Mr. Atul Sobti Takes Over As Director General, SCOPE

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale. -

Government of India Ministry of Finance Department of Investment and Public Asset Management

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF INVESTMENT AND PUBLIC ASSET MANAGEMENT BACKGROUND MATERIAL FOR ECONOMIC EDITOR’S CONFERENCE MANDATE The mandate of the Department of Investment and Public Asset Management (DIPAM), inter-alia, includes disinvestment of Government’s shareholding in Central Public Sector Enterprises (CPSEs), matters relating to GoI’s investment in equity like capital restructuring, bonus, dividends and other related issues. DISINVESTMENT POLICY • On February, 2016, a new policy for management of Government investment in CPSEs, including disinvestment and strategic sale was approved. This was to leverage the assets of CPSEs for generation of resources for investment in new projects. This allows CPSEs to divest individual assets like land, manufacturing units etc. to release their asset value for making investment in new project. • The Department of Disinvestment (DoD) has been renamed as Department of Investment and Public Asset Management (DIPAM) with enhanced mandate of efficient management of Government investment in CPSEs by addressing issues such as capital restructuring, dividend, bonus shares etc. The approach is towards capital management from investor’s point of view. OBJECTIVES The objectives of Disinvestment Policy are: - (a) Promote people’s ownership of CPSEs to share in their prosperity through disinvestment. (b) Enables efficient management of public investment in CPSEs for accelerating economic development and augmenting Government’s resources for higher expenditure. (c) Listing of CPSEs on stock exchanges to facilitate development and deepening of capital market and spread of equity culture. (d) Raising budgetary resources for the Government. 1 COPREHENSIVE MANAGEMENT OF GOI’s INVESTMENT IN CPSEs • The Government recognizes its investment in CPSEs as an important asset for accelerating economic growth and is committed to efficient use of these resources to achieve optimum return. -

List of Nodal Officer

List of Nodal Officer Designa S.No tion of Phone (With Company Name EMAIL_ID_COMPANY FIRST_NAME MIDDLE_NAME LAST_NAME Line I Line II CITY PIN Code EMAIL_ID . Nodal STD/ISD) Officer 1 VIPUL LIMITED [email protected] PUNIT BERIWALA DIRT Vipul TechSquare, Golf Course Road, Sector-43, Gurgaon 122009 01244065500 [email protected] 2 ORIENT PAPER AND INDUSTRIES LTD. [email protected] RAM PRASAD DUTTA CSEC BIRLA BUILDING, 9TH FLOOR, 9/1, R. N. MUKHERJEE ROAD KOLKATA 700001 03340823700 [email protected] COAL INDIA LIMITED, Coal Bhawan, AF-III, 3rd Floor CORE-2,Action Area-1A, 3 COAL INDIA LTD GOVT OF INDIA UNDERTAKING [email protected] MAHADEVAN VISWANATHAN CSEC Rajarhat, Kolkata 700156 03323246526 [email protected] PREMISES NO-04-MAR New Town, MULTI COMMODITY EXCHANGE OF INDIA Exchange Square, Suren Road, 4 [email protected] AJAY PURI CSEC Multi Commodity Exchange of India Limited Mumbai 400093 0226718888 [email protected] LIMITED Chakala, Andheri (East), 5 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 6 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 7 NECTAR LIFE SCIENCES LIMITED [email protected] SUKRITI SAINI CSEC NECTAR LIFESCIENCES LIMITED SCO 38-39, SECTOR 9-D CHANDIGARH 160009 01723047759 [email protected] 8 ECOPLAST LIMITED [email protected] Antony Pius Alapat CSEC Ecoplast Ltd.,4 Magan Mahal 215, Sir M.V. Road, Andheri (E) Mumbai 400069 02226833452 [email protected] 9 SMIFS CAPITAL MARKETS LTD. -

