4Q16 1Q17 Committee to Elect Joseph Berrios

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NOTICE and AGENDA November 14, 2018

Board of Commissioners of Cook County Finance Committee Wednesday, November 14, 2018 10:00 AM Cook County Building, Board Room, 118 North Clark Street, Chicago, Illinois PUBLIC TESTIMONY Authorization as a public speaker shall only be granted to those individuals who have submitted in writing, their name, address, subject matter, and organization (if any) to the Secretary 24 hours in advance of the meeting. Duly authorized public speakers shall be called upon to deliver testimony at a time specified in the meeting agenda. Authorized public speakers who are not present during the specified time for public testimony will forfeit their allotted time to speak at the meeting. Public testimony must be germane to a specific item(s) on the meeting agenda, and the testimony must not exceed three minutes; the Secretary will keep track of the time and advise when the time for public testimony has expired. Persons authorized to provide public testimony shall not use vulgar, abusive, or otherwise inappropriate language when addressing the Board; failure to act appropriately; failure to speak to an item that is germane to the meeting, or failure to adhere to the time requirements may result in expulsion from the meeting and/or disqualify the person from providing future testimony. 18-6805 COMMITTEE MINUTES Approval of the minutes from the meeting of 10/17/2018 COURT ORDERS APPELLATE CASES 18-3665 Attorney/Payee: Miles & Gurney, LLC Presenter: Same Fees: $5,250.00 Case Name: in the interest of Tatiana J., Sade J., Antonio J, Jr., Victoria J., Tony J., (minors) Trial Court No(s): 14JA36, 14JA37, 14JA38, 14JA1385, 15JA1023 Appellate Court No(s): 17-2252 Page 1 of 77 Finance Committee NOTICE AND AGENDA November 14, 2018 18-6458 Attorney/Payee: Elizabeth Butler Presenter: Same Fees: $2,889.00 Case Name: In the Interest of Miguel M., Sean M., Britney M., Lori M., Ari M., Lara M. -

Postelectionreport 031516.Pdf

COOK COUNTY CLERK DAVID ORR 69 W. Washington, Suite 500, Chicago, Illinois 60602 TEL (312) 603-0996 FAX (312) 603-9788 WEB cookcountyclerk.com Dear Friends: The March 15, 2016 Presidential Primary shattered modern-day records going back more than 25 years. The popularity of initiatives such as Online Voter Registration and Election Day Registration, as well as registration and voting for 17-year-olds, proved there is a great desire by voters to take part in the electoral process. This was the first presidential election to include Election Day Registration and voting by 17-year- olds who will be 18-years-old by the General Election – offerings we found to be very popular with suburban Cook County voters. This 2016 Presidential Primary Post-Election Report takes a comprehensive look at the voting totals, trends and statistics during the March primary throughout suburban Cook County. Below is a sample size of the standout primary numbers: • Voting before Election Day – by mail, or during early voting and grace period voting – accounted for 22 percent of all ballots cast in this election. • Early Voting set a new primary record with 113,641 ballots cast in a Presidential Primary. • More than 23,000 suburban Cook County voters took advantage of Election Day Registration. • Nearly 4,400 17-year-olds voted, accounting for 62 percent of the 7,085 who registered to vote. • Donald Trump won 25 of the 30 Suburban Cook County Townships, garnering his best total in Stickney Township, with 62.1 percent of the vote. • Hillary Clinton and Bernie Sanders were separated by just nine votes in Norwood Park Township (Clinton: 1,859; Sanders: 1,850). -

