Regional Profile 2014-16

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Youth Sport and COVID-19

Emerald Open Research Emerald Open Research 2020, 2:27 Last updated: 10 JUN 2020 STUDY PROTOCOL Youth sport and COVID-19: a potential generation lost [version 1; peer review: awaiting peer review] Murray Drummond , Sam Elliott , Claire Drummond, Ivanka Prichard SHAPE Research Centre, Flinders University, Bedford Park, SA, 5000, Australia First published: 19 May 2020, 2:27 Open Peer Review v1 https://doi.org/10.35241/emeraldopenres.13661.1 Latest published: 19 May 2020, 2:27 Reviewer Status AWAITING PEER REVIEW https://doi.org/10.35241/emeraldopenres.13661.1 Any reports and responses or comments on the Abstract article can be found at the end of the article. This conceptual / study protocol paper provides important context around the role of sport in Australia where sport provides aspects of community agency through participation, organisation and volunteerism. It provides a descriptive analysis of how sport assists young people in developing physical and mental “fitness” through its community orientation. However, it also provides discussion around the potential of a “generation lost” to sport as a consequence of the coronavirus disease 2019 (COVID-19) pandemic. The conceptual nature of this paper means that the data collection underpinning this research has not yet been conducted. However, given that we have applied for human research ethics along with having accrued sporting clubs and organisations eager to be involved in the research, we are planning to roll out this research by mid 2020. The design will be based on mixed methods approach whereby large-scale surveys together with focus groups and interviews will be central to the research data collection process. -

Indoor Cricket in South Australia

SOUTH AUSTRALIAN CRICKET INFRASTRUCTURE STRATEGY STATE OF PLAY AND INFRASTRUCTURE FRAMEWORK REPORT | MAY 2019 1 CONTENTS This document will act as a project hold point, ensuring the proposed infrastructure framework South Australian Cricket Infrastructure Strategy is reviewed and tested with the Project Reference Group, and that participation and facility data analysis is true and accurate prior to the development of the Draft South Australian Cricket State of Play and Infrastructure Framework Report Infrastructure Strategy. 1. Executive Summary 3 2. Cricket in South Australia – State of Play 9 DATA COLLECTION 3. Premier Cricket 19 Cricket participation figures presented and analysed in this report have been informed by the 2017/18 Cricket Census. This data is derived from annual auditing of Australian cricket 4. Indoor Cricket 21 participation. A ‘participant’ is defined by the Australian Cricket Census as someone who 5. Regional summaries – Metro 23 participates in at least four sessions of a formal cricket program. 6. Regional summaries - Country 30 The Cricket Census includes participants registered in formalised cricket competitions and programs across South Australia. This includes local club and association competition and entry 7. Appendices 37 level programs. Indoor cricket participant numbers are captured and reported on separately. The census data does not include participants aligned with informal and/or social cricket competitions, schools programs or any other cricket participation opportunities outside of ABOUT THIS DOCUMENT affiliated club competitions and programs. This State of Play and Infrastructure Framework Report provides: Regional participation figures presented in this report are based on the physical location of an 1. A ‘State of Play’ of cricket across South Australia including: individual player’s home club location and not necessarily their home address. -

Preliminary Assessment of a Strategic Port Expansion Option – Port Prepared For: Port Pirie Regional Council Pirie Regional Council Revision: FINAL 20 December 2013

