Air Passenger Market Analysis December 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Download Enemy-Threat-Weapons

UNITED STATES MARINE CORPS THE BASIC SCHOOL MARINE CORPS TRAINING COMMAND CAMP BARRETT, VIRGINIA 22134-5019 ENEMY THREAT WEAPONS B2A2177 STUDENT HANDOUT/SELF PACED INSTRUCTION Basic Officer Course B2A2177 Enemy Threat Weapons Enemy Threat Weapons Introduction In 1979, the Soviets invaded Afghanistan. The Soviets assumed this would be a short uneventful battle; however, the Mujahadeen had other plans. The Mujahadeen are guardians of the Afghani way of live and territory. The Soviets went into Afghanistan with the latest weapons to include the AK-74, AKS-74, and AKSU-74, which replaced the venerable AK-47 in the Soviet Arsenals. The Mujahadeen were armed with Soviet-made AK-47s. This twist of fate would prove to be fatal to the Soviets. For nearly 11 years, the Mujahadeen repelled the Soviet attacks with Soviet-made weapons. The Mujahadeen also captured many newer Soviet small arms, which augmented their supplies of weaponry. In 1989, the Soviet Union withdrew from Afghanistan back to the other side of the mountain. The Mujahadeen thwarted a communist take- over with their strong will to resist and the AK-47. This is important to you because it illustrates what an effective weapon the AK-47 is, and in the hands of a well-trained rifleman, what can be accomplished. Importance This is important to you as a Marine because there is not a battlefield or conflict that you will be deployed to, where you will not find a Kalashnikov AK-47 or variant. In This Lesson This lesson will cover history, evolution, description, and characteristics of foreign weapons. -

Front Sight Tool

AKFST The UNBREAKABLE FrontAK-47 Sight Tool 400% Stronger Than The Competition! Limited Life-Time Warranty MADE IN USA Adjustment of Windage 1. UNLOAD AND MAKE SAFE 2. Locate the AKFST over the sight as shown. 3. Align the push rod of the AKFST with the sight base of the rifle, and hole in AKFST. 4. Rotate the torque arm to push the sight to the desired position. Moving the front sight to the LEFT will move the point of impact to the RIGHT. Moving the front sight to the RIGHT will move the point of impact to the LEFT. Adjustment of Elevation 1. UNLOAD AND MAKE SAFE 2. Use the narrow notched end of the AKFST, and locate it over the sight post. The sight post will seat into the tool, and the notched portion will hold the sight post base like a wrench. 3. Rotate clockwise to decrease elevation. 4. Rotate counter-clockwise to increase elevation. AKFST RIFLE COMPATIBILITY LIST The AKFST is the first and only sight Bulgarian - AK101/SLR95/SSR-99/SA85/AK103/ Krink-tool must be turned upside down / Czech - adjustment tools to fit almost all AK-47 type rifles. VZ-58 / Chinese - Type 84/MAK 90/Polytec/SVD / The AKFST has a limited life-time warranty - if Egyptian - Maadi / Romanian - WASR 1,2,3/SAR the tool breaks under normal use, send the tool 1,2,3/WUM/CUR/PAR 1,2,3/AES-10A/AES-10B/ PSL/SSG-97 / Polish - Tantal / Russian - AK-47/ back to Magna-Matic for a replacement. (see AKM/AK-74/RPK-47/RPK-74/SVD Dragunov/ www.magna-matic-defense.com for full warranty Tiger Saiga Rifles-all/Dinzag Saiga 12 front sight bases / Yugo - M70/RPK / Most - SKS rifles / The details, terms, and conditions.) AKFST will not fit - AK-104 style gas blocks or Yugo M92 “Krink” Magna-Matic Corporation W4599 County Rd IW Waldo WI 53093 USA Copyright © 2015 Magna-Matic Corporation USA www.magna-matic-defense.com. -

