February 2018 Editor C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Here in Between, It’S Likely That the Challenges Facing the Aviation Industry Are Leading You and Your Family to Plan for Changes in Your Income and Lifestyle

August 2020 Aero Crew News Your Source for Pilot Hiring and More.. Aero Crew News Your Source for Pilot Hiring and More.. For every leg of your journey AeroCrewNews.com AeroCrewSolutions.com TOP PAY & ADDING 36 ERJ145s in 2020 Train and fly within 3 months Proud Aviate Program Partner Jump to each section Below by clicking on the title or photo. contentsAugust 2020 20 28 22 30 24 Also Featuring: Letter from the Publisher 8 Aviator Bulletins 10 Career Vectors 32 4 | Aero Crew News BACK TO CONTENTS the grid US Cargo US Charter US Major Airlines US Regional Airlines ABX Air Airshare Alaska Airlines Air Choice One Alaska Seaplanes GMJ Air Shuttle Allegiant Air Air Wisconsin Ameriflight Key Lime Air American Airlines Cape Air Atlas Air/Southern Air Omni Air International Delta Air Lines CommutAir FedEx Express Ravn Air Group Frontier Airlines Elite Airways iAero Airways XOJET Aviation Hawaiian Airlines Endeavor Air Kalitta Air JetBlue Airways Envoy Key Lime Air US Fractional Southwest Airlines ExpressJet Airlines UPS FlexJet Spirit Airlines GoJet Airlines NetJets Sun Country Airlines Grant Aviation US Cargo Regional PlaneSense United Airlines Horizon Air Empire Airlines Key Lime Air Mesa Airlines ‘Ohana by Hawaiian Piedmont Airlines PSA Airlines Republic Airways The Grid has moved online. Click on the Silver Airways airlines above to go directly to that airline, Skywest Airlines or go to www.AeroCrewNews.com/thegrid. Star Mania Air, Inc. July 2020 | 5 A FINANCIAL PARTNER TO HELP YOU ALTER COURSE As the ripple effects of this pandemic continue to create turbulence in every area of our daily lives, we understand that you and your loved ones are uncertain about the future of your career, your goals, and your financial security. -

United-2016-2021.Pdf

27010_Contract_JCBA-FA_v10-cover.pdf 1 4/5/17 7:41 AM 2016 – 2021 Flight Attendant Agreement Association of Flight Attendants – CWA 27010_Contract_JCBA-FA_v10-cover.indd170326_L01_CRV.indd 1 1 3/31/174/5/17 7:533:59 AMPM TABLE OF CONTENTS Section 1 Recognition, Successorship and Mergers . 1 Section 2 Definitions . 4 Section 3 General . 10 Section 4 Compensation . 28 Section 5 Expenses, Transportation and Lodging . 36 Section 6 Minimum Pay and Credit, Hours of Service, and Contractual Legalities . 42 Section 7 Scheduling . 56 Section 8 Reserve Scheduling Procedures . 88 Section 9 Special Qualification Flight Attendants . 107 Section 10 AMC Operation . .116 Section 11 Training & General Meetings . 120 Section 12 Vacations . 125 Section 13 Sick Leave . 136 Section 14 Seniority . 143 Section 15 Leaves of Absence . 146 Section 16 Job Share and Partnership Flying Programs . 158 Section 17 Filling of Vacancies . 164 Section 18 Reduction in Personnel . .171 Section 19 Safety, Health and Security . .176 Section 20 Medical Examinations . 180 Section 21 Alcohol and Drug Testing . 183 Section 22 Personnel Files . 190 Section 23 Investigations & Grievances . 193 Section 24 System Board of Adjustment . 206 Section 25 Uniforms . 211 Section 26 Moving Expenses . 215 Section 27 Missing, Interned, Hostage or Prisoner of War . 217 Section 28 Commuter Program . 219 Section 29 Benefits . 223 Section 30 Union Activities . 265 Section 31 Union Security and Check-Off . 273 Section 32 Duration . 278 i LETTERS OF AGREEMENT LOA 1 20 Year Passes . 280 LOA 2 767 Crew Rest . 283 LOA 3 787 – 777 Aircraft Exchange . 285 LOA 4 AFA PAC Letter . 287 LOA 5 AFA Staff Travel . -

