Survey of the Large-Scale Office Building Market in Tokyo S 23 Wards

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Certified Facilities (Cooking)

List of certified facilities (Cooking) Prefectures Name of Facility Category Municipalities name Location name Kasumigaseki restaurant Tokyo Chiyoda-ku Second floor,Tokyo-club Building,3-2-6,Kasumigaseki,Chiyoda-ku Second floor,Sakura terrace,Iidabashi Grand Bloom,2-10- ALOHA TABLE iidabashi restaurant Tokyo Chiyoda-ku 2,Fujimi,Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku 1-8-1 Yurakucho, Chiyoda-ku banquet kitchen The Peninsula Tokyo hotel Tokyo Chiyoda-ku 24th floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Peter The Peninsula Tokyo hotel Tokyo Chiyoda-ku Boutique & Café First basement, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Peninsula Tokyo hotel Tokyo Chiyoda-ku Second floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku Hei Fung Terrace The Peninsula Tokyo hotel Tokyo Chiyoda-ku First floor, The Peninsula Tokyo,1-8-1 Yurakucho, Chiyoda-ku The Lobby 1-1-1,Uchisaiwai-cho,Chiyoda-ku TORAYA Imperial Hotel Store restaurant Tokyo Chiyoda-ku (Imperial Hotel of Tokyo,Main Building,Basement floor) mihashi First basement, First Avenu Tokyo Station,1-9-1 marunouchi, restaurant Tokyo Chiyoda-ku (First Avenu Tokyo Station Store) Chiyoda-ku PALACE HOTEL TOKYO(Hot hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku Kitchen,Cold Kitchen) PALACE HOTEL TOKYO(Preparation) hotel Tokyo Chiyoda-ku 1-1-1 Marunouchi, Chiyoda-ku LE PORC DE VERSAILLES restaurant Tokyo Chiyoda-ku First~3rd floor, Florence Kudan, 1-2-7, Kudankita, Chiyoda-ku Kudanshita 8th floor, Yodobashi Akiba Building, 1-1, Kanda-hanaoka-cho, Grand Breton Café -

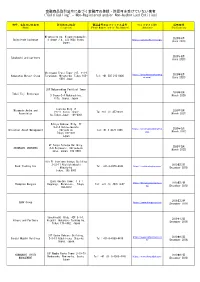

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) Miyakojima-ku, Higashinodamachi, 2020年6月 SwissTrade Exchange 4-chōme−7−4, 534-0024 Osaka, https://swisstrade.exchange/ (June 2020) Japan 2020年6月 Takahashi and partners (June 2020) Shiroyama Trust Tower 21F, 4-3-1 https://www.hamamatsumerg 2020年6月 Hamamatsu Merger Group Toranomon, Minato-ku, Tokyo 105- Tel: +81 505 213 0406 er.com/ (June 2020) 0001 Japan 28F Nakanoshima Festival Tower W. 2020年3月 Tokai Fuji Brokerage 3 Chome-2-4 Nakanoshima. (March 2020) Kita. Osaka. Japan Toshida Bldg 7F Miyamoto Asuka and 2020年3月 1-6-11 Ginza, Chuo- Tel:+81 (3) 45720321 Associates (March 2021) ku,Tokyo,Japan. 104-0061 Hibiya Kokusai Bldg, 7F 2-2-3 Uchisaiwaicho https://universalassetmgmt.c 2020年3月 Universal Asset Management Chiyoda-ku Tel:+81 3 4578 1998 om/ (March 2022) Tokyo 100-0011 Japan 9F Tokyu Yotsuya Building, 2020年3月 SHINBASHI VENTURES 6-6 Kojimachi, Chiyoda-ku (March 2023) Tokyo, Japan, 102-0083 9th Fl Onarimon Odakyu Building 3-23-11 Nishishinbashi 2019年12月 Rock Trading Inc Tel: +81-3-4579-0344 https://rocktradinginc.com/ Minato-ku (December 2019) Tokyo, 105-0003 Izumi Garden Tower, 1-6-1 https://thompsonmergers.co 2019年12月 Thompson Mergers Roppongi, Minato-ku, Tokyo, Tel: +81 (3) 4578 0657 m/ (December 2019) 106-6012 2019年12月 SBAV Group https://www.sbavgroup.com (December 2019) Sunshine60 Bldg. 42F 3-1-1, 2019年12月 Hikaro and Partners Higashi-ikebukuro Toshima-ku, (December 2019) Tokyo 170-6042, Japan 31F Osaka Kokusai Building, https://www.smhpartners.co 2019年12月 Sendai Mubuki Holdings 2-3-13 Azuchi-cho, Chuo-ku, Tel: +81-6-4560-4410 m/ (December 2019) Osaka, Japan. -

