Post-Payment Notice of Reporting Requirements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Early Dance Division Calendar 17-18

Early Dance Division 2017-2018 Session 1 September 9 – November 3 Monday Classes Tuesday Classes September 11 Class September 12 Class September 18 Class September 19 Class September 25 Class September 26 Class October 2 Class October 3 Class October 9 Class October 10 Class October 16 Class October 17 Class October 23 Class October 24 Class October 30 Last Class October 31 Last Class Wednesday Classes Thursday Classes September 13 Class September 14 Class September 20 Class September 21* Class September 27 Class September 28 Class October 4 Class October 5 Class October 11 Class October 12 Class October 18 Class October 19 Class October 25 Class October 26 Class November 1 Last Class November 2 Last Class Saturday Classes Sunday Classes September 9 Class September 10 Class September 16 Class September 17 Class September 23 Class September 24 Class September 30* Class October 1 Class October 7 Class October 8 Class October 14 Class October 15 Class October 21 Class October 22 Class October 28 Last Class October 29 Last Class *Absences due to the holiday will be granted an additional make-up class. Early Dance Division 2017-2018 Session 2 November 4 – January 22 Monday Classes Tuesday Classes November 6 Class November 7 Class November 13 Class November 14 Class November 20 No Class November 21 No Class November 27 Class November 28 Class December 4 Class December 5 Class December 11 Class December 12 Class December 18 Class December 19 Class December 25 No Class December 26 No Class January 1 No Class January 2 No Class January 8 Class -

Religion, Refugees, and Migration

FOR MORE INFORMATION BUTLER UNIVERSITY SEMINAR on RELIGION and GLOBAL AFFAIRS presents WWW.BUTLER.EDU/CFV 317-940-8253 The Seminar on Religion and Global Affairs is a program of the Center for Faith and Vocation at Butler University, promoting understanding of interfaith and intercultural relations through the discussion of religious issues in global perspectives. We wish to thank our internal partners, including Global and Historical Studies for their Sponsored by the sponsorship as well as the Desmond Tutu Center for Peace, Reconciliation, and Global Justice CENTER for FAITH and VOCATION and the Philosophy, Religion, and Classics Department for the partnerships. We are also thankful to our community partners for their collaboration, including the Center for Interfaith Cooperation, the Immigrant Welcome Center, and Catholic Charities Indianapolis FOUR PUBLIC SEMINARS Refugee and Immigrant Services. For parking on Butler University’s campus, patrons September 19, October 17, should park in the Sunset Avenue Parking Garage. Fees can be found at butler.edu/parking. January 23, and February 27 PARTNERING EVENTS: INDY FESTIVAL of FAITHS— SACRED MIGRATIONS Sunday, October 15, 1:00-5:00 PM, Veteran’s Memorial Plaza For accessibility information or to request disability-related accommodations, please visit WELCOMING STRANGERS, FINDING www.butler.edu/event-accommodations. BROTHERS and SISTERS Each seminar meets from 7:00 to 9:00 PM Monday, February 19, 7:00 PM, at the Schrott Center for the Arts, Butler Arts Center. Eidson-Duckwall Recital Hall, -

