Transcript of Chair Powell's Press Conference

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Thursday Calendar 20142018

THURSDAY Five-Year Calendar Unit 2014 20152016 2017 2018 Week # 1 Jan. 2 - Jan. 9 Jan. 1 - Jan. 8 Jan. 7 - Jan. 14 Jan. 5 - Jan. 12 Jan. 4 - Jan. 11 2 Jan. 9 - Jan. 16 Jan. 8 - Jan. 15 Jan. 14 - Jan. 21 Jan. 12 - Jan. 19 Jan. 11 - Jan. 18 3 Jan. 16 - Jan. 23 Jan. 15 - Jan. 22 Jan. 21 - Jan 28 Jan. 19 - Jan. 26 Jan. 18 - Jan. 25 4 Jan. 23 - Jan. 30 Jan. 22 - Jan. 29 Jan. 28 - Feb. 4 Jan. 26 - Feb. 2 Jan. 25 - Feb. 1 5 Jan. 30 - Feb. 6 Jan. 29 - Feb. 5 Feb. 4 - Feb. 11 Feb. 2- Feb. 9 Feb. 1 - Feb. 8 6 Feb. 6 - Feb. 13 Feb. 5 - Feb. 12 Feb. 11 - Feb. 18 Feb. 9 - Feb. 16 Feb. 8 - Feb. 15 7 Feb. 13 - Feb. 20 Feb. 12 - Feb. 19 Feb. 18 - Feb. 25 Feb. 16 - Feb. 23 Feb. 15 - Feb. 22 8 Feb. 20 - Feb. 27 Feb. 19 - Feb. 26 Feb. 25 - Mar. 3 Feb. 23 - Mar. 2 Feb. 22 - Mar. 1 9 Feb. 27 - Mar. 6 Feb. 26 - Mar. 5 Mar. 3 - Mar. 10 Mar. 2 - Mar. 9 Mar. 1 - Mar. 8 10 Mar. 6 - Mar. 13 Mar. 5 - Mar. 12 Mar. 10 - Mar. 17 Mar. 9 - Mar. 16 Mar. 5 - Mar. 15 11 Mar. 13 - Mar. 20 Mar. 12 - Mar. 19 Mar. 17 - Mar. 24 Mar. 16 - Mar. 23 Mar. 15 - Mar. 22 12 Mar. 20 - Mar. 27 Mar. 19 - Mar. 26 Mar. 24 - Mar. 31 Mar. 23 - Mar. 30 Mar. 22 - Mar. -

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No

Pricing*, Pool and Payment** Due Dates January - December 2021 Mideast Marketing Area Federal Order No. 33 Class & Market Administrator Payment Dates for Producer Milk Component Final Pool Producer Advance Prices Payment Dates Final Payment Due Partial Payment Due Pool Month Prices Release Date Payrolls Due & Pricing Factors PSF, Admin., MS Cooperative Nonmember Cooperative Nonmember January February 3 * February 13 February 22 December 23, 2020 February 16 ** February 16 February 17 Janaury 25 January 26 February March 3 * March 13 March 22 January 21 * March 15 March 16 March 17 February 25 February 26 March March 31 * April 13 April 22 February 18 * April 15 April 16 April 19 ** March 25 March 26 April May 5 May 13 May 22 March 17 * May 17 ** May 17 ** May 17 April 26 ** April 26 May June 3 * June 13 June 22 April 21 * June 15 June 16 June 17 May 25 May 26 June June 30 * July 13 July 22 May 19 * July 15 July 16 July 19 ** June 25 June 28 ** July August 4 * August 13 August 22 June 23 August 16 ** August 16 August 17 July 26 ** July 26 August September 1 * September 13 September 22 July 21 * September 15 September 16 September 17 August 25 August 26 September September 29 * October 13 October 22 August 18 * October 15 October 18 ** October 18 ** September 27 ** September 27 ** October November 3 * November 13 November 22 September 22 * November 15 November 16 November 17 October 25 October 26 November December 1 * December 13 December 22 October 20 * December 15 December 16 December 17 November 26 ** November 26 December January 5, 2022 January 13, 2022 January 22, 2022 November 17 * January 18, 2022 ** January 18, 2022 ** January 18, 2022 ** December 27 ** December 27 ** * If the release date does not fall on the 5th (Class & Component Prices) or 23rd (Advance Prices & Pricing Factors), the most current release preceding will be used in the price calculation. -

