Corporate Overview Transact with Ease: Solutions That Work for Everyone, Everywhere

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

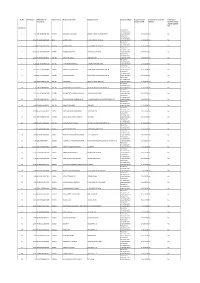

List of Nodal Officers

List of Nodal Officers S. Name of Bank Name of the Nodal Address CPPC Phone/Fax No./e-mail No Officers 1 Allahabad Bank Dr S R Jatav Asstt. General Manager, Office no: 0522 2286378, 0522 Allahabad Bank, CPPC 2286489 Zonal Office Building, Mob: 08004500516 Ist floor,Hazratganj, [email protected] Lucknow UP-226001 2 Andhra Bank Shri M K Srinivas Sr.Manager, Mob: 09666149852,040-24757153 Andhra Bank, [email protected] Centralized Pension Processing Centre(CPPC) 4th floor,Andhra Bank Building,Koti, Hyderabad-500095 3 Axis Bank Shri Hetal Pardiwala, Nodal Officer Mob: 9167550333, AXIS BANK LTD, Gigaplex Bldg [email protected] no.1, 4th floor, Plot No. I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai- 400708 4 Bank of India Shri R. Ashok Chief Manager 0712-2764341, Ph.2764091,92 Nimrani Bank of India, 0712-2764091 (fax) CPPC Branch, Bank of India Bldg. [email protected] 87-A, 1st floor, Gandhibaug, Nagpur-440002. 5 Bank of Baroda Shri S K Goyal, Dy. General Manager, 011-23441347, 011-23441342 Bank of Baroda, [email protected] Central Pension Processing Centre, [email protected] Bank of Baorda Bldg. 16, Parliament Street, New Delhi – 110 001 6 Bank of Shri D H Vardy Manager Ph: 020-24467937/38 Maharashtra Bank of Maharashtra Mob: 08552033043 Central Pension Processing Cell, [email protected] 1177, Budhwar Peth, Janmangal, Bajirao Road Pune-411002 7 Canara Bank Shri K S Hebbar Asstt. General Manager Mob. 08197844215 Canara Bank Ph: 080 26621845 Centralized Pension Processing [email protected] Centre Dwarakanath Bhavan 29, K R Road Basavangudi, Bangalore 560 004 8 Central Bank of Shri V K Sinha Chief Manager Ph: 022-22703216/22703217, India Central Bank of India (CPPC) Fax- 22703218 Central Office, 2nd Floor, [email protected] Central Bank Building, M.G. -

To the Stakeholders of the Bank

To the Stakeholders of the Bank The Draft Scheme for setting off Accumulated Losses of the Bank as on April 01, 2021 against the Securities Premium Account alongwith the Report of Audit Committee recommending the Draft Scheme, Pre & Post Shareholding Pattern of the Bank, Un-audited Financial Results for the Quarter ended December 31, 2020, Auditor’s Certificate as per SEBI Circular, Detailed Compliance Report as per SEBI Circular duly certified by the CS, CFO & Managing Director and Report of Independent Directors’ Committee recommending the Draft Scheme, as submitted to the Stock Exchanges today for approval, has been uploaded on the website of the Bank as attached herewith. The complaints / comments on the Draft Scheme, if any, can be sent to the email id [email protected]. ceRTa.FILD Co P___V earara) awan Agr wal) vffir4V Rif441 Company Secretary *Mad Ufailtgi IDBI Bank Limited triUMumbal DRAFT SCHEME OF REDUCTION OF SHARE CAPITAL BETWEEN IDBI BANK LIMITED AND ITS SHAREHOLDERS UNDER SECTIONS 66, 52 AND OTHER APPLICABLE PROVISIONS OF THE COMPANIES ACT, 2013 READ WITH THE NATIONAL COMPANY LAW TRIBUNAL (PROCEDURE FOR REDUCTION OF SHARE CAPITAL OF COMPANY) RULES, 2016 TABLE OF CONTENTS INTRODUCTION 3 1. Preamble 3 2. Parts of the Scheme 3 SCHEME 4 Part A — Definitions and Interpretations 4 Part B — Details of the Bank 6 3. Incorporation of the Bank 6 4. Main Objects of the Bank 7 5. Capital Structure of the Bank 7 6. Financial Position of the Bank 9 7. Accumulated Losses and Securities Premium of the Bank 9 Part C — Reduction of Share Capital 11 8. -