Shiodome Shiba-Rikyu Building, Kaigan, Minato-Ku, Tokyo

Shiodome Shiba-Rikyu Building, Kaigan, Minato-ku, Tokyo View this office online at: https://www.newofficeasia.com/details/offices-shiodome-shiba-rikyu-kaigan-to kyo This serviced office centre at the heart of Shiodome offers completely white-label offices with a professional team of admin and IT staff to keep things running smoothly. The offices boast exceptional views over Rainbow Bridge and Shibarikyu Park as well as an enviable list of facilities including conference / meeting rooms, a video conferencing system and 24 hour access. Transport links Nearest tube: Daimon Station Nearest railway station: JR Hamamatsu-cho Station Nearest road: Daimon Station Nearest airport: Daimon Station Key features 24 hour access Access to multiple centres nation-wide Access to multiple centres world-wide Administrative support AV equipment Business park setting Car parking spaces Close to railway station Conference rooms Conference rooms High speed internet High-speed internet IT support available Meeting rooms Modern interiors Near to subway / underground station Reception staff Security system Telephone answering service Town centre location Video conference facilities Location The Shiodome district offers an exceptionally convenient location, especially for international travelers, with the Henada airport just 14 minutes away. There are numerous shops and hotels in the surrounding area and the rest of the city / country can be easily reached thanks to the Daimon tube and the JR Hamamatsu-cho Station. Points of interest within 1000 metres Hamamatsuchō (railway station) -

Shaping Tokyo: Land Development and Planning Practice in the Early Modern Japanese Metropolis Carola Hein Bryn Mawr College, [email protected]

Bryn Mawr College Scholarship, Research, and Creative Work at Bryn Mawr College Growth and Structure of Cities Faculty Research Growth and Structure of Cities and Scholarship 2010 Shaping Tokyo: Land Development and Planning Practice in the Early Modern Japanese Metropolis Carola Hein Bryn Mawr College, [email protected] Let us know how access to this document benefits ouy . Follow this and additional works at: http://repository.brynmawr.edu/cities_pubs Part of the Architecture Commons, History of Art, Architecture, and Archaeology Commons, and the Urban Studies and Planning Commons Custom Citation Hein, Carola. "Shaping Tokyo: Land Development and Planning Practice in the Early Modern Japanese Metropolis." Journal of Urban History 36, no. 4 (2010): 447-484. This paper is posted at Scholarship, Research, and Creative Work at Bryn Mawr College. http://repository.brynmawr.edu/cities_pubs/20 For more information, please contact [email protected]. Shaping Tokyo: Land Development and Planning Practice in the Early Modern Japanese Metropolis Carola Hein Manuscript submitted to the Journal of Urban History in August 2007, revised and resubmitted March 2008. When German architect Bruno Taut drove in 1936 along the major road linking Tokyo and Yokohama, he criticized the inadequacy and superficiality of the modernizing Japanese built landscape. He later wrote about his revulsion: "I in particular had heard so much about Tokyo that I had no desire to see the city on the spot. […] In passing through the Inland Sea we had absorbed scenery of such rare beauty, had found so little of vulgar trash 1 in such buildings as could be glimpsed, that we could hardly take in the crabbed pretentiousness, the ludicrous would-be modernity of the tin façades that confronted us, could not fathom the loud hideousness of this confusion of architectural styles. -

