Entertainment One Shareholders Vote to Approve Acquisition by Hasbro

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

From Director Michael Bay and Executive Producer Steven

From Director Michael Bay and Executive Producer Steven Spielberg, the Biggest Movie of the Year Worldwide, TRANSFORMERS: Revenge of the Fallen is Unleashed on Blu-ray and DVD --DreamWorks Pictures' and Paramount Pictures' $820+ Million Global Smash Returns to Earth October 20 Armed with Explosive Special Features to Bring the Epic Battle Home in Two-Disc Blu-ray and DVD Sets HOLLYWOOD, Calif., Aug 20, 2009 -- With more action and more thrills, TRANSFORMERS: Revenge of the Fallen captivated audiences to earn over $820 million at the box office and become the #1 movie of the year in North America and throughout the world. The latest spectacular adventure in the wildly popular TRANSFORMERS franchise will make its highly-anticipated DVD and Blu-ray debut on October 20, 2009 in immersive, two-disc Special Editions, as well as on a single disc DVD, from DreamWorks Pictures and Paramount Pictures in association with Hasbro; distributed by Paramount Home Entertainment. The eagerly-awaited home entertainment premiere will be accompanied by one of the division's biggest marketing campaigns ever, generating awareness and excitement of galactic proportions. (Photo: http://www.newscom.com/cgi-bin/prnh/20090820/LA64007) From director Michael Bay and executive producer Steven Spielberg, in association with Hasbro, TRANSFORMERS: Revenge of the Fallen delivers non-stop action and fun in an all-new adventure that the whole family can enjoy. Featuring out-of-this- world heroes in the form of the mighty AUTOBOTS and a malevolent and powerful villain known as THE FALLEN, the film boasts some of the most sensational--and complex--visual effects in film history set against the backdrop of spectacular locations around the world. -

Hasbro Second Quarter 2012 Financial Results Conference Call Management Remarks July 23, 2012

Hasbro Second Quarter 2012 Financial Results Conference Call Management Remarks July 23, 2012 Debbie Hancock, Hasbro, Vice President, Investor Relations: Thank you and good morning everyone. Our second quarter earnings release was issued earlier this morning and is available on our website. Additionally, also available on our web site, are presentation slides containing information covered in today’s earnings release and call. The press release and presentation include information regarding Non-GAAP financial measures included in today's call. Please note that during today’s call, whenever we discuss earnings per share or EPS, we are referring to earnings per diluted share. This morning, Brian Goldner, Hasbro’s President and Chief Executive Officer, and Deb Thomas, Hasbro’s CFO, will review our second quarter financial results and discuss important factors impacting our performance. Following their statements, David Hargreaves, Hasbro’s Chief Operating Officer, will join Brian and Deb to field your questions. Before we begin, please note that during this call and the question and answer session that follows, members of Hasbro management may 1 make forward-looking statements concerning management's expectations, goals, objectives and similar matters. These forward- looking statements may include comments concerning our product and entertainment plans, anticipated product performance, business opportunities, plans and strategies, costs, financial goals and expectations for our future financial performance, including expectations for revenues and earnings per share in 2012. There are many factors that could cause actual results or events to differ materially from the anticipated results or other expectations expressed in these forward-looking statements. Some of those factors are set forth in our annual report on form 10-K, our most recent 10-Q, in today's press release and in our other public disclosures. -

