Executive Compensation Metlife Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sunrise Beverage 2021 Craft Soda Price Guide Office 800.875.0205

SUNRISE BEVERAGE 2021 CRAFT SODA PRICE GUIDE OFFICE 800.875.0205 Donnie Shinn Sales Mgr 704.310.1510 Ed Saul Mgr 336.596.5846 BUY 20 CASES GET $1 OFF PER CASE Email to:[email protected] SODA PRICE QUANTITY Boylan Root Beer 24.95 Boylan Diet Root Beer 24.95 Boylan Black Cherry 24.95 Boylan Diet Black Cherry 24.95 Boylan Ginger Ale 24.95 Boylan Diet Ginger Ale 24.95 Boylan Creme 24.95 Boylan Diet Creme 24.95 Boylan Birch 24.95 Boylan Creamy Red Birch 24.95 Boylan Cola 24.95 Boylan Diet Cola 24.95 Boylan Orange 24.95 Boylan Grape 24.95 Boylan Sparkling Lemonade 24.95 Boylan Shirley Temple 24.95 Boylan Original Seltzer 24.95 Boylan Raspberry Seltzer 24.95 Boylan Lime Seltzer 24.95 Boylan Lemon Seltzer 24.95 Boylan Heritage Tonic 10oz 29.95 Uncle Scott’s Root Beer 28.95 Virgil’s Root Beer 26.95 Virgil’s Black Cherry 26.95 Virgil’s Vanilla Cream 26.95 Virgil’s Orange 26.95 Flying Cauldron Butterscotch Beer 26.95 Bavarian Nutmeg Root Beer 16.9oz 39.95 Reed’s Original Ginger Brew 26.95 Reed’s Extra Ginger Brew 26.95 Reed’s Zero Extra Ginger Brew 26.95 Reed’s Strongest Ginger Brew 26.95 Virgil’s Zero Root Beer Cans 17.25 Virgil’s Zero Black Cherry Cans 17.25 Virgil’s Zero Vanilla Cream Cans 17.25 Virgil’s Zero Cola Cans 17.25 Reed’s Extra Cans 26.95 Reed’s Zero Extra Cans 26.95 Reed’s Real Ginger Ale Cans 16.95 Reed’s Zero Ginger Ale Cans 16.95 Maine Root Mexican Cola 28.95 Maine Root Lemon Lime 28.95 Maine Root Root Beer 28.95 Maine Root Sarsaparilla 28.95 Maine Root Mandarin Orange 28.95 Maine Root Spicy Ginger Beer 28.95 Maine Root Blueberry 28.95 Maine Root Lemonade 12ct 19.95 Blenheim Regular Ginger Ale 28.95 Blenheim Hot Ginger Ale 28.95 Blenheim Diet Ginger Ale 28.95 Cock & Bull Ginger Beer 24.95 Cock & Bull Apple Ginger Beer 24.95 Double Cola 24.95 Sunkist Orange 24.95 Vernor’s Ginger Ale 24.95 Red Rock Ginger Ale 24.95 Cheerwine 24.95 Diet Cheerwine 24.95 Sundrop 24.95 RC Cola 24.95 Nehi Grape 24.95 Nehi Orange 24.95 Nehi Peach 24.95 A&W Root Beer 24.95 Dr. -

Keurig to Acquire Dr Pepper Snapple for $18.7Bn in Cash

Find our latest analyses and trade ideas on bsic.it Coffee and Soda: Keurig to acquire Dr Pepper Snapple for $18.7bn in cash Dr Pepper Snapple Group (NYSE:DPS) – market cap as of 17/02/2018: $28.78bn Introduction On January 29, 2018, Keurig Green Mountain, the coffee group owned by JAB Holding, announced the acquisition of soda maker Dr Pepper Snapple Group. Under the terms of the reverse takeover, Keurig will pay $103.75 per share in a special cash dividend to Dr Pepper shareholders, who will also retain 13 percent of the combined company. The deal will pay $18.7bn in cash to shareholders in total and create a massive beverage distribution network in the U.S. About Dr Pepper Snapple Group Incorporated in 2007 and headquartered in Plano (Texas), Dr Pepper Snapple Group, Inc. manufactures and distributes non-alcoholic beverages in the United States, Mexico and the Caribbean, and Canada. The company operates through three segments: Beverage Concentrates, Packaged Beverages, and Latin America Beverages. It offers flavored carbonated soft drinks (CSDs) and non-carbonated beverages (NCBs), including ready-to-drink teas, juices, juice drinks, mineral and coconut water, and mixers, as well as manufactures and sells Mott's apple sauces. The company sells its flavored CSD products primarily under the Dr Pepper, Canada Dry, Peñafiel, Squirt, 7UP, Crush, A&W, Sunkist soda, Schweppes, RC Cola, Big Red, Vernors, Venom, IBC, Diet Rite, and Sun Drop; and NCB products primarily under the Snapple, Hawaiian Punch, Mott's, FIJI, Clamato, Bai, Yoo- Hoo, Deja Blue, ReaLemon, AriZona tea, Vita Coco, BODYARMOR, Mr & Mrs T mixers, Nantucket Nectars, Garden Cocktail, Mistic, and Rose's brand names. -

