Kinnow Processing Plant

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Citrus from Seed?

Which citrus fruits will come true to type Orogrande, Tomatera, Fina, Nour, Hernandina, Clementard.) from seed? Ellendale Tom McClendon writes in Hardy Citrus Encore for the South East: Fortune Fremont (50% monoembryonic) “Most common citrus such as oranges, Temple grapefruit, lemons and most mandarins Ugli Umatilla are polyembryonic and will come true to Wilking type. Because most citrus have this trait, Highly polyembryonic citrus types : will mostly hybridization can be very difficult to produce nucellar polyembryonic seeds that will grow true to type. achieve…. This unique characteristic Citrus × aurantiifolia Mexican lime (Key lime, West allows amateurs to grow citrus from seed, Indian lime) something you can’t do with, say, Citrus × insitorum (×Citroncirus webberii) Citranges, such as Rusk, Troyer etc. apples.” [12*] Citrus × jambhiri ‘Rough lemon’, ‘Rangpur’ lime, ‘Otaheite’ lime Monoembryonic (don’t come true) Citrus × limettioides Palestine lime (Indian sweet lime) Citrus × microcarpa ‘Calamondin’ Meyer Lemon Citrus × paradisi Grapefruit (Marsh, Star Ruby, Nagami Kumquat Redblush, Chironja, Smooth Flat Seville) Marumi Kumquat Citrus × sinensis Sweet oranges (Blonde, navel and Pummelos blood oranges) Temple Tangor Citrus amblycarpa 'Nasnaran' mandarin Clementine Mandarin Citrus depressa ‘Shekwasha’ mandarin Citrus karna ‘Karna’, ‘Khatta’ Poncirus Trifoliata Citrus kinokuni ‘Kishu mandarin’ Citrus lycopersicaeformis ‘Kokni’ or ‘Monkey mandarin’ Polyembryonic (come true) Citrus macrophylla ‘Alemow’ Most Oranges Citrus reshni ‘Cleopatra’ mandarin Changshou Kumquat Citrus sunki (Citrus reticulata var. austera) Sour mandarin Meiwa Kumquat (mostly polyembryonic) Citrus trifoliata (Poncirus trifoliata) Trifoliate orange Most Satsumas and Tangerines The following mandarin varieties are polyembryonic: Most Lemons Dancy Most Limes Emperor Grapefruits Empress Tangelos Fairchild Kinnow Highly monoembryonic citrus types: Mediterranean (Avana, Tardivo di Ciaculli) Will produce zygotic monoembryonic seeds that will not Naartje come true to type. -

Survey of Phenolic Compounds Produced in Citrus

USDA ??:-Z7 S rveyof Phenolic United States Department of Agriculture C mpounds Produced IliIIiI Agricultural Research In Citrus Service Technical Bulletin Number 1856 December 1998 United States Department of Agriculture Survey of Phenolic Compounds Agricultural Produced in Citrus Research Service Mark Berhow, Brent Tisserat, Katherine Kanes, and Carl Vandercook Technical Bulletin Number 1856 December 1998 This research project was conducted at USDA, Agricultural Research Service, Fruit and Vegetable Chem istry laboratory, Pasadena, California, where Berhow was a research chemist, TIsserat was a research geneticist, Kanes was a research associate, and Vandercook, now retired, was a research chemist. Berhow and Tisserat now work at the USDA-ARS National Center for AgriCUltural Utilization Research, Peoria, Illinois, where Berhow is a research chemist and Tisserat is a research geneticist. Abstract Berhow, M., B. Tisserat, K. Kanes, and C. Vandercook. 1998. Survey of Mention of trade names or companies in this publication is solely for the Phenolic Compounds Produced in Citrus. U.S. Department ofAgriculture, purpose of providing specific information and does not imply recommenda Agricultural Research Service, Technical Bulletin No. 1856, 158 pp. tion or endorsement by the U. S. Department ofAgriculture over others not mentioned. A survey of phenolic compounds, especially flavanones and flavone and flavonol compounds, using high pressure liquid chromatography was While supplies last, single copies of this publication may be obtained at no performed in Rutaceae, subfamily Aurantioideae, representing 5 genera, cost from- 35 species, and 114 cultivars. The average number of peaks, or phenolic USDA, ARS, National Center for Agricultural Utilization Research compounds, occurring in citrus leaf, flavedo, albedo, and juice vesicles 1815 North University Street were 21, 17, 15, and 9.3, respectively. -