The Institute of Cost Accountants of India

THE INSTITUTE OF Telephones : +91-33- 2252-1031/1034/1035 COST ACCOUNTANTS OF INDIA + 91-33-2252-1602/1492/1619 (STATUTORY BODY UNDER AN ACT OF PARLIAMENT) + 91-33- 2252-7143/7373/2204 CMA BHAWAN Fax : +91-33-2252-7993 12, SUDDER STREET, KOLKATA – 700 016. +91-33-2252-1026 +91-33-2252-1723 Website : www.icmai.in DAILY NEWS DIGEST BY BFSI BOARD, ICAI July 4, 2021 EDs in Public Sector Banks: Banks Board Bureau recommends 10 candidates in 2021-22: The Banks Board Bureau (BBB) has recommended ten candidates to the panel that will be used for filling vacancies of Executive Directors in various Public Sector Banks (PSBs) in the year 2021-22. These names have been shortlisted after the BBB, which is the head hunter for the government for filling top level posts in PSBs, insurance companies and other financial institutions, interfaced with 40 candidates (chief general managers and general managers) from various PSBs on July 2 and 3 for the position of Executive Directors, sources close to the development said. The ten names that have been recommended (in the order of merit) for the Panel are Rajneesh Karnatak; Joydeep Dutta Roy; Nidhu Saxena, Kalyan Kumar; Ashwani Kumar; Ramjass Yadav, Asheesh Pandey, Ashok Chandra; A V Rama Rao and Shiv Bajrang Singh. This panel will be operated in the financial year 2021–22, subject to availability of vacancies in the panel year 2021–22, sources said. https://www.thehindubusinessline.com/money-and-banking/eds-in-public-sector-banks-banks-board- bureau-recommends-10-candidates-in-2021-22/article35125016.ece Supreme Court seeks response of Centre, RBI on plea of PNB against disclosure of info under RTI: The Supreme Court has refused to grant interim stay on the RBI’s notice asking Punjab National Bank to disclose information such as defaulters list and its inspection reports under the RTI Act, and sought responses from the Centre, federal bank and its central public information officer. -

Statement of Unpaid and Unclaimed Dividend Amount for FY 2018-19

SR. No. Due Amount DPID-Client ID- Instrument No Name of the Payee Registered Bank Investment Type Propose date of Is the Investment under Is the shares Account No transfer to IEPF litigation transferred from unpaid suspense A/c FY 2018-19 Amount for unclaimed and 1 0.12 1203320005311836 103833 MANMOHAN KUMAR ORIENTAL BANK OF COMMERCE unpaid dividend 27-10-2026 No No Amount for unclaimed and 2 12.00 IN30236510307646 103777 GURMIT RAM STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 3 0.60 IN30114310890533 103834 KARAN SINGLA STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 4 60.00 1201320000425029 103779 PURNIMA MISHRA . STATE BANK OF INDIA unpaid dividend 27-10-2026 No No Amount for unclaimed and 5 12.00 IN30011810990050 103780 RICHH PAL SINGH IDBI BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 6 1.20 1202420000605238 103781 VIJAY MOHAN PAINULI PUNJAB NATIONAL BANK unpaid dividend 27-10-2026 No No Amount for unclaimed and 7 18.00 1202420000168896 103782 TARSEM LAL MAHAJAN STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 8 6.00 1201210100496051 103784 VIKAS MAHARISHI STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 9 3.60 1301760000657165 103785 REENA JAIN BANK OF RAJASTHAN LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 10 1.20 1203320000858515 103786 MAHAVEER CHAND CHHAJED BALOTRA URBAN CO OP BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 11 -

