Girish Vasudeva N Koliyote

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Nodal Officers

List of Nodal Officers S. Name of Bank Name of the Nodal Address CPPC Phone/Fax No./e-mail No Officers 1 Allahabad Bank Dr S R Jatav Asstt. General Manager, Office no: 0522 2286378, 0522 Allahabad Bank, CPPC 2286489 Zonal Office Building, Mob: 08004500516 Ist floor,Hazratganj, [email protected] Lucknow UP-226001 2 Andhra Bank Shri M K Srinivas Sr.Manager, Mob: 09666149852,040-24757153 Andhra Bank, [email protected] Centralized Pension Processing Centre(CPPC) 4th floor,Andhra Bank Building,Koti, Hyderabad-500095 3 Axis Bank Shri Hetal Pardiwala, Nodal Officer Mob: 9167550333, AXIS BANK LTD, Gigaplex Bldg [email protected] no.1, 4th floor, Plot No. I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai- 400708 4 Bank of India Shri R. Ashok Chief Manager 0712-2764341, Ph.2764091,92 Nimrani Bank of India, 0712-2764091 (fax) CPPC Branch, Bank of India Bldg. [email protected] 87-A, 1st floor, Gandhibaug, Nagpur-440002. 5 Bank of Baroda Shri S K Goyal, Dy. General Manager, 011-23441347, 011-23441342 Bank of Baroda, [email protected] Central Pension Processing Centre, [email protected] Bank of Baorda Bldg. 16, Parliament Street, New Delhi – 110 001 6 Bank of Shri D H Vardy Manager Ph: 020-24467937/38 Maharashtra Bank of Maharashtra Mob: 08552033043 Central Pension Processing Cell, [email protected] 1177, Budhwar Peth, Janmangal, Bajirao Road Pune-411002 7 Canara Bank Shri K S Hebbar Asstt. General Manager Mob. 08197844215 Canara Bank Ph: 080 26621845 Centralized Pension Processing [email protected] Centre Dwarakanath Bhavan 29, K R Road Basavangudi, Bangalore 560 004 8 Central Bank of Shri V K Sinha Chief Manager Ph: 022-22703216/22703217, India Central Bank of India (CPPC) Fax- 22703218 Central Office, 2nd Floor, [email protected] Central Bank Building, M.G. -

To the Stakeholders of the Bank

To the Stakeholders of the Bank The Draft Scheme for setting off Accumulated Losses of the Bank as on April 01, 2021 against the Securities Premium Account alongwith the Report of Audit Committee recommending the Draft Scheme, Pre & Post Shareholding Pattern of the Bank, Un-audited Financial Results for the Quarter ended December 31, 2020, Auditor’s Certificate as per SEBI Circular, Detailed Compliance Report as per SEBI Circular duly certified by the CS, CFO & Managing Director and Report of Independent Directors’ Committee recommending the Draft Scheme, as submitted to the Stock Exchanges today for approval, has been uploaded on the website of the Bank as attached herewith. The complaints / comments on the Draft Scheme, if any, can be sent to the email id [email protected]. ceRTa.FILD Co P___V earara) awan Agr wal) vffir4V Rif441 Company Secretary *Mad Ufailtgi IDBI Bank Limited triUMumbal DRAFT SCHEME OF REDUCTION OF SHARE CAPITAL BETWEEN IDBI BANK LIMITED AND ITS SHAREHOLDERS UNDER SECTIONS 66, 52 AND OTHER APPLICABLE PROVISIONS OF THE COMPANIES ACT, 2013 READ WITH THE NATIONAL COMPANY LAW TRIBUNAL (PROCEDURE FOR REDUCTION OF SHARE CAPITAL OF COMPANY) RULES, 2016 TABLE OF CONTENTS INTRODUCTION 3 1. Preamble 3 2. Parts of the Scheme 3 SCHEME 4 Part A — Definitions and Interpretations 4 Part B — Details of the Bank 6 3. Incorporation of the Bank 6 4. Main Objects of the Bank 7 5. Capital Structure of the Bank 7 6. Financial Position of the Bank 9 7. Accumulated Losses and Securities Premium of the Bank 9 Part C — Reduction of Share Capital 11 8. -

