Singapore- Office Q2 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Clinics in Downtown Core Open on Friday 24 Jan 2020

LIST OF CLINICS IN DOWNTOWN CORE OPEN ON FRIDAY 24 JAN 2020 POSTAL S/N NAME OF CLINIC BLOCK STREET NAME LEVEL UNIT BUILDING TEL OPENING HOURS CODE 1 ACUMED MEDICAL GROUP 16 COLLYER QUAY 02 03 INCOME AT RAFFLES 049318 65327766 8.30AM-12.30PM 2 AQUILA MEDICAL 160 ROBINSON ROAD 05 01 SINGAPORE BUSINESS FEDERATION CENTER 068914 69572826 11.00AM- 8.00PM 3 AYE METTA CLINIC PTE. LTD. 111 NORTH BRIDGE ROAD 04 36A PENINSULA PLAZA 179098 63370504 2.30PM-7.00PM 4 CAPITAL MEDICAL CENTRE 111 NORTH BRIDGE ROAD 05 18 PENINSULA PLAZA 179098 63335144 4.00PM-6.30PM 5 CITYHEALTH CLINIC & SURGERY 152 BEACH ROAD 03 08 GATEWAY EAST 189721 62995398 8.30AM-12.00PM 6 CITYMED HEALTH ASSOCIATES PTE LTD 19 KEPPEL RD 01 01 JIT POH BUILDING 089058 62262636 9.00AM-12.30PM 7 CLIFFORD DISPENSARY PTE LTD 77 ROBINSON ROAD 06 02 ROBINSON 77 068896 65350371 9.00AM-1.00PM 8 DA CLINIC @ ANSON 10 ANSON ROAD 01 12 INTERNATIONAL PLAZA 079903 65918668 9.00AM-12.00PM 9 DRS SINGH & PARTNERS, RAFFLES CITY MEDICAL CENTRE 252 NORTH BRIDGE RD 02 16 RAFFLES CITY SHOPPING CENTRE 179103 63388883 9.00AM-12.30PM 10 DRS THOMPSON & THOMSON RADLINK MEDICARE 24 RAFFLES PLACE 02 08 CLIFFORD CENTRE 048621 65325376 8.30AM-12.30PM 11 DRS. BAIN + PARTNERS 1 RAFFLES QUAY 09 03 ONE RAFFLES QUAY - NORTH TOWER 048583 65325522 9.00AM-11.00AM 12 DTAP @ DUO MEDICAL CLINIC 7 FRASER STREET B3 17/18 DUO GALLERIA 189356 69261678 9.00AM-3.00PM 13 DTAP @ RAFFLES PLACE 20 CECIL STREET 02 01 PLUS 049705 69261678 8.00AM-3.00PM 14 FULLERTON HEALTH @ OFC 10 COLLYER QUAY 03 08/09 OCEAN FINANCIAL CENTRE 049315 63333636 -

POISED for a GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected]

COLLIERS QUARTERLY OFFICE | SINGAPORE | RESEARCH | Q4 2020 | 14 JANUARY 2021 Shirley Wong POISED FOR A GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected] Tricia Song 2021–25 Director and Head | Research | Insights & Q4 2020 Full Year 2021 Annual Average Singapore > CBD Grade A office showed resilience with +65 6531 8536 Recommendations [email protected] 336,900 sq ft net absorption in 2020 despite CBD Grade A rents declined 2.1% GDP contraction of 5.8%, driven by previous QOQ in Q4 2020 and 5.4%* for Demand flexible workspace commitments. In 2021, -59,600 sq ft 787,900 sq ft 894,000 sq ft the full year to SGD9.57 (USD7.24) we expect technology to drive demand. per sq foot, on weak global > We expect relatively muted CBD Grade A economic conditions. We forecast supply in 2021-2022, with annual expansion rents to grow 5.5% by the end of averaging 2.6% of stock versus 4.7% for the 0 sq ft 783,900 sq ft 883,000 sq ft 2021, on an eventual economic Supply last five years. 2023 should see higher supply rebound and benign supply. at 4.5% of stock. We forecast new demand in 2021 Annual Average to be driven by the technology QOQ / YOY / Growth 2021–25 / End Q4 End 2021 End 2025 sector. Meanwhile, Q4 2020 CBD > CBD Grade A rents declined 2.1% in Q4 2020 Grade A vacancy of 5.2% (+1.8pp 1.0pp-2.1%* +3.7% and 5.4%* for the full year to SGD9.57 5.5% YOY) could tighten over the next (USD7.24) per sq foot. -

