Guidelines to Fill in the Nbfi Returns-1, 2 & 3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

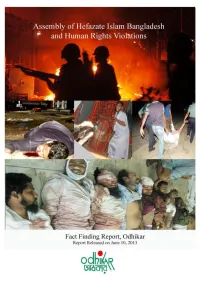

Odhikar's Fact Finding Report/5 and 6 May 2013/Hefazate Islam, Motijheel

Odhikar’s Fact Finding Report/5 and 6 May 2013/Hefazate Islam, Motijheel/Page-1 Summary of the incident Hefazate Islam Bangladesh, like any other non-political social and cultural organisation, claims to be a people’s platform to articulate the concerns of religious issues. According to the organisation, its aims are to take into consideration socio-economic, cultural, religious and political matters that affect values and practices of Islam. Moreover, protecting the rights of the Muslim people and promoting social dialogue to dispel prejudices that affect community harmony and relations are also their objectives. Instigated by some bloggers and activists that mobilised at the Shahbag movement, the organisation, since 19th February 2013, has been protesting against the vulgar, humiliating, insulting and provocative remarks in the social media sites and blogs against Islam, Allah and his Prophet Hazrat Mohammad (pbuh). In some cases the Prophet was portrayed as a pornographic character, which infuriated the people of all walks of life. There was a directive from the High Court to the government to take measures to prevent such blogs and defamatory comments, that not only provoke religious intolerance but jeopardise public order. This is an obligation of the government under Article 39 of the Constitution. Unfortunately the Government took no action on this. As a response to the Government’s inactions and its tacit support to the bloggers, Hefazate Islam came up with an elaborate 13 point demand and assembled peacefully to articulate their cause on 6th April 2013. Since then they have organised a series of meetings in different districts, peacefully and without any violence, despite provocations from the law enforcement agencies and armed Awami League activists. -

Internship Report “Trade Operations of Dhaka Bank Limited-CPC”

Internship Report on “Trade Operations of Dhaka Bank Limited-CPC” Submitted to: Dr. Suman Paul Chowdhury Assistant Professor, and Coordinator, MBA Program BRAC Business School Submitted by: Md. Neaz Hossain Department: BBS Program: BBA Student ID: 08104038 Date of Submission: 2017 Letter of Transmittal Date: 2017 Dr. Suman Paul Chowdhury Assistant Professor, and Coordinator, MBA Program BRAC Business School Subject: Submission of Internship Report Dear Sir, With due respect, I would like to inform you that I have done my internship report on Trade Operations of Dhaka Bank Limited-CPC as per your instruction. I have worked with the LC team of CPC Trade Operations for three months (from Nov 1st 2016 to Jan 31st 2017). During these three months I have learned a lot of things from the team, not only the academic requirements but also to work hard. Considering the limited time and knowledge I have gathered through work experience, I have tried to prepare an informative report explaining very basic understanding of Trade & Finance of Dhaka Bank Limited. I will be grateful if you kindly approve this effort and give me your valuable judgment upon this report. Sincerely Yours, Md. Neaz Hossain Student ID: 08104038 BRAC Business School _______________________________ Acknowledgement The number of people to whom I am grateful is way too many to count. But first, I am grateful to my Creator Allah for helping me throughout my life. Then my parents, without their love and support I wouldn’t be here. I also would like to thank all of my teachers for their effort in educating me. -