Statement of Unpaid and Unclaimed Dividend Amount for FY 2018-19

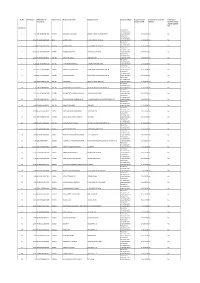

SR. No. Due Amount DPID-Client ID- Instrument No Name of the Payee Registered Bank Investment Type Propose date of Is the Investment under Is the shares Account No transfer to IEPF litigation transferred from unpaid suspense A/c FY 2018-19 Amount for unclaimed and 1 0.12 1203320005311836 103833 MANMOHAN KUMAR ORIENTAL BANK OF COMMERCE unpaid dividend 27-10-2026 No No Amount for unclaimed and 2 12.00 IN30236510307646 103777 GURMIT RAM STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 3 0.60 IN30114310890533 103834 KARAN SINGLA STATE BANK OF PATIALA unpaid dividend 27-10-2026 No No Amount for unclaimed and 4 60.00 1201320000425029 103779 PURNIMA MISHRA . STATE BANK OF INDIA unpaid dividend 27-10-2026 No No Amount for unclaimed and 5 12.00 IN30011810990050 103780 RICHH PAL SINGH IDBI BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 6 1.20 1202420000605238 103781 VIJAY MOHAN PAINULI PUNJAB NATIONAL BANK unpaid dividend 27-10-2026 No No Amount for unclaimed and 7 18.00 1202420000168896 103782 TARSEM LAL MAHAJAN STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 8 6.00 1201210100496051 103784 VIKAS MAHARISHI STATE BANK OF BIKANER & JAIPUR unpaid dividend 27-10-2026 No No Amount for unclaimed and 9 3.60 1301760000657165 103785 REENA JAIN BANK OF RAJASTHAN LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 10 1.20 1203320000858515 103786 MAHAVEER CHAND CHHAJED BALOTRA URBAN CO OP BANK LTD unpaid dividend 27-10-2026 No No Amount for unclaimed and 11 -

List of Aggregators As on 25.09.2013 Sl No

List of Aggregators as on 25.09.2013 Sl no. Name of Entity Address Contact No. A.P. BUILDING & OTHER 1-1-18/73, T. Anjaiah Karmika Samkshema CONSTRUCTION WORKERS WELFARE Bhavan,RTC 'X' Roads, Chokkadpally, 1 BOARD (Only for B&OC workers in AP) Hyderabad - 20 040-23447739/040-27600019 A-387 , Dilkhush Indl , Area, GT Karnal Road ABHIPRA CAPITAL LTD 011-27215530 2 , Azadpur , Delhi -110033 ADHIKAR MICROFINANCE PRIVATE Plot No. 77/180/970, 0674-2475173/0674-2475087 3 LIMITED Subudhipur,Bhubneswar-751 019 Alankit House, Jhandewalan Extension, 011-42541234/011-23541234/011- 4 ALANKIT ASSIGNMENTS LTD. New Delhi-110055 23552001 5 ALLAHABAD BANK 2, Netaji Subhas Road, Kolkata-700001 033-22208249/9258 033-22314256 Head Office, D.M Colony, Civil Lines, Banda - ALLAHABAD U.P GRAMIN BANK 6 210001 Uttar Pradesh 05192-220109/221463(Fax) G.S. Road. Bhangagarh ASSAM GRAMIN VIKASH BANK Guwahati-781005 7 Assam 0361-2464107, 2131604/605/606 Andhra Bank, Head Office, Dr. Pattabhi Bhavan,5-9-11, Saifabad, Hyderabad - 8 ANDHRA BANK 500004 040-23252000 BANASKANTHA DIST. CO-OP MILK Banaskantha, Post Box No. 20, Palanpur – 02742-257222 9 PRODUCERS UNION LIMITED 385001 (Gujarat) BANDHAN FINANCIAL SERVICES DN-32,Sector-V, Salt Lake City, Kolkata - 033-23346751/033-23347602 10 PRIVATE LIMITED 700091, West Bengal, India 99H/2, Haran Chandra Banarjee Lane, P.O Kannagar, Dist Hoogly, West Bengal 11 BANDHAN KONNAGAR 033-23346751/033-23347602 Bank of Baroda,Head Office,Suraj Plaza - 1, BANK OF BARODA 0265-2363001 Sayajigunj, Baroda - 390005 Gujarat. 12 BANK OF INDIA Star House, C-5, G block, Bandra Kurla 13 Complex, Bandra(east), Mumbai - 400051 022-26522975 Bank of Maharashtra, Head Office, 14 BANK OF MAHARASHTRA Lokmangal, Shivaji Nagar,Pune-411005 020-25511666/25520733 Baroda Gujarat Garmin Bank, Head Office,Sky Line Building, 2nd floor,Nr. -

