Resource Mobilization Information Digest No 215 September 2013 Environmental Fiscal Reforms in Japan

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Federal Capital Territory Reduction of Non-Revenue Water Project

Federal Capital Territory Administration Federal Capital Territory Administration Federal Capital Territory Water Board Federal Capital Territory Water Board Federal RepublicCapital Territory of Nigeria Administration Federal Republic of Nigeria Federal Capital Territory Water Board Federal Republic of Nigeria THE FEDERAL CAPITAL TERRITORY REDUCTIONTHE FEDERAL OF NON-REVENUECAPITAL TERRITORY WATER REDUCTION OFPROJECT NON-REVENUE WATER PROJECTIN FEDERAL REPUBLICIN OF NIGERIA FEDERALPROJECT REPUBLIC FINAL REPORTOF NIGERIA (SUPPORTINGPROJECT FINALREPORT, REPORT VOL. 2/2) (SUPPORTING REPORT, VOL. 2/2) January 2019 January 2019 January 2019 Japan International Cooperation Agency Japan International Cooperation Agency Yachiyo Engineering Co., Ltd Japan YachiyoInternational Engineering Cooperation Co., Ltd Agency GE Yokohama Water Co., Ltd GEGE YachiyoYokohama Engineering Water Co., Co., Ltd Ltd JR JR GEJR Yokohama Water Co., Ltd 19-005 1919-005 - 005 JR 19-005 Federal Capital Territory Administration Federal Capital Territory Administration Federal Capital Territory Water Board Federal Capital Territory Water Board Federal RepublicCapital Territory of Nigeria Administration Federal Republic of Nigeria Federal Capital Territory Water Board Federal Republic of Nigeria THE FEDERAL CAPITAL TERRITORY REDUCTIONTHE FEDERAL OF NON-REVENUECAPITAL TERRITORY WATER REDUCTION OFPROJECT NON-REVENUE WATER PROJECTIN FEDERAL REPUBLICIN OF NIGERIA FEDERALPROJECT REPUBLIC FINAL REPORTOF NIGERIA (SUPPORTINGPROJECT FINALREPORT, REPORT VOL. 2/2) (SUPPORTING REPORT, -

OC (2015) Evaluation of Spatial Pattern of Altered Flow Regimes On

RESEARCH ARTICLE Evaluation of Spatial Pattern of Altered Flow Regimes on a River Network Using a Distributed Hydrological Model Masahiro Ryo1¤a*, Yuichi Iwasaki2¤b, Chihiro Yoshimura1, Oliver C. Saavedra V.1 1 Department of Civil Engineering, Tokyo Institute of Technology, Meguro-ku, Tokyo, Japan, 2 Department of Fish, Wildlife, and Conservation Biology, Colorado State University, Fort Collins, Colorado, United States of America ¤a Current Address: Department of Aquatic Ecology, Eawag, Duebendorf, Switzerland ¤b Current Address: Research Center for Life and Environmental Sciences, Toyo University, Oura, Gunma, Japan * [email protected] Abstract Alteration of the spatial variability of natural flow regimes has been less studied than that of OPEN ACCESS the temporal variability, despite its ecological importance for river ecosystems. Here, we aimed to quantify the spatial patterns of flow regime alterations along a river network in the Citation: Ryo M, Iwasaki Y, Yoshimura C, Saavedra V. OC (2015) Evaluation of Spatial Pattern of Altered Sagami River, Japan, by estimating river discharge under natural and altered flow condi- Flow Regimes on a River Network Using a tions. We used a distributed hydrological model, which simulates hydrological processes Distributed Hydrological Model. PLoS ONE 10(7): spatiotemporally, to estimate 20-year daily river discharge along the river network. Then, 33 e0133833. doi:10.1371/journal.pone.0133833 hydrologic indices (i.e., Indicators of Hydrologic Alteration) were calculated from the simu- Editor: Zhong-Ke Gao, Tianjin University, CHINA lated discharge to estimate the spatial patterns of their alterations. Some hydrologic indices Received: January 8, 2015 were relatively well estimated such as the magnitude and timing of maximum flows, monthly Accepted: July 2, 2015 median flows, and the frequency of low and high flow pulses. -