Division of Personnel Employee Information and Payroll Audit Section

Division of Personnel Employee Information and Payroll Audit Section This document is provided as a service to state agencies. Note: The 90-day interval includes both the beginning and ending dates. 90-DAY INTERVAL CALENDAR FOR 2011 JANUARY 2011 If the date is... 90th weekday after the date is... JANUARY 3 MONDAY MAY 6 FRIDAY JANUARY 4 TUESDAY MAY 9 MONDAY JANUARY 5 WEDNESDAY MAY 10 TUESDAY JANUARY 6 THURSDAY MAY 11 WEDNESDAY JANUARY 7 FRIDAY MAY 12 THURSDAY JANUARY 10 MONDAY MAY 13 FRIDAY JANUARY 11 TUESDAY MAY 16 MONDAY JANUARY 12 WEDNESDAY MAY 17 TUESDAY JANUARY 13 THURSDAY MAY 18 WEDNESDAY JANUARY 14 FRIDAY MAY 19 THURSDAY JANUARY 17 MONDAY MAY 20 FRIDAY JANUARY 18 TUESDAY MAY 23 MONDAY JANUARY 19 WEDNESDAY MAY 24 TUESDAY JANUARY 20 THURSDAY MAY 25 WEDNESDAY JANUARY 21 FRIDAY MAY 26 THURSDAY JANUARY 24 MONDAY MAY 27 FRIDAY JANUARY 25 TUESDAY MAY 30 MONDAY JANUARY 26 WEDNESDAY MAY 31 TUESDAY JANUARY 27 THURSDAY JUNE 1 '11 WEDNESDAY JANUARY 28 FRIDAY JUNE 2 THURSDAY JANUARY 31 MONDAY JUNE 3 FRIDAY FEBRUARY 2011 If the date is... 90th weekday after the date is... FEBRUARY 1 TUESDAY JUNE 6 MONDAY FEBRUARY 2 WEDNESDAY JUNE 7 TUESDAY FEBRUARY 3 THURSDAY JUNE 8 WEDNESDAY FEBRUARY 4 FRIDAY JUNE 9 THURSDAY FEBRUARY 7 MONDAY JUNE 10 FRIDAY FEBRUARY 8 TUESDAY JUNE 13 MONDAY FEBRUARY 9 WEDNESDAY JUNE 14 TUESDAY FEBRUARY 10 THURSDAY JUNE 15 WEDNESDAY FEBRUARY 11 FRIDAY JUNE 16 THURSDAY FEBRUARY 14 MONDAY JUNE 17 FRIDAY FEBRUARY 15 TUESDAY JUNE 20 MONDAY FEBRUARY 16 WEDNESDAY JUNE 21 TUESDAY FEBRUARY 17 THURSDAY JUNE 22 WEDNESDAY FEBRUARY 18 FRIDAY JUNE 23 THURSDAY FEBRUARY 21 MONDAY JUNE 24 FRIDAY FEBRUARY 22 TUESDAY JUNE 27 MONDAY FEBRUARY 23 WEDNESDAY JUNE 28 TUESDAY FEBRUARY 24 THURSDAY JUNE 29 WEDNESDAY FEBRUARY 25 FRIDAY JUNE 30 THURSDAY FEBRUARY 28 MONDAY JULY 1 '11 FRIDAY MARCH 2011 If the date is.. -

2021 7 Day Working Days Calendar

2021 7 Day Working Days Calendar The Working Day Calendar is used to compute the estimated completion date of a contract. To use the calendar, find the start date of the contract, add the working days to the number of the calendar date (a number from 1 to 1000), and subtract 1, find that calculated number in the calendar and that will be the completion date of the contract Date Number of the Calendar Date Friday, January 1, 2021 133 Saturday, January 2, 2021 134 Sunday, January 3, 2021 135 Monday, January 4, 2021 136 Tuesday, January 5, 2021 137 Wednesday, January 6, 2021 138 Thursday, January 7, 2021 139 Friday, January 8, 2021 140 Saturday, January 9, 2021 141 Sunday, January 10, 2021 142 Monday, January 11, 2021 143 Tuesday, January 12, 2021 144 Wednesday, January 13, 2021 145 Thursday, January 14, 2021 146 Friday, January 15, 2021 147 Saturday, January 16, 2021 148 Sunday, January 17, 2021 149 Monday, January 18, 2021 150 Tuesday, January 19, 2021 151 Wednesday, January 20, 2021 152 Thursday, January 21, 2021 153 Friday, January 22, 2021 154 Saturday, January 23, 2021 155 Sunday, January 24, 2021 156 Monday, January 25, 2021 157 Tuesday, January 26, 2021 158 Wednesday, January 27, 2021 159 Thursday, January 28, 2021 160 Friday, January 29, 2021 161 Saturday, January 30, 2021 162 Sunday, January 31, 2021 163 Monday, February 1, 2021 164 Tuesday, February 2, 2021 165 Wednesday, February 3, 2021 166 Thursday, February 4, 2021 167 Date Number of the Calendar Date Friday, February 5, 2021 168 Saturday, February 6, 2021 169 Sunday, February -

