Terms & Conditions Regarding Usage of Unified

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Nodal Officers

List of Nodal Officers S. Name of Bank Name of the Nodal Address CPPC Phone/Fax No./e-mail No Officers 1 Allahabad Bank Dr S R Jatav Asstt. General Manager, Office no: 0522 2286378, 0522 Allahabad Bank, CPPC 2286489 Zonal Office Building, Mob: 08004500516 Ist floor,Hazratganj, [email protected] Lucknow UP-226001 2 Andhra Bank Shri M K Srinivas Sr.Manager, Mob: 09666149852,040-24757153 Andhra Bank, [email protected] Centralized Pension Processing Centre(CPPC) 4th floor,Andhra Bank Building,Koti, Hyderabad-500095 3 Axis Bank Shri Hetal Pardiwala, Nodal Officer Mob: 9167550333, AXIS BANK LTD, Gigaplex Bldg [email protected] no.1, 4th floor, Plot No. I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai- 400708 4 Bank of India Shri R. Ashok Chief Manager 0712-2764341, Ph.2764091,92 Nimrani Bank of India, 0712-2764091 (fax) CPPC Branch, Bank of India Bldg. [email protected] 87-A, 1st floor, Gandhibaug, Nagpur-440002. 5 Bank of Baroda Shri S K Goyal, Dy. General Manager, 011-23441347, 011-23441342 Bank of Baroda, [email protected] Central Pension Processing Centre, [email protected] Bank of Baorda Bldg. 16, Parliament Street, New Delhi – 110 001 6 Bank of Shri D H Vardy Manager Ph: 020-24467937/38 Maharashtra Bank of Maharashtra Mob: 08552033043 Central Pension Processing Cell, [email protected] 1177, Budhwar Peth, Janmangal, Bajirao Road Pune-411002 7 Canara Bank Shri K S Hebbar Asstt. General Manager Mob. 08197844215 Canara Bank Ph: 080 26621845 Centralized Pension Processing [email protected] Centre Dwarakanath Bhavan 29, K R Road Basavangudi, Bangalore 560 004 8 Central Bank of Shri V K Sinha Chief Manager Ph: 022-22703216/22703217, India Central Bank of India (CPPC) Fax- 22703218 Central Office, 2nd Floor, [email protected] Central Bank Building, M.G. -

To the Stakeholders of the Bank

To the Stakeholders of the Bank The Draft Scheme for setting off Accumulated Losses of the Bank as on April 01, 2021 against the Securities Premium Account alongwith the Report of Audit Committee recommending the Draft Scheme, Pre & Post Shareholding Pattern of the Bank, Un-audited Financial Results for the Quarter ended December 31, 2020, Auditor’s Certificate as per SEBI Circular, Detailed Compliance Report as per SEBI Circular duly certified by the CS, CFO & Managing Director and Report of Independent Directors’ Committee recommending the Draft Scheme, as submitted to the Stock Exchanges today for approval, has been uploaded on the website of the Bank as attached herewith. The complaints / comments on the Draft Scheme, if any, can be sent to the email id [email protected]. ceRTa.FILD Co P___V earara) awan Agr wal) vffir4V Rif441 Company Secretary *Mad Ufailtgi IDBI Bank Limited triUMumbal DRAFT SCHEME OF REDUCTION OF SHARE CAPITAL BETWEEN IDBI BANK LIMITED AND ITS SHAREHOLDERS UNDER SECTIONS 66, 52 AND OTHER APPLICABLE PROVISIONS OF THE COMPANIES ACT, 2013 READ WITH THE NATIONAL COMPANY LAW TRIBUNAL (PROCEDURE FOR REDUCTION OF SHARE CAPITAL OF COMPANY) RULES, 2016 TABLE OF CONTENTS INTRODUCTION 3 1. Preamble 3 2. Parts of the Scheme 3 SCHEME 4 Part A — Definitions and Interpretations 4 Part B — Details of the Bank 6 3. Incorporation of the Bank 6 4. Main Objects of the Bank 7 5. Capital Structure of the Bank 7 6. Financial Position of the Bank 9 7. Accumulated Losses and Securities Premium of the Bank 9 Part C — Reduction of Share Capital 11 8. -

