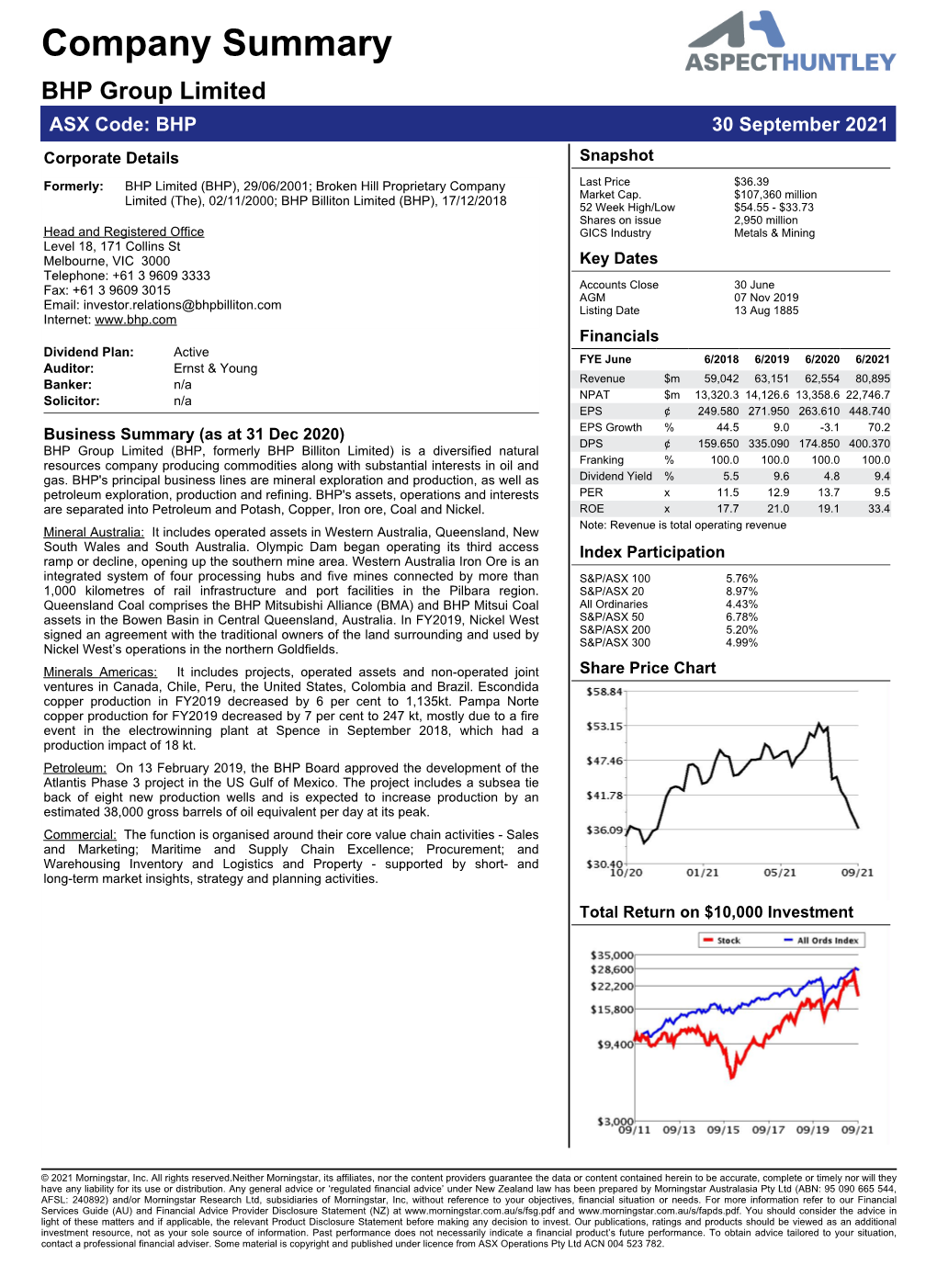

Company Summary BHP Group Limited ASX Code: BHP 30 September 2021 Corporate Details Snapshot

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Operating and Financial Reviews Application of ASIC’S Regulatory Guide

