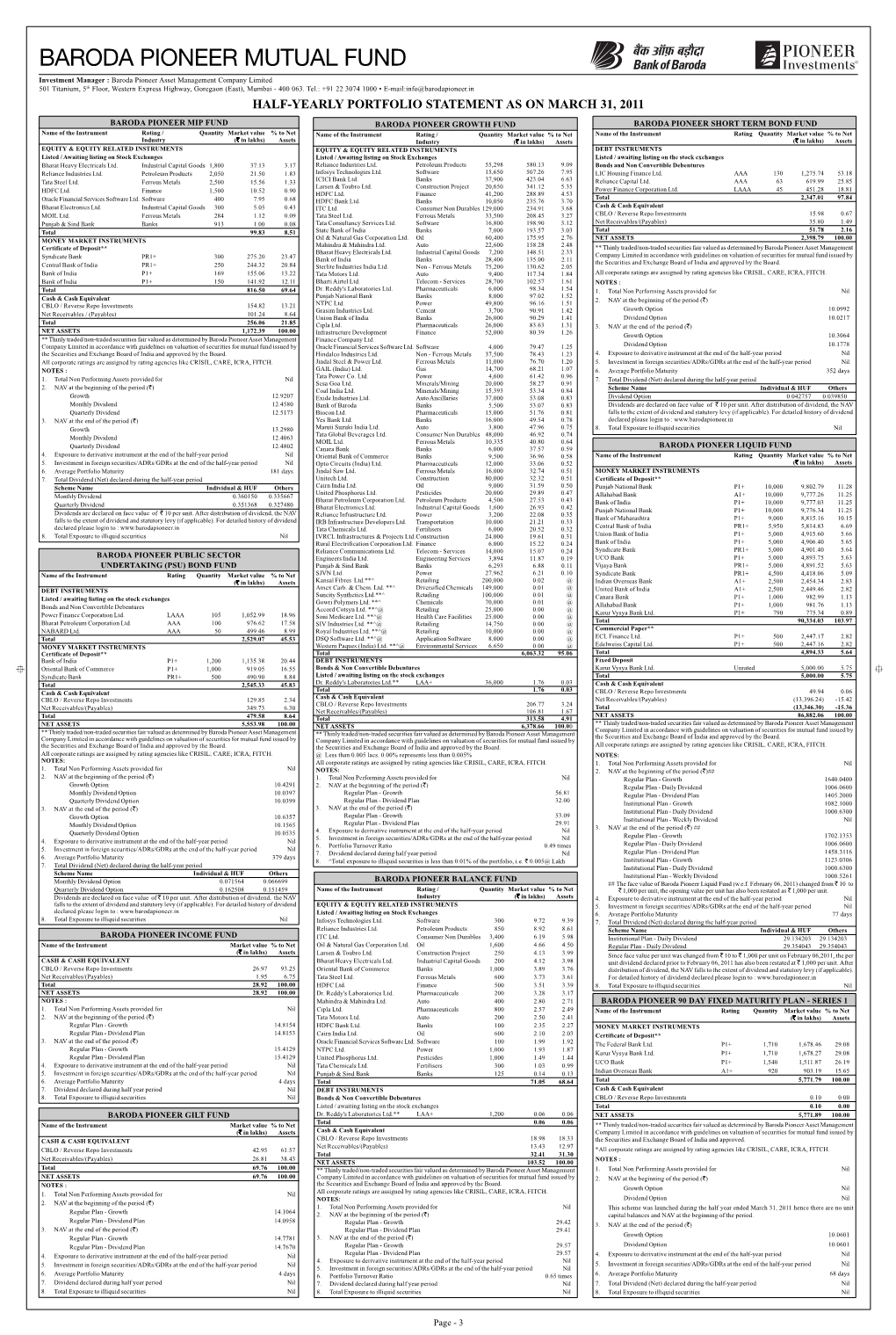

HY Portfolio

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Terms and Conditions for the Icici Bank Indian Rupee Travel Card

