Hasbro Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Distribution De Jeux Et Jouets

IndexPresse Business Etude Secteurs & marchés Distribution de jeux et jouets Face à la domination des grandes surfaces et à la hausse de l’e-commerce, quel nouveau modèle pour le circuit spécialisé ? secteurs & marchés Distribution de jeux et jouets Face à la domination des grandes surfaces et à la hausse de l’e-commerce, quel nouveau modèle pour le circuit spécialisé ? ntre 2013 et 2018, la part des spécialistes de la distribution de jeux et jouets en France s’est for te- ment contractée sous l’effet de la progression du circuit de l’e-commerce. Auparavant immuable et solide, le secteur fait désormais face à une décélération des ventes et à une transformation du Epaysage de la distribution. Les redressements judiciaires de l’américain Toys’R’Us et de l’enseigne française La Grande Récré ali- mentent les inquiétudes des experts et des professionnels. La distribution spécialisée de jeux et jouets s’interroge sur son avenir. Fondé sur les codes anciens du commerce physique, son modèle doit être repensé pour répondre aux nouvelles attentes des consommateurs, sans renier pour autant les forces qui ont fait son succès. Les enseignes agissent pour asseoir leur ancrage local tout en investissant la sphère numérique. Les réseaux continuent de se développer. Les formats s’ajustent. Le multicanal s’impose. Face à la guerre des prix instaurée par les pure players de l’e-commerce et les grandes surfaces alimen- taires (GSA), il s’agit pour le circuit spécialisé de miser sur ses qualités propres pour faire la différence. L’expertise, la précision de l’offre et la relation de proximité doivent s’imposer pour développer le lien émotionnel qui le rapproche de ses clients. -

Music Industry Tastemaker Randy Jackson Joins Hasbro's PLAYSKOOL Brand to Celebrate the Launch of LET's ROCK! ELMO

September 20, 2011 Music Industry Tastemaker Randy Jackson Joins Hasbro's PLAYSKOOL Brand to Celebrate the Launch of LET'S ROCK! ELMO Most Interactive Elmo Toy Yet Invites Kids to Make Music in Rock Star Fashion PAWTUCKET, R.I., Sept. 20, 2011 /PRNewswire/ -- Are you ready to rock? It's show time as Hasbro Inc.'s (NASDAQ: HAS) iconic PLAYSKOOL brand introduces the LET'S ROCK! ELMO interactive plush, the most innovative Elmo toy yet. Joined by music industry veteran and Grammy Award-winning producer Randy Jackson, LET'S ROCK! ELMO made his official debut at a private event yesterday at the Empire Hotel in New York, NY. Known for his ability to guide the next generation of music superstars into the spotlight, Jackson was on hand to offer advice as LET'S ROCK! ELMO takes the stage at retail this fall. The truly interactive LET'S ROCK! ELMO plush character sings, plays instruments, and invites little musicians to rock out with him! To view the multimedia assets associated with this release, please click: http://www.multivu.com/mnr/52202-randy-jackson-joins- hasbro-playskool-for-let-s-rock-elmo-launch (Photo: http://photos.prnewswire.com/prnh/20110920/MM70945 ) Children can sing along with their favorite red furry rocker to six on-board songs, including the popular "Elmo's World," "What Elmo Likes About You" and original "Elmo Likes to Rock & Roll," while the LET'S ROCK! ELMO toy jams along. When children hand LET'S ROCK! ELMO the included drums, tambourine or microphone, he recognizes which instrument he is playing! Little musicians can join in with a LET'S ROCK! guitar, keyboard or microphone (each sold separately) to form their own rock band with the LET'S ROCK! ELMO toy. -