Sharekhan Special August 31, 2021

Sharekhan Special August 31, 2021 Index Q1FY2022 Results Review Automobiles • Capital Goods • Consumer Discretionary • Consumer Goods • Infrastructure/Cement/Logistics/Building Material • IT • Oil & Gas • Pharmaceuticals • Agri Inputs and Speciality Chemical • Miscellaneous • Visit us at www.sharekhan.com For Private Circulation only Q1FY2022 Results Review In-line quarter, healthy outlook Results Review Results Summary: After ending FY2021 on a strong note, Q1FY2022 earnings of broader indices showed a promising start (Nifty/ Sensex companies’ PAT rose 100%/66% y-o-y) in the new fiscal with strong growth momentum on low base. Management commentaries on earnings outlook remained positive, on improving economic activity post second COVID-19 wave and anticipation of strong demand revival. Demand recovery and ramp-up of vaccinations look encouraging. We expect economic activity to increase in the upcoming festive season. Nifty trades at 23x and 20x EPS based on FY2022E/FY2023E EPS, at a premium to mean average. Valuation gap between large and mid-caps has shrunk, we advise investors to focus on stocks with strong earnings growth potential with reasonable valuation. High-conviction investment ideas: o Large-caps: Infosys, ICICI Bank, M&M, L&T, UltraTech, SBI, HDFC Ltd, Godrej Consumer Products, Divis Labs and Titan. o Mid-caps: NAM India, BEL, Gland Pharma, Dalmia Bharat, Laurus Labs, Max Financial Services, LTI. o Small-caps: TCI Express, Kirloskar Oil, Suprajit Engineering, Repco Home Finance, PNC Infratech, Mahindra Lifespaces, Birlasoft. After ending FY2021 on a strong note, Q1FY2022 corporate earnings of broader indices showed a promising start with continued strong growth momentum on the low base of Q1FY2021, though it was along the expected lines. -

Disinvestment of Psus 179. Shri Shivakumar C. Udasi: Shri

• GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF INVESTMENT AND PUBLIC ASSET MANAGEMENT LOKSABHA UNSTARRED QUESTION NO. 179 TO BE ANSWERED ON MONDAY, NOVEMBER 18, 2019 KARTIKA 27,1941 (SAKA) Disinvestment of PSUs 179. Shri Shivakumar C. Udasi: Shri Muraleedharan: Shri Rajeshbhai Chudasama: Shri Malook Nagar: Will the Minister of FINANCE be pleased to state: (a)the details of the target set by the Government / Department of Investment and Public Asset Management to raise the amount through disinvestment drive during the financial year along with the steps taken to accelerate the disinvestment process; (b)whether the Government has taken any decision on BPCL and other Public Sector Undertakings (PSUs)/ State-owned companies for disinvestment and if so, the details thereof and the reasons therefore; (c)the details of proceeds received due to disinvestment of PSUs, year-wise along with the details of PSUs where disinvestment took place, either fully or partially including the percentage of stake sold; (d)whether the PSUs sold were profit-making or loss-making and if so, the details thereof along with the number of PSUs which were converted from the stature of PSU to private and the reasons for selling profit-making PSUs; (e)the efforts made by the Government to restructure and re-finance the undertakings to revive before taking a decision of disinvestment; and (f) the details of provisions being made by the Government to tide over the loss incurred by loss-making telecom Government undertakings like BSNL, MTNL etc? -------- • ANSWER THE MINISTER OF STATE IN THE MINISTRY OF FINANCE (SHRI ANURAG SINGH THAKUR) a) The Budget target for disinvestment during 2019-20 has been set at Rs. -