Runway Excursion During Landing, Delta Air Lines Flight 1086, Boeing MD-88, N909DL, New York, New York, March 5, 2015

Runway Excursion During Landing Delta Air Lines Flight 1086 Boeing MD-88, N909DL New York, New York March 5, 2015 Accident Report NTSB/AAR-16/02 National PB2016-104166 Transportation Safety Board NTSB/AAR-16/02 PB2016-104166 Notation 8780 Adopted September 13, 2016 Aircraft Accident Report Runway Excursion During Landing Delta Air Lines Flight 1086 Boeing MD-88, N909DL New York, New York March 5, 2015 National Transportation Safety Board 490 L’Enfant Plaza, S.W. Washington, D.C. 20594 National Transportation Safety Board. 2016. Runway Excursion During Landing, Delta Air Lines Flight 1086, Boeing MD-88, N909DL, New York, New York, March 5, 2015. Aircraft Accident Report NTSB/AAR-16/02. Washington, DC. Abstract: This report discusses the March 5, 2015, accident in which Delta Air Lines flight 1086, a Boeing MD-88 airplane, N909DL, was landing on runway 13 at LaGuardia Airport, New York, New York, when it departed the left side of the runway, contacted the airport perimeter fence, and came to rest with the airplane’s nose on an embankment next to Flushing Bay. The 2 pilots, 3 flight attendants, and 98 of the 127 passengers were not injured; the other 29 passengers received minor injuries. The airplane was substantially damaged. Safety issues discussed in the report relate to the use of excessive engine reverse thrust and rudder blanking on MD-80 series airplanes, the subjective nature of braking action reports, the lack of procedures for crew communications during an emergency or a non-normal event without operative communication systems, inaccurate passenger counts provided to emergency responders following an accident, and unclear policies regarding runway friction measurements and runway condition reporting. -

Economic Vitality Study

June 2009 Final Technical Report ECONOMIC VITALITY ANALYSIS STUDY Prepared for: County of San Diego Airports Prepared by: McCLELLAN‐PALOMAR AIRPORT 2008 ECONOMIC VITALITY ANALYSIS FINAL TECHNICAL REPORT Prepared for: County of San Diego Airports June 2009 Prepared by: 401 B Street, Suite 600 San Diego, CA 92101 www.kimley‐horn.com Final Technical Report 1 Economic Vitality Analysis 2008 THIS PAGE INTENTIONALLY LEFT BLANK Final Technical Report 2 2008 Economic Vitality Analysis Table of Contents EXECUTIVE SUMMARY .................................................................................................................................... 7 Section 1 – STUDY BACKGROUND .................................................................................................................. 9 1.1 Introduction ........................................................................................................................................... 9 1.2 Methodology for the Economic Vitality Analysis ................................................................................. 10 1.3 McClellan‐Palomar Airport Overview .................................................................................................. 11 1.4 Regional Socioeconomic Trends .......................................................................................................... 11 1.4.1 City of Carlsbad and North County West MSA ................................................................................. 13 1.4.2 San Diego County ............................................................................................................................. -