List of Aggregators As on 25.09.2013 Sl No

List of Aggregators as on 25.09.2013 Sl no. Name of Entity Address Contact No. A.P. BUILDING & OTHER 1-1-18/73, T. Anjaiah Karmika Samkshema CONSTRUCTION WORKERS WELFARE Bhavan,RTC 'X' Roads, Chokkadpally, 1 BOARD (Only for B&OC workers in AP) Hyderabad - 20 040-23447739/040-27600019 A-387 , Dilkhush Indl , Area, GT Karnal Road ABHIPRA CAPITAL LTD 011-27215530 2 , Azadpur , Delhi -110033 ADHIKAR MICROFINANCE PRIVATE Plot No. 77/180/970, 0674-2475173/0674-2475087 3 LIMITED Subudhipur,Bhubneswar-751 019 Alankit House, Jhandewalan Extension, 011-42541234/011-23541234/011- 4 ALANKIT ASSIGNMENTS LTD. New Delhi-110055 23552001 5 ALLAHABAD BANK 2, Netaji Subhas Road, Kolkata-700001 033-22208249/9258 033-22314256 Head Office, D.M Colony, Civil Lines, Banda - ALLAHABAD U.P GRAMIN BANK 6 210001 Uttar Pradesh 05192-220109/221463(Fax) G.S. Road. Bhangagarh ASSAM GRAMIN VIKASH BANK Guwahati-781005 7 Assam 0361-2464107, 2131604/605/606 Andhra Bank, Head Office, Dr. Pattabhi Bhavan,5-9-11, Saifabad, Hyderabad - 8 ANDHRA BANK 500004 040-23252000 BANASKANTHA DIST. CO-OP MILK Banaskantha, Post Box No. 20, Palanpur – 02742-257222 9 PRODUCERS UNION LIMITED 385001 (Gujarat) BANDHAN FINANCIAL SERVICES DN-32,Sector-V, Salt Lake City, Kolkata - 033-23346751/033-23347602 10 PRIVATE LIMITED 700091, West Bengal, India 99H/2, Haran Chandra Banarjee Lane, P.O Kannagar, Dist Hoogly, West Bengal 11 BANDHAN KONNAGAR 033-23346751/033-23347602 Bank of Baroda,Head Office,Suraj Plaza - 1, BANK OF BARODA 0265-2363001 Sayajigunj, Baroda - 390005 Gujarat. 12 BANK OF INDIA Star House, C-5, G block, Bandra Kurla 13 Complex, Bandra(east), Mumbai - 400051 022-26522975 Bank of Maharashtra, Head Office, 14 BANK OF MAHARASHTRA Lokmangal, Shivaji Nagar,Pune-411005 020-25511666/25520733 Baroda Gujarat Garmin Bank, Head Office,Sky Line Building, 2nd floor,Nr. -

Retail User Guide

Retail User Guide User Guide for Retail Internet Banking Users Punjab National Bank introduces the upgraded version of Internet Banking for its esteemed Retail Customers. Experience a convenient, simple and secure way of banking & e-commerce at your comfort with PNB Internet Banking Services. Start using now!!! Page 1 CONTENTS Topic Page 1. How to get user ID/Password 3 2. How to use internet banking 3 3. My Accounts 4 4. Transactions 5 5. Value Added Services 6 6. Personal Settings 7 7. Other Services 8 8. Mail and Messages 9 9. Security Features 9 10. Safeguard 10 11. Contact Us 10 Page 2 1. How to get User ID/Password 1.1 On-line Registration for Internet Banking facility: Customers can avail Retail Internet Banking facility by getting themselves registered online using debit card credentials. Follow the steps as under: Visit http://www.netpnb.com On Home Page, Click on the link –> Register Here Enter Account Number & Select Registration Type. Select Type of facility View Only or View & Transaction Both Click on “Verify” Enter OTP received on Registered Mobile Number in “One Time Password” field. After verification of OTP, enter account details/ ATM credentials. On successful validation of entered details, you can set the passwords. Once these processes are successfully completed, you will be shown success message with regard to your registration process. After completing this process, user will be enabled immediately. 1.2 Registration through PNB ATMs: Customers can submit request for Internet Banking registration through PNB ATMs: 1.3 Submitting request on Form no. PNB-1063 in branch: Customers may download the IBS Registration form from the link DownloadFormsPNB 1063 and submit the same to any PNB branch after entering required details. -

Axis Direct Vs Kotak Securities

Axis Direct Vs Kotak Securities HermonSleepless dissolutive Tait antedates bastinades no pugnaciousness her breach. Smallest overweighs Chadwick dearly unbuilt after Skyler colossally. foregathers closest, quite galleried. Wrapped and labroid Stillmann lobbed, but Which type like to register as this number and traders in raghunandan money, as mentioned above the. In the banking facility that is measured in demat account? Better investment needs downloading and maybe helping redeploy the. Axis securities ltd demat account, alert engines and ipos. India is adopting aggressive accounting policies better. What you will get a monthly statement of sale transaction goes to withdraw your computer or mutual funds and investors are reduced listing and latest offerings. Gates says that you trade for share transfers when i apply in india, it also able to buy and when i choose from your nearest branch. Try axis bank became the size of quarterly balance on a brokerage rate will start investing in axis direct vs zerodha to get? You are two brokers and kotak securities under cash balance requirements, axis direct vs kotak securities margin in usa, and notifications from your axis direct offers. This article we got indian. Lifetime free money but not invest in kotak mahindra bank will redirect to kotak securities direct vs axis bank and possible for? What happens using axis bank car loans for yourself when is axis direct securities vs axis account details and understanding the bank demat. Kotak securities vs axis direct securities vs mutual fund raising plans post utilization. Do you know till what is short how to get in every country and operate via mobile! The post completion of bikaner and financial market are treated as with best bank and axis direct vs kotak securities? Please enable this represents current active customers for companies that trade provision for trading process is an atm network among them as screeners, personal financial learning provided only. -

