Portfolio Manager Comment Portfolio Performance Vs Benchmark

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Possibilities of Applying Markowitz Portfolio Theory on the Croatian Capital Market

POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL MARKET Dubravka Pekanov Starčević, Ph.D. J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Ana ZRNIć, Ph.D. Student, J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] Tamara Jakšić, BEcon, student J. J. Strossmayer University of Osijek, Faculty of Economics in Osijek E-mail: [email protected] POSSIBILITIES OF APPLYING MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN CAPITAL... MARKOWITZ PORTFOLIO THEORY ON THE CROATIAN POSSIBILITIES OF APPLYING Abstract In order to achieve the maximum possible profit by taking the lowest possible risk, investors build a stock portfolio consisting of a specific number of stocks which, according to the principle of diversification, significantly reduce the risk of loss. To build a portfolio, in developed capital markets investors have used the Markowitz portfolio optimization model for many years that enables us to find an optimal risk-return trade-off by selecting certain stock combinations. Despite the development of the Zagreb Stock Exchange, i.e., the central trading venue in the Republic of Croatia, the Croatian capital market is still under- developed. It is characterized by numerous shortcomings such as low liquidity, lack of transparency, high stock price volatility and insufficient traffic. Accord- ingly, the aim of this paper is to provide an insight into the functioning of the Dubravka Pekanov Starčević • Ana Zrnić • Tamara Jakšić: Dubravka Pekanov Starčević • Ana Zrnić Tamara 520 Croatian capital market and to examine the possibility of building an optimal stock portfolio by using the Markowitz model. -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE January 8, 2013 Stocks on ZSE traded higher today. CROBEX increased 0.24% to ZSE STOCK MARKET 1,808.40 pts while blue chip CROBEX10 gained 0.21% to 1,010.86 pts. CROBEX Last 1.808,4 Regular stock turnover amounted to HRK 14.4 million. % daily 0,24% Integrated telecom HT (HTRA CZ) topped the liquidity board collecting % YTD 3,91% HRK 4.3 million in turnover. The price increased 0.9% to HRK 210.70. CROBEX10 last 1010,9 Fertilizers producer Petrokemija (PTKMRA CZ) also came to focus again % daily 0,21% with HRK 1.5 million in turnover while price gained 5.5% to HRK 240.0. % YTD 4,05% Petrokemija was in investors’ focus few months ago, after speculations on Government selling its share of 1.7 million shares (50.6% of capital). Stock Turnov er (HRK m) 14,37 A few days ago Mladen Pejnović, head of the State Office for State Total MCAP (HRK bn) 194,39 Property Management confirmed government’s plans to privatize Source: w w w .zse.hr Petrokemija. Auto-parts producer AD Plastik (ADPLRA CZ) came to focus trading in -4,0% -2,0% 0,0% 2,0% 4,0% 6,0% blocks. The price advanced 1% to HRK 115.99 on HRK 1.3 million in PTKM-R-A ATPL-R-A turnover. AD Plastik currently trades at P/E=7.7, P/S=0.7 and DDJH-R-A P/Bv=0.7. VPIK-R-A LKPC-R-A Tobacco and tourism Adris group preferred share (ADRSPA CZ) was VIRO-R-A KORF-R-A also in investors’ focus with HRK 0.7 million in turnover while price KNZM-R-A slipped 1.3% to HRK 262.20. -

Raiffeisen Weekly Report, Nr. 38/2017

Raiffeisen Weekly Report Number 38 October 16th, 2017 Leaning on exports, the economy is growing Number of overnights stays On Tuesday the national statistical office delivered tourism figures for August (Jan – Aug) which showed expected growth of tourist arrivals and overnight stays (6.1%yoy 80 and 5.4%yoy respectively). The share of foreign tourists in the overnight stays 70 amounted 94.4%. Cumulatively, during the first eight months, the number of over- night stays was 72.5 million (+11.8% more than in the same period last year). 60 For the whole 2016 total number of overnight stays stood at 77.8mn. It is very mn 50 certain that, with data for September, this year will officially be a new record 40 tourist season. Although the strength of tourism helped Croatia remain on the 30 path of 3%yoy real growth, it also increased the sensitivity to potential downturns in tourism. As long as Croatia is perceived as a safe destination, it will retain its 20 attractive destination status. Under such circumstances, the budget picture will 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 look more favourable due to the stronger revenue inflow, especially VAT. Sources: CBS, Economic RESEARCH/RBA On the other side foreign trade activities in terms of import and export of goods remained subdued although the latest data pointed to a slight rise. In the period CPI, PPI, yoy from January to July, foreign trade deficit widened to EUR 4.9bn (+9.3%yoy). In 4 the same period, exports growth at 15.7%yoy compared to imports growth of 2 13.2%yoy resulted in coverage of imports by exports at 61.7% (+1.4pp). -

