HLDI Insurance Fire Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Veloster. Live Loud

Veloster. Live loud. We have one goal – to be Australia’s most-loved car company. We’re driven by the simple philosophy that life’s most incredible moments shouldn’t be reserved for a select few. Everyone is entitled to experience an amazing drive. So how do we make that happen? We start by pushing our own boundaries, by making premium standard, and by engineering the most enjoyable ride possible. The Veloster is Hyundai at its creative, imaginative best; a car for those who like to stand out from the crowd. With its unique sports coupe design, it makes a bold statement and turns heads wherever you go, while never sacrificing substance for style. While you’re living loud on the outside, the Veloster’s stylish interior is your personal space on the move, fitted with an array of new technology and connected features. You’ll also feel connected to the road, thanks to the extensive local suspension development program we’ve carried out, to perfect the Veloster’s ride and handling for Australian conditions. All of which ensures the new Hyundai Veloster is every bit as exciting to drive as it looks. Veloster. Style. Driven. Beauty shouldn’t be sacrificed for practicality. Just because you own a sporty coupe, with the sharp lines and daring desirability that the Veloster exudes, doesn’t mean you need to miss out on the practicality and versatility of a conventional hatchback. What Hyundai has done is combine both, giving you the best of both worlds. The Veloster looks like a two-door sports car, with its cascading grille and sleek lines, making it seem ready to pounce. -

Finishing the Year Strong – Top Segment Gainers

SHOPPER FINISHING THE YEAR STRONG – TOP SEGMENT GAINERS TRENDS Car shopping traffic was up overall in Q4 on Autotrader, with more than half of mainstream car, truck, and SUV segments posting double-digit growth compared to the prior quarter. SNAPSHOT Four luxury segments – the three SUV segments and luxury’s fullsize car segment – experienced the largest percentage growth in traffic among the 17 segments, contributing to a strong finish for luxury overall (+14%). Despite upward momentum for many, rises for some mean declines for others – 30 of more than 200 segment models face an uphill battle to start the year, having dropped a half share point in Q4. Among those benefiting from the increased shopping, Ford makes the biggest statement at a brand level, boasting 13 “top 3 model movers” across their respective segments. All Mainstream segments experience increased 17 traffic in Q4 Growth in traffic + among Car, SUV, and 11% Truck segments brands tout three or more # of models to see the greatest models among the top three traffic growth in their respective 9 segment gainers segment 12% 11% 7% 29 35 shopping activity growth by segment domestics imports Autotrader New Car Prospects, Q4’18 vs. Q3’18 1 SHOPPER TRENDS NON-LUXURY CARS SNAPSHOT TOP 3 GAINERS: TRAFFIC & SHARE OF SEGMENT SUBCOMPACT CAR COMPACT CAR VOLUME GROWTH SHARE GROWTH VOLUME GROWTH SHARE GROWTH +1% Ford Fiesta Ford Fiesta +7% Honda Civic Toyota Corolla Hyundai Accent Hyundai Accent Toyota Corolla Kia Forte Toyota Yaris Toyota Yaris Ford Focus Hyundai Veloster Total # of 18 -

Hyundai Motor America Reports Record-Setting May 2021 Sales

Hyundai Motor America Reports Record-Setting May 2021 Sales • Best Total and Retail Sales Month Ever • May Total Sales Increased 56%; May Retail Sales Grew 54% • All-Time Monthly Records for Venue and Kona EV; May Records for Tucson, Palisade, Kona, Ioniq EV, Ioniq PHEV and Veloster N FOUNTAIN VALLEY, Calif., June 2, 2021 – Hyundai Motor America reported total May sales of 90,017 units, a 56% increase compared with May 2020. Hyundai again set an all-time monthly sales record for the third consecutive month. Fleet sales increased 95%, representing 6% of total volume. “It’s a great achievement for the entire organization to set a new monthly total and retail sales record for the third month in a row,” said Randy Parker, senior vice president, National Sales, Hyundai Motor America. “Consumer demand across the Hyundai lineup remains strong and we continue to work closely with our manufacturing and supply chain partners to meet this extraordinary demand.” May Retail Highlights May was also the best retail month ever, with 84,351 retail sales, up 54%. Retail sales rose for the entire lineup with SUVs (+34%), cars (+105%) and eco-friendly vehicles (+887%), all growing substantially. Eco-friendly vehicles also accounted for 11% of the retail volume. May Total Sales Summary May-21 May-20 % Chg 2021 YTD 2020 YTD % Chg Hyundai 90,017 57,619 56% 334,670 222,462 50% Hyundai Motor America 10550 Talbert Avenue www.HyundaiNews.com Fountain Valley, CA 92708 www.HyundaiUSA.com May Product and Corporate Activities • IONIQ 5 North American Reveal: Hyundai unveiled the IONIQ 5 for North America, disrupting the EV market with its targeted driving range of 300 miles, sleek design, advanced technology and best-in-class ultra-fast charging from 10 to 80 percent in just 18 minutes • Robert Wickens Races Again: Inspired to overcome a horrific IndyCar accident in 2018, Robert Wickens returned to the cockpit in a Hyundai Veloster N TCR car at the Mid-Ohio Sports Car Course • Hyundai Motor Group Investment Pledge: Hyundai Motor Group announced its plan to invest $7.4 billion in the U.S. -