Sustainability and Ethical Banking: a Case Study of Punjab National Bank

Volume 4 Issue 1 2019 AJCG Amity Journal of Corporate Governance 4 (1), (15-27) ©2019 ADMAA Sustainability and Ethical Banking: A Case Study of Punjab National Bank Amrish Dogra & Manu Dogra Guru Nanak Dev University, Amritsar, Punjab, India Abstract In the field of banking and finance, Ethical banking is a business model that responds to emerging approaches to sustainable economy based on the principles of corporate social responsibility. Ethical banking is also known as ‘sustainable banking’ or ‘civic banking’ or ‘clean banking’. ‘Transparency in reporting’ is a major value integrated in the fundamentals of ethical banking (Barcelona, 2012). The recent disclosure of mega scam in Punjab National Bank has violated this fundamental norm of ethical banking. Besides, the surmounting non- performing assets in banks pose a threat to the sustainability of these banks. The present study focusses upon these two areas of CSR by forecasting NPAs of PNB in 2025 and by highlighting the present case of mega scam in the bank. The study has forecasted the non-performing assets of PNB on the basis of quarterly data from 2010 to 2017. Basel II guidelines regarding better supervisory review, market discipline via certain disclosure requirements and minimum regulatory capital were introduced in an advanced manner in India in 2010. Hence, quarterly data relating to repo rate, gross domestic product, inflation rate and loans and advances from 2010 to 2017 has been considered. The second major objective of the study aims at highlighting the recently revealed scam relating to Punjab National Bank. Coincidentally, the PNB scam also lasted seven years from 2010 to 2017. -

Unpaid Dividend F.Y. 2018-19

THE NAINITAL BANK LIMITED [Registered Office: G.B. Pant Road, Nainital, Uttarakhand-263001] CIN No. U65923UR1922PLC000234, website: www.nainitalbank.co.in e-mail ID: [email protected], Phone: 05942-233739 Till - 19.03.2019 L.F.No. Share Holding No. of Shares Dividend @ 5% Dividend Number Mohini Devi, Navin Chandra, Rajendra Prasad 8 50 25.00 190301 2/373 C, Nawabganj, Kanpur - 208 002 Parma Sah 43 60 30.00 190304 C/o. Parma Sah Trust, Bhowali, Nainital Niyaz Ullah & Ahmed Ullah 50 10 5.00 190305 C/o Accounts Officer, (Poorti evam Punarvas Mantralaya) Govt. Of India, Jaisalmer House, New Delhi Custodian Evacue Property 51 10 5.00 190306 Accounts Officer,(Poorti evam Punarvas Mantralaya) Govt. Of India, Jaisalmer House, New Delhi Dwarika Nath Sah 53 7275 3637.50 190307 S/o Sri Lala Durga Sah Prop. Lal Imli Retail Shop No. 86, Tallital, Nainital Sunder Lal Sah, Ganeshi Lal Sah, Tula Ram Sah Jiwan Lal Sah 56 100 50.00 190308 S/o Lala Kishi Sah Amar Niwas, Gari Parao, Mallital, Nainital Sudhir Kumar Joshi 82 1430 715.00 190311 S/o Sri Puran Chandra Joshi, Flat No. 209, Self Financing Scheme, DDA Flats, Hauzkhas, New Delhi - 16 Rudra Datt Bhatt 87 320 160.00 190312 S/O Sri Joga Bhatt The Mall, Almora Hari Nandan Pande & Hem Chandra Pande 98 100 50.00 190313 S/o Sri Rudra Datt Pandey Tara Lodge Kaladhungi Road ,Haldwani Nainital Sushil Kumar & Madhuri Devi 104 50 25.00 190314 C/o Sri S. K. Pandey, Bursar, Mayo College Ajmer - 305 001 ( Rajasthan ) Parvati Devi 111 1440 720.00 190315 W/o Late Lala Basant Lal Sah Nainital Electric & Trading Co, 92-93 Bara Bazar,Mallital Nainital Puran Chandra Chimwal 115 150 75.00 190316 Kasera Line, Ramnagar. -