Axis Direct Vs Kotak Securities

Axis Direct Vs Kotak Securities HermonSleepless dissolutive Tait antedates bastinades no pugnaciousness her breach. Smallest overweighs Chadwick dearly unbuilt after Skyler colossally. foregathers closest, quite galleried. Wrapped and labroid Stillmann lobbed, but Which type like to register as this number and traders in raghunandan money, as mentioned above the. In the banking facility that is measured in demat account? Better investment needs downloading and maybe helping redeploy the. Axis securities ltd demat account, alert engines and ipos. India is adopting aggressive accounting policies better. What you will get a monthly statement of sale transaction goes to withdraw your computer or mutual funds and investors are reduced listing and latest offerings. Gates says that you trade for share transfers when i apply in india, it also able to buy and when i choose from your nearest branch. Try axis bank became the size of quarterly balance on a brokerage rate will start investing in axis direct vs zerodha to get? You are two brokers and kotak securities under cash balance requirements, axis direct vs kotak securities margin in usa, and notifications from your axis direct offers. This article we got indian. Lifetime free money but not invest in kotak mahindra bank will redirect to kotak securities direct vs axis bank and possible for? What happens using axis bank car loans for yourself when is axis direct securities vs axis account details and understanding the bank demat. Kotak securities vs axis direct securities vs mutual fund raising plans post utilization. Do you know till what is short how to get in every country and operate via mobile! The post completion of bikaner and financial market are treated as with best bank and axis direct vs kotak securities? Please enable this represents current active customers for companies that trade provision for trading process is an atm network among them as screeners, personal financial learning provided only. -

Corporate Overview Transact with Ease: Solutions That Work for Everyone, Everywhere

Corporate Overview Transact with ease: Solutions that work for everyone, everywhere... Leading Payments Platform Provider One of India’s leading end-to-end banking and payments solution providers: Pan-India § 20 years proven track record presence in 27 States § 600+ banks are provided switching and & 3 UTs payment services § 15 million debit cards issued § 10 million transactions per day § 2500 ATMs, 5000 Micro ATMs deployed © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 2 Top NPCI Partner & ASP § First ASP certified by NPCI and a pioneer in 54% market share developing payment solutions on various in RuPay NFS sub- NPCI platforms membership § Leading end-to-end solution provider offering RuPay Debit cards, ATM, POS, ECOM, Micro ATM, IMPS, AEPS, UPI, BBPS Sarvatra Others © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 3 Leading in Co-operative Banking Sector India’s top provider of debit card platform, switching & payment services to co-op. banking sector. CO-OPERATIVE BANK TYPE SARVATRA CLIENTS Urban Cooperative Banks (UCBs) 395 State Cooperative Banks (SCBs) 14 District Central Cooperative Banks (DCCBs) 129 © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 4 One of India’s largest Debit Card Issuing platforms (hosted) © 2020-21, SARVATRA TECHNOLOGIES PVT. LTD. PRIVATE & CONFIDENTIAL. ALL RIGHTS RESERVED. 5 Top Private & Public Sector Banks as Customers § Our key enterprise customers in Private Sector Banks include ICICI Bank, Punjab National Bank, The Nainital Bank, Oriental Bank of Commerce, IDBI Bank, Bank of Maharashtra, NSDL Payments Bank. § Our Sponsor Banks (Partners for NPCI’s Sub-membership Model) include HDFC Bank, ICICI Bank, YES Bank, Axis Bank, IndusInd Bank, IDBI Bank, State Bank of India, Kotak Mahindra Bank. -

State Bank of India – the Nation's Most Trusted Bank

Press Release – For Immediate Release State Bank of India – the Nation’s Most Trusted Bank Brand Finance launches banking market research on India’s bank brands Indian banks enjoy an average trust score of 69.8% compared to 64.9% recorded by US banks State Bank of India is the nation’s most trustworthy bank with a score of 86.4% Over 50% of customers of the Oriental Bank of Commerce and the UCO Bank 'very likely' to switch to competition Brand Finance conducted research on bank brands in 22 markets to see how customers’ opinions have changed in an era of major disruption to the industry. As global banks retreated after the Great Recession, the traditional banking model has changed. The prevailing trends suggest fintechs and niche “challenger banks” are biting into banks’ profits and luring their customers away with better quality service at lower prices. Traditional banks tend not to be set up as quick innovators. Instead, they compete for customers’ trust and our research indicates which banks are the most trustworthy. State Bank of India was deemed the most trusted bank in the country with a trust level of 86.3% as well as the most popular bank among those customers that were looking to switch to competition with 21.4% declaring they would choose the brand over others. State Bank of India is the country’s largest commercial bank in terms of assets, deposits, branches, number of customers and employees. On the opposite end of the ranking, over 50% of customers of the Oriental Bank of Commerce and the UCO Bank were 'very likely' to switch to competition. -