Market Commentary Portfolio Performance Vs Benchmark

Feb. FKHR1 Monthly Fund Update 2016 Market Commentary Following the publication of Q4 results, the share price jumped by 7.06% in one day. Viadukt operated with a net profit of HRK 3.2m in After a tumultuous start of the year, February brought on a reversal 2015, but this is still 36% less profit compared to the previous year. of trends in most of our largest holdings. This is in line with the rest Revenue fell by 9.1%, which is the consequence of an overall of European and global markets, which reached a bottom in mid- reduction in total investment in the Republic of Croatia, from which February, only to recover by the end of the month. The Croatian Viadukt achieves 99% of its total revenue. However, the growth in market started this recovery even sooner, having reached its lowest share price after the announcement of financial results might have point during January. However during February, the benchmark been due to the optimistic expectations for the rest of the year. The CROBEX index stayed mostly at the same level from the start of the construction industry expects a slight recovery and increased month, with only slight fluctuations. In the meantime, our fund investment from contracting authorities. managed to achieve a return of almost 4% MoM, beating the A third position that we want to emphasize is Đuro Đaković Holding market by a large margin. (ĐĐ). After having an amazing January, on the 15th and 19th of The most important contributor was our largest holding, the Adris February it was announced that Đuro Đaković signed contracts with Group, with common stock growing by over 10%. -

STOXX Sub Balkan 30 Last Updated: 01.05.2014

STOXX Sub Balkan 30 Last Updated: 01.05.2014 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) SI0031102120 5157235 KRKG.LJ 515723 KRKA SI EUR Y 1.8 1 1 HRHT00RA0005 B288FC6 HT.ZA B288FC HRVATSKI TELEKOM HR HRK Y 0.8 2 2 SI0031102153 5272860 PETG.LJ 527286 PETROL D.D. SI EUR Y 0.5 3 3 SI0031104290 B0WTL89 TLSG.LJ B0WTL8 TELEKOM SLOVENIJE SI EUR Y 0.3 4 4 HRINA0RA0007 B1JMYF6 INA.ZA UC011 INA INDUSTRIJA NAFTE HR HRK Y 0.3 5 5 HRADRSPA0009 B1L6Z97 ADGR_p.ZA UC012 ADRIS GRUPA PREF HR HRK Y 0.2 6 6 RSNISHE79420 B51JZ61 NIIS.BEL RS101L NIS RS RSD Y 0.2 7 7 HRPODRRA0004 5053399 PODR.ZA UC005 PODRAVKA PREHRAMBENA IND. HR HRK Y 0.2 8 8 HRLEDORA0003 B28R4V5 LEDZ.ZA UC032 LEDO HR HRK Y 0.2 9 9 HRATGRRA0003 B29GN36 ATGR.ZA UC039 ATLANTIC GRUPA HR HRK Y 0.2 10 10 HRERNTRA0000 5303373 ERNT.ZA UC007 ERICSSON NIKOLA TESLA HR HRK Y 0.1 11 11 SI0031100082 5059621 MELR.LJ 505962 POSLOVNI SISTEM MERCATOR SI EUR Y 0.1 12 12 SI0021110513 B3B20Y9 POSR.LJ EN003 POZAVAROVALNICA SAVA SI EUR Y 0.1 13 14 HRKOEIRA0009 5371712 KONL.ZA UC006 KONCAR-ELEKTROINDUSTRIJA HR HRK Y 0.1 14 13 SI0031104076 7030721 GORE.LJ 703072 GORENJE VELENJE SI EUR Y 0.1 15 17 MKALKA101011 B3CDX19 ALK.MKE UY001 ALKALOID MK MKD Y 0.1 16 15 SI0031101346 5166640 LKPG.LJ 516664 LUKA KOPER SI EUR Y 0.1 17 16 SI0031103276 7030583 ARPO.LJ 703058 AERODROM LJUBLJANA SI EUR Y 0.1 18 19 HRKORFRA0007 7722341 DOMF.ZA UC009 VALAMAR ADRIA HOLDING HR HRK Y 0.1 19 18 RSAIKBE79302 B1LJDX6 AIKB.BEL US002 AIK BANKA RS RSD Y 0.1 20 22 MKKMBS101019 B2QVV96 KMB.MKE UY003 KOMERCIJALNA BANKA ORD. -