Resume-08-12-2021

Mike Milo Resume updated 08-12-2021 • OBJECTIVE: • To create stories, characters and animation that move the soul and make people laugh. CREDITS: • DIRECTOR- Warner Bros. Animation-HARLEY QUINN (current) • WRITER and PUNCH-UP on unannounced Netflix/ Universal- WOODY WOODPECKER movie • Supervising DIRECTOR- Age of Learning/Animasia- YOUNG THINKER’S LABORATORY • Story Artist- Apple TV- THE SNOOPY SHOW • Story Artist- Warner Bros. Animation SCOOBY DOO HALLOWEEN • DIRECTOR- Bento Box/ Apple TV- WOLFBOY AND THE EVERYTHING TREE • Freelance Animation DIRECTOR for Cartoon Network/HBO Max’s TIG ‘n’ SEEK • SHOWRUNNER/DIRECTOR- Universal’s WOODY WOODPECKER • DIRECTOR-Warner Bros. Animation- SCOOBY DOO AND GUESS WHO • Freelance Animation DIRECTOR for Warner Bros. Animation LOONEY TUNES 1000-ongoing • Freelance Animation DIRECTOR for Cartoon Network's CRAIG OF THE CREEK • Story Artist- CURIOUS GEORGE- Universal/DreamWorks • Creator, Writer, Director, Designer, Story Artist- GENIE HUNTERS- Cartoon Network • Freelance Animation DIRECTOR for Cartoon Network's UNCLE GRAMPA • Freelance Animation DIRECTOR for Cartoon Network's Justice League Action • Freelance Animation DIRECTOR for Netflix’s STRETCH ARMSTRONG • Storyboard Supervisor/Director/Teacher/Technology consultant: storyboards, writing, animation, design, storyboard direction and timing- RENEGADE ANIMATION • Freelance Storyboards and writing- THE TOM AND JERRY SHOW- Renegade Animation Freelance Animation DIRECTOR for Cartoon Network's BEN 10 • Freelance Flash cartoons for PEOPLE MAGAZINE and ESSENCE MAGAZINE • Flash storyboards, Direction, animation and design- Education.com on BRAINZY • Freelance Exposure Sheets for Marvel Entertainment- AVENGERS ASSEMBLE • Flash storyboards for Amazon pilot: HARDBOILED EGGHEADS • •Character Design and Development- Blackspot Media NYC- IZMOCreator, Writer, Director, Designer, Story Artist- Nickelodeon development BORIS OF THE FOREST with BUTCH HARTMAN • •Story Artist at Nickelodeon Animation Studios- FAIRLY ODD PARENTS • •Freelance Character Design at Animae Studios- LA FAMILIA P. -

GI JOE: RETALIATION Film to Be Released in 3D

May 23, 2012 G.I. JOE: RETALIATION Film to Be Released in 3D Hasbro Reaffirms 2012 Guidance that it Expects to Grow Revenues and Earnings Per Share Absent the Impact of Foreign Exchange PAWTUCKET, R.I.--(BUSINESS WIRE)-- Hasbro, Inc (NASDAQ:HAS), and Paramount Pictures, announced today that G.I. JOE: RETALIATION will now be released in 3D. The film, originally slated for release in June 2012, is scheduled to be released March 29, 2013. "It is increasingly evident that 3D resonates with movie-goers globally and together with Paramount, we made the decision to bring fans an even more immersive entertainment experience," said Brian Goldner, Hasbro's President and CEO. "In 2012, we continue to have several strong motion picture and television entertainment backed properties that are selling well at retail and our entertainment strategy remains strong and on-track," Goldner said. "Through our own Hasbro Studios for television and in partnership with several movie studios including Paramount, Universal, Sony and Relativity, we are creating entertainment experiences around many of our highly popular iconic brands. For the full year 2012, we continue to believe, absent the impact of foreign exchange, we will again grow revenues and earnings per share." Certain statements in this release contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include expectations concerning the Company's potential performance in 2012, including with respect to its revenues and earnings per share, and business goals and may be identified by the use of forward- looking words or phrases. The Company's actual actions or results may differ materially from those expected or anticipated in the forward-looking statements due to both known and unknown risks and uncertainties. -

Eone Annual Report 2019

2019 Annual Report and Accounts Unlocking the power & value of creativity We are focused on building the leading talent-driven, platform- agnostic entertainment company in the world. Through our deep creative relationships we are able to produce the highest quality content for the world’s markets. We are powered by global reach, scale and local market knowledge to generate maximum value for this content. Strategic Report SR Governance G Financial Statements FS Unlocking the Unlocking the value of originality power & value p.10 of creativity Unlocking the power of creativity p.12 Strategic report Governance 02 At a glance 66 Corporate governance 04 Chairman’s statement 68 Board of Directors 06 Chief Executive Officer’s review 70 Corporate governance report 10 Unlocking the power 78 Audit Committee report & value of creativity Unlocking the 86 Nomination Committee report value of direction 20 Market Review 90 Directors’ Remuneration report p.14 22 Business Model 118 Directors’ report: 24 Strategy additional information 26 Key performance indicators Financial statements Business review 122 Independent auditor’s report 28 Family & Brands 127 Consolidated financial statements 36 Film, Television & Music 131 Notes to the consolidated financial statements Unlocking the 46 Finance review power of storytelling 51 Principal risks and uncertainties Visit our website: entertainmentone.com p.16 58 Corporate responsibility Unlocking the value of talent p.18 entertainmentone.com 1 AT A GLANCE Performance highlights Strong growth in underlying EBITDA -