Factsheet March 2016

Crosses `100 Crores* BOI AXA SHORT TERM INCOME FUND . AVERAGE MATURITY AND MODIFIED DURATION The fund is currently maintaining a Modified Duration of 0.56 and an Average Maturity of 0.90 years (as of March 31, ‘16) Hence, the fund is well positioned to take advantage of the middle segment of the yield curve where we see maximum value Why invest ASSET QUALITY in BOI AXA The fund is maintaining a judicious mix between Corporate Bonds, Money Market instruments and Government Securities This enables the fund to earn accrual income from its Corporate Bonds while also benefiting from tactical trading Short Term opportunities through G-Secs Income CREDIT QUALITY The fund is currently is 83.31% invested in G-Secs, AAA and A1+ rated instruments Fund? It is also ~2.33% invested in Unrated instruments in order to enhance the portfolio yield The fund’s portfolio yield is currently at 9.66% (as of March 31, ‘16) Refer Pg. No.3 for Product Labelling *As on 06/04/2016 Facts in Figures Monthly fund analysis and market reviews March 2016 Fund Manager’s Views The last repo rate cut by RBI appears to be one of last few rate cuts in this interest rate easing cycle. A further rate cut from here has to be driven by fall in inflation more than anything else. To explain it better, RBI has forecasted CPI inflation to be around 5% for this financial year. At the same time RBI intends to Alok Singh maintain a real positive interest rate of 1.5%-2%. -

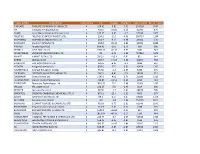

Ticker Symbol Ticker Name Ticker Group LTP Change Change % Trade Volume No

Ticker Symbol Ticker Name Ticker Group LTP Change Change % Trade Volume No. of Trades TINPLATE TINPLATE COMPANY OF INDIA LTD. A 169.95 -9.95 -5.53 153718 3337 NH Narayana Hrudayalaya Ltd A 401.5 -21.85 -5.16 12932 676 YAARII Yaarii Digital Integrated Services Ltd A 100.35 -4.95 -4.7 67244 1006 PRESTIGE PRESTIGE ESTATES PROJECTS LTD. A 294.2 -12.5 -4.08 185797 1354 RESPONIND RESPONSIVE INDUSTRIES LTD. A 162.9 -6.75 -3.98 26584 770 RAMCOSYS RAMCO SYSTEMS LTD. A 504.8 -20.35 -3.88 33782 2838 PAISALO Paisalo Digital Ltd A 666.45 -26.2 -3.78 699 166 KPRMILL K.P.R. Mill Limited A 1183.35 -45.35 -3.69 3442 943 MOREPENLAB MOREPEN LABORATORIES LTD. A 39 -1.45 -3.58 484850 1675 VMART V-MART RETAIL LTD. A 2812.9 -102.9 -3.53 821 345 SOBHA Sobha Limited A 504.7 -17.65 -3.38 10297 738 ELGIEQUIP ELGI EQUIPMENTS LTD. A 195.5 -6.25 -3.1 9966 597 NEOGEN Neogen Chemicals Ltd A 878.6 -27.5 -3.03 10454 1267 NAVNETEDUL Navneet Education Limited A 75.55 -2.3 -2.95 6298 273 EVEREADY EVEREADY INDUSTRIES INDIA LTD. A 282.5 -8.45 -2.9 19378 571 DALBHARAT Dalmia Bharat Ltd A 1543.3 -43.8 -2.76 21030 5329 FLUOROCHEM Gujarat Fluorochemicals Ltd A 730.85 -19.55 -2.61 9223 743 THYROCARE Thyrocare Technologies Ltd A 1010.35 -25.7 -2.48 15603 1332 VRLLOG VRL Logistics Ltd A 226.35 -5.6 -2.41 3614 206 SPENCER Spencers Retail Ltd A 68.95 -1.7 -2.41 28478 509 ORIENTCQ ORIENTAL CARBON & CHEMICALS LTD.-$ A 873.1 -21.4 -2.39 4605 373 SUVEN SUVEN LIFE SCIENCES LTD. -

