Endogeneities of Optimum Currency Areas: What Brings Countries Sharing a Single Currency Closer Together?” by P

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Theory of Optimum Currency Areas and Business Cycle Synchronization in Central and Eastern European Countries

TALLINN UNIVERSITY OF TECHNOLOGY Tallinn School of Economics and Business Administration Department of Finance and Economics Chair of Finance and Banking Natalia Levenko THE THEORY OF OPTIMUM CURRENCY AREAS AND BUSINESS CYCLE SYNCHRONIZATION IN CENTRAL AND EASTERN EUROPEAN COUNTRIES Master’s thesis Supervisor: Professor Karsten Staehr Tallinn 2014 I declare I have written the master’s thesis independently. All works and major viewpoints of the other authors, data from other sources of literature and elsewhere used for writing this paper have been referenced. Natalia Levenko …………………………… (signature, date) Student’s code: 122351 Student’s e-mail address: [email protected] Supervisor: Professor Karsten Staehr The paper conforms to the requirements set for the master’s thesis …………………………………………… (signature, date) Chairman of defence committee: Permitted to defence …………………………………………… (title, name, signature, date) TABLE OF CONTENTS ABSTRACT ............................................................................................................................... 4 1. INTRODUCTION .................................................................................................................. 5 2. THEORETICAL STUDIES ................................................................................................... 8 2.1. The theory of the optimum currency areas ........................................................................ 8 2.1.1. The original theory ................................................................................................... -

Euro Zone Debt Crisis: Theory of Optimal Currency Area

View metadata, citation and similar papers at core.ac.uk brought to you by CORE provided by UGD Academic Repository UDC 339.738(4-672EU) Original scientific paper Vesna GEORGIEVA SVRTINOV1) Diana BOSKOVSKA 2) Aleksandra LOZANOSKA3) Olivera GJORGIEVA-TRAJKOVSKA4) EURO ZONE DEBT CRISIS: THEORY OF OPTIMAL CURRENCY AREA Abstract Creation of a monetary union, carries along certain costs and benefits. Benefits of monetary union mainly stem from reducing transaction costs and eliminating exchange-rate uncertainty. On the other side, a country that joins a currency union, therefore gives up the opportunity to select a monetary policy, that it regards as optimal for its own circumstances. In this paper we explain the criteria of optimum currency area (OCA): degree of trade, similarity of business cycles, degree of labor and capital mobility and system of risk sharing. Viewed through the prism of these criteria, EMU is currently far from being an optimal currency area, especially in fulfillment criteria of labor mobility and fiscal integration. The aim of the paper is to highlight certain shortcomings of the EMU, such as its vulnerability to asymmetric shocks and its inability to act as predicted by the theory of optimum currency areas. Furthermore, we explain the reasons behind the difficulties that the euro area faced, and the problems that led to the outbreak of the sovereign debt crisis. At 1) PhD, “Ss. Cyril and Methodius University” in Skopje, Institute of Economics- Skopje, Republic of Macedonia, e-mail: [email protected]. 2) PhD, “Ss. Cyril and Methodius University” in Skopje, Institute of Economics-Skopje, Republic of Macedonia, e-mail: [email protected] 3) PhD, “Ss. -

ECB Policy and Eurozone Fragility: Was De Grauwe Right?

ECB Policy and Eurozone Fragility: Was De Grauwe Right? ORKUN SAKA*, ANA-MARIA FUERTES and ELENA KALOTYCHOU Cass Business School, City University London, U.K First draft: November 2013; This draft: May 2014 Abstract De Grauwe’s Eurozone fragility hypothesis states that member countries of a monetary union are highly vulnerable to a self‐fulfilling mechanism by which the efforts of investors to avoid losses from default can end up triggering the very default they fear. We test this hypothesis by applying an eclectic methodology to a time window around Draghi’s “whatever‐it‐takes” pledge on July 26, 2012 which was soon after followed by the actual announcement of the Outright Monetary Transactions (OMT) program. The principal components of Eurozone credit default spreads (CDS) validate this choice of break date. An event study reveals significant pre‐announcement contagion from Spain to Italy, Belgium, France and Austria. Furthermore, the analysis of time‐series regression residuals confirms frequent clusters of large bad shocks to the CDS spreads of the above four Eurozone countries but soley during the pre‐announcement period. Our findings support the Eurozone fragility hypothesis and endorse the OMT program. Keywords: Sovereign debt; Eurozone; European Central Bank; Outright Monetary Transactions; Self-fulfilling panic. JEL classification: E44, F36, G15, C52. _____________________________________________________________________ * Corresponding author. Cass Business School, 24 Chiswell Street London, EC1Y 4UE United Kingdom; Tel: +44 (0)75 9306 9236; [email protected]. † We are grateful to Paul De Grauwe, José-Luis Peydró and Christian Wagner for their useful comments and suggestions. We also thank participants at the Young Finance Scholars’ Conference and Quantitative Finance Workshop at the University of Sussex (May 2014), and seminar participants at Cass Business School, Keele University and Brunel University. -