2021-2022 Custom & Standard Information Due Dates

2021-2022 CUSTOM & STANDARD INFORMATION DUE DATES Desired Cover All Desired Cover All Delivery Date Info. Due Text Due Delivery Date Info. Due Text Due May 31 No Deliveries No Deliveries July 19 April 12 May 10 June 1 February 23 March 23 July 20 April 13 May 11 June 2 February 24 March 24 July 21 April 14 May 12 June 3 February 25 March 25 July 22 April 15 May 13 June 4 February 26 March 26 July 23 April 16 May 14 June 7 March 1 March 29 July 26 April 19 May 17 June 8 March 2 March 30 July 27 April 20 May 18 June 9 March 3 March 31 July 28 April 21 May 19 June 10 March 4 April 1 July 29 April 22 May 20 June 11 March 5 April 2 July 30 April 23 May 21 June 14 March 8 April 5 August 2 April 26 May 24 June 15 March 9 April 6 August 3 April 27 May 25 June 16 March 10 April 7 August 4 April 28 May 26 June 17 March 11 April 8 August 5 April 29 May 27 June 18 March 12 April 9 August 6 April 30 May 28 June 21 March 15 April 12 August 9 May 3 May 28 June 22 March 16 April 13 August 10 May 4 June 1 June 23 March 17 April 14 August 11 May 5 June 2 June 24 March 18 April 15 August 12 May 6 June 3 June 25 March 19 April 16 August 13 May 7 June 4 June 28 March 22 April 19 August 16 May 10 June 7 June 29 March 23 April 20 August 17 May 11 June 8 June 30 March 24 April 21 August 18 May 12 June 9 July 1 March 25 April 22 August 19 May 13 June 10 July 2 March 26 April 23 August 20 May 14 June 11 July 5 March 29 April 26 August 23 May 17 June 14 July 6 March 30 April 27 August 24 May 18 June 15 July 7 March 31 April 28 August 25 May 19 June 16 July 8 April 1 April 29 August 26 May 20 June 17 July 9 April 2 April 30 August 27 May 21 June 18 July 12 April 5 May 3 August 30 May 24 June 21 July 13 April 6 May 4 August 31 May 25 June 22 July 14 April 7 May 5 September 1 May 26 June 23 July 15 April 8 May 6 September 2 May 27 June 24 July 16 April 9 May 7 September 3 May 28 June 25. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

2021-2022 Academic Year

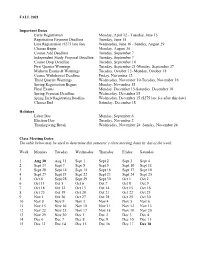

FALL 2021 Important Dates Early Registration Monday, April 12 - Tuesday, June 15 Registration Payment Deadline Tuesday, June 15 Late Registration ($275 late fee) Wednesday, June 16 - Sunday, August 29 Classes Begin Monday, August 30 Course Add Deadline Tuesday, September 7 Independent Study Proposal Deadline Tuesday, September 7 Course Drop Deadline Tuesday, September 14 First Quarter Warnings Tuesday, September 21-Monday, September 27 Midterm Exams & Warnings Tuesday, October 12- Monday, October 18 Course Withdrawal Deadline Friday, November 12 Third Quarter Warnings Wednesday, November 10-Tuesday, November 16 Spring Registration Begins Monday, November 15 Final Exams Monday, December 13-Saturday, December 18 Spring Payment Deadline Wednesday, December 15 Spring Early Registration Deadline Wednesday, December 15 ($275 late fee after this date) Classes End Saturday, December 18 Holidays Labor Day Monday, September 6 Election Day Tuesday, November 2 Thanksgiving Break Wednesday, November 24–Sunday, November 28 Class Meeting Dates The table below may be used to determine this semester’s class meeting dates by day of the week. Week Monday Tuesday Wednesday Thursday Friday Saturday 1 Aug 30 Aug 31 Sept 1 Sept 2 Sept 3 Sept 4 2 Sept 13 Sept 7 Sept 8 Sept 9 Sept 10 Sept 11 3 Sept 20 Sept 14 Sept 15 Sept 16 Sept 17 Sept 18 4 Sept 27 Sept 21 Sept 22 Sept 23 Sept 24 Sept 25 5 Oct 4 Sept 28 Sept 29 Sept 30 Oct 1 Oct 2 6 Oct 11 Oct 5 Oct 6 Oct 7 Oct 8 Oct 9 7 Oct 18 Oct 12 Oct 13 Oct 14 Oct 15 Oct 16 8 Oct 25 Oct 19 Oct 20 Oct 21 Oct 22 Oct 23 9 -