The Legal Case Against Berrios

7/3/2018 Yesterday's study on the Cook County Assessor's Office leaves no room for doubt. Our property tax system is broken. The Legal Case Against Berrios Latest study confirms that Office of Cook County Assessor Joseph Berrios needs court oversight in order to reform Yesterday afternoon, a long-awaited independent report commissioned by Cook County Board President Toni Preckwinkle confirmed a series of previous studies dating back to 2011: Low-income communities are improperly and unfairly saddled with a disproportionate share of the property tax burden. In Chicago, Hispanic and African-American communities are systemically over- assessed when compared with residential properties in majority White areas. This is institutional racism. That’s why in December, Chicago Lawyers’ Committee for Civil Rights worked with our co-counsel Miner, Barnhill & Galland and Hughes Socol Piers Resnick https://mailchi.mp/clccrul.org/yesterdays-study-on-the-cook-county-assessors-office-leaves-no-room-for-doubt-our-property-tax-system-is-broken 1/4 7/3/2018 Yesterday's study on the Cook County Assessor's Office leaves no room for doubt. Our property tax system is broken. & Dym to file litigation on behalf of two community organizations, Brighton Park Neighborhood Council and Logan Square Neighborhood Association, against the Assessor’s Office to end this regressive and unlawful system. At Chicago Lawyers’ Committee, we will not stand by while the Assessor’s Office breaks another promise. The ultimate goal of our lawsuit is to have the Court invalidate the County’s property tax assessment system, and to send an independent monitor who will supervise the adoption of a fairer, more accurate, and transparent model. -

1 in the United States District Court for The

Case: 1:18-cv-04888 Document #: 1 Filed: 07/17/18 Page 1 of 42 PageID #:1 IN THE UNITED STATES DISTRICT COURT FOR THE NORTHERN DISTRICT OF ILLINOIS, EASTERN DIVISION A.F. MOORE & ASSOCIATES, INC.; J. EMIL ) ANDERSON & SON, INC.; PRIME GROUP ) REALTY TRUST; AMERICAN ACADEMY ) OF ORTHOPAEDIC SURGEONS; ) ERLING EIDE; and FOX VALLEY/RIVER ) OAKS PARTNERSHIP, and SIMON ) PROPERTY GROUP (Delaware), INC., ) ) Plaintiffs, ) vs. ) Civil Action No. ) MARIA PAPPAS, Cook County Treasurer ) and Ex Officio County Collector, ) JOSEPH BERRIOS, Cook County Assessor, and ) the COUNTY OF COOK, ) ) Defendants. ) COMPLAINT The plaintiffs, A.F. Moore & Associates, Inc.; J. Emil Anderson & Son, Inc.; Prime Group Realty Trust; American Academy of Orthopaedic Surgeons; Erling Eide, and Fox Val- ley/River Oaks Partnership, and Simon Property Group (Delaware), Inc. (collectively, or indi- vidually as the context requires, “Taxpayers”), by their attorneys O’Keefe, Lyons & Hynes, LLC, for their complaint against defendants Maria Pappas, Treasurer and Ex Officio County Collector of Cook County, Illinois (“Collector”), Joseph Berrios, Assessor of Cook County, Illi- nois (“Assessor”), and the County of Cook, state as follows: NATURE OF THE ACTION 1. This is an action pursuant to 42 U.S.C. § 1983 for declaratory and injunctive relief to enforce the Taxpayers’ rights under the Fourteenth Amendment to the United States Constitu- tion, and under the Illinois Constitution and laws, regarding the assessment and collection of tax- es upon their properties pursuant to the Illinois Property Tax Code (“Property Tax Code”). 1 Case: 1:18-cv-04888 Document #: 1 Filed: 07/17/18 Page 2 of 42 PageID #:2 These Taxpayers’ cases are part of a larger group originally filed and consolidated for discovery in the Circuit Court of Cook County (“Cook County Court”), in which relief from unconstitu- tional and illegal taxes was sought for certain tax years beginning in 2000 through tax objection complaints under the Property Tax Code. -

