3Rd Quarter 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Announcement February 22, 2019

Announcement February 22, 2019 Indxx USA Regional Banking Index will be reconstituted after the close of trading hours on February 28, 2019. Listed below are the constituents that will be added to the existing index: S.No ISIN Company Name 1 US5116561003 Lakeland Financial Corporation 2 US42234Q1022 Heartland Financial USA, Inc. 3 US3369011032 1st Source Corporation 4 US89214P1093 TowneBank 5 US4461501045 Huntington Bancshares Incorporated 6 US1637311028 Chemical Financial Corporation 7 US2298991090 Cullen/Frost Bankers, Inc. 8 US1176651099 Bryn Mawr Bank Corporation 9 US72346Q1040 Pinnacle Financial Partners, Inc. 10 US90539J1097 Union Bankshares Corporation 11 US81768T1088 ServisFirst Bancshares Inc 12 US06652K1034 BankUnited, Inc. 13 US6952631033 PacWest Bancorp 14 US9897011071 Zions Bancorporation, N.A. 15 US05945F1030 BancFirst Corporation 16 US15201P1093 CenterState Bank Corporation Listed below are the constituents that will be deleted from the existing index: S.No ISIN Company Name 1 US03076K1088 Ameris Bancorp 2 US05561Q2012 BOK Financial Corporation 3 US1011191053 Boston Private Financial Holdings, Inc. 4 US1547604090 Central Pacific Financial Corp. 5 US1972361026 Columbia Banking System, Inc. 6 US2937121059 Enterprise Financial Services Corp 7 US3198291078 First Commonwealth Financial Corporation 8 US3202091092 First Financial Bancorp. 9 US3205171057 First Horizon National Corporation 10 US52471Y1064 LegacyTexas Financial Group, Inc. 11 US7838591011 S&T Bancorp, Inc. 12 US8404411097 South State Corporation 13 US84470P1093 Southside Bancshares, Inc. 14 US9027881088 UMB Financial Corporation 15 US9197941076 Valley National Bancorp Listed below are the new index constituents that will be effective at the close of trading hours on February 28, 2019. Weights as of S.No ISIN Company Name Feb 21, 2019 1 US1491501045 Cathay General Bancorp 2.00% 2 US8984021027 Trustmark Corporation 2.00% 3 US4590441030 International Bancshares Corporation 2.00% 4 US1266001056 CVB Financial Corp. -

O'neil Elected CEO, First Financial Cleburne Morris Is Chairman In

April 9, 2012 www.bankersdigest.com Volume 140, No. 14 O’Neil Elected CEO, Morris Is Chairman in McCaskill Tapped Sabine First Financial Cleburne Mountain Home, AR Reg President, MidSouth First Financial Bankshares Inc., Mountain Home Bancshares Inc. has an- MidSouth Bank, N. A., Lafayette, LA, Abilene, TX, has announced the elec- nounced the election of Cynthia Morris has combined its West Louisiana Re- tion of Tom O’Neil as chairman of the gion with portions as CEO of subsid- board following of its East Texas iary First Finan- the retirement of Region, including cial Bank, N. A., Chairman Denny the Beaumont and Cleburne. He will Smith, who will Vidor markets, to join the existing continue to serve create the Sabine management team as member of the Region. The bank of Matt Reynolds, board of directors. has named Blake president, and Mountain Home McCaskill as the Craig Beskow, ex- O’Neil Bancshares is the Morris Sabine Region- McCaskill ecutive vice presi- parent company al President. He dent. of First National Bank & Trust, Moun- joined MidSouth in 2010 and was O’Neil has served as president of tain Home, AR; Bank of Pocahontas, previously president of the West Loui- subsidiary First Financial Bank, N. Pocahontas, AR; and Integrity First siana Region. A., Eastland, since 2009. He entered Bank, Jonesboro, AR. McCaskill has two decades of bank- banking in 1980 with the OCC and Morris, a cum laude graduate of Wil- ing experience. Before joining Mid- joined First Financial in 1998 as a se- liam Woods University, Fulton, MO, South, he worked for Capital One as nior vice president and commercial began her banking career in 1976 and a vice president for business banking lender in Abilene. -