Optimum Currency Areas and European Monetary Integration: Evidence from the Italian and German Unifications

Optimum Currency Areas and European Monetary Integration: Evidence from the Italian and German Unifications Roger Vicquery´ * London School of Economics November 2017 Abstract Recent events have sparked renewed research interest in international monetary integration and currency areas. This paper provides new empirical evidence on the predictive power and endogeneity of the Optimum Currency Areas (OCA) framework, by analyzing the wave of European monetary integration occuring between 1852 and the establishment of the international gold standard. This period witnessed to the creation of two national monetary unions lasting to this day, Italy and Germany, as well as monetary integration around Britain and France. I estimate the ex-ante optimality of various monetary arrangements, relying on a newly collected dataset allowing to proxy the assymetry of shocks across European regions. My findings support the predictive power of the OCA framework. In particular, I find that, opposite to Germany, Italian pre-unitary states did not form an OCA at unification. I argue that this might have contributed to the arising of the Italian ”Southern Question”. I then explore a possible channel through which monetary integration might aggravate regional inequality, by investigating the endogenous effects of monetary integration. Looking at the Italian monetary unification, I find evidence in support of Krugman’s (1993) pessimist view on the endogenous effects of monetary integration, where integration- induced specialization and factor mobility increase the risk of asymmetric shocks and regional hysteresis phenomenons. On the other hand, the experience of the Italian and German unification does not seem to be characterized by the OCA endogeneity theorized by Frankel and Rose (1998). -

The Theory of an 'Optimum Currency Area'

THE THEORY OF AN ‘OPTIMUM CURRENCY AREA’ JAROSŁAW KUNDERA* INTRODUCTION The conception of an optimum currency area was elaborated by Canadian economist R. Mundell in his famous article published under the same title in the American Economic Review in September 1961. This theory has been further developed by other economists (R.I. McKinnon, P.B. Kenen and H. Grubel), who refined Mundell’s reasoning. The main goal of this paper is to analyse and distinguish the main components of the optimum currency area. Taking into consideration the experiences from the current crisis in the euro zone, the question arises if the theory of an ‘Optimum Currency Area’ correctly explains the conditions for a functioning monetary union, and if the present euro zone crisis can be explained through it. From the point of view of the EU Member States, it is also interesting to see how this theory, elaborated mainly in 1960–1970, applies to the four freedoms of the European Single Market. In other words, if the economy of a Member State (Poland included) corresponds to the assumptions of the optimum currency area. In every economy, monetary and fiscal policy as the state’s two main economic policies must act in harmony. So the question thus arises of how the fiscal policies in partner states in conditions of a common currency would work. Lack of proper coordination between the centralized monetary policy of the European Central Bank and decentralized fiscal policies in Member States is treated as one of the causes of the current crisis in the euro zone. I. -

PAUL DE GRAUWE (Uccle, Bélgica 1946)

PAUL DE GRAUWE (Uccle, Bélgica 1946) Breve reseña curricular. Doctor por la Johns Hopkins University, 1974 Catedrático de Economía Internacional, Katholieke Universiteit of Leuven (Bélgica), 1975-2012. Catedrático de Economía Política Europea en la London School of Economics desde 2012. Ostenta la Cátedra John Paulson en Economía Política Europea del Instituto Europeo. Doctor Honoris Causa de las universidades de Sankt Gallen (Suiza), Turku (Finlandia), Génova (Italia), Valencia y Maastricht (Holanda). Profesor visitante de numerosas universidades: Universidad de Paris, Universidad de Michigan, Universidad de Pensilvania, Universidad Humboldt de Berlín, Universidad Libre de Bruselas, Universidad Católica de Lovaina, Universidad de Amsterdam, Universidad de Milán, Universidad de Tilburg, Universidad de Kiel. Investigador Visitante del FMI, el Consejo de Gobernadores de la Reserva Federal, el Banco de Japón y el Banco Central Europeo. Miembro del Grupo de Análisis de Política Económica que asesoró al Presidente Barroso. Director del grupo de investigación en Macroeconomía y finanzas internacionales de CESifo de la Universidad de Munich. Investigador del Centro de Estudios Europeos de Política Económica de Bruselas, y del CEPR de Londres. Senador (1991-1995, 1999-2003) y Parlamentario (1995-1999) de las Cámaras de Bélgica por el partido de los Liberales y Demócratas Flamencos. Premio Arkprijs van Vrije Woord (Premio Arca de Discurso Libre) Pertenece, desde 2004, a la Real Academia Flamenca de Ciencias y Artes de Bélgica. Algunas publicaciones 9 libros, de los que cabe destacar: 1. Paul De Grauwe & Jacques Mélitz (ed.), 2005. "Prospects for Monetary Unions after the Euro," MIT Press Books, The MIT Press, edition 1, volume 1, number 0262042304, January. 2. -