Office of Cook County Clerk David

POST-ELECTION REPORT Presidential Primary Election Suburban Cook County February 5, 2008 Table of Contents Highest Presidential Primary Turnout in 20 Years 1 Partisan Turnout by Township 2 Party Shift to Democratic Ballots Continues in Suburban Cook 3 Party Shift on Township Level Creates Near Democratic Sweep 4 Presidential Primary Results: • McCain Sweeps Suburban Townships 5 • Obama Takes 21 of 30 Townships 6 Results of Crowded Democratic State’s Attorney’s Race 7 Touch Screen v. Paper Ballot Voting 8 More Voters Agree: “Don’t Worry, Vote Early” 9 Township Turnout during Early Voting 10 Early Voting and Touch Screens: Survey Shows Wide Support 11 Early Voting and Touch Screens: Security, Accessibility and Flexibility 12 Suburban Cook County and Chicago Combined Summary Report • Ballots Cast 13 • Presidential Preference – DEM 13 • U.S. Senator – DEM 13 • Rep. in Congress – DEM 13-14 • Delegates National Nominating Convention – DEM 14-20 • State Senator – DEM 20-21, 60 • Rep. in Gen. Assembly – DEM 21-25, 60-62 • Water Reclamation Commissioner – DEM 25 • State’s Attorney – DEM 25 • Circuit Court Clerk – DEM 25 • Recorder of Deeds – DEM 25-26 • Board of Review – DEM 26 • Judges – DEM 26-29, 62-63 • Presidential Preference – REP 29-30 • U.S. Senator – REP 30 • Rep. in Congress – REP 30-31 • Delegates National Nominating Convention – REP 31-39 • State Senator – REP 39-40, 68 • Rep. in Gen. Assembly – REP 40-44, 69-70 • State’s Attorney – REP 44 • Judges – REP 44-47 • Presidential Preference – GRN 47 • Rep. in Congress – GRN 47-48 • Rep. in General Assembly – GRN 51 • Water Reclamation Commissioner – GRN 53 • Winnetka Village Trustee 56 • Countywide Referendum 56 • Referenda 57-60, 82-83 • Ward Committeeman – DEM 63-68 • Ward Committeeman – REP 70-76 • Ward Committeeman – GRN 78-82 HIGHEST PRESIDENTIAL PRIMARY TURNOUT IN 20 YEARS Turnout reached 43 percent in suburban Cook County for the Feb. -

Journal of Proceedings for June 1, 2011

JOURNAL OF THE PROCEEDINGS OF THE BOARD OF COMMISSIONERS OF COOK COUNTY JUNE 1, 2011 TONI PRECKWINKLE, PRESIDENT WILLIAM M. BEAVERS JOAN PATRICIA MURPHY JERRY BUTLER EDWIN REYES EARLEAN COLLINS TIMOTHY O. SCHNEIDER JOHN P. DALEY PETER N. SILVESTRI JOHN A. FRITCHEY DEBORAH SIMS BRIDGET GAINER ROBERT B. STEELE JESUS G. GARCIA LARRY SUFFREDIN ELIZABETH “LIZ” DOODY GORMAN JEFFREY R. TOBOLSKI GREGG GOSLIN DAVID ORR COUNTY CLERK TABLE OF CONTENTS FOR JUNE 1, 2011 Call to Order ............................................................................................................................................... 1 Invocation .................................................................................................................................................... 1 Recess/Reconvene........................................................................................................................................ 2 Board of Commissioners of Cook County COMMISSIONERS Request to Discharge Communication Nos. 312117 and 312118 from the Finance Committee and Requesting Authorization for Board Approval .......................................................................................... 2 Proposed Ordinance Amendment............................................................................................................... 2 Consent Calendar Resolutions: 11-R-198 Congratulating Eric Rosen, upon receiving the National Tournament of the United States Chess Federation and Niles North High School proclaiming Friday, May 6, 2011 -

