRANA ALBANIA AMC MOBILE [ALBAM] 1 ALBANIA EAGLE MOBILE [ALBEM] ALBANIA PLUS MOBILE [ALBM4] ALBANIA VODAFONE MOBILE [ALBVF] ALGERIA ALGERIA DJEZZY MOBILE - Orascom Telecom Algerie Spa [DZAOT] ALGERIA OTHER MOBILE - Algerie Telecom (AMN) [DZAA1] ALGERIA WATANIYA MOBILE - Wataniya Telecom Algerie [DZAWT] ALGERIA OTHER MOBILE – Other AMERICAN SAMOA AMERICAN SAMOA MOBILE ANDORRA ANDORRA MOBILE - S.T.A (MOBILAND) [ANDMA] ANDORRA MOBILE – Other ANGOLA ANGOLA OTHER MOBILE - Movicel [AGOMV] ANGOLA UNITEL MOBILE - Unitel [AGOUT] ANGOLA OTHER MOBILE ANGUILLA ANGUILLA DIGICEL MOBILE - (Digicel Mossel) [JAMDC] ANGUILLA MOBILE - (C & W) [AIACW] ANGUILLA MOBILE – Other ANTARCTICA AUS AUS TERRITORES ANTARCTICA GSM AQ ANTIGUA AND BARBUDA ANTIGUA AND BARBUDA MOBILE - C & W [ATGCW] ANTIGUA DIGICEL MOBILE - (Digicel) [JAMDC] -

27.03.2019 Eur

GLOBAL+ G+ GLOBAL G TOTTOLI T PRIME P 27.03.2019 EUR Network TADIG Profile IOT AG LEG Internet Blocking Callthrough Main AEROMOBILE NORAM G 0.0000 Closed Closed ONAIR - On Waves AAMOW G 0.4916 Closed Closed AEROMOBILE NORAM G+ 0.0124 3.5632 3.2022 Opened Closed AEROMOBILE NORAM T 0.0000 Closed Closed SAMOA WEST MOBILE - Bluesky [WSMGS] WSMGS G+ 0.0136 0.8314 0.0395 Opened Closed Australia TADIG Profile IOT AG LEG Internet Blocking Callthrough Main AUSTRALIA VODAFONE MOBILE - Vodafone AUSVF G 0.5711 Closed Closed AUSTRALIA OPTUS MOBILE - Singtel Optus Limited (YES OPTUS) AUSOP G 0.0000 0.1018 0.0233 Opened Available AUSTRALIA TELSTRA MOBILE - (Telstra MobileNet) AUSTA G 0.0000 0.1076 0.1123 Opened Available AUSTRALIA VODAFONE MOBILE - Vodafone AUSVF G+ 0.0637 0.7919 0.4113 Closed Closed Singtel Optus AUSOP R1 0.0000 0.0807 0.0080 Opened Available AUSTRALIA OPTUS MOBILE - Singtel Optus Limited (YES OPTUS) AUSOP G+ 0.0124 0.1080 0.0175 Opened Available AUSTRALIA TELSTRA MOBILE - (Telstra MobileNet) AUSTA G+ 0.0124 0.0918 Opened Closed AUSTRALIA VODAFONE MOBILE - Vodafone AUSVF T 3.4409 Closed Closed Singtel Optus AUSOP R2 0.0000 0.1471 0.0214 Opened Available AUSTRALIA OPTUS MOBILE - Singtel Optus Limited (YES OPTUS) AUSOP T 0.0000 0.0931 0.0087 Opened Available Callthrought AUSTRALIA TELSTRA MOBILE - (Telstra MobileNet) AUSTA T 1.1555 Closed Closed Austria TADIG Profile IOT AG LEG Internet Blocking Callthrough Main AUSTRIA T-MOBILE MOBILE - T-Mobile AUTMM G+ 0.0000 0.0568 0.0086 Opened Available 3/Orange/One Connect AUTCA R1 0.0000 0.0852