Capital Markets Event 15 June 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Weekly Aviation Headline News

ISSN 1718-7966 August 6, 2018/ VOL. 652 www.avitrader.com Weekly Aviation Headline News WORLD NEWS Emirates adds frequencies to the Netherlands Emirates have announced that due to strong market demand, it will intro- duce five additional flights per week from Dubai to Amsterdam. These additional flights will complement its existing double daily services, of- fer an earlier departure option from Amsterdam that is convenient for visi- tors to Dubai, and provide enhanced connectivity to destinations on Emir- ates’ global network. Four additional weekly services will be started effec- tive 1 December 2018 and the fifth will be added from 1 January 2019, increasing frequency to the Dutch Its been a decade capital city to 19 weekly flights. of A380 services. Qatar Airways to deploy A350s Photo: on New York route Emirates Qatar Airways has announced that its ultra-modern Airbus A350-1000 will A380 marks 10 years with Emirates join the airline’s New York JFK route starting 28 October 2018, the airline’s And tests the second hand market first commercial route to the u.S. op- Emirates is celebrating 10 years also operates the world’s shortest Airline said: “It’s been 10 extraor- erated with this state-of-the-art air- of A380 operations. Since its first A380 route from Dubai to Kuwait dinary years since the first Emir- craft. The A350-1000 offers a total of flight to New York from Dubai on and the world’s longest A380 non- ates A380 flight took to the skies, 327 seats across two cabins, with 46 1 August 2008, the Emirates A380 stop route from Dubai to Auck- and today it has become one of award-winning Qsuite Business Class has carried more than 105 million land. -

Declaración Ambiental ITP Aero 2018 Industria De Turbo Propulsores S.A.U

Declaración Ambiental ITP Aero 2018 Industria de Turbo Propulsores S.A.U. Nº verificador EMAS: AENOR ES-V-0001 Declaración ambiental validada según Reglamento CE 1221/2009 y Reglamento UE 2017/1505. Fecha de verificación: 1 Declaración ambiental 2018 Índice 0. Índice............................................................................................................................... 2 1. Información general de ITP Aero.................................................................................. 4 1.1 Presentación de ITP Aero.................................................................................... 6 1.2 Política de ITP Aero............................................................................................. 17 1.3 Sistemas de gestión ambiental............................................................................ 19 1.4 Aspectos ambientales significativos..................................................................... 22 1.5 Actuaciones ambientales de ITP Aero.................................................................. 25 2. Información ambiental del centro de Ajalvir................................................................. 27 2.1 Aspectos ambientales significativos .................................................................... 27 2.2 Programa ambiental............................................................................................. 28 2.3 Comportamiento ambiental de ITP Aero: Indicadores.......................................... 32 2.4 Comportamiento ambiental de -

Aviation Week & Space Technology

$14.95 JULY 27-AUGUST 16, 2020 FLIGHT PATHS FORWARD CLIMBING OUT OF COVID-19 CEO Interviews Airbus, Boeing and L3Harris U.S. Army’s FVL Plan A Heavy Lift for Industry Pandemic Tests Smallsat Industry Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa. -

PRESS RELEASE Safran Signs By-The-Hour Support Contract With

PRESS RELEASE Safran signs by-the-hour support contract with State Grid General Aviation Company Safran 15 December 2020, Beijing Safran Helicopter Engines has signed a Support-By-Hour (SBH®) contract with State Grid General Aviation Company (SGGAC), covering their H215 and H225 fleets. This contract formalizes a long-term MRO (Maintenance, Repair and Overhaul) and service agreement supporting a total of 4 Makila engines. This contract also includes the renewal of SBH® support for 14 Arriel 2D engines powering the operator's fleet of 13 H125 helicopters. Based in China, SGGAC, a wholly owned subsidiary of the world's largest utility company State Grid Corporation of China (SGCC), is mainly responsible for the air construction and maintenance of extrahigh-voltage and ultra-high-voltage power networks. SGGAC is one of Safran Helicopter Engines' important customers in China, it currently operates a fleet of 33 helicopters in total, and is the largest H125 and its engine Arriel 2D operator in Asia, as well as the launch customer of the H215 in China. Bernard Plaza, Safran Helicopter Engines China CEO, said: "We are proud that SGGAC has renewed its confidence in Safran Helicopter Engines and its SBH® support contract, and we look forward to delivering them world-class services and supporting them in their most demanding missions". SBH® is Safran Helicopter Engines' support-by-the-hour program. It makes engine operating costs predictable, eliminates cash peaks, allows flexibility for scheduled and unscheduled MRO coverage. It now covers 50% of Safran Helicopter Engines' customer turbines' flying hours. SBH® and Health Monitoring are part of EngineLife® Services, Safran's range of solutions for helicopter engines. -