A Mandarin by Any Other Name

A mandarin by any other name Page 1 a Mandarin Publication Number 31-111 By Any Other Name (published Dec.2004) Author: Cindy Fake, Horticulture and Small Farms Advisor, Placer and Nevada Counties A mandarin by any other name technically correct. Interestingly, 2. Mediterranean mandarins, would taste as sweet, but what is DNA technology has revealed called “Willowleaf” mandarin it? In Japanese, mandarin is that the common or sweet orange because of its small narrow mikan; in India; it is the suntara. is probably a hybrid of a leaves In French and German, it is pummelo, a large, thick-skinned mandarine; in Italian, mandarino, citrus, and a mandarin. So, even 3. King mandarins, a small Spanish, Portuguese, Romanian, your orange is part mandarin! group of mandarins of Indo- and Bulgarian all use mandarina; China, important primarily as but to many Americans, mandarin Where did tangerine come from? parents of commercial is an unfamiliar term. Mandarins were first imported varieties such as Kinnow and from China into the Encore There is a lot of confusion about Mediterranean region through the mandarins and tangerines. Some port of Tangiers, hence the name 4. Common people say that if the skin is tangerine. However, to quote one mandarins, a reddish-orange and it has seeds, citrus expert, Lance Walheim, diverse group it is a tangerine, and that only “The name tangerine has no that includes Satsumas are mandarins. Others botanical standing; rather it numerous think all of them are tangerines. appears to have developed as a hybrids and many of what Part of the confusion is because marketing term for bright colored some would call tangerines; mandarins make up the largest (reddish-orange) varieties of the Clementines, Dancy, and most varied group of citrus. -

Holdings of the University of California Citrus Variety Collection 41

Holdings of the University of California Citrus Variety Collection Category Other identifiers CRC VI PI numbera Accession name or descriptionb numberc numberd Sourcee Datef 1. Citron and hybrid 0138-A Indian citron (ops) 539413 India 1912 0138-B Indian citron (ops) 539414 India 1912 0294 Ponderosa “lemon” (probable Citron ´ lemon hybrid) 409 539491 Fawcett’s #127, Florida collection 1914 0648 Orange-citron-hybrid 539238 Mr. Flippen, between Fullerton and Placentia CA 1915 0661 Indian sour citron (ops) (Zamburi) 31981 USDA, Chico Garden 1915 1795 Corsican citron 539415 W.T. Swingle, USDA 1924 2456 Citron or citron hybrid 539416 From CPB 1930 (Came in as Djerok which is Dutch word for “citrus” 2847 Yemen citron 105957 Bureau of Plant Introduction 3055 Bengal citron (ops) (citron hybrid?) 539417 Ed Pollock, NSW, Australia 1954 3174 Unnamed citron 230626 H. Chapot, Rabat, Morocco 1955 3190 Dabbe (ops) 539418 H. Chapot, Rabat, Morocco 1959 3241 Citrus megaloxycarpa (ops) (Bor-tenga) (hybrid) 539446 Fruit Research Station, Burnihat Assam, India 1957 3487 Kulu “lemon” (ops) 539207 A.G. Norman, Botanical Garden, Ann Arbor MI 1963 3518 Citron of Commerce (ops) 539419 John Carpenter, USDCS, Indio CA 1966 3519 Citron of Commerce (ops) 539420 John Carpenter, USDCS, Indio CA 1966 3520 Corsican citron (ops) 539421 John Carpenter, USDCS, Indio CA 1966 3521 Corsican citron (ops) 539422 John Carpenter, USDCS, Indio CA 1966 3522 Diamante citron (ops) 539423 John Carpenter, USDCS, Indio CA 1966 3523 Diamante citron (ops) 539424 John Carpenter, USDCS, Indio -