Certified for Publication in the Court of Appeal of The

Filed 10/10/17 CERTIFIED FOR PUBLICATION IN THE COURT OF APPEAL OF THE STATE OF CALIFORNIA SECOND APPELLATE DISTRICT DIVISION TWO JETSUITE, INC., B279273 Plaintiff and Appellant, (Los Angeles County Super. Ct. No. BC559245) v. COUNTY OF LOS ANGELES, Defendant and Respondent. APPEAL from a judgment of the Superior Court of Los Angeles County. Michael L. Stern, Judge. Affirmed. Ajalat, Polley, Ayoob & Matarese, Richard J. Ayoob, Gregory R. Broege and Sevanna Hartonians for Plaintiff and Appellant. Mary C. Wickham, County Counsel, Albert Ramseyer, Principal Deputy County Counsel and Richard Girgado, Senior Deputy County Counsel; Lamb & Kawakami, Michael K. Slattery and Shane W. Tseng for Defendant and Respondent. * * * * * * Due process prohibits a state from imposing a tax on the full value of personal property if other states also have the right to tax that property, and whether those states have that right turns on whether that property has “situs” in those other states. (Central R. Co. v. Pennsylvania (1962) 370 U.S. 607, 611-614 (Central); Flying Tiger Line, Inc. v. County of Los Angeles (1958) 51 Cal.2d 314, 318 (Flying Tiger).) The taxing authority in this case sought to impose property tax on the full value of six jets used to operate an on-demand “air taxi” service. During the pertinent timeframe, one of those jets flew to 309 different airports in 42 different states and six different countries. This case accordingly presents the question: Does the fact that an aircraft touches down in another state, without more, mean that the other state has acquired situs over the aircraft under the traditional due process test for situs, such that California may no longer tax the full value of the aircraft? We conclude that the answer is “no,” and affirm the judgment below. -

B T P S Journal of Transport Literature JTL|RELIT Vol

B T P S Journal of Transport Literature JTL|RELIT Vol. 8, n. 2, pp. 38-72, Apr. 2014 Brazilian Transportation www.transport-literature.org Planning Society Research Directory ISSN 2238-1031 Measurement of a cost function for US airlines: restricted and unrestricted translog models [Mensuração de uma função de custo para companhias aéreas norte-americanas: modelos translog restritos e irrestritos] William J. Meland* University of Minnesota - United States Submitted 7 Jan 2013; received in revised form 28 Mar 2013; accepted 16 Jun 2013 Abstract This paper continues and expands several themes from previous studies of commercial airline cost functions. A well specified industrial cost function reveals characteristics about the market players, such as economies of scale and the cost elasticities with respect to operational styles. Using a translog specification, and its restricted first-order form, this paper updates previous parameter estimates, reworks the experimental design, and gives new analysis to describe the spectrum of choices facing airline firms in recent years. The translog model in this paper allows the energy cost share to interact with other variables and illuminate what factors may exacerbate cost sensitivity to energy prices, an advance in this specific area of interpretation. The result shows that fuel cost shares tend to be higher with older equipment, smaller fleet sizes, and to be increasing in aircraft size and seating density. The restricted first-order model indicates that older aircraft designs are more costly to operate, even accounting for operational style. This may imply that airlines with poorer access to capital suffer a cost disadvantage, particularly during a fuel spike – also a new contribution of the paper. -