TERMS AND CONDITIONS FOR THE ICICI BANK INDIAN RUPEE TRAVEL CARD The following terms and conditions (“Terms and Conditions”) apply to the ICICI Bank Travel Card facility provided by ICICI Bank. For your own benefit and protection you should read these terms and conditions carefully before availing ICICI Bank Indian Rupee Travel Card. These are ICICI Bank’s standard terms and conditions on the basis of which it provides the ICICI Bank Indian Rupee Travel Card. If you do not understand any of the terms or conditions, please contact us for further information. Your use of the ICICI Bank Indian Rupee Travel Card will indicate your acceptance of these terms and conditions. ICICI Bank Indian Rupee Travel Card is issued by ICICI Bank and distributed by ICICI Bank UK PLC to the customers in the United Kingdom (UK). ICICI Bank Limited is incorporated in India and regulated by the Reserve Bank of India (RBI). ICICI Bank UK PLC is a 100% owned subsidiary of ICICI Bank Limited. ICICI Bank UK PLC’s role is solely to distribute the INR Travel Cards to individuals in the UK and assist in facilitating the documentation to initiate the relationship with ICICI Bank. Definitions In these Terms and Conditions, the following words have the meanings set out hereunder, unless the context indicates otherwise. “ICICI Bank Limited”, means ICICI Bank Limited, a company incorporated under the Companies Act. 1956 of India and licensed as a bank under the Banking Regulation Act, 1949 and having its registered office at Landmark, Race Course Circle, Vadodara 390 007, and its corporate office at ICICI Bank Towers, Bandra Kurla Complex, Mumbai 400 051. -

List of Nodal Officers

List of Nodal Officers S. Name of Bank Name of the Nodal Address CPPC Phone/Fax No./e-mail No Officers 1 Allahabad Bank Dr S R Jatav Asstt. General Manager, Office no: 0522 2286378, 0522 Allahabad Bank, CPPC 2286489 Zonal Office Building, Mob: 08004500516 Ist floor,Hazratganj, [email protected] Lucknow UP-226001 2 Andhra Bank Shri M K Srinivas Sr.Manager, Mob: 09666149852,040-24757153 Andhra Bank, [email protected] Centralized Pension Processing Centre(CPPC) 4th floor,Andhra Bank Building,Koti, Hyderabad-500095 3 Axis Bank Shri Hetal Pardiwala, Nodal Officer Mob: 9167550333, AXIS BANK LTD, Gigaplex Bldg [email protected] no.1, 4th floor, Plot No. I.T.5, MIDC, Airoli Knowledge Park, Airoli, Navi Mumbai- 400708 4 Bank of India Shri R. Ashok Chief Manager 0712-2764341, Ph.2764091,92 Nimrani Bank of India, 0712-2764091 (fax) CPPC Branch, Bank of India Bldg. [email protected] 87-A, 1st floor, Gandhibaug, Nagpur-440002. 5 Bank of Baroda Shri S K Goyal, Dy. General Manager, 011-23441347, 011-23441342 Bank of Baroda, [email protected] Central Pension Processing Centre, [email protected] Bank of Baorda Bldg. 16, Parliament Street, New Delhi – 110 001 6 Bank of Shri D H Vardy Manager Ph: 020-24467937/38 Maharashtra Bank of Maharashtra Mob: 08552033043 Central Pension Processing Cell, [email protected] 1177, Budhwar Peth, Janmangal, Bajirao Road Pune-411002 7 Canara Bank Shri K S Hebbar Asstt. General Manager Mob. 08197844215 Canara Bank Ph: 080 26621845 Centralized Pension Processing [email protected] Centre Dwarakanath Bhavan 29, K R Road Basavangudi, Bangalore 560 004 8 Central Bank of Shri V K Sinha Chief Manager Ph: 022-22703216/22703217, India Central Bank of India (CPPC) Fax- 22703218 Central Office, 2nd Floor, [email protected] Central Bank Building, M.G. -

18 December 2020 Reliance and Bp Announce First Gas from Asia's

18 December 2020 Reliance and bp announce first gas from Asia’s deepest project • Commissioned India's first ultra-deepwater gas project • First in trio of projects that is expected to meet ~15% of India’s gas demand and account for ~25% of domestic production Reliance Industries Limited (RIL) and bp today announced the start of production from the R Cluster, ultra-deep-water gas field in block KG D6 off the east coast of India. RIL and bp are developing three deepwater gas projects in block KG D6 – R Cluster, Satellites Cluster and MJ – which together are expected to meet ~15% of India’s gas demand by 2023. These projects will utilise the existing hub infrastructure in KG D6 block. RIL is the operator of KG D6 with a 66.67% participating interest and bp holds a 33.33% participating interest. R Cluster is the first of the three projects to come onstream. The field is located about 60 kilometers from the existing KG D6 Control & Riser Platform (CRP) off the Kakinada coast and comprises a subsea production system tied back to CRP via a subsea pipeline. Located at a water depth of greater than 2000 meters, it is the deepest offshore gas field in Asia. The field is expected to reach plateau gas production of about 12.9 million standard cubic meters per day (mmscmd) in 2021. Mukesh Ambani, chairman and managing director of Reliance Industries Limited added: “We are proud of our partnership with bp that combines our expertise in commissioning gas projects expeditiously, under some of the most challenging geographical and weather conditions. -

