1 | Page December 9, 2014 Project Backgrounder Enbridge's Move To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

URBAN DESIGN BRIEF Submitted To: Submitted By: 108 STREET & JASPER AVENUE URBAN DESIGN BRIEF TABLE of CONTENTS

108 Street and Jasper Avenue INFORMAL PRESENTATION TO EDC & URBAN DESIGN BRIEF Submitted to: Submitted by: 108 STREET & JASPER AVENUE URBAN DESIGN BRIEF TABLE OF CONTENTS 1.0 PROJECT OVERVIEW 1 INSPIRATION 38 OWNERSHIP GROUP 2 4.0 DESIGN INTENT & RESPONSE TO URBAN DESIGN PROJECT TEAM 3 PRINCIPLES 39 INTRODUCTION 4 SITE DESCRIPTION 5 DESIGN OVERVIEW 7 2.0 CONTEXT ANALYSIS 9 SITE IMAGES 10 CAPITAL BOULEVARD 12 JASPER AVENUE 13 LAND USE, FUNCTION, AND CHARACTER 14 ACCESSIBILITY AND CONNECTIVITY 16 URBAN PATTERN 18 BUILT FORM 19 VISUAL QUALITY AND LEGIBILITY 20 3.0 PROPOSED DESIGN 25 PROPOSED DESIGN 27 BUILDING USES 28 SITE PLAN 29 ELEVATIONS 30 ELEVATIONS 32 KEY FEATURES 35 108 STREET & JASPER AVENUE URBAN DESIGN BRIEF i ii 108 STREET & JASPER AVENUE URBAN DESIGN BRIEF 1.0 PROJECT OVERVIEW 108 STREET & JASPER AVENUE URBAN DESIGN BRIEF 1 Page 1 OWNERSHIP GROUP Pangman Development Corporation John Day Developments - John Day is Maclab Development Group is an Probus Project Management is an is an Edmonton-based real estate an Edmonton-born lawyer and local Alberta based development company Edmonton based firm committed to development corporation. Pangman developer with a deep affection where success is long-term. We see project management excellence doesn’t just build buildings. We create for the city, and the projects he ourselves as neighbours developing and bringing integrity to each project innovative spaces that improve undertakes reflect that sentiment. neighbourhoods. As a family-owned while providing innovative and people’s lives. Spaces that honour Recently, John, with Pangman company, our values and our creative solutions based on life cycle the ground they sit on and make Development Corporation acting commitment to our community are performance and sustainability. -

Real Estate Terminology Matching Exercise in Your Groups Please Match the Following Terms to the the Best Possible Definition

APPENDIX Real Estate Terminology Matching Exercise In your groups please match the following terms to the The best possible definition. terms for #27 are provided next to mortgage terms. Terms: Business Taxes, Return on Investment (ROI), Net Rent, Anchor, Gross Building Area (GBA), Density, Annual Debt Service, Term, Capitalization and Capitalization Rate, Vacancy, Net Effective Rent , Market Value, Common Area, Common Area & Maintenance Costs (CAM), Common Retail Unit (CRU), Tenant Improvements (TI’s), Occupied Space, Debt, Discounting and Discount Rate, Renewal, Efficiency, Equity, Operating Costs, Return on Equity (ROE), Floor Area Ratio (FAR), Gross Rent, Gross Rent Multiplier (GRM), Interim Financing, Internal Rate of Return (IRR), Inducements, Lead Tenant, Rent Step, Leverage, Loan to value ratio (LTV), Management Costs, Property Taxes, Market Rent, Mortgage, Net Absorption, Net Absorption Rate, Net Operating Income, Net Present Value, Net Rentable Area, Occupancy Rate, Percentage Rent, Vacancy Rate, Sub-lease Space, Site Area 1. A large (usually retail) tenant that often pays less rent, but is used to attract other retail tenants to the complex. 2. Is the annual periodic payment of interest and principal required to amortize a mortgage loan (sometimes referred to as the carrying charge). 3. A municipal tax that is charged directly to tenants. In Calgary, it is based upon a percentage of net rent. 4. This is calculated by dividing the net operating income by the sale price. This is often used an expression of expected risk and return. The market value of a property can be estimated by dividing its net operating income by this. 5. The non-rentable areas of a building, including lobbies, hallways, elevators, stairs, loading and parking facilities, maintenance and operational areas. -