Bottles on the Border: the History and Bottles of the Soft Drink Industry In

Bottles on the Border: The History and Bottles of the Soft Drink Industry in El Paso, Texas, 1881-2000 © Bill Lockhart 2010 [Revised Edition – Originally Published Online in 2000] Chapter 5d Chapter 5d Later Empire Companies, Part II, and Duffy’s Draft Beverages Grapette Bottling Company (1941-1969) History Grapette was a relative latecomer to the El Paso bottling industry, although the company began shortly after franchises were first offered by the Grapette Company of Camden, Arkansas, in 1940. The founder of Grapette, Benjamin T. Fooks, originally opened a service station in Camden, Arkansas, but had left the business to begin a bottling plant by 1926. He expanded over the next few years and experimented with flavors including a grape drink. He purchased the registered trademarks, Grapette, Lemonette, and Orangette from Rube Goldstein in 1940 and officially began marketing Grapette in the Spring of that year as the B.T. Fooks Mfg. Co. In 1946, he renamed the business the Grapette Co. He sold the company in 1972 to the Rheingold Corp., a group that became the victim of a hostile takeover by PepsiCo in 1975. Pepsi sold the Grapette line to Monarch in 1977, and the brand was discontinued in the U.S. The drink is still available overseas in 1998 (Magnum 1998). The Grapette Bottling Co. opened its doors in El Paso in 1941, during the World War II sugar rationing period and survived until 1969. In its earliest days, Grapette actually bottled Seven-Up for A.L. Randle who then distributed the product from the Seven-Up Bottling Company next door. -

PDF Product Guide

05/24/21 To Place an Order, Call (207)947-0321 Fax: (207)947-0323 ITEM # DESCRIPTION PACK ITEM # DESCRIPTION PACK COCKTAIL MIXES COFFEE FLAVORED 14678 ROLAND OLIVE JUICE DIRTY*MARTIN 12/25.4OZ 10927 MAINE'S BEST COFFEE JAMAICAN ME CRAZY 2 24/2.25OZ 2008 OCEAN SPRAY DRINK MIX BLOODY MARY 12/32 OZ 11282 MAINE'S BEST COFFEE VACATIONLND VANILLA 24/2.25OZ 26628 MAYSON'S MARGARITA MIX ON THE ROCKS 4/1 GAL 11516 MAINE'S BEST COFFEE HARBORSIDE HAZELNUT 24/2.25OZ 26633 MAYSON'S MARGARITA MIX FOR FROZEN 4/1 GAL 83931 NewEngland COFFEE REG FRNCH VAN CRAZE 24/2.5OZ 26634 MAYSON'S MARGARITA STRAWBERRY PUREE 4/1 GAL 83933 NewEngland COFFEE REG HAZELNUT CRAZE 24/2.5OZ 26637 MAYSON'S MARGARITA RASPBERRY PUREE 4/1 GAL 83939 NewEngland COFFEE REG PUMPKIN SPICE 24/2.5OZ 26639 MAYSON'S MARGARITA PEACH PUREE 4/1 GAL 83940 NewEngland COFFEE REG CINNAMON STICKY B 24/2.5OZ 26640 MAYSON'S MARGARITA WATERMELON PUREE 4/1 GAL 26724 MAYSON'S MARGARITA MANGO PUREE 4/1 GAL 83831 Packer DRINK MIX LEMON POWDER 12/1GAL COFFEE REGULAR 83890 COCO LOPEZ DRINK MIX CREAM COCONUT 24/15oz 10444 MAXWELL HOUSE COFFEE HOTEL & REST 112/1.6OZ 84011 Rose's SYRUP GRENADINE 12/1LTR 10479 Folgers COFFEE LIQ 100% COLOMBIAN 2/1.25L 10923 MAINE'S BEST COFFEE REG ACADIA BLEND 2O 42/2OZ 10924 MAINE'S BEST COFFEE REG COUNTY BLEND 1. 42/1.5OZ CAPPUCCINO 10930 MAINE'S BEST COFFEE REG DWNEAST DARK 2. 24/2.25OZ 90343 Int Coffee CAPPUCCINO FRENCH VAN 6/2LB 1410 Maxwellhse COFFEE REGULAR MASTERBLEND 64/3.75 OZ 23529 MAINE'S BEST COFFEE SEBAGO BLEND 42/2.25OZ 23531 NEW ENGLAND COFFEE EXTREME KAFFEINE -