TARP Capital Purchase Program Recipients

TARP Capital Purchase Program Recipients Date Name of Institution City State Investment Type Investment 2/6/2009 Alaska Pacific Bancshares, Inc. Juneau AK Preferred Stock w/Warrants 4,781,000 Alaska Total: 1 12/19/2008 BancTrust Financial Group, Inc. Mobile AL Preferred Stock w/Warrants $50,000,000 11/14/2008 Regions Financial Corp. Birmingham AL Preferred Stock w/Warrants $3,500,000,000 12/5/2008 Superior Bancorp Inc. Birmingham AL Preferred Stock w/Warrants $69,000,000 12/23/2008 United Bancorporation of Alabama, Inc. Atmore AL Preferred Stock w/ Warrants $10,300,000 Alabama Total: 4 12/12/2008 Bank of the Ozarks, Inc. Little Rock AR Preferred Stock w/Warrants $75,000,000 1/16/2009 Home Bancshares, Inc. Conway AR Preferred Stock w/ Warrants 50,000,000 2/ 1/23/2009 Liberty Bancshares, Inc. Jonesboro AR Preferred Stock w/ Exercised Warrants 57,500,000 2/ 1/30/2009 Rogers Bancshares, Inc. Little Rock AR Preferred Stock w/ Exercised Warrants 25,000,000 3/ 1/16/2009 Southern Bancorp, Inc. Arkadelphia AR Preferred Stock 11,000,000 Arkansas Total: 5 2/ 1/30/2009 Goldwater Bank, N.A. Scottsdale AZ Preferred Stock w/ Exercised Warrants 2,568,000 Arizona Total: 1 11/14/2008 Bank of Commerce Holdings Redding CA Preferred Stock w/Warrants $17,000,000 12/5/2008 Bank of Marin Bancorp Novato CA Preferred Stock w/Warrants $28,000,000 2/ 1/30/2009 Beach Business Bank Manhattan Beach CA Preferred Stock w/ Exercised Warrants 6,000,000 12/23/2008 Bridge Capital Holdings San Jose CA Preferred Stock w/ Warrants $23,864,000 11/14/2008 Broadway Financial Corporation -

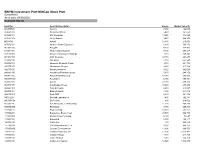

BNYM Investment Port:Midcap Stock Port (Unaudited) As of Date: 09/30/2020 Common Stocks

BNYM Investment Port:MidCap Stock Port (Unaudited) As of date: 09/30/2020 Common Stocks Identifier Security Description Shares Market Value ($) 002535300 Aaron's 7,450 422,043 00404A109 Acadia Healthcare 5,480 161,550 004498101 ACI Worldwide 13,250 346,223 00508Y102 Acuity Brands 9,470 969,255 BD845X2 Adient 12,480 216,278 00737L103 Adtalem Global Education 6,800 166,872 00766T100 AECOM 4,170 174,473 018581108 Alliance Data Systems 7,130 299,317 01973R101 Allison Transmission Holdings 7,110 249,845 00164V103 AMC Networks 10,710 264,644 023436108 Amedisys 2,760 652,547 025932104 American Financial Group 3,310 221,704 03073E105 AmerisourceBergen 2,220 215,162 042735100 Arrow Electronics 5,620 442,069 04280A100 Arrowhead Pharmaceuticals 5,670 244,150 045487105 Associated Banc-Corp 47,940 605,003 05329W102 Autonation 6,980 369,451 05368V106 Avient 23,030 609,374 053774105 Avis Budget Group 10,600 278,992 05464C101 Axon Enterprise 2,410 218,587 062540109 Bank of Hawaii 4,830 244,012 06417N103 Bank OZK 6,630 141,352 090572207 Bio-Rad Laboratories 1,480 762,881 09073M104 Bio-Techne 880 218,002 05550J101 BJs Wholesale Club Holdings 11,270 468,269 09227Q100 Blackbaud 3,750 209,363 103304101 Boyd Gaming 18,350 563,162 105368203 Brandywine Realty Trust 93,500 966,790 11120U105 Brixmor Property Group 6,300 73,647 117043109 Brunswick 8,150 480,117 12685J105 Cable One 300 565,629 127190304 CACI International, Cl. A 3,980 848,377 12769G100 Caesars Entertainment 11,890 666,553 133131102 Camden Property Trust 11,390 1,013,482 134429109 Campbell Soup 4,440 -