Market Index Uniflex 10%

Investment and retirement 5% 10% Market Index Uniflex 10% 25% Main Product Features 25% 6-year term (not redeemable before maturity) Guarantee of principal on maturity of 100% Low management fees of 1% per year 10% 15% $500 minimum deposit An easy way to diversify Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Even under a scenario where the return of each share is negative, this product may produce a global positive return Sector diversification of the Market Index Uniflex How it works On the settlement date, a starting level will be determined for each Canadian share included in the portfolio. On the maturity date, a ratio of the closing level over the starting level for each share will be computed. The 8 best performing shares during the 6-year term will be automatically assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) Exposure to 20 Canadian companies included in the S&P/TSX 60 Index Company Sector Company Sector Metro Inc. Scotiabank Consumer staples Loblaw Companies Limited The Toronto-Dominion Bank Royal Bank of Canada Financial services Bank of Montreal Enbridge Inc. Sun Life Financial Inc. TransCanada Corporation Cenovus Energy Inc. Energy Canadian Natural Resources Limited Canadian National Railway Industrials Suncor Energy Inc. -

ANNUAL INFORMATION FORM for the YEAR ENDED DECEMBER 31, 2015 February 19, 2016

ENBRIDGE INC. ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2015 February 19, 2016 Enbridge Inc. 2015 Annual Information Form TABLE OF CONTENTS DOCUMENTS INCORPORATED BY REFERENCE As of the date hereof, portions of the MD&A and the audited consolidated financial statements of Enbridge as at and for the year ended December 31, 2015, as filed with the securities commissions or similar authorities in each of the provinces of Canada, as detailed below, are specifically incorporated by reference into and form an integral part of this AIF. These documents are available on SEDAR which can be accessed at www.sedar.com. Page Reference From Annual Financial AIF Statements MD&A GLOSSARY ................................................................................................... 1 PRESENTATION OF INFORMATION ........................................................... 4 12 FORWARD-LOOKING INFORMATION .........................................................5 CORPORATE STRUCTURE ......................................................................... 6 GENERAL DESCRIPTION OF THE BUSINESS ............................................ 7 1-2, 14-19 GENERAL DEVELOPMENT OF THE BUSINESS ....................................... 10 2-4, 8-9, 16-21, 23-39, 59-60, 67-69, 73-74 LIQUIDS PIPELINES ................................................................................... 16 1, 40-52 GAS DISTRIBUTION ................................................................................... 17 1, 52-55 GAS PIPELINES, PROCESSING AND ENERGY SERVICES -

Top News Before the Bell Stocks To

TOP NEWS • A hunt for any storage space turns urgent as oil glut grows With oil depots that normally store crude oil onshore filling to the brim and supertankers mostly taken, energy companies are desperate for more space. The alternative is to pay buyers to take their U.S. crude after futures plummeted to a negative $37 a barrel on Monday. • Corporate America seeks legal protection for when coronavirus lockdowns lift Major U.S. business lobbying groups are asking Congress to pass measures that would protect companies large and small from coronavirus-related lawsuits when states start to lift pandemic restrictions and businesses begin to reopen. • Teck Resources profit falls short as lockdowns, energy unit bite Teck Resources reported a much bigger-than-expected 84% plunge in quarterly profit, hit by shutdowns due to the coronavirus outbreak and weak performance in its energy unit. • U.S. energy industry steps up lobbying for Fed's emergency aid -letters The U.S. energy industry has asked the Federal Reserve to change the terms of a $600 billion lending facility so that oil and gas companies can use the funds to repay their ballooning debts, according to a letter seen by Reuters. • Coca-Cola sees 2nd quarter sales hit from coronavirus lockdown Coca-Cola forecast a significant hit to current-quarter results as restaurants, theaters and other venues that represent about half of the company's revenue remain closed because of the coronavirus pandemic. BEFORE THE BELL Canada's main stock index futures slid as U.S. oil futures continued to trade in the negative after their first ever sub-zero dive on Monday, furthering concerns of a global recession in the coming months. -