Reference: 239048 Project: Preliminary Assessment of a Strategic Port Expansion Option – Port Prepared for: Port Pirie Regional Council Pirie Regional Council Revision: FINAL 20 December 2013 Document Control Record Document prepared by: Aurecon Australia Pty Ltd ABN 54 005 139 873 55 Grenfell Street Adelaide SA 5000 Australia T +61 8 8237 9777 F +61 8 8237 9778 E [email protected] W aurecongroup.com A person using Aurecon documents or data accepts the risk of: a) Using the documents or data in electronic form without requesting and checking them for accuracy against the original hard copy version. b) Using the documents or data for any purpose not agreed to in writing by Aurecon. Preliminary Assessment of a Strategic Port Expansion Option – Port Pirie Regional Council Date | 20 December 2013 Reference | 239048 Revision | FINAL Aurecon Australia Pty Ltd ABN 54 005 139 873 55 Grenfell Street Adelaide SA 5000 Australia T +61 8 8237 9777 F +61 8 8237 9778 E [email protected] W aurecongroup.com Contents 1 Overview of this Preliminary Assessment 4 1.1 Purpose & Key Topics Covered in this Preliminary Assessment 4 1.2 Key Findings 5 1.3 Limitations of this Preliminary Assessment 6 1.4 Contacts for Interested Parties 6 2 Port Pirie – A Strategic Service Hub for the Minerals & Resources Sector 7 2.1 Growing Exploration Activity in South Australia 7 2.2 Introduction to Port Pirie 8 2.3 Access to Prime Infrastructure 10 2.4 Development Role of Port Pirie Council and Regional Development Australia Yorke & Mid North 11 2.5 Background -

![Youth Sport and COVID-19: a Potential Generation Lost [Version 1; Peer Review: 1 Not Approved]](https://docslib.b-cdn.net/cover/7423/youth-sport-and-covid-19-a-potential-generation-lost-version-1-peer-review-1-not-approved-157423.webp)

Youth Sport and COVID-19: a Potential Generation Lost [Version 1; Peer Review: 1 Not Approved]

Emerald Open Research Emerald Open Research 2020, 2:27 Last updated: 21 SEP 2021 STUDY PROTOCOL Youth sport and COVID-19: a potential generation lost [version 1; peer review: 1 not approved] Murray Drummond , Sam Elliott , Claire Drummond, Ivanka Prichard SHAPE Research Centre, Flinders University, Bedford Park, SA, 5000, Australia v1 First published: 19 May 2020, 2:27 Open Peer Review https://doi.org/10.35241/emeraldopenres.13661.1 Latest published: 19 May 2020, 2:27 https://doi.org/10.35241/emeraldopenres.13661.1 Reviewer Status Invited Reviewers Abstract This conceptual / study protocol paper provides important context 1 around the role of sport in Australia where sport provides aspects of community agency through participation, organisation and version 1 volunteerism. It provides a descriptive analysis of how sport assists 19 May 2020 report young people in developing physical and mental “fitness” through its community orientation. However, it also provides discussion around 1. Haydn Morgan, University of Bath, Bath, the potential of a “generation lost” to sport as a consequence of the coronavirus disease 2019 (COVID-19) pandemic. The conceptual United Kingdom nature of this paper means that the data collection underpinning this Any reports and responses or comments on the research has not yet been conducted. However, given that we have applied for human research ethics along with having accrued sporting article can be found at the end of the article. clubs and organisations eager to be involved in the research, we are planning to roll out this research by mid 2020. The design will be based on mixed methods approach whereby large-scale surveys together with focus groups and interviews will be central to the research data collection process. -

Professional Report

Rail Tram & Bus Union National Office Attachment 1 RTBU Analysis of Eyre Peninsula Grain Transport February 2003 Contents Introduction .......................................................................................................1 Grain Product Diversification............................................................................2 Continued Growth in Grain Production............................................................2 Operational Efficiency of Eyre Peninsula Rail .................................................3 a) Summer Heat Restrictions ......................................................................3 b) Inland Silo load-out rates .........................................................................3 c) Track Speeds ...........................................................................................3 d) Port Lincoln wagon discharge rates........................................................3 e) Short crossing loops ................................................................................3 f) Grain receival time at Port Lincoln ...........................................................4 g) Track and loco quality..............................................................................4 Security in Grain Supply to Export Shipping....................................................5 True Cost of Road Transport ...........................................................................5 Cooperation in a networked industry ...............................................................5 -

STRATEGIC DIRECTIONS PLAN 2021-2030 Ii CITY of PORT LINCOLN – Strategic Directions Plan CONTENTS