Nicholas Wylie Et Al V. Hyundai Motor America

Case 8:16-cv-02102 Document 1 Filed 11/22/16 Page 1 of 30 Page ID #:1 1 Jordan L. Lurie (SBN 130013) [email protected] 2 Tarek H. Zohdy (SBN 247775) [email protected] 3 Cody R. Padgett (SBN 275553) [email protected] 4 Karen L. Wallace (SBN 272309) [email protected] 5 Capstone Law APC 1875 Century Park East, Suite 1000 6 Los Angeles, California 90067 Telephone: (310) 556-4811 7 Facsimile: (310) 943-0396 8 Troy L. Isaacson, Esq., (Cal. Bar No. 186834, NV Bar No. 6690) Norberto J. Cisneros, Esq., (Cal. Bar No. 182001, NV Bar No. 8782) 9 Barbara M. McDonald, Esq., (Cal. Bar No. 281722, NV Bar No. 11651) MADDOX | ISAACSON | CISNEROS LLP 10 11920 Southern Highlands Parkway, Suite 100 Las Vegas, Nevada 89141 11 Telephone: (702) 366-1900 Facsimile: (702) 366-1999 12 13 Attorneys for Plaintiffs Nicholas and Shawna Wylie 14 UNITED STATES DISTRICT COURT 15 CENTRAL DISTRICT OF CALIFORNIA 16 17 NICHOLAS WYLIE and SHAWNA Case No.: 8:16-CV-02102 WYLIE (fka BROWN), 18 individually, and on behalf of a class CLASS ACTION COMPLAINT of similarly situated individuals, FOR: 19 Plaintiffs, (1) Violation of Nevada Deceptive 20 Trade Practices Act v. (2) Breach of Common Law Implied 21 Warranty of Merchantability and HYUNDAI MOTOR AMERICA, a Breach of Implied Warranty 22 California corporation, pursuant to Nev. Rev. Stat. §§104.2314 and 104A.2212 23 Defendant. (3) Breach of Implied Warranty pursuant to the Magnuson-Moss 24 Warranty Act (4) Unjust Enrichment 25 DEMAND FOR JURY TRIAL 26 27 28 CLASS ACTION COMPLAINT Case 8:16-cv-02102 Document 1 Filed 11/22/16 Page 2 of 30 Page ID #:2 1 INTRODUCTION 2 1. -

Hyundai Leads Manufacturers' Championship

Hyundai Leads Manufacturers’ Championship Rory van der Steur (left) and Denis Dupont stand on the podium alongside Parker Chase and Ryan Norman at the IMSA Michelin Pilot Challenge Road America 120 at Road America in Elkhart Lake, Wisc., Saturday, August 7, 2021. (Photo/Bryan Herta Autosport/LAT) ELKHART LAKE, Wisc., Aug. 10, 2021 – Despite challenging and rainy conditions, Van der Steur Racing hung on for their first podium finish in the IMSA Michelin Pilot Challenge. Denis Dupont and Rory van der Steur finished in second place, driving the #19 Hyundai Veloster N TCR. Ryan Norman and Parker Chase started from the pole position in the #98 Elantra N TCR and secured third place after recovering from a near miss with the wall. These results helped move Hyundai to the top of the manufacturers’ championship, leading Honda by 20 points and Audi by 40 points with just three races remaining. Taylor Hagler and Michael Lewis retained their lead of the drivers’ championship despite an 11th place finish. Ryan Norman and Parker Chase jumped to second place in the drivers’ championship with their third-place finish. Hyundai Motor America 10550 Talbert Avenue www.HyundaiNews.com Fountain Valley, CA 92708 www.HyundaiUSA.com Hyundai’s next race will be the Hyundai Monterey Sports Car Championship at WeatherTech Laguna Raceway on Saturday, Sept. 11, 2021. For more information about the race visit bryanhertaautosport.com. Hyundai Finishing Results Position Drivers Team Car 2 R. van der Steur/ D. Dupont Van der Steur Racing #19 Veloster N TCR 3 R. Norman / P. Chase Bryan Herta Autosport #98 Elantra N TCR 4 H. -