Digital Experiences in Banking 2019

ANALYSIS REPORT Digital Experiences in Banking 2019 Table of Contents 01 Introduction 3 About Us 02 Trends and Insights 5 Extractable is the digital strategy and experience design partner for 03 Results and Findings 7 financial services firms committed Our Approach 8 to delivering exceptional customer User Experience 10 experience. We plan, design, build, and optimize digital channels to Analytics and SEO 12 drive increased brand awareness, Visual Design and Branding 14 acquisition, and share of wallet Key Functionality 16 while reducing support costs and Content 18 churn. Our experience working Digital Marketing 20 with over 100 banks, credit unions, investment management firms, 04 Future of Digital Banking 23 retirement services providers, Digitally. Intelligently. Forward. 23 brokerages, and transaction Conclusion 23 servicers gives us rare insight into the challenges you face and how to solve for them, while generating positive ROI. EXTRACTABLE | 1 Extractable takes a deep dive 1 Home BancShares $14 B FORBES 2018 into the first 20 “Forbes 2018 2 Western Alliance Bancorp $20 B Top 100 Best Banks in America”1 3 Bank OZK $21 B 4 First Merchants $9 B BEST BANKS to analyze digital experiences 5 East West Bancorp $36 B across the industry. Find out 6 Community Bank System $11 B IN AMERICA what we learned. 7 Prosperity Bancshares $22 B 8 FCB Financial Holdings $10 B 9 First Hawaiian $21 B 10 Glacier Bancorp $10 B 11 Columbia Banking System $10 B 12 Cathay General Bancorp $16 B 13 Cullen/Frost Bankers $31 B 14 South State Bank $11 B 15 First Republic Bank $84 B 16 Bank of Hawaii $17 B 17 WesBanco $10 B 18 International Bancshares $12 B 19 Independent Bank Group $9 B 20 Hope Bancorp $14 B 1 The order of the list varies from what Forbes published originally. -

Continental National Bank Charter Number 16325

PUBLIC DISCLOSURE May 20, 2019 COMMUNITY REINVESTMENT ACT PERFORMANCE EVALUATION Continental National Bank Charter Number 16325 1801 SW First Street Miami, FL 33135 Office of the Comptroller of the Currency Miami Field Office 9850 NW 41st Street, Suite 260 Miami, FL 33178 NOTE: This document is an evaluation of this institution's record of meeting the credit needs of its entire community, including low- and moderate-income neighborhoods, consistent with safe and sound operation of the institution. This evaluation is not, and should not be construed as, an assessment of the financial condition of this institution. The rating assigned to this institution does not represent an analysis, conclusion, or opinion of the federal financial supervisory agency concerning the safety and soundness of this financial institution. Charter Number: 16325 Table of Contents Overall CRA Rating……...……………………………………………………………….. 1 Description of Institution………….……………………………………………………… 2 Scope of the Evaluation……………………………………………………………………2 Discriminatory or Other Illegal Credit Practices Review………………………..……….. 3 State Rating…….………………………………………………………………………... 4 State of Florida………………..………………………………………………. 4 Appendix A: Scope of Examination………….…………………………………………A-1 Appendix B: Summary of MMSA and State Ratings…………………………………...B-1 Appendix C: Definitions and Common Abbreviations………………………………….C-1 Appendix D: Tables of Performance Data………………………………………………D-1 i Charter Number: 16325 Overall CRA Rating Institution’s CRA Rating: This institution is rated Outstanding The lending test is rated: Outstanding The community development test is rated: Outstanding The major factors that support this rating include: The Lending Test rating is based on the excellent distribution of loans in low- and moderate-income (LMI) geographies, a reasonable distribution of lending among businesses of different sizes, a substantial majority of loans purchased or originated are in the assessment area (AA), and a reasonable loan-to-deposit (LTD) ratio. -

PORTFOLIO of INVESTMENTS – As of December 31, 2020 (Unaudited)

PORTFOLIO OF INVESTMENTS – as of December 31, 2020 (Unaudited) Loomis Sayles Small Cap Value Fund ________________________________Shares Description ____________________________________________________________ Value (†) Common Stocks – 98.9% of Net Assets Aerospace & Defense – 1.0% 64,870 Aerojet Rocketdyne Holdings, Inc.(a) $ 3,428,379 36,809 BWX Technologies, Inc. ______________2,218,847 ______________5,647,226 Auto Components – 3.2% 134,171 Cooper Tire & Rubber Co. 5,433,925 288,336 Dana, Inc. 5,628,319 20,928 Fox Factory Holding Corp.(a) 2,212,299 38,655 LCI Industries ______________5,012,780 ______________18,287,323 Banks – 13.5% 158,448 Ameris Bancorp 6,032,115 185,530 Atlantic Union Bankshares Corp. 6,111,358 172,148 BancorpSouth Bank 4,723,741 147,547 Bryn Mawr Bank Corp. 4,514,200 215,661 CVB Financial Corp. 4,205,390 271,568 Home BancShares, Inc. 5,290,145 234,144 OceanFirst Financial Corp. 4,362,103 95,010 Pinnacle Financial Partners, Inc. 6,118,644 132,588 Popular, Inc. 7,467,356 76,931 Prosperity Bancshares, Inc. 5,335,934 62,945 South State Corp. 4,550,924 133,304 TCF Financial Corp. 4,934,914 146,089 Triumph Bancorp, Inc.(a) 7,092,621 113,313 Wintrust Financial Corp. ______________6,922,291 ______________77,661,736 Beverages – 1.0% 364,847 Primo Water Corp. ______________5,720,801 Biotechnology – 1.6% 45,738 Emergent BioSolutions, Inc.(a) 4,098,125 31,964 United Therapeutics Corp.(a) ______________4,851,815 ______________8,949,940 Building Products – 2.6% 45,224 American Woodmark Corp.(a) 4,244,273 52,093 Armstrong World Industries, Inc. -