2021-2022 Academic Calendar

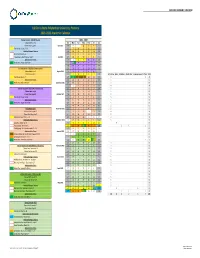

2021‐2022 ACADEMIC CALENDAR California State Polytechnic University, Pomona 2021‐2022 Academic Calendar Summer Session I 2021 (10 weeks) 2021 ‐ 2022 Classes Start: June 2 Sun Mon Tue Wed Thu Fri Sat Classes End: August 6 June 2021 30 31 1 2 345 Final Exams: August 9 ‐ 13 6789101112 Holidays/Campus Closures 13 14 15 16 17 18 19 Memorial Day: May 31 20 21 22 23 24 25 26 Independence Day Observed: July 5 July 2021 27 28 29 30 1 2 3 Administrative Dates 4 5 678 910 Grades Due: August 16 @ 6 am 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Summer Session II 2021 (1st 5‐week session) 25 26 27 28 29 30 31 Classes Start: June 2 August 2021 123456 7 Classes End: July 2 8 9 10 11 12 13 14 Instruction Exam Evaluation Grades Due Commencement Other Total Final Exams: July 6 ‐ 7 15 16 17 18 19 20 21 2 2 4 Administrative Dates 22 23 24 25 26 27 28 5 5 Grades Due: July 12 @ 6 am September 2021 29 30 31 1 2 3 4 5 5 5 6 7 8 9 10 11 4 4 Summer Session III 2021 (2nd 5‐week session) 12 13 14 15 16 17 18 5 5 Classes Start: July 8 19 20 21 22 23 24 25 5 5 Classes End: August 6 October 2021 26 27 28 29 30 1 2 5 5 Final Exams: August 9 ‐ 10 3456789 5 5 Administrative Dates 10 11 12 13 14 15 16 5 5 Grades Due: August 16 @ 6 am 17 18 19 20 21 22 23 5 5 24 25 26 27 28 29 30 5 5 Fall Semester 2021 November 2021 31123456 5 5 Classes Start: August 19 7891011 12 13 4 4 Classes End: December 5 14 15 16 17 18 19 20 5 5 Final Exams: December 6 ‐ 12 21 22 23 24 25 26 27 3 3 Holidays/Campus Closures December 2021 28 29 30 1 2 3 4 5 5 Labor Day: September 6 5 67891011 5 5 Veterans Day: November 11 12 13 14 15 16 17 18 11 35 Thanksgiving. -

L:\Session Dates\2023 Session Dates.Wpd

SESSION DATES Current: 2022 January 4, 2022 - January 14 Legislation may be prefiled January 18 Opening day (noon) February 2 Deadline for introduction February 17 Session ends (noon) March 9 Legislation not acted upon by governor is pocket vetoed May 18 Effective date of legislation not a general appropriation bill or a bill carrying an emergency clause or other specified date Future: 2023 January 3, 2023 - January 13 Legislation may be prefiled January 17 Opening day (noon) February 16 Deadline for introduction March 18 Session ends (noon) April 7 Legislation not acted upon by governor is pocket vetoed June 16 Effective date of legislation not a general appropriation bill or a bill carrying an emergency clause or other specified date Prior: 2021 First Special Session March 30 Opening day (noon) March 31 Session ended April 20 Legislation not acted upon by governor is pocket vetoed June 29 Effective date of legislation not a general appropriation bill or a bill carrying an emergency clause or other specified date 2021 January 4, 2021 - January 15 Legislation may be prefiled January 19 Opening day (noon) February 18 Deadline for introduction March 20 Session ends (noon) April 9 Legislation not acted upon by governor is pocket vetoed June 18 Effective date of legislation not a general appropriation bill or a bill carrying an emergency clause or other specified date 2020 Second Special Session November 24 Opening day (11:00 a.m.) November 24 Session ended December 14 Legislation not acted upon by governor is pocket vetoed February 22, 2021 -