Curriculum Vitae of Speakers

Public Hearing Strengthening Economic Governance in the EU Brussels Room JAN 4Q2 Thursday, 13 January 2011 9:30 - 12:30 CURRICULUM VITAE OF SPEAKERS MARIO MONTI President of Bocconi University and former Commissioner Mario Monti is president of Bocconi University, Milan. He is also European chairman of the Trilateral Commission and honorary president of Bruegel, the European think-tank he launched in 2005. He is the author of the report to the President of the European Commission on “A new strategy for the single market” (May 2010). As the EU-appointed coordinator for the electricity interconnection between France and Spain, he brokered an agreement between the two heads of governments in June 2008. He was a member of the Attali Committee on French economic growth, set up by President Sarkozy (2007-2008). He was for ten years a member of the European Commission, in charge of the Internal market, Financial services and Tax policy (1995-1999), then of Competition (1999-2004). In addition to a number of high-profile cases (e.g. GE/Honeywell, Microsoft, the German Landesbanken), he introduced radical modernization reforms of EU antitrust and merger control and led, with the US authorities, the creation of the International Competition Network (ICN). Born in Varese, Italy, in 1943, he graduated from Bocconi University and did graduate studies at Yale University. Prior to joining the European Commission, he had been professor of economics and rector at Bocconi. 1 PAUL DE GRAUWE Professor of International Economics, KU Leuven Paul De Grauwe is professor of international economics at the University of Leuven, Belgium. -

The Governance of a Fragile Eurozone Paul De Grauwe* No

The Governance of a Fragile Eurozone Paul De Grauwe* No. 346, May 2011 Abstract When entering a monetary union, member countries change the nature of their sovereign debt in a fundamental way, i.e. they cease to have control over the currency in which their debt is issued. As a result, financial markets can force these countries’ sovereigns into default. In this sense, member countries of a monetary union are downgraded to the status of emerging economies. This makes the monetary union fragile and vulnerable to changing market sentiments. It also makes it possible that self-fulfilling multiple equilibria arise. This paper analyzes the implications of this fragility for the governance of the eurozone. It concludes that the new governance structure – the European Stability Mechanism (ESM), which is intended to be successor starting in 2013 of the European Financial Stability Mechanism (EFSF), created in May 2010 – does not sufficiently recognize this fragility. Some of the features of the new financial assistance are likely to increase this fragility. In addition, it is also likely to present member countries from using the automatic stabilizers during a recession. This is surely a step backward in the long history of social progress in Europe. The author concludes by suggesting a different approach for dealing with these problems. * Paul De Grauwe is Professor of Economics at the University of Leuven and Senior Associate Research Fellow at CEPS. The author is grateful to Daniel Gros, Martin Wolf and Charles Wyplosz for comments and suggestions. CEPS Working Documents are intended to give an indication of work being conducted within CEPS’ research programmes and to stimulate reactions from other experts in the field. -

Power, Ideas and Networks Epistemic Power Over

Ref. Ares(2016)2400007 - 24/05/2016 Enlighten – WP 1 - Power, ideas and networks Epistemic power over ideas after a fast-burning crisis – the case of the ecology of Brussels-based think tanks Ramona Coman & Frederik Ponjaert (Draft 3.0 – December 2015) Contents INTRODUCTION ............................................................................................................................. 2 Part I - Theoretical discussion: the power of fields and the power over ideas .. 6 The power over Ideas: the static hierarchies and properties of professional ecologies7 Power through ideas: the dynamic effects of cross-location and hyper-scientization 8 Professional mobility and the cross-location effect ......................................................... 8 The hyper-scientization of politics ...................................................................................... 9 Part II - Data collection and methodology: sequence, network and content analysis ............................................................................................................................................. 10 Part III - The considered ecology of Brussels-based think tanks ........................... 11 Field Effect: Securing their position as central nodes both with and beyond the Brussels ecology .......................................................................................................................... 11 Cross-location: networks of institutions and networks of people ................................. 16 The hyper-scientization -