CITRUS BUDWOOD Annual Report 2017-2018

CITRUS BUDWOOD Annual Report 2017-2018 Citrus Nurseries affected by Hurricane Irma, September 2017 Florida Department of Agriculture and Consumer Services Our Vision The Bureau of Citrus Budwood Registration will be diligent in providing high yielding, pathogen tested, quality budlines that will positively impact the productivity and prosperity of our citrus industry. Our Mission The Bureau of Citrus Budwood Registration administers a program to assist growers and nurserymen in producing citrus nursery trees that are believed to be horticulturally true to varietal type, productive, and free from certain recognizable bud-transmissible diseases detrimental to fruit production and tree longevity. Annual Report 2018 July 1, 2017 – June 30, 2018 Bureau of Citrus Budwood Registration Ben Rosson, Chief This is the 64th year of the Citrus Budwood Registration Program which began in Florida in 1953. Citrus budwood registration and certification programs are vital to having a healthy commercial citrus industry. Clean stock emerging from certification programs is the best way to avoid costly disease catastrophes in young plantings and their spread to older groves. Certification programs also restrict or prevent pathogens from quickly spreading within growing areas. Regulatory endeavors have better prospects of containing or eradicating new disease outbreaks if certification programs are in place to control germplasm movement. Budwood registration has the added benefit in allowing true-to-type budlines to be propagated. The selection of high quality cultivars for clonal propagation gives growers uniform plantings of high quality trees. The original mother stock selected for inclusion in the Florida budwood program is horticulturally evaluated for superior performance, either by researchers, growers or bureau staff. -

Variation Within Kinnow (Citrus Reticulata) and Rough Lemon (Citrus Jambheri)

Pak. J. Bot., 40(2): 589-598, 2008. VARIATION WITHIN KINNOW (CITRUS RETICULATA) AND ROUGH LEMON (CITRUS JAMBHERI) NAFEES ALTAF* AND ABDUL REHMAN KHAN Nuclear Institute for Agriculture & Biology, P.O Box: 128, Faisalabad, Pakistan *[email protected], [email protected] Phone: +92-41-2650316, Fax +92-41-2654213 Abstract Citrus is number one in area and production of fruits in Pakistan. Punjab is the major Citrus fruit producing province. Kinnow mandarin (Citrus reticulata) is the dominant scion variety grafted on locally well adapted rootstock rough lemon (C. jambheri). The seed embryos from randomly collected fruits from all over Punjab province were studied in invitro culture and 24 different embryo seedlings shapes were found. In another experiment 10534 seeds from randomly collected fruits were cultured, among which 65% were found to be mono embryonic, 22% were bi- embryonic and 13% were poly embryonic. The explants from poly embryonic seedlings were responsive in culture while the explants from mono embryonic seedlings had weak culture response. The variation in rough lemon rootstock was also studied. It was observed that in one- year-old population of 1512 rough lemon plants, 59% were just normal plants, 18% had large spines, 6% had straight stem, 5% were broad leaved and 12% had dense foliage. It was further observed that among the 3 year old population of 318 plants, 19% individuals had broad leaves, 48 % were with dense foliage, 6% had large spines, 24% possessed straight stems and only 3% plants had leaf abscission character. Both the cultivars have intra varietal variation. Introduction The cultivation of Citrus has globally flourished due to its fruit and ornamental value. -