Download the File

Assessment Report of CPSEs on Corporate Governance for the year 2013-14 Grading for the Sl.No. Name of CPSEs (As per Survey) Administrative Ministry year 2013-14 1 NATIONAL SEEDS CORPN. Department of Excellent LTD. Agriculture and Cooperation 2 STATE FARMS CORPORATION Department of Excellent OF INDIA LTD. Agriculture and Cooperation 3 ELECTRONICS CORPN. OF Department of Atomic Excellent INDIA LTD. Energy 4 URANIUM CORPORATION OF Department of Atomic Very Good INDIA LTD. Energy 5 INDIAN RARE EARTHS LTD. Department of Atomic Excellent Energy 6 NUCLEAR POWER CORPN. OF Department of Atomic Excellent INDIA LTD. Energy 7 BHARATIYA NABHIKIYA Department of Atomic Excellent VIDYUT NIGAM LTD. Energy 8 INDIAN MEDICINES & Department of AYUSH Good PHARMACEUTICAL CORPN. LTD. 9 BIOTECHNOLOGY INDUSTRY Department of Fair RESEARCH ASSISTANCE Biotechnology COUNCIL 10 HINDUSTAN Department of Excellent FLUOROCARBONS LIMITED Chemicals & Petrochemicals 11 HINDUSTAN INSECTICIDES Department of Excellent LTD. Chemicals & Petrochemicals 12 TAMIL NADU TRADE Department of Good PROMOTION ORGANISATION Commerce 13 KARNATAKA TRADE Department of Excellent PROMOTION ORGANISATION Commerce 14 STCL LTD. Department of Good Commerce 15 STATE TRADING CORPN. OF Department of Excellent INDIA LTD. Commerce 16 M M T C LTD. Department of Excellent Commerce 17 P E C LTD. Department of Good Commerce 18 EXPORT CREDIT GUARANTEE Department of Excellent CORPN.OF INDIA LTD. Commerce 19 INDIA TRADE PROMOTION Department of Excellent ORGANISATION Commerce 20 BEML LTD. Department of Defence Excellent Production 21 VIGNYAN INDUSTRIES LTD. Department of Defence Excellent Production 22 HINDUSTAN SHIPYARD LTD. Department of Defence Excellent Production 23 MISHRA DHATU NIGAM LTD. Department of Defence Excellent Production 24 GARDEN REACH Department of Defence Excellent SHIPBUILDERS & ENGINEERS Production LTD. -

Year of Energy Audit Sector Name of Industry 2019-20

2019-20 Year of Energy Sector Name of Industry Audit 2019-20 Petrochemical IOCL Sangrur DO 2019-20 Petrochemical IOCL UPSO-2, Noida Office 2019-20 Petrochemical HPCL Kota LPG 2019-20 Petrochemical HPCL Hoshiarpur LPG 2019-20 Petrochemical IOCL Srinagar Depot 2019-20 Petrochemical HPCL Jammu LPG 2019-20 Petrochemical IOCL Bharatpur Terminal 2019-20 Railways NE Railway Lucknow Railway Station 2019-20 Petrochemical IOCL Utarlai Barmer AFS 2019-20 Petrochemical IOCL Aonla Depot 2019-20 Petrochemical IOCL UPSO-2, Haridwar LPG 2019-20 Petrochemical IOCL Ajmer LPG 2019-20 Petrochemical BPCL Srinagar Depot 2019-20 Petrochemical IOCL UPSO-2, Agra Terminal 2019-20 Petrochemical IOCL Amritsar DO 2019-20 Automobile AG Industries Pvt Ltd, Bawal, Sector-5 2019-20 Automobile AG Industries Pvt Ltd, Bawal, Sector-6 2019-20 Petrochemical IOCL NRO Yusuf Sarai 2019-20 Petrochemical IOCL UPSO-2, Lakhimpur Kheri LPG 2019-20 Petrochemical IOCL Jhunjhunu LPG Bottling Plant 2019-20 Petrochemical IOCL Kargil Depot 2019-20 Petrochemical IOCL Jaisalmer AFS 2019-20 Petrochemical IOCL Jaipur Terminal 2019-20 Automobile AG Industries Pvt Ltd, IMT Manesar 2019-20 Solar OIL 9 MW Solar Plant in Rajasthan 2019-20 Building OIL Office Building in Rajasthan 2019-20 Railways NCR Allahabad Jn. Railway Station 2019-20 Railways NCR Kanpur Central Railway Station 2019-20 Petrochemical IOCL Karnal AO 2019-20 Petrochemical IOCL Shimla DO 2019-20 Automobile Guru Nanak Auto Enterprises Limited, Phagwara 2019-20 Railways MCF, Raebreily Railway thru TAC Automation Pvt Ltd 2019-20 Petrochemical -