Country Wise List of Our Foreign Correspondents Sonali Bank Limited

Country wise list of our Foreign correspondents as on 31-12-2018. Prepared bv : Sonali Bank limited Foreign Remittance Management Division Head office.Dhaka. Courtesv : Sonali Bank limited (Product Development Team) Business Development Division Head office,Dhaka. E mail-dgmb ddp dt@s on aliban k. co m.b d Md Mizanur Rahman Md Zillur Rahman Sikder Senior Principal officer Senior ofl.icer Product Development Team. Product Der elopment Team. mob-01708159313. mob-019753621 15. Corp Bank Country dents as on 3ut2na18 Sl.No. Name ofCountry No. o No. of SI. No. Name ofCountry No. of No. of Corp. RMA Corn. RMA 01. Afganistan J I 45. Malaysia t2 12 02. Australia 8 7 46. Monaco I I 03. Algeria J 1 41. Malta 2 04. Argentina I Z I 48. Netherlands 8 7 , 05. Albenia i 49. New Zealand J J 06. Austria 7 6 50. Nepal 2 2 07. Balrain J J 51. Norway 2 I 08. Belgium 9 7 52. Nigeria I ) 09. Bhutan 2 53. Oman I q 2 10. Bulgaria 4 4 54. Pakistan 18 18 ll Brunei I 55, Poland 3 1 12. Brazrl 4 2 56. Philippines 5 5 lJ. Republic ofBelarus I 57. Portugal 4 J 14. Canada 8 7 58. Qatar 6 5 15. China 4 l3 59. Romania 1 1 16. Chile I I 60 Russia 9 8 17. Croatia I 61. SaudiArabia l6 t5 18. Cyprus I I o/.. Senegal 1 1 t 19. CzechRepublic 6 J 63. Serbia + J ,1 20. Denmark J J 64. Srilanka 5 21. -

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION of BANGLADESH (ICB) 02 BRAC BANK LIMITED 03 EASTERN BANK

Bank Code Br. Code Bank & Branch Name 01 INVESTMENT CORPORATION OF BANGLADESH (ICB) 01 Head Office, Purana Paltan, Dhaka 02 Local Office, Nayapaltan, Dhaka 03 Chittagong Branch, Chittagong 04 Khulna Branch, Khulna 05 Rajshahi Branch, Rajshahi 06 Barisal Branch, Barisal 07 Sylhet Branch, Sylhet 08 Bogra Branch, Bogra 02 BRAC BANK LIMITED 01 Asad Gate Branch, Dhaka 02 Banani Branch, Dhaka 03 Bashundhara Branch, Dhaka 04 Donia Branch, Dhaka 05 Eskaton Branch, Dhaka 06 Graphics Building Branch, Motijheel, Dhaka 07 Uttara Branch, Dhaka 08 Shyamoli Branch, Dhaka 09 Gulshan Branch, Dhaka 10 Manda Branch, Dhaka 11 Mirpur Branch, , Dhaka 12 Nawabpur Branch, Dhaka 13 Rampura Branch, Dhaka 14 Narayanqani Branch, Narayanganj 15 Agrabad Branch, Chittagong 16 CDA Avenue Branch, Chittagong 17 Potia Branch, Chittagong 18 Halisohor Branch, Chittagong 19 Kazirdeuri Branch, Chittagong 20 Momin Road Branch, Chittagong 21 Bogra Branch, Bogra 22 Rajshahi Branch, Rajshahi 23 Jessore Branch, Jessore 24 Khulna Branch, Khulna 25 Barisal Branch, Barisal 26 Zindabazar Branch, Sylhet 03 EASTERN BANK LIMITED 01 Principal Branch, Dilkusha, Dhaka 02 Motijheel Branch, Dhaka 03 Mirpur Branch, Dhaka 04 Bashundhara Branch, Dhaka 05 Shyamoli Branch, Dhaka 06 Narayanganj Branch 07 Jessore Branch 08 Choumuhoni Branch 09 Agrabad Branch, Chittagong 10 Khatunganj Branch, Chittagong 11 Bogra Branch, Bogra 12 Khulna Branch, Khulna 13 Rajshahi Branch, Rajshahi 14 Savar Branch, Savar, Dhaka 15 Moulvi Bazar Branch, Sylhet Page # 1 Bank Code Br. Code Bank & Branch Name 04 BANK ASIA LIMITED 01 Principal Office , Motijheel C.A., Dhaka 02 Corporate Branch, Dhaka 03 Gulshan Branch, Dhaka 04 Uttara Branch, Dhaka 05 North South Rd. -