AXA Insurance Pte Ltd Company Reg No. 199903512M 8 Shenton Way, #24-01, AXA Tower Singapore 068811 Thank You for Investing with AXA

03/2018 AXA Insurance Pte Ltd Company Reg No. 199903512M 8 Shenton Way, #24-01, AXA Tower Singapore 068811 Thank you for investing with AXA We are pleased to present to you the Annual Report of AXA Pulsar, AXA Polaris and AXA Optimus range of sub-funds for the 12 months ending 31 December 2017. Bullish markets with low volatility 2017 was considered a very good year for investments in general as stock markets around the world had strong returns with very low volatility. Worries over the new US President Donald Trump initiating trade protectionist measures simmered down as he focused more on immigration measures and verbal sparring with the North Koreans. Economies around the world also reported generally better growth than previous years with unemployment numbers falling. Inflation remained weaker than expected, likely due to slow wage increases and technology disruptions bringing down costs. Global equity markets had another good year (MSCI World was up about 14% in Singapore dollar terms) with the European markets driving the best returns in Singapore dollar terms. Emerging markets have outperformed global markets in 2017 as economic growth in this region is improving as well (MSCI Emerging Markets was up more than 27% in Singapore dollar terms with China being the main contributor). Fixed income markets on the other hand continue to face challenges with the anticipation of more Federal Reserve rate hikes and the gradual ending of Quantitative Easing by the other developed nations. Government bonds were mainly flat while bonds with higher risks delivered low positive returns. We are pleased to share that our fixed income delivered mostly positive returns ranging from -2% to 11% while our mixed assets funds delivered positive returns from 4% to 12% (all in Singapore dollar terms). -

A Review of the Singapore Office Market

Singapore Q1/Q2 2019 Published 1st March 2019 Singapore | Hong Kong The Office A review of the Singapore office market Index P2 Building Rental Table (Islandwide) P3 Leasing Options – New Downtown & Economy Range P4 Demand – who is moving where P5 Featured New Development – 9 Penang Road P6 Special Feature – Co-working space P7 Leasing Options – Raffles Place & Tanjong Pagar P8 Supply / Rentals / Forecast Corporate Locations (S) Pte Ltd License No. L3010044A Marina One T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg RENTAL GUIDE 1st March 2019 Summary of Asking Rates Raffles Place / New Downtown Bangkok Bank Building TBA City Hall / Marina Centre / Beach Rd Chinatown / River Valley Road BEA Building $7.50 18 Robinson $12.00 Capital Tower $10.00 11 Beach Road Full Central Mall $7.00 20 Collyer Quay $11.00-$13.00 Cecil Court $5.80 30 Hill Street Full CES Centre $5.50+ 55 Market Street $7.00 China Square Central $8.50 Beach Centre $7.80 Chinatown Point $6.50 6 Battery Road $14.00 City House $7.80+ Bugis Junction Towers $7.80 Great World City $7.00 Asia Square T1 & T2 $14.00 Far East Finance Bldg $7.00 Centennial Tower $14.80 Kings Centre $7.00 Bank of China Building Full Far Eastern Bank Bildg Full Duo Tower $10.50 The Central $9.80 Bank of Singapore Centre $9.50 GB Building $6.00+ Funan $9.00 UE Square $8.00 Bharat Building $6.50 Keck Seng Tower $6.00 Manulife Centre $10.00+ Valley Point $7.00 CapitaGreen $13.50 Manulife Tower $9.50 Millenia Tower $14.80 Capital Square Full MYP Plaza $7.00 Odeon Tower -