CITY OF PORT LINCOLN STRATEGIC DIRECTIONS PLAN 2021-2030 ii CITY OF PORT LINCOLN – Strategic Directions Plan CONTENTS 1 FOREWORD 2 CITY PROFILE 4 ACKNOWLEDGEMENT OF COUNTRY 5 COMMUNITY ASPIRATIONS 6 VISION, MISSION and VALUES 8 GOAL 1. ECONOMIC GROWTH AND OPPORTUNITY 10 GOAL 2. LIVEABLE AND ACTIVE COMMUNITIES 12 GOAL 3. GOVERNANCE AND LEADERSHIP 14 GOAL 4. SUSTAINABLE ENVIRONMENT 16 GOAL 5. COMMUNITY ASSETS AND PLACEMAKING 18 MEASURING OUR SUCCESS 20 PLANNING FRAMEWORK 21 COUNCIL PLANS Prepared by City of Port Lincoln Adopted by Council 14 December 2020 RM: FINAL2020 18.80.1.1 City of Port Lincoln images taken by Robert Lang Photography FOREWORD On behalf of the City of Port Lincoln I am pleased to present the City's Strategic Directions Plan 2021-2030 which embodies the future aspirations of our City. This Plan focuses on and shares the vision and aspirations for the future of the City of Port Lincoln. The Plan outlines how, over the next ten years, we will work towards achieving the best possible outcomes for the City, community and our stakeholders. Through strong leadership and good governance the Council will maintain a focus on achieving the Vision and Goals identified in this Plan. The Plan defines opportunities for involvement of the Port Lincoln community, whether young or old, business people, community groups and stakeholders. Our Strategic Plan acknowledges the natural beauty of our environment and recognises the importance of our natural resources, not only for our community well-being and identity, but also the economic benefits derived through our clean and green qualities. -

TRAVEL Eyre Peninsula, South Australia

TRAVEL Eyre Peninsula, South Australia CaptionPort Lincolnhere National Park is dotted with caves. Eyre Peninsula From the Ocean to the Outback XPERIENCE THE UNTOUCHED through massive sand dunes, swimming Eand remote beauty of the Eyre with Australian sea lions and dolphins Peninsula in South Australia. From at the same time (the only place in spectacular coastal landscapes to the Australia where you can do this), wildly beautiful outback, and the visiting arguably Australia’s best native wildlife that call them home, you'll revel koala experience, seeing landscapes in the diversity of this genuine ocean-to- that only a few ever see from the raw, outback tour. rugged and natural coastline to the ep SA Unsurpassed in its beauty, this extraordinary colours of the red sands, region also teems with another truly blue skies and glistening white salt lakes AG TRAVEL special quality - genuine hospitality of the Gawler Ranges. from its colourful characters. You'll The icing on the cake of this trip is Dates: meet a host of locals during your visit the opportunity to sample the bounty of 10–18 Feb 2021 to Port Lincoln, the seafood capital of the ocean here, including taking part in 26 Feb–7 March 2021 Australia, and the stunning, ancient and a seafood masterclass with marron and 24 ApriL–2 May 2021 geologically fuelled Gawler Ranges. oysters direct from the local farms. 9–17 Oct 2021 Each day you'll enjoy memorable Accommodation is on Port Lincoln’s email: and unique wildlife, geological, foreshore overlooking Boston Bay, and [email protected] culinary, photographic and educational then, in the outback, at Kangaluna phone: 0413 560 210 experiences, including a 4WD safari Luxury Bush Camp. -

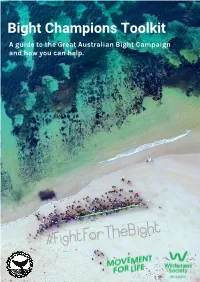

Bight Champions Toolkit a Guide to the Great Australian Bight Campaign and How You Can Help