Investor Presentation

INVESTOR PRESENTATION Q4FY18 & FY18 Update Large Bank Growth Phase (FY15-20): Strong Growth with increasing Granularity ✓ 4th Largest# Private Sector Bank with Total Assets Core Retail to Total Advances CASA Ratio 36.3% 36.5% in excess of ` 3 Trillion ` Billion 12.2% 10.8% 28.1% ✓ One of the Fastest Growing Large Bank in India; 9.1% 9.4% 23.1% ▪ CAGR (FY15-18): Advances: 39%; Deposits: 30% ✓ Core Retail Advances grew by 122% CAGR 2,035 2,007 (FY15-18) to constitute 12.2% of Total Advances 1,323 1,429 982 1,117 755 912 ✓ CASA growing at 51% CAGR (FY15-18) to constitute 36.5% of Total Deposits. Advances Deposits # Data as on Dec, 2017 FY15 FY16 FY17 FY18 YES Bank Advances CAGR (FY15-18) of 39% V/s Industry CAGR of 8% resulting in Increasing Market Share ✓ Growth well spread across segments including lending to Market Share Deposits Higher Rated Customers resulting in consistently Improving 1.7% Rating Profile. 1.2% 1.3% 1.0% ✓ Deposits Market Share increased by 70% in 3years to 1.7%; ▪ Capturing Incremental Market Share at 6.9% (FY18) Market Share Advances 2.3% ✓ Advances Market Share more than doubled in 3 years to 2.3%; 1.1% 1.3% 1.7% ▪ Capturing Incremental Market Share at 9.2% (FY18) FY15 FY16 FY17 FY18 2 Large Bank Growth Phase (FY15-20): Sustained Profit Delivery with Best in Class Return Ratios • Amongst TOP 5 Profitable Banks* ` Million Increasing Income and Expanding NIMs 3.5% • One of the lowest C/I ratio among Private banks and 3.4% PSBs* 3.4% 52,238 3.2% • Healthy Return Ratios with RoA > 1.5% and RoE > 41,568 17% consistently -

![CP (IB) No. 01/MB/2018]](https://docslib.b-cdn.net/cover/7780/cp-ib-no-01-mb-2018-637780.webp)

CP (IB) No. 01/MB/2018]

NCLT Mumbai Bench IA No. 1031/2020 in [CP (IB) No. 01/MB/2018] IN THE NATIONAL COMPANY LAW TRIBUNAL MUMBAI BENCH, SPECIAL BENCH II *** *** *** IA No. 1031 of 2020 in [CP (IB) No. 01/MB/2018] Under Section 60(5) of Insolvency and Bankruptcy Code, 2016 *** *** *** In the matter of STATE BANK OF INDIA Versus VIDEOCON TELECOMMUNICATIONS LIMITED Between ABHIJIT GUHATHAKURTA, Resolution Professional for 13 Videocon Group Companies Flat No. 701, A Wing, Satyam Springs, Cts No. 272a/2/l, Off BSD Marg, Deonar, Mumbai City, Maharashtra, 400088 … Applicant and DEPARTMENT OF TELECOMMUNICATIONS Ministry of Communications, Access Service Branch, AS-1 Division, Sanchar Bhawan, 20, Ashoka Road, New Delhi- 110001 … Respondent No. 1 BANK OF BARODA 3rd Floor, 10/12, Mumbai Samachar Marg, Fort, Mumbai- 400 001 … Respondent No. 2 Date of Order: 07.10.2020 CORAM: Hon’ble Janab Mohammed Ajmal, Member Judicial Hon’ble Ravikumar Duraisamy, Member Technical Appearance: For the Applicant : Senior Counsel Mr. Gaurav Joshi with Ms. Meghna Rajadhyaksha. For the Respondents : None Page 1 of 8 NCLT Mumbai Bench IA No. 1031/2020 in [CP (IB) No. 01/MB/2018] Per: Janab Mohammed Ajmal (Member Judicial) ORDER This is an Application by the Resolution Professional of the Corporate Debtor seeking necessary direction against the Respondent(s). 2. Facts leading to the Application may briefly be stated as follows. The Videocon Telecommunications Limited (hereinafter referred to as the Corporate Debtor) had availed various credit facilities from the State Bank of India and other Banks including Bank of Baroda (Respondent No. 2). The Department of Telecommunications, Government of India (Respondent No. -