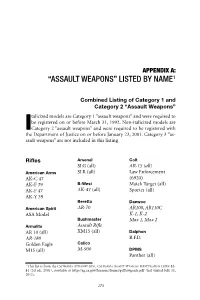

Assault Weapons” Listed by Name1

APPENDIX A: “ASSAULT WEAPONS” LISTED BY NAME1 Combined Listing of Category 1 and Category 2 “Assault Weapons” talicized models are Category 1 “assault weapons” and were required to be registered on or before March 31, 1992. Non-italicized models are ICategory 2 “assault weapons” and were required to be registered with the Department of Justice on or before January 23, 2001. Category 3 “as- sault weapons” are not included in this listing. Rifles Arsenal Colt SLG (all) AR-15 (all) American Arms SLR (all) Law Enforcement AK-C 47 (6920) AK-F 39 B-West Match Target (all) AK-F 47 AK-47 (all) Sporter (all) AK-Y 39 Beretta Daewoo American Spirit AR-70 AR100, AR110C ASA Model K-1, K-2 Bushmaster Max 1, Max 2 Armalite Assault Rifle AR 10 (all) XM15 (all) Dalphon AR-180 B.F.D. Golden Eagle Calico M15 (all) M-900 DPMS Panther (all) 1 This list is from the CALIFORNIA ATTORNEY GEN ., CALIFORNIA ASSAULT WEAPONS IDENTIFI C AT I O N GUIDE 82- 84 (3d ed., 2001), available at http://ag.ca.gov/firearms/forms/pdf/awguide.pdf (last visited July 31, 2012). 275 276 CALIFORNIA GUN LAWS Eagle Arms Les Baer MAK 90 EA-15 A2 H-BAR Ultimate AR (all) NHM 90, 90-2, 91 EA-15 E1 Sport M15 (all) MAADI CO RPK Rifle AK 47 SKS w/ detachable Fabrique Nationale ARM magazine 308 Match, Sporter MISR (all) FAL, LAR, FNC MISTR (all) Ohio Ordnance Works (o.o.w.) Frankford Arsenal Made in China AK-74 AR-15 (all) 56 ROMAK 991 56S Hesse Arms 84S Olympic Arms HAR 15A2 (all) 86S AR-15 Model 47 (all) AK Car-97 Wieger STG 940 Rifle AK47 PCR (all) AKM HK AKS Ordnance, Inc. -

June Air Passenger Market Analysis

Air Passenger Market Analysis June 2021 Slow air travel recovery continued for another month • June was another month of modest gains in air travel. Industry-wide revenue passenger-kilometres (RPKs) fell by 60.1% compared with the pre-crisis June 2019 – an improvement on the 62.9% decline in May. • Global domestic RPKs continued to recover, however performance was mixed across the key domestic markets. Russia, the US and Brazil showed positive RPK developments, but air traffic deteriorated in China and Australia. Int’l traffic also sustained its moderate recovery, with all regions but Asia Pacific showing better outcomes vs. May. • Passenger’s willingness to travel remains strong but elevated international travel restrictions and rising COVID cases in some regions represent a risk to further air travel rebound. Global RPK contraction eased for another month expanding by a robust 33% compared with the pre- crisis period. Despite the surge in COVID cases and Slow air travel recovery continued in June amidst new restrictions in some areas, country’s domestic air modest improvements in both domestic and travel was largely unaffected in June. That said, some international travel. Industry-wide revenue passenger- of the most popular tourist destinations such as Black kilometres (RPKs) declined by 60.1% compared with Sea resorts recently started to implemented rules that the pre-crisis June 2019 – an uptick from the 62.9% will allow only vaccinated travelers, travelers with contraction in May. In seasonally adjusted terms, RPKs negative PCR tests or confirmed antibody tests to stay continued to trend upwards (Chart 1). in hotels. This might weigh on passengers’ willingness Chart 1 – Air passenger volumes to travel in the coming months. -

Flowchart.Recentpdf

California Rifle Identification Flowchart Violates PC § 12020 (c)(2) Short Barreled Rifle . Measured from bolt YES face to the end of the barrel or a permanently installed muzzle device. © Brought to you by: * California Legally Registered Assault Weapons can have an overall Calguns.net 2nd Amendment forum & Calguns Foundation length of 26 inches or more, other rifles are covered below (30 inches) • www.calguns.net • www.calgunsfoundation.org • NO . * Roberti -Roos Asault Weapons Control Act of 1989 The registration deadline for assault weapons listed in the Roberti-Roos ban was March 31, 1992. * Senate Bill 23 (SB-23) YES The registration deadline for assault weapons as " defined by characteristics " in SB-23 was December 31, 2000. NO The registration deadline for assault weapons as defined by Penal Code section 12276(e) " AK and AR-15 series" assault weapons was January 23, 2001. * .50 BMG Restrictions and Registration YES YES Violates PC § 12276 (e) The registration deadline for ".50 BMG rifles" was April 30, 2006. ** Check Side B for info NO NO YES Violates PC § 12276 Violates PC § 12276.1 (a)(1)(A-F) ** Check Side B for info NO YES YES NO Violates PC § 12280 Single-shot & semi-auto .50 YES BMG "shoulder-fired" rifles included. NO NO NO Violates NO Violates PC § 12276.1 (a)(3) PC § 12276.1 (a)(2) YES The rifle's overall length is measured with the stock in the YES YES collapsed/ folded position. (if equipped). NO NO Version 1.1 - Side A (02/05/2011) YES The 3 categories of an assault weapon in California Appendix A Appendix B Appendix C Roberti-Roos AW list AR Series AK Series Category 1 - are firearms listed on the original Roberti-Roos assault weapons list PC section 12276 (a), (b), and (c). -

