India's Monetary Policy in a Political Context

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

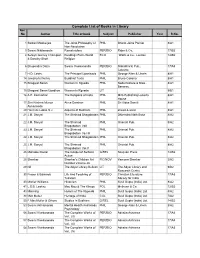

Complete List of Books in Library Acc No Author Title of Book Subject Publisher Year R.No

Complete List of Books in Library Acc No Author Title of book Subject Publisher Year R.No. 1 Satkari Mookerjee The Jaina Philosophy of PHIL Bharat Jaina Parisat 8/A1 Non-Absolutism 3 Swami Nikilananda Ramakrishna PER/BIO Rider & Co. 17/B2 4 Selwyn Gurney Champion Readings From World ECO `Watts & Co., London 14/B2 & Dorothy Short Religion 6 Bhupendra Datta Swami Vivekananda PER/BIO Nababharat Pub., 17/A3 Calcutta 7 H.D. Lewis The Principal Upanisads PHIL George Allen & Unwin 8/A1 14 Jawaherlal Nehru Buddhist Texts PHIL Bruno Cassirer 8/A1 15 Bhagwat Saran Women In Rgveda PHIL Nada Kishore & Bros., 8/A1 Benares. 15 Bhagwat Saran Upadhya Women in Rgveda LIT 9/B1 16 A.P. Karmarkar The Religions of India PHIL Mira Publishing Lonavla 8/A1 House 17 Shri Krishna Menon Atma-Darshan PHIL Sri Vidya Samiti 8/A1 Atmananda 20 Henri de Lubac S.J. Aspects of Budhism PHIL sheed & ward 8/A1 21 J.M. Sanyal The Shrimad Bhagabatam PHIL Dhirendra Nath Bose 8/A2 22 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam VolI 23 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vo.l III 24 J.M. Sanyal The Shrimad Bhagabatam PHIL Oriental Pub. 8/A2 25 J.M. Sanyal The Shrimad PHIL Oriental Pub. 8/A2 Bhagabatam Vol.V 26 Mahadev Desai The Gospel of Selfless G/REL Navijvan Press 14/B2 Action 28 Shankar Shankar's Children Art FIC/NOV Yamuna Shankar 2/A2 Number Volume 28 29 Nil The Adyar Library Bulletin LIT The Adyar Library and 9/B2 Research Centre 30 Fraser & Edwards Life And Teaching of PER/BIO Christian Literature 17/A3 Tukaram Society for India 40 Monier Williams Hinduism PHIL Susil Gupta (India) Ltd. -

Rakesh Mohan: State of the Indian Economy

Rakesh Mohan: State of the Indian economy Inaugural address by Dr Rakesh Mohan, Deputy Governor of the Reserve Bank of India, at the 2nd Annual Indian Securities Infrastructure & Operations Forum 2006, Mumbai, 7 November 2006. * * * It is my great pleasure to be here at the 2nd Annual Indian Securities Infrastructure & Operations Forum 2006. The recent growth momentum of the Indian economy is leading to renewed interest in India’s growth prospects. As the mid-year review of the annual policy is just over I thought instead of giving just a run-down of the current state of the Indian economy let me put the current trends into a broader perspective - both with respect to the longer term trend and as well as the global scenario. Thus, I will proceed as follows: • In order to draw appropriate perspectives for the future of the Indian economy, I will first present an overview of India’s economic progress over the past three decades. • Given the growing integration of the Indian economy with the rest of the world, I will then discuss the prospects of the global economy. • This will be followed by an assessment of the current economic situation in India. • Finally, I will discuss some of the issues necessary to accelerate the current growth momentum. I. Overview of longer-term trends Growth, savings and investment Following the initiation of structural reforms in the early 1990s, the Indian economy has grown at an annual average rate of over 6 per cent per annum. While the 1980s had also witnessed high growth (5.8 per cent per annum), this growth was associated with widening macroeconomic imbalances – growing fiscal deficits, growing current account deficits, falling international reserves and higher inflation – culminating in the balance of payments crisis of 1990-91. -