Bight Champions Toolkit A guide to the Great Australian Bight Campaign and how you can help. Contents Great Australian Bight Campaign in a nutshell 2 Our Vision 2 Who is the Great Australian Bight Alliance? 3 Bight Campaign Background 4 A Special Place 5 The Risks 6 Independent oil spill modelling 6 Quick Campaign Snapshot 7 What do we want? 8 What you can do 9 Get the word out there 10 How to be heard 11 Writing it down 12 Comments on articles 13 Key Messages 14 Media Archives 15 Screen a film 16 Host a meet-up 18 Setting up a group 19 Contacting Politicians 20 Become a leader 22 Get in contact 23 1 Bight campaign in a nutshell THE PLACE, THE RISKS AND HOW WE SAVE IT “ The Great Australian Bight is a body of coast Our vision for the Great and water that stretches across much of Australian Bight is for a southern Australia. It’s an incredible place, teaming with wildlife, remote and unspoiled protected marine wilderness areas, as well as being home to vibrant and thriving coastal communities. environment, where marine The Bight has been home to many groups of life is safe and healthy. Our Aboriginal People for tens of thousands of years. The region holds special cultural unspoiled waters must be significance, as well as important resources to maintain culture. The cliffs of the Nullarbor are valued and celebrated. Oil home to the Mirning People, who have a special spills are irreversible. We connection with the whales, including Jidarah/Jeedara, the white whale and creation cannot accept the risk of ancestor. -

EPLGA Draft Minutes 4 Sep 15.Docx 1

Minutes of the Eyre Peninsula Local Government Association Board Meeting held at Wudinna Community Club on Friday 4 September 2015 commencing at 10.10am. Delegates Present: Bruce Green (Chair) President, EPLGA Roger Nield Mayor, District Council of Cleve Allan Suter Mayor, District Council of Ceduna Kym Callaghan Chairperson, District Council of Elliston Eddie Elleway Councillor, District Council of Franklin Harbour Dean Johnson Mayor, District Council of Kimba Julie Low Mayor, District Council of Lower Eyre Peninsula Neville Starke Deputy Mayor, City of Port Lincoln Sherron MacKenzie Mayor District Council of Streaky Bay Sam Telfer Mayor District Council of Tumby Bay Tom Antonio Deputy Mayor, City of Whyalla Eleanor Scholz Chairperson, Wudinna District Council Guests/Observers: Tony Irvine Executive Officer, EPLGA Geoffrey Moffatt CEO, District Council of Ceduna Peter Arnold CEO, District Council of Cleve Phil Cameron CEO, District Council of Elliston Dave Allchurch Councillor, District Council of Elliston Eddie Elleway Councillor, District Council of Franklin Harbour Daryl Cearns CEO, District Council of Kimba Debra Larwood Manager Corporate Services, District Council of Kimba Leith Blacker Acting CEO, District Council of Lower Eyre Peninsula Rob Donaldson CEO, City of Port Lincoln Chris Blanch CEO, District Council of Streaky Bay Trevor Smith CEO, District Council of Tumby Bay Peter Peppin CEO, City of Whyalla Adam Gray Director, Environment, LGA of SA Matt Pinnegar CEO, LGA of SA Jo Calliss Regional Risk Coordinator, Western Eyre -

Monuments and Memorials

RGSSA Memorials w-c © RGSSA Memorials As at 13-July-2011 RGSSA Sources Commemorating Location Memorial Type Publication Volume Page(s) Comments West Terrace Auld's headstone refurbished with RGSSA/ACC Auld, William Patrick, Grave GeoNews Geonews June/July 2009 24 Cemetery Grants P Bowyer supervising Plaque on North Terrace façade of Parliament House unveiled by Governor Norrie in the Australian Federation Convention Adelaide, Parliament Plaque The Proceedings (52) 63 presences of a representative gathering of Meeting House, descendants of the 1897 Adelaide meeting - inscription Flinders Ranges, Depot Society Bicentenary project monument and plaque Babbage, B.H., Monument & Plaque Annual Report (AR 1987-88) Creek, to Babbage and others Geonews Unveiled by Philip Flood May 2000, Australian Banks, Sir Joseph, Lincoln Cathedral Wooden carved plaque GeoNews November/December 21 High Commissioner 2002 Research for District Council of Encounter Bay for Barker, Captain Collett, Encounter bay Memorial The Proceedings (38) 50 memorial to the discovery of the Inman River Barker, Captain Collett, Hindmarsh Island Tablet The Proceedings (30) 15-16 Memorial proposed on the island - tablet presented Barker, Captain Collett, Hindmarsh Island Tablet The Proceedings (32) 15-16 Erection of a memorial tablet K. Crilly 1997 others from 1998 Page 1 of 87 Pages - also refer to the web indexes to GeoNews and the SA Geographical Journal RGSSA Memorials w-c © RGSSA Memorials As at 13-July-2011 RGSSA Sources Commemorating Location Memorial Type Publication Volume -