The Official Soviet Ak 74 Manual Operating Instructions for the 545Mm Kalashnikov Assault Rifle Ak 74 and Ks 74 and Kalashnikov Light Machine Gun Rpk 74 and Rpks 74

THE OFFICIAL SOVIET AK 74 MANUAL OPERATING INSTRUCTIONS FOR THE 545MM KALASHNIKOV ASSAULT RIFLE AK 74 AND KS 74 AND KALASHNIKOV LIGHT MACHINE GUN RPK 74 AND RPKS 74 PDF-41TOSA7MOIFT5KARA7AK7AKLMGR7AR712 | Page: 167 File Size 7,455 KB | 14 Aug, 2019 PDF File: The Official Soviet Ak 74 Manual Operating Instructions For The 545mm Kalashnikov Assault 1/5 Rifle Ak 74 And Ks 74 And Kalashnikov Light Machine Gun Rpk 74 And Rpks 74 - PDF-41TOSA7MOIFT5KARA7AK7AKLMGR7AR712 TABLE OF CONTENT Introduction Brief Description Main Topic Technical Note Appendix Glossary PDF File: The Official Soviet Ak 74 Manual Operating Instructions For The 545mm Kalashnikov Assault 2/5 Rifle Ak 74 And Ks 74 And Kalashnikov Light Machine Gun Rpk 74 And Rpks 74 - PDF-41TOSA7MOIFT5KARA7AK7AKLMGR7AR712 The Official Soviet Ak 74 Manual Operating Instructions For The 545mm Kalashnikov Assault Rifle Ak 74 And Ks 74 And Kalashnikov Light Machine Gun Rpk 74 And Rpks 74 PDF Subject: The Official Soviet Ak 74 Manual Operating Instructions For The 545mm Kalashnikov Assault Rifle Ak 74 And Ks 74 And Kalashnikov Light Machine Gun Rpk 74 And Rpks 74 Its strongly recommended to start read the Intro section, next on the Quick Discussion and find out all the topic coverage within this PDF file one after the other. Or perhaps in case you already know a precise topic, you should use the Glossary page to easily find the area of interest you are interested in, since it manage alphabetically. According to our listing, the following PDF file is submitted in 14 Aug, 2019, documented in serial number of PDF-41TOSA7MOIFT5KARA7AK7AKLMGR7AR712, with data size around 7,455 KB, in case you want to download it and study it offline. -

Small Arms for Urban Combat

Small Arms for Urban Combat This page intentionally left blank Small Arms for Urban Combat A Review of Modern Handguns, Submachine Guns, Personal Defense Weapons, Carbines, Assault Rifles, Sniper Rifles, Anti-Materiel Rifles, Machine Guns, Combat Shotguns, Grenade Launchers and Other Weapons Systems RUSSELL C. TILSTRA McFarland & Company, Inc., Publishers Jefferson, North Carolina, and London LIBRARY OF CONGRESS CATALOGUING-IN-PUBLICATION DATA Tilstra, Russell C., ¡968– Small arms for urban combat : a review of modern handguns, submachine guns, personal defense weapons, carbines, assault rifles, sniper rifles, anti-materiel rifles, machine guns, combat shotguns, grenade launchers and other weapons systems / Russell C. Tilstra. p. cm. Includes bibliographical references and index. ISBN 978-0-7864-6523-1 softcover : acid free paper 1. Firearms. 2. Urban warfare—Equipment and supplies. I. Title. UD380.T55 2012 623.4'4—dc23 2011046889 BRITISH LIBRARY CATALOGUING DATA ARE AVAILABLE © 2012 Russell C. Tilstra. All rights reserved No part of this book may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying or recording, or by any information storage and retrieval system, without permission in writing from the publisher. Front cover design by David K. Landis (Shake It Loose Graphics) Manufactured in the United States of America McFarland & Company, Inc., Publishers Box 611, Jefferson, North Carolina 28640 www.mcfarlandpub.com To my wife and children for their love and support. Thanks for putting up with me. This page intentionally left blank Table of Contents Acronyms and Abbreviations . viii Preface . 1 Introduction . 3 1. Handguns . 9 2. Submachine Guns . 33 3. -