Real Estate Sector 4 August 2015 Japan

Deutsche Bank Group Markets Research Industry Date Real estate sector 4 August 2015 Japan Real Estate Yoji Otani, CMA Akiko Komine, CMA Research Analyst Research Analyst (+81) 3 5156-6756 (+81) 3 5156-6765 [email protected] [email protected] F.I.T.T. for investors Last dance Bubbles always come in different forms With the big cliff of April 2017 in sight, enjoy the last party like a driver careening to the cliff's brink. Japan is now painted in a completely optimistic light, with the pessimism which permeated Japan after the Great East Japan Earthquake in 2011 forgotten and expectations for the 2020 Tokyo Olympics riding high. The bank lending balance to the real estate sector is at a record high, and we expect bubble-like conditions in the real estate market to heighten due to increased investment in real estate to save on inheritance taxes. History repeats itself, but always in a slightly different form. We have no choice but to dance while the dance music continues to play. ________________________________________________________________________________________________________________ Deutsche Securities Inc. Deutsche Bank does and seeks to do business with companies covered in its research reports. Thus, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. DISCLOSURES AND ANALYST CERTIFICATIONS ARE LOCATED IN APPENDIX 1. MCI (P) 124/04/2015. Deutsche Bank Group Markets Research Japan Industry Date 4 August 2015 Real Estate Real estate sector FITT Research Yoji Otani, CMA Akiko Komine, CMA Research Analyst Research Analyst Last dance (+81) 3 5156-6756 (+81) 3 5156-6765 [email protected] [email protected] Bubbles always come in different forms Top picks With the big cliff of April 2017 in sight, enjoy the last party like a driver Mitsui Fudosan (8801.T),¥3,464 Buy careening to the cliff's brink. -

Kagurazaka Campus 1-3 Kagurazaka,Shinjuku-Ku,Tokyo 162-8601

Tokyo University of Science Kagurazaka Campus 1-3 Kagurazaka,Shinjuku-ku,Tokyo 162-8601 Located 3 minutes’ walk from Iidabashi Station, accessible via the JR Sobu Line, the Tokyo Metro Yurakuchom, Tozai and Namboku Lines, and the Oedo Line. ACCESS MAP Nagareyama- Unga Otakanomori Omiya Kasukabe Noda Campus 2641 Yamazaki, Noda-shi, Chiba Prefecture 278-8510 Kanamachi Kita-Senju Akabane Tabata Keisei-Kanamachi Ikebukuro Nishi- Keisei-Takasago Nippori Katsushika Campus 6-3-1 Niijuku, Katsushika-ku, Nippori Oshiage Tokyo 125-8585 Asakusa Ueno Iidabashi Ochanomizu Shinjuku Kinshicho Akihabara Asakusabashi Kagurazaka Campus Kanda 1-3 Kagurazaka, Shinjuku-ku, Tokyo 162-8601 Tokyo ■ From Narita Airport Take the JR Narita Express train to Tokyo Station. Transfer to the JR Yamanote Line / Keihin-Tohoku Line and take it to Akihabara Station. Transfer to the JR Sobu Line and take it to Iidabashi Station. Travel time: about 1 hour 30 minutes. ■ From Haneda Airport Take the Tokyo Monorail Line to Hamamatsucho Station. Transfer to the JR Yamanote Line / Keihin-Tohoku Line and take it to Akihabara Station. Transfer to the JR Sobu Line and take it to Iidabashi Station. Travel time: about 45 minutes. ■ From Tokyo Station Take the JR Chuo Line to Ochanomizu Station. Transfer to the JR Sobu Line and take it to Iidabashi Station. Travel time: about 10 minutes. ■ From Shinjuku Station Take the JR Sobu Line to Iidabashi Station. Travel time: about 12 minutes. Building No.10 Building No.11 Annex Building No.10 Building No.5 CAMPUS MAP Annex Kagurazaka Buildings For Ichigaya Sta. Building No.11 Building No.12 Building No.1 1 Building No.6 Building No.8 Building Building No.13 Building Building (Morito Memorial Hall) No.7 No.2 No.3 3 1 The Museum of Science, TUS (Futamura Memorial Hall) & Building Mathematical Experience Plaza No.9 2 2 Futaba Building (First floor: Center for University Entrance Examinations) Tokyo Metro Iidabashi Sta. -