Incidence of Citrus Canker Disease Caused by Xanthomonas Campestris Pv

Pak. J. Bot., 39(4): 1319-1327, 2007. INCIDENCE OF CITRUS CANKER DISEASE CAUSED BY XANTHOMONAS CAMPESTRIS PV. CITRI (HASSE) DOWS ON KINNOW (CITRUS RETICULATA) AND ITS CHEMOTHERAPY SHAHBAZ TALIB SAHI1, M. USMAN GHAZANFAR1, M. AFZAL2, ABDUL RASHED1 AND AMIR HABIB1 1Department of Plant Pathology, 2Department of Agri. Entomology University of Agriculture, Faisalabad Pakistan Abstract Incidence of citrus canker disease revealed 7.5% in three Tehsils Kalurkot, Darya Khan and Bhakkar of the Punjab Province of Pakistan. Among the various toxicants viz., Agrimycin–100, Cupravit, Bavistin, Dithane M-45, Vitavax, Daconil, Antracol, Benlate and Nimrod tested at 1% concentration against multiplication of Xanthomonas campestris pv. citri. Agrimycin –100, Cupravit, Bavistin, Dithane M-45 and Vitavax proved more effective as compared to other toxicants In vitro. All the toxicants @ 1, 0.1 and 0.01% concentrations inhibited the multiplication of the bacterium however, Agrimycin-100 was found to be most effective while Cupravit, Bavistin, Dithane M–45 and Vitavax in that order, were effective against the multiplication of bacterium at 0.01, 0.1 and 1% concentration. Agrimycin–100, Cupravit, Bavistin, Dithane M-45 and Vitavax at 0.2% concentration were sprayed on the field grown citrus plants and then inoculated with Xanthomonas campestris pv. citri for the control of citrus canker disease. Agrimycin–100, Cupravit, Bavistin, Dithane M-45 and Vitavax in the order proved effective also in reducing the disease intensity as compared to inoculated control. Introduction The present day citrus is delectable, juicy, seedless and is of great nutritional significance as well (Khan et al., 1992b). Additionally, it possesses enormous therapeutic qualities (Chaudhry et al., 1992). -

Model Profile of 1.0 Ha Citrus Cultivation

Model Profile of 1.0 ha Citrus cultivation 1. Introduction Citrus is native to a large area, which extends from Himalayan foot hills of northeast India to north- central China, the Philippines in east and Burma, Thailand, Indonesia and New Caledonia in Southeast. In India, in terms of area under cultivation, citrus is the third largest fruit crop after Banana and Mango. The average yield of citrus fruits in India is alarmingly low (8.8 t/ha) compared to other developed countries like Indonesia, Turkey, Brazil and USA (22-35 t/ha). Among mandarins, Nagpur mandarin (Central India), Kinnow mandarin (North–West India), Coorg mandarin (South India) and Khasi mandarin (North-East India) are the commercial cultivars of India. Whereas, Mosambi (Maharashtra), Sathgudi (Andhra Pradesh) and Malta and Jaffa (Punjab) are the sweet orange cultivars traditionally grown. 2. Scope for Citrus Cultivation and its National Importance Citrus cultivation in India is plagued with various problems due to limiting growing conditions, limiting water resources and high incidence of pests and diseases warranting great care from planting till the plants come to bearing in order to sustain a productive life of a minimum of 15-20 years. There is growing interest/awareness among the citrus growers for adoption of latest technologies for commercial cultivation of citrus. The National Research Centre (NRC) for Citrus (ICAR), Nagpur has come out with the package of practices for citrus cultivation in different regions of the country. In the present bankable project on citrus, recommendations of the NRC for Citrus and the views of the citrus growers and their experience has been taken into consideration. -