Charter Report - 2019 Prospectuses

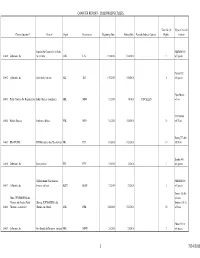

CHARTER REPORT - 2019 PROSPECTUSES Beginning Number of Type of Aircraft Charter Operator Carrier Origin Destination Date Ending Date Remarks/Indirect Carrier Flights & No. of Seats Embraer 135 19-001 Resort Air Services RVR Aviation (air taxi) DAL-89TE LAJ-DAL-89TE 2/22/2019 12/15/2019 94 w/30 sts New England Air Transport Inc. PILATUS PC-12 19-002 JetSmarter Inc. (air taxi) FLL MYN 2/8/2019 2/8/2019 1 w/6 guests Hawker 800 w/8 19-003 JetSmarter Inc. Jet-Air, LLC (air taxi) FLL HPN 3/3/2019 3/3/2019 1 guests Gulfstream G200 w/10 19-004 JetSmarter Inc. Chartright Air Inc. (air taxi) FLL YYZ 3/7/2019 3/7/2019 1 guests Domier 328 Jet Ultimate Jetcharters, LLC dba w/30sts/ Ultimate Jet Shuttle Public Ultimate JETCHARTERS, LLC Embraer 135 Jet 19-005 Charters Inc.(co-charterer) dba Ultimate Air Shuttle CLT PDK 2/25/2019 2/24/2020 401 w/30 sts Citation C J2 19-006 JetSmarter Inc. Flyexclusive, Inc. (air taxi) ORL TEB 3/30/2019 3/30/2019 1 w/6 guests Phenom 300 19-007 JetSmarter Inc. GrandView Aviation (air taxi) JAX MTN 3/24/2019 3/24/2019 1 w/7 guests Aviation Advantage/E-Vacations Corp Boeing 737-400 19-008 (co-charterer) Swift Air SJU-PUJ-POP-etc PUJ-SJU-CUN-etc 6/3/2019 8/3/2019 50 w/150 sts Boeing 737-400 19-009 PrimeSport Southwest Airlines BOS ATL 2/1/2019 2/4/2019 50 w/150 sts CHARTER REPORT - 2019 PROSPECTUSES Delux Public Charter, LLC EMB-135 w/30 19-010 JetBlue Airways Corporation dba JetSuite X (commuter) KBUR-KLAS-KCCR-etc KLAS-KBUR-KCCR-etc 4/1/2019 7/1/2019 34,220 sts Glulfstream IV- 19-011 MemberJets, LLC Prine Jet, LLC (air taxi) OPF-TEB-MDW--etc TEB-OPF-PBI-etc 2/14/2019 12/7/2019 62.5 SP w/10 sts Phenom 300 19-012 JetSmarter Inc. -

Aviation Consumer Protection Division Issued: May 2018

1 U.S. Department of Transportation Air Travel Consumer Report A Product Of The OFFICE OF AVIATION ENFORCEMENT AND PROCEEDINGS Aviation Consumer Protection Division Issued: May 2018 Flight Delays1 March 2018 Mishandled Baggage1 March 2018 January - March 2018 Oversales1 1st. Quarter 2018 Consumer Complaints2 March 2018 (Includes Disability and January - March 2018 Discrimination Complaints) Airline Animal Incident Reports4 March 2018 Customer Service Reports to 3 the Dept. of Homeland Security March 2018 1 Data collected by the Bureau of Transportation Statistics. Website: http://www.bts.gov 2 Data compiled by the Aviation Consumer Protection Division. Website: http://www.transportation.gov/airconsumer 3 Data provided by the Department of Homeland Security, Transportation Security Administration 4 Data collected by the Aviation Consumer Protection Division 2 TABLE OF CONTENTS Section Section Page Page Flight Delays (continued) Introduction Table 8 31 3 List of Regularly Scheduled Domestic Flights with Tarmac Flight Delays Delays Over 3 Hours, By Marketing/Operating Carrier Explanation 4 Table 8A 32 Branded Codeshare Partners 5 List of Regularly Scheduled International Flights with Table 1 6 Tarmac Delays Over 4 Hours, By Carrier Overall Percentage of Reported Flight Appendix 33 Operations Arriving On Time, by Marketing Carrier Mishandled Baggage Table 1A 7 Explanation 34 Overall Percentage of Reported Flight Ranking 35 Operations Arriving On Time, by Operating Carrier Ranking— (Year-to-Date) 36 Table 1B 8 Oversales Overall Percentage of Reported Flight Explanation 37 Operations Arriving On Time, by Marketing Carrier, Rank Ranking — (Quarterly) 38 By Month, and Year-to-Date (YTD) Ranking— (Year-to-Date) 39 Table 2 9 Consumer Complaints Number of Reported Flight Arrivals and Percentage Explanation 40 Arriving On Time, by Marketing Carrier and Airport Complaint Tables 1-5 41 Table 2A 13 Summary, Complaint Categories, U.S. -