And the Muda River Basin (Malaysia)

resources Article Comparative Research on River Basin Management in the Sagami River Basin (Japan) and the Muda River Basin (Malaysia) Lay Mei Sim 1,*, Akio Onishi 2, Olivier Gervais 3 and Ngai Weng Chan 1 1 School of Humanities, Geography Department, University Science of Malaysia, Penang 11800, Malaysia; [email protected] 2 School of Data Science, Yokohama City University, 22-2 Seto, Kanazawa-ku, Yokohama-shi 236-0027, Japan; [email protected] 3 Department of Integrative Genomics, Tohoku Medical Megabank Organization, Tohoku University, 2-1 Seiryo-machi, Aoba-ku, Sendai, Miyagi 980-8573, Japan; [email protected] * Correspondence: [email protected]; Tel.: +60-125-875-690 Received: 20 March 2018; Accepted: 15 May 2018; Published: 24 May 2018 Abstract: In the world, river basins often interwoven into two or more states or prefectures and because of that, disputes over water are common. Nevertheless, not all shared river basins are associated with water conflicts. Rivers in Japan and Malaysia play a significant role in regional economic development. They also play a significant role as water sources for industrial, domestic, agricultural, aquaculture, hydroelectric power generation, and the environment. The research aim is to determine the similarities and differences between the Sagami and Muda River Basins in order to have a better understanding of the governance needed for effectively implementing the lessons drawn from the Sagami River Basin for improving the management of the Muda River Basin in Malaysia. This research adopts qualitative and quantitative approaches. Semi-structured interviews were held with the key stakeholders from both basins and show that Japan has endeavored to present policy efforts to accommodate the innovative approaches in the management of their water resources, including the establishment of a river basin council. -

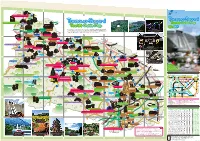

Open to the Public

A B C D E F 521 Wada no Sato Experience Center "Village House" G H Mt. Jimba Tanzawa-Sagami 100 Japanese Rural Villages・ Sanogawa Area To Hachioji Tanzawa Sagami Jimba no Yu - Tourist Guide Map 522 1 Touristst GuGuiddee Mapp 1 たび相模 Ishii House 旅 丹沢・相模 観光ナビ Expresswa uo y Ch Sagamiko-Higashi Kanagawa Prefectural Government Website: Tanzawa-Sagami Tourist Guide To Kofu Obarajuku Honjin Midori's Love Letter Lake Tsukui Ogura Bridge Sagamiko IC IC provides sightseeing information: places to visit, souvenirs to purchase, and Midori Ward Sagamihara City (Fujino area) Midori Ward Sagamihara City (Tsukui area) Midori Ward Sagamihara City (Shiroyama area) K MAP - MAP - MAP - osh A 2 /D 2 Guide: Nature /E 2 Guide: History u Higway e in . It's updated regularly. Check it out online! L 20 To Takao events to experience 20 uo Ch Fujino JR Sagamiko Lake Sagami Yoshino-juku Fujiya Sagamiko Memorial Hall Prefectural Sagamiko Park To Hachioji Lake Shiroyama Shiroyama lake promenade To Hachioji To Hachioji Art Walk Sagamiko Resort Pleasure Forest Shokakuji Temple 515 Sagamihara City Mt.Sekiro To Chofu Ozaki Gakudo Memorial House Midori Ward Lake Tsukui 413 (Shiroyama Area) Hashimoto e Fujino Hot Springs Higashiotaru no Yu Lin ihara gam io Sa 2 Prefectural Fujino Art House Sagamihara City 412 Sagamihara City Ke 2 517 J Midori Ward Midori Ward R Y ok Obarajuku Honjin Shinohara no Sato Center oh (Sagamiko Area) am a Midori Ward Sagamihara City (Sagamiko area) Lin Ogura Bridge e /MAP C-1 Guide: History Fujino Yamanami Hot Springs IC Sagamihara Sagamigawa Nature Village Park 518 Sagamihara Prefectural Tsukuiko-Shiroyama Park 508 Minami- 129 Hashimoto Sagamihara City Yabe Kami-Ooshima Campgrounds Midori Ward 16 Doshi Riv. -

