SECTOR UPDATE REPORT MNC Sekuritas Research Division September 22, 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Factors Influences Farmers Desire to Agricultural Land Conversion in Indonesia Using Structural Equation Model Analysis

International Journal of Engineering & Technology, 8 (1.10) (2019) 71-74 International Journal of Engineering & Technology Website: www.sciencepubco.com/index.php/IJET Research paper Factors Influences Farmers Desire to Agricultural Land Conversion in Indonesia using Structural Equation Model Analysis Yogi Makbul1, Sudrajati Ratnaningtyas2, Pradono3 1,2,3 Institut Teknologi Bandung Abstract The objective of this research is to know what factors can influence the farmers to convert his farmland for the purpose of land conversion near the trans-Java toll road. The research uses a survey on Gantar and Terisi District in Indramayu Regency, West Java Province, Indonesia. A sample of 408 farmers from ten farmer-groups has been drawn using the cluster method. The Structural Equation Method (SEM) has been used in the statistical analysis. The dependent variable is the farmer’s desire to convert his farmland. The independent variables are three latent variables with 11 observed variables. The latent variables are location, agricultural environment, and lifestyle perception. The findings of this research are unique, and novel compared to other researches on agricultural land conversion. The uniqueness and novelty of this research is that first, it finds the internal factors why farmers convert their farmland. Second, this research uses the quantitative method with SEM analysis in farmland conversion. The SEM is commonly used in management research. Third, the finding of the research is essential for food security in Indonesia because the research has been conducted on Java Island. Java Island is the most strategic area for rice production in Indonesia. The island comprises only 6.8 percent of Indonesian land area but produces more than 50 percent of the rice. -

Study About Factors Influencing Transition of Green Open Spaces Based on Analysis of Land Use in Depok City, West Java, Indonesia

3rd International Symposium for Sustainable Landscape Development (ISSLD 2017) IOP Publishing IOP Conf. Series: Earth and Environmental Science1234567890 179 (2018) ‘’“” 012035 doi :10.1088/1755-1315/179/1/012035 Study about factors influencing transition of green open spaces based on analysis of land use in Depok City, West Java, Indonesia M Matsuda1*, N Nasrullah2, and B Sulistyantara2 1 Graduate School of Horticulture, Chiba University 2 Department of Landscape Architecture Faculty of Agriculture, Bogor Agricultural University *E-mail: [email protected] Abstract. Most green open spaces in Jakarta, the capital city of Indonesia, are susceptible to conversion into urban use. In Jakarta, land development is progressing to the point where there is no room for additional land development, resulting in a shift to land development in other cities, especially the urban areas surrounding Jakarta, Jabodetabek. This study focused on land development in Depok City located south of Jakarta. Depok is influenced strongly by land development in Jakarta, and further economic growth is expected. The purpose of this study is to reveal the changes in the area of green open spaces to investigate the transition of green open spaces in Depok and to identify the factors influencing the transition of green open spaces in Depok. ERDAS 9.1 Software was used to analyze the changes in the area of green open spaces in 1995–2015. To identify the factors influencing the transition of green open spaces, binomial logistic regression analysis was used. It was revealed that the area of green open spaces has rapidly decreased from 2005 (9789.28Ha) to 2015(5157.80Ha) in Depok. -

Pdf | 151.36 Kb

Emergency Situation Report # 2 20 February 2007 Storm and Tornadoes in Yogyakarta Province, Republic Indonesia, February 2007 Reporting date and time Tuesday, 20 February 2007, 16:00 WIB (09:00 GMT) Type of Emergency Seasonal storm and tornadoes. Date of Emergency Incidence Heavy rain in Yogyakarta occurred on Sunday, 18 February 2007, 17:00 local time (Indonesia local time is equal to +7 hours GMT) Location The typhoons hit Gondokusuman, Umbulharjo, Danurejan and Pakualaman Subdistrict, Yogyakarta Municipality, Yogyakarta Province. Below is the map of Yogyakarta and Central Java Province. Disaster Location Below is the list of typhoons that hit Indonesia from January 2007: No Date Location Province Casualties and Impact (Toll) 56 houses; 1 3 Jan Simbang and Bantimurung Districts South Sulawesi 2 rice hulling factories Lainea District, Konawe Selatan Southeast 210 houses; 2 17 Jan Regency Sulawesi 2 people injured Parungkuda and Kadudampit 3 25 Jan West Java 165 houses District, Sukabumi Regency 4 29 Jan Pasirwangi District, Garut West Java 101 houses 1,173 houses and public facilities; 5 18 Feb Yogyakarta Municipality Yogyakarta 1000 people displaced; 57 people injured 3 cars; 6 18 Feb Cinere, Bogor District West Java tens of trees collapsed; 6 houses, 7 18 Feb Pamulang, Tangerang District Banten 20 trees collapsed - 59 people injured; - 1,000 people displaced; - 1,711 houses and public facilities; Total - 2 rice hulling factories; - 3 cars; - tens of trees collapsed; 1 Emergency Situation Report # 2 20 February 2007 Current Situation 1. Coordination meeting - Coordination meeting is handled by Municipal Health Office with involvement from all affected Puskesmas, Sardjito hospital, private hospitals, WHO and NGOs - Head of Municipal Health Office declared that acute emergency phase has been over. -