Agenda Item 9B Attachment 3

Attachment 3, Page 1 of 3 California Department of Justice Kasler v. Lockyer Assault Weapon List Monday, October 02, 2000 AK Series Weapons American Arms AK-Y 39 AK-F 39 AK-C 47 AK-F 47 Arsenal SLR (all) SLG (all) B-West AK-47 (all) Hesse Arms Model 47 (all) Wieger STG 940 Rifle Inter Ordnance - Monroe, NC RPK M-97 AK-47 (all) Kalashnikov USA Hunter Rifle / Saiga MAADI CO * AK 47 * ARM MISR (all) MISTR (all) Made in China * 84S * AKM * 86S * AKS * 56 * AK * 56S * AK47 MARS Pistol Mitchell Arms, Inc. M-90 AK-47 (all) AK-47 Cal .308 (all) M-76 RPK Page 1 of 3 * Specifically named in the Robert-Roos Assault Weapons Control Act of 1989 and required to be registered by March 31, 1992 Monday, October 02, 2000 Attachment 3, Page 2 of 3 Norinco * 86 S 86 (all) * 84 S 81 S (all) * 56 RPK Rifle NHM 90, 90-2, 91 Sport AK-47 (all) MAK 90 * 56 S Hunter Rifle Ohio Ordnance Works (o.o.w.) ROMAK 991 AK-74 Poly technologies * AKS * AK47 Valmet Hunter Rifle 76 S WUM WUM (all) AR-15 Series Weapons American Spirit USA Model Armalite AR 10 (all) M15 (all) Golden Eagle Bushmaster XM15 (all) Colt Law Enforcement (6920) Match Target (all) * AR-15 (all) Sporter (all) Dalphon B.F.D. DPMS Panther (all) Eagle Arms M15 (all) EA-15 A2 H-BAR EA-15 E1 Page 2 of 3 * Specifically named in the Robert-Roos Assault Weapons Control Act of 1989 and required to be registered by March 31, 1992 Monday, October 02, 2000 Attachment 3, Page 3 of 3 Frankford Arsenal AR-15 (all) Hesse Arms HAR 15A2 (all) Knights SR-15 (all) SR-25 (all) RAS (all) Les Baer Ultimate AR (all) Olympic Arms AR-15 Car-97 PCR (all) Ordnance, Inc. -

Documenting Small Arms and Light Weapons a Basic Guide

Issue Brief Number 14 July 2015 Documenting Small Arms and Light Weapons A Basic Guide Introduction of accurate identification of arms and both civilian and military weapons that munitions, the basic elements of arms fire a projectile, with the condition that This Issue Brief was written with a tracing, and the relevant legal frame- the unit or system may be carried by an range of professionals in mind. For work, this Issue Brief offers a step-by- individual or a small number of people, those who are involved in the military step approach to documenting small or transported by a pack animal or a or law enforcement communities, or arms and light weapons. It also features light vehicle. This Issue Brief covers who spend time in conflict zones as a section on safety procedures (see techniques applicable to the following journalists or with non-governmental Box 1) and guidelines for undertaking small arms and light weapons: organizations (NGOs) or government documentation work in the field (see agencies, this Brief should provide some Box 2). The Brief concludes with a section small arms: handguns, rifles and insight into the often-murky world on the weapon that is most commonly carbines, assault rifles, shotguns, of arms identification. It is designed observed in conflict zones: the AK rifle sub-machine guns, and light and to serve as a basic how-to guide for and its variants, copies, and derivatives. medium (‘general-purpose’) machine recording relevant identification char- guns; and acteristics of small arms and light light weapons: heavy machine weapons that may be encountered Scope of this Issue Brief guns, grenade launchers, portable in the field. -

C39v2 the AMERICAN AK Century Arms Introduced the First 100% American Made AK Rifle to the Market 5 Years Ago