Tokyo Sightseeing Route

Mitsubishi UUenoeno ZZoooo Naationaltional Muuseumseum ooff B1B1 R1R1 Marunouchiarunouchi Bldg. Weesternstern Arrtt Mitsubishiitsubishi Buildinguilding B1B1 R1R1 Marunouchi Assakusaakusa Bldg. Gyoko St. Gyoko R4R4 Haanakawadonakawado Tokyo station, a 6-minute walk from the bus Weekends and holidays only Sky Hop Bus stop, is a terminal station with a rich history KITTE of more than 100 years. The “Marunouchi R2R2 Uenoeno Stationtation Seenso-jinso-ji Ekisha” has been designated an Important ● Marunouchi South Exit Cultural Property, and was restored to its UenoUeno Sta.Sta. JR Tokyo Sta. Tokyo Sightseeing original grandeur in 2012. Kaaminarimonminarimon NakamiseSt. AASAHISAHI BBEEREER R3R3 TTOKYOOKYO SSKYTREEKYTREE Sttationation Ueenono Ammeyokoeyoko R2R2 Uenoeno Stationtation JR R2R2 Heeadad Ofccee Weekends and holidays only Ueno Sta. Route Map Showa St. R5R5 Ueenono MMatsuzakayaatsuzakaya There are many attractions at Ueno Park, ● Exit 8 *It is not a HOP BUS (Open deck Bus). including the Tokyo National Museum, as Yuushimashima Teenmangunmangu The shuttle bus services are available for the Sky Hop Bus ticket. well as the National Museum of Western Art. OkachimachiOkachimachi SSta.ta. Nearby is also the popular Yanesen area. It’s Akkihabaraihabara a great spot to walk around old streets while trying out various snacks. Marui Sooccerccer Muuseumseum Exit 4 ● R6R6 (Suuehirochoehirocho) Sumida River Ouurr Shhuttleuttle Buuss Seervicervice HibiyaLine Sta. Ueno Weekday 10:00-20:00 A Marunouchiarunouchi Shuttlehuttle Weekend/Holiday 8:00-20:00 ↑Mukojima R3R3 TOKYOTOKYO SSKYTREEKYTREE TOKYO SKYTREE Sta. Edo St. 4 Front Exit ● Metropolitan Expressway Stationtation TOKYO SKYTREE Kaandanda Shhrinerine 5 Akkihabaraihabara At Solamachi, which also serves as TOKYO Town Asakusa/TOKYO SKYTREE Course 1010 9 8 7 6 SKYTREE’s entrance, you can go shopping R3R3 1111 on the first floor’s Japanese-style “Station RedRed (1 trip 90 min./every 35 min.) Imperial coursecourse Theater Street.” Also don’t miss the fourth floor Weekday Asakusa St. -

Tokyo, Japan 16-19 May 2006 I

TAS Group meeting - Tokyo, Japan 16-19 May 2006 I – ADMINISTRATIONS & ROA (Recognized Operating Agencies) ARS Saudi Arabia Karuna Raman TIWARI Bharat Sanchar Nigam Ltd. Saudi Telecom B1305 Statesman House 13th floor NEW DELHI Nasser Abdullah AL JAIAN Tel: +91 11 23734224 Saudi Telecom Company Fax: +91 11 23734024 P.O. Box 87912 Email: [email protected] RIYADH – 11652 Tel: +966 1 4528463 Fax: +966 1 4700700 INS Indonesia Email: [email protected] Gunawan HUTAGALUNG Ahmed Ibrahim M. AL MANSOUR Directorate General of Posts and Saudi Telecom Company Telecommunications P.O. Box 87912 Jl. Medan Merdeka Barat 17 RIYADH – 11652 JAKARTA 10110 Tel: +966 1 4529100 Tel: +62 21 3835847 Fax: +966 1 4568630 Fax: +62 21 3862873 Email: [email protected] Email: [email protected] Mohannad Mohammad MAKKI Saudi Telecom Company J Japan P.O. Box 87912 RIYADH – 11652 Takeshi HIROSE Tel: +966 1 4529133 Ministry of Internal Affairs and Fax: +966 1 4700700 Communications Email: [email protected] 1-2, Kasumigaseki 2-Chome, Chiyoda-ku 100-8926 TOKYO Tel: +81 3 5253 5922 IND India (Rep. of) Fax: +81 3 5253 5925 Email: [email protected] Anand KHARE Bharat Sanchar Nigam Ltd. Mitsuhiro HISHIDA 406-A, Statesman House, Connaught Place Ministry of Internal Affairs and NEW DELHI Communications Tel: +91 11 23765451 1-2, Kasumigaseki 2-Chome, Chiyoda-ku Fax: +91 11 23765467 100-8926 TOKYO Email: [email protected] Tel: +81 3 5253 5922 Fax: +81 3 5253 5925 Sahib Dayal SAXENA Email: [email protected] Chairman, TAS Group Bharat Sanchar Nigam Ltd. -

