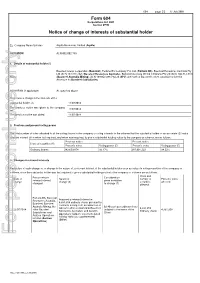

Form 604 Notice of Change of Interests of Substantial Holder and Signed by Me, Adam Handley (Solicitor)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Iron Ore Imports to Be Paid in Yuan JFE Steel, Baowu Forms JV to Make

China Calling Iron ore imports to be paid in yuan the DCE, Yongfeng will buy some of vivid examples of the gradual transfer Vale’s iron ore fines with settlement of iron ore pricing from overseas based on DCE’s iron ore futures markets to China, experts said. prices for May 2020 delivery as well “In the past, international as a premium/discount, known as a companies mostly referred to basis trading contract. overseas benchmarks, such as “The decision to switch to the Platts benchmark for iron ore and new settlement mode shows that Brent for crude, for pricing in their hina is taking steps to pay Brazil attaches importance to the commodity transactions, including Cfor its huge iron ore imports Chinese market by choosing a more with Chinese companies. This is in yuan, a move experts said shows convenient way to sell iron ore to very abnormal considering the huge a gradual but irreversible trend that Chinese buyers,” Liu Wensheng, market demand from China,” Wu China will play a more decisive role deputy director of the ferrous metal Chenhui, a non-ferrous metals in pricing metal commodities department at First Futures, told the expert, told the Global Times. thanks to the country’s burgeoning Global Times adding that the new China, the largest iron ore market demands. basis trading mode can help importer in the world, imported Brazilian miner Vale SA recently Chinese iron and steel 1.064 billion tons of iron ore in 2018, signed a physical iron ore spot deal manufacturing companies avoid according to customs data released to supply the Shandong-based steel foreign exchange risks. -

Asset Purchase Agreement; (2) Proposed Appointment of Directors; (3) Proposed Appointment of Supervisors; and (4) Notice of 2021 Second Extraordinary General Meeting

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Chongqing Iron & Steel Company Limited, you should at once hand this circular and the accompanying proxy forms and reply slips to the purchaser or transferee or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. (1) DISCLOSEABLE AND CONNECTED TRANSACTIONS – ASSET PURCHASE AGREEMENT; (2) PROPOSED APPOINTMENT OF DIRECTORS; (3) PROPOSED APPOINTMENT OF SUPERVISORS; AND (4) NOTICE OF 2021 SECOND EXTRAORDINARY GENERAL MEETING Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders A letter from the Board is set out from pages 1 to 7 of this circular. A notice convening the EGM to be held at 2:00 p.m. on Thursday, 12 August 2021 at Chongqing Iron & Steel Conference Center, No. 2 Jiangnan Avenue, Jiangnan Street, Changshou District, Chongqing, the PRC, is set out on pages 47 to 49 of this circular. -

For Personal Use Only Use Personal For

604 page 2/2 15 July 2001 Form 604 Corporations Act 2001 Section 671B Notice of change of interests of substantial holder To Company Name/Scheme Aquila Resources Limited ( Aquila ) ACN/ARSN ACN 092 002 769 1. Details of substantial holder (1) Baosteel Group Corporation ( Baosteel ), Fortune BS Company Pte. Ltd. ( Fortune BS ), Baosteel Resources Australia Pty Ltd (ACN 154 815 362) ( Baosteel Resources Australia ), Baosteel Australia Mining Company Pty Ltd (ACN 100 513 844) Name (Baosteel Australia Mining ), ACN 169 052 288 Pty Ltd ( SPV ) and each of Baosteel's other subsidiaries listed in Annexure A ( Baosteel Subsidiaries ) ACN/ARSN (if applicable) As specified above There was a change in the interests of the substantial holder on 11/07/2014 The previous notice was given to the company 11/07/2014 on The previous notice was dated 11/07/2014 2. Previous and present voting power The total number of votes attached to all the voting shares in the company or voting interests in the scheme that the substantial holder or an associate (2) had a relevant interest (3) in when last required, and when now required, to give a substantial holding notice to the company or scheme, are as follows: Previous notice Present notice Class of securities (4) Person’s votes Voting power (5) Person’s votes Voting power (5) Ordinary Shares 383,659,874 93.17% 387,991,232 94.22% 3. Changes in relevant interests Particulars of each change in, or change in the nature of, a relevant interest of the substantial holder or an associate in voting securities of the company -