List of Aggregators As on 25.09.2013 Sl No

List of Aggregators as on 25.09.2013 Sl no. Name of Entity Address Contact No. A.P. BUILDING & OTHER 1-1-18/73, T. Anjaiah Karmika Samkshema CONSTRUCTION WORKERS WELFARE Bhavan,RTC 'X' Roads, Chokkadpally, 1 BOARD (Only for B&OC workers in AP) Hyderabad - 20 040-23447739/040-27600019 A-387 , Dilkhush Indl , Area, GT Karnal Road ABHIPRA CAPITAL LTD 011-27215530 2 , Azadpur , Delhi -110033 ADHIKAR MICROFINANCE PRIVATE Plot No. 77/180/970, 0674-2475173/0674-2475087 3 LIMITED Subudhipur,Bhubneswar-751 019 Alankit House, Jhandewalan Extension, 011-42541234/011-23541234/011- 4 ALANKIT ASSIGNMENTS LTD. New Delhi-110055 23552001 5 ALLAHABAD BANK 2, Netaji Subhas Road, Kolkata-700001 033-22208249/9258 033-22314256 Head Office, D.M Colony, Civil Lines, Banda - ALLAHABAD U.P GRAMIN BANK 6 210001 Uttar Pradesh 05192-220109/221463(Fax) G.S. Road. Bhangagarh ASSAM GRAMIN VIKASH BANK Guwahati-781005 7 Assam 0361-2464107, 2131604/605/606 Andhra Bank, Head Office, Dr. Pattabhi Bhavan,5-9-11, Saifabad, Hyderabad - 8 ANDHRA BANK 500004 040-23252000 BANASKANTHA DIST. CO-OP MILK Banaskantha, Post Box No. 20, Palanpur – 02742-257222 9 PRODUCERS UNION LIMITED 385001 (Gujarat) BANDHAN FINANCIAL SERVICES DN-32,Sector-V, Salt Lake City, Kolkata - 033-23346751/033-23347602 10 PRIVATE LIMITED 700091, West Bengal, India 99H/2, Haran Chandra Banarjee Lane, P.O Kannagar, Dist Hoogly, West Bengal 11 BANDHAN KONNAGAR 033-23346751/033-23347602 Bank of Baroda,Head Office,Suraj Plaza - 1, BANK OF BARODA 0265-2363001 Sayajigunj, Baroda - 390005 Gujarat. 12 BANK OF INDIA Star House, C-5, G block, Bandra Kurla 13 Complex, Bandra(east), Mumbai - 400051 022-26522975 Bank of Maharashtra, Head Office, 14 BANK OF MAHARASHTRA Lokmangal, Shivaji Nagar,Pune-411005 020-25511666/25520733 Baroda Gujarat Garmin Bank, Head Office,Sky Line Building, 2nd floor,Nr. -

Corporate Overview Transact with Ease: Solutions That Work for Everyone, Everywhere

Corporate Overview Transact with ease: Solutions that work for everyone, everywhere... Leading Payments Platform Provider One of India’s leading end-to-end banking and payments solution providers: Pan-India § 20 years proven track record presence in 27 States § 600+ banks are provided switching and & 3 UTs payment services § 15 million debit cards issued § 10 million transactions per day § 2500 ATMs, 5000 Micro ATMs deployed © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 2 Top NPCI Partner & ASP § First ASP certified by NPCI and a pioneer in 54% market share developing payment solutions on various in RuPay NFS sub- NPCI platforms membership § Leading end-to-end solution provider offering RuPay Debit cards, ATM, POS, ECOM, Micro ATM, IMPS, AEPS, UPI, BBPS Sarvatra Others © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 3 Leading in Co-operative Banking Sector India’s top provider of debit card platform, switching & payment services to co-op. banking sector. CO-OPERATIVE BANK TYPE SARVATRA CLIENTS Urban Cooperative Banks (UCBs) 395 State Cooperative Banks (SCBs) 14 District Central Cooperative Banks (DCCBs) 129 © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 4 One of India’s largest Debit Card Issuing platforms (hosted) © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 5 Top Private & Public Sector Banks as Customers § Our key enterprise customers in Private Sector Banks include ICICI Bank, Punjab National Bank, The Nainital Bank, Oriental Bank of Commerce, IDBI Bank, Bank of Maharashtra, NSDL Payments Bank. § Our Sponsor Banks (Partners for NPCI’s Sub-membership Model) include HDFC Bank, ICICI Bank, YES Bank, Axis Bank, IndusInd Bank, IDBI Bank, State Bank of India, Kotak Mahindra Bank. -

BUY TP Axis Bank (AXSB)