Usef-I Q2 2021

Units Cost Market Value U.S. EQUITY FUND-I U.S. Equities 88.35% Domestic Common Stocks 10X GENOMICS INC 5,585 868,056 1,093,655 1ST SOURCE CORP 249 9,322 11,569 2U INC 301 10,632 12,543 3D SYSTEMS CORP 128 1,079 5,116 3M CO 11,516 2,040,779 2,287,423 A O SMITH CORP 6,897 407,294 496,998 AARON'S CO INC/THE 472 8,022 15,099 ABBOTT LABORATORIES 24,799 2,007,619 2,874,948 ABBVIE INC 17,604 1,588,697 1,982,915 ABERCROMBIE & FITCH CO 1,021 19,690 47,405 ABIOMED INC 9,158 2,800,138 2,858,303 ABM INDUSTRIES INC 1,126 40,076 49,938 ACACIA RESEARCH CORP 1,223 7,498 8,267 ACADEMY SPORTS & OUTDOORS INC 1,036 35,982 42,725 ACADIA HEALTHCARE CO INC 2,181 67,154 136,858 ACADIA REALTY TRUST 1,390 24,572 30,524 ACCO BRANDS CORP 1,709 11,329 14,749 ACI WORLDWIDE INC 6,138 169,838 227,965 ACTIVISION BLIZZARD INC 13,175 839,968 1,257,422 ACUITY BRANDS INC 1,404 132,535 262,590 ACUSHNET HOLDINGS CORP 466 15,677 23,020 ADAPTHEALTH CORP 1,320 39,475 36,181 ADAPTIVE BIOTECHNOLOGIES CORP 18,687 644,897 763,551 ADDUS HOMECARE CORP 148 13,034 12,912 ADOBE INC 5,047 1,447,216 2,955,725 ADT INC 3,049 22,268 32,899 ADTALEM GLOBAL EDUCATION INC 846 31,161 30,151 ADTRAN INC 892 10,257 18,420 ADVANCE AUTO PARTS INC 216 34,544 44,310 ADVANCED DRAINAGE SYSTEMS INC 12,295 298,154 1,433,228 ADVANCED MICRO DEVICES INC 14,280 895,664 1,341,320 ADVANSIX INC 674 15,459 20,126 ADVANTAGE SOLUTIONS INC 1,279 14,497 13,800 ADVERUM BIOTECHNOLOGIES INC 1,840 7,030 6,440 AECOM 5,145 227,453 325,781 AEGLEA BIOTHERAPEUTICS INC 287 1,770 1,998 AEMETIS INC 498 6,023 5,563 AERSALE CORP -

CONTACT Paula Gomez [email protected] 305-807-8996

CONTACT Paula Gomez [email protected] 305-807-8996 CITY NATIONAL BANK OF FLORIDA COMPLETED MORE THAN $4 BILLION IN LOANS IN 2020, OUTLINES PATH TO CONTINUED GROWTH IN 2021 CEO Jorge Gonzalez Announces Launch of City National Private, Expanded Wealth Management Services, and New Executive Leadership MIAMI, FL – March 01, 2021 – City National Bank of Florida (CNB), Florida’s Big Bank Alternative, solidified its position among the state’s largest community banks in 2020, funding loans totaling more than $4 billion and sustaining continuous operations amidst the Covid-19 pandemic. CNB closed 2020 with almost $19 billion in assets – up from approximately $3 billion one decade prior. The bank attributes this growth to a steadfast commitment to client service during the pandemic, a sharp focus on technologies that enabled seamless operations and remote banking, and an emphasis on funding loans that provided capital to the businesses driving Florida’s economy. Looking ahead, CNB is focused on expanding its Private Banking and Wealth Management services under a new City National Private brand, increasing its market share in Central Florida, and identifying opportunities for organic growth among CNB’s existing clientele. Additionally, the bank has added four seasoned banking and finance executives who will help drive CNB’s strategic growth. “Our attention in 2020 was aimed at sustaining operations and ensuring CNB clients had the support they needed to withstand unimaginable circumstances during the pandemic,” said City National Bank Vice Chairman and CEO Jorge Gonzalez. “Fortunately, CNB spent the past decade investing in products and technologies that enabled us to deliver a high level of service while keeping our employees safe. -