Comprehensive Utilization of Iron-Bearing Converter Wastes Hu Long, Dong Liu, Lie-Jun Li, Ming-Hua Bai, Yanzhong Jia and Wensheng Qiu

Chapter Comprehensive Utilization of Iron-Bearing Converter Wastes Hu Long, Dong Liu, Lie-Jun Li, Ming-Hua Bai, Yanzhong Jia and Wensheng Qiu Abstract Basic oxygen furnace (BOF) sludge is composed of not only valuable iron but also impurities like Zn, Pb, and some alkaline oxides. It is collected from wet clean- ing system in steelmaking plants. How to deal with these double identity wastes? Will the traditional landfill treatments result in environmental pollution? What technologies have been developed recently, and is it actually useful? In this chapter, physical-chemical properties and mineralogical phases of converter sludge were characterized, and different recycling technologies were introduced. The proven metalized pellet-producing process would be highlighted that green pellets made from iron-bearing sludge are dried and preheated in a traveling grate firstly, and then reduced at high temperature in a rotary kiln or a rotary hearth furnace (RHF) to get direct reduced iron (DRI), served as a good iron source for blast furnace. Keywords: BOF sludge, iron bearing, metalized pellet, direct reduced iron, environment friendly 1. Introduction BOF sludge is collected from wet cleaning system in steelmaking plants. It is composed of not only valuable iron but also impurities like Zn, Pb, and some alkaline oxides [1–3]. Traditional landfill treatments inevitably result in environmental pollu- tion because of the contained heavy metal and the high pH values of water-absorbed soil [4, 5]. Sintering is another recycling way to treat the sludge as raw material for sintering ore and fed to the blast furnace (BF). However, it leads to the circulation and accumulation of zinc in BF [6, 7]. -

This Circular Is Important and Requires Your Immediate Attention

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker, registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in METALLURGICAL CORPORATION OF CHINA LTD.*, you should at once hand this circular and the accompanying form of proxy to the purchaser or transferee or to the bank, stockbroker, licensed securities dealer or other agent through whom the sale or transfer was effected for transmission to the purchaser or transferee. Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. PROPOSED APPROVAL OF THE PROPOSAL OF THE REPORT ON FINAL ACCOUNTS OF THE COMPANY FOR THE YEAR 2019 PROPOSED APPROVAL OF THE PROPOSAL OF PROFIT DISTRIBUTION PLAN OF THE COMPANY FOR THE YEAR 2019 PROPOSED APPROVAL OF THE PROPOSAL OF THE EMOLUMENTS OF DIRECTORS AND SUPERVISORS OF THE COMPANY FOR THE YEAR 2019 PROPOSED APPROVAL OF THE PROPOSAL OF THE PLAN OF GUARANTEES TO BE PROVIDED BY THE COMPANY FOR THE YEAR 2020 PROPOSED APPROVAL OF THE PROPOSAL OF GRANT OF GENERAL MANDATE TO THE BOARD OF DIRECTORS TO ISSUE SHARES AND PROPOSED APPROVAL OF THE PROPOSAL OF AMENDMENTS TO THE ARTICLES OF ASSOCIATION AND THE RULES OF PROCEDURE FOR GENERAL MEETINGS A letter from the Board of Directors of the Company is set out on pages 1 to 16 of this circular. -

Company 2018/5/17 Nanyang Hanye Special Steel Co. LTD 2018/4/3 Yuncheng Yunhai Aluminum Co