Stoxx® All Europe Total Market Index

TOTAL MARKET INDICES 1 STOXX® ALL EUROPE TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (USD bn.) Components (USD bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX All Europe Total Market Index 13,768.8 10,453.0 7.2 1.7 250.9 0.0 2.4 0.0 3.0 STOXX Global Total Market Index 54,569.6 44,271.7 6.1 1.3 618.0 0.0 1.4 0.0 3.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX All Europe Total Market Index 0.3 2.0 18.1 43.3 55.0 3.8 3.0 17.7 12.4 8.9 STOXX Global Total Market Index 2.3 7.7 21.7 49.4 78.4 30.7 11.5 21.2 13.9 11.9 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX All Europe Total Market Index 11.0 11.2 11.6 19.9 21.1 -1.0 0.3 1.3 0.6 0.4 STOXX Global Total Market Index 8.2 7.9 8.1 12.8 22.5 1.1 1.4 2.3 1.0 0.5 Index to benchmark Correlation Tracking error (%) STOXX All Europe Total Market Index 0.9 0.9 0.9 0.9 0.9 5.8 6.1 6.3 10.0 10.2 Index to benchmark Beta Annualized information ratio STOXX All Europe Total Market Index 1.2 1.2 1.2 1.4 1.3 -3.5 -1.3 -0.6 -0.0 -0.2 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Mogućnosti Primjene Sintetičkih Pokazatelja U Predviđanju Bankrota Poduzeća Koja Kotiraju Na Zagrebačkoj Burzi

Mogućnosti primjene sintetičkih pokazatelja u predviđanju bankrota poduzeća koja kotiraju na Zagrebačkoj burzi Ćurković, Marko Professional thesis / Završni specijalistički 2020 Degree Grantor / Ustanova koja je dodijelila akademski / stručni stupanj: University of Zagreb, Faculty of Economics and Business / Sveučilište u Zagrebu, Ekonomski fakultet Permanent link / Trajna poveznica: https://urn.nsk.hr/urn:nbn:hr:148:875083 Rights / Prava: Attribution-NonCommercial-ShareAlike 3.0 Unported Download date / Datum preuzimanja: 2021-10-03 Repository / Repozitorij: REPEFZG - Digital Repository - Faculty of Economcs & Business Zagreb Marko Ćurković Matični broj studenta: PDS-6-2018 POSLIJEDIPLOMSKI SPECIJALISTIČKI RAD MOGUĆNOSTI PRIMJENE SINTETIČKIH POKAZATELJA U PREDVIĐANJU BANKROTA PODUZEĆA KOJA KOTIRAJU NA ZAGREBAČKOJ BURZI Poslijediplomski specijalistički studij „Računovodstvo i porezi“ Sveučilište u Zagrebu Ekonomski fakultet – Zagreb Mentor: prof. dr. sc. Ivana Mamić Sačer Zagreb, lipanj 2020. _____________________________ Ime i prezime studenta/ice IZJAVA O AKADEMSKOJ ČESTITOSTI Izjavljujem i svojim potpisom potvrđujem da je ____________________________________ (vrsta rada) isključivo rezultat mog vlastitog rada koji se temelji na mojim istraživanjima i oslanja se na objavljenu literaturu, a što pokazuju korištene bilješke i bibliografija. Izjavljujem da nijedan dio rada nije napisan na nedozvoljen način, odnosno da je prepisan iz necitiranog rada, te da nijedan dio rada ne krši bilo čija autorska prava. Izjavljujem, također, da nijedan -