Operating and Financial Reviews Application of ASIC’s regulatory guide April 2014 kpmg.com.au Foreword The debate on the current corporate reporting model has now reached the highest international business agenda. This publication is an assessment of one recent domestic contribution to that debate – ASIC’s Regulatory Guide 247 Effective disclosure in an operating and financial review (RG 247) issued in March 2013. A year on, listed companies are applying RG 247, with many making additional and better quality disclosures about operations, financial position, business strategies and prospects for future financial years in the operating and financial reviews included in annual reports. However, there continues to be opportunities for companies to enhance these disclosures. Indeed, there are opportunities for companies to improve the corporate reporting suite more generally so as to better tell their own value creation story, providing a clear explanation of “Good corporate reporting has an important role to play in helping to restore the trust their business model, value drivers and risks, and their prospects for the future. that has been lost. Companies need to communicate more clearly, openly and effectively This publication, the third in the series, is intended to help Boards and Management address with investors and other stakeholders about how they plan to grow in a sustainable way. the gap in current corporate reporting. It includes observations on the application of RG 247 For their part, stakeholders are demanding greater transparency around strategy, in the most recent reporting season, highlighting disclosure areas where entities should business models and risks, and the commercial prospects of the enterprises and continue to focus their attention, using over 30 pages of good disclosure examples drawn institutions with which they engage. -

Reopening Norwich Park Coal Mine – from BHP Secret Internal Briefing Paper for BHP

® CFMEU Mining and Energy COMMONCAUSE Strong Union. Safer Workplace. www.cfmeu.com.au www.ourjobs.org.au VOL 81 NO. 1 FEBRUARY/ MARCH 2015 Reopening Norwich Park coal mine – from BHP secret internal briefing paper for BHP: “….. the success of the project will be dependent on being able to operate the mine efficiently while using labour that is paid significantly less than is currently the case at surrounding existing operations. A strong desire has been expressed that labour should be sourced from lower paying areas outside of Queensland (Adelaide, Melbourne for example). They are likely to try and leverage off the labour model used at Norwich Park to generate lower cost labour models at their other operations.” REGISTERED BY AUSTRALIA POST PP 243184/00025 POST AUSTRALIA BY REGISTERED Helping industry return their workers home, healthy and safe every day. In 2013-14, Coal Services partnered with industry to ensure a safe workplace and a healthy workforce. Mines Rescue • 550 skilled Brigadesmen response ready and around 60,000 training hours dedicated to building safety leaders for the NSW coal industry. Coal Mines Insurance • Paid $71.8 million towards compensation and treatment costs to support injured workers through their injury recovery and return to work. CS Health • Completed 11,457 pre-placement and periodic health surveillance medicals to monitor the health of the workforce and protect against occupational disease. Regulation & Compliance • Conducted respirable and inhalable dust sampling on 4,660 workers across every coal mine sites in NSW, including surface and underground operations and coal handling plants. www.coalservices.com.au 2014 Issue 04 - CSPL Stats.indd 1 25/07/2014 12:26:00 PM General President Tony Maher Reports CFMEU’s key role in Queensland and Victorian election wins hanks to the magnificent and the systematic destruction of our now in the Queensland Parliament role played by members of mining communities. -

Mining in Conflicted Lands

Lessons learned from Case Studies of InternationalInternational Investment Financial in Extractive Flows and Land-use Industries and the Environment Best Practices for Transnational Investment in Extractive and Land Use Sectors School of International Service American University Foreword With the wave of globalization and the empowerment of civil societies around the world, foreign investment has become an increasingly important issue due to the inherent social and environmental impacts that foreign companies inflict upon the local communities in which they operate. The results of foreign investment are complicated: some investment improves local economic, environmental, and social conditions, while other investment leads to tensions between transnational companies and local communities. There are currently few broadly agreed-upon standards that guide how foreign companies should invest and behave in host countries in order to achieve not only business benefits, but also social responsibility and environmental sustainability. This portfolio of best and worst practices of foreign investment exhibits both positive and negative cases of foreign investment. This document is the cooperative product of the World Resources Institute (WRI) and the American University (AU) practicum team. IFFE’s Senior Associate, Mr. Hu Tao, and Research Analyst, Denise Leung, worked closely with the practicum team to develop the project. The AU practicum team consisted of professors Dr. Ken Conca and Dr. Judy Shapiro and eleven graduate students: Stephanie DaCosta, Kristin DeValue, Hilary Kirwan, Lauren Lane, John Noel, Sebastian O’Connor, Schuyler Olsson, Jen Richmond, Natnari Sihawong, Toussaint Webster, and Yuxi Zhao. In March 2013, the AU practicum team travelled to Beijing, China, to present their initial research and coordinate with a WRI partner research team from Beijing Normal University. -

Submission 190 11.1.2 25/05/2015 Submission 190 11.1.2 25/05/2015 CFMEU SUBMISSION