Charters 2018.Xlsx

CHARTER REPORT ‐ 2018 PROSPECTUSES Total No. Of Type of Aircraft Charter Operator* Carrier* Origin Destination Beginning Date Ending Date Remarks/Indirect Carriers Flights # oft sts Superior Air Charter dba JetSuite PHENOM 300 18-001 JetSmarter, Inc. Air (air taxi) OAK LAS 1/30/2018 1/30/2018 1 w/7 guests Ciation CJ2 18-002 JetSmarter, Inc. Flyexclusive (air taxi) FLL TED 1/30/2018 1/30/2018 1 w/6 guests Piper Navajo 18-003 Public Charters dba Regional Sky Public Charters (commuter) MBL MDW 3/1/2018 65/4/18 CANCELLED w/8 sts 737-700/800 18-004 Holiday Express Southwest Airlines PHL MCO 3/6/2018 4/28/2018 32 w/175 sts Boeing 737-400 18-005 RISA TRAVEL TEM Enterprises dba Xtra Airways MIA PUJ 6/9/2018 8/23/2018 18 w/159 sts Hawker 800 18-006 JetSmarter, Inc. Jet-A (air taxi) FLL HPN 3/3/2018 3/3/2018 1 w/8 guests Dolphin Atlantic/Gold Aviation PHENOM 300 18-007 JetSmarter, Inc. Services (air taxi) KBCT KFRG 3/3/2018 3/3/2018 1 w/7 guests Dornier 328 Jet Ultime JETCHARTERS dba w/30 sts Ultimate Air Shuttle/ Public Ultimate JETCHARTERS dba Embraer 135 Jet 18-008 Charters (co-charterer) Ultimate Air Shuttle LUK PDK 3/20/2018 5/31/2018 52 w/30 sts Pilatus PC-12 18-009 JetSmarter, Inc. New Englad Air Transport (air taxi) FKK MYNN 2/8/2018 2/8/2018 1 w/6 guests 1 7/24/2018 CHARTER REPORT ‐ 2018 PROSPECTUSES HAV-MIA-SCU-HOG- 737-800 18-010 ViajeHoy dba Havana Air Swift Air, LLC MIA-TPA TPA-HAV 2/1/2018 1/31/2019 1,780 w/172 psgrs MN Airlines dba Sun Country MN Airlines dba Sun Country 18-011 Airlines Airlines MSP PHL 1/21/2018 1/21/2018 2 737-800 w/168 sts King Air B200 18-012 JetSmarter, Inc. -

2013 Jetsuite

JetSuite’s vision to provide the freedom and exhilaration of private air travel to more people than ever is realized through efficient operations, acute attention to detail, acclaimed customer service, and industry-leading safety practices. And JetSuite continues to be the only jet charter company to guarantee its instant, online quotes for its fleet of WiFi-equipped JetSuite Edition CJ3 and Phenom 100 aircraft. Refreshingly transparent! ©©2013 2014 JetSuiteJetSuite || jetsuite.com JetSuite.com THE EXECUTIVE TEAM ALEX WILCOX, CEO With over two decades of experience in creating highly innovative air carriers in ways that have improved air travel for millions, Alex Wilcox now serves as CEO of JetSuite – a private jet airline which launched operations in 2009. In co-founding JetSuite in 2006, Alex brought new technology and unprecedented value to an industry in dire need of it. JetSuite is a launch customer for the Embraer Phenom 100, an airplane twice as efficient and more comfortable than other jets performing its missions, as well as the JetSuite Edition CJ3 from Cessna. Also a founder of JetBlue, Alex was a driving force behind many airline industry changing innovations, including the implementation of live TV on board and all-leather coach seating. Alex was also named a Henry Crown Fellow by the Aspen Institute. KEITH RABIN, PRESIDENT AND CHIEF FINANCIAL OFFICER With a background that spans over a decade in the financial services and management consulting industries, Keith Rabin has served as President of JetSuite since 2009. Prior to co-founding JetSuite, Keith was a Partner at New York based hedge fund Verity Capital, where he was responsible for portfolio management and the development of Verity’s sector shorting strategy. -