Hyundai 2019 Model Year Changes Below Is a Summary of Changes to the Hyundai Lineup for 2019 Model Year. This Document Will Be U

Hyundai 2019 Model Year Changes Below is a summary of changes to the Hyundai lineup for 2019 model year. This document will be updated regularly, creating a one-stop shop for the most up-to-date Hyundai vehicle lineup news. For additional product updates please subscribe to Hyundai News Alerts. You can also visit HyundaiNews.com for latest news on sales, pricing and technology. Please visit the product pages at HyundaiNews.com for more complete information. The models included in this guide are: 2019 Veloster – All New 2019 Veloster N – All New 2019 Hyundai Santa Fe – All New with name change: 2018 Santa Fe Sport → 2019 Santa Fe 2019 Hyundai Nexo – All New 2019 Hyundai Kona Electric – All New 2019 Hyundai Tucson – Redesigned (Mid-cycle Refresh) 2019 Hyundai Accent – Carryover 2019 Hyundai Elantra – Redesigned (Mid-cycle Refresh) 2019 Hyundai Elantra GT – Carryover 2019 Hyundai Ioniq – Carryover 2019 Hyundai Sonata – Carryover 2019 Hyundai Sonata Hybrid and Plug-In Hybrid – Carryover 2019 Hyundai Kona – Carryover 2019 Hyundai Santa Fe XL – Name change: 2018 Santa Fe → 2019 Santa Fe XL 2019 Hyundai Veloster – All New The Veloster is an all-new model for 2019. High performance N model added to the lineup. 2019 Veloster Product Overview Unique and Innovative Styling • Sleek coupe hatchback profile w/ hidden rear door on passenger side (2+1 design) • New driver-oriented asymmetric interior layout with available two-tone roof • LED Daytime Running Lights, Headlights & Taillights Improved Dynamics • Standard Nu 2.0L Atkinson Cycle with a 6-speed -

Hyundai-Kia Application Guide

Zed-FULL HYUNDAI, KIA OBD APPLICATION LIST MAKE MODEL YEAR PIN CODE KEY PROG. REMOTE PROG. SYSTEM Hyundai Accent w/Prox 2013-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Azera w/Prox 2012-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Elantra w/Prox 2011-2013 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Elantra w/Prox 2014-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Equus Prox 2011-2012 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Equus Prox 2013-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Genesis 4 Door Sedan w/Prox 2009-2013 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Genesis 4 Door Sedan w/Prox 2014-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Genesis 2 Door Coupe w/Prox 2010-2013 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Santa Fe w/PROX 2013-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Sonata w/Prox 2011-2013 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Sonata w/Prox 2014-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Sonata Hybrid w/Prox 2014-2015 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Veloster Prox 2012-2013 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Vera Cruz Prox 2008-2014 DLR/Nastf/ETC currently yes, prox yes, prox Hyun/Kia Prox Hyundai Vera Cruz Twist Prox 2007-2009 DLR/Nastf/ETC currently no -

Part 573 Safety Recall Report 20V-746

OMB Control No.: 2127-0004 Part 573 Safety Recall Report 20V-746 Manufacturer Name : Hyundai Motor America Submission Date : DEC 01, 2020 NHTSA Recall No. : 20V-746 Manufacturer Recall No. : 198 Manufacturer Information : Population : Manufacturer Name : Hyundai Motor America Number of potentially involved : 128,948 Address : 10550 Talbert Avenue Estimated percentage with defect : 1 % Fountain Valley CA 92708 Company phone : 800-633-5151 Vehicle Information : Vehicle 1 : 2015-2016 Hyundai Veloster Vehicle Type : LIGHT VEHICLES Body Style : HATCHBACK Power Train : GAS Descriptive Information : Certain model year 2015-2016 Hyundai Veloster vehicles equipped with 1.6-liter “Gamma” GDI engines and produced by May 26, 2014 through July 13, 2016 by Hyundai Motor Company in the Republic of Korea. The involved vehicles were determined jointly by Hyundai and NHTSA’s Office of Defects Investigation (“ODI”) during a review of Hyundai’s response(s) to investigations PE19-003. Production Dates : MAY 26, 2014 - JUL 13, 2016 VIN Range 1 : Begin : NR End : NR Not sequential Vehicle 2 : 2012-2012 Hyundai Santa Fe Vehicle Type : LIGHT VEHICLES Body Style : SUV Power Train : GAS Descriptive Information : Certain model year 2012 Hyundai Santa Fe vehicles equipped with 2.4-liter “Theta II” MPI engines and produced from January 10, 2012 through July 3, 2012 by Hyundai Motor Manufacturing Alabama and Kia Motor Company in the Republic of Korea. The involved vehicles were determined jointly by Hyundai and NHTSA’s Office of Defects Investigation (“ODI”) during -