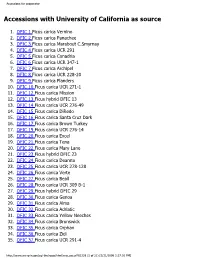

Accessions for Cooperator

Accessions for cooperator Accessions with University of California as source 1. DFIC 1 Ficus carica Vernino 2. DFIC 2 Ficus carica Panachee 3. DFIC 3 Ficus carica Marabout C.Smyrnay 4. DFIC 4 Ficus carica UCR 291 5. DFIC 5 Ficus carica Conadria 6. DFIC 6 Ficus carica UCR 347-1 7. DFIC 7 Ficus carica Archipel 8. DFIC 8 Ficus carica UCR 228-20 9. DFIC 9 Ficus carica Flanders 10. DFIC 10 Ficus carica UCR 271-1 11. DFIC 12 Ficus carica Mission 12. DFIC 13 Ficus hybrid DFIC 13 13. DFIC 14 Ficus carica UCR 276-49 14. DFIC 15 Ficus carica DiRedo 15. DFIC 16 Ficus carica Santa Cruz Dark 16. DFIC 17 Ficus carica Brown Turkey 17. DFIC 19 Ficus carica UCR 276-14 18. DFIC 20 Ficus carica Excel 19. DFIC 21 Ficus carica Tena 20. DFIC 22 Ficus carica Mary Lane 21. DFIC 23 Ficus hybrid DFIC 23 22. DFIC 24 Ficus carica Deanna 23. DFIC 25 Ficus carica UCR 278-128 24. DFIC 26 Ficus carica Verte 25. DFIC 27 Ficus carica Beall 26. DFIC 28 Ficus carica UCR 309 B-1 27. DFIC 29 Ficus hybrid DFIC 29 28. DFIC 30 Ficus carica Genoa 29. DFIC 31 Ficus carica Alma 30. DFIC 32 Ficus carica Adriatic 31. DFIC 33 Ficus carica Yellow Neeches 32. DFIC 34 Ficus carica Brunswick 33. DFIC 35 Ficus carica Orphan 34. DFIC 36 Ficus carica Zidi 35. DFIC 37 Ficus carica UCR 291-4 http://www.ars-grin.gov/cgi-bin/npgs/html/cno_acc.pl?61329 (1 of 21) [5/31/2009 3:37:10 PM] Accessions for cooperator 36. -

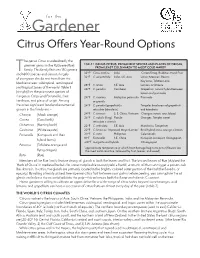

Citrus Offers Year-Round Options

for the Gardener Citrus Offers Year-Round Options he genus Citrus is undoubtedly the premier genus in the Rutaceae (Rue) TABLE 1. GENUS CITRUS: PROMINENT SPECIES AND PLACES OF ORIGIN, FROM LEAST COLD HARDY TO MOST COLD HARDY family. This family features 150 genera T 32ºF* Citrus medica India Citron/Etrog, Buddha’s Hand Fruit and 1600 species and consists largely 32ºF C. aurantiifolia India, S.E. Asia Limes: Mexican, Bearss, of evergreen shrubs and trees from the Key Lime, Tahitian Lime Mediterranean, subtropical, semitropical 28ºF C. limon S.E. Asia Lemons or limonia and tropical zones of the world. Table 1 26ºF C. paradisi Carribean Grapefruit: natural hybrid between (at right) lists the prominent species of lemon and pummelo the genus Citrus (and Fortunella), their 24ºF C. maxima Malaysian peninsula Pummelo hardiness, and place of origin. Among or grandis the other significant food and ornamental 24ºF C. paradisi (grapefruit) x Tangelo: bred cross of grapefruit genera in the family are – reticulata (Mandarin) and Mandarin Choisya (Mock orange) 24ºF C. sinensis S. E. China, Vietnam Oranges: sweet, sour, blood 24ºF C. nobilis (King) Florida Oranges: Temple, sweet Correa (Coral bells) reticulata x sinensis Dictamnus (Burning bush) 22ºF C. reticulata S.E. Asia Mandarins, Tangerines Casimiroa (White zapote) 22ºF C. limon cv. ‘Improved Meyer Lemon’ Bred hybrid cross, orange x lemon Fortunella (Kumquats and their 20ºF C. mitis Phillipines Calamondin 18ºF Fortunella S.E. China Kumquat, Limequat, Orangequat, hybrid forms) -20ºF margarita and hybrids Citrangequat Poncirus (Trifoliate orange and * approximate temperature at which frost damage begins to occur (flowers are flying dragon) the most cold-sensitive, followed by fruit, leaves, and wood) Ruta (Rue) Members of the Rue family feature strong oil glands in both the leaves and fruit. -