List-Of-Bin-Locations-1-1.Pdf

List of publicly accessible locations where E-Bins are deployed* *This is a working list, more locations will be added every week* Name Location Type of Bin Placed Ace The Place CC • 120 Woodlands Ave 1 3-in-1 Bin (ICT, Bulb, Battery) Apple • 2 Bayfront Avenue, B2-06, MBS • 270 Orchard Rd Battery and Bulb Bin • 78 Airport Blvd, Jewel Airport Ang Mo Kio CC • Ang Mo Kio Avenue 1 3-in-1 Bin (ICT, Bulb, Battery) Best Denki • 1 Harbourfront Walk, Vivocity, #2-07 • 3155 Commonwealth Avenue West, The Clementi Mall, #04- 46/47/48/49 • 68 Orchard Road, Plaza Singapura, #3-39 • 2 Jurong East Street 21, IMM, #3-33 • 63 Jurong West Central 3, Jurong Point, #B1-92 • 109 North Bridge Road, Funan, #3-16 3-in-1 Bin • 1 Kim Seng Promenade, Great World City, #07-01 (ICT, Bulb, Battery) • 391A Orchard Road, Ngee Ann City Tower A • 9 Bishan Place, Junction 8 Shopping Centre, #03-02 • 17 Petir Road, Hillion Mall, #B1-65 • 83 Punggol Central, Waterway Point • 311 New Upper Changi Road, Bedok Mall • 80 Marine Parade Road #03 - 29 / 30 Parkway Parade Complex Bugis Junction • 230 Victoria Street 3-in-1 Bin Towers (ICT, Bulb, Battery) Bukit Merah CC • 4000 Jalan Bukit Merah 3-in-1 Bin (ICT, Bulb, Battery) Bukit Panjang CC • 8 Pending Rd 3-in-1 Bin (ICT, Bulb, Battery) Bukit Timah Plaza • 1 Jalan Anak Bukit 3-in-1 Bin (ICT, Bulb, Battery) Cash Converters • 135 Jurong Gateway Road • 510 Tampines Central 1 3-in-1 Bin • Lor 4 Toa Payoh, Blk 192, #01-674 (ICT, Bulb, Battery) • Ang Mo Kio Ave 8, Blk 710A, #01-2625 Causeway Point • 1 Woodlands Square 3-in-1 Bin (ICT, -

One Raffles Quay

Proposed Acquisition of One-Third Stake in One Raffles Quay 30 July 2007 Summary K-REIT Asia proposes to acquire Keppel Land’s one-third stake in One Raffles Quay (ORQ) for about $941.5 mil Significant maiden acquisition ¾ Asset size more than doubles from $677 mil to $1.62 bn ¾ Net lettable area grows from 786,603 sf to 1.23 mil sf ¾ Expected to be yield-accretive 2 Current Portfolio Prudential Tower Keppel Towers GE Tower Bugis Junction Towers Total Net Lettable Area (NLA): 786,603 sf Total portfolio value: $677 million1 1. Portfolio value as at 31 Dec 2006 3 Enlarged Portfolio with ORQ Total portfolio value to $1.62 billion Prudential Tower1 Keppel Towers Total NLA to 1.23 million sf One Raffles Quay2 GE Tower Bugis Junction Towers 4 1. K-REIT Asia owns approximately 44% of strata area of the building (108,439 sf) 2. K-REIT Asia’s attributable one-third share of the asset’s NLA is about 445,188 sf One Raffles Quay Up Close One Raffles Quay Strategically located in new downtown at Marina Bay with direct underground access to Raffles Place MRT station. One of the largest office developments in Singapore with about 1.3 million sf of NLA and 100% committed occupancy. Close to Marina Bay Sands Integrated Resort and Formula 1 night race circuit. 6 One Raffles Quay – Key Information Gross Lettable Area 1,339,407 sf Net Lettable Area 1,335,565 sf Carpark Lots 713 Number of Tenants 31 Title Leasehold estate of 99 years commencing from 13 June 2001 Property Description Comprises a 50-storey North Tower, a 29-storey South Tower and an underground -