Factsheetmarch11

March 2011 EQUITY OUTLOOK The Indian benchmark indices ended FII Equity Flows: Turn Buyers for First Time in 2011 March on a positive note after being 7,000 Cash (US$m) 6,373 6,000 Futures (US$m) 5,580 down ~13% between January and 5,000 3,777 4,159 February 2011. The benchmark gained 4,000 3,000 2,405 Gaurav Kapur 2,220 1,556 2,100 1,740 SENIOR MANAGER - EQUITY about 5.6% during March 2011, 2,000 1,358 1,299 1,000 406 329 making it the second best performing 231 0 -1,000 -529 -363 market in the world for the month. The CNX midcap index also was -737 -993 -826 -2,000 -1,016 -1,257 -1,989 -1,387 up 5.8% over the same period. FIIs were net buyers of ~US$1.5 bn -3,000 -4,000 -3,417 during March, however, they are still net sellers worth around 1 1 1 0 0 0 0 0 0 0 0 0 1 1 1 1 1 1 1 1 1 1 1 1 - - - - - - - - - - - - r l t r b n y v c n g p a c u p e a a o e US$650 mn year-to-date. u u e J J M F O A J N D A S M Source: Morgan Stanley Research Asia was the best performing Emerging Markets region in March, rising by 7.1%, while Emerging Markets Ex Asia (+4.7%), despite underperforming, remained resilient in the face of the ongoing political turmoil in the neighboring Middle East North Africa (MENA) region and the rumbling sovereign debt crisis in Europe. -

First Light 11May-Research

FIRST LIGHT 11 May 2021 Click or tap here to e nter text. RESEARCH TOP PICKS [#3 Meeting of Minds] Automobiles LARGE-CAP IDEAS Gearing up for EV battery technology Company Rating Target DCB Bank | Target: Rs 100 | +10% | ADD Cipla Buy 1,000 Recoveries to improve gradually – upgrade to ADD TCS Buy 3,780 BOB Economics Research | Weekly Wrap Tech Mahindra Buy 1,190 Local restrictions impact economic activity MID-CAP IDEAS Company Rating Target SUMMARY Alkem Labs Buy 3,750 Greenply Industries Buy 195 Automobiles Laurus Labs Buy 540 We hosted Stefan Louis, CEO of Nexcharge – a technology-based JV between Transport Corp Buy 320 Exide Industries and Leclanché of Switzerland – catering to lithium-ion tech in Source: BOBCAPS Research India. The company is eyeing business in the domestic 2W, 3W, bus and telecom segments. Per Stefan, the complex nature of battery technology would warrant DAILY MACRO INDICATORS 2D 1M 12M JVs between auto OEMs and battery manufacturers. He expects the Indian Indicator Current (%) (%) (%) lithium-ion battery industry to grow to Rs 40bn-50bn in four years and US 10Y 1.58 1bps (8bps) 94bps Nexcharge to capture 25% of the market with double-digit margins once local yield (%) India 10Y 6.02 4bps (11bps) (1bps) manufacturing begins. yield (%) USD/INR 73.51 0.3 (0.1) 3.0 Click here for the full report. Brent Crude 68.28 0.3 8.8 131.8 (US$/bbl) Dow 34,778 0.7 4.0 45.7 DCB Bank Shanghai 3,419 (0.7) (1.8) 19.1 DCB Bank’s (DCBB) Q4FY21 PAT of Rs 0.8bn (+13% YoY) beat our estimate Sensex 49,206 0.5 0.0 56.5 India FII 6 May MTD CYTD FYTD on below-expected provisions. -

Everything on BHIM App for UPI-Based Payments

Everything on BHIM app for UPI-based payments BHIM UPI app - From linking bank accounts to sending payments. BHIM is based on UPI, which is the Universal Payments Interface and thus linked directly to a bank account. The new digital payments app calledBHIM is based on the Unified Payments Interface (UPI). The app is currently available only on Android; so iOS, Windows mobile users etc are left out. BHIM is also supposed to support Aadhaar-based payments, where transactions will bepossible just with a fingerprint impression, but that facility is yet to roll out. What can BHIM app do? BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). If you have signed up for UPI based payments on your respective bank account, which is also linked to your mobile number, then you’ll be able to use the BHIM app to conduct digital transactions. BHIM app will let you send and receive money to other non-UPI accounts or addresses. You can also send money via IFSC and MMID code to users, who don’t have a UPI-based bank account. Additionally, there’s the option of scanning a QR code and making a direct payment. Users can create their own QR code for a certain fixed amount of money, and then the merchant can scan it and the deduction will be made. BHIM app is like another mobile wallet? No, BHIM app is not a mobile wallet. In case of mobile wallets like Paytm or MobiKwik you store a limited amount of money on the app, that can only be sent to someone who is using the same wallet. -