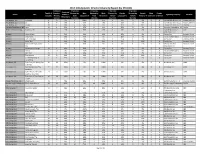

2017 DGA Episodic Director Diversity Report (By STUDIO)

2017 DGA Episodic Director Diversity Report (by STUDIO) Combined # Episodes # Episodes # Episodes # Episodes Combined Total # of Female + Directed by Male Directed by Male Directed by Female Directed by Female Male Female Studio Title Female + Signatory Company Network Episodes Minority Male Caucasian % Male Minority % Female Caucasian % Female Minority % Unknown Unknown Minority % Episodes Caucasian Minority Caucasian Minority A+E Studios, LLC Knightfall 2 0 0% 2 100% 0 0% 0 0% 0 0% 0 0 Frank & Bob Films II, LLC History Channel A+E Studios, LLC Six 8 4 50% 4 50% 1 13% 3 38% 0 0% 0 0 Frank & Bob Films II, LLC History Channel A+E Studios, LLC UnReal 10 4 40% 6 60% 0 0% 2 20% 2 20% 0 0 Frank & Bob Films II, LLC Lifetime Alameda Productions, LLC Love 12 4 33% 8 67% 0 0% 4 33% 0 0% 0 0 Alameda Productions, LLC Netflix Alcon Television Group, Expanse, The 13 2 15% 11 85% 2 15% 0 0% 0 0% 0 0 Expanding Universe Syfy LLC Productions, LLC Amazon Hand of God 10 5 50% 5 50% 2 20% 3 30% 0 0% 0 0 Picrow, Inc. Amazon Prime Amazon I Love Dick 8 7 88% 1 13% 0 0% 7 88% 0 0% 0 0 Picrow Streaming Inc. Amazon Prime Amazon Just Add Magic 26 7 27% 19 73% 0 0% 4 15% 1 4% 0 2 Picrow, Inc. Amazon Prime Amazon Kicks, The 9 2 22% 7 78% 0 0% 0 0% 2 22% 0 0 Picrow, Inc. Amazon Prime Amazon Man in the High Castle, 9 1 11% 8 89% 0 0% 0 0% 1 11% 0 0 Reunion MITHC 2 Amazon Prime The Productions Inc. -

“Deck the Walls” Coffee Bean & Tea Leaf®

The Help Group ... because every child deserves a great future FALL 2009 BRIAN GOLDNER, MARY URQUHART & MAX MAYER TO BE HONORED AT THE HELP GROUP’S 2009 TEDDY BEAR BALL he Help Group is pleased to announce that has helped to create brighter futures for children three remarkable individuals will be honored with autism. Max Mayer, the gifted writer-director of T at The Help Group’s 2009 Teddy Bear Ball. the acclaimed motion picture “Adam,” will receive This 13th annual holiday the Spirit of Hope Award gala celebration will be for raising important held on Monday, December public awareness and 7th, 2009, at the Beverly understanding through Hilton Hotel. his sensitive portrayal of a young man with Asperger’s BRIAN GOLDNER Brian Goldner, President Disorder. Gala Chairs are and CEO of Hasbro Inc., Brian Grazer, Cheryl & will receive The Help Haim Saban, and Bill Group’s Help Humanitarian Urquhart. MARY URQUHART MAX MAYER Award in recognition of his far-reaching philanthropic leadership and A toy industry veteran, Brian Goldner is widely commitment to children’s causes. Parent advocate recognized for leading the evolution of Hasbro from Mary Urquhart will receive the Champion for Children Award in a traditional toy and game company to a leader in world-class recognition of her heartfelt spirit of giving and volunteerism that family entertainment. Brian is responsible for Hasbro’s business continued on page 3 THE HELP GROUP’S NEW AUTISM CENTER CURRENTLY UNDER CONSTRUCTION “Deck the Walls” DEDICATED TO EDUCATION, RESEARCH, PARENT & PROFESSIONAL TRAINING AND OUTREACH for The Help Group children at your local Coffee Bean & Tea Lea f® this holiday season! see story on page 5 see story on page 7 BOARD OF DIRECTORS CIRCLE OF FRIENDS Gary H. -

Are You Suprised ?