CEIS Review Visual Presentation

CEIS Review, Inc. Consulting Services to the Financial Community Loan Review Programs Loan Loss Reserve General & Specialized ALLL Methodology Validation Acquisition Due Diligence ALLL Methodology Refinement Portfolio Stress Testing & Credit Process & Concentration Analysis Procedures Reviews CRE & C&I Adherence to Regulatory & Impairment Analysis Industry Best Practices Management & Administration Management Office Joseph J. Hill, Chairman, President, CEO [email protected] Elaine M. Cottrell, Managing Principal, COO [email protected] Elizabeth Williams, Managing Director, Special Projects [email protected] Justin J. Hill, Managing Director, Marketing & Administration [email protected] Matthew Tuck, Managing Director, Senior Editor [email protected] Gary Dycus, Executive Consultant, Senior Response Editor [email protected] Segment Review Managers / Specialists John P. Macukas, Managing Director, Structured Finance Review [email protected] Santiago Morera, Managing Director, International Review [email protected] Caridad Errazquin, Managing Director, Editor [email protected] Paul H. Gottwald, Director, Real Estate Review [email protected] Dean Giglio, Managing Director, Stress Testing [email protected] David Vest, Managing Director, Stress Testing [email protected] Administration & Analysis Christopher Fredericks, Director, Chief Analyst & LR Administrator [email protected] Kimberly Phillips, Marketing & Administrative Assistant [email protected] Monika Sinkiewicz, -

Rank the Banks Florida – 2017 Q1 Disclosure Statement

Rank The Banks Florida – 2017 Q1 Disclosure Statement This material has been prepared from publicly available information by certain personnel of Banks Street Partners, LLC and its affiliate, BSP Securities, LLC, and not by an equity research department. It is not classified as investment research or a research recommendation, nor does it constitute analysis substantive enough on which to base an investment decision. It is provided solely for informational purposes and is not an invitation or offer to subscribe for or purchase any product or service. The data contained herein is from sources believed to be reliable but may be subject to revision at any time without notice. Banks Street Partners, LLC and its personnel may, from time to time, participate or invest in transactions with issuers of securities referred to herein, perform services for or solicit business from such issuers, and/or have a position or effect transactions in the securities or derivatives thereof. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance. The information set forth above has been obtained from or based upon sources believed by the personnel to be reliable, but we do not represent or warrant its accuracy or completeness and are not responsible for losses or damages arising out of errors, omissions or changes in market factors. This material does not purport to contain all of the information that an interested party may desire and, in fact, provides only a limited view of a particular market. -

IRR Southwest Florida Profile.Pub

Integra Realty Resources IRR Southwest Florida Southwest Florida 2770 Horseshoe Dr S. Suite 3 Office Profile Naples, Florida 34104 T 239.643.6888 F 239.643.6871 Overview of Experse [email protected] Key Personnel irr.com/southweslorida Core Competencies Client List References Key Personnel Qualificaons Corporate Profile Compeve Advantage Contact Us Integra Realty Resources Overview of Experse Southwest Florida 2770 Horseshoe Dr S. Suite 3 Naples, Florida 34104 T 239.643.6888 Integra Realty Resources – Southwest Florida provides valuaon F 239.643.6871 and consulng services for various types of real property with an [email protected] emphasis on investment grade real estate. We provide consulng, irr.com/southwes lorida evaluaon, valuaon, feasibility and market study services for commercial, industrial, apartment and vacant land properes. We serve major naonal and regional banks, pension fund advisors, DUS and HUD MAP mortgages bankers, investment advisory firms, Fortune 500 companies, private clients, developers, lenders, inventors, governmental agencies, and other professionals concerned with the value and feasibility of real property. Over the past 24 years of serving all parts of Southwest Florida, Including Marco Island, Naples, Fort Myers, Cape Coral, Port Charloe, Punta Gorda, Sarasota and Bradenton. We have provided advice on most major commercial properes, suburban office and business parks, retail properes including regional malls, lifestyle centers and power centers, golf courses, and marinas; as well as the largest mulfamily properes in the region including mixed use mulfamily and high rise condominium developments. Principal Markets Served Florida Counes Collier Lee Charloe Hendry Sarasota Manatee Hardee Desoto Glades 2 Integra Realty Resources Key Personnel Southwest Florida 2770 Horseshoe Dr S.