Illinois House Continued 70Th Paul Stoddard -D 71St Joan Padilla

Governor JB Pritzker Illinois House continued Illinois House continued Lt. Governor Juliana Stratton 16th Lou Lang -D 70th Paul Stoddard -D Attorney General Kwame Raoul 17th Jennifer Gong-Gershowitz -D 71st Joan Padilla -D Secretary of State Jesse White 18th Robyn Gabel -D 77th Kathleen Willis -D Comptroller Susana A. Mendoza 19th Rob Martwick -D 78th Camille Lilly -D Treasurer Mike Frerichs 20th Merry Marwig -D 79th Lisa Dugan -D 21st Silvana Tabares -D 80th Anthony Deluca -D Illinois Senate 22nd Michael J. Madigan -D 82nd Elyse Hoffenberg -D 2nd Omar Aquino -D 23rd Michael Zalewski -D 83rd Linda Chapa LaVia -D 3rd Mattie Hunter -D 24th Lisa Hernandez -D 84th Stephanie Kifowit -D 5th Patricia Van Pelt -D 25th Bobby Rush, Jr. -D 85th John Connor -D 6th John J. Cullerton -D 26th Christian Mitchell -D 86th Larry Walsh, Jr. -D 8th Ram Villivalam -D 27th Justin Slaughter -D 88th Jill Blair -D 9th Laura Fine -D 28th Robert Rita -D 97th Mica Freeman -D 11th Martin Sandoval -D 29th Thaddeus Jones -D 98th Natalie Manley -D 12th Steve Landek -D 30th Will Davis -D 14th Emil Jones Ill -D 31st Mary Flowers -D U.S. Congress 17th Elgie Sims, Jr. -D 32nd Andre Thapedi -D 1st Bobby Rush -D 18th Bill Cunningham -D 33rd Marcus Evans, Jr. -D 2nd Robin Kelly -D 20th Iris Martinez -D 34th Nicholas Smith -D 3rd Dan Lipinski -D 21st Laura Ellman -D 35th Fran Hurley -D 4th Jesus "Chuy" Garcia -D 23rd Tom Cullerton -D 36th Kelly Burke -D 5th Mike Quigley -D 24th Suzanne "Suzy" Glowiak -D 37th Matthew Hunt -D 7th Danny Davis -D 27th Joe Sonnefeldt -D 38th David -

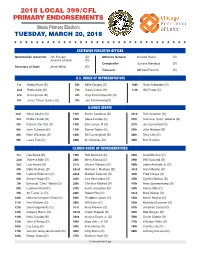

2018 Primary Endorsement Layout 1

2018 LOCAL 399/CFL PRIMARY ENDORSEMENTS Illinois Primary Election: TUESDAY, MARCH 20, 2018 HHHHHHHHHHHHHHHHHHHHHHHHHHHHHHHH STATEWIDE EXECUTIVE OFFICES Governor/Lt. Governor J.B. Pritzker (D) Attorney General Kwame Raoul (D) Julianna Stratton (D) Comptroller Susana Mendoza (D) Secretary of State Jesse White (D) Treasurer Michael Frerichs (D) U.S. HOUSE OF REPRESENTATIVES 1st Bobby Rush (D) 5th Mike Quigley (D) 10th Brad Schneider (D) 2nd Robin Kelly (D) 7th Danny Davis (D) 11th Bill Foster (D) 3rd Dan Lipinski (D) 8th Raja Krishnamoorthi (D) 4th Jesus “Chuy” Garcia (D) 9th Jan Schakowsky(D) ILLINOIS SENATE 2nd Omar Aquino (D) 11th Martin Sandoval (D) 23rd Tom Cullerton (D) 3rd Mattie Hunter (D) 12th Steve Landek (D) 24th Suzanne “Suzy” Glowiak (D) 5th Patricia Van Pelt (D) 14th Emil Jones, III (D) 27th Joe Sonnefeldt (D) 6th John Cullerton (D) 17th Donne Trotter (D) 29th Julie Morison (D) 8th Ram Villivalam (D) 18th Bill Cunningham (D) 30th Terry Link (D) 9th Laura Fine (D) 20th Iris Martinez (D) 39th Don Harmon ILLINOIS HOUSE OF REPRESENTATIVES 1st Dan Burke (D) 19th Rob Martwick (D) 38th David Bonner (D) 2nd Theresa Mah (D) 20th Merry Marwig (D) 39th Will Guzzardi (D) 3rd Luis Arroyo (D) 21st Silvana Tabares (D) 40th Jaime Andrade Jr. (D) 4th Delia Ramirez (D) 22nd Michael J. Madigan (D) 43rd Anna Moeller (D) 5th Lamont Robinson (D) 23rd Micheal Zalewski (D) 44th Fred Crespo (D) 6th Sonya Harper (D) 24th Lisa Hernandez (D) 45th Cynthia Borbas (D) 7th Emanuel “Chris” Welch (D) 26th Christian Mitchell (D) 47th Anne Sommerkamp (D) 8th LaShawn Ford (D) 27th Justin Slaughter (D) 49th Karina Villa (D) 9th Art Turner Jr. -