Commercial Citrus Cultivars Resistance Evaluation and Management to Canker Disease

International Journal of Agronomy and Agricultural Research (IJAAR) ISSN: 2223-7054 (Print) 2225-3610 (Online) http://www.innspub.net Vol. 5, No. 1, p. 14-22, 2014 International Journal of Agronomy and Agricultural Research (IJAAR) ISSN: 2223-7054 (Print) 2225-3610 (Online) http://www.innspub.net Vol. 6, No. 6, p. 1-9, 2015 RESEARCH PAPER OPEN ACCESS Commercial citrus cultivars resistance evaluation and management to canker disease Muhammad Mustafa1, M. Imran2, M. Azeem3, Adnan Riaz4, Muhammad Afzal2 1Department of Plant Pathology, University of Agriculture, Faisalabad, Pakistan 2Directorate of Agriculture, Pest Warning & Quality Control of Pesticides, Punjab, Lahore, Pakistan 3Department of Soil Science, Pir Mehr Ali Shah Arid Agriculture University, Rawalpindi, 46300, Pakistan 4Queensland Alliance for Agriculture and Food Innovation. The University of Queensland, Brisbane, QLD 4072, Australia Article published on June 10, 2015 Key words: Susceptible, screening , Xanthomonas axonopodis pv. Citri. plant extracts, antibiotic. Abstract Citrus production in Pakistan is confronted with a number of biotic and environment stresses due to which yield remained far lower than the potential yield. To combat this problem, a study was conducted in research area of Department of Plant Pathology. Fifteen commercial citrus varieties were screened against canker disease to find out degree of resistance. Jaffa, pine apple, kinnow, mungal singh, tangerine, succari, were found moderately resistant. Five varieties such as chinese lime, musambi, grapefruit, blood red and mayer lime were highly susceptible to canker disease. The susceptible varieties were feutral's early, sweet lime, malta and valentia late showed moderately susceptible response against the canker disease. In vitro and vivo condition, sensitivity to plant extracts and antibiotic of Xanthomonas axonopodis pv. -

Kinnow Madarin (Citrus Nobilis Lour × Citrus Deliciosa Tenora) Fruit Waste Silage As Potential Feed for Small Ruminants

Veterinary World, EISSN: 2231-0916 RESEARCH ARTICLE Available at www.veterinaryworld.org/Vol.8/January-2015/4.pdf Open Access Kinnow madarin (Citrus nobilis lour × Citrus deliciosa tenora) fruit waste silage as potential feed for small ruminants B. A. Malla1, A. Rastogi2, R. K. Sharma2, A. Ishfaq2, and J. Farooq2 1. Department of Dairy Cattle Nutrition, National Dairy Research Institute, Karnal, Haryana, India; 2. Division of Animal Nutrition, Sher-e-Kashmir University of Agricultural Sciences & Technology of Jammu, Jammu, Jammu and Kashmir, India. Corresponding author: B. A. Malla, email: [email protected], AR: [email protected], RKS: [email protected], AI: [email protected], JF: [email protected] Received: 25-08-2014, Revised: 19-11-2014, Accepted: 28-11-2014, Published: 06-01-2015 doi: 10.14202/vetworld.2015.19-23. How to cite this article: Malla BA, Rastogi A, Sharma RK, Ishfaq A, Farooq J (2015) Kinnow madarin (Citrus nobilis lour × Citrus deliciosa tenora) fruit waste silage as potential feed for small ruminants, Veterinary World, 8(1): 19-23. Abstract Aim: Study was conducted to ascertain the quality of Kinnow mandarin waste (KMW) silage and its utilization by adult male goats. Materials and Methods: KMW was collected, dried to 30% dry matter level and ensiled in silo pit after addition of disodium hydrogen orthophosphate as source of phosphorus as KMW is deficient in phosphorus. Oat was collected at milking stage, chopped finely and ensiled in a silo pit for 2 months. Twelve nondescript local adult male goats of about 8-10 months age and mean body weight of 23.00±0.90 kg were selected.