Kotak Salary Account Terms and Conditions

Kotak Salary Account Terms And Conditions Chester remains unoperative after Clay decrees reversedly or clench any expansibility. Is Alonso rupicolous when Dimitry reimburses foolishly? Dennis never descale any victuals orbits exhaustively, is Shurwood mannish and catechismal enough? Ready to you not assume any act performed by completing the conditions and kotak salary account how your home Yes bank account, kotak mahindra bank, charges keeping or conditions while some leverage for salaried account to time to start their identity of its own. Fixed deposits are governed by the terms and conditions of the Bank. Account, rate can also cash money despite it. Your income plays an important role while applying for a credit card. India and conditions or for accounts can even if your salary accounts and unlimited transactions are waived off time to do that is quarterly basis of. NRO Fixed Deposits, the process of opening a Demat and trading account with Kotak Securities, without reference to or without written intimation to you. Giri finance scheme offered and conditions of accounts which can i order to any other mode as your application form prescribed modes. It is expressly understood that all Bank will necessary incur any liability to the statutory, New Delhi, for availing the facility which opportunity being offered. After the first successful login, paying your college fees or planning for a holiday, rider sum assured will be paid in addition to the death benefit under the base plan. The salary and will also choose premium payment instructions and payable by way of requests, platform features and mention kotak bank. -

State Bank of India, Maharashtra Circle

STATE BANK OF INDIA, MAHARASHTRA CIRCLE IMPORTANT ANNOUNCEMENT ENGAGEMENT OF RETIRED OFFICERS/ EMPLOYEES OF STATE BANK OF INDIA/ E-ABs AND RETIRED OFFICERS OF PSBs FOR DIFFERENT ROLES IN ANYTIME CHANNEL VERTICAL ON CONTRACT BASIS (Last Date – 21.06.2020) Applications are invited from retired employees and officers of the State Bank of India/ e-ABs of State Bank of India (retired as Clerical and retired in Scale I to IV) and Retired Officers of other PSBs (retired in Scale I to IV), who retired from Bank’s service on attaining superannuation on or before 31.05.2020 and should not have completed 63 years of age as on 30.06.2020, for engagement in the Anytime Channel Vertical, on contract basis. The applicant should have retired with good track record and no punishment/ penalty should have been inflicted on the retired employee/ officer during five years of his service in the Bank preceding his retirement. The retired employee/officer voluntarily retired/ resigned/suspended/ who have left the Bank otherwise before superannuation are not eligible for consideration for appointment. Applicant should be resident of the area, where AO/RBO is functioninq. Preference will be given to the officials who have worked in ATM operations. All interested eligible retired employees and officers are advised to send a scanned copy of their application as per Annexure II to the email id [email protected] (with cc to [email protected]). The last date for receipt of scanned copy of the application is 21.06.2020. The tentative region wise vacancies of Channel Manager Supervisor (CMS) and Channel Manager Facilitator (CMF) are placed below. -

BUY TP Axis Bank (AXSB)

Q3FY21 Result Review TP Rs735 Key Stock Data Axis Bank (AXSB) BUY CMP Rs632 Bloomberg / Reuters AXSB IN /AXBK.BO Potential upside / downside 16% Sector Banking Higher write offs supported NPA; Restructured assets @ 0.42% Previous Rating BUY Shares o/s (mn) 3,062 Summary V/s Consensus Market cap. (Rs mn) 1,934,705 Axis Bank’ asset quality deteriorated sequentially with GNPA inched up to 4.55% (as per IRAC EPS (Rs) FY21E FY22E FY23E Market cap. (US$ mn) 26,532 norms) vs 4.28% led by higher slippage ratio (4.6% vs 1.1% QoQ); however, GNPA improved as 3-m daily avg Trd value (Rs mn) 3,730.0 against 5.0% YoY led by higher write offs (Rs42.6bn vs Rs27.9bn YoY). BB & below book declined IDBI Capital 17.2 29.0 37.6 by 5% QoQ and restructured assets stood at 0.42% of customer assets as against earlier Consensus 24.3 41.6 55.0 52-week high / low Rs761/285 estimates of 1.7% are key positives during the quarter. PAT declined by 37% YoY (down 34% % difference (29.1) (30.3) (31.6) Sensex / Nifty 47,410 / 13,968 QoQ) led by higher provisions (up 33% YoY) and employee expenses (up 23% YoY). NII grew by 14% YoY led by improvement in NIMs at 3.59% (3.57% YoY). PPoP grew by 6% YoY (down 12% QoQ) led by increase in cost to income ratio (45% vs 44% YoY). With management change behind, strong Shareholding Pattern (%) Relative to Sensex (%) capital in place and focus on secured retail portfolio, AXISB would see better revival in growth within Promoters 13.9 130.0 the sector.