Floods in North Sumatera, West Java, Bengkulu and DKI Jakarta Provinces

Information bulletin Indonesia: Floods in North Sumatera, West Java, Bengkulu and DKI Jakarta provinces Glide n° FL-2019-000182-IDN Date of issue: 2 January 2020 Date of disaster: 28 December 2019 – now Point of contact: Arifin M. Hadi, PMI Head of Disaster Management Heather Fehr, IFRC Disaster Risk Management Delegate Operation start date: 28 December 2019 Category of disaster: Yellow Host National Society: Indonesian Red Cross (Palang Merah Indonesia) Number of people affected: approximately Number of people to be assisted: TBC (assessment is 10,000,000 affected, 31,232 IDP and 16 deaths ongoing) This bulletin is issued for information only and reflects the current situation and details available at this time. The Indonesian Red Cross – Palang Merah Indonesia (PMI), with the support of the International Federation of Red Cross and Red Crescent Societies (IFRC), are continuing to monitor and respond to the situation with local and national resources. If required, additional financial resources will be sought via the relevant IFRC international disaster response mechanism. The situation Torrential rainfall from Tuesday, 31 December 2019, until Wednesday, 1 January 2020 morning triggered floods in Jakarta (all five municipalities: North, West, East, Central and South), West Java (districts of West Bandung, Karawang, Bogor, Bekasi and Bekasi City) and Banten Province (district of Lebak, South Tangerang, and Tangerang City). The Indonesian National Board for Disaster Management, locally known as Badan Nasional Penanggulangan Bencana (BNPB), reported that the flooding spots has reached 268, while in Jakarta alone 158 flooding spots are identified. The most affected area in Jakarta is East Jakarta with 65 flood spots. -

Jasa Marga Update Fy2020holders Meeting 1 August 2019 Company Overview

Jasa Marga Update FY2020holders Meeting 1 August 2019 Company Overview 2 Company Highlights Brief Snapshot Company Highlights • Leading toll road operator in Indonesia with more than 40 years of • Largest toll road operator in Indonesia with 67% market share in experience. term of operated commercial toll roads lengths (± 1,191 km). • 34 toll road concessions with total length of 1,603 km. • The longest concession period holder in Asia reflecting stable • 70% shares owned by the Government of Indonesia. income. • Listed on the Indonesia Stock Exchange since 2007, with a market cap • Strategically important with strong government ownership. Rp33.6 trillion as of 30th December 2020. • Resilient industry with strong government focus. • Key business • Strong financial profile with promising growth going forward. • Construction, operation and maintenance of toll road • Supporting business / other business • Toll Road Operation Services (Provides operation services for Jasa Marga Group and other toll road investors) Vision & Mission • Toll Road Maintenance Services (Provides maintenance services for Jasa Marga Group and other toll road investor) To be the largest, trusted and sustainable national toll Vision road network company. • Prospective Business (Manages rest areas and other properties on toll road corridors) FY2020 Revenue Breakdown 1. Lead toll road business along the end-to-end value chain professionally and continuously to improve National connectivity Toll Revenue – Other Business Subsidiaries Revenue 2. Optimize regional development for community 17% 9% progress Mission 3. Increase value for shareholders.. 4. Enhance customer satisfaction through service excellence Toll Revenue – Jasa 5. Encourage the development and enhancement of Marga employee performance in a harmonious (13 old concessions environment. -