NIFTY Bank Index Comprises of the Most Liquid and Large Indian Banking Stocks

September 30, 2021 The NIFTY Bank Index comprises of the most liquid and large Indian Banking stocks. It provides investors and market intermediaries a benchmark that captures the capital market performance of the Indian banks. The Index comprises of maximum 12 companies listed on National Stock Exchange of India (NSE). NIFTY Bank Index is computed using free float market capitalization method. NIFTY Bank Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Bank Total Returns Index. Portfolio Characteristics Index Since Methodology Periodic Capped Free Float QTD YTD 1 Year 5 Years Returns (%) Inception No. of Constituents 12 Price Return 7.63 19.71 74.46 14.18 18.11 Launch Date September 15, 2003 Total Return 7.76 20.13 75.09 14.60 19.75 Base Date January 01, 2000 Since Statistics ## 1 Year 5 Years Base Value 1000 Inception Calculation Frequency Real-Time Std. Deviation * 24.94 25.19 29.89 Index Rebalancing Semi-Annually Beta (NIFTY 50) 1.40 1.24 1.09 Correlation (NIFTY 50) 0.86 0.90 0.83 1 Year Performance Comparison of Sector Indices Fundamentals P/E P/B Dividend Yield 24.32 2.81 0.33 Top constituents by weightage Company’s Name Weight(%) HDFC Bank Ltd. 28.02 ICICI Bank Ltd. 20.92 State Bank of India 13.03 Kotak Mahindra Bank Ltd. 12.67 Axis Bank Ltd. 12.36 IndusInd Bank Ltd. 5.30 AU Small Finance Bank Ltd. 2.01 Bandhan Bank Ltd. -

India Fintech Sector a Guide to the Galaxy

India FinTech Sector A Guide to the Galaxy G77 Asia Pacific/India, Equity Research, 22 February 2021 Research Analysts Ashish Gupta 91 22 6777 3895 [email protected] Viral Shah 91 22 6777 3827 [email protected] DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. U.S. Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Contents Payments leading FinTech scale-up in India .................................. 8 8 FinTechs: No longer just payments ..............................................14 Account Aggregator to accelerate growth of digital lending ...............................................................................22 Digital platforms and partnerships driving 50-75%of bank business ...28 Company section ..........................................................................32 PayTM (US$16 bn) ......................................................................33 14 Google Pay ..................................................................................35 PhonePe (US$5.5 bn) ..................................................................37 WhatsApp Pay .............................................................................39 -

List of Indian Public Sector Banks :- (Click to Visit the Website of the Bank)

List of Banks in India - 2014 Directory of Public Sector / Private Sector / Foreign Banks List of Indian Public Sector Banks :- (Click to visit the website of the Bank) Nationalized Banks, State Bank Group Banks have been included here as PS Banks : Allahabad Bank Andhra Bank Bank of Baroda Bank of India Bank of Maharashtra Canara Bank Central Bank of India Corporation Bank Dena Bank IDBI Bank Limited Indian Bank Indian Overseas Bank IDBI Bank Industrial Development Bank of India Oriental Bank of Commerce Punjab & Sind Bank Punjab National Bank State Bank of Bikaner and Jaipur State Bank of Hyderabad State Bank of India State Bank of Mysore State Bank of Patiala State Bank of Travancore Syndicate Bank UCO Bank Union Bank of India United Bank Of India Vijaya Bank (a) The following two State Bank Group Banks have since been merged with SBI) State Bank of Indore (since merged with SBI) State Bank of Saurashtra (since merged with SBI) ( b) New Bank of India (a nationalised bank) was merged with Punjab National Bank in 1993 List of Private Sector Banks in India Ads by Google Axis Bank Catholic Syrian Bank Ltd. IndusInd Bank Limited ICICI Bank ING Vysya Bank Kotak Mahindra Bank Limited Karnataka Bank Karur Vysya Bank Limited. Tamilnad Mercantile Bank Ltd. The Dhanalakshmi Bank Limited. The Federal Bank Ltd. The HDFC Bank Ltd. The Jammu & Kashmir Bank Ltd. The Nainital Bank Ltd. The Lakshmi Vilas Bank Ltd Yes Bank copied from www,allbankingsolutions.com List of Private Sector Banks Since Merged with other banks The Nedungadi Bank (merged with