NUTRITIONAL GUIDE January 2020

NUTRITIONAL GUIDE January 2020 Nutritional and Calorie Guide Hot Food Items Bakery Items Fountain and Frozen Beverages Coffee Drinks The nutritional information is derived from a computer analysis of recipes with the assistance of an ESHA Research Nutrition Labeling and Formulation Software (Genesis R&D 9.11.0 Version), and standard supplier product formulations. The rounding of figures is based on the US Food and Drug Administration NLEA Guidelines. Variations within the nutritional values may occur due to the use of regional suppliers, manufacturing tolerances, minor differences in preparation techniques at the store level, recipe revisions, periodic product formulation changes and other factors. 3 11/01/2019 Table of Contents Hot Food Items 5 Bakery Items 14 Fountain & Frozen Beverages 22 Coffee Drinks 83 The nutritional information is derived from a computer analysis of recipes with the assistance of an ESHA Research Nutrition Labeling and Formulation Software (Genesis R&D 9.11.0 Version), and standard supplier product formulations. The rounding of figures is based on the US Food and Drug Administration NLEA Guidelines. Variations within the nutritional values may occur due to the use of regional suppliers, manufacturing tolerances, minor differences in preparation techniques at the store level, recipe revisions, periodic product formulation changes and other factors. 4 11/01/2019 NachoTaco Cheese Sauce Queso Blanco Cheese Sauce Ghels Chili Sauce 09/24/2019 09/24/2019 09/24/2019 Taco Cheese Sauce Queso Blanco Cheese Sauce Gehls Chili -

Daily from 7AM to 11PM EXT 8206 Would You Like to Order in Advance? Please Contact Us at [email protected]

Daily from 7AM to 11PM EXT 8206 Would you like to order in advance? Please contact us at [email protected] ICED TEA AND JUICES WATER Electrolit Flavors 625 mL Bonafont 1 L Gatorade Flavors 500 mL Bonafont 1.5 L Jumex orange, pineapple, mango, peach, apple Fiji 1 L And cranberry 1 L Fiji 500 mL Sonrisa Juice grapefruit 1 L Perrier 499 mL Cold/hot tea Starbucks Product Perrier 330 mL Green Lipton tea 600 mL San Pellegrino 500 mL Twinings pure chamomile tea, box 25 pieces Schweppes Tonic V8 Splash 413 mL San Pellegrino Limonata 11.5 oz Canada Dry club soda 355 mL DAIRY Brand Dressing (Ranch and Caesar) SODAS Greek yogurt Pepsi 2 L Ice cream: 1 scoop, 2 scoops, 3 scoops, in the following flavors: Pepsi 600 mL vanilla, chocolate, rocky road, vanilla caramel, pistachio, strawberry, Pepsi 355 mL raspberry, lime, hazelnut, berry, cheese cake and mango Diet Pepsi 600 mL Lala whole milk 1L Diet Pepsi 2 L Lala light milk 1 L Diet Pepsi 355 mL Lala Non-Lactose Milk 1L 7 Up 600 mL Coconut Milk 7up 2 L Butter without salt 90 g 7up 355 mL Mayonnaise Mirinda 2 L Philadelphia cream cheese Mirinda 600 mL Manchego cheese Mirinda 355 mL Cheese with pepers Manzanita 2 L Cheese with chili Manzanita 600 mL Silk milk Almond Pacific Manzanita 355 mL Ades Soy Milk Monster energy 473 mL Yoplait Yogurt Cereal, Natural, Strawberry, Mango 125 g Dr Pepper 12 oz Yoplait Yogurt pineapple coconut, Peach, Strawberry, Natural 220 g Red Bull 250 mL Red Bull Sugar free 250 mL BEER Boos Energy Drink Bud Light 355 mL Squirt 600 mL Budweiser 355 mL Squirt 2 L Corona -