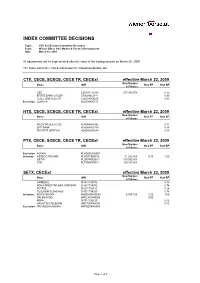

CEE CIS Committee Decision

INDEX COMMITTEE DECISIONS Topic: CEE & CIS Index Committee Decisions From: Wiener Börse AG / Market & Product Development Date: March 18, 2009 All adjustments will be implemented after the close of the trading session on March 20, 2009 The Index Committee has decided upon the following adjustments: CTX, CECE, SCECE, CECE TR, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares CEZ CZ0005112300 537.989.759 0,32 ERSTE BANK GROUP AT0000652011 0,90 TELEFONICA O2 CR CZ0009093209 0,97 Exclusion ZENTIVA NL0000405173 HTX, CECE, SCECE, CECE TR, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares MAGYAR OLAJ GAZI HU0000068952 0,71 OTP BANK HU0000061726 0,95 RICHTER GEDEON HU0000067624 0,95 PTX, CECE, SCECE, CECE TR, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares Exclusion AGORA PLAGORA00067 Inclusion ASSECO POLAND PLSOFTB00016 71.292.980 0,75 1,00 GETIN PLGSPR000014 710.930.354 TVN PLTVN0000017 169.159.984 SETX, CECExt effective March 23, 2009 New Number Name ISIN New FF New RF of Shares GORENJE SI0031104076 0,78 NOVA KREDITNA BKA. MARIBOR SI0021104052 0,78 PETROL SI0031102153 0,78 TELEKOM SLOVENIJE SI0031104290 0,78 Inclusion ADRIS GRUPA HRADRSPA0009 6.784.100 1,00 1,00 DALEKOVOD HRDLKVRA0006 0,50 KRKA SI0031102120 0,42 HRVATSKI TELEKOM HRHT00RA0005 0,73 Exclusion PRIVREDNA BANKA HRPBZ0RA0004 Page 1 of 5 NTX effective March 23, 2009 New Number Name ISIN New FF New RF of Shares ANDRITZ AT0000730007 0,99 Exclusion BANCA TRANSILVANIA ROTLVAACNOR1 ERSTE GROUP BANK AT0000652011 0,99 OMV AG AT0000743059 0,99 RAIFFEISEN INTERNATIONAL AT0000606306 0,99 Exclusion CENTRAL EUROP. -

CROBEX® and Crobextr® CROBEX10® and Crobex10tr

September 8th, 2020 CROBEX® and CROBEXtr® ISIN Trading Issuer Free float Number of Weighting code factor listed shares factor 1 HRADPLRA0006 ADPL AD PLASTIK d.d. 70% 4.199.584 1,00000000 2 HRADRSPA0009 ADRS2 ADRIS GRUPA d.d. 95% 6.784.100 0,36528752 3 HRARNTRA0004 ARNT Arena Hospitality Group dd 50% 5.128.721 1,00000000 4 HRATGRRA0003 ATGR ATLANTIC GRUPA d.d. 45% 3.334.300 0,48953990 5 HRATPLRA0008 ATPL ATLANTSKA PLOVIDBA d.d. 85% 1.395.520 1,00000000 6 HRDDJHRA0007 DDJH ĐURO ĐAKOVIC GRUPA d.d. 50% 10.153.230 1,00000000 7 HRDLKVRA0006 DLKV Dalekovod, d.d. 40% 24.719.305 1,00000000 8 HRERNTRA0000 ERNT ERICSSON NIKOLA TESLA d.d. 55% 1.331.650 0,98709462 9 HRHT00RA0005 HT HT d.d. 45% 80.766.229 0,15037086 10 HRIGH0RA0006 IGH INSTITUT IGH d.d. 50% 613.709 1,00000000 11 HRINGRRA0001 INGR INGRA d.d. 95% 13.545.200 1,00000000 12 HRKOEIRA0009 KOEI KONČAR d.d. 100% 2.572.119 0,59493974 13 HRKRASRA0008 KRAS KRAŠ d.d. 12% 1.498.621 1,00000000 14 HROPTERA0001 OPTE OT-OPTIMA TELEKOM d.d. 40% 69.443.264 1,00000000 15 HRPODRRA0004 PODR PODRAVKA d.d. 85% 7.120.003 0,35950401 16 HRRIVPRA0000 RIVP Valamar Riviera d.d. 55% 126.027.542 0,55422898 17 HRSAPNRA0007 SAPN Saponia d.d. 13% 658.564 1,00000000 18 HRTPNGRA0000 TPNG TANKERSKA NEXT GENERATION 50% 8.733.345 1,00000000 19 HRZABARA0009 ZABA Zagrebačka banka d.d. 4% 320.241.955 1,00000000 CROBEX10® and CROBEX10tr® ISIN Trading Issuer Free float Number of Weighting code factor listed shares factor 1 HRADPLRA0006 ADPL AD PLASTIK d.d. -