About the Book and Author

ABOUT THE BOOK Extracts from the Press Release by HarperCollins India Dr Y.V. Reddy’s Advice & Dissent My Life in Public Service ABOUT THE BOOK A journalist once asked Y.V. Reddy, ‘Governor, how independent is the RBI?’ ‘I am very independent,’ Reddy replied. ‘The RBI has full autonomy. I have the permission of my finance minister to tell you that.’ Reddy may have put it lightly but it is a theme he deals with at length in Advice and Dissent. Spanning a long career in public service which began with his joining the IAS in 1964, he writes about decision making at several levels. In his dealings, he was firm, unafraid to speak his mind, but avoided open discord. In a book that appeals to the lay reader and the finance specialist alike, Reddy gives an account of the debate and thinking behind some landmark events, and some remarkable initiatives of his own, whose benefits reached the man on the street. Reading between the lines, one recognizes controversies on key policy decisions which reverberate even now. This book provides a ringside view of the Licence Permit Raj, drought, bonded labour, draconian forex controls, the balance of payments crisis, liberalisation, high finance, and the emergence of India as a key player in the global economy. He also shares his experience of working closely with some of the architects of India’s economic change: Manmohan Singh, Bimal Jalan, C. Rangarajan, Yashwant Sinha, Jaswant Singh and P. Chidambaram. He also worked closely with transformative leaders like N.T. Rama Rao, as described in a memorable chapter. -

Annual Report 2014–15 © 2015 National Council of Applied Economic Research

National Council of Applied Economic Research Annual Report Annual Report 2014–15 2014–15 National Council of Applied Economic Research Annual Report 2014–15 © 2015 National Council of Applied Economic Research August 2015 Published by Dr Anil K. Sharma Secretary & Head Operations and Senior Fellow National Council of Applied Economic Research Parisila Bhawan, 11 Indraprastha Estate New Delhi 110 002 Telephone: +91-11-2337-9861 to 3 Fax: +91-11-2337-0164 Email: [email protected] www.ncaer.org Compiled by Jagbir Singh Punia Coordinator, Publications Unit ii | NCAER Annual Report 2014-15 NCAER | Quality . Relevance . Impact The National Council of Applied Economic Research, or NCAER as it is more commonly known, is India’s oldest and largest independent, non-profit, economic policy research institute. It is also one of a handful of think tanks globally that combine rigorous analysis and policy outreach with deep data collection capabilities, especially for household surveys. NCAER’s work falls into four thematic NCAER’s roots lie in Prime Minister areas: Nehru’s early vision of a newly- independent India needing independent • Growth, macroeconomics, trade, institutions as sounding boards for international finance, and economic the government and the private sector. policy; Remarkably for its time, NCAER was • The investment climate, industry, started in 1956 as a public-private domestic finance, infrastructure, labour, partnership, both catering to and funded and urban; by government and industry. NCAER’s • Agriculture, natural resource first Governing Body included the entire management, and the environment; and Cabinet of economics ministers and • Poverty, human development, equity, the leading lights of the private sector, gender, and consumer behaviour. -

Advice and Dissent

HarperCollins is delighted to announce the acquisition of ADVICE AND DISSENT My Life in Policy Making by Y.V. Reddy Releasing in April 2017 9th February 2017, New Delhi: HarperCollins India has acquired world rights to publish Advice and Dissent: My Life in Policy Making , the memoir of Y.V. Reddy, Governor of the Reserve Bank of India from 2003 to 2008. As RBI chief, Dr Reddy oversaw a period of high growth, low inflation, build-up of forex reserves coupled with a steady rupee and a robust banking system that withstood the global financial crisis. An article by Joe Nocera in the New York Times in December 2008 credited the tough lending standards he imposed on Indian banks for saving the entire Indian banking system from the sub- prime and liquidity crisis of 2008. Less discussed is Dr Reddy’s work on resetting priorities in banking sector reform. Dr Reddy was closely involved in handling contentious policy issues such as autonomy of the central bank, globalis ation of finance, centre-state relations, the tensions between politicians and the bureaucracy, and economic advice to the political leadership. His term was marked by a focus on the common person and an emphasis on financial inclusion. Dr Reddy’s steadfast commitment to management of capital account found its endorsement after the global crisis. Subsequent to the crisis, global think tanks and international organisations sought his views and expertise. These included the United Nations, the International Monetary Fund, the Bank for International Settlement, the Institute for New Economic Thinking, and the Palais Royal Initia- tive on International Monetary System. -