Annual Report Details the Last 12 Months Activity Undertaken by the EPLGA, Its Financial Accounts, and Operative Regional Collaborative Partnerships

EYRE PENINSULA LOCAL GOVERNMENT ASSOCIATION A N N U A L R E P O R T 2019-20 W W W . E P L G A . C O M . A U Authors: Peter Scott Executive Officer Eyre Peninsula Local Government Association Sue Henriksen Business Support Officer Regional Development Australia Eyre Peninsula Inc. Cover photo: Murphy's Haystacks, Eyre Peninsula. Photo: SATC. Eyre Peninsula Local Government Association THE PRESIDENT’S REPORT This annual report details the last 12 months activity undertaken by the EPLGA, its financial accounts, and operative regional collaborative partnerships. The vision and goal of the EPLGA, to “enable Eyre Peninsula councils to excel, innovate, and thrive”, has never been more relevant for the region than now. We have been facing many challenges and opportunities, with the need for the councils of the EP to be working closely together. The EPLGA has seen a change in the position of Executive Officer, with Tony Irvine retiring at the end of 2019. The contribution which Tony has made over many years of involvement with local government on the Eyre Peninsula deserves recognition, especially his time as the EPLGA Executive Officer. The EPLGA is in a much stronger position due to the work which has been done by Tony over his tenure. Peter Scott was appointed in February 2020, bringing with him already established knowledge and relationships from his prior employment. With this appointment, there was also developed a shared service agreement with RDAEP to deliver economic development projects agreed with a joint workplan arrangement. These new and unique arrangements will help local government have a strong interest in economic development and also make economic savings for both organisations. -

Port Spencer Grain Export Facility Peninsula Ports

Port Spencer Grain Export Facility Peninsula Ports Amendment to Public Environmental Report IW219900-0-NP-RPT-0003 | 2 8 November 2019 Amend ment to Pu blic Envir onm ental Rep ort Peninsula P orts Amendment to Public Environmental Report Port Spencer Grain Export Facility Project No: IW219900 Document Title: Amendment to Public Environmental Report Document No.: IW219900-0-NP-RPT-0003 Revision: 2 Date: 8 November 2019 Client Name: Peninsula Ports Client No: Client Reference Project Manager: Scott Snedden Author: Alana Horan File Name: J:\IE\Projects\06_Central West\IW219900\21 Deliverables\AMENDMENT TO THE PER\Amendment to PER_Rev 2.docx Jacobs Group (Australia) Pty Limited ABN 37 001 024 095 Level 3, 121 King William Street Adelaide SA 5000 Australia www.jacobs.com © Copyright 2020 Jacobs Group (Australia) Pty Limited. The concepts and information contained in this document are the property of Jacobs. Use or copying of this document in whole or in part without the written permission of Jacobs constitutes an infringement of copyright. Limitation: This document has been prepared on behalf of, and for the exclusive use of Jacobs’ client, and is subject to, and issued in accordance with, the provisions of the contract between Jacobs and the client. Jacobs accepts no liability or responsibility whatsoever for, or in respect of, any use of, or reliance upon, this document by any third party. Document history and status Revision Date Description By Review Approved H 31.10.2019 Draft AH NB SS 0 1.11.2019 Draft issued to DPTI AH SS DM 1 8.11.2019 Issued to DPTI AH SS DM 2 13.1.2020 Re-issued Volume 1 to DPTI.