The Legacy of the Eurozone Crisis and How to Overcome It

Paul De Grauwe The legacy of the Eurozone crisis and how to overcome it Article (Published version) (Refereed) Original citation: de Grauwe, Paul (2016) The legacy of the Eurozone crisis and how to overcome it. Journal of Empirical Finance. ISSN 0927-5398 DOI: 10.1016/j.jempfin.2016.01.015 Reuse of this item is permitted through licensing under the Creative Commons: © 2016 Elsevier B.V. CC BY-NC-ND 4.0 This version available at: http://eprints.lse.ac.uk/65539/ Available in LSE Research Online: February 2016 LSE has developed LSE Research Online so that users may access research output of the School. Copyright © and Moral Rights for the papers on this site are retained by the individual authors and/or other copyright owners. You may freely distribute the URL (http://eprints.lse.ac.uk) of the LSE Research Online website. ÔØ ÅÒÙ×Ö ÔØ The legacy Of The EUROZONE crisis and how To Overcome It Paul De Grauwe PII: S0927-5398(16)30004-4 DOI: doi: 10.1016/j.jempfin.2016.01.015 Reference: EMPFIN 872 To appear in: Journal of Empirical Finance Received date: 29 July 2015 Revised date: 22 January 2016 Accepted date: 27 January 2016 Please cite this article as: De Grauwe, Paul, The legacy Of The EURO- ZONE crisis and how To Overcome It, Journal of Empirical Finance (2016), doi: 10.1016/j.jempfin.2016.01.015 This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. -

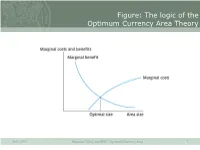

The Logic of the Optimum Currency Area Theory

Figure: The logic of the Optimum Currency Area Theory SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 1 Benefits of a Currency Area • Elimination of transaction costs and comparability of prices. • Elimination of exchange rate risk (for transactions and FDI). • More independent central bank. • Benefits of an international currency. SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 2 Costs of a Currency Area • Costs arise because, when joining monetary union, a country loses monetary policy instrument (e.g. exchange rate) • This is costly when asymmetric shocks occur SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 3 Costs of a Currency Area • The loss of monetary independence fundamentally changes the capacity of governments to finance their budget deficits. • Members of monetary union issue debt in currency over which they have no control. • Liquidity crisis Solvency Crisis. • Stand-alone countries can always create liquidity. (inflation might be a problem but cannot be forced to default against their will!) • This makes a monetary union fragile. SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 4 Costs of a Currency Area • Diversity in a currency area is costly because a common currency makes it impossible to react to each and every local particularity. • The theory of optimum currency areas (OCA) aims at identifying these costs more precisely. SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 5 Shocks and the Exchange Rate SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 6 Asymmetric Shocks SuSe 2013 Monetary Policy and EMU: Optimum Currency Area 7 Other sources of asymmetry • Different labour market institutions – Centralized versus non-centralized wage bargaining – Symmetric shocks (e.g. -

The Political Economy of the Euro Crisis

The Political Economy of the Euro Crisis Mark Copelovitch University of Wisconsin – Madison [email protected] Jeffry Frieden Harvard University [email protected] Stefanie Walter University of Zurich [email protected] Lead article for the special issue “The Political Economy of the Euro Crisis,” forthcoming in Comparative Political Studies The euro crisis has developed into the most serious economic and political crisis in the history of the European Union (EU). By 2016, nine years after the outbreak of the global financial crisis in 2007, economic activity in the EU and the Eurozone was still below its pre- crisis level. At this point, the joint effects of the global financial crisis and the euro crisis have caused more lasting economic damage in Europe than the Great Depression of the 1930s (Crafts, 2013). The political consequences have also been severe. Conflict among EU member states has threatened the progress of European integration, while polarization and unrest have unsettled domestic politics in a host of European countries. The crisis has indeed brought into question the very nature and future of European integration generally, and of monetary integration specifically. To date, there has been substantial economic analysis of the crisis in the Eurozone, which has recently culminated in the emergence of a widely shared consensus on its causes (Baldwin et al., 2015). However, economists often fail to appreciate the large role that politics has played in the run-up, evolution, and attempts at resolution of the euro crisis. The typical economic approach has been to note that the Eurozone is not an optimal currency area 1 , and to subsequently conclude that the long-term survival of the Eurozone requires the creation of a set of institutions to act as substitutes – such as fiscal union, banking union, and/or the establishment of a larger, permanent transfer mechanism to replace the European Stability Mechanism (e.g., De Grauwe, 2013; Lane, 2012; Pisani-Ferry, 2012).