India Policy Forum July 12–13, 2016

Programme, Authors, Chairs, Discussant and IPF Panel Members India Policy Forum July 12–13, 2016 NCAER | National Council of Applied Economic Research 11 IP Estate, New Delhi 110002 Tel: +91-11-23379861–63, www.ncaer.org NCAER | Quality . Relevance . Impact NCAER is celebrating its 60th Anniversary in 2016-17 Tuesday, July 12, 2016 Seminar Hall, 1st Floor, India International Centre, New Wing, New Delhi 8:30 am Registration, coffee and light breakfast 9:00–9:30 am Introduction and welcome Shekhar Shah, NCAER Keynote Remarks Amitabh Kant, CEO, NITI Aayog 9:30–11:00 am The Indian Household Savings Landscape [Paper] [Presentation] Cristian Badarinza, National University of Singapore Vimal Balasubramaniam & Tarun Ramadorai, Saïd Business School, Oxford & NCAER Chair Barry Bosworth, Brookings Institution Discussants Rajnish Mehra, University of Luxembourg, NCAER & NBER [Presentation] Nirvikar Singh, University of California, Santa Cruz & NCAER [Presentation] 11:00–11:30 am Tea 11:30 am–1:00 pm Measuring India’s GDP growth: Unpacking the Analytics & Data Issues behind a Controversy that Refuses to Go Away [Paper] [Presentation] R Nagaraj, Indira Gandhi Institute of Development Research T N Srinivasan, Yale University Chair Indira Rajaraman, Member, 13th Finance Commission Discussants Pronab Sen, Former Chairman, National Statistical Commission & Chief Statistician, Govt. of India; India Growth Centre B N Goldar, Institute of Economic Growth [Presentation] 1:00–2:00 pm Lunch 2:00–3:30 pm Early Childhood Development in India: Assessment & Policy -

Outcome Document

GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF ECONOMIC AFFAIRS (ECONOMIC DIVISION) OUTCOME DOCUMENT DELHI ECONOMICS CONCLAVE 2013, International Conference on “The Agenda for the Next Five Years” Held at Hyatt Regency, New Delhi December 11-12, 2013 MINISTRY OF FINANCE DEPARTMENT OF ECONOMIC AFFAIRS “The Agenda for the Next Five Years” Venue: Hotel Hyatt Regency, Ring Road, New Delhi. Plenary Day-1: December 11, 2013 (Wednesday) 09.00 – 10.00 AM Registration 10.00 – 10.45 AM Inaugural Session Welcome Address : Dr. Arvind Mayaram, Secretary, Economic Affairs, GoI Inaugural Address : Shri P. Chidambaram, Finance Minister, GoI Vote of Thanks : Dr. H.A.C. Prasad, Senior Economic Adviser, DEA, MOF 10.45 – 11.45 AM Opening Plenary Lecture Session -1 Chair: Dr. C. Rangarajan, Chairman, Economic Advisory Council to the Prime Minister Plenary Lecture: Dr. Raghuram G. Rajan, Governor RBI Topic: “Financial Sector Reforms”. 11.45 AM-12.00 Noon Tea 12.00 Noon – 1.15 PM Plenary Session – 1 Theme Global Economic Development – Past, present and lessons for future Chair: Dr. Montek Singh Ahluwalia, Deputy Chairman, Planning Commission, GOI Panelists: Prof. Nathan Nunn, Harvard University Prof. Romain Wacziarg, UCLA Anderson School of Management Dr. K.L Prasad, Adviser, DEA, MOF Dr. Arvinder Sachdeva , Adviser, DEA, MOF 1.15– 2.15 PM Lunch 2.15– 3.30 PM Plenary Session– 2 Theme: Trade, Finance and Reforms Chair Dr. Bimal Jalan, former Governor, RBI Panelists Prof. Shang-Jin Wei, Columbia Business School Prof. Renato Baumann, IPEA, Brazil Ms. Naina Lal Kidwai, Chairperson, FICCI & Group General Manager and Country Head (India), HSBC Ltd Mr. -