Press Release February 23, 2021

Press Release February 23, 2021 Replacements in Indices The Index Maintenance Sub-Committee (Equity) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from March 31, 2021 (close of March 30, 2021). 1) NIFTY 50 The following company is being excluded: Sr. No. Company Name Symbol 1 GAIL (India) Ltd. GAIL The following company is being included: Sr. No. Company Name Symbol 1 Tata Consumer Products Ltd. TATACONSUM The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bank of Baroda BANKBARODA 2 Container Corporation of India Ltd. CONCOR 3 General Insurance Corporation of India GICRE 4 Hindustan Zinc Ltd. HINDZINC 5 Oracle Financial Services Software Ltd. OFSS 6 Power Finance Corporation Ltd. PFC 7 Tata Consumer Products Ltd. TATACONSUM The following companies are being included: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Apollo Hospitals Enterprise Ltd. APOLLOHOSP 3 GAIL (India) Ltd. GAIL 4 Jubilant Foodworks Ltd. JUBLFOOD 5 MRF Ltd. MRF Sr. No. Company Name Symbol 6 Vedanta Ltd. VEDL 7 Yes Bank Ltd. YESBANK 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bombay Dyeing & Manufacturing Co. Ltd. BOMDYEING 2 CARE Ratings Ltd. CARERATING 3 Chennai Petroleum Corporation Ltd. CHENNPETRO 4 D.B.Corp Ltd. DBCORP 5 ESAB India Ltd. ESABINDIA 6 Gujarat Mineral Development Corporation Ltd. GMDCLTD 7 Hathway Cable & Datacom Ltd. HATHWAY 8 Heritage Foods Ltd. -

Name of State Sl.No Stockist Name Address Contact Number Email-Id Covering Area/ District Supplying/ Linked Cfa

NAME OF STATE SL.NO STOCKIST NAME ADDRESS CONTACT NUMBER EMAIL-ID COVERING AREA/ DISTRICT SUPPLYING/ LINKED CFA 52-11-9/19,FLOT NO.B-102,1ST FLOOR,GREEN HOMES 1 SUDHA TRADERS 9848192024 [email protected] VISHAKAPATNAM HYDERABAD APARTMENTS,NER INDOR ANDHRA PRADESH STADIUM,VISHAKAPTNAM #76-14-227/3,1ST FLOOR,KANAKA 2 VEERESH PHARMA DURGAMMA STREET,TEACHER 9848121756 [email protected] VIJAYAWADA HYDERABAD COLONY,BHAVANIPURAM,VIJAYAWADA PIRMOHANI DALDALI ROAD, KADAM 1 SHIV MEDICO 8986170460,7004255354 [email protected] JAILS/ DISTRICTS/ ESICS, BIHAR PATNA KUA,PATNA BIHAR 2 KRISHNA ENTERPRISES P.C.COLONY, KANKARBAGH, PATNA 9572524009,9931493353 [email protected] E C RAILWAY/JAIL/DISTRICTS, BIHAR PATNA AASHO CHAK, NEAR PATNA AIIMS/JAILS/MEDICAL 3 SHIVAM ENTERPRISES 7250025680,9162445008 [email protected] PATNA MARVEL,PATNA COLLEGES/DISTRICS, BIHAR 15/11, ARPA COMPLEX, OPP. RAIPUR, BILASPUR, KORBA, KORIA, 1 EXCEL LIFECARE 9893120605 [email protected] RAIPUR NAVBHARATH PRESS, BILASPUR (C.G.) MANENDRAGARH CHHATTISGARH 15, SHRI RAM HOSEIRY MARKET, 0771-4023001, 2 MEHER MARKETING PAGARIYA COMPLEX, PANDRI BUS [email protected] RAIPUR RAIPUR 9826323046 STAND, RAIPUR (C.G.) C-18 ABHISHEK COMPLEX - 1 NEAR M:9426632323 TEL:079- 1 SUNSHINE MARKETING HARIPURA BUS STAND , ASARWA , [email protected] GUJRAT, DAMAN,SILVASA AHMEDABAD PHARMA 22163023 GUJARAT AHMEDABAD. DIU& DAMAN NISHA PHARMA DADRA & 107,PRATIBHA COMPLEX B/H.SAKAR-1 NAGAR HAVELI 2 NISHA PHARMA OPP.GANDHIGRAM RAILWAY STATION 079-26576797 DIU AHMEDABAD PHARMA OFF.ASHRAM ROAD AHMEDABAD. 380 006 # 550 GROUND FLOOR, 4TH CROSS, 1 SUPRA 9448068778 [email protected] GOA/ GOVT. HOSPITALS BANGALORE_VIJAYANAGAR MAHALAKSHMI LAYOUT, GOA SHREE ANNAPURNESHWARI 2 OPP. -