From Director Michael Bay and Executive Producer Steven

From Director Michael Bay and Executive Producer Steven Spielberg, the Biggest Movie of the Year Worldwide, TRANSFORMERS: Revenge of the Fallen is Unleashed on Blu-ray and DVD --DreamWorks Pictures' and Paramount Pictures' $820+ Million Global Smash Returns to Earth October 20 Armed with Explosive Special Features to Bring the Epic Battle Home in Two-Disc Blu-ray and DVD Sets HOLLYWOOD, Calif., Aug 20, 2009 -- With more action and more thrills, TRANSFORMERS: Revenge of the Fallen captivated audiences to earn over $820 million at the box office and become the #1 movie of the year in North America and throughout the world. The latest spectacular adventure in the wildly popular TRANSFORMERS franchise will make its highly-anticipated DVD and Blu-ray debut on October 20, 2009 in immersive, two-disc Special Editions, as well as on a single disc DVD, from DreamWorks Pictures and Paramount Pictures in association with Hasbro; distributed by Paramount Home Entertainment. The eagerly-awaited home entertainment premiere will be accompanied by one of the division's biggest marketing campaigns ever, generating awareness and excitement of galactic proportions. (Photo: http://www.newscom.com/cgi-bin/prnh/20090820/LA64007) From director Michael Bay and executive producer Steven Spielberg, in association with Hasbro, TRANSFORMERS: Revenge of the Fallen delivers non-stop action and fun in an all-new adventure that the whole family can enjoy. Featuring out-of-this- world heroes in the form of the mighty AUTOBOTS and a malevolent and powerful villain known as THE FALLEN, the film boasts some of the most sensational--and complex--visual effects in film history set against the backdrop of spectacular locations around the world. -

Merchandising, Transmediality and Nostalgia in Power Rangers Super Megaforce Ross P

[email protected] @DefConG Going Legendary: Merchandising, Transmediality and Nostalgia in Power Rangers Super Megaforce Ross P. Garner School of Journalism, Media and Cultural Studies Cardiff University Introduction • Research questions: • How do forms of nostalgia become constructed in programmes primarily targeting children? • What cultural issues do these industrially-located strategies intersect with? • Approach taken: • Nostalgia as discourse. • Addressing social, cultural, historical and industrial contexts. • Case study: • Power Rangers Super Megaforce (Saban Brands 2014) Introducing Legendary Mode Diegetic Codings of Objects Decontextualized Nostalgia Decontextualized Nostalgia and Imagined Audiences • Audiences targeted: • Fans • ‘Child’ = primary audience: • “Boys aged 4-8” (Saban Brands 2013: 2) • “As they get older, children repeatedly (and often fiercely) reject their former enthusiasms: differences of as little as a couple of years carry enormous significance.” (Buckingham and Sefton- Green 2004: 15). • Adults: • Intertextual pleasures (Gordon 2003) • Inter-generational bridging. Decontextualized Nostalgia, Adults and Reassurance • Useful framework = Giddens (1991)…: • Trust in abstract systems = subjective anxiety and powerlessness. • Counter this through reflexive self-narratives and ontological security. • …but add to this: • Davis (1979: 41) on nostalgia and self-identity. • Holdsworth (2011) – TV rememberance = show and context. • Discourses constructing the Power Rangers: • Violence; consumerist; aesthetic dismissals -

Eone Annual Report 2019

2019 Annual Report and Accounts Unlocking the power & value of creativity We are focused on building the leading talent-driven, platform- agnostic entertainment company in the world. Through our deep creative relationships we are able to produce the highest quality content for the world’s markets. We are powered by global reach, scale and local market knowledge to generate maximum value for this content. Strategic Report SR Governance G Financial Statements FS Unlocking the Unlocking the value of originality power & value p.10 of creativity Unlocking the power of creativity p.12 Strategic report Governance 02 At a glance 66 Corporate governance 04 Chairman’s statement 68 Board of Directors 06 Chief Executive Officer’s review 70 Corporate governance report 10 Unlocking the power 78 Audit Committee report & value of creativity Unlocking the 86 Nomination Committee report value of direction 20 Market Review 90 Directors’ Remuneration report p.14 22 Business Model 118 Directors’ report: 24 Strategy additional information 26 Key performance indicators Financial statements Business review 122 Independent auditor’s report 28 Family & Brands 127 Consolidated financial statements 36 Film, Television & Music 131 Notes to the consolidated financial statements Unlocking the 46 Finance review power of storytelling 51 Principal risks and uncertainties Visit our website: entertainmentone.com p.16 58 Corporate responsibility Unlocking the value of talent p.18 entertainmentone.com 1 AT A GLANCE Performance highlights Strong growth in underlying EBITDA -