Date(year-month-day) Company 2018/5/17 Nanyang hanye special steel co. LTD 2018/4/3 Yuncheng yunhai aluminum co. LTD 2018/2/5 Shaoguan Songshan Iron and Steel Group co. LTD 2018/1/31 Shougang Group shuicheng steel co. LTD 2017/12/14 Beiman special steel co. LTD 2017/9/20 Duopu alloy co. LTD 2017/8/3 Desheng steel co. LTD 2017/5/14 Beiman special steel co. LTD 2017/3/20 Hongxin metal recycling co. LTD 2017/3/20 Henan yuguang gold and lead co. LTD 2017/3/10 Guangxi huayin aluminum co. LTD 2017/3/6 Luoyang iron and steel co. LTD 2016/10/16 Xinjiang kunyu iron and steel co. LTD 2016/6/22 Henan branch of China aluminum corporation 2016/4/1 Linyi sande special steel co. LTD 2015/11/29 Shandong Fulai Stainless Steel Co. Ltd. 2015/9/2 Beijing Shougang Co., Ltd 2015/8/31 Huaxinyuan iron and steel co. 2015/4/2 Henan Zhongyuan Special Steel Co.,Ltd. 2014/12/8 Jiyuan iron and steel co. LTD 2014/8/6 Shanxi huaze of China aluminum corporation 2014/7/2 Fengzhen city fengye ferro-alloy co. LTD 2014/3/28 Guangxi shenglong metallurgy co. LTD 2014/3/23 Yukun iron and steel group co. LTD 2014/1/7 The second plant of Taiyuan iron and steel (group) co. LTD 2013/12/5 Jinxu steel structure co. LTD 2013/11/21 North steel group jinding heavy industry co. LTD 2013/11/11 Xinjiang bayi steel structure co. LTD 2013/9/29 Kunming iron and steel co. -

CSR Report 2010

2010 Baosteel CSR Report Overview About This Report This is the third report on social responsibility ever published by Baosteel Group Corporation (Baosteel or Corporation for short). The Report has been compiled in accordance with the Guidelines for Social Responsibility Performance by Central Enterprises (Document No. 2008-01) issued by the State- Owned Assets Supervision and Administration Commission of the State Council, the Sustainability Reporting Guidelines (G3 version) of the Global Reporting Initiative (GRI), the 10 principles of the United Nations Global Compact, the theoretical research achievements of the Guidelines of the Chinese Academy of Social Sciences for the Compilation of Social Responsibility Reports by Chinese Enterprises, and Baosteel’s practical conditions. Coverage Unless otherwise specified, this Report mainly describes Baosteel’s corporate governance, value creation, environment, employee, community and supply chain from January 1, 2010 to December 31, 2010. This Report covers the business segments of iron and steel, resource development and logistics, extended steel processing, engineering and technical services, coal chemical industry, finance and investment, and production services (see the following part for details on business sections and company profile). Language and Format This Report is published in Chinese and English. If the two versions differ, the Chinese version shall prevail. If you has any question about this Report, please call or write to us in the following ways: Corporate Communication Dept Baosteel Group Corporation Room 2105, Baosteel Tower, 370 Pudian Road, Pudong New Area, Shanghai, China Postcode: 200122 Tel: +0086 21 58350000-1064 Fax: +0086 21 68403773 Email: [email protected] This report is published in the formats of print and electronic document. -

