Quarterly Scheduled Banks Statistics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Size and Share of Consumer Finance Products in Bangladesh

MONTHLYMON BUSINESS REVIEW VOLVOLUME: 06 ISSUE: 08 SSEPTEMBER-OCTOBEREP 2015 Market Size and Share of Consumer Finance Products in Bangladesh 5 4 6 28 20 5% 4% 60 14 11% 3% 7 3 14 3% 147 28% 7 1% 3 8 0.0.7% 9 229 44% 2 1 MTBiz MONTHLY BUSINESS REVIEW VOLUME: 06 ISSUE: 08 SEPTEMBER-OCTOBER 2015 Contents Market Size and Share of Consumer Finance Products in Bangladesh 02 5 National News 4 6 28 The Central Bank 04 20 5% 4% Banking Industry 06 60 14 11% 3% MTB News & Events 10 7 3 14 Industryypp Appointments 14 3% 147 28% Business & Economyy 7 15 1% 3 8 0.70. % International News 9 229 44% Business & Economy 18 2 Economic Forecast 22 Wells Fargo Monthly Outlook 24 1 Developed & Published by MTB Group R&D Please send feedback to: Disclaimer: [email protected] MTBiz is printed for non-commercial & selected individual-level distribution in order to sharing information among stakeholders only. MTB takes no responsibility for any individual investment decision based on the All rights reserved @ 2015 information at MTBiz. This review is for information purpose only and the comments and forecasts are intended to be of general nature and are current as of the date of publication. Information is obtained from Design & Printing: secondary sources which are assumed to be reliable but their accuracy cannot be guaranteed. The name of Corporate Communications the other companies, products and services are the properties of their respective owners and are protected by copyright, trademark and other intellectual property laws. -

Weekly Market Update DSEX Lost 1.85% in the Week

October 21, 2018 (Week: October 21, 2018 - October 25, 2018) Dhaka Stock Exchange DSEX lost 1.85% in the week Weekly Market Update Capital Market Overview Table 1: Index The market closed negative this week. The benchmark index DSEX (-1.85%) lost 99.48 points and closed the week at 5,282.04 Index Closing Opening ∆(Pts) 31-Dec-2016 ∆% Week ∆%YTD points. The blue-chip index DS30 (-1.06%) lost 20.01 points and stood at 1,876.06 points. The shariah based index DSES (-1.59%) closed in red and stood at 1,223.79 points. DSEX, DS30 and DSES all posted negative YTD return of –15.41%, -17.83%, and – DSEX 5,282.04 5,381.52 -99.48 6,244.52 -1.85% -15.41% 12.00% respectively. DS30 1,876.06 1,896.07 -20.01 2,283.23 -1.06% -17.83% Total Turnover During The Week (DSE) : BDT 20.5 billion (USD 246.3 million) DSES 1,223.79 1,243.54 -19.75 1,390.67 -1.59% -12.00% Average Daily Turnover Value (ADTV): BDT 4.1 billion (∆% Week: -19.7%) Market P/E: 16.78x Table 2: Market Statistics Market P/B: 2.16x This Week Last Week %Change Daily Index Movement during the Week: Mn BDT 19,128,728.0 19,443,906.7 -1.6% Mcap The market performed five sessions during the week. Market opened with a negative performance by -0.94% in the first session and Mn USD 230,106.2 233,897.6 remained be negative in the second session by –1.49%. -

Final Flyer-Finlit 5.5 X

MONEY TALKS, LEARN ITS LANGUAGE FINANCIAL LITERACY ! Promote entrepreneurship and set up of enterprises Minimize the negative effect of migration: ! Lack of psychological/emotional preparation for and access to finance. ! reintegration/lack of emotional bond with the family Financial literacy is knowledge about personal Discuss family issues that drain resources and assist management of finances. It gives the twin benefits of the migrants and family in coping with negative impact ! Lack of economic opportunities in communities of origin protecting from financial frauds as well as planning for BENEFITS OF FINANCIAL LITERACY of migration on the family relations MIGRATION financially secured future. Financial literacy gives Basic financial literacy helps you become self-sufficient SETTING FINANCIAL GOAL consumers the necessary knowledge and skills required and achieve financial stability. This includes being able Migration is a way to move from one place to another in to assess the suitability of various financial products and to save money, distinguish the difference between order to live and work. Movement of people from their Financial Goal Year 10 investments available in the financial market. wants and needs, manage a budget, pay the bills, buy a home to another city, state or country for a job, residency home, pay for college and plan for retirement. Literacy or some other reasons is called migration. REASONS TO PROVIDE FINANCIAL helps you create a realistic roadmap that will take them Year 8 EDUCATION FOR MIGRANTS AND THEIR through their daily lives and make good financial SOCIAL IMPACTS OF MIGRATION FAMILIES decisions. After arriving in the host country, migrants may Year 5 experience various social issues such as difficulty in ! Maximize the benefits of better economic and Understanding your finances help reduce the risk of To Do adjusting to new work and life environment, language employment situations in the host country for the becoming a victim of fraud. -