Inside Matters the Pepsi Bottling Group, Inc

2004 ANNUAL REPORT Inside Matters The Pepsi Bottling Group, Inc. is the world’s largest manufacturer, seller and distributor of carbonated and non-carbonated Pepsi-Cola beverages. Outside 2004 Facts about PBG U.S. the U.S. Total Number of Plants: 46 50 96 Number of Distribution Centers: 254 267 521 Number of Employees: 31,700 33,000 64,700 Percentage of Volume: 61% 39% 100% U.S. / Canada Brand Mix Trademark Pepsi Trademark Mountain Dew Aquafina Other PepsiCo brands Dr Pepper Sierra Mist Other Non-PepsiCo brands Lipton SoBe Tropicana Frappuccino Europe Brand Mix Trademark Pepsi Other PepsiCo brands KAS Aqua Minerale Other Non-PepsiCo brands 7 UP IVI Fruko Mexico Brand Mix Electropura Trademark Pepsi Manzanita Sol Mirinda Squirt 7 UP Other PepsiCo brands Garci Crespo Other Non-PepsiCo brands Financial Highlights $ in millions, except per share data 2004 2003 2002 Chairman’s Letter Net Revenues $10,906 $10,265 $9,216 Page 2 Pro Forma Net Revenues1 $10,906 $10,265 $8,926 PBG / U.S. and Canada Operating Income $976 $ 956 $ 898 $ in millions Page 4 Diluted$800 EPS $ 1.73 $ 1.50 $ 1.46 Pro Forma Diluted EPS2 $ 1.73 $ 1.56 $ 1.46 PBG / Mexico $700 Net Cash Provided by Operations $ 1,251 $ 1,084 $1,014 Page 8 Capital$600 Expenditures $ (717) $ (644) $ (623) PBG / Europe Net$500 Cash Provided by Operations, $534 Page 10 less Capital Expenditures $ 534 $ 440 $ 391 $400 $440 Board of Directors 1 Fiscal year 2002 has been adjusted to reflect$391 the adoption of Emerging Issues Task Force (EITF) Issue Page 12 No.$300 02-16. -