TED STEVENS ANCHORAGE INTERNATIONAL AIRPORT Anchorage, Alaska

TED STEVENS ANCHORAGE INTERNATIONAL AIRPORT Anchorage, Alaska PFC Quarterly Report - Receipts Collected For the Quarter Ended March 31,2009 (Application No. 1 ) Application #99-01-C-00-ANC & 99-01-C-01-ANC $22,000,000.00 0.00 Total Collection Authority $22,000,000.00 PFC Revenue Received Air Carriers Current Quarter Previous Quarters Cumulative Aces Airlines 32.12 32.12 Aer Lingus 317.44 317.44 Aerovias De Mexico 122.58 122.58 Aero Mexico 98.53 98.53 Air Canada 136,476.21 136,476.21 Air France 1,764.99 1,764.99 Air New Zealand 2,094.33 2,094.33 Air Pacific 8.67 8.67 Airlines Services Corporation 37.96 37.96 Air Wisconsin Airlines 46.54 46.54 Alaska Airlines 11,024,874.06 11,024,874.06 Alitalia Airlines 1,051.51 1,051.51 All Nippon Airways Co 1,905.64 1,905.64 Aloha Airlines 7,152.82 7,152.82 America Central Corp 23.36 23.36 America West Airlines 228,474.04 228,474.04 American Airlines 509,508.22 509,508.22 American Trans Air 6,513.14 6,513.14 Asiana Airlines 2,125.95 2,125.95 Atlantic Coast Airline 96.36 96.36 Avianca 8.76 8.76 Big Sky Airlines 87.36 87.36 British Airways 12,272.36 12,272.36 Canada 3000 10,999.72 10,999.72 Cathay Pacific Airways 271.27 271.27 China Airlines 78,473.09 78,473.09 Condor Flugdienst, GMBH 63,889.95 63,889.95 Continental Airlines 1,380,859.31 1,380,859.31 Czech Airlines 348.36 348.36 Delta Airlines 1,673,182.33 1,673,182.33 Elal Israel Airlines 110.74 110.74 Emirates 14.57 14.57 Era Aviation, Inc. -

Low Cost Carriers: How Are They Changing the Market Dynamics of the U.S

Low Cost Carriers: How Are They Changing the Market Dynamics of the U.S. Airline Industry? by Erfan Chowdhury An Honours essay submitted to Carleton University in fulfillment of the requirements for the course ECON 4908, as credit toward the degree of Bachelor of Arts with Honours in Economics. Department of Economics Carleton University Ottawa, Ontario April 26, 2007 Abstract : The year 1978 was a landmark year for the airline industry. It was the year the airline deregulation was introduced in the United States. Following the deregulation, many airlines set up operation across the country and started to challenge the dominance of traditional full service carriers (FSC) which translated to better service and lower fares for the consumers. However, the initial success of deregulation was short lived and by the late 1980’s most of the newly formed airlines either went out of business or was purchased by their FSC rivals. In spite of this, by the mid 1990’s, a new breed of airlines called low cost carriers (LCC) started to challenge the dominance of full service carriers in the short haul market. The LCCs did not provide any frills such as meals or in-flight-entertainment, but offered ultra low fares on short haul point to point routes. Today, LCCs have a strong presence in every market segment across the U.S with one third share of the domestic air travel market.. This paper will study how the LCC’s are winning the battle against the full service carriers and how the strong presence of LCCs has impacted the U.S.