18. Appendix-3.Indd

Appendix -3 Bangladesh: Some Selected Statistics 269 Bangladesh: Some Selected Statistics Appendix -3 Table-I Trends in Major Macroeconomic Indicators Indicators FY16 FY17 FY18 FY19R FY20P 123456 1. GDP growth (at FY06 constant market prices) 7.11 7.28 7.86 8.15 5.24 2. Growth of broad money (M2) 16.35 10.88 9.24 9.88 12.66 3. Growth of GDP defl ator (base: FY06=100) 6.73 6.28 5.60 4.46 4.51 4. CPI Infl ation Rate (12-month average) 5.92 5.44 5.78 5.48 5.65 5. Foreign exchange reserves (billion USD) 30.17 33.49 32.94 32.72 36.04 6. Net foreign assets of the banking system (billion BDT) 2331.36 2666.97 2646.74 2724.00 2973.36 7. Exchange rate (BDT/USD, Period Average) 78.26 79.12 82.10 84.03 84.78 8. REER index as of end June@ 100.00 102.48 100.69 105.70 107.63 9. Per capita GDP in BDT (at current market prices) 108378.49 122152.42 137517.83 153577.93 166888.17 (As percentage of GDP) 10. Domestic savings 24.98 25.33 22.83 25.02 25.31 11. Investment 29.65 30.51 31.23 31.57 31.75 12. Revenue income 9.98 10.18 9.62 9.91 12.45* 13. Recurrent expenditures 8.33 8.33 7.95 8.57 9.83* 14. Revenue surplus (+) / Revenue defi cit (-) 1.65 1.86 1.67 1.34 2.62* 15. -

BCBL Annual Report 2017

Annual Report 2017 Bangladesh Commerce Bank Limited evsjv‡`k Kgvm© e¨vsK wjwg‡UW Annual Report 2017 Bangladesh Commerce Bank Limited ANNAUL REPORT 2017 01 Annual Report 2017 Bangladesh Commerce Bank Limited CONTENTS Letter of Transmittal 03 Notice of the 20th Annual General Meeting 04 Vision & Mission 06 Our Strategic Priorities 07 Company Milestones 08 Corporate Directory 09 Ownership Composition 10 Composition of Board & It’s Committees 11 Director’s Profile 12 Message from the Honorable Chairman 18 Message from the Managing Director & CEO 20 Shareholder’s Information Five Years at a Glance 23 Graphical Presentation 25 Credit Ratings of BCBL 30 Value Addition Statements 31 Report of the Board Audit Committee 32 Director’s Report 34 Corporate Events 2017 40 Report on Corporate Governance 42 Corporate Social Responsibility (CSR) 52 Report of the CRO 53 Market Disclosure on Risk Based Capital under Basel-III 56 CEO’s & CFO’s Declaration to the Board of Directors 74 Our Products 75 Financial Statements of BCBL Independent Auditor’s Report 79 Consolidated Financial Statements 82 Bank’s Financial Statements 87 Notes to the Financial Statements 93 Financial Statements of CBSIL Independent Auditor’s Report 134 Financial Statements 136 Notes to Financial Statements of CBSIL 140 BCBL Network 158 Form of Proxy 163 02 Annual Report 2017 Bangladesh Commerce Bank Limited LETTER OF TRANSMITTAL All Shareholders of Bangladesh Commerce Bank Limited Bangladesh Bank Bangladesh Securities & Exchange Commission (BSEC) Registrar of Joint Stock Companies & -