Steel Bar Circularthis Link Will Open in New Window

List of Bar Pattern Codes for Quality Assured Manufacturers to CS2 : 2012 ( July 2021 ) Page 1 of 2 Origin Bar Pattern Code Manufacturer Name CS2:2012 CS2:2012 BS4449:2005 Q.A. Cert. Grade 500B Grade B500B Expiry Date Grade 500B (Coil) (Coil / Decoiled Bar) Algeria ALA1 Tosyali Algerie Fer Et Acier # 11.12.2021 China CHA82 Shenzhen Welmetal Steel Co., Ltd. # 08.06.2017 CHA85, CHA103 Tianjin Tiantie Zhaer Steel Production Co. Ltd. # 17.11.2016 CHA86 Jiangsu Yonggang Group Co., Ltd. # # # 19.05.2022 CHA87 Tianjin Iron & Steel Group Co., Ltd. # 15.09.2018 CHA88 Rizhao Steel Wire Co., Ltd # 15.09.2018 CHA93 Gaoming Jianming Steel Rolling Fty. Ltd. of Foshan # 22.06.2018 CHA96 Guangzhou Panyu Yufeng Iron & Steel Co., Ltd. # 07.07.2022 CHA97 Hebei Taigang Iron and Steel Rolling Co., Ltd # 30.06.2016 CHA98 Jiangsu Prosperity Steel Co., Ltd. # 06.01.2015 CHA101 Wuhu Xinxing Ductile Iron Pipes Co., Ltd. # 25.07.2017 CHA102 Tianjin Metallurgy Group Zha San Metal Material Science & Technology Co., Ltd. # 15.09.2018 CHA104 Zhuhai Yueyufeng Iron & Steel Co., Ltd. # 18.06.2016 CHA105, CHA116 Jiangyin Xicheng Steel Co., Ltd. # 26.09.2023 CHA106 Jiangsu Shagang Group Co., Ltd. # 07.05.2022 CHA108 Guangxi Guigang Iron and Steel Group Co., Ltd. # 15.09.2021 CHA109, CHA140 Zenith Steel Group Co., Ltd. # 14.06.2024 CHA112 Benxi Beiying Iron & Steel (Group) Co., Ltd. # 19.05.2023 CHA114, CHA151 Hebei Jinxi Iron and Steel Group Co., Ltd. # 12.08.2022 CHA115 Shandong Iron and Steel Company Ltd. Laiwu Company # 27.01.2024 CHA117 SGIS Songshan Co., Ltd. -

The Institutional Perspective on Outward Foreign Direct Investment

The Institutional Perspective on Outward Foreign Direct Investment from China: the Relationship between the Government and Firms QIAN CHENG, BA. MSc. Thesis submitted to the University of Nottingham for the degree of Doctor of Philosophy July 2012 I Abstract China's outward foreign direct investment (OFDI) has increased considerably in the last few decades. The development of China's OFDI has distinct features, in particular the fact that the major investors undertaking large-scale deals are state-owned enterprises. However, they have few competitive advantages compared with their international counterparts. As mainstream theories have difficulty in providing a reasonable explanation of China's OFDI, this thesis analyses the Chinese government's home country measures (HCMs) and their effects on OFDI, contributing to the understanding of the institutional analysis in international business. Based on the analyses of26 key policies and regulations, the Chinese government's role as a supervisor to examine and approve OFDI activities is addressed, as well its role as a promoter to support the Chinese enterprises' investment in the international economy. Regarding the administration, regulations for examining and approving the OFDI projects have been relaxed, which supports the improvement ofOFDI. However, the outcomes of post- investment monitoring and extraterritorial controls are under question. The Chinese government supports OFDI largely by means of special funds and preferential loans issued by the institutions and banks. Additionally, China's OFDI information system primarily functions to provide data and information for policy formulation and complement the financial support. Employing data of 50 largest Chinese business groups ranked by overseas assets, their overseas subsidiaries and cross-border mergers and acquisitions, it is understood that their motivation for undertaking OFDI is to address their competitive disadvantages rather than to exploit their competitive advantages. -