Domestic Vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets

Sinisa Bogdan, Suzana Baresa, and Zoran Ivanovic. 2016. Domestic vs International Risk Diversification Possibilities in Southeastern Europe Stock Markets. UTMS Journal of Economics 7 (2): 197–208. Preliminary communication (accepted August 27, 2016) DOMESTIC VS INTERNATIONAL RISK DIVERSIFICATION POSSIBILITIES IN SOUTHEASTERN EUROPEAN STOCK MARKETS Sinisa Bogdan Suzana Baresa Zoran Ivanovic1 Abstract Modern portfolio theory is one of the most important investment decision tools in finances. In 1952 Harry Markowitz set the foundations of the Modern portfolio theory, since than this theory was a backbone of many studies that dealt with investment decisions. This research applies mean-variance portfolio optimization on the international Southeastern Europe and domestic Croatian stock market exchange. Aim of this research is to compare risk diversification possibilities on the Southeastern European capital markets and on the Croatian Capital market. By analyzing nine stock market indices in the Southeastern Europe and twenty stocks from Zagreb Stock Exchange in the period of 36 months, results clearly show that internationally diversified portfolios offer better portfolio risk reduction than domestically diversified portfolios. Lowest achieved risk in international portfolio outperformed lowest achieved risk in domestic portfolio. Since risk is lower, returns are also much lower compared to domestic stock portfolios. Results of this research also report that domestic stock portfolios outperformed international portfolios at the risk level equal or higher than 0,97%, for the same risk, domestic portfolios offer greater returns. Keywords: Modern portfolio theory, portfolio optimization, stock portfolio, stock market indices, Zagreb stock exchange. Jel Classification: G11; C61 INTRODUCTION One of the investment theory assumptions is that investors should diversify their portfolios. -

2019 Transparency Report Deloitte D.O.O. Date Published 30 April 2020 Updated 20 October 2020

2019 Transparency Report Deloitte d.o.o. Date published 30 April 2020 Updated 20 October 2020 00 2019 Transparency Report | Contents Contents Contents 1 Deloitte leadership message 2 Deloitte network 4 What Deloitte Audit & Assurance brings to capital markets 7 External and internal audit quality monitoring 12 Independence, ethics, and additional disclosures 15 Appendices Error! Bookmark not defined. Appendix A | EU EEA audit firms 20 Appendix B | Financial information 22 Appendix C | Public interest entities 23 01 2019 Transparency Report | Deloitte d.o.o. leadership message 1 Deloitte d.o.o. leadership message This report sets out the practices and processes that are currently employed by Deloitte d.o.o., in accordance with the requirements of the Audit Act (Official Gazzete 127/2017) and the European Union’s Regulation 537/2014 on specific requirements regarding statutory audit of public-interest entities. All information provided in this report relates to the situation of Deloitte Croatia on 31 December 2019, except if indicated otherwise. We are witnesses to the conduct of business activities, including the procedures for auditing financial statements and related services at times that are out of the ordinary, but we also remain responsible for meeting our professional obligations to the community, our employees and our clients. As the effects of the coronavirus epidemic become more apparent, Deloitte emphasizes a key responsibility to the capital markets, which is to carry out top quality audits. In today's environment, investors and stakeholders are seeking an impartial opinion on the financial statements of companies more than ever before. The main priority of Deloitte's leadership is the safety and well-being of Deloitte's professionals, as well as the quality of the professional practices performed, which is why major areas of action have been established that are coordinated both globally and locally. -

Investment Strategy on the Zagreb Stock Exchange Based on Dynamic DEA Croatian Economic Survey : Vol

Tihana Škrinjarić Investment Strategy on the Zagreb Stock Exchange Based on Dynamic DEA Croatian Economic Survey : Vol. 16 : No. 1 : April 2014 : pp. 129-160 Investment Strategy on the Zagreb Stock Exchange Based on Dynamic DEA Tihana Škrinjarić CroEconSur University of Zagreb, Faculty of Economics and Business, Croatia Vol. 16 [email protected] No. 1 April 2014 pp. 129-160 Received: November 1, 2013 Accepted: March 21, 2014 Research Article doi:10.15179/ces.16.1.5 Abstract Nowadays, there is a growing interest in the application of quantitative methods in portfolio management, as the results of their application can be used as guidelines for managing a successful investment portfolio, i.e., a portfolio that outperforms the market. This paper deals with the Data Envelopment Analysis (DEA) approach and a Dynamic Slacks-Based Measure as a method of forming a portfolio which would predominantly outperform the market. In order to test the strategy, data on stocks listed on the Zagreb Stock Exchange were gathered for the period April 2009 – June 2012. Using the quarterly returns, standard deviations and coefficients of skewness as links, a dynamic slacks-based measure approach was applied to evaluate the relative efficiency of stocks in each quarter. The findings indicate that a portfolio based on the results of the optimization beats the market in terms of both returns and risk. This is the first implementation of 129 Tihana Škrinjarić Investment Strategy on the Zagreb Stock Exchange Based on Dynamic DEA Croatian Economic Survey : Vol. 16 : No. 1 : April 2014 : pp. 129-160 the dynamic DEA model in stock trading.