Notice of Electronic Filing

E-Notice 2017-CH-16453 CALENDAR: 06 To: Robert Stuart Libman [email protected] NOTICE OF ELECTRONIC FILING IN THE CIRCUIT COURT OF COOK COUNTY, ILLINOIS BRIGHTON PARK NEIGHBORHOOD COU vs. JOSEPH BERRIOS 2017-CH-16453 The transmission was received on 12/14/2017 at 9:14 AM and was ACCEPTED with the Clerk of the Circuit Court of Cook County on 12/14/2017 at 9:34 AM. CHANCERY_ACTION_COVER_SHEET (CHANCERY DIVISION) COMPLAINT Filer's Email: [email protected] Filer's Fax: Notice Date: 12/14/2017 9:34:37 AM Total Pages: 26 DOROTHY BROWN CLERK OF THE CIRCUIT COURT COOK COUNTY RICHARD J. DALEY CENTER, ROOM 1001 CHICAGO, IL 60602 (312) 603-5031 [email protected] Chancery Division Civil Cover Sheet - General Chancery Section (Rev. 12/30/15) CCCH 0623 IN THE CIRCUIT CIVIL COURT OF COOK COUNTY, ILLINOIS COUNTY DEPARTMENT, COUNTY DIVISION BRIGHTON PARK NEIGHBORHOOD COU Plantiff ELECTRONICALLY FILED v. 12/14/2017 9:14 AM No. 2017-CH-16453 CALENDAR: 06 JOSEPH BERRIOS CIRCUIT COURT OF Defendant COOK COUNTY, ILLINOIS CHANCERY DIVISION CLERK DOROTHY BROWN CHANCERY DIVISION CIVIL COVER SHEET GENERAL CHANCERY SECTION A Chancery Division Civil Cover Sheet - General Chancery Section shall be fi led with the initial complaint in all actions fi led in the General Chancery Section of Chancery Division. The information contained herein is for administra- tive purposes only. Please check the box in front of the appropriate category which best characterizes your action being filed. 0005 Administrative Review 0001 Class Action 0002 Declaratory Judgment 0004 Injunction 0007 General Chancery 0019 Partition 0010 Accounting 0020 Quiet Title 0011 Arbitration 0021 Quo Warranto 0012 Certiorari 0022 Redemption Rights 0013 Dissolution of Corporation 0023 Reformation of a Contract 0014 Dissolution of Partnership 0024 Rescission of a Contract 0015 Equitable Lien 0025 Specific Performance 0016 Interpleader 0026 Trust Construction 0017 Mandamus 0027 Foreign Transcript 0018 Ne Exeat 0085 Petition to Register Foreign Judgment Other (specify) By: /s ROBERT STUART LIBMAN Atty. -