2018 - 2019 Days of Rotation Calendar

2018 - 2019 DAYS OF ROTATION CALENDAR Day # Date Rotation Day Type Notes Day # Date Rotation Day Type Notes Saturday, October 13, 2018 Sunday, October 14, 2018 Monday, September 3, 2018 Holiday/Vaca Labor Day 27 Monday, October 15, 2018 Day 3 In Session 1 Tuesday, September 4, 2018 Day 1 In Session 28 Tuesday, October 16, 2018 Day 4 In Session 2 Wednesday, September 5, 2018 Day 2 In Session 29 Wednesday, October 17, 2018 Day 5 In Session 3 Thursday, September 6, 2018 Day 3 In Session 30 Thursday, October 18, 2018 Day 6 In Session 4 Friday, September 7, 2018 Day 4 In Session 31 Friday, October 19, 2018 Day 1 In Session Saturday, September 8, 2018 Saturday, October 20, 2018 Sunday, September 9, 2018 Sunday, October 21, 2018 Monday, September 10, 2018 Day Holiday/Vaca Rosh Hashanah 32 Monday, October 22, 2018 Day 2 In Session 5 Tuesday, September 11, 2018 Day 5 In Session 33 Tuesday, October 23, 2018 Day 3 In Session 6 Wednesday, September 12, 2018 Day 6 In Session 34 Wednesday, October 24, 2018 Day 4 In Session 7 Thursday, September 13, 2018 Day 1 In Session 35 Thursday, October 25, 2018 Day 5 In Session 8 Friday, September 14, 2018 Day 2 In Session 36 Friday, October 26, 2018 Day 6 In Session Saturday, September 15, 2018 Saturday, October 27, 2018 Sunday, September 16, 2018 Sunday, October 28, 2018 9 Monday, September 17, 2018 Day 3 In Session 37 Monday, October 29, 2018 Day 1 In Session 10 Tuesday, September 18, 2018 Day 4 In Session 38 Tuesday, October 30, 2018 Day 2 In Session Wednesday, September 19, 2018 Day Holiday/Vaca Yom Kippur 39 Wednesday, October 31, 2018 Day 3 In Session 11 Thursday, September 20, 2018 Day 5 In Session 40 Thursday, November 1, 2018 Day 4 In Session 12 Friday, September 21, 2018 Day 6 In Session 41 Friday, November 2, 2018 Day 5 In Session Saturday, September 22, 2018 Saturday, November 3, 2018 Sunday, September 23, 2018 Sunday, November 4, 2018 13 Monday, September 24, 2018 Day 1 In Session 42 Monday, November 5, 2018 Day 6 In Session 14 Tuesday, September 25, 2018 Day 2 In Session Tuesday, November 6, 2018 Prof Dev. -

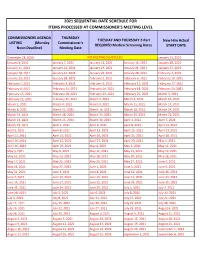

2021 Sequential Date List

2021 SEQUENTIAL DATE SCHEDULE FOR ITEMS PROCESSED AT COMMISSIONER'S MEETING LEVEL COMMISSIONERS AGENDA THURSDAY TUESDAY AND THURSDAY 2-Part New Hire Actual LISTING (Monday Commissioner's REQUIRED Medical Screening Dates START DATE Noon Deadline) Meeting Date December 28, 2020 NO MEETING SCHEDULED January 13, 2021 January 4, 2021 January 7, 2021 January 12, 2021 January 14, 2021 January 20, 2021 January 11, 2021 January 14, 2021 January 19, 2021 January 21, 2021 January 27, 2021 January 18, 2021 January 21, 2021 January 26, 2021 January 28, 2021 February 3, 2021 January 25, 2021 January 28, 2021 February 2, 2021 February 4, 2021 February 10, 2021 February 1, 2021 February 4, 2021 February 9, 2021 February 11, 2021 February 17, 2021 February 8, 2021 February 11, 2021 February 16, 2021 February 18, 2021 February 24, 2021 February 15, 2021 February 18, 2021 February 23, 2021 February 25, 2021 March 3, 2021 February 22, 2021 February 25, 2021 March 2, 2021 March 4, 2021 March 10, 2021 March 1, 2021 March 4, 2021 March 9, 2021 March 11, 2021 March 17, 2021 March 8, 2021 March 11, 2021 March 16, 2021 March 18, 2021 March 24, 2021 March 15, 2021 March 18, 2021 March 23, 2021 March 25, 2021 March 31, 2021 March 22, 2021 March 25, 2021 March 30, 2021 April 1, 2021 April 7, 2021 March 29, 2021 April 1, 2021 April 6, 2021 April 8, 2021 April 14, 2021 April 5, 2021 April 8, 2021 April 13, 2021 April 15, 2021 April 21, 2021 April 12, 2021 April 15, 2021 April 20, 2021 April 22, 2021 April 28, 2021 April 19, 2021 April 22, 2021 April 27, 2021 April -