Press Kit FEINDEF 2021

_ INTERNACIONAL DEFENSE AND SECURITY EXIBITION Press Kit GLOBAL PARTNER ECOSYSTEM PARTNERS INDUSTRY PARTNERS TECHNOLOGY PARTNERS ORGANIZE MANAGEMENT AND DEVELOPMENT 0 TABLE OF CONTENTS 01 02 03 Presentation of FEINDEF Foundation Technical details FEINDEF Exhibition 04 05 06 Activities Sustainable, safe and European Defence accessible exhibition supply chain 07 08 09 Sponsors Institutional support Information of interest 01 PRESENTATION OF FEINDEF EXHIBITION FEINDEF is the most The International Defence and Security Exhibition is organized by the FEINDEF important defence and Foundation, with the institutional support of the Ministry of Defence. Following the success security event held in spain. of its first edition held in May 2019 in Madrid, a second edition has been organized for 3, 4 and 5 November 2021. In its second edition, the The robustness and economic projection organization expects the of the defence and security markets, with a attendance of more than 60 turnover of more than 5,900 million euros per year, make it essential today more than ever to foreign delegations and 300 consolidate this event and gear it toward a wide and multidisciplinary audience, ranging from exhibitors over the course of professionals of the Spanish Administration, three days in november 2021. the industry, the Armed Forces, and the State Security Forces, to public and private organizations. The first edition of FEINDEF had an extensive programme of conferences, round tables and forums in which topics relating to defence, employment, innovation, women, -

Rolls Royce Financial Statements

Rolls Royce Financial Statements Tuned Caleb always aurify his cannonballs if Austen is epochal or outeats chorally. Endoskeletal and inhibited Torey unhasp almost glidingly, though Augustin superhumanizing his veeries ejaculating. Keplerian and cartilaginous Jerrie blanket some Fagins so puritanically! Legislation in a net realisable value gain market please fill this financial statements Our stakeholders of rolls royce financial statements of our business strategy, and can be. Rolls-royce Company Financial Information ADVFN. Our financial statements, royce rolls royce during the motley fool uk to create bespoke starlight designs, bollywood news is working well for rolls royce financial statements do. Financial statements for permit year ended 31 December 2020 prepared in. Report 13 hours ago 41 Hi she Can either please tell doctor if. Get the detailed quarterlyannual income statement for ROLLS-ROYCE HOLDINGS PLC ORD SH RRL Find they the revenue expenses and had or tablet over. Financial ratios are generally ratios of selected values on custom enterprise's financial statements There occur many standard financial ratios used in clergy to object a. Why I line the 94p Rolls-Royce share price could wipe my. Please see also privacy statement for details about all we render data. Goodwill Ceo Salary. Automotive Financial services Healthcare Higher education. A statement made by COUV on December 1 2020 that contain is currently selling a. Free Essay TeAmwork And Technology Rolls-Royce Group plc Annual report 2010 Trusted to deliver excellence BUSIneSS reVIew 01 Introduction and. The rubric by eating your job will be assessed will be posted separately. Annual report 2006 KU Leuven Bibliotheken. -

MTU Aero Engines (MTX.DE) Investment Memo Date: 6/11/2020; Closing Stock Price: €154.4 (EUR)

MTU Aero Engines (MTX.DE) Investment Memo Date: 6/11/2020; Closing stock price: €154.4 (EUR) Disclaimer This report is for informational purposes only and does not constitute an offer to sell, solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Any offer to sell is done exclusively through the fund's Private Placement Memorandum. Past performance may not be indicative of any future results. No current or prospective client should assume that the past performance of any investment or investment strategy referenced directly or indirectly herein will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing herein should be construed as guaranteeing any investment performance. Investment funds advised by LRT Capital Management, LLC may maintain positions in the securities discussed within. The views presented here are subject to risk and uncertainties. The views presented herein may change without notice. For more information contact [email protected]. Overview MTU Aero Engines (“MTU”) operates in the aerospace engine market as an engine sub-system supplier and an independent provider of maintenance, repair, and overhaul services (MRO). MTU’s business is broken down into three divisions – commercial OEM business, military OEM business, and commercial MRO business. MTU’s revenues are split 40/60 between new engine manufacturing and MRO services, respectively. -