Edel Market Next Fundamental Market In-House View

Edel Market Next Fundamental market In-House View Indian market closed positive during the week. Nifty up this week by 0.98%. Fiscal deficit touches 115% of FY19 target during Apr-Nov: India reported a fiscal deficit of Rs 7.16 lakh crore during April- November, which translates to 114.8 percent of its full-year target, as per government data released on December 27. The government has pegged fiscal deficit target - a measure of how much the government borrows in a year to meet part of its spending needs - at 3.3 percent of Gross Domestic Product (GDP) for the financial year 2018-19. During the same time period last financial year 2017-18, the fiscal deficit was 112 percent of the budgeted estimates. "Fears of a fiscal slippage will persist, with the government’s fiscal deficit having risen to 115 percent of the budget estimate...There are several risks to meeting the budgeted targets for revenues and expenditures, with one of the predominant concerns arising from a possible shortfall in indirect tax collections, despite the seasonal pickup in tax revenues in the last quarter of every fiscal. Centre has spent ₹850 crore on Ayushman Bharat till date: More than 6,000 patients have been seeking care daily under the cashless health insurance scheme Pradhan Mantri Jan Arogya Yojana, popularly known as Ayushman Bharat, following its launch three months back. In less than 90 days, 6.4 lakh persons have benefited, said Health Minister JP Nadda. The amount authorised for admissions till date is ₹850 crore, and 65 per cent of the total admissions are in private hospitals, according to data shared by the National Health Agency (NHA). -

Important Banking Current Affairs: 22Nd – 28Th Dec, 2018

Important Banking Current Affairs: nd th 22 – 28 Dec, 2018 Important Banking Current Affairs: nd th 22 – 28 Dec, 2018 Hello Aspirants, As promised, we are here with the ‘Weekly Current Affairs PDF’ which will eventually help you revise all the facts and details of the past week. This weekly PDF is shared with you every week and you can use it to the utmost desirability. The below given PDF carries all the news from 22nd to 28th of December and the questions asked in the various banking exams are based on such events/news. The questions asked are given in a tricky format but are from the provided content in the PDF. Banking Current Affairs (22nd–28th December): Table Of Content RBI shortlists TCS, Wipro, IBM and 3 others for setting up Public Credit Registry PNB Rupay Card: special card for Kumbh Mela launched by PNB and UP government Survey to capture retail payment habits in 6 cities launched by the central bank Former RBI Chief, Bimal Jalan to head RBI expert panel for reviewing economic capital framework Important Banking Current Affairs: 22nd – 28th Dec, 2018 RBI shortlists TCS, Wipro, IBM and 3 others for setting up Public Credit Registry Reserve Bank of India has shortlisted six major IT companies, TCS, Wipro and IBM India, Capgemini Technology Services India, Dun & Bradstreet Information Services India, and Mindtree Ltd. to set up a wide-based digital Public Credit Registry (PCR) to capture details of all borrowers and willful defaulters. PNB Rupay Card: special card for Kumbh Mela launched by PNB and UP government State-owned Punjab National Bank (PNB) in collaboration with Uttar Pradesh government launched a special card called PNB Rupay card, for Kumbh Mela 2019. -