INTERNATIONAL FINANCE INVESTMENT and COMMERCE BANK LIMITED Audited Financial Statements As at and for the Year Ended 31 December 2019

INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Audited Financial Statements as at and for the year ended 31 December 2019 INTERNATIONAL FINANCE INVESTMENT AND COMMERCE BANK LIMITED Consolidated Balance Sheet as at 31 December 2019 Amount in BDT Particulars Note 31 December 2019 31 December 2018 PROPERTY AND ASSETS Cash 18,056,029,773 16,020,741,583 Cash in hand (including foreign currency) 3.a 2,872,338,679 2,899,030,289 Balance with Bangladesh Bank and its agent bank(s) (including foreign currency) 3.b 15,183,691,094 13,121,711,294 Balance with other banks and financial institutions 4.a 5,637,834,204 8,118,980,917 In Bangladesh 4.a(i) 4,014,719,294 6,823,590,588 Outside Bangladesh 4.a(ii) 1,623,114,910 1,295,390,329 Money at call and on short notice 5 910,000,000 3,970,000,000 Investments 47,216,443,756 32,664,400,101 Government securities 6.a 41,369,255,890 27,258,506,647 Other investments 6.b 5,847,187,866 5,405,893,454 Loans and advances 232,523,441,067 210,932,291,735 Loans, cash credit, overdrafts etc. 7.a 221,562,693,268 198,670,768,028 Bills purchased and discounted 8.a 10,960,747,799 12,261,523,707 Fixed assets including premises, furniture and fixtures 9.a 6,430,431,620 5,445,835,394 Other assets 10.a 9,606,537,605 9,003,060,522 Non-banking assets 11 373,474,800 373,474,800 Total assets 320,754,192,825 286,528,785,052 LIABILITIES AND CAPITAL Liabilities Borrowing from other banks, financial institutions and agents 12.a 8,215,860,335 9,969,432,278 Subordinated debt 13 2,800,000,000 3,500,000,000 Deposits and other -

Internship Report “Analysis of Banking Industry & Janata Bank Limited”

Internship Report On “Analysis of Banking Industry & Janata Bank Limited” “Analysis of Banking Industry & Janata Bank Limited”: An Internship Report Submitted to: Dr. Md. Mohan Uddin Professor Submitted by: Arup Saha ID- 111 143 003 October 9, 2018 UNITED INTERNATIONAL UNIVERSITY Letter of Transmittal October 9, 2018 Dr. Md. Mohan Uddin Professor School of Business & Economics United International University Subject: Submission of Internship report Dear Sir, It is indeed, an honor to deliver my internship report on “Analysis of Banking Industry & Janata Bank Limited”, as a prerequisite for the completion of my BBA program, as per your instructions. In preparing this report, I have tried my best to include all the related information to make the report magnificent and workable one and in doing so I have tried my outermost to live up to your criterion. It will be a happy moment for me if I hear further clarification from you. May I, Therefore, hope that you would be kind enough to accept my endeavor and oblige thereby. Yours Sincerely, ……………............ Arup Saha ID - 111 143 003 United International University Acknowledgement At first, I would like to express my profound gratefulness to almighty GOD for giving me strength and mobility to finish the report within time Then, I congratulated and lay my sincerest thankfulness to my honorable supervisor, Dr. Md. Mohan Uddin, Professor, United International University, for his help, encouragement, guidance, and valuable suggestions throughout the entire period of this study, within which it could not have been feasible to submit this report on time. It was an eminent scope for me to complete my internship program at Janata Bank Limited, Hazaribagh Branch. -