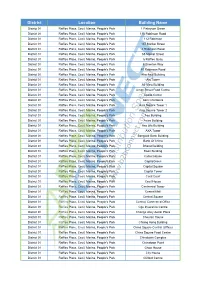

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01 -

2020 MICE Directory

2020 MICE Directory EMPOWERING COMMERCE, CAPABILTIES, COMMUNITY CONTENTS MESSAGES 5 Message from SACEOS President 6 Message from Singapore Tourism Board EVENT CALENDARS 28 Calendar of Conferences 2020 31 Calendar of Exhibitions 2020 36 Calendar of Conferences 2021 38 Calendar of Exhibitions 2021 VENUE 44 Auditorium, Conventions & Exhibitions Centres 57 Hotels 69 Unique Venues DIRECTORY LISTING 81 SACEOS Members Listings 116 General Listings 209 Singapore Statutory Boards & Government Agencies 217 Advertiser’s Index SACEOS DIRECTORY 2020 Message from SACEOS President I Message from Singapore Tourism Board MR ALOYSIUS ARLANDO MS MELISSA OW President Singapore Association of Deputy Chief Executive Convention & Exhibition Singapore Tourism Board Organisers & Suppliers (SACEOS) Welcome to the 2020 edition of MICE e-directory – the industry’s go-to guide. SACEOS is a community-based association of the MICE industry whose members contribute to a rich history of successful corporate events, business meetings and conventions and exhibitions in Singapore. 2019 was another exciting year for Singapore’s business events landscape. The city maintains its momentum as a leading global business events hub, This year in 2020, SACEOS rang in the new decade with a big bang - by unveiling our brand playing host to a vibrant array of business events across various industry PRESIDENT new visual identity, a symbol of transformation, and a timely reflection that represents a hallmark clusters, and keeping its position as Asia Pacific’s leading city in the 2018 for the next phase of our growth, our hope, our unified future. global ranking by the International Congress and Convention Association MESSAGE (ICCA), and top international meeting country since 2013 in the Union of Singapore is a key player in the ASEAN region and the rest of the world. -

Ministry of Health List of Approved Providers for Antigen Rapid Testing for COVID-19 at Offsite Premises List Updated As at 6 Aug 2021

Ministry of Health List of Approved Providers for Antigen Rapid Testing for COVID-19 at Offsite Premises List updated as at 6 Aug 2021. S/N Service Provider Site of Event Testing Address of Site Date of Event Contact No. 1 OCBC Square 1 Stadium Place #01-K1/K2, Wave - Mall, Singapore 397628 57 Medical Clinic (Geylang Visitor Centre of Singapore Sports Hub 8 Stadium Walk, Singapore 397699 - 66947078 Bahru) Suntec Singapore Convention and Exhibition 1 Raffles Boulevard Singapore 039593 - Centre 2 57 Medical Clinic (Yishun) Holiday Inn Singapore Atrium 317 Outram Road, Singapore 169075 - 62353490 3 Asiamedic Wellness Asiamedic Astique The Aesthetic Clinic Pte. 350 Orchard Road #10-00 Shaw House - 67898888 Assessment Centre Ltd. Singapore 238868 4 Former Siglap Secondary School 10 Pasir Ris Drive 10, Singapore Acumen Diagnostics Pte. Ltd. - 69800080 519385 5 9 Dec 2020 13 and 14 Jan 2021 10 Bayfront Avenue, Singapore 24 and 25 Jan 2021 Sands Expo and Convention Centre 018956 4 Feb 2021 24 and 25 Mar 2021 19 Apr 2021 PUB Office 40 Scotts Road, #22-01 Environment - Building, Singapore 228231 The Istana 35 Orchard Road, Singapore 238823 3 and 4 Feb 2021 Ally Health 67173737 11 Feb 2021 One Marina Boulevard 1 Marina Boulevard, Singapore 018989 11 Feb 2021 Rasa Sentosa Singapore 101 Siloso Road, Singapore 098970 Shangri-La Hotel Singapore 22 Orange Grove Road, Singapore 22 Apr 2021 258350 D'Marquee@Downtown East 1 Pasir Ris Close, Singapore 519599 - Intercontinental Hotel 80 Middle Road, Singapore 188966 - Palfinger Asia Pacific Pte Ltd 4 Tuas Loop, Singapore 637342 - Page 1 of 148 ST ENGINEERING MARINE LTD. -

Singapore Office Q4/2020

Singapore – February 2021 MARKET IN MINUTES Offi ce Savills Research Savills team Please contact us for further information SINGAPORE Marcus Loo CEO, Singapore +65 6415 3893 [email protected] Ashley Swan Executive Director Commercial +65 6415 3872 [email protected] Rents soften marginally in Q4 RESEARCH Although offi ce leasing activity was generally more muted in Q4 compared Alan Cheong Executive Director to other quarters in the year, it was broadly similar to Q4/2019 levels. Singapore +65 6415 3641 • Demand for offi ce space largely emanated from tenants quarter-on-quarter (QoQ) to 7.0% in Q4/2020. On the back of [email protected] looking for replacement space because of the need to move more completions and reduced demand in 2020, the vacancy Simon Smith out of older buildings to be redeveloped, as well as tenants rate grew signifi cantly by 2.6 ppts year-on-year (YoY). Senior Director with offi ce leases due for renewal. Asia Pacifi c • The average monthly rents in Savills basket of CBD Grade A +852 2842 4573 • Owing to the uncertainties arising from the pandemic, tenants offi ces declined by 1.8% QoQ to S$9.52 per sq ft in Q4/2020. [email protected] are continuing to adopt a wait-and-see approach and looking In 2020, CBD Grade A offi ce rents fell by 5.6% YoY, a reversal MCI (P) No. 022/10/2020 for clarity on trends to emerge on future workplace practices from the 2.9% increase posted in 2019. -