J.D. Power 2020 U.S. Initial Quality Study Ranks Hyundai Tucson and Veloster Tops in Their Segments

J.D. Power 2020 U.S. Initial Quality Study Ranks Hyundai Tucson and Veloster Tops in their Segments FOUNTAIN VALLEY, Calif., June 24, 2020 – The J.D. Power 2020 U.S. Initial Quality Study (IQS)sm ranked Hyundai Tucson as the best compact SUV in initial quality today. The Hyundai Veloster also earned the top score in the compact sporty car vehicle segment. Additional vehicles in Hyundai’s lineup performed well, with Accent and Elantra both finishing second in their respective segments, while Santa Fe was third. Barry Ratzlaff (left), chief customer officer, Hyundai Motor America and Omar Rivera, director, quality and service engineering, Hyundai Motor America accept J.D. Power IQS trophies for the Hyundai Tucson and Veloster. Hyundai Motor America 10550 Talbert Avenue www.HyundaiNews.com Fountain Valley, CA 92708 www.HyundaiUSA.com “Outperforming the best vehicles in a segment is always a major milestone for Hyundai,” said Barry Ratzlaff, chief customer officer, Hyundai Motor America. “These accomplishments are a testament to the entire company’s dedication, including design, engineering, manufacturing, service, field teams and our dealer partners, to deliver the highest quality vehicles to our customers.” The 2020 U.S. Initial Quality Study is based on responses from 87,282 purchasers and lessees of new 2020 model-year vehicles who were surveyed after 90 days of ownership. The study, which provides manufacturers with information to facilitate the identification of problems and drive product improvement, was fielded from February through May 2020. The 2020 redesign marks the fifth generation of the study, which is now based on a 223-question battery organized into nine vehicle categories: infotainment; features, controls and displays; exterior; driving assistance (new for 2020); interior; powertrain; seats; driving experience; and climate. -

Hyundai Preps for the All-New Veloster's Appearance in Marvel Studios' Ant-Man and the Wasp with a Fully Integrated Marketin

Hyundai Preps for the All-New Veloster’s Appearance in Marvel Studios’ Ant-Man and The Wasp with a Fully Integrated Marketing Plan New Ant-Man and The Wasp-Inspired Hyundai Commercial Captures an Awkward Stoplight Exchange Featuring the All-New 2019 Veloster Turbo Enlarged, Packaged Toy Veloster On Display at the World Premiere of Marvel Studios’ Ant-Man and The Wasp Hyundai Gives Marvel Fans in Los Angeles a Chance to Attend an Exclusive, Early Screening FOUNTAIN VALLEY, Calif., June 11, 2018 – The all-new Hyundai Veloster will be making its Hollywood debut in Marvel Studios’ Ant-Man and The Wasp and Hyundai is suiting up to give fans an action-packed experience. Leading up to the July 6 release, Hyundai is tapping into Ant-Man’s superpowers with a fully integrated marketing plan that includes new commercials, an interactive sweepstakes and much more. “Having our all-new Veloster immersed in the Marvel Cinematic Universe is a great way to entertain consumers and showcase the vehicle’s stylish design and performance capabilities to a massive audience,” said Dean Evans, CMO, Hyundai Motor America. “We wanted to take full advantage of this collaboration by engaging fans and providing them with experiences beyond the big screen.” “There’s so much fun to be had with this film, which is why we’re elated about the approach that Hyundai has taken with their campaign,” said Mindy Hamilton, Marvel’s SVP of Global Partnerships & Hyundai Motor America 10550 Talbert Avenue www.HyundaiNews.com Fountain Valley, CA 92708 www.HyundaiUSA.com Marketing. “The humor is there, the heart is there, and the creativity is firing on all cylinders because they’re experimenting with the same sizing and scale gags that our heroes encounter all throughout the movie.” Hyundai’s Ant-Man and The Wasp Broadcast Creative Starting on June 11, Hyundai will air the new Ant-Man and The Wasp-inspired ad “Stoplight Standoff” on U.S. -