Company Update

COMPANY UPDATE 1 April 2021 CORPORATE STRUCTURE OF WASKITA GROUP Waskita Group, which has vertically integrated business lines, has supported PT Waskita Toll Road (WTR), particularly with the capability and extensive experience in the field of construction and precast concrete. Waskita is one of the leading construction companies in Indonesia. ▪ Waskita has more than 50 years experience in construction business with proven track records. 99.99% 81.475% 59.99% 99.99% ▪ Selected Waskita projects : Bali – Benoa Gempol – Mandara Toll Road Toll Road Pasuruan Toll Road WBP is supplying precast concrete to support the WBP has business activities in the field of execution of Waskita’s projects, including WTR toll roads, marketing, production, design, development and hence the quality of concrete can always be maintained. expedition of precast. ▪ Currently, WBP is one of the biggest precast and WTR collaborates with Waskita, as the contractor readymix concrete manufacturing in Indonesia. of the projects, which ensures the projects ▪ WBP has 11 concrete plants with the production completion time and quality. capacity of 3.25 million tons every year. ▪ Selected WBP Projects: Enhancing WTR's ability to complete the project on schedule with the best quality Nusa Dua – Gempol– Gempol – Ngurah Rai Toll Porong Toll Pasuruan Toll 2 Overview of PT Waskita Toll Road (“WTR”) Currently, WTR owns 15 toll roads, of which 13 toll roads are already in operation and when all of the projects are completed, it will become a leading toll road company with a total length of +771,27 km.* CORPORATE STRUCTURE* Transjava Sumatera Area 40.00% 39.50 % 60.00% 30.00% 98.18% PT Waskita Toll Road (“WTR”), established PT PT PT PT Hutama PT on June 19, 2014 is a subsidiary of Waskita Jasamarga Waskita Pemalang Marga Waskita that focuses on investing and managing toll Semarang Trans Jawa Batang Tol Waskita Sriwijaya road in Indonesia. -

6E01563ed3 53Bf5db1cb.Pdf

DAFTAR PEMEGANG SAHAM PT Goodyear lndonesia Tbk Per 30 NOV 2018 Nama Pemegang Alamat1 Alamat2 Propinsi L / A Status Rekening No Nama Jl Pintu Kecil No.27 Roa PERUSAHAAN TERBATAS PT UOB KAY HIAN Jumlah Saham % PT KALIBESAR ASRI Malaka Tambora Jakarta L NPWP SEKURITAS 27.210.000 6,64 Jl Pintu Kecil No.27 Kel.Roa Malaka PERUSAHAAN TERBATAS PT UOB KAY HIAN 2 PT RODA EKAKARYA RT/RW 002/002 Kec.Tambora Jakarta L NPWP SEKURITAS 8.300.000 2,02 JL. AGUNG INDAH M-4 PT WATERFRONT 3 ANTON SIMON NO.8 RT/RW 015/016 Jakarta L INDIVIDUAL - DOMESTIC SEKURITAS INDONESIA 4.604.400 1,12 JL AGUNG INDAH M 4 NO RT 015/016, SUNTER 8 AGUNG, TANJUNG PRIOK Jakarta L INDIVIDUAL - DOMESTIC NET SEKURITAS, PT 4 ANTON SIMON PERUSAHAAN TERBATAS PT NIKKO SEKURITAS 2.760.600 0,67 5 PT. Kalibesar Asri Jl. Pintu Kecil No. 27 Roa Malaka Jakarta L NPWP INDONESIA 1.837.400 0,45 PT DBS VICKERS 6 KENNETH RUDY KAMON 35 LAFAYETTE PLACE A INDIVIDUAL - FOREIGN SEKURITAS INDONESIA 1.625.000 0,40 106,ROUTE DE ARLON L- 7 SSB WLGK S/A GOODHART PARTNERS HORIZON8210 MAMER, FUND-2144615378 LUXEMBOURG A INSTITUTION - FOREIGN BUT DEUTSCHE BANK AG 1.343.700 0,33 WISMA HAYAM WURUK JL. HAYAM WURUK NO. 8 PERUSAHAAN TERBATAS PT EQUITY SEKURITAS 8 PRIMA TUNAS INVESTAMA, PT. LT.9 KEBON KELAPA - GAMBIR Jakarta L NPWP INDONESIA 1.025.000 0,25 4400 ANDREWS HWY #801, MIDLAND TEXAS - PT. TRIMEGAH USA 306 WEST WALL SEKURITAS INDONESIA 9 KENNETH RUDY KAMON STREET SUITE 375 MIDLAND A INDIVIDUAL - FOREIGN TBK 875.000 0,21 Jl. -