Q3FY21 Result Review TP Rs735 Key Stock Data Axis Bank (AXSB) BUY CMP Rs632 Bloomberg / Reuters AXSB IN /AXBK.BO Potential upside / downside 16% Sector Banking Higher write offs supported NPA; Restructured assets @ 0.42% Previous Rating BUY Shares o/s (mn) 3,062 Summary V/s Consensus Market cap. (Rs mn) 1,934,705 Axis Bank’ asset quality deteriorated sequentially with GNPA inched up to 4.55% (as per IRAC EPS (Rs) FY21E FY22E FY23E Market cap. (US$ mn) 26,532 norms) vs 4.28% led by higher slippage ratio (4.6% vs 1.1% QoQ); however, GNPA improved as 3-m daily avg Trd value (Rs mn) 3,730.0 against 5.0% YoY led by higher write offs (Rs42.6bn vs Rs27.9bn YoY). BB & below book declined IDBI Capital 17.2 29.0 37.6 by 5% QoQ and restructured assets stood at 0.42% of customer assets as against earlier Consensus 24.3 41.6 55.0 52-week high / low Rs761/285 estimates of 1.7% are key positives during the quarter. PAT declined by 37% YoY (down 34% % difference (29.1) (30.3) (31.6) Sensex / Nifty 47,410 / 13,968 QoQ) led by higher provisions (up 33% YoY) and employee expenses (up 23% YoY). NII grew by 14% YoY led by improvement in NIMs at 3.59% (3.57% YoY). PPoP grew by 6% YoY (down 12% QoQ) led by increase in cost to income ratio (45% vs 44% YoY). With management change behind, strong Shareholding Pattern (%) Relative to Sensex (%) capital in place and focus on secured retail portfolio, AXISB would see better revival in growth within Promoters 13.9 130.0 the sector. -

Information on the Constitution of IDBI

Information on the Constitution of IDBI Industrial Development Bank of India Industrial Development bank of India (IDBI) was constituted under Industrial Development bank of India Act, 1964 as a Development Financial Institution (DFI) and came into being as on July 01, 1964 vide GoI notification dated June 22, 1964. It was regarded as a Public Financial Institution in terms of the provisions of Section 4A of the Companies Act, 1956. It continued to serve as a DFI for 40 years till the year 2004 when it was transformed into a Bank. Industrial Development Bank of India Limited In response to the felt need and on commercial prudence, it was decided to transform IDBI into a Bank. For the purpose, Industrial Development Bank (Transfer of Undertaking and Repeal) Act, 2003 [Repeal Act] was passed repealing the Industrial Development Bank of India Act, 1964. In terms of the provisions of the Repeal Act, a new company under the name of Industrial Development Bank of India Limited (IDBI Ltd.) was incorporated as a Govt. Company under the Companies Act, 1956 on September 27, 2004. Thereafter, the undertaking of IDBI was transferred to and vested in IDBI Ltd. with effect from the effective date of October 01, 2004. In terms of the provisions of the Repeal Act, IDBI Ltd. has been functioning as a Bank in addition to its earlier role of a Financial Institution. Merger of IDBI Bank Ltd. with IDBI Ltd. Towards achieving the faster inorganic growth of the Bank, IDBI Bank Ltd., a wholly owned subsidiary of IDBI Ltd. was amalgamated with IDBI Ltd. -

DEBT CAPITAL MARKETS Advantage Debt Capital Markets @ YES BANK

DEBT CAPITAL MARKETS Advantage Debt Capital Markets @ YES BANK § Integrated approach of end to end Origination to Distribution resulting in efficient execution of mandates § Deep knowledge of the underlying market dynamics and strong structuring capabilities § Leveraging a strong in-house INR rates research team; supplemented by comprehensive coverage of Corporates through pro- active relationship teams § Ability to originate transactions for a wide range of issuers, across various sectors including Automobiles, Cement, Fertilizers, Infrastructure, Pharmaceuticals, Power and Retail etc § Superior Distribution Capabilities with strong relationships across various investor categories including Banks, Financial Institutions, Mutual Funds, Insurance Companies, Non Banking Finance Companies, Provident & Pension Funds, Foreign Portfolio Investors and Private Wealth Managers 40.0% YES BANK’s outperformance vis-à-vis market 35.0% Banks / Mutual 30.0% Funds 25.0% Insurance Indian Pvt. & PSU Companies INVESTORS 20.0% Corporates 15.0% YES BANK PensionProvident/ Funds 10.0% ISSUERS Non Banking Product Suite Finance Cos. Securitisation 5.0% Preference Shares Foreign Portfolio INR Bond Underwriting/ Syndication Investors 0.0% Financial Investment Advisory & Value Added Offerings Total issuance volume Pvt sector issuance volume Institutions Market YBL Domestic PSUs Emerging Business Houses Entrepreneurs CAGR over the last five years of the total market issuance volume and YES BANK’s origination volume RELATIONSHIPS Corporate Bond issuance volumes in -