Number of Top-Level Facilities Certified in FY 2020

March 25, 2021 PRESS RELEASE Tokyo Metropolitan Government Bureau of Environment TMG Certifies 30 “Top-Level Facilities” for Outstanding Global Warming Countermeasure Efforts Under the Tokyo Cap-and-Trade Program In FY 2010, the Tokyo Metropolitan Government (TMG) started the world’s first urban Cap- and-Trade Program for large facilities. Under this program, TMG annually certifies “Top-Level” and “Near-Top-Level” facilities that have demonstrated excellence in efforts to counter global warming. TMG certified 17 “Top-Level” facilities and 13 “Near-Top-Level” facilities in FY 2020. Number of Top-Level Facilities Certified in FY 2020 Certified Level Category I Category II Total Top-Level 14 3 17 Near-Top-Level 13 0 13 Total 27 3 30 Category Ⅰ: office facilities, commercial facilities, research facilities, district cooling and heating facilities, etc. Category Ⅱ: factories, water supply and sewage facilities, etc. Certified Facilities in FY 2020 Business Category Level Facility Name Location Facility Owner Category Chiyoda IINO BUILDING IINO Kaiun Kaisha, Ltd. Office facilities City IKEBUKURO DISTRICT IKEBUKURO DISTRICT District cooling Toshima HEATING AND COOLING HEATING AND COOLING and heating City CO., LTD. CO., LTD. facilities District cooling Heat Supply Center in Kanda- Chiyoda TOKYO TOSHI SERVICE and heating Surugadai District City COMPANY facilities Chuo GINZA MITSUI BUILDING Mitsui Fudosan Co., Ltd. Office facilities City Chiyoda Sapia Tower East Japan Railway Company Office facilities City Minato JR Shinagawa east Building East Japan Railway Company Office facilities City TOKYO GARDEN TERRACE Chiyoda SEIBU PROPERTIES INC. Office facilities KIOICHO City Top- Ⅰ Level TOBU RAILWAY CO.,LTD. Sumida Commercial TOKYO SKYTREE TOWN TOBU TOWER SKYTREE City facilities CO.,LTD. -

Shibuya City Industry and Tourism Vision

渋谷区 Shibuya City Preface Preface In October 2016, Shibuya City established the Shibuya City Basic Concept with the goal of becoming a mature international city on par with London, Paris, and New York. The goal is to use diversity as a driving force, with our vision of the future: 'Shibuya—turning difference into strength'. One element of the Basic Concept is setting a direction for the Shibuya City Long-Term Basic Plan of 'A city with businesses unafraid to take risks', which is a future vision of industry and tourism unique to Shibuya City. Each area in Shibuya City has its own unique charm with a collection of various businesses and shops, and a great number of visitors from inside Japan and overseas, making it a place overflowing with diversity. With the Tokyo Olympic and Paralympic Games being held this year, 2020 is our chance for Shibuya City to become a mature international city. In this regard, I believe we must make even further progress in industry and tourism policies for the future of the city. To accomplish this, I believe a plan that further details the policies in the Long-Term Basic Plan is necessary, which is why the Industry and Tourism Vision has been established. Industry and tourism in Shibuya City faces a wide range of challenges that must be tackled, including environmental improvements and safety issues for accepting inbound tourism and industry. In order to further revitalize the shopping districts and small to medium sized businesses in the city, I also believe it is important to take on new challenges such as building a startup ecosystem and nighttime economy. -