December 2014

News and views from: ISSUE 28 DECEMBER 2014 ISSUE 28 DECEMBER 2014 LIVECORPORATE PLAY Arts For All More Food and Fashion Options From 12 to 14 November, visitors and working Shopping and dining gets more exciting with the arrival of two new tenants at Marina Bay Link Mall (MBLM). ISSUE 28 DECEMBER 2014014 MCI (P) 050/09/2014 professionals in Marina Bay were treated to a series of arts performances at Marina Bay Link Mall as part of PLAY > Pg1-3.Have a Red, Red X’mas > Pg6.More Food and Fashion Options > Pg6.The Art of Ageing > Pg6.Symphony in the City the National Arts Council’s (NAC) Arts in Your CORPORATE > Pg4.Nurturing Leaders > Pg4.Exercising Emergency Preparedness > Pg4.Maximising Water Efficiency > Pg4.Jardine Takes Up 33-Storey Challenge > Pg5.Arts for All Neighbourhood initiative. WORK > Pg5.UBS Unveils New Skyline Signage > Pg5.ABN AMRO Rises Again New Opera Singapore refreshed traditional opera, These included an energetic fusion of comedy and bel canto music, a making the art form enjoyable and accessible. contemporary dance that took the audience on a mesmerising journey of PLAY self-exploration, and a refreshing operatic showcase centred on the universal theme of love. MOS Burger offers delicious Japanese hamburgers, prepared only upon order. Fans of fashion from Korea and Japan can now find a trendy outfit at S.H.E. Raffles Quay Asset Management (RQAM) has partnered with NAC to host regular arts activities to increase the vibrancy at Marina Bay Financial Fans of premium Japanese hamburger chain MOS Burger can now pick up a S.H.E. -

Location of Overseas Offices

Location of Overseas Offices (As of December 31, 2012 except for Mizuho Securities, which is as of January 4, 2013) Network of Mizuho Corporate Bank Mizuho Corporate Bank (China), Ltd. Mizuho Corporate Bank (Malaysia) Dalian Economic & Technological Berhad Development Area Sub-Branch Level 27, Menara Maxis, Kuala Lumpur City 22nd Floor, International Business Building of Centre, 50088 Kuala Lumpur, Malaysia Asia and Oceania Gugeng, No.81 Hongmei Area, Dalian Economic & TEL 60-3-2058-6881 (Country/Region) Technological Development Area, Dalian, Liaoning Province 116600, Myanmar China The People's Republic of China TEL 86-411-8793-5670 Yangon Representative Office Mizuho Corporate Bank (China), Ltd. Room No.6055, 6th Floor, Sedona Business 23rd Floor, Shanghai World Financial Center, Nanjing Representative Office Apartment, No.1, Ka Ba Aye Pagoda Road, Yankin 100 Century Avenue, Pudong New Area, Room 2220, Suning Universal Hotel, Township, Yangon, Republic of the Union of Shanghai 200120, 188 Guangzhou Road, Nanjing, Myanmar The People's Republic of China Jiangsu Province 210024, TEL 95-1-544-071 TEL 86-21-3855-8888 The People's Republic of China TEL 86-25-8332-9379 Philippines Mizuho Corporate Bank (China), Ltd. Beijing Branch Xiamen Representative Office Manila Branch 8th Floor, West Wing, World Financial Center, Room 2102, The Bank Center, No.189 Xiahe Road, 26th Floor, Citibank Tower, Valero Street corner No.1 Dong San Huan Zhong Road, Siming District, Xiamen, Fujian Province 361003, Villar Street, Salcedo Village, 1227 Makati City, Chaoyang District, Beijing 100020, The People's Republic of China Metro Manila, Philippines The People's Republic of China TEL 86-592-239-5571 TEL 63-2-860-3500 TEL 86-10-6525-1888 Hong Kong Singapore Mizuho Corporate Bank (China), Ltd.