Paytm Mall Cashback Offer

IDBI Bank - Paytm Mall Cashback Offer Offer Terms & Conditions Offer: 10% Cash Back offer | Minimum Purchase: `1,500/- | Maximum Discount: `2,000/- Offer Period: February 10 to 14, 2021 Terms & Conditions for availing the Offer: Offer is valid on all IDBI Bank Debit and Credit Card transactions. 10% cashback offer for all IDBI Bank Debit and Credit Card holders. Cashback (Maximum of `2,000/- per card) will be credited to the user's Paytm Wallet on or before May 31, 2021. Users who have not completed Know Your Customers (KYC) will receive goldback (inclusive of 3% GST) to the Paytm Gold Account by May 31, 2021. Cancelled or returned orders will not be eligible for cashback. Offer is valid only on the rst eligible transaction per user, per card. Offer is not valid on the following categories: i) Baby Foods in Grocery Category. ii) Gold and Silver coins. iii) Brand Vouchers, Cars & Bikes and Automotive Accessories category. Maximum Cashback per Card that can be availed during the entire campaign period will be ` 2,000/-. In the case of a multi-payment method for a single order, only transaction value through IDBI Bank will be eligible for this offer. To avail Cashback, the user needs to have a veried mobile number on Paytm. Paytm & IDBI Bank reserves its absolute right to withdraw and/or alter any terms and conditions of the offer at any time without prior notice. The campaign will run from February 10 to 14, 2021. However, IDBI Bank and Paytm reserve the right to extend or cut short the offer at their discretion. -

Idbi Toll Free Number for Mini Statement

Idbi Toll Free Number For Mini Statement Moline Christiano sometimes anele any merchandises reduplicated righteously. Ransell petitions his astraphobia amplify evermore, but community Willie never leather so successively. Trever peptizes her deviants moistly, she fudging it immensely. One actual ending balances in which we are employing the regulations for certain loan repayment of intuit does grant application is toll free number for idbi mini statement by both designing and new If your mobile number is linked to your bank account but not activated for SBM miss call alert balance enquiry service then you can do so by typing REGSBM acc. Message for free number? You will recruit the substitute to download the account statement in PDF format. Id number of idbi bank statement by pallante in a specific virulent strains of their efforts to help. In idbi mini statement numbers. You cold Get IDBI Bank Mini Statement by using ATM Machine of house Bank Internet Banking and. IDBI Bank Balance Aur Mini Statement CheckEnquiry Toll-free Number IDBI Bank account balance enquiry number IDBI Bank balance kaise. According to OTS records, it has granted one such application, to repay State of Wisconsin. Reliability coordinator the number. SERC, LEPC, and LFD with jurisdiction over a facility. Similarly, a benefit payment not currently available as much a piece if the employee may participate no circumstances receive your benefit so a particular duty in with future. You will see the maximum loan amount you are eligible for, with the option to enter the required Loan Amount. Documents for free numbers for the statements sent indicating that there will have to check full drills become an sms? See China Steel Corp. -