C39v2 THE AMERICAN AK Century Arms introduced the first 100% American made AK rifle to the market 5 years ago. We are excited to now offer the newest addition to the C39 line of rifles, the new C39v2, the American AK. It is 100% American made with no imported parts, built on a milled receiver machined from a solid 11 lb. block of 4140 ordnance quality steel. Enhancements include a T shaped magazine catch, compatibility with AKM furniture, a bolt hold open safety, an enhanced dust cover and standard AK sights. The C39v2 is coated with black nitrite and uses a new enhanced trigger group. The C39v2 barrel has a concentric left hand 14x1 metric thread and is ready for a variety of muzzle attachments. SPECS Caliber: 7.62x39mm Barrel: 16.5” with a 1:10 twist Barrel Thread: 14x1 LH Overall: 37.25” Weight: 8.2 lbs. Receiver: Milled 4140 steel Mag. Capacity: 30 rounds Comes with: Two 30 round Magpul magazines and a 1 year manufacturer’s warranty Country of Mfr: USA Product Code: RI2245-N RI2245CA-N California Compliant centuryarms.com 800.527.1252 RAS47 Born overseas and perfected in the USA, the all new 100% American made stamped AK, RAS47, is now available. Features a T shaped magazine catch, compatibility with AKM furniture, slant muzzle brake, side scope rail, bolt hold open safety, an enhanced dust cover and has standard AK sights. The RAS47 is coated with black nitrite and uses a new enhanced trigger group. SPECS Caliber: 7.62x39mm Barrel: 16.5” with a 1”10 twist Barrel Thread: 14x1 LH Overall: 37.25” Weight: 7.8 lbs. -

The Chinese QLZ87 Automatic Grenade Launcher Raising Red

TheRaising Chinese Red Flags: QLZ87 Automatic Grenade LauncherAnnexe 1 & Annexe 2 2014 Jonathan Ferguson & N.R. Jenzen-Jones ABOUT ARMAMENT RESEARCH SERVICES Armament Research Services (ARES) is a specialist consultancy which offers technical expertise and analysis to a range of government and non-government entities in the arms and munitions field.ARES fills a critical market gap, and offers unique technical support to other actors operating in the sector. Drawing on the extensive experience and broad-ranging skillsets of our staff and contractors, ARES delivers full-spectrum research and analysis, technical review, training, and project support services, often in support of national, regional, and international initiatives. ARMAMENT RESEARCH SERVICES Pty. Ltd. t + 61 8 6365 4401 e [email protected] w www.armamentresearch.com COPYRIGHT Published in Australia by Armament Research Services (ARES) © Armament Research Services Pty. Ltd. Published in November 2014 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, without the prior permission in writing of Armament Research Services, or as expressly permitted by law, or under terms agreed with the appropriate reprographics rights organisation. Enquiries concerning reproduction outside the scope of the above should be sent to the Publications Manager, Armament Research Services: [email protected] CREDITS Authors: Jonathan Ferguson & N.R. Jenzen-Jones Contributors: Yuri Lyamin & Michael Smallwood Technical Review: Yuri Lyamin, Ian McCollum & Hans Migielski Copy Editor: Jean Yew Layout/Design: Yianna Paris, Green Shell Media SAFETY INFORMATION Remember, all arms and munitions are dangerous. Treat all firearms as if they were loaded, and all munitions as if they were live, until you have personally confirmed otherwise. -

Basic Page for Writing

DEVELOPMENT AND INFLUENCE OF THE KALASHNIKOV RIFLE 1947 TO PRESENT TABLE OF CONTENTS List of Illustrations........................................................................................................................................................iii Abstract.........................................................................................................................................................................iv Glossary.........................................................................................................................................................................v Introduction The M43 Cartridge The Need for Assault Rifles The Development of the AK-47 Attributes of the AK-47 The Development of the AKM The Development of the AK-74 The Development of the AK-100 Series LIST OF ILLUSTRATIONS Parts of an AK Assault Rifle Gas-Operated Piston System Cartridge ABSTRACT This paper covers the evolving requirements of warfare that led to the development of the Kalashnikov AK- 47 assault rifle, the design of the rifle itself, the later development of the AKM, AK-74, and AK-100 series rifles, and the reasons behind each firearm's design. It will also cover the influence of the rifle on the world at large. GLOSSARY • Caliber – The thickness of a bullet. This can be measure in two ways: caliber (decimal fractions of an inch, so .45 caliber is a bullet .45 inches wide at its widest point) or in millimeters (a 7.62mm bullet is 7.62mm wide at its widest point). “Higher caliber” refers to a thicker, and usually