K. Wah Construction Materials Limited

K. WAH CONSTRUCTION MATERIALS LIMITED (Incorporated in Hong Kong with limited liability) (Stock Code: 27) ANNOUNCEMENT OF ANNUAL RESULTS FOR THE YEAR ENDED 31ST DECEMBER 2003 ANNUAL RESULTS MANAGEMENT DISCUSSION AND ANALYSIS The Board of Directors of K. Wah Construction Materials Limited (the ‘‘Company’’) is pleased to announce the audited consolidated results Review and Outlook of Operation of the Company and its subsidiaries (collectively referred to as the ‘‘Group’’) for the year ended 31st December 2003 as follows: Overview The Group’s turnover for the year ended 31st December 2003 was HK$1,130,894,000, representing an increase of HK$119,895,000 over the previous year. Turnover and profit before taxation for the year ended 31st December 2003 were HK$1,131 million and HK$42 million, as compared to HK$1,011 million and HK$70 million for the year ended 31st December 2002 respectively. The Group’s turnover was slightly higher than The Group’s profit attributable to shareholders for the year ended 31st December 2003 amounted to HK$40,205,000, representing a last year but the profit before taxation decreased by approximately 40% from last year due to deteriorating market environment in Hong decrease of HK$22,123,000 over the previous year. Kong. FINAL DIVIDEND Despite additional contribution from the gradual phasing in of certain new projects in the Mainland China, the profit of the Group as a whole decreased as compared to last year. The Board of Directors has resolved to recommend at the forthcoming annual general meeting to be held on 31st May 2004 a final scrip dividend for the year ended 31st December 2003 of 1 cent per share, with a cash option, totalling HK$12,690,000, payable to the Business in Hong Kong shareholders whose names appear on the register of members of the Company at the close of business on 31st May 2004 (2002: a final In 2003, the economy of Hong Kong has further worsened due to the outbreak of SARS and the war in Iraq. -

E Annual Report 2004.Pdf

2 Major Events and Awards of the Year 4 Corporate Information 5 Notice of Annual General Meeting 8 Chairman’s Statement 10 Corporate Governance 12 Management Discussion and Analysis 25 Good Corporate Citizenship 26 Investor Relations 27 Financial Calendar 28 Five-Year Summary 30 Further Corporate Information 34 Report of the Directors 45 Report of the Auditors 46 Consolidated Profit and Loss Statement 47 Consolidated Balance Sheet 48 Company Balance Sheet 49 Consolidated Cash Flow Statement 50 Consolidated Statement of Changes in Equity 51 Notes to the Financial Statements Our Mission We are a sizeable construction materials company continuously in search of excellence in all that we do. It is our mission to satisfy market demand and customer needs with high quality products and services. With vision, perseverance and teamwork, we strive to be a leader in the industry that we serve and to provide shareholders with the best return on their investment. The Company The predecessor of K. Wah Construction Materials Limited (the ‘‘Company’’) was first listed on the Hong Kong Stock Exchange in 1991 as International Pipe Limited, a leading company in the manufacture, sale and distribution of concrete pipes and other precast concrete products. Currently, the Company’s numerous subsidiaries and associated companies supply various types of construction materials and products to both private and public sectors in Hong Kong and the Mainland. It is the most integrated construction materials company listed on the Hong Kong Stock Exchange and is also one of the major construction materials suppliers in Hong Kong. The founder and Chairman of the Company, Dr. -

馬 鞍 山 鋼 鐵 股 份 有 限 公 司 Maanshan Iron & Steel Company

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. 馬鞍山鋼鐵股份有限公司 Maanshan Iron & Steel Company Limited (A joint stock limited company incorporated in the People’s Republic of China) (Stock Code: 00323) OVERSEAS REGULATORY ANNOUNCEMENT RESPONSE OF CHINA BAOWU STEEL GROUP CORPORATION LIMITED ON THE NOTICE REGARDING CHINA SECURITIES REGULATORY COMMISSION’S FIRST FEEDBACK ON THE REVIEW OF ADMINISTRATIVE PERMISSION ITEMS This announcement is made pursuant to Rule 13.10B under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited. Reference is made to the “Response of China Baowu Steel Group Corporation Limited on the Notice Regarding China Securities Regulatory Commission’s First Feedback on the Review of Administrative Permission Items” (the “Response”) published by Maanshan Iron & Steel Company Limited (the “Company”) on the website of the Shanghai Stock Exchange at www.sse.com.cn. The Response was prepared in Chinese and the English version is for reference only. Reference is made to the acquisition offer report summary of overseas regulatory announcement of the Company dated 2 June 2019 (the “Announcement”), pursuant to Rule 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited. Unless otherwise defined, capitalized terms used in the Response shall have the same meanings as those defined in the Announcement.