Q3 & Q4 Social Media Report

Q3 & Q4 SOCIAL MEDIA REPORT 2015 Twitter Activity Overview 141,819 4,439 535 ORGANIC IMPRESSIONS TOTAL ENGAGEMENTS LINK CLICKS Audience Growth AUDIENCE GROWTH, BY MONTH NEW FOLLOWER ALERTS ACTUAL FOLLOWERS GAINED 5 0 0 4 0 0 3 0 0 2 0 0 1 0 0 0 J U L A U G S E P T O C T N O V D E C 2 0 1 5 FOLLOWER METRICS TOTALS Total Followers 931 New Follower alerts 1,263 Actual Followers gained 668 People that you followed 2,004 Twitter Profiles Report | 1 of 6 Posts & Conversations MESSAGES PER MONTH RECEIVED SENT 2 0 0 1 5 0 1 0 0 5 0 0 J U L A U G S E P T O C T N O V D E C 2 0 1 5 SENT/RECEIVED METRICS TOTALS The number of messages you sent increased by Tweets sent 881 260.8% Direct Messages sent 3 since previous date range Total Sent 884 The number of messages you Mentions received 280 received increased by Direct Messages received 33 206.9% since previous date range Total Received 313 Twitter Profiles Report | 2 of 6 Your Content & Engagement Habits SENT MESSAGE CONTENT YOUR TWEETING BEHAVIOR 64% 341 CONVERSATION PLAIN TEXT 36% UPDATES 881 228 T W E E T S S E N T PAGE LINKS 45% NEW CONTACTS 312 55% PHOTO LINKS EXISTING CONTACTS Twitter Profiles Report | 3 of 6 Audience Engagement ENGAGEMENT COUNT REPLIES RETWEETS FAVORITES TWEETS SENT 2 0 0 1 5 0 1 0 0 5 0 0 J U L A U G S E P T O C T N O V D E C 2 0 1 5 ENGAGEMENT METRICS TOTALS The number of engagements increased by Replies 137 388.3% Retweets 257 since previous date range Retweets with Comments 15 Favorites 826 The number of impressions per Engagements per Follower 4.8 Tweet increased by Impressions per Follower 152.3 50.2% since previous date range Engagements per Tweet 5.0 Impressions per Tweet 161.0 Engagements per Impression 3.1% Twitter Profiles Report | 4 of 6 Audience Demographics FOLLOWERS BY AGE FOLLOWERS BY GENDER 18-20 21-24 51% 25-34 FEMALE FOLLOWERS 35-44 45-54 49% 55-64 MALE FOLLOWERS 65+ Women between ages of 25-34 appear to be the leading force among your recent followers. -

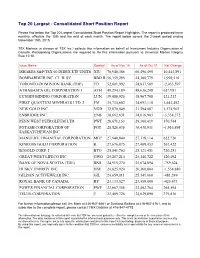

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Enbridge 2012 Corporate Social Responsibility Report Social

ENBRIDGE 2012 CORPORATE SOCIAL RESPONSIBILITY REPORT SOCIAL PERFORMANCE ENBRIDGE 2012 CORPORATE SOCIAL RESPONSIBILITY REPORT TABLE OF CONTENTS ABOUT ENBRIDGE .............................................................. 1 LA6 Percentage of total workforce represented in formal joint management-worker health and safety committees that help ABOUT THE ENBRIDGE 2012 CORPORATE SOCIAL monitor and advise on occupational health and safety RESPONSIBILITY REPORT ................................................. 2 programs. ............................................................................... 43 FORWARD-LOOKING INFORMATION ................................ 3 LA7 Rates of injury, occupational diseases, lost days and absenteeism, and number of work-related fatalities by region AWARDS AND RECOGNITION ............................................ 4 and by gender. ....................................................................... 44 STRATEGY AND PROFILE ................................................. 5 LA8 Education, training, counseling, prevention and risk- control programs in place to assist workforce members, their ORGANIZATIONAL PROFILE ............................................ 5 families or community members regarding serious diseases. REPORT PARAMETERS .................................................. 6 ................................................................................................ 44 GOVERNANCE, COMMITMENTS AND ENGAGEMENT ... 12 LA9 Health and safety topics covered in formal agreements with trade unions. .................................................................. -

Mining, Energy & Manufacturing Spring 2021

SPRING 2021 Mining, Energy & Manufacturing Monday, May 31, 2020 • Page B13 The Vaderstad facility at Langbank where 60 new production staff and a second shift will be added to meet growing demand. Vaderstad adding to staff to meet growing demand BY KEVIN WEEDMARK this plant but it doesn’t amount to a whole lot today,” he “We always say draw a 50 km circle around the plant Vaderstad is undergoing a major ramping up of produc- says. “So it’s mostly Canada. Our distribution footprint and that’s really our catchment area,” he says. tion, adding 60 production employees and a second pro- grew over the course of the last little while, so that cer- Wasylyk says one of the biggest challenges of having to duction shift at its Langbank production facility, which tainly helped, but I think the real reason is that it is a qual- EULQJSHROSHLQIURPRXWRIDUHDLVÀQGLQJHQRXJKKRXV- manufactures tillage, drilling and planting machinery for ity machine and performs well, in the Western Canadian ing for them in the local area. WKHDJLQGXVWU\$GGLWLRQDOVXSSRUWVWDͿZLOOEHDGGHGDW conditions in particular.” “That’s probably one of the major challenges quite hon- the Langbank facility as well. +HVD\VRIWKHQHZSURGXFWLRQVWDͿ9DGHUVWDGZLOO estly,” he says. “You’re trying to recruit people of course, Jason Wasylyk, Director of Operations for Vaderstad, be looking for people with a variety of skillsets. but then you’ve got to put them somewhere and it’s not which employs 200 people in Canada, says production is “Welders, painters, assemblers, warehouse folks, ship- always that easy. It might be the biggest challenge. There ramping up because of booming sales. -