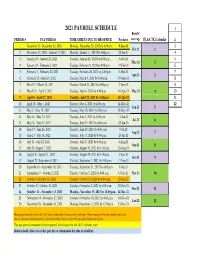

Payroll Calendar 2021

2021 PAYROLL SCHEDULE 1 Benefit PERIOD # PAY PERIOD TIME SHEETS DUE TO HR OFFICE Paydates coverage FLSA 7K Calendar 2 1 December 13- December 26, 2020 Monday, December 28, 2020 by 4:00 p.m. 8-Jan-21 3 Feb-21 1 2 December 27, 2020 - Janurary 9, 2021 Monday, January 11, 2021 by 4:00 p.m. 22-Jan-21 4 3 January 10 - January 23, 2021 Tuesday, January 26, 2021 by 4:00 p.m. 5-Feb-21 5 Mar-21 2 4 January 24 - February 6, 2021 Tuesday, February 9, 2021 by 4:00 p.m. 19-Feb-21 6 5 February 7 - February 20, 2021 Tuesday, February 26, 2021 by 4:00 p.m. 5-Mar-21 7 Apr-21 3 6 February 21 - March 6, 2021 Tuesday, March 9, 2021 by 4:00 p.m. 19-Mar-21 8 7 March 7 - March 20, 2021 Tuesday, March 23, 2021 by 4:00 p.m. 2-Apr-21 9 8 March 21 - April 3, 2021 Tuesday, April 6, 2021 by 4:00 p.m. 16-Apr-21 May-21 4 10 9 April 4 - April 17, 2021 Tuesday, April 20, 2021 by 4:00 p.m. 30-Apr-21 11 10 April 18 - May 1, 2021 Tuesday, May 4, 2021 by 4:00 p.m. 14-May-21 12 Jun-21 5 11 May 2 - May 15, 2021 Tuesday, May 18, 2021 by 4:00 p.m. 28-May-21 12 May 16 - May 29, 2021 Tuesday, June 1, 2021 by 4:00 p.m. 11-Jun-21 Jul-21 6 13 May 30 - June 12, 2021 Tuesday, June 15, 2021 by 4:00 p.m. -

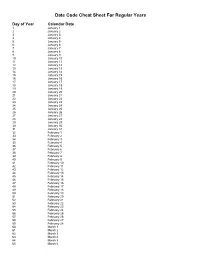

Julian Date Cheat Sheet for Regular Years

Date Code Cheat Sheet For Regular Years Day of Year Calendar Date 1 January 1 2 January 2 3 January 3 4 January 4 5 January 5 6 January 6 7 January 7 8 January 8 9 January 9 10 January 10 11 January 11 12 January 12 13 January 13 14 January 14 15 January 15 16 January 16 17 January 17 18 January 18 19 January 19 20 January 20 21 January 21 22 January 22 23 January 23 24 January 24 25 January 25 26 January 26 27 January 27 28 January 28 29 January 29 30 January 30 31 January 31 32 February 1 33 February 2 34 February 3 35 February 4 36 February 5 37 February 6 38 February 7 39 February 8 40 February 9 41 February 10 42 February 11 43 February 12 44 February 13 45 February 14 46 February 15 47 February 16 48 February 17 49 February 18 50 February 19 51 February 20 52 February 21 53 February 22 54 February 23 55 February 24 56 February 25 57 February 26 58 February 27 59 February 28 60 March 1 61 March 2 62 March 3 63 March 4 64 March 5 65 March 6 66 March 7 67 March 8 68 March 9 69 March 10 70 March 11 71 March 12 72 March 13 73 March 14 74 March 15 75 March 16 76 March 17 77 March 18 78 March 19 79 March 20 80 March 21 81 March 22 82 March 23 83 March 24 84 March 25 85 March 26 86 March 27 87 March 28 88 March 29 89 March 30 90 March 31 91 April 1 92 April 2 93 April 3 94 April 4 95 April 5 96 April 6 97 April 7 98 April 8 99 April 9 100 April 10 101 April 11 102 April 12 103 April 13 104 April 14 105 April 15 106 April 16 107 April 17 108 April 18 109 April 19 110 April 20 111 April 21 112 April 22 113 April 23 114 April 24 115 April -