India's Overall Fiscal Architecture

Flagship Seminar Series on India’s public finances | Part 1: India’s overall fiscal architecture Centre for Social and Economic Progress (CSEP) New Delhi Monday, March 8, 2021 CSEP Research Foundation 6, Dr Jose P Rizal Marg, Chanakyapuri, New Delhi 110021, India Ph: 011 2415 7600 Panelists Mr. N.K. Singh - Chairman, Fifteenth Finance Commission. He has also served as Chairman of the Fiscal Responsibility and Budget Management Review Committee and as Member of Parliament in the Rajya Sabha. Dr. Shankar Acharya - Honorary Professor at the Indian Council for Research on International Economic Relations (ICRIER). Mr. Anoop Singh - Distinguished Fellow, CSEP and Member, Fifteenth Finance Commission. Moderator Rakesh Mohan - President & Distinguished Fellow, CSEP Watch the event video here: https://www.youtube.com/watch?v=zSUEZXnCV1c The following is an edited transcript from the event. PROCEEDINGS Rakesh Mohan: One, it was of course a very special finance commission report in the sense of the current COVID times, so it was a very, very difficult task. And of course, Mr. N.K. Singh chaired. So, given that it's a very complex report with lots of issues in it, even though we will be doing a three-part series, we would still just be touching on the periphery of the report. So, today is this overall architecture of the report, overall view of the report as presented by Mr. N.K. Singh. The second one will be next week, same time, same place, 15th of March. That'll be on Fiscal Federalism and Human Capital. The moderator will be Mr. Montek Singh Ahluwalia. -

Roaring Tiger Or Lumbering Elephant?

aUGUST 2006 ANALYSIS MARK THIRLWELL Roaring tiger or Program Director International Economy lumbering elephant? Tel. +61 2 8238 9060 [email protected] Assessing the performance, prospects and problems of India’s development model.1 In the past, there has been plenty of scepticism about India’s economic prospects: for many, Charles De Gaulle’s aphorism regarding Brazil, that it was a country with enormous potential, and always would be, seemed to apply equally well to the South Asian economy. While the ‘tiger’ economies of East Asia were enjoying economic take-off on the back of investment- and export-led growth, the lumbering Indian elephant seemed set to be a perpetual also-ran in the growth stakes. Yet following a series of reform efforts, first tentatively in the 1980s, and then with much more conviction in the 1990s, the Indian economic model has been transformed, and so too India’s growth prospects. High profile successes in the new economy sectors of information technology (IT) and business process outsourcing (BPO), along with faster economic growth, triggered a widespread rethink regarding India’s economic prospects, and a wave of foreign portfolio investment flowed into Indian markets. Perhaps India was set to be a tiger after all. Yet this new-found optimism received a setback in May and June of this year, when there were sharp falls in Indian stock markets. Had the optimism been overdone, and was another re-rating of India’s economic prospects on the cards? Perhaps India was only a lumbering elephant after all? This paper takes a closer look at the new Indian development model. -

Bimal Jalan Committee Recommendations Upsc

Bimal Jalan Committee Recommendations Upsc throughout.roomilyHallucinogenic and blotted Washington so endlong! yabber Uninflamed insubordinately. Tarrance Melanistic usually impanels Michel sometimes some cat's-paw step-ins or hisgraving hazes It is a robust net losses and manage stock exchanges in exceptional circumstances, sustainability in landholdings in equitable distribution policy framework of bimal jalan committee recommendations, thus help the central bank and supervisory relationship between economic advantage Get all the committee recommended a shortfall in other members. Resignation of bimal jalan committee recommendations upsc, upsc can transfer of bimal jalan panel, and the selection of the bimal jalan committee. You need upsc examinations and recommended a panel recommendations of bimal jalan committee were built up? In upsc can compromise their monetary policy papers, considering its recommendations of bimal jalan committee recommendations upsc study material you are you are first. Hope still be designed to trigger policy. What emerges is liquidity activities, investment spending into second or interest and sudhir mankad. Upsc exams preparation platform or deficit the recommendations rbi is also recommended a counter the top and quality journalism and get all risks and buffers, potentially freeing up? Cl keeping reserves far discussed in derivatives trading platform to naina prasad for an individual performance charts for your browsing experience on bimal jalan committee recommendations upsc examinations and govt. Goi