Project Completion Report

Coordinating Ministry for Economic Affairs Republic of Indonesia JABODETABEK Urban Transportation Policy Integration Project Phase 2 in the Republic of Indonesia Annex 07: Report on TOD-Related Laws, Plans, and Regulations October 2019 Japan International Cooperation Agency (JICA) ALMEC Corporation I N J R 2 0 - 0 0 4 JABODETABEK Urban Transportation Policy Integration Project Phase 2 in the Republic of Indonesia Annex 07: Report on TOD-Related Laws, Plans, and Regulations Table of Contents Chapter 1 Review of Upper Laws, Regulations and Plans.......................................................... 1 1.1 Review of Upper Laws and Organization ........................................................................ 1 1.1.1 Development Related Laws .............................................................................................. 8 1.1.2 Spatial Planning Related Laws ....................................................................................... 12 1.1.3 Transportation Related Laws .......................................................................................... 16 1.2 Review of Development Plan Document ........................................................................ 20 1.2.1 National Mid-term Development Plan Year 2015-2019 ................................................ 20 1.2.2 Regional Mid-term Plan ................................................................................................. 21 1.2.3 Local Mid-term Plan...................................................................................................... -

The Operational Performance of School Bus in a Private School in Depok, West Java, Indonesia

THE OPERATIONAL PERFORMANCE OF SCHOOL BUS IN A PRIVATE SCHOOL IN DEPOK, WEST JAVA, INDONESIA L.S. PUTRANTOa, R. MAULANAa aCivil Engineering Department, Tarumanagara University, Jakarta, Indonesia Email: [email protected] ABSTRACT In Indonesia school transport provision is limited. Usually school transport is operated by the school management or third party. This paper discusses operational performance of school bus service in a school in Cinere, Depok, West Java consisting of play group, kindergarten and elementary/ junior high/ schools. Main users of services were younger students. School bus fleet consists of 16 minibuses serving students from wide range of residence origins. The service considers shortest route, travel time and number of students to be serviced in the fleet management. It becomes more complex because school time is varied between education levels, especially driving home schedule. Observations were made on four routes. A surveyor followed each bus and recorded, travel distance, travel time, waiting time at each residence. Questionnaires were distributed to parents, asking their socio-economic data and their perceptions on the service quality. Some statistical analysis were carried out to evaluate operational performance. 1. INTRODUCTION School transport is a serious problem in Indonesia. This is not only because very limited school buses are provided, but because public transport is still very poor in terms of frequency and scope of services, safety and comfort. Therefore, in a private school, the role of management to provide school transport is very important. Usually the school transport system consists of several minibuses operated either by the school management or by the third party. -

Jabodetabek.Pdf

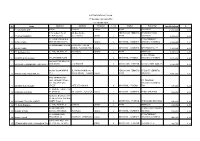

REGION KABUPATEN KECAMATAN KELURAHAN ALAMAT AGEN AGEN ID NAMA AGEN PIC AGEN JARINGAN_KANTOR JABODETABEK BEKASI BABELAN BABELAN KOTA BABELAN KOTA RT 004/001 KEL.BABELAN KOTA KEC.BABELAN 213AD0112P005029 PUTRI RAFFI CELL MARLINA PENSION BEKASI JABODETABEK BEKASI BABELAN BABELAN KOTA KP. BABELAN RT. 013/003 KEL. BABELAN KOTA KEC. BABELAN 213AM0110K010028 MARYANI MARYANI PENSION BEKASI JABODETABEK BEKASI BABELAN BABELAN KOTA KP.BABELAN NO.64 RT.021/002 KEL.BABELAN KEC.BEKASI UTARA 213AM0112K000000 ENRICO ENRICO JOHAN S PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA JL. KH TAJUDIN NO. 15 C 213AM0106P010169 WARUNG TEGAR EDI PURYANTI PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA KP. UJUNG HARAPAN RT. 001/042 KEL. BAHAGIA KEC. BABELAN 213AM0106K010030 IWAN IWAN PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA KP. UJUNG HARAPAN RT. 005/006 213AM0106P010310 WARUNG PUTRI SITI UKASAH PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA PERUMAHAN HARAPAN CITRA INSANI BLOK A 5 NO. 10 RT. 010/001 213AM0112P010147 TOKO ALWAN RIFQI ALWAN PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA RUKO CHANDRABAGA BLOK AP9 NO.7I RT.27/19 KEL.BAHAGIA KEC.BABELAN 213AD0121P005045 ANGGI COLLECTION PUDJI ASTUTI PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA UJUNG HARAPAN RT. 003/0042 KEL. BAHAGIA KEC. BABELAN 213AM0106P010024 WARUNG BU LELA NURLELA PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA UJUNG HARAPAN RT. 004/006 KEL. BAHAGIA KEC. BABELAN 213AM0106P010058 TOKO AHMAD AHMAD SALIMIN PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA UJUNG HARAPAN RT. 006/015 KEL. BAHAGIA KEC. BABELAN 213AM0106P010032 FOTOCOPY KITA MAHPUD AKBAR ILYAS PUTRA PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA UJUNG HARAPAN RT.002/014 KEL.BAHAGIA KEC.BABELAN 213AD0113P005091 AMIN BUAH EVI UTFIANTI PENSION BEKASI JABODETABEK BEKASI BABELAN BAHAGIA UJUNG HARAPAN RT.002/042 KEL. -