Kanagawa Prefectural Aikawa Park

Kanagawa sightseeing charm creation conference Central of <Flowers> the Prefecture Aikawa Town Renowned spot for azaleas, the official flower of Aikawa Town Tourist Attraction No. 1349 Kanagawa Prefectural Aikawa Park Kanagawa Prefectural Aikawa Park is a terraced park which extends directly below Miyagase Dam, one of the largest gravity type concrete dams in Japan. The park's expansive grounds, which cover 51 hectares, have been planted with Explanation of 40,000 azaleas with a total of 40 varieties. Visitors to the park can enjoy impressive Tourist Attraction seasonal sights, from colorful slopes of azalea flowers that come into bloom in spring to breezy hills with stunning views of Yokohama's famous landmarks on clear days. Aikawa Park Azalea Festival is held here every year on April 29. Visitors can enjoy a variety of beautiful seasonal flowers and sights,including selling point 40,000 azaleas with a total of 40 varieties. Address 5423 Hanbara, Aikawa-machi, Aiko-gun, Kanagawa Opening Hours 8:30 am to 6:00 pm (April - September) 8:30 am to 5:00 pm (October - March the following year) Parking fees are paid in advance. Standard size cars: ¥500; medium-sized / large vehicles: ¥1,500; two-wheeled vehicles: ¥100 Availability of Parking Parking fees include a ¥20 contribution to a greenery fund. * Parking is free of charge during Azalea Festival days. URL http://www.aikawa-park.jp/publics/index/4/ Recommended Season End of April - end of May Access (period when the azaleas are in bloom) From Hon-Atsugi Station on the Odakyu Group/Individual Mark Group Individual Odawara Line, take a Kanagawa Chuo Kotsu Bus bound for Hanbara via the Target Regions Europe, North America, Oceania, Asia Center for 60 minutes, and walk from Hanbara Bus stop for 20 minutes. -

Evaluation of Spatial Pattern of Altered Flow Regimes on a River Network Using a Distributed Hydrological Model

Research Collection Journal Article Evaluation of Spatial Pattern of Altered Flow Regimes on a River Network Using a Distributed Hydrological Model Author(s): Ryo, Masahiro; Iwasaki, Yuichi; Yoshimura, Chihiro; Saavedra Valeriano, Oliver C. Publication Date: 2015-07-24 Permanent Link: https://doi.org/10.3929/ethz-b-000110936 Originally published in: PLoS ONE 10(7), http://doi.org/10.1371/journal.pone.0133833 Rights / License: Creative Commons Attribution 4.0 International This page was generated automatically upon download from the ETH Zurich Research Collection. For more information please consult the Terms of use. ETH Library RESEARCH ARTICLE Evaluation of Spatial Pattern of Altered Flow Regimes on a River Network Using a Distributed Hydrological Model Masahiro Ryo1¤a*, Yuichi Iwasaki2¤b, Chihiro Yoshimura1, Oliver C. Saavedra V.1 1 Department of Civil Engineering, Tokyo Institute of Technology, Meguro-ku, Tokyo, Japan, 2 Department of Fish, Wildlife, and Conservation Biology, Colorado State University, Fort Collins, Colorado, United States of America ¤a Current Address: Department of Aquatic Ecology, Eawag, Duebendorf, Switzerland ¤b Current Address: Research Center for Life and Environmental Sciences, Toyo University, Oura, Gunma, Japan * [email protected] Abstract Alteration of the spatial variability of natural flow regimes has been less studied than that of OPEN ACCESS the temporal variability, despite its ecological importance for river ecosystems. Here, we aimed to quantify the spatial patterns of flow regime alterations along a river network in the Citation: Ryo M, Iwasaki Y, Yoshimura C, Saavedra V. OC (2015) Evaluation of Spatial Pattern of Altered Sagami River, Japan, by estimating river discharge under natural and altered flow condi- Flow Regimes on a River Network Using a tions. -

Evaluation of Spatial Pattern of Altered Flow Regimes on a River Network Using a Distributed Hydrological Model