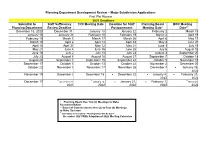

2021 Subdivision Calendar

Planning Department Development Review – Major Subdivision Applications First Plat Review 2021 Deadlines Submittal to Staff Sufficiency TRC Meeting Date Deadline for Staff Planning Board BOC Meeting Planning Department Review Deadline Postponement Meeting Date* Date** December 18, 2020 December 31 January 13 January 22 February 2 March 15 January 15 January 29 February 10 February 19 March 2 April 19 February 19 March 5 March 17 March 26 April 6 May 17 March 19 April 2 April 14 April 23 May 4 June 21 April 16 April 30 May 12 May 21 June 1 July 19 May 21 June 4 June 16 June 25 July 6 August 16 June 18 July 2 July 14 July 23 August 3 September 20 July 23 August 6 August 18 August 27 September 7 October 18 August 20 September 3 September 15 September 24 October 5 November 15 September 17 October 1 October 13 October 22 November 2 December 20 October 22 November 5 November 17 November 26 December 7 ▪ January 18, 2022 November 19 December 3 December 15 ▪ December 22 ▪ January 4, ▪ February 21, 2022 2022 ▪ ▪ ▪ December 17 December 31, January 12, ▪ January 21, ▪ February 1, March 21, 2021 2022 2022 2022 2022 * Planning Board Has Two (2) Meetings to Make Recommendation ** Board of Commissioners Has Up to Four (4) Meetings to Make Decision ▪ 2021 Dates are Tentative – Meeting Dates Will Be Set in December 2021 With Adoption of 2022 Meeting Calendars Construction/Final Plat Review – Administrative* 2021 Deadlines Submittal to Staff Sufficiency TRC Meeting Date Planning Review Deadline Department For TRC December 23, 2020 January 6 January 13 January -

June 16, 2021 COVID-19 Status Report Oak Park Village Board of Trustees

June 16, 2021 COVID-19 Status Report Oak Park Village Board of Trustees To: Village President and Village Board of Trustees Fr: Cara Pavlicek, Village Manager The memo is a weekly status report presented Wednesdays and provides a brief summary of information regarding Village of Oak Park operational activities in response to COVID-19. On Tuesday, June 15, 2021, the Village Declaration of an Emergency Affecting Public Health sunset. With that, the report is being updated to show weekly data. Additionally demographic data is being researched and an update on that information will be presented in coming weeks. Information will continue to be shared on the Village website. New COVID-19 Cases Today, the Village of Oak Park Department of Public Health received notification of the following new COVID-19 cases: Date # of Cases Cases this week (June 9 – 15) 5 Cases last week (June 2 – 8) 2 Excluding individuals for which street addresses are not yet determined, the State of Illinois reports a total of three thousand two hundred and six (3206) Oak Park COVID-19 cases. It is important to note that as patient tracking and case follow-up occurs, individuals listing the number of Oak Park cases reported may change depending on residency confirmation. The Oak Park Department of Public Health is notified of positive tests as established by state and local public health protocol. Because of privacy laws, no additional information can be released about the individuals. It is noted, that privacy precludes location information regarding individuals tested to anyone other than Public Health Officials and First Responders. -

2021 Rezoning Review Schedule

City of Waukee | 2021 ZONING AMENDMENT REVIEW SCHEDULE APPLICATION STAFF APPLICANT PUBLIC P & Z P & Z COUNCIL COUNCIL COUNCIL COUNCIL DUE COMMENTS REVISIONS by HEARING SUBMITTAL MEETING SUBMITTAL MEETING MEETING MEETING by 5:00 p.m. SENT 5:00 p.m. DATE SET by 5:00 p.m. 6:00 p.m. by 5:00 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. 5:30 p.m. [1st Consider.] [2nd Consider.] [3rd Consider.] (TUES.) (TUES.) (TUES.) (MON.) (THUR.) (TUES.) (WED.) (MON.) (MON.) (MON.) November 17 November 24 December 1 December 7 December 17 December 22 December 30 January 4 January 18 February 1 December 8 December 15 December 22 December 21 January 7 January 12 January 13 January 18 February 1 *February 16* December 22 December 29 January 5 January 4 January 21 January 26 January 27 February 1 *February 16* March 1 January 5 January 12 January 19 January 18 February 4 February 9 February 10 *February 16* March 1 March 15 January 19 January 26 February 2 February 1 February 18 February 23 February 24 March 1 March 15 April 5 February 2 February 9 February 16 *February 16* March 4 March 9 March 10 March 15 April 5 April 19 February 16 February 23 March 2 March 1 March 18 March 23 March 31 April 5 April 19 May 3 March 2 March 9 March 16 March 15 April 8 April 13 April 14 April 19 May 3 May 17 March 16 March 23 March 30 April 5 April 22 April 27 April 28 May 3 May 17 June 7 March 30 April 6 April 13 April 19 May 6 May 11 May 12 May 17 June 7 June 21 April 13 April 20 April 27 May 3 May 20 May 25 June 2 June 7 June 21 *July 6* April 27 May 4 May 11 May 17 June 3 June 8 June