Terms and Conditions for Unified Payment Interface (Upi)

#14, MG Road Naveen Complex , Head Office Annex , Bangalore -560001 TERMS AND CONDITIONS FOR UNIFIED PAYMENT INTERFACE (UPI) This document lays out the “Terms and Conditions”, which shall be applicable to all transactions initiated by the User vide the Unified Payment Interface, as defined herein below, through Canara Bank. Before usage of the “Unified Payment Interface”, users are advised to carefully read and understand these Terms and Conditions. Usage of the Unified Payment Interface by the user shall be construed as deemed acceptance of these Terms and Conditions mentioned herein below. Definitions: The following words and expressions shall have the corresponding meanings wherever appropriate. Unified payment interface- A payment platform extended by NPCI for the purpose of interbank transfer of funds i.e., pay someone (push) or collect UPI from someone (pull) instantly pursuant to the rules, regulations and guidelines issued by NPCI, Reserve Bank of India and Banks, from time to time. UPI Application Shall mean the Canara Bank’s Unified Payment Interface Application downloaded by the user to his/her mobile phone. Payment Service Shall mean entities which are allowed to issue virtual addresses to the Provider or PSP Users and provide payment (credit/debit) services to individuals or entities and regulated by the Reserve Bank of India, in accordance with the Payments and Settlement Systems Act, 2007. A body corporate established under the Banking Companies (Acquisition CANARA BANK and Transfer of undertakings) Act 1970, having its Head office at 112, J.C. Road, Bangalore – 560 002 (hereinafter termed as "PSP") which expression shall, unless repugnant to the context or meaning thereof, shall include its successors and permitted assigns. -

February 17, 2020

February 17, 2020 The Manager, Listing Department The General Manager The National Stock Exchange of India Ltd. The Bombay Stock Exchange Limited Exchange Plaza Listing Department Bandra Kurla Complex 15th Floor, P J Towers Bandra (E) Mumbai-400 051 Dalal Street, Mumbai-400 001 NSE Trading Symbol- DEN BSE Scrip Code- 533137 Dear Sirs, Sub.: Media Release titled “Scheme of Amalgamation and Arrangement amongst Network18, TV18, Den & Hathway” Dear Sirs, Attached is the Media Release being issued by the Company titled “Scheme of amalgamation and Arrangement amongst Network18, TV18, Den & Hathway”. You are requested to take the above on record. Thanking You, FCS No. :6887 MEDIA RELEASE Scheme of Amalgamation and Arrangement amongst Network18, TV18, Den & Hathway Consolidates media and distribution businesses of Reliance Creates Media & Distribution platform comparable with global standards of reach, scale and integration News Broadcasting business of TV18 to be housed in Network18 Cable and Broadband businesses of Den and Hathway to be housed in two separate wholly-owned subsidiaries of Network18 February 17, 2020: Reliance Industries (NSE: RELIANCE) announced a consolidation of its media and distribution businesses spread across multiple entities into Network18. Under the Scheme of Arrangement, TV18 Broadcast (NSE: TV18), Hathway Cable & Datacom (NSE: HATHWAY) and Den Networks (NSE: DEN) will merge into Network18 Media & Investments (NSE: NETWORK18). The Appointed Date for the merger shall be February 1, 2020. The Board of Directors of the respective companies approved the Scheme of Amalgamation and Arrangement at their meetings held today. The broadcasting business will be housed in Network18 and the cable and ISP businesses in two separate wholly owned subsidiaries of Network18. -

FAQ 1. What Is Sovereign Gold Bond (SGB)? Who Is the Issuer

स륍मान आपके वि�िास का HONOURS YOUR TRUST (Government of India Undertaking) FAQ 1. What is Sovereign Gold Bond (SGB)? Who is the issuer? SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India. 2. Why should I buy SGB rather than physical gold? What are the benefits? The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc. 3. Are there any risks in investing in SGBs? There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for. 4. Who is eligible to invest in the SGBs? Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities, charitable institutions, etc. -