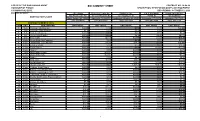

Bid Summary Sheet Contract No

OFFICE OF THE PURCHASING AGENT BID SUMMARY SHEET CONTRACT NO. 14-04-24 TOWNSHIP OF EDISON DESCRIPTION: RECREATION GAMES AND EQUIPMENT 100 MUNICIPAL BLVD. BID OPENING: OCTOBER 10, 2014 EDISON, NJ 08817 ARC Sports Metuchen Center Inc. Flaghouse Inc. S & S Worldwide School Specialty Inc. 850 Peach Lake Rd 10-12 Embroidery St 601 Flaghouse Dr 75 Mill St 140 Marble Dr CONTRACTOR'S NAME North Salem, NY 10560 Sayreville, NJ 08872 Hasbrouck Heights, NJ 07604 Colchester, CT 06415 Lancaster, PA 17601 (203) 775-4140 (732) 418-1388 (800) 793-7900 (800) 642-7354 (888) 388-3224 CONTRACT EXPIRES:1/9/16 ITEM UNIT DESCRIPTION UNIT PRICE UNIT PRICE UNIT PRICE UNIT PRICE UNIT PRICE 1 Sets Checkers (No Boards) NO BID $1.65 $1.53 $1.76 NO BID 2 Sets Checkers (With Boards) $2.75 $2.75 $3.34 $3.07 $2.58 3 Sets Chinese Checkers NO BID $2.95 $4.61 $9.10 $3.56 4 Dz Chess Sets (Plastic) NO BID $35.00 $4.18 $56.40 $43.32 5 Sets Bocci Balls NO BID $21.95 NO BID $12.00 $11.98 6 Each Koosh Balls (No Paddles) NO BID $2.95 $2.12 $2.46 $13.46 7 Each Ladder Ball Toss (Blongo) NO BID $21.50 $27.29 $21.00 NO BID 8 Each Hackey Sacks NO BID $2.95 $2.52 $1.76 $11.98 9 Each Potato Sacks NO BID $2.00 $1.00 * $14.64 * $13.24 10 Each "Skip It" NO BID $5.50 NO BID $1.40 $9.73 11 Pairs Magic Mitts & Balls NO BID NO BID NO BID $5.70 $4.30 12 Each Magic Mitts Balls NO BID NO BID NO BID $1.32 *$5.38 13 Each Frisbee NO BID $3.95 $6.11 $1.00 $4.67 14 Each Ring Toss NO BID $11.95 $10.07 $9.80 $10.86 15 Each Hoola Hoops 30" NO BID $1.95 *$36.97 * $24.48 * $16.25 16 Each Hoola Hoops 36" NO BID $2.25 * $47.74 * $30.96 * $17.72 17 Each Chinese Jump Ropes NO BID $2.95 $2.58 $1.13 $8.63 18 Each Rubber Jump Ropes-9 ft. -

Connecticut Word Wizards Win National School SCRABBLE(R) Championship

May 5, 2007 Connecticut Word Wizards Win National School SCRABBLE(R) Championship 100 Teams From Across the Nation Competed for National Title PROVIDENCE, R.I., May 5 /PRNewswire/ -- More than a million students play the SCRABBLE® game in approximately 20,000 schools nationwide. Students from across the country hung on every word to see which team would triumph at the 2007 National School SCRABBLE Championship held this weekend in Providence at the Rhode Island Convention Center. A team from the Ridgefield Library in Ridgefield, Conn. won the 2007 National School SCRABBLE Championship. Aune (pronounced Ow-na) Mitchell, 14 of Ridgefield, Conn. and her teammate Matthew Silver, 13 of Westport, Conn. walked away with $5,000. During the final Championship round, the Connecticut team defeated Joey Krafchick, 12 of Roswell, Ga. and Dorian Hill, 13 of Lithonia, Ga. This year's competition had a new twist: ESPN will telecast the Championship as kids head back to school in late August/September 2007. SCRABBLE, the world's most popular crossword game, combines the vocabulary skills of crossword puzzles and anagrams, with the additional element of chance. A family favorite since 1948, the board game today is found in one out of every three homes, according to Hasbro, makers of the SCRABBLE game in the United States and Canada. "Kids everywhere, from all parts of the country, and from all walks of life, love to play SCRABBLE because it's challenging, fun and allows the kids to be creative," says John D. Williams, Jr., executive director, National SCRABBLE Association. "It's not unusual for competitors of this event to have been competing against adults -- and beating them - -in SCRABBLE tournaments across the country." Word Play: Let the Games Begin Teams of 5-8 grade students from the Oregon to Florida competed, playing in teams of two in the tournament. -

Hasbro Third Quarter 2016 Financial Results Conference Call Management Remarks October 17, 2016