Financial Statement 2018-19.Pdf

Basu Banerjee Nath & Co. A Wahab & Co. Chartered Accountants Chartered Accountants Independent Auditor's Report To the Shareholders/ Management of Probashi Kallyan Bank Report on the Financial Statements Report on the Financial Statements Opinion We have audited the financial statements of Probashi Kallyan Bank which comprise the Balance Sheet as at 30 June 2019 and Profit and Loss Account, Statement of Changes in Equity and Cash flow Statement for the year then ended, and notes to the Financial Statements, including a summary of significant accounting policies. In our opinion, the accompanying Financial Statements present fairly, in all material respects, (or give a true and fair view of) the Balance Sheet of the Probashi Kallyan Bank as at 30 June 2019 and of its financial performance for the year then ended in accordance with International Financial Reporting Standards (IFRSs) and comply with the Bank Companies Act 1991, and other applicable laws and regulations. Basis for opinion We conducted our audit in accordance with International Standards on Auditing (ISAs).Our responsibilities under those Standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are independent of the Bank in accordance with the International Ethics Standards Board for Accountants Code of Ethics for Professional Accountants (IESBA Code) together with the ethical requirements that are relevant to our audit of the Financial Statements in Bangladesh and we have fulfilled our other ethical responsibilities in accordance with these requirements and the IESBA Code. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion. -

Probashi Kallyan Bank

*l Auditors'Report And Audited Financial Statements For the vear ended June 30. 2020 eror*mnqutqtr ffiB{@ r s{rfi q1.d* ,sr1 PROBASHI KALLYAN BANK ] A. WAHAB & CO. BASU BANERJEE NATH & CO. Chartered Accountants Chartered Accountants Hotel Purbani, Annex-2 14th Floor; Dhaka Trade Center (llth Floor) 1 Dilkusha ClA, Dhaka-1000. 99rKazi Nazrul Islam Avenue Phone : 880-2-958 5626, 9 57 5293 Kawran Bazar, Dhaka-1215. Phone: 880- 02-91 267 63, 9113357 ), I Basu Banerjee Nath & Co. A. Wahab & Co. Chartered Accountants Chartered Accountants T Probashi Kallyan Bank For the year ended 30 June 2020 T Table of Contents SI. No. Particulars Paee No. I I Independent Auditors' Report t-4 2 Balance Sheet 5-6 I ., Profit & Loss Account 1 4 Statement of Changes in Equity 8 : 5 Cash Flow Statement 9 6 Liquidity Statement 10 r 1 Notes to the Accounts t1-28 8 Highlights on the overall Activities of the Bank 29 ; I 9 Fixed Asseles Schedule ( Annexure-A ) 30 I I I I I rI Il I I I t Basu Banerjee Nath & Co. A. Wahab & Co. Chartered Accountants Chartered Accountants T lndependent Auditor's Report t To the Shareholders of Probashi Kallyan Bank Report on the Financial Statements t Opinion We have audited the financial statements of Probashi Kallyan Bank which comprise the Balance Sheet as at 30 June 2020 and Profit and Loss Account, Statement of Changes in Equity and Cash Flow Statement for the year then ended, and notes to the financial statements, including a summary I of significant accounting policies. -