SPENCER DAVIS 1967 E L A R B OLITA D RIVE, Glendale, CA 912 0 8 818- 353- 9519 S UMMARY Accomplished designer and illustrator. Experienced with traditional animation, as well as working digitally. W ORK E XPERIENCE BENTOBOX ENTERTAINMENT NORTH HOLLYWOOD, CA 2019-2020 LAYOUT DESIGNER–Various Projects DISNEY ANIMATION BURBANK, CA 2015-2018 LAYOUT DESIGNER –Milo Murphy’s Law SIX POINT HARNESS GLENDALE, CA 2014-2015 LAYOUT DESIGNER –Fresh Beat Band of Spies VISION SCENERY BURBANK, CA 2012-2013 MODEL BUILDER –Various Projects ROUGHDRAFT GLENDALE, CA 2011 LAYOUT DESIGN -Napoleon Dynamite CARTOON NETWORK BURBANK, CA 2010 LAYOUT DESIGNER–Flapjack NICKELODEON ANIMATION BURBANK, CA 2009 P ROP DESIGNER –Penguins of Madagascar KD LEARNING BURBANK, CA 2007-2008 DESIGNER/ENVIRONMENT BUILDER FOR K IDS’ V IRTUAL WORLD –ZooKazoo.com FILM ROMAN NORTH HOLLYWOOD, CA 2006-2007 BACKGROUND S TORYBOARD ARTIST –King of the Hill NICKELODEON ANIMATION BURBANK, CA 2005-2006 LAYOUT SUPERVISOR- Cat Scratch DISNEY ANIMATION BURBANK, CA 2004 LAYOUT DESIGNER–Super Monkey Team Hyperforce Go COMEDY CENTRAL GLENDALE, CA 2003 FREELANCE LAYOUT ARTIST –Kid Notorious FILM ROMAN NORTH HOLLYWOOD, CA 2003 LAYOUT ARTIST –Freeforall; X-Men CREATIVE CAPERS GLENDALE, CA 2003 CONCEPT DESIGN ARTIST – Kelly Dream Club RENEGADE ANIMATION BURBANK, CA 2003 FREELANCE LAYOUT AR TIST – Captain Sturdy NICKELODEON ANIMATION BURBANK, CA 2002 LAYOUT ARTIST- Invador Zim DIC ENTERTAINMENT BURBANK, CA 2000 LAYOUT ARTIST- Various Projects 1990-1999 INFORMATION AVAILABLE UPON REQUEST E DUCATION Bachelor of Arts in Illustration- Graduated with Honors Art Center College of Design, Pasadena, California W ORK E XPERIENCE NICKELODEON ANIMATION BURBANK, CA 1998 LAYOUT ARTIST- Angry Beavers DONALD PENNINGTON’S INC. -

Bill's Resume.May.04.2013

WILLIAM C. WALDMAN III 1407 West Oak Street Burbank, CA 91506 (818)563-3993 [email protected] Objectives: Seeking a Character Animator position for Animation Production Work Experience 3/13-present Animator/ Warner Bros. Animation Char.Layout “Tom & Jerry and the Mighty Dragon” 11/12-3/13 Animator Duck Soup Studios Walt Disney World “Sorcerers Of The Magic Kingdom” "Smurfy Hollow" DVD Extra "Mathias Project" "Timon & Pumbaa Safety Smart--Transportation" 6/12-11/12 Animator/ Warner Bros. Animation Char.Layout “Tom & Jerry's Giant Adventure” 3/12-5/12 Animator Duck Soup Studios "Timon & Pumbaa Safety Smart--Electronics" 8/11-2/12 Animator/ Warner Bros. Animation Char.Layout “Robin Hood And His Merry Mouse” 5/11-7/11 Animator Duck Soup Studios “Smurfs Christmas Carol” DVD Extra 3/11-4/11 Animator Creative Capers Entertainment Walt Disney World “Sorcerers Of The Magic Kingdom” 7/09-2/11 Animator/ Warner Bros. Animation Char. Layout/ “ Tom And Jerry Meet Sherlock Holmes” Storyboard “Looney Tunes” TV Series Revisionist “Tom And Jerry and The Wizard Of Oz” 6/08-7/09 Animator Walt Disney Feature Animation “The Princess And The Frog” 4/08-6/08 Animator DreamWorks Animation “Kung Fu Panda” DVD extras 11/07-3/08 Storyboard Universal Cartoon Studios Revisionist “Curious George 2: Monkey On The Run” 3/07-8/07 Storyboard Warner Brothers TV Animation Revisionist/ “Tom And Jerry Tales” Char. Layout: 6/06-3/07 Animator/ Rough Draft Studios Char. Layout “The Simpson’s Movie” 5/06-6/06 Animator Disney Toon Studios “Disney Princess” DVD (Animation corrections) 3/05-5/06 Animator/ Warner Brothers TV Animation Char. -