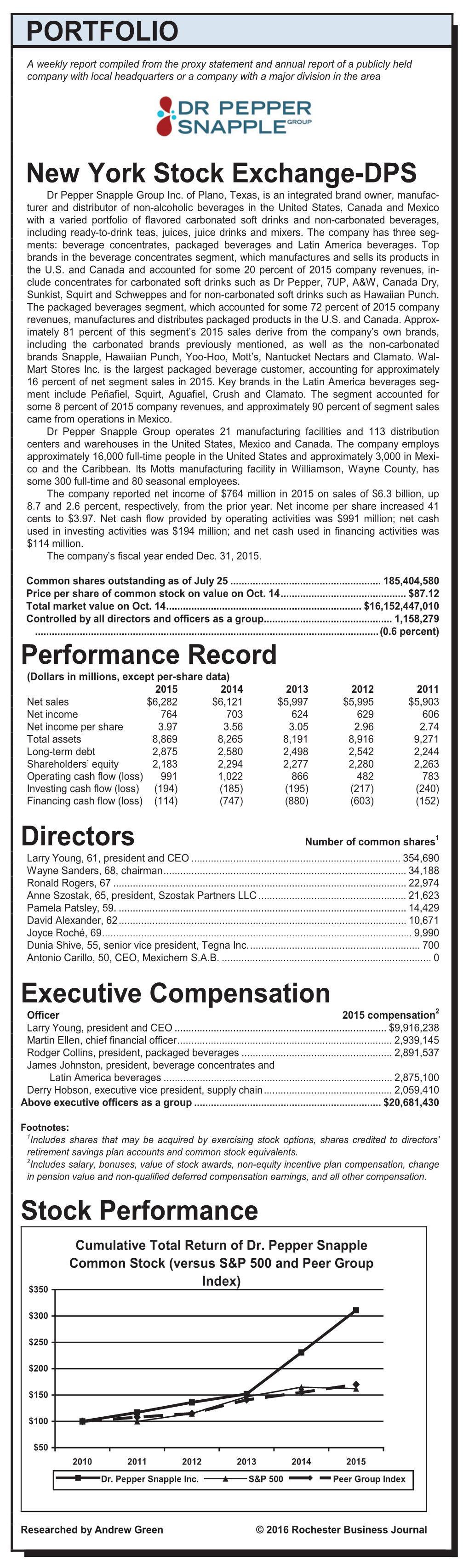

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance

DR PEPPER SNAPPLE GROUP ANNUAL REPORT DPS at a Glance NORTH AMERICA’S LEADING FLAVORED BEVERAGE COMPANY More than 50 brands of juices, teas and carbonated soft drinks with a heritage of more than 200 years NINE OF OUR 12 LEADING BRANDS ARE NO. 1 IN THEIR FLAVOR CATEGORIES Named Company of the Year in 2010 by Beverage World magazine CEO LARRY D. YOUNG NAMED 2010 BEVERAGE EXECUTIVE OF THE YEAR BY BEVERAGE INDUSTRY MAGAZINE OUR VISION: Be the Best Beverage Business in the Americas STOCK PRICE PERFORMANCE PRIMARY SOURCES & USES OF CASH VS. S&P 500 TWO-YEAR CUMULATIVE TOTAL ’09–’10 JAN ’10 MAR JUN SEP DEC ’10 $3.4B $3.3B 40% DPS Pepsi/Coke 30% Share Repurchases S&P Licensing Agreements 20% Dividends Net Repayment 10% of Credit Facility Operations & Notes 0% Capital Spending -10% SOURCES USES 2010 FINANCIAL SNAPSHOT (MILLIONS, EXCEPT EARNINGS PER SHARE) CONTENTS 2010 $5,636 NET SALES +2% 2009 $5,531 $ 1, 3 21 SEGMENT +1% Letter to Stockholders 1 OPERATING PROFIT $ 1, 310 Build Our Brands 4 $2.40 DILUTED EARNINGS +22% PER SHARE* $1.97 Grow Per Caps 7 Rapid Continuous Improvement 10 *2010 diluted earnings per share (EPS) excludes a loss on early extinguishment of debt and certain tax-related items, which totaled Innovation Spotlight 23 cents per share. 2009 diluted EPS excludes a net gain on certain 12 distribution agreement changes and tax-related items, which totaled 20 cents per share. See page 13 for a detailed reconciliation of the Stockholder Information 12 7 excluded items and the rationale for the exclusion. -

Cadenza Document

VGM Club Report Date: Jul 2019 Contracted Manufacturer Report Mfr Name Has Rebate Has Pricing 3M Y Y Abbott Nutrition Y N ACH Food Companies Y N Advance Food Products LLC AFP Y Y AdvancePierre Y Y Agro Farma Inc Y Y Ajinomoto Windsor Inc (formerly Windsor Frozen Foods) Y N Allied Buying Corporation (ABC) Y N All Round Foods Bakery Products Y N Alpha Baking/National Baking Y N American Licorice Co Y N American Metalcraft Y N American Roland Food Corp Y N Amplify Snack Brands Y N Amy's Kitchen Inc Y N Anchor Packaging Y Y Antonio Mozzarella Factory Y N Appetizers And Inc Y Y Apple & Eve Y Y Argo Tea Y Y Arizona Tea - Hornell Brewing Company Y Y Armanino Foods Y Y Armour-Eckrich Meats LLC DBA Carando Y N Armour Eckrich - Smithfield Y Y Ateeco/Mrs T's Pierogies Y Y Atlantic Mills Co Y Y Awake Chocolate Y N Azar Nut Company Y N Bagcraft Packaging LLC Y N Bake N Joy Inc Y N Bakery De France Y Y Ballard Brands Y Y BarFresh Corporation Inc Y Y Barilla America Inc Y Y Basic American Food Co Y Y Bay Valley Foods LLC Y N Belgioioso Cheese Inc Y N Bel Kaukauna Cheese Co Y Y Berks Packing Co Inc Y N Berry Plastics Diet Kits Y N Berry Plastics Liners Y Y Beverage Air Y N Page 1 Of 9 VGM Club Report Date: Jul 2019 Contracted Manufacturer Report Mfr Name Has Rebate Has Pricing Beyond Meat Y Y B&G Foods Inc Y Y Big City Reds /American Foods Y N Big Red Inc Y Y BioSelect N Y Biscomerica Corp. -