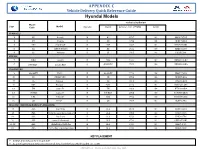

Hyundai Models Technical Bulletin# Model Page Code Model Hyundai Model Revision Date (YYMM) Rev

APPENDIX C Vehicle Delivery Quick Reference Guide Hyundai Models Technical Bulletin# Model Page Code Model Hyundai Model Revision Date (YYMM) Rev# COMPACTS 2 HC Accent H HC 1707 R4 HHC1707R4 3 PD Elantra H PD 1703 R3 HPD1703R3 4 CN7 ElantraGT H CN7 2007 R1 HCN72007R1 5 AE IONIQ Hybrid H AE 1611 R6 HAE1611R6 6 JS Veloster H JS 1803 R4 HJS1803R4 SEDANS 7 DN8 Sonata H DN8 1910 R2 HDN81910R2 8 DN8 HEV Sonata HEV H DN8 HEV 1910 R0 HDN81910R0 CROSSOVERS 9 OS, OSEV Kona H OS, OSEV 1710 R3 HOS1710R3 10 FE NEXO FCEV H FE 1804 R4 HFE1804R4 11 TL Tucson H TL 1906 R4 HTL1906R4 12 NX4 Tucson H NX4 2102 R HNX42102R0 13 TM Santa Fe H TM 1808 R4 HTM1808R4 1 14 TM HEV Santa Fe H TM HEV 1808 R0 HTMHEV18R0 15 LX2 Palisade H LX2 1902 R5 HLX21902R5 16 QX Venue H QX 1907 R2 HQX1907R2 RELATED TECHNICAL HANDLING BULLETINS 17 ALL Seat Belts H ALL 0919 R1 GHK1902R1 18 ALL Hybrids must be turned-off H ALL 0825 R0 GHK2008R0 19 ALL No Starts H ALL 0720 R0 GHK2007R0 20 ALL Covid-19 Protocol H ALL 0720 R1 GHK20716R1 21-23 ALL Undelivered vehicles H ALL 1020 R0 GHK2010R0 24 ALL STI – Key control process H ALL 1020 R0 GHK2009R0 KEYPLACEMENT All keys must be placed in Cup Holder As a theft prevention measure, remove all keys from the last vehicle loaded on trailer APPENDIX – C Version 2.0 Publish Date May 2021 NUMBER: DATE: Technical Bulletin HHC1707R4 07 Jul 2017 HYUNDAI KIA MODEL YEAR: MODELFeb 2014CODE: X 2021 HC SUBJECT: MY2021 Hyundai Accent Sedan COMMENTS: TRUCK HAULAWAY a. -

Small Minivan Compact Minivan Convertible & Roadster

AUTOMOTIVE NEWS EUROPE DATA MINICAR SUBCOMPACT H1 2017 H1 2016 change H1 2017 H1 2016 change 1. Fiat Panda 110,797 109,855 +0.9% 1. Renault Clio 184,908 174,125 +6.2% 2. Fiat 500 108,376 103,491 +4.7% 2. Volkswagen Polo 171,817 167,464 +2.6% 3. Volkswagen Up 51,958 53,247 -2.4% 3. Ford Fiesta 156,717 159,427 -1.7% 4. Hyundai i10 48,703 44,085 +10.5% 4. Opel/Vauxhall Corsa 138,877 147,615 -5.9% 5. Toyota Aygo 46,774 47,370 -1.3% 5. Peugeot 208 132,234 138,471 -4.5% 6. Renault Twingo 42,035 46,845 -10.3% 6. Citroen C3 116,515 71,708 +62.5% 7. Kia Picanto 33,852 28,373 +19.3% 7. Dacia Sandero 108,704 94,395 +15.2% 8. Peugeot 108 31,987 36,395 -12.1% 8. Toyota Yaris 101,840 104,219 -2.3% 9. Citroen C1 30,255 35,790 -15.5% 9. Skoda Fabia 97,555 92,715 +5.2% 10. Opel Karl/Vauxhall Viva 28,459 32,381 -12.1% 10. Seat Ibiza 64,084 67,910 -5.6% Segment total 648,753 657,739 -1.4% Segment total 1,598,089 1,526,244 +4.7% COMPACT MIDSIZE H1 2017 H1 2016 change H1 2017 H1 2016 change 1. Volkswagen Golf 234,290 260,763 -10.2% 1. Volkswagen Passat 95,416 111,767 -14.6% 2. Opel/Vauxhall Astra 132,079 124,996 +5.7% 2. Skoda Superb 45,281 48,427 -6.5% 3.