Market Size and Share of Consumer Finance Products in Bangladesh

MONTHLYMON BUSINESS REVIEW VOLVOLUME: 06 ISSUE: 08 SSEPTEMBER-OCTOBEREP 2015 Market Size and Share of Consumer Finance Products in Bangladesh 5 4 6 28 20 5% 4% 60 14 11% 3% 7 3 14 3% 147 28% 7 1% 3 8 0.0.7% 9 229 44% 2 1 MTBiz MONTHLY BUSINESS REVIEW VOLUME: 06 ISSUE: 08 SEPTEMBER-OCTOBER 2015 Contents Market Size and Share of Consumer Finance Products in Bangladesh 02 5 National News 4 6 28 The Central Bank 04 20 5% 4% Banking Industry 06 60 14 11% 3% MTB News & Events 10 7 3 14 Industryypp Appointments 14 3% 147 28% Business & Economyy 7 15 1% 3 8 0.70. % International News 9 229 44% Business & Economy 18 2 Economic Forecast 22 Wells Fargo Monthly Outlook 24 1 Developed & Published by MTB Group R&D Please send feedback to: Disclaimer: [email protected] MTBiz is printed for non-commercial & selected individual-level distribution in order to sharing information among stakeholders only. MTB takes no responsibility for any individual investment decision based on the All rights reserved @ 2015 information at MTBiz. This review is for information purpose only and the comments and forecasts are intended to be of general nature and are current as of the date of publication. Information is obtained from Design & Printing: secondary sources which are assumed to be reliable but their accuracy cannot be guaranteed. The name of Corporate Communications the other companies, products and services are the properties of their respective owners and are protected by copyright, trademark and other intellectual property laws. -

Independent Auditor's Report and Audited Consolidated & Separate Financial Statements for the Year Ended 31 December 2016

Dhaka Bank Limited and its subsidiaries Independent Auditor's Report and Audited Consolidated & Separate Financial Statements For the year ended 31 December 2016 BDBL Bhaban (Level -13 & 14), 12 Kawran Bazar Commercial Area, Dhaka - 1215, Bangladesh. ACNABIN Cbartered Accowntants BDBL Bhaban (Level-13 & 14) Telephone: (88 02) 81.44347 ro 52 1.2 Kawran Bazar Commercial Area (88 02) 8189428 to 29 Dhaka-121.5, Bangladesh. Facsimile: (88 02) 8144353 e-mail: <[email protected]> Web: www.acnabin.com INDEPENDENT AUDITOR'S REPORT TO THE SHAREHOLDERS OF DHAKA BANK LIMITED Report on the Financial Statements We have audited the accompanying consolidated financial statements of Dhaka Bank Limited and its subsidiaries namely Dhaka Bank Securities Limited and Dhaka Bank Investment Limited ("the Group") as well as the separate financial statements of Dhaka Bank Limited ("the Bank"), which comprise the consolidated balance sheet of the Group and the separate balance sheet as at 31" December 2016 and the consolidated and separate profit and loss accounts, consolidated and separate statements of changes in equity and consolidated and separate cash flow statements for the year then ended and a summary of significant accounting policies and other explanatory information. Management's Responsibility for the Financial Statements and Internal Controls Management is responsible for the preparation of consolidated financial statements of the Group and also the separate financial statements of the Bank that give a true and fair view in accordance with Bangladesh -