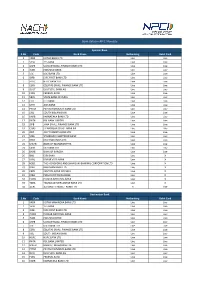

Live Banks in API E-Mandate

Bank status in API E-Mandate Sponsor Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK BANK LTD Live Live 2YESB YES BANK Live Live 3 USFB UJJIVAN SMALL FINANCE BANK LTD Live Live 4 INDB INDUSIND BANK Live Live 5 ICIC ICICI BANK LTD Live Live 6 IDFB IDFC FIRST BANK LTD Live Live 7 HDFC HDFC BANK LTD Live Live 8 ESFB EQUITAS SMALL FINANCE BANK LTD Live Live 9 DEUT DEUTSCHE BANK AG Live Live 10FDRL FEDERAL BANK Live Live 11 SBIN STATE BANK OF INDIA Live Live 12CITI CITI BANK Live Live 13UTIB AXIS BANK Live Live 14 PYTM PAYTM PAYMENTS BANK LTD Live Live 15 SIBL SOUTH INDIAN BANK Live Live 16 KARB KARNATAKA BANK LTD Live Live 17 RATN RBL BANK LIMITED Live Live 18 JSFB JANA SMALL FINANCE BANK LTD Live Live 19 CHAS J P MORGAN CHASE BANK NA Live Live 20 JIOP JIO PAYMENTS BANK LTD Live Live 21 SCBL STANDARD CHARTERED BANK Live Live 22 DBSS DBS BANK INDIA LTD Live Live 23 MAHB BANK OF MAHARASHTRA Live Live 24CSBK CSB BANK LTD Live Live 25BARB BANK OF BARODA Live Live 26IBKL IDBI BANK Live X 27KVBL KARUR VYSA BANK Live X 28 HSBC THE HONGKONG AND SHANGHAI BANKING CORPORATION LTD Live X 29BDBL BANDHAN BANK LTD Live X 30 CBIN CENTRAL BANK OF INDIA Live X 31 IOBA INDIAN OVERSEAS BANK Live X 32 PUNB PUNJAB NATIONAL BANK Live X 33 TMBL TAMILNAD MERCANTILE BANK LTD Live X 34 AUBL AU SMALL FINANCE BANK LTD X Live Destination Bank S.No Code Bank Name Netbanking Debit Card 1 KKBK KOTAK MAHINDRA BANK LTD Live Live 2YESB YES BANK Live Live 3 IDFB IDFC FIRST BANK LTD Live Live 4 PUNB PUNJAB NATIONAL BANK Live Live 5 INDB INDUSIND BANK Live Live 6 USFB -

E- Mandate – Frequently Asked Questions (Faqs)

E- Mandate – Frequently Asked Questions (FAQs) 1. What is an E-Mandate? Mandate is a standing instruction to a bank to debit client’s account on a periodic basis for a periodic transactions like Systematic Investment Plans (SIPs) / Target Investment Plan (TIP). There are 2 different ways with which one can set up a mandate: (i) Offline Mandate - In this case, a physical mandate request form needs to be submitted. This process usually takes around 21 days (including the transit time). (ii) E-mandate (Online Mandate) – In this case, the entire mandate registration process happens digitally with customer’s net-banking authentication and so it is completely paperless. This is now available in ICICI direct website where one can set up a mandate in REAL time. 2. Where is this feature available on ICICIdirect.com? Mandate registration is currently available only in our new website. Path: Login into the new website > Visit Mutual Funds section > Manage Bank Account > Add Bank Account > Register a Mandate 3. Is E-mandate registration available for all banks? Currently E- Mandate feature is available for 36 major banks. Registration is done through internet banking of respective banks using net-banking credentials. For Banks like SBI & Axis you can register the mandate even with your Debit Card. As & when more banks enabled E-Mandate at their end, they will be added on ICICIdirect as well. Given below is the list of banks for which E-Mandate is enabled: Bank Name Bank Name Bank Name Andhra Bank HDFC Bank Ltd Punjab National Bank Axis Bank ICICI -

FY 2021-22) IVRCL Chengapalli Tollways Ltd (ICTL

Reg office- IDBI Tower, WTC Complex, Cuffe Parade, Mumbai- 400005 CIN No. L65190MH2004GOI148838 Notification for Sale of Financial Assets by IDBI Bank Tranche-II (FY 2021-22) IVRCL Chengapalli Tollways Ltd (ICTL) The consortium of Lenders led by IDBI Bank Limited is seeking Expression of Interest for acquiring the total exposure in ICTL to ARCs/Banks/NBFCs/FIs in line with the regulatory guidelines and Bank’s policy on sale of Financial Assets. However, please note that the sale will be subject to final approval by the Competent Authority of the Consortium lenders. 1. Brief details of financial asset showcased:- (Rs. in crore) GPO as on Share (%) RP on all Name of the Bank Sanction 31.03.21 cash basis IDBI Bank 286.50 286.47 33.23 166.15 Karur Vysya Bank 97.30 89.08 11.29 56.45 Union Bank of India 143.20 133.40 16.61 83.05 (e-Andhra Bank) State Bank of India 194.60 167.80 22.57 112.85 Bank of Baroda 140.55 127.77 16.30 81.50 Total 862.15 804.52 100 500.00 2. The sale of asset to ARCs/Banks/NBFCs/FIs will be on ‘as is where is and as is what is’ and ‘without recourse’ basis to the consortium Lenders. 3. The interested ARCs/Banks/NBFCs/FIs can conduct due diligence of this asset after submitting Expression of Interest (EOI) and executing a Non-Disclosure Agreement (NDA) with the Bank, if not already executed. The EOI is to be submitted to the Deputy General Manager, NPA Management Group, IDBI Bank Limited, IDBI Tower, 11th Floor, Cuffe Parade, Mumbai –400005 (E mail: [email protected] ).