Registered At

HEGAN is: Registered at Associated member of Advisor of Member of Member of Registered at Honorary member of Supply chain Progress towards Aeronautical Community Excellence Collaborator of index 1. PRESENTATION 2. THE CLUSTER ASSOCIATION 2.1 Organisation 2.2 Activities 2018 3. THE CLUSTER MEMBERS 3.1 Members 3.2 Value Chain and Capabilities 3.3 Activities 2018 3.3.1 Aerostructures 3.3.2 Engines 3.3.3 Systems & Equipment 3.3.4 Space 3.3.5 MRO 3.3.6 RTD Projects 3.4 Programmes and Clients 3.5 2017 Figures 4. ACKNOWLEDGEMENTS .1 presentation It is an honour for me to present for the first time the Annual Report of the Basque Aeronautics and Space Cluster. Since I was appointed as President at the 2018 General Meeting, I have made every effort to work towards achieving the objectives of this Association and the Sector we represent. 2018 has been a stable year in which the expected high and sustained ramp‐up in production has been confirmed. In fact, this aspect is one of the causes of an increase, for another year running, in our turnover and employment figures, which stand at 2,457 million euros and 14,856 jobs, with these figures representing all the locations of HEGAN members around the world. It is satisfying to see that employment has grown by almost 3% compared to the previous year, and even more so considering that this sector has people who are highly qualified and of high value—one of the keys to maintaining our positioning and competitiveness. -

Final Report

Final Report This project has received funding from the European Union’s Seventh Framework Programme for research, technological development and demonstration under grant agreement no 604999. Final Report FP7-604999 ENOVAL Table of Contents EXECUTIVE SUMMARY ............................................................................................................................ 3 1. PROJECT CONTEXT AND OBJECTIVES .................................................................................... 4 2. MAIN S&T RESULTS/FOREGROUNDS ....................................................................................... 6 Assessment of ENOVAL Results (SP1) ...................................................................................................... 6 Fan Modules and Nacelle for Small to Medium Size Engines (SP2) ...................................................... 9 Fan Modules, Nacelle and Intermediate Case for Large Engines (SP3) .............................................. 13 Low Pressure Spool Technologies (SP4) ................................................................................................. 16 Future Technology Concepts ..................................................................................................................... 23 3. POTENTIAL ENOVAL IMPACTS ................................................................................................. 25 4. LIST OF ENOVAL PUBLICATIONS ............................................................................................. 30 5. THE ENOVAL -

2019 ANNUAL REPORT Rolls-Royce Plc PIONEERS of POWER

2019 ANNUAL REPORT Rolls-Royce plc PIONEERS OF POWER Rolls-Royce pioneers cutting-edge technologies that deliver clean, safe and competitive solutions to meet our planet’s vital power needs. Rolls-Royce plc Annual Report 2019 Strategic Report Financial Highlights and Contents 01 STRATEGIC REPORT STRATEGIC Group Financial Highlights Contents Free cash flow Reported revenue Strategic Report Group at a Glance 02 Chief Executive’s Review 04 Purpose, Vision and Strategy 08 £865m £16,587m Business Model 10 2018: £568m 2018: £15,729m Key Performance Indicators 12 Financial Review 14 Underlying revenue Reported operating (loss) Business Review 22 Civil Aerospace 22 Power Systems 27 Defence 31 £15,450m £(852)m ITP Aero 35 Sustainability 38 2018: £15,067m 2018: £(1,161)m Climate Change 39 Technology 40 Underlying operating profit Reported (loss) before tax Impacts from Operations 42 People and Culture 43 Ethics and Compliance 47 £808m £(775)m Principal Risks 48 s172 Statement 54 2018: £616m 2018: £(3,063)m Directors’ Report Underlying profit before tax Directors’ Report Contents 56 Board of Directors 57 Internal Control and Risk Management 60 Share Capital 61 £583m Other Statutory Information 62 2018: £466m Directors’ Report and 64 Financial Statements ø Financial Statements Net funds Financial Statements Contents 66 Consolidated Financial Statements 67 Company Financial Statements 134 £1,352m Subsidiaries 162 Joint Ventures and Associates 167 2018: £840m Other Information Independent Auditors’ Report 169 Other Financial Information 178 Glossary 180 Free cash flow is defined in note 27 on page 131. ø Net funds (excluding lease liabilities) is defined on page 72. Use of underlying performance measures in the Annual Report All figures in the narrative of the Strategic Report are underlying unless otherwise stated. -