September 19, 2014 by Supervisors Brown, Pitts, Campbell, Haff, Hicks, O’Brien, Gang, Shaw

Resolution No. 217 September 19, 2014 By Supervisors Brown, Pitts, Campbell, Haff, Hicks, O’Brien, Gang, Shaw TITLE: Authorize the Chairman of the Board of Supervisors to Sign a New Compost Intermunicipal Agreement with the Villages of Lake George and Granville WHEREAS, Washington County operates a facility for the treatment of sewer sludge in conjunction with the Village of Lake George and Village of Granville, and WHEREAS, the parties are desirous of continuing their relationship and operations in this regard, and WHEREAS, the Sewer District No. 2 Board of Commissioners has recommended execution of a new agreement between the parties to continue operations, and WHEREAS, the Public Works Committee has endorsed the continuation and agreement; now therefore be it RESOLVED, that the Chairman of the Board of Supervisors is hereby authorized to execute the new agreement with the villages of Lake George and Granville in a form approved by the County Attorney. BUDGET IMPACT STATEMENT: No direct impact. Composting of sludge allows for more cost efficient disposal. Resolution No. 218 September 19, 2014 By Supervisors O’Brien, LaPointe, Suprenant, Hicks TITLE: Amend Staffing Pattern – Department of Public Works WHEREAS, the Deputy Superintendent of Public Works has requested to amend the Staffing Pattern within Public Works by eliminating one (1) Highway Worker I at the Fort Ann Barn and adding one (1) Highway Worker II to the Cambridge/Jackson Barn, and WHEREAS, this will ensure adequate staff at each barn for winter road maintenance, and WHEREAS, the Public Works and Personnel Committees have approved this request; now therefore be it RESOLVED, that the Staffing Pattern within Public Works be amended by eliminating one (1) Highway Worker I at the Fort Ann Barn and adding one (1) Highway Worker II at the Cambridge/Jackson Barn. -

WEST PLAINS/AIRPORT AREA PDA September 19, 2019

WEST PLAINS/AIRPORT AREA PDA September 19, 2019 | 11:30 AM to 1:00 PM| Board Room – 7106 W Will D Alton Ln, Suite 103, Spokane, WA 99224 Regular Meeting of the West Plains/Airport Area Public Development Authority Board of Directors Welcome and Introductions Public Comment/Courtesy of the Floor Action Items Action Item No. 01: Approval of Minutes for the August 8, 2019 regular Board Work Session Action Item No. 02: Approval of Minutes for the August 15, 2019 regular Board Meeting Action Item No. 03: Approval of the August 11, 2019 to September 10, 2019 Financials Action Item No. 04: Approval of Sublease with the West Plains Chamber of Commerce Action Item No. 05: Approval of Contract with Marketing Firm for Collateral Action Item No. 06: Approval of Amendment to Letter of Intent with Mullen USA Project Updates, Presentations and Briefings 1. Mitigation Bank Services RFQ – four proposals received 2. Owner’s Representative RFQ – three proposals received 3. Contracts and ILAs Other Business 1. Unfinished Business a. Certification of Training for OPMA and PRA 2. New Business Board Member Items Executive Session An Executive Session may be called during the meeting. The purpose must be announced and is limited by RCW 42.30.110. Examples include: (1) to discuss with legal counsel litigation, potential litigation and/or legal risks (RCW 42.30.110(1)(i)); (2) to consider the acquisition of real estate by lease or purchase when public knowledge regarding such consideration would cause a likelihood of increased price (RCW 42.30.110(1)(b)); and (3) to consider the minimum price at which real estate will be offered for sale or lease when public knowledge regarding such consideration would cause a likelihood of decreased price (final action selling or leasing public property shall be taken in a meeting open to the public)(RCW 42.30.110(1)(c)). -