Sl. Correspondent / Bank Name SWIFT Code Country

International Division Relationship Management Application( RMA ) Total Correspondent: 156 No. of Country: 36 Sl. Correspondent / Bank Name SWIFT Code Country 1 ISLAMIC BANK OF AFGHANISTAN IBAFAFAKA AFGHANISTAN 2 MIZUHO BANK, LTD. SYDNEY BRANCH MHCBAU2S AUSTRALIA 3 STATE BANK OF INDIA AUSTRALIA SBINAU2S AUSTRALIA 4 KEB HANA BANK, BAHRAIN BRANCH KOEXBHBM BAHRAIN 5 MASHREQ BANK BOMLBHBM BAHRAIN 6 NATIONAL BANK OF PAKISTAN NBPABHBM BAHRAIN 7 AB BANK LIMITED ABBLBDDH BANGLADESH 8 AGRANI BANK LIMITED AGBKBDDH BANGLADESH 9 AL-ARAFAH ISLAMI BANK LTD. ALARBDDH BANGLADESH 10 BANGLADESH BANK BBHOBDDH BANGLADESH 11 BANGLADESH COMMERCE BANK LIMITED BCBLBDDH BANGLADESH BANGLADESH DEVELOPMENT BANK 12 BDDBBDDH BANGLADESH LIMITED (BDBL) 13 BANGLADESH KRISHI BANK BKBABDDH BANGLADESH 14 BANK ASIA LIMITED BALBBDDH BANGLADESH 15 BASIC BANK LIMITED BKSIBDDH BANGLADESH 16 BRAC BANK LIMITED BRAKBDDH BANGLADESH 17 COMMERCIAL BANK OF CEYLON LTD. CCEYBDDH BANGLADESH 18 DHAKA BANK LIMITED DHBLBDDH BANGLADESH 19 DUTCH BANGLA BANK LIMITED DBBLBDDH BANGLADESH 20 EASTERN BANK LIMITED EBLDBDDH BANGLADESH EXPORT IMPORT BANK OF BANGLADESH 21 EXBKBDDH BANGLADESH LTD 22 FIRST SECURITY ISLAMI BANK LIMITED FSEBBDDH BANGLADESH 23 HABIB BANK LTD HABBBDDH BANGLADESH 24 ICB ISLAMI BANK LIMITED BBSHBDDH BANGLADESH INTERNATIONAL FINANCE INVESTMENT 25 IFICBDDH BANGLADESH AND COMMERCE BANK LTD (IFIC BANK) 26 ISLAMI BANK LIMITED IBBLBDDH BANGLADESH 27 JAMUNA BANK LIMITED JAMUBDDH BANGLADESH 28 JANATA BANK LIMITED JANBBDDH BANGLADESH 29 MEGHNA BANK LIMITED MGBLBDDH BANGLADESH 30 MERCANTILE -

News Blaze of the Week August 16, 2020 Issue 09

News Blaze of the Week August 16, 2020 Issue 09 Page | 1 Research and Development Unit Editorial Panel Quotation Corner Fahmida Chowdhury EVP & Principal, DBTI In charge R&DU “You only live once, but if you do it Farzana Afroz PO, R&DU right, once is enough.” — Mae West “Money and success don’t change people; they merely amplify what is already there.” — Will Smith Contact us: “Life is not a problem to be solved, but a [email protected] reality to be experienced.” – Soren Kierkegaard Page | 2 Govt Initiatives Banks and Financial Institutions Govt to form 'Delta Fund' to finance climate projects 05 18 banks added to bKash Add Money service 08 Agreement on first bio-tech plant signed 05 Southeast Bank Limited shifted its Pragati Sarani Branch at the Bank's own premises at Pearl 09 Pubali Bank donates bus to BSMMU 09 Karmasangsthan Bank launches loan product 09 Banks seek Tk 18 million as interest subsidy 10 Abdul Hai Sarker elected chairman of Dhaka Bank 10 National Milestone Shahjalal Islami Bank approves 10pc dividend 11 Per capita income rises to $2,064 06 IPDC offers exclusive auto loan 11 College fees being paid through 'Nagad' 12 Prime Bank, Ajkerdeal partner for MSME credit 12 Central Bank Regulation BB relaxes loan restructuring policy for NBFIs 07 BB asks banks to tap NRB deposits 07 Page | 3 Corporate Market Update Stock Market Update Walton's IPO subscription begins today 16 Stocks rebound after five months 13 Ten cos account for 27pc DSE transactions 13 Square Pharma tops DSE turnover chart 14 DSEX exceeds 4,600-mark as -