State Bank of India – the Nation's Most Trusted Bank

Press Release – For Immediate Release State Bank of India – the Nation’s Most Trusted Bank Brand Finance launches banking market research on India’s bank brands Indian banks enjoy an average trust score of 69.8% compared to 64.9% recorded by US banks State Bank of India is the nation’s most trustworthy bank with a score of 86.4% Over 50% of customers of the Oriental Bank of Commerce and the UCO Bank 'very likely' to switch to competition Brand Finance conducted research on bank brands in 22 markets to see how customers’ opinions have changed in an era of major disruption to the industry. As global banks retreated after the Great Recession, the traditional banking model has changed. The prevailing trends suggest fintechs and niche “challenger banks” are biting into banks’ profits and luring their customers away with better quality service at lower prices. Traditional banks tend not to be set up as quick innovators. Instead, they compete for customers’ trust and our research indicates which banks are the most trustworthy. State Bank of India was deemed the most trusted bank in the country with a trust level of 86.3% as well as the most popular bank among those customers that were looking to switch to competition with 21.4% declaring they would choose the brand over others. State Bank of India is the country’s largest commercial bank in terms of assets, deposits, branches, number of customers and employees. On the opposite end of the ranking, over 50% of customers of the Oriental Bank of Commerce and the UCO Bank were 'very likely' to switch to competition. -

Government of India Ministry of Heavy Industries and Public Enterprises Department of Public Enterprises

GOVERNMENT OF INDIA MINISTRY OF HEAVY INDUSTRIES AND PUBLIC ENTERPRISES DEPARTMENT OF PUBLIC ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 1428 TO BE ANSWERED ON THE 11th FEBRUARY, 2020 ‘Job Reservation for SCs, STs and OBCs in PSUs’ 1428. SHRI A.K.P. CHINRAJ : SHRI A. GANESHAMURTHI : Will the Minister of HEAVY INDUSTRIES AND PUBLIC ENTERPRISES be pleased to state:- (a) whether the Government is planning to revamp job reservations issue for Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in State-run companies following sharp fall of employment opportunities to them consequent upon disinvestment in all the Public Sector Enterprises (PSEs); (b) if so, the details thereof; (c) whether it is true that the Department of Investment and Public Asset Management (DIPAM) is examining the issue of job reservations for SCs, STs and OBCs in State run companies following disinvestment and if so, the details thereof; (d) the total disinvestment made in various PSEs company and category-wise during the last three years along with the reasons for disinvestment; (e) the total number of SCs, STs and OBCs presently working in various PSEs company and category-wise; and (f) the total number of SCs, STs and OBCs who lost their jobs in these companies during the said period? ANSWER THE MINISTER FOR HEAVY INDUSTRIES & PUBLIC ENTERPRISES (SHRI PRAKASH JAVADEKAR) (a to d): Job reservation is available to Scheduled Castes (SCs), Scheduled Tribes (STs) and Other Backward Classes (OBCs) in Central Public Sector Enterprises (CPSEs) as per the extant Government policy. The Government follows a policy of disinvestment in CPSEs through Strategic Disinvestment and Minority Stake sale. -

Ankur Sangal Principle Associate Ashoka Estate, 12Th Floor 24 Barakhamba Road New Delhi 110 001, India T

Ankur Sangal Principle Associate Ashoka Estate, 12th Floor 24 Barakhamba Road New Delhi 110 001, India T: +91 11 4151 5454 F: +91 11 4151 5318 E: [email protected] Practices: Ankur handles Intellectual Property Rights Litigation and Prosecution. Ankur’s fora of practice include Supreme Court of Intellectual Property Right India, High Courts, District Courts, Intellectual Property Appellate Board and Copyright Board. He also advises our various clients on advertisement and media laws. He is also involved in domain Education: dispute matters at the UNDRP level as well as at INDRP level. He also advises our clients with regard to their disputes before the LL.B., (Hons), IP University, Delhi Advertisement Standard Council of India (ASCI). (2010) Diploma in Intellectual Property Right IP Contentious Diploma in Cyber Law • • Represented various FMCG companies, including Hindustan Unilever Limited, GlaxoSmithKline Consumer Healthcare Professional Affiliations: Limited, Mondelez Foods India Limited (Cadbury), United Breweries Holdings Limited, Emami Limited, Neo Foods Bar Council of Delhi India Private Limited, Gujarat Co-Operative Milk Marketing Federation Limited (Amul), before various tribunals, Delhi High Court Bar Association including Supreme Court, Delhi High Court and District Courts, with regard to their trade mark and corporate name disputes. Represented• various companies including Greenlight Planet India Limited, Woman Care Global with regard to their design contentious disputes. • Represented various pharmaceuticals companies, including Lupin Pharmaceuticals Limited, Hetero Drugs Company Limited, Ranbaxy Laboratories Limited, Alembic Pharmaceuticals Limited, Yash Pharmaceuticals Limited and Albert David Limited, before various tribunals, including Trade Mark Authorities, District Courts and High Court, with regard to their trade mark contentious disputes.