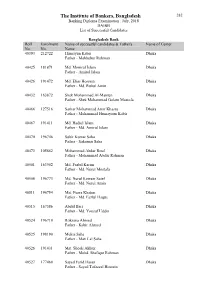

Complete DAIBB

The Institute of Bankers, Bangladesh 282 Banking Diploma Examination : July, 2018 DAIBB List of Successful Candidates Bangladesh Bank Roll Enrolment Name of successful candidates & Father's Name of Center No. No. Name 40393 212722 Humayun Kabir Dhaka Father - Mahbubur Rahman 40425 181871 Md. Monirul Islam Dhaka Father - Amirul Islam 40426 191472 Md. Elias Hossain Dhaka Father - Md. Ruhul Amin 40432 163872 Shek Mohammad Al-Mamun Dhaka Father - Shek Mohammad Golam Mostofa 40466 127516 Sarkar Mohammad Amir Khasru Dhaka Father - Mohammad Humayoun Kabir 40467 191411 Md. Hadiul Islam Dhaka Father - Md. Amirul Islam 40470 196746 Subir Kumar Saha Dhaka Father - Sukumar Saha 40473 105862 Mohammad Abdur Rouf Dhaka Father - Mohammad Abdur Rahman 40501 163902 Md. Fazlul Karim Dhaka Father - Md. Nurul Mostafa 40508 196773 Md. Nurul Kowser Saief Dhaka Father - Md. Nurul Amin 40511 196754 Mst. Fuara Khatun Dhaka Father - Md. Fazlul Haque 40515 167586 Abdul Bari Dhaka Father - Md. Yousuf Uddin 40524 196710 Roksana Ahmed Dhaka Father - Kabir Ahmed 40525 198190 Mukta Saha Dhaka Father - Mati Lal Saha 40526 191431 Mst. Sheoli Akhter Dhaka Father - Mohd. Shafiqur Rahman 40527 177460 Sayed Farid Hasan Dhaka Father - Sayed Tofazzal Hossain The Institute of Bankers, Bangladesh 283 Banking Diploma Examination : July, 2018 DAIBB List of Successful Candidates Bangladesh Bank Roll Enrolment Name of successful candidates & Father's Name of Center No. No. Name 40540 196751 Sujan Sarkar Dhaka Father - Nikhil Sarkar 40561 187460 Rowshan Ara Bithy Dhaka Father - Md. Ayub Ali 40617 196748 Md. Mahmudul Haque Bhuiyan Dhaka Father - Md. Shirajul Haque Bhuiyan 40711 165150 Md. Ayub Ali Dhaka Father - Md. Shohidul Islam 40742 157630 Faizunnessa Mousumi Dhaka Father - Farid Uddin Ahmed 40751 167554 Farhana Sultana Chowdhury Dhaka Father - Md. -

Covid-19 and Risk Involvement in the Banking Sector of Bangladesh: a Study

Original article International Journal of Research - GRANTHAALAYAH ISSN (Online): 2350-0530 June 2021 9(6), 158–167 ISSN (Print): 2394-3629 COVID-19 AND RISK INVOLVEMENT IN THE BANKING SECTOR OF BANGLADESH: A STUDY 1 2 3 Dhanonjoy Kumar , Sraboni Bagchi and Shimul Ray 1Associate Professor, Department of Management, Islamic University, Kushtia, Bangladesh 2Lecturer, Department of Tourism and Hospitality Management, Pabna University of Science and Technology, Pabna, Bangladesh 3Lecturer, Department of Human Resource Management, Islamic University, Kushtia, Bangladesh ABSTRACT Covid-19 pandemic has arrived at a widespread risky situation in our indi- vidual, inancial and communal lives. Now the whole world is thrilled by the cruel clutch of the corona virus and its victim is the global economy. The study focuses on discovering the risk involved in Covid-19 of the banking sec- tor in Bangladesh. Qualitative approach was used to attain the purpose of this study. The study revealed that Covid-19 has a countless effect on the economy and on the banking sector in Bangladesh. In the critical moment of lockdown, Bangladeshi banking sector faces huge inancial losses, increasing non-performing loans, individual investment and decreasing operating prof- Received 9 June 2021 its. Bank employees are affected seriously for performing their daily activities. Accepted 21 June 2021 Published 30 June 2021 They are passing their days with great fear. Corresponding Author Dhanonjoy Kumar, dhanonjoykum [email protected] Keywords: Covid19, Bank, Economy, Npls, Bangladesh DOI 10.29121/ granthaalayah.v9.i6.2021.4021 Funding: This research received 1. INTRODUCTION no speciic grant from any funding In March 2020 Covid-19 was conirmed to have spread in Bangladesh. -

Internship Report on General Banking Activities of Janata Bank Limited: a Study on Mohakhali Corporate Branch, Dhaka