Ginza Opens As Building, a Trend-Setting Retail Harvest Club

CONTENTS MESSAGE FROM THE PRESIDENT 02 MESSAGE FROM THE PRESIDENT As a core company of the Tokyu Fudosan Holdings Group, 03 HISTORY OF TOKYU LAND CORPORATION We are creating a town to solve social issues through 05 ABOUT TOKYU FUDOSAN HOLDINGS GROUP value creation by cooperation. 06 GROUP’S MEDIUM- AND LONG-TERM MANAGEMENT PLAN 07 URBAN DEVELOPMENT THAT PROPOSES NEW LIFESTYLES 07 THE GREATER SHIBUYA AREA CONCEPT 09 LIFE STORY TOWN 11 URBAN DEVELOPMENT 25 RESIDENTIAL 33 WELLNESS 43 OVERSEAS BUSINESSES 47 REAL ESTATE SOLUTIONS Tokyu Land Corporation is a comprehensive real estate company the aging population and childcare through the joint development of with operations in urban development, residential property, wellness, condominiums and senior housing. In September 2017, we celebrated overseas businesses and more. We are a core company of Tokyu the opening of the town developed in the Setagaya Nakamachi Fudosan Holdings Group. Since our founding in 1953, we have Project, our first project for creating a town which fosters interactions 48 MAJOR AFFILIATES consistently worked to create value by launching new real estate between generations. 49 HOLDINGS STRUCTURE businesses. We have expanded our business domains in response to For the expansion of the scope of cyclical reinvestment business, changing times and societal changes, growing from development to we are expanding the applicable areas of the cyclical reinvestment 50 TOKYU GROUP PHILOSOPHY property management, real estate agency and, in particular, a retail business to infrastructure, hotels, resorts and residences for business encouraging work done by hand. These operations now run students, in our efforts to ensure the expansion of associated assets independently as Tokyu Community Corporation, Tokyu Livable, Inc. -

Hotels Near Suidobashi Station.Pdf

Suidobashi Station, Tokyo, Japan Sun 9 - Fri 14, August 2015, 5 nights, 1 room, 1 adult ! Change search " Filter Sorted by Distance Tokyu Stay Suidobashi # # # # # $ Iidabashi 0.25 km to Suidobashi Station Excellent 4.4 / 5 % Great Rate* ¥63,080 ¥37,036 price for 5 nights excluding taxes & fees Hotel Niwa Tokyo # # # #& # $ Iidabashi 0.29 km to Suidobashi Station Outstanding 4.7 / 5 % Special Deal Save 27% ¥98,485 ¥68,940 price for 5 nights excluding taxes & fees Hotel Wing International Korakuen # # # # # $ Iidabashi 0.30 km to Suidobashi Station Good 3.7 / 5 % Great Rate* ¥40,377 ¥30,725 price for 5 nights excluding taxes & fees YMCA Asia Youth Center # # #& # # $ Iidabashi 0.42 km to Suidobashi Station Good 3.5 / 5 % Great Rate* ¥28,180 ¥23,065 price for 5 nights excluding taxes & fees Hotel Villa Fontaine Kudanshita # # # # # $ Iidabashi 0.58 km to Suidobashi Station Excellent 4.2 / 5 % Great Rate* ¥84,624 ¥63,130 price for 5 nights excluding taxes & fees Hotel Kizankan $ # # # # # $ Tokyo 0.67 km to Suidobashi Station Good 3.5 / 5 % Great Rate* ¥64,766 ¥37,880 price for 5 nights excluding taxes & fees Hotel Villa Fontaine JIMBOCHO # # # # # $ Iidabashi 0.70 km to Suidobashi Station Excellent 4.1 / 5 % Great Rate* ¥64,111 ¥46,603 price for 5 nights excluding taxes & fees Hotel Grand Palace # # # #& # $ Iidabashi 0.74 km to Suidobashi Station Excellent 4.0 / 5 % Special Deal Save 30% ¥78,840 ¥55,190 price for 5 nights excluding taxes & fees APA Hotel Tokyo-Kudanshita # # # # # $ Iidabashi 0.76 km to Suidobashi Station Good