All Products Are Pareve Unless Indicated D=Dairy Or M=Meat

New to All products are pareve unless indicated D=Dairy or M=Meat. Due to limited space, this list contains only products manufactured by companies and/or plants certified within the last three months. Brands listed directly beneath one another indicate that the product list immediately below is identical for all brands. PR ODUCTS ARE CERTIF I E D ONLY WH EN BEARING TH E SYMBOL Compiled by Zeh a va Ful d a 4c Seltzer Citrus Mist Green Tea Cappuccino French Vanilla Iced Tonic Water Golden Cola Champagne Green Tea W/ginseng & Plum Juice Tea Mix ........................................D Tropical Punch Wild Cherry Seltzer Green Tea W/honey & Ginseng Cappuccino Mix-coffee Flavor..........D Vanilla Cream Soda Green Tea With Ginseng & Asia Plum Cappuccino Mix-mocha Flavor........D Wildberry Seltzer American Dry Green Tea With Ginseng And Honey Iced Tea Mix-decaffeinated Yellow Lightning Club Soda Green Tea With Honey (64oz) Iced Tea Mix-lemon Flavor Green Tea With Honey And Ginseng Anderson Erickson Iced Tea Mix-peach Flavor Adirondack Clear ‘n’ Natural Honey Lemon Premium Tea Blue Raspberry Fruit Bowl................D Iced Tea Mix-raspberry Flavor Blackberry Soda Kahlua Iced Coffee ..........................D Lite Egg Nog....................................D Iced Tea Mix-sugar Free Cherry Soda Latte Supreme..................................D Lemonade Flavor Drink Mix Cranberry Soda Lemon Iced Tea Diet Cranberry Soda Anytime Drink Crystals Lemon Tea A & W Diet Loganberry Soda Lemonade W/10% Real Lemon Juice Cream Soda Diet Raspberry Lime Soda -

Keurig Dr Pepper Annual Report 2021

Keurig Dr Pepper Annual Report 2021 Form 10-K (NYSE:KDP) Published: February 25th, 2021 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED December 31, 2020 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO COMMISSION FILE NUMBER 001-33829 kdp-20201231_g1.jpg Keurig Dr Pepper Inc. (Exact name of registrant as specified in its charter) Delaware 98-0517725 (State or other jurisdiction of incorporation or organization) (I.R.S. employer identification number) 53 South Avenue Burlington, Massachusetts 01803 (Address of principal executive offices) (781) 418-7000 (Registrant's telephone number, including area code) Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). -

A Guide to the Soft Drink Industry Acknowledgments

BREAKING DOWN THE CHAIN: A GUIDE TO THE SOFT DRINK INDUSTRY ACKNOWLEDGMENTS This report was developed to provide a detailed understanding of how the soft drink industry works, outlining the steps involved in producing, distributing, and marketing soft drinks and exploring how the industry has responded to recent efforts to impose taxes on sugar-sweetened beverages in particular. The report was prepared by Sierra Services, Inc., in collaboration with the Supply Chain Management Center (SCMC) at Rutgers University – Newark and New Brunswick. The authors wish to thank Kristen Condrat for her outstanding support in all phases of preparing this report, including literature review and identifying source documents, writing, data analysis, editing, and final review. Special thanks also goes to Susanne Viscarra, who provided copyediting services. Christine Fry, Carrie Spector, Kim Arroyo Williamson, and Ayela Mujeeb of ChangeLab Solutions prepared the report for publication. ChangeLab Solutions would like to thank Roberta Friedman of the Yale Rudd Center for Food Policy and Obesity for expert review. For questions or comments regarding this report, please contact the supervising professors: Jerome D. Williams, PhD Prudential Chair in Business and Research Director – The Center for Urban Entrepreneurship & Economic Development (CUEED), Rutgers Business School – Newark and New Brunswick, Management and Global Business Department 1 Washington Park – Room 1040 Newark, NJ 07102 Phone: 973-353-3682 Fax: 973-353-5427 [email protected] www.business.rutgers.edu/CUEED Paul Goldsworthy Senior Industry Project Manager Department of Supply Chain Management & Marketing Sciences Rutgers Business School Phone: 908-798-0908 [email protected] Design: Karen Parry | Black Graphics The National Policy & Legal Analysis Network to Prevent Childhood Obesity (NPLAN) is a project of ChangeLab Solutions.