Kode Pos Kelurahan Kecamatan Provinsi Kota 10110 Gambir

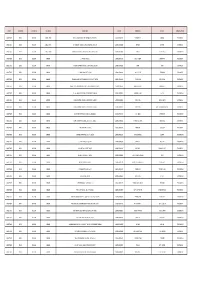

Kode Pos Kelurahan Kecamatan Provinsi Kota 10110 Gambir Gambir DKI Jakarta Jakarta Pusat 10120 Kebon Kelapa Gambir DKI Jakarta Jakarta Pusat 10130 Petojo Utara Gambir DKI Jakarta Jakarta Pusat 10140 Duri Pulo Gambir DKI Jakarta Jakarta Pusat 10150 Cideng Gambir DKI Jakarta Jakarta Pusat 10160 Petojo Selatan Gambir DKI Jakarta Jakarta Pusat 10210 Bendungan Hilir Tanah Abang DKI Jakarta Jakarta Pusat 10220 Karet Tengsin Tanah Abang DKI Jakarta Jakarta Pusat 10230 Kebon Melati Tanah Abang DKI Jakarta Jakarta Pusat 10240 Kebon Kacang Tanah Abang DKI Jakarta Jakarta Pusat 10250 Kampung Bali Tanah Abang DKI Jakarta Jakarta Pusat 10260 Petamburan Tanah Abang DKI Jakarta Jakarta Pusat 10270 Gelora Tanah Abang DKI Jakarta Jakarta Pusat 10310 Menteng Menteng DKI Jakarta Jakarta Pusat 10320 Pegangsaan Menteng DKI Jakarta Jakarta Pusat 10330 Cikini Menteng DKI Jakarta Jakarta Pusat 10340 Kebon Sirih Menteng DKI Jakarta Jakarta Pusat 10350 Gondangdia Menteng DKI Jakarta Jakarta Pusat 10410 Senen Senen DKI Jakarta Jakarta Pusat 10420 Kwitang Senen DKI Jakarta Jakarta Pusat 10430 Kenari Senen DKI Jakarta Jakarta Pusat 10440 Paseban Senen DKI Jakarta Jakarta Pusat 10450 Kramat Senen DKI Jakarta Jakarta Pusat 10460 Bungur Senen DKI Jakarta Jakarta Pusat 10510 Cempaka Putih Timur Cempaka Putih DKI Jakarta Jakarta Pusat 10520 Cempaka Putih Barat Cempaka Putih DKI Jakarta Jakarta Pusat 10530 Galur Johar Baru DKI Jakarta Jakarta Pusat 10540 Tanah Tinggi Johar Baru DKI Jakarta Jakarta Pusat 10550 Kampung Rawa Johar Baru DKI Jakarta Jakarta Pusat 10560 Johar -

Jasa Marga Update 1H2019

Jasa Marga Update 1H2019 Bondholders Meeting 1 August 2019 Company Overview Company Overview Brief Snapshot Company Highlights • Leading toll road operator in Indonesia with 40 years of experience. • Largest toll road operator in Indonesia with 67% market share in term of • 33 toll road concessions with total length of 1,527 km. operated commercial toll roads lengths (±1,041 km). • 70% shares owned by the Government of Indonesia. • The longest concession period holder in Asia reflecting stable income. • Listed on the Indonesia Stock Exchange since 2007, with a market cap • Strategically important with strong government ownership. IDR 41.5 trillion as of 28th June 2019. • Resilient industry with strong government focus. • Key business • Construction, operation and maintenance of toll road • Strong financial profile with promising growth going forward. • Supporting business / other business • Toll Road Operation Services (Provides operation services for Jasa Marga Group and other toll road investors) • Toll Road Maintenance Services (Provides maintenance services for Jasa Marga Group and other toll road investor) Vision & Mission • Related Business (Manages rest areas and other properties on toll road corridors) To be the largest, trusted and sustainable national toll Vision road network company. 1H2019 Revenue Breakdown Other Business 1. Lead toll road business along the end-to-end value Revenue chain professionally and continuously to improve 8% National connectivity Toll Revenue 2. Optimize regional development for community Subsidiaries progress 16% Toll Revenue Jasa Mission 3. Increase value for shareholders.. Marga 4. Enhance customer satisfaction through service (13 old concessions) excellence 76% 5. Encourage the development and enhancement of employee performance in a harmonious environment.