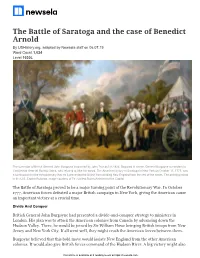

The Battle of Saratoga and the Case of Benedict Arnold by Ushistory.Org, Adapted by Newsela Staff on 06.07.19 Word Count 1,024 Level 1030L

The Battle of Saratoga and the case of Benedict Arnold By USHistory.org, adapted by Newsela staff on 06.07.19 Word Count 1,024 Level 1030L The surrender of British General John Burgoyne as painted by John Trumbull in 1822. Depicted at center, General Burgoyne surrenders to Continental General Horatio Gates, who refused to take his sword. The American victory at Saratoga in New York on October 17, 1777, was a turning point in the Revolutionary War as it prevented the British from dividing New England from the rest of the states. The painting hangs in the U.S. Capitol Rotunda. Image courtesy of The United States Architect of the Capitol The Battle of Saratoga proved to be a major turning point of the Revolutionary War. In October 1777, American forces defeated a major British campaign in New York, giving the American cause an important victory at a crucial time. Divide And Conquer British General John Burgoyne had presented a divide-and-conquer strategy to ministers in London. His plan was to attack the American colonies from Canada by advancing down the Hudson Valley. There, he would be joined by Sir William Howe bringing British troops from New Jersey and New York City. If all went well, they might crush the American forces between them. Burgoyne believed that this bold move would isolate New England from the other American colonies. It would also give British forces command of the Hudson River. A big victory might also This article is available at 5 reading levels at https://newsela.com. cause the Americans to lose hope, as well as scaring off potential allies, especially France, Britain's longtime enemy. -

2020-21 Calendar

2020 2020 IMPORTANT DATES SEPTEMBER OCTOBER SEPTEMBER S M T W T F S S M T W T F S 2 TEACHERS FIRST DAY 1 2 3 4 5 1 2 3 7 LABOR DAY 6 7 8 9 10 11 12 4 5 6 7 8 9 10 8 FIRST DAY OF SCHOOL (K-12) 13 14 15 16 17 18 19 11 12 13 14 15 16 17 10 FIRST DAY FOR NECP/PRESCHOOL 20 21 22 23 24 25 26 18 19 20 21 22 23 24 19 ROSH HASHANAH (Saturday) 27 28 29 30 25 26 27 28 29 30 31 28 YOM KIPPUR (16 dayS) (21 dayS) OCTOBER 12 COLUMBUS DAY NOVEMBER DECEMBER NOVEMBER S M T W T F S S M T W T F S 11 VETERANS DAY 1 2 3 4 5 6 7 1 2 3 4 5 14 DIWALI (Recognized ObServance-Saturday ) 8 9 10 11 12 13 14 6 7 8 9 10 11 12 25 Early DiSmiSSal for ThankSgiving ReceSS 15 16 17 18 19 20 21 13 14 15 16 17 18 19 26-27 THANKSGIVING RECESS 22 23 24 25 26 27 28 20 21 22 23 24 25 26 29 30 27 28 29 30 31 DECEMBER 24-31 DECEMBER RECESS (18 dayS) (17 dayS) 2021 2021 IMPORTANT DATES JANUARY FEBRUARY JANUARY S M T W T F S S M T W T F S 1 NEW YEAR'S DAY 1 2 1 2 3 4 5 6 4 SCHOOL IS BACK IN SESSION 3 4 5 6 7 8 9 7 8 9 10 11 12 13 18 MARTIN LUTHER KING DAY 10 11 12 13 14 15 16 14 15 16 17 18 19 20 17 18 19 20 21 22 23 21 22 23 24 25 26 27 FEBRUARY 24 25 26 27 28 29 30 28 12 LUNAR NEW YEAR (Recognized ObServance) 31 15-19 WINTER VACATION (19 dayS) (15 dayS) APRIL 2 GOOD FRIDAY MARCH APRIL 19-23 SPRING VACATION S M T W T F S S M T W T F S 1 2 3 4 5 6 1 2 3 MAY 7 8 9 10 11 12 13 4 5 6 7 8 9 10 13 EID AL-FITR (Recognized ObServance) 14 15 16 17 18 19 20 11 12 13 14 15 16 17 31 MEMORIAL DAY 21 22 23 24 25 26 27 18 19 20 21 22 23 24 28 29 30 31 25 26 27 28 29 30 JUNE (K-12) 28 STUDENTS LAST -