Los Angeles Mission 2019

EC7.7 REPORT FOR ACTION Los Angeles Mission 2019 Date: August 13, 2019 To: Economic and Community Development Committee From: General Manager, Economic Development and Culture Wards: All SUMMARY On May 9, 2019, Mayor John Tory, alongside Deputy Mayor Michael Thompson, Councillor Paula Fletcher and key City staff led a delegation of 30 Toronto screen industry companies and organizations to Los Angeles to strengthen existing relationships and foster new ones with Los Angeles’ leading film, television and digital media companies in order to secure more investment in Toronto. The delegation, the largest to date for this mission, presented a unified voice for the jurisdiction and showcased Toronto’s commitment to growing the industry beyond the $2 billion it contributed to the city in 2018. Messaging from Mayor Tory, Deputy Mayor Thompson, Councillor Fletcher, City staff and delegates was focused on infrastructure growth, workforce development and customer service during this unprecedented golden age of content creation. This report provides an overview of the Mayor’s Los Angeles Mission including key activities and outcomes. RECOMMENDATIONS The General Manager, Economic Development and Culture recommends that: 1. City Council receive this report for information. FINANCIAL IMPACT The total cost of the trade mission was $152,822.42. The net cost after sponsorship contributions of $133,193.16 was $19,629.26. This amount was included in Economic Development and Culture's 2019 Approved Operating Budget, under the Film and Entertainment Industries activity. Future investments in Toronto by companies met in Los Angeles will result in benefits to the City. Los Angeles Mission 2019 Page 1 of 9 The Chief Financial Officer and Treasurer has reviewed this report and agrees with the financial impact information. -

The Magic of Friendship Comes to the Big Screen in a New My Little Pony Movie from Hasbro's Allspark Pictures and Lionsgate

The Magic of Friendship Comes to the Big Screen in a New My Little Pony Movie from Hasbro's Allspark Pictures and Lionsgate August 7, 2015 The Magic of Friendship Comes to the Big Screen in a New My Little POny Movie from Hasbro's Allspark Pictures and Lionsgate SANTA MONICA, Calif. and PAWTUCKET, R.I., Aug. 7, 2015 /PRNewswire/ -- Lionsgate (NYSE: LGF), a premier next generation global content leader, and Hasbro, Inc. (NASDAQ: HAS), a global company creating the world's best play experiences, are teaming up to prove that "friendship is magic" as the two companies bring Hasbro's world famous MY LITTLE PONY franchise to the big screen. Meghan McCarthy, fan-favorite writer and producer for the My Little Pony: Friendship is Magic animated series, is penning the screenplay, which will be produced by Hasbro's Allspark Pictures. Lionsgate will be distributing and marketing the film globally (except in China). Tony® and Emmy Award®-winning actress Kristin Chenoweth will voice a new character in the film, which is Hasbro's first animated feature. The MY LITTLE PONY brand has been enchanting fans of all ages worldwide for more than 30 years with its socially relevant messages of acceptance and friendship. What started in 1983 as a toy line of colorful ponies with unique symbols, called "cutie marks," has since exploded into international, multi-media, pop culture phenomena that grossed over $1 billion in retail sales in 2014. The entertainment continues to engage and inspire kids and families in over 180 countries across the globe. "We are pleased to partner with Hasbro to bring their brands to audiences in new and exciting ways," said Lionsgate Motion Picture Group Co-President Erik Feig. -

Hasbro Annual Report 2020

Hasbro Annual Report 2020 Form 10-K (NASDAQ:HAS) Published: February 27th, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 29, 2019 Commission file number 1-6682 Hasbro, Inc. (Exact Name of Registrant As Specified in its Charter) Rhode Island 05-0155090 (State of Incorporation) (I.R.S. Employer Identification No.) 1027 Newport Avenue Pawtucket, Rhode Island 02861 (Address of Principal Executive Offices) (Zip Code) Registrant’s telephone number, including area code (401) 431-8697 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock HAS The NASDAQ Global Select Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ or No ☐. Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ or No ☒. Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.