An Innovative Growth Model for Competitive Development of Private Commercial Banks of Bangladesh

AN INNOVATIVE GROWTH MODEL FOR COMPETITIVE DEVELOPMENT OF PRIVATE COMMERCIAL BANKS OF BANGLADESH _________________________________ AN INNOVATIVE GROWTH MODEL FOR COMPETITIVE DEVELOPMENT OF PRIVATE COMMERCIAL BANKS OF BANGLADESH Thesis submitted in fulfillment of the requirements for the Degree Of DOCTOR OF BUSINESS ADMINISTRATION by Md. Zahid Hossain Registration No: 05/2013-2014, Session 2013-14 Re-registration No: 13/2018-2019 (পুনঃ), Session 2018-2019 Under the supervision of Dr. A.K.M. Saiful Majid Institute of Business Administration UNIVERSITY OF DHAKA DHAKA-1000 Institute of Business Administration UNIVERSITY OF DHAKA January, 2020 Declaration I declare herewith that this thesis, entitled, “An Innovative Growth Model for Competitive Development of Private Commercial Banks of Bangladesh” is exclusively my own work in pursuance of the award of Doctor of Business Administration under the supervision of Professor. A.K.M. Saiful Majid, Institute of Business Administration, University of Dhaka. I also declare that the matter contained in this thesis has not been submitted for the award of any other degree at other universities or institutions. Md. Zahid Hossain Registration No: 05/2013-2014, Session 2013-14 Re-registration No: 13/2018-2019 (পুনঃ), Session 2018-2019 Institute of Business Administration UNIVERSITY OF DHAKA Certificate of the Supervisor This is to certify that the thesis, entitled, “An Innovative Growth Model for Competitive Development of Private Commercial Banks of Bangladesh” submitted by Mr. Md. Zahid Hossain to the University of Dhaka, is a record of original research work carried out by him under my supervision in Institute of Business Administration, University of Dhaka. Mr. Md. Zahid Hossain has worked sincerely in preparing this thesis and the thesis is, in my opinion, worthy of consideration for the award of degree of Doctor of Business Administration in accordance with the rules and regulations for this university. -

Policy Analysis Unit* (PAU)

Policy Analysis Unit* (PAU) Policy Note Series: PN 0703 Recent Experiences in the Foreign Exchange and Money Markets Md. Habibur Rahman, Ph. D Shubhasish Barua Policy Analysis Unit Research Department Bangladesh Bank September 2006 Copyright © 2006 by Bangladesh Bank * The Bangladesh Bank (BB), in cooperation with the World Bank Institute (WBI), has formed the Policy Analysis Unit (PAU) within its Research Department in July 2005. The aim behind this initiative is to upgrade the capacity for research and policy analysis at BB. As part of its mandate PAU will prepare and publish, among other, several Policy Notes on macroeconomic issues every quarter. The precise topics of these Notes are chosen by the Resident Economic Adviser in consultation with the senior management of the Bangladesh Bank. These papers are primarily intended as background documents for the policy guidance of the senior management of BB. Neither the Board of Directors nor the management of the Bangladesh Bank, nor WBI, nor any agency of the Government of Bangladesh or the World Bank Group necessarily endorses any or all of the views expressed in these papers. The latter reflect the judgment based on professional analysis carried out by the staff of the Policy Analysis Unit, and hence the usual caveat as to the veracity of research reports applies. [An electronic version of this paper is available at www.bangladeshbank.org.bd] i Recent Experiences in the Foreign Exchange and Money Markets Md. Habibur Rahman, Ph. D∗ and Shubhasish Barua∗ September 2006 Abstract Over the last two fiscal years both the foreign exchange and the money markets in Bangladesh experienced notable volatility, which resulted in substantial depreciation of BDT against major currencies and a temporary rise in the interest rate in the money market.