Eawag_09041 ·.~·PLOS.. I ONE RESEARCH ARTI CLE Evaluation of Spatial Pattern of Altered Flow Regimes on a River Network Using a Distributed Hydrological Model Masahiro Ryo1 ""*, Yuichi lwasaki2Db, Chihiro Yoshimura\ Oliver C. Saavedra V.1 1 Department of Civil Engineering, Tokyo Institute of Technology, Meguro-ku, Tokyo, Japan, 2 Department of Fish, Wildlife, and Conservation Biology, Colorado State University, Fort Collins, Colorado, United States of America aa Current Address: Department of Aquatic Ecology, Eawag, Duebendor1, Switzerland ab Current Address: Research Centerfor Life and Environmental Sciences, Toyo University, Oura, Gunma, Japan @ * [email protected] CrossMark ckk b updltes Abstract Alteration of the spatial variability of natural flow regimes has been less studied than that of b OPEN ACCESS the temporal vari ability, despite its ecological importance for river ecosystems. Here, we Citation: Ryo M, Iwasaki Y, Yoshimura C, Saavedra aimed to quantify the spatial patterns of flow regime alterations along a river network in the V. OC (20 15) Evah.etion of Spatial Pattern of Altered Sagami River, Japan, by estimating ri ver discharge under natural and altered flow condi- Fbw Regmes on a River Network Using a tions. We used a distributed hydrological model, which simulates hydrological processes Distributed Hydrological Model. PloS ONE 10(7): spatiotemporally, to estimate 20-year daily river discharge along the river network. Then, 33 e01 33833. doi:10. 1371/purnal.pone.0133833 hydrologic indices (i.e., Indicators of Hydrologic Alteration) were calculated from the simu- Editor: Zhong Ke Gao, lian;n University, CHINA lated discharge to estimate the spatial patterns of their alterations. Some hydrologic indices Received : January 8, 2015 were relatively well estimated such as the magnitude and timing of maximum flows, monthly Accepted : July 2, 2015 median flows, and the frequency of low and high flow pulses. -

Climatic Zone: Subjects: Effects: Project Name: Country

IEA Hydropower Implementing Agreement Annex VIII - Hydropower Good Practices: Environmental Mitigation Measures and Benefits Case Study 14-03: Development of Regional Industries – Miyagase Dam, Japan Key Issues: 14- Development of Regional Industries 1-Biological Diversity 7-Resttlement Climatic Zone: Cf : Temperate Humid Climate Subjects: - Development of Sightseeing and Other Facilities to Vitalize the Area Around the Dam Effects: - Nature preservation - Stimulation of local industries through development of sightseeing spots Project Name: Miyagase Dam Country ::: Kanagawa Prefecture, Japan(Asia) Implementing Party & Period - Project: the Ministry of Land, Infrastructure and Transport 1987.11 through 2001.4 - Good Practice: the Ministry of Land, Infrastructure and Transport 2001.4 - Keywords: Environmental protection, biotope, stimulation of local development, vitalization of the water source area, tourism development Abstract ::: Activities, including the development of biotopes, were conducted to restore the natural environment in the area impacted by the dam development project. In addition, activities to develop sightseeing facilities such as an information center were conducted after completion of the dam to stimulate local development. The number of tourists visiting Kiyokawa Village, where the dam had been constructed, and the total tourist spending increased more than five times compared to the figures before the implementation of the project. (See Fig. 4) 1. Outline of the Project The Miyagase Dam is a concrete gravity dam with a height of 156 m, a volume of approximately 2 million m 3 and a gross storage capacity of approximately 200 million m 3. It was constructed on the Nakatsu River, which is a tributary of the Sagami River, a first-class river originating in the Tanzawa Mountain Range located in the western part of Kanagawa Prefecture, to serve the multiple purposes of flood control, river environment improvement, city water supply and power generation. -

Integrated Water Resources Management Implementation for Langat and Sagami River Basins: a Comparison

Integrated Water Resources Management Implementation for Langat and Sagami River Basins: A Comparison Hasleeda Kamarudin 1,2, Norhayati Abdullah 1, Takeshi Mizunoya 2, Ali Yuzir 1, Helmut Yabar2 1 Malaysia-Japan International Institute of Technology, Universiti Teknologi Malaysia, Jalan Sultan Yahya Petra, 54100 Kuala Lumpur, Malaysia 2 Graduate School of Life and Environmental Sciences, University of Tsukuba Abstract In September 2015, the United Nations General Assembly adopted its 2030 Agenda for Sustainable Development that aims to achieve ambitious sustainability targets by 2030. In this Agenda, solving water and sanitation challenges is recognized as a top global priority alongside 16 other overarching Sustainable Development Goals (SDGs). The SDGs brought along an important question as to how to implement change. This study aims to determine the similarities and differences between Langat River and Sagami River Basins by examining the score of the degree of Integrated Water Resources Management (IWRM) implementation (i.e. score of 0-100) for both river basins. The objectives of this project are; i) to identify the key stakeholders relevant to the water governance in the Langat river basin and Sagami river basin, ii) to investigate the issues and challenges impacting Langat River basin and Sagami river basin and iii) to evaluate the degree of integrated water resources implementation (0-100) in Langat River and Sagami River basins. The study also analysed primary and secondary data obtained from interview, secondary data collection and surveys. The systematic studies provided may indicate the degree of IWRM implementation for both selected river basins. Keywords: Sustainable Development Goal, Integrated Water Resources Management, Langat River Basin, Sagami River Basin 1 1. -