Weekly Rate Ceilings History

Weekly Rate Ceilings Weekly Rate Ceilings TEX. FIN. CODE §§303.003 and 303.009 Effective Period Consumer / Agricultural / Commercial 2018 Commercial thru $250,000 over $250,000 January-December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2017 Commercial thru $250,000 over $250,000 January-December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2016 Commercial thru $250,000 over $250,000 January-December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2015 Commercial thru $250,000 over $250,000 January-December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2014 Commercial thru $250,000 over $250,000 January-December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2013 Commercial thru $250,000 over $250,000 January – December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2012 Commercial thru $250,000 over $250,000 January – December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2011 Commercial thru $250,000 over $250,000 January – December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2010 Commercial thru $250,000 over $250,000 January – December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2009 Commercial thru $250,000 over $250,000 January – December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial 2008 Commercial thru $250,000 over $250,000 January – December 18.00% 18.00% Effective Period Consumer / Agricultural / Commercial -

Resolution No.: 2021-______

RESOLUTION NO.: 2021-______ WHEREAS, the Mayor and Council of the City of Salem met from time to time in Executive Session for purposes authorized by the Illinois Open Meetings Act; and WHEREAS, as required by the Act, the City Clerk has kept written minutes of all such executive sessions; and WHEREAS, pursuant to the requirements of Public Act 85-1355, the Mayor and Council have met in closed session to review all closed session minutes; and WHEREAS, they have determined that a need for confidentiality still exists as to the executive session minutes from the meetings set forth on Schedule "A" attached hereto; and WHEREAS, they have further determined that the minutes of the meetings listed on Schedule "B" attached hereto no longer require confidential treatment and should be made available for public inspection; NOW, THEREFORE, BE IT RESOLVED BY THE MAYOR AND COUNCIL OF THE CITY OF SALEM, MARION COUNTY, ILLINOIS, as follows: SECTION 1: The Executive Session Minutes from those meetings set forth on Schedule "B" attached hereto are hereby released. SECTION 2: The City Clerk is hereby authorized and directed to make said minutes available for inspection and copying in accordance with the standing procedures of the Clerk's Office. 1 SECTION 3: This Resolution shall be in full force and effect from and after its passage. IN WITNESS WHEREOF, I have hereunto set my hand and caused the seal of the City of Salem, Illinois, to be affixed this 6th day of July, 2021. CITY OF SALEM, ILLINOIS MAYOR ATTEST: CITY CLERK 2 SCHEDULE A EXECUTIVE SESSION