Bill Status Aug-2019

MOIL LIMITED VENDOR PAYMENTS AT HO AUG-2019 Vendor name PO Number Bill No Bill Date Payment Amount ORIENT TRADING CORPORATION 9600006660 22 30-07-2019 1,97,720.00 ORIENT TRADING CORPORATION 9600006660 23 30-07-2019 Indian Environment 9700000090 IECRS/MING PL/60 17-07-2019 1,64,800.00 ABHIRAJ ENTERPRISES 9400002506 21 29-07-2019 40,235.50 VERTIV ENERGY PRIVATE LIMITED 9300000103 20/404/BO/1059 16-07-2019 4,85,063.04 LALLAN SHARMA 9200004244 018 19-08-2019 18,752.00 Sharad Advertising Pvt. Ltd. 9500000650 MUM/19-20/2 06-05-2019 94,592.00 AGGREGATE INNOVATIONS 9600007313 008 05-08-2019 1,41,200.00 MUDRASHILPA OFFSET PRINTERS 9500000647 385 25-07-2019 71,500.00 Jai Ambey Body Works 9200004128 142 30-07-2019 1,45,600.00 MINE TECH SERVICES 9700000097 378 14-08-2019 1,40,250.00 SARKAR DECORATOR 9200004210 87 17-08-2019 1,87,364.00 Central Mine Planning Design Instit 9700000070 20/HQ/SER/20/C74 30-07-2019 80,19,000.00 ATLANTIS ENGINEERS 9200003163 AE/2019-20/12 24-07-2019 43,47,026.04 H S TAGORE 9200003025 15 31-07-2019 33,82,727.36 H S TAGORE 9200003037 14 31-07-2019 21,68,934.75 H S TAGORE 9200003335 HST/016 31-07-2019 4,51,427.80 H S TAGORE 9200003332 001 31-07-2019 H S TAGORE 9200003335 HST/016 31-07-2019 6,41,320.95 H S TAGORE 9200003332 HST/017 31-07-2019 H S TAGORE 9200003332 HST/017 31-07-2019 D C S LIMITED MUN/411 DCS/MUN/37 07-08-2019 26,60,740.69 Maheshwari Mining Pvt Ltd UKW/20 19-20/03 01-08-2019 77,16,335.20 Maheshwari Mining Pvt Ltd 9700000045 MMPLBGT-16 08-08-2019 25,31,553.60 Maheshwari Mining Pvt Ltd 9700000045 MMPLBGT-03 08-08-2019