Enbridge's Energy Infrastructure Projects

Enbridge’s Energy Infrastructure Projects Last Updated: Aug. 4, 2021 Energy Infrastructure Projects Table of Contents Crude Oil and Liquids Pipelines .................................................................................................... 3 Natural Gas Transmission Pipelines ............................................................................................. 4 Natural Gas Distribution .............................................................................................................. 12 Offshore Projects ........................................................................................................................ 14 Power Generation ....................................................................................................................... 15 Power Transmission ................................................................................................................... 16 Wind Energy ............................................................................................................................... 17 Page 2 of 19 Energy Infrastructure Projects Crude Oil and Liquids Pipelines Line 3 Replacement Program Construction of the $5.3-billion Canadian portion of the Line 3 Replacement Program is complete and began commercial service in December 2019. The $2.9-billion U.S. portion of the Line 3 Replacement Program, known as the Line 3 Replacement Project, consists of replacing existing 34-inch pipe with new 36-inch pipe for 13 miles in North Dakota, 337 miles in Minnesota, and -

Q1 2015 BTY.COM 3 Canada: a Continuing Success Story OVERVIEW More People, More Investment, More Projects

Market Q1 Intelligence 2015 Report Oil price bust is a boon to other sectors BTY.COM Contents 5 Overview 5 Escalation Summary 6 Regional Snapshots 6 Ontario 8 British Columbia 10 Alberta 12 Saskatchewan 14 Quebec 16 Manitoba 17 Atlantic Region 18 United States 20 Cost Data Parameters Comparison FEATURED STORIES 4 Canada: a continuing success story 5 More people, more investment, more projects 9 Taller wood buildings gain ground across Canada 11 Major mining prospects north (and south) of 60 13 Mobility is key for meeting labour demand 15 Making the most of modular construction 19 U.S. has potential to become world’s largest market for P3 projects 2 BTY Group Market Intelligence Report - Q1 2015 BTY.COM 3 Canada: a continuing success story OVERVIEW More people, more investment, more projects Joe Rekab Toby Mallinder Gord Smith Managing Partner Partner Partner WELCOMING 2015 WITH CONFIDENCE EXPORTING OUR EXPERTISE CELEBRATING P3 ACCOMPLISHMENTS A lower oil price notwithstanding, housing starts reflect the steady influx: 2015 Escalation the continuing flow of people to, and 189,000 units in 2014 and 189,500 in 2015. It’s an ill wind that blows no good – so goes Resurgent U.S. and overseas economies The continuing success of the Canadian investment in Canada will help keep Summary the old saying. The drop in the price of oil are also creating opportunity for the construction industry is due in no small workloads stable in 2015. Sustained Construction will remain strong in BC, may be painful for oil producing provinces, Canadian construction industry. Many of measure to the projects procured using investment in the energy sector in while activity levels settle back from Downward pressure is but it is blowing plenty of good across other Canada’s leading builders have taken on the P3/AFP models. -

THE FUTURE of RETAIL in DOWNTOWN EDMONTON DOWNTOWN BUSINESS ASSOCIATION of EDMONTON 10121 Jasper Ave NW Edmonton, AB T5J 4X6

2018 THE FUTURE OF RETAIL IN DOWNTOWN EDMONTON DOWNTOWN BUSINESS ASSOCIATION OF EDMONTON 10121 Jasper Ave NW Edmonton, AB T5J 4X6 www.edmontondowntown.com To Support, Connect, and Enrich Edmonton’s Downtown Community REPORT RESEARCHED AND WRITTEN BY: Mohammed Siddique Photo Credit: Jeff Wallace CONTENTS 2 Introduction 3 Methodology 01. BACKGROUND 4 History of Shopping 5 Shifts in the Customer Shopping Habits 02. DOWNTOWN PROFILE 8 Downtown Profile 11 Retail in Downtown 03. SURVEY & ANALYSIS 14 Survey & Analysis 04. STRATEGIES FOR RETAIL 28 Strategies for Retail 30 Popular Retail Streets in Canada 32 Key Takeaways 34 Think Residential DOWNTOWN BUSINESS ASSOCIATION 2018 REPORT 1 INTRODUCTION The Downtown Business Association (DBA) of Edmonton is proud to be providing value to our members and wants to ensure that we continue channelling our efforts to make Downtown more vibrant and inviting. Every year since 2004, the DBA has compiled a report on a topic of relevance to Edmonton’s Downtown business community. In this year’s report, we discuss the changes OBJECTIVE in consumer shopping habits and analyze The Future of Retail and a growing the preferences of consumers for shopping Downtown, the theme outlined here is in Downtown Edmonton. We also discuss the based on an assessment of the current factors that affect consumer shopping and retail landscape in Downtown Edmonton. how we can better prepare for the population The objective of the report is to study the infill that will be happening Downtown over the Downtown neighbourhood, consumer next 5-10 years to increase the quality of living preferences and shopping habits of the in the Downtown neighbourhood.