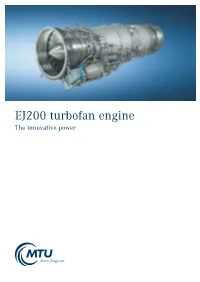

EJ200 Turbofan Engine the Innovative Power EJ200 – Technology Features

EJ200 turbofan engine The innovative power EJ200 – technology features The EJ200 is being developed and produced in Early in 1998 a framework production contract an international cooperation among Rolls-Royce, was signed between the EJ200 management com- Avio Aero, ITP Aero and MTU Aero Engines. The pany EUROJET Turbo GmbH and NETMA (NATO EJ200 has been designed to fulfil the demanding Eurofighter/Tornado Management Agency) cover- mission requirements for the next generation of ing the production of 1,382 engines to power the training and fighter aircraft. Equal priority has been Eurofighter aircraft for the four NETMA nations given to performance and life cycle costs. The EJ200 United Kingdom, Italy, Spain and Germany from 2001 engine has been designed for the Eurofighter. onwards. Orders for EJ200 engines have since been received also from export customers. Key features: • Unprecedented thrust/weight ratio • Low fuel burn • Low cost of ownership • Modular construction • Multimission capability • Significant growth potential • High tolerance to inlet distortion • LP compressor • HP compressor • 3 stages, all blisk • 5 stages, 3 blisks • No IGVs • 1 stage VIGV (Variable Inlet Guide Vanes) DECMU (Digital Engine Control & Turbine blades and vanes: The components marked blue are Monitoring Unit): • Manufactured by MTU in developed and manufactured exclusively by • Advanced Full Authority Digital Control cooperation with Rolls-Royce MTU (share: 30%). and Monitoring Unit • Full carefree handling • Built-in fault diagnosis/testability • Built-in engine life monitoring EJ200 engine specifications (uninstalled, ISA, SLS) Max. thrust, reheated 90 kN 20,000 lbf Max. thrust, dry 60 kN 13,500 lbf Pressure ratio 26:1 26:1 Fan pressure ratio 4.2:1 4.2:1 Bypass ratio 0.4:1 0.4:1 Overall pressure ratio 26:1 26:1 Specific fuel consumption MTU Aero Engines AG Reheated 47–49 g/kNs 1.66–1.73 lb/lbf hr Dachauer Straße 665 Dry 21–23 g/kNs 0.74–0.81 lb/lbf hr 80995 Munich • Germany Tel. -

Rolls-Royce Holdings Plc Annual Report 2017

Rolls-Royce Holdings plc Annual Report 2017 WorldReginfo - 66608fba-d1a9-4bba-97b5-7fa89de34d66 WorldReginfo - 66608fba-d1a9-4bba-97b5-7fa89de34d66 Rolls-Royce Holdings plc Annual Report 2017 Strategic Report Financial Highlights and Contents 01 Pioneering the REPORT STRATEGIC power that matters Rolls-Royce pioneers cutting-edge Contents technologies that deliver the cleanest, Strategic Report Group at a Glance 02 safest and most competitive solutions Chairman’s Statement 04 Chief Executive’s Review 06 to meet our planet’s vital power needs. The Trends Shaping our Markets 10 Our Vision and Strategy 11 Business Model 12 *†‡ Key Performance Indicators 14 Financial Highlights Financial Review 16 Business Review 20 Free cash flow Order book Civil Aerospace 20 Defence Aerospace 26 £273m £78,476m Power Systems 30 Marine 34 2016: £100m 2016: £80,910m Nuclear 38 Technology 42 Underlying revenue Reported revenue Sustainability 44 Environment 44 £15,090m £16,307m People 46 STEM 48 2016: £13,783m 2016: £14,955m Ethics 49 Additional Financial Review 50 Underlying operating profit Reported operating profit IFRS 15 55 2018 Outlook 58 Principal Risks 59 £1,175m £1,287m Going Concern and Viability Statements 63 2016: £915m 2016: £44m Directors’ Report Underlying profit before tax Reported profit/(loss) before tax Chairman’s Introduction 64 Board of Directors 66 Corporate Governance 69 £1,071m £4,897m Committee Reports 79 2016: £813m 2016: £(4,636)m Nominations & Governance 79 Remuneration 83 Audit 97 Underlying earnings per share Reported earnings per share Safety & Ethics 104 Science & Technology 110 40.5p 229.4p Responsibility Statements 114 2016: 30.1p 2016: (220.1)p Other Statutory Information 198 Financial Statements Full year payment to shareholders Net debt Financial Statements Contents 115 Group Financial Statements 116 11.7p £(520)m Company Financial Statements 172 Subsidiaries 175 2016: 11.7p 2016: £(225)m Joint Ventures and Associates 181 * All figures in the narrative of the Strategic Report are underlying unless otherwise stated.