Internship report on General Banking Activities of Janata Bank Limited: A study on Mohakhali Corporate Branch, Dhaka. Submitted to Feihan Ahsan Lecturer BRAC Business School BRAC University Submitted by Khandaker Junaed Hossain Id. 13304145 BRAC Business School BRAC University Date of Submission. 05.04.2018 i Internship Report on General Banking Activities of Janata Bank Limited Mohakhali Corporate Branch, Dhaka. ii Letter of Transmittal 5th April, 2018 To Feihan Ahsan Lecturer BRAC Business School BRAC University Subject: Submission of the internship report on “General Banking Activities of Janata Bank Limited: Mohakhali Corporate Branch, Dhaka.” Dear Sir, With due respect, I would like to say that, it’s a great pleasure to submit internship report on “General Banking Activities of Janata Bank Limited: Mohakhali Corporate Branch, Dhaka” as part of the BUS400 course. Last few months I gain several knowledge and practical experience by doing my internship. I was assigned supplementary department, where I worked on to gather information about all kind of transaction and documentation. I have attempted my best to assemble all the information identified with the topic of this paper over the most recent couple of months. Regardless of the different troubles confronted while setting up this report it was an extraordinary trial for me to work at ”Janata Bank Limited” and I truly delighted in being a piece of the gathering. Sincerely yours, Khandaker Junaed Hossain Id. 13304145 BRAC Business School BRAC University iii Acknowledgement Alhumdulillah, as a matter of first importance I need to express appreciation to the all-powerful Allah, who give me the superiority to finish this report effectively. -

Probashi Kallyan Bank

Himalayan Economics and Business Management Open Access Research Article Specialized Banks’ Performance Analysis and Impact of Bank Size: A study on Bangladesh Krishi Bank (BKB) & Probashi Kallyan Bank Md. Monzur Hossain*¹ Mst. Rinu Fatema² and Md Shafiul Hossain³ 1Lecturer, Department of Finance and Banking, Comilla University, Cumilla, Bangladesh 2Assistant Professor, Department of Tourism and Hospitality Management, Noakhali Science and Technology University, Noakhali, Bangladesh 3BBA, Department of Accounting & Information Systems, University of Dhaka, Bangladesh Abstract: The inspiration steers behind this workout is to weigh up the financial *Corresponding Author performance of Specialized Banks of Bangladesh based on their financial attributes Md. Monzur Hossain especially prioritizing the financial proportions as specialized banks are playing pivotal in financial advancement of Bangladesh. Two particular banks out of three are picked for this Article History research. This paper presents the through scrutinization of financial performance for the Received: 25.12.2020 period 2015–2019 by enacting financial proportions (ratio). The proportions which have Accepted: 12.01.2021 been taken into consideration are the bank's deposit, credits, total assets, shareholders’ Published: 20.01.2021 equity, ROE, ROD, ROA, ROI, profit margin ratio and interest income. Simple linear regression is taken to test the effect of bank size on the financial execution of these Citations: aforesaid Financial Institutions. The investigation unleashed that the banks maintaining higher deposit, credits, or assets don't generally imply that has better benefit execution. The Md. Monzur Hossain Mst. Rinu Fatema and Md Shafiul Hossain (2021); examination additionally acknowledged the two hypotheses and found that the financial Specialized Banks’ Performance performance of these banks is emphatically affected by the bank size. -

Internship Report on Uttara Bank

Internship Report On Uttara Bank Asik Rayhan Anik This report is submitted to the school of Business and Economics, United International University as a partial requirement for the degree fulfillment of Bachelor of Business Administration General Activities of Uttara Bank Submitted to: DR. SEYAMA SULTANA Associate Professor Submitted by: Asik Rayhan Anik 111 161 090 BBA in Marketing School of Business and Economics United international university Date of submission 22 October 2020 Letter of Transmittal 22 October 2020 To, DR. Seyama Sultana Associate Professor United International University United City Madani Avenue Subject: Submission of Internship Report Dear Madam, I would like to submit my Uttara Bank internship paper, which has been prepared for completing my United International University BBA curriculum. I have a corporate introduction and attempted to utilize my study experience and leanings during this tenure. While preparing this report, I had the occasion to talk about work with high authorities. I hope I can reach your expectation through this report. It will be a significant privilege for me to get input and recommendations from you for this report. Sincerely, Asik Rayhan Anik ID - 111 161 090 3 | P a g e Declaration I am Asik Rayhan Anik, a student of School of Business & Economics (Marketing) of United International University, Bangladesh, do hereby declare that the Internship Report on Uttara Bank is an original work and has not been previously submitted for any degree, diploma, title or recognition. Asik Rayhan Anik School of Business & Economics United International University 4 | P a g e Acknowledgement I thank Allah for giving me great well-being, confidence and the ability to complete the report.