Hasbro Third Quarter 2016 Financial Results Conference Call Management Remarks October 17, 2016 Debbie Hancock, Hasbro, Vice President, Investor Relations: Thank you and good morning everyone. Joining me this morning are Brian Goldner, Hasbro’s Chairman, President and Chief Executive Officer, and Deb Thomas, Hasbro’s Chief Financial Officer. Today, we will begin with Brian and Deb providing commentary on the company’s performance and then we will take your questions. Our third quarter earnings release was issued this morning and is available on our website. Additionally, presentation slides containing information covered in today’s earnings release and call are also available on our site. The press release and presentation include information regarding Non-GAAP financial measures. Please note that whenever we discuss earnings per share or EPS, we are referring to earnings per diluted share. Before we begin, I would like to remind you that during this call and the question and answer session that follows, members of Hasbro 1 management may make forward-looking statements concerning management's expectations, goals, objectives and similar matters. There are many factors that could cause actual results or events to differ materially from the anticipated results or other expectations expressed in these forward-looking statements. Some of those factors are set forth in our annual report on form 10-K, our most recent 10-Q, in today's press release and in our other public disclosures. We undertake no obligation to update any forward-looking statements made today to reflect events or circumstances occurring after the date of this call. I would now like to introduce Brian Goldner. -

Viewing Wars

Viewing Wars: Action Heroes and Canadian Mothers Concerns about Violent Television for Boys 3-6 Stephen Kline Media Analysis Laboratory Simon Fraser University Canada (draft June 2, 1999) Much of the growing interest in the analysis of audiences is written against the previous effects approach to understanding mass media. These models primarily theorized the influence of mass media rather narrowly as the flow of a dominant meaning from TV (stimulus) to audiences (respondents) and subsumed the idea that ‘reception’ could best be understood as the ’assimilation and storage of that meaning’. Since the late 1970’s however, challenged by a new theorizing of separate encoding and decoding processes (Hall’s 1980), communications studies has become aware of the fragmentation of mass media audiences and the active assimilation of media content (Morley 1986, Schroder 1994). This has inspired greater interest in viewers motivations and choices underlying viewing, and the reception processes have become the focal point for an audience centred study of communication and media culture (Livingstone 1998). There is a growing interest in applying this approach to children’s relationship to media (Livingstone 1999). In this regard, the work of the Himmelweit project using cross national comparative research on children and youth audiences is providing an empirical basis for a broad and subtle understanding of the global problem of children and media. Yet in the light of research that shows young audiences often make diverse, unexpected and even aberrant readings of their media, there is a growing need to better theorize the ‘diversity’ in young peoples media use and audiences (David Buckingham 1993, 1997). -

Power Rangers” Franchise to Nickelodeon

SABAN BRINGS “POWER RANGERS” FRANCHISE TO NICKELODEON Eighteenth Season of Power Rangers to Air on Nickelodeon and Nicktoons in 2011; 700-Episode Library Bows on Nicktoons in 2010 NEW YORK, May 13, 2010 – Nickelodeon, the number-one entertainment brand for kids, and SCG Power Rangers LLC, an affiliate of Saban Brands, have partnered to make Nick the U.S. television platform for Power Rangers, the long-running kids’ TV phenomenon now heading into its 18th television season. The partnership marks the return of the global franchise to its original developer, Haim Saban, who developed and produced the original “Mighty Morphin Power Rangers” series in 1993. Financial terms of the deal were not disclosed. “We are truly excited to be partners with Haim Saban and his team,” said Cyma Zarghami, President, Nickelodeon/MTVN Kids and Family Group. “As one of the original leaders in kids’ television he helped to create powerful brand equity for Power Rangers and with partnerships like this Nickelodeon will be able to build a broader audience, superserve multiple demos, especially boys, and expand our programming offerings.” “We are delighted to be partnering with Nickelodeon to bring the ever-popular Power Rangers to a whole new generation of viewers,” said Haim Saban, the original developer of Power Rangers. “With Nickelodeon’s reach we are at the beginning of a new era for one of the world’s leading children’s entertainment properties.” “The Saban Brands team is looking forward to collaborating with the experts at Nick to re-launch and propel the new Power Rangers like never before,” said Elie Dekel, President of Saban Brands. -