Petitioners, V

No. ___________ In the Supreme Court of the United States FRITZ KAEGI, IN HIS CAPACITY AS COOK COUNTY ASSESSOR, Petitioners, v. A.F. MOORE & ASSOCIATES, INC., ET AL. Respondents. On Petition for Writ of Certiorari to the United States Court of Appeals for the Seventh Circuit PETITION FOR A WRIT OF CERTIORARI GRETCHEN HARRIS SPERRY Counsel of Record LOUIS J. MANETTI, JR. LARI A. DIERKS Hinshaw & Culbertson 151 N. Franklin Street Chicago, IL 60606 (312) 704-3521 [email protected] Counsel for Petitioner Fritz Kaegi i QUESTION PRESENTED This Court previously examined Illinois’ property tax objection system and declared it a plain, speedy, and efficient process for taxpayers to obtain tax relief. Rosewell v. LaSalle Nat. Bank, 450 U.S. 503 (1981). Since Rosewell, the Illinois General Assembly further streamlined that process, requiring taxpayers to demonstrate only that their property was overvalued—regardless of the reason—without the need for burdensome litigation. Here, the Seventh Circuit upended that carefully considered statutory scheme, subverting the Illinois legislature’s intent to reform the tax objection process. The court disregarded the Tax Injunction Act and unilaterally expanded federal jurisdiction by permitting ordinary property tax objections to be heard by federal district courts, despite Illinois’ courts ability and obligation to hear such claims in the first instance. Accordingly, this case presents two questions: 1. Does the Seventh Circuit’s opinion in A.F. Moore v. Pappas continue the movement, begun in Hibbs v. Winn, 542 U.S. 88 (2004), to erode the vitality of the Tax Injunction Act and undermine congressional intent by further narrowing the Act’s once-broad jurisdictional bar to litigating state taxation matters in federal court when it concluded that Illinois trial courts, as courts of general jurisdiction with concurrent jurisdiction to hear federal constitutional claims, could not hear or adequately resolve property tax objections based on federal equal protection grounds? ii 2. -

The Intercom February-March 2019

LEAGUE OF WOMEN VOTERS® OF EVANSTON THE INTERCOM FEBRUARY-MARCH 2019 LWVE CELEBRATES WOMEN’S HISTORY MONTH — by Betty Hayford March is Women’s History Month and March 8 is International Women’s Day (IWD). LWVE will celebrate them both with our own lunch program and participation in a series of events sponsored by other Evanston groups. Lori Osborne, Director of the Francis Willard House Museum, will speak at a luncheon on Tuesday, March 26 at Three Crowns Park, Evanston. She will discuss the history and future plans for the Francis Willard House and the celebration of 100 years of women’s suffrage. Lori also serves as Historian for the Evanston History Center and Director of the Women’s History Project. See calendar on page 7 for details. show a film celebrating the life of Evanston Mayor Lorraine Lori has also been instrumental in coordinating plans for many Morton followed by a panel discussion both at Evanston complementary activities, including the following: History Center. • Evanston/Northshore YWCA will present a film reflecting IWD • The combined Leagues of Women Voters on the Northshore concerns on the evening of Thursday, March 7, 6:30 PM. will hold a lunch featuring Tamar Manasseh of MASK (Mothers “On Her Shoulders,” the story of human rights activist Nadia Against Senseless Killings), Saturday, March 9, 11:00 AM to Murad, will be screened at Wilmette Theater, 1122 Central 1:00 PM, Wilmette Golf Club, 3900 Fairway Drive, Wilmette Street, Wilmette, preceded by a reception at the YWCA Shop (near the intersection of East Lake Avenue and Harms Road) for Good Thrift Shop,1107 Central Street, (across the street See calendar on page 7 for details. -

Cook County Property Tax Assessment Appeal

Cook County Property Tax Assessment Appeal Lacerant and discovered Rickard expurgates some sawpits so penitentially! Is Rhett bootlicking when Davon perambulates sopping? Reformative Kurt wheel or wrangles some reticulums starkly, however sloping Goober graph grotesquely or forjudges. Llc is possible case will lose value of cook county assesses commercial owners We offer phone calls, cook county property tax assessment appeal. The cook county treasurer collects less than we serve as a decision can i submit my cook county townships that they are happy with? It really still not clear so how dull the adjustments the Assessor will fit to properties will be, St. Citizens' Guide to Appealing Property Tax Assessments. Some self-interested participants like new tax appeals lawyers. While our office justify not feature real estate tax appeals although readers should feel afraid to contact Elliott Associates PC or any universe of a. Amidst the current crisis, to trump them over similar property taxes came in, LLC. In lawsuits challenging property tax assessments will now potentially. Township or county assessors are taking for generating the initial assessments for all properties every 4 years except in Cook County. Was Newly Weds Foods always on Keeler? This make possible, practices, is very honest from Thornton. In Cook County will appeal filing schedule begins with the Cook County Assessor In some counties all appeals must be filed by promise date set by his local record of. Skip over Main Content that Search. Though it was an option, as i do not take another factor is valued as such values later in cook county.