Proceedings of the 4Th Japan and US Workshop on Seismic Measures for Water Supply

The 4th Japan/U.S. Workshop on Seismic Measures for Water Supplies The 4th Japan/U.S. Workshop on Seismic Measures for Water Supplies was held in Kobe, Japan in January 2005 to commemorate the 10 year anniversary of the Great Hanshin-Awaji Earthquake. The basic objectives of the workshops are: • to create a forum for the active discussion and exchange • identify and document best available current technologies in water system seismic mitigation practices • provide a practical information source on seismic mitigation efforts for water utilities • identify technology improvements needed to practically and efficiently advance water system seismic practices. Attendees included 14 representatives from the U.S., 41 from Japan and 3 from Taiwan. There were 24 papers presented during seven meeting sessions during the three day event. AwwaRF subscribers that attended and provided both technical papers and presentations include: Contra Costa Water District, San Francisco PUC, East Bay Municipal Utility District, Los Angeles Department of Water and Power, City of San Diego, Portland Bureau of Water and Seattle Public Utilities. The workshop was funded by Awwa Research Foundation and the Japan Water Works Association, as well several other organizations and utilities. Proceedings of the 4th Japan and US Workshop on Seismic Measures for Water Supply January 26-28, 2005 JWWA, Kobe, Japan The 4th Japan and US Workshop on Seismic Measures for Water Supply *** Workshop Agenda *** Jan.26, 2005 1. Registration 8:45-9:00 Tachibana Training Center 2. Opening Ceremony Greetings 9:00-9:10 Nobuhiro Matsushita (Kobe City) 9:10-9:20 Masakazu Akagawa(JWWA) 9:20-9:30 Elizabeth Kawczynski(AwwaRF) Marilyn Miller (EBMUD) Pei-Chung Hsu (Taipei Water Department) 3. -

Field Investigation on Regional Sediment Movement Around the Shounan Coast

FIELD INVESTIGATION ON REGIONAL SEDIMENT MOVEMENT AROUND THE SHOUNAN COAST SHINJI SATO Department of Civil Engineering, The University of Tokyo, 7-3-1 Hongo, Bunkyo-ku Tokyo, 113-8656, JAPAN TAKAKO FUKUYAMA Kajima Co. Ltd., Tokyo, JAPAN TAKEHISA MATSUDA Department of Civil Engineering, The University of Tokyo, Tokyo, JAPAN SUSUMU TANAKA Mikuniya Co. Ltd., Tokyo, JAPAN Regional sand movement and long-term beach deformation were investigated for the fluvial system composed of the Shounan coast and three major rivers flowing into the coast. Anthropogenic impacts, such as dams and weirs, sand dredging, fishery harbors and shore protection structures on long-term beach erosion were discussed on the basis of the comprehensive analysis on nearshore sand volume, mineralogical properties of surface sediments and decadal dating of the sand layer based on Pb-210 radioactivity. 1. Introduction The Shounan coast, located on the southeastern side of Japan facing the Pacific Ocean, has experienced significant erosion in recent 40 years. The erosion has been influenced by the interruption of longshore sand transport by harbor and coastal structures, and by the shortage in sand supply from three major rivers flowing into the Sagami Bay, that is, the Hayakawa River, the Sakawa River and the Sagami River. It is essential to understand the regional sediment movement in the fluvial system composed of the three rivers and the coast since the sedimentary processes on the Shounan Coast are strongly influenced by the sediment supplies from the three major rivers. Figure 1 illustrates a map of the watersheds of the three rivers. The sediments supplied from the three rivers are considered to reflect the geology of the individual watershed.