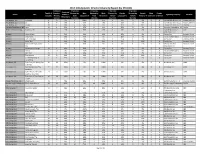

2017 DGA Episodic Director Diversity Report (By STUDIO)

2017 DGA Episodic Director Diversity Report (by STUDIO) Combined # Episodes # Episodes # Episodes # Episodes Combined Total # of Female + Directed by Male Directed by Male Directed by Female Directed by Female Male Female Studio Title Female + Signatory Company Network Episodes Minority Male Caucasian % Male Minority % Female Caucasian % Female Minority % Unknown Unknown Minority % Episodes Caucasian Minority Caucasian Minority A+E Studios, LLC Knightfall 2 0 0% 2 100% 0 0% 0 0% 0 0% 0 0 Frank & Bob Films II, LLC History Channel A+E Studios, LLC Six 8 4 50% 4 50% 1 13% 3 38% 0 0% 0 0 Frank & Bob Films II, LLC History Channel A+E Studios, LLC UnReal 10 4 40% 6 60% 0 0% 2 20% 2 20% 0 0 Frank & Bob Films II, LLC Lifetime Alameda Productions, LLC Love 12 4 33% 8 67% 0 0% 4 33% 0 0% 0 0 Alameda Productions, LLC Netflix Alcon Television Group, Expanse, The 13 2 15% 11 85% 2 15% 0 0% 0 0% 0 0 Expanding Universe Syfy LLC Productions, LLC Amazon Hand of God 10 5 50% 5 50% 2 20% 3 30% 0 0% 0 0 Picrow, Inc. Amazon Prime Amazon I Love Dick 8 7 88% 1 13% 0 0% 7 88% 0 0% 0 0 Picrow Streaming Inc. Amazon Prime Amazon Just Add Magic 26 7 27% 19 73% 0 0% 4 15% 1 4% 0 2 Picrow, Inc. Amazon Prime Amazon Kicks, The 9 2 22% 7 78% 0 0% 0 0% 2 22% 0 0 Picrow, Inc. Amazon Prime Amazon Man in the High Castle, 9 1 11% 8 89% 0 0% 0 0% 1 11% 0 0 Reunion MITHC 2 Amazon Prime The Productions Inc. -

Movie Inventory - Dvd 7/8/2020 Movie Title Rating

MOVIE INVENTORY - DVD 7/8/2020 MOVIE TITLE RATING 12 STRONG R THE 15:17 PARIS PG-13 1917 R 21 BRIDGES R 47 METERS DOWN PG-13 47 METERS DOWN UNCAGED PG-13 6 DAYS R 7 DAYS IN ENTEBBE PG-13 ABOMINABLE PG ACTS OF VIOLENCE R AD ASTRA PG-13 ADDAMS FAMILY PG ADRIFT PG-13 AFTER PG-13 AFTERMATH R AIR STRIKE R ALADDIN PG ALEX & ME G ALICE THROUGH THE LOOKING GLASS PG ALITA: BATTLE ANGEL PG-13 ALL THE MONEY IN THE WORLD R ALMOST CHRISTMAS PG13 ALPHA PG-13 AMERICAN ANIMALS R AMERICAN ASSASSIN R AMERICAN MADE R AMITYVILLE: THE AWAKENING PG-13 ANGEL HAS FALLEN R THE ANGRY BIRDS MOVIE PG-13 THE ANGRY BIRDS MOVIE 2 PG ANNA R ANNABELLE: COMES HOME R ANNABELLE: CREATION R ANNIHILATION R ANT-MAN PG-13 ANT-MAN: THE WASP PG-13 AQUAMAN PG-13 PAGE 1 of 17 MOVIE INVENTORY - DVD 7/8/2020 MOVIE TITLE RATING ARCTIC PG-13 ARSENAL R THE ART OF RACING IN THE RAIN PG ASSASIN'S CREED PG-13 ASSASSINATION NATION R ATOMIC BLONDE R AVENGERS: AGE OF ULTRON PG-13 AVENGERS: ENDGAME PG-13 AVENGERS: INFINITY WAR PG-13 BAD BOYS FOR LIFE R BAD MOMS R A BAD MOMS CHRISTMAS R BAD SANTA 2 R BAD TIMES AT THE EL ROYALE R BAMBIE G BARBIE & MARIPOSA THE FAIRY PRINCESS UNRATED BARBIE & THE DIAMOND CASTLE UNRATED BARBIE & THE 3 MUSKETEERS UNRATED BARBIE IN A MERMAID TALE 2 UNRATED BARBIE IN PRINCESS POWER UNRATED THE BEACH BUM R BEATRIZ AT DINNER R A BEAUTIFUL DAY IN THE NEIGHBORHOOD PG BEAUTY & THE BEAST PG BEFORE I FALL PG-13 THE BEGUILED R BEIRUT DVD BLU RAY R BEN IS BACK R THE BEST OF ENEMIES PG-13 BLACK AND BLUE R BLACK CHRISTMAS PG-13 BLACK PANTHER PG-13 BLACKkKLANSON R BLADE RUNNER