Submission 190 11.1.2 25/05/2015 Submission 190 11.1.2 25/05/2015 CFMEU SUBMISSION Contents Executive Summary ..................................................................................... 1 Recommendations ....................................................................................... 2 Background .................................................................................................. 3 Construction phase........................................................................ 3 Production phase........................................................................... 4 Major issues faced by commuting workers include:....................... 5 Terms of reference ....................................................................................... 6 The health impacts on workers and their families.......................... 6 The effects on families of rostering practices in mines using FIFO workforces ............................................................................ 7 The extent and projected growth in FIFO work practices by region and industry ........................................................................ 8 The costs and/or benefits and structural incentives and disincentives, including tax settings, for companies choosing a FIFO workforce .............................................................................. 9 The effect of a 100% non-resident FIFO workforce on established communities; including community wellbeing, the price of housing and availability, and access to services and -

Sustainability Report 2019

Sustainability Report 2019 Minera Escondida Pampa Norte Sustainability Report 2019 1 Our Charter We are BHP, a leading global resources company. Our Purpose Our Values To bring people and resources Sustainability together to build a better world. Putting health and safety first, being environmentally responsible and supporting our communities. Our Strategy Our strategy is to have the best Integrity capabilities, best commodities Doing what is right and doing what we say we will do. and best assets, to create long-term value and high returns. Respect Embracing openness, trust, teamwork, diversity and relationships that are mutually beneficial. Performance Achieving superior business results by stretching our capabilities. Simplicity Focusing our efforts on the things that matter most. Accountability Defining and accepting responsibility and delivering on our commitments. We are successful when: Our people start each day with a sense of purpose and end the day with a sense of accomplishment. Our teams are inclusive and diverse. Our communities, customers and suppliers value their relationships with us. Our asset portfolio is world-class and sustainably developed. Our operational discipline and financial strength enables our future growth. Our shareholders receive a superior return on their investment. Mike Henry Chief Executive Officer February 2020 Scope of the Report This Sustainability Report details the annual management of BHP in Minera Escondida Ltda., Cerro Colorado Ltda. and Minera Spence S.A. Chile, in the economic, social and environmental arenas for the period The document was prepared according to the latest version of the between January 1 and December 31, 2019. There are no restatements Global Reporting Initiative (GRI) standards, in the essential compliance of information or relevant changes with respect to the last published option, and has undergone an external verification process. -

A Review of the Economic Issues Raised in Relation to Criterion (B)

A review of the economic issues raised in relation to criterion (b) A report for DLA Piper 13 July 2018 HoustonKemp.com Report authors Greg Houston Daniel Young Contact Us Sydney Singapore Level 40 8 Marina View 161 Castlereagh Street #15-10 Asia Square Tower 1 Sydney NSW 2000 Singapore 018960 Phone: +61 2 8880 4800 Phone: +65 6817 5010 Disclaimer This report is for the exclusive use of the HoustonKemp client named herein. There are no third party beneficiaries with respect to this report, and HoustonKemp does not accept any liability to any third party. Information furnished by others, upon which all or portions of this report are based, is believed to be reliable but has not been independently verified, unless otherwise expressly indicated. Public information and industry and statistical data are from sources we deem to be reliable; however, we make no representation as to the accuracy or completeness of such information. The opinions expressed in this report are valid only for the purpose stated herein and as of the date of this report. No obligation is assumed to revise this report to reflect changes, events or conditions, which occur subsequent to the date hereof. All decisions in connection with the implementation or use of advice or recommendations contained in this report are the sole responsibility of the client. HoustonKemp.com A review of the economic issues raised in relation to criterion (b) Contents Executive summary i 1. Introduction 1 1.1 Scope of this report 1 1.2 Framework for advice 2 1.3 Structure of this report 2 2. -

DBCT Declaration Review – Addendum and Disclosure of Data

18 June 2018 Mr Ravi Prasad Queensland Competition Authority Dear Ravi DBCT Declaration Review – addendum and disclosure of data DBCTM's submission of 30 May 2018 in respect of the DBCT declaration review which was redacted for publication (the DBCTM submission) contained the following appendices: • Appendix 10 - HoustonKemp expert report on criterion (b) (HoustonKemp Report on (b)); and • Appendix 12 - AME Coal Industry Report (AME Report). HoustonKemp Report on (b) was redacted for confidential data of AME and Wood Mackenzie contained in the tables in Appendices A1 and A3 to that report. The AME Report did not contain confidential information of AME in Figures 14, 15 and 16 of that report. DBCTM has now obtained the consent of AME and Wood Mackenzie for the disclosure of that information. Accordingly, please find attached for publication: • A copy of the AME Report which includes Figures 14, 15 and 16. • A copy of the HoustonKemp Report on (b) with the data in tables in Appendices A1 and A3 unredacted. Note that some information on pages 14, 15, 23, 24, and 28 of the report remains redacted as it is confidential information of particular users of DBCTM. We note that the source of the data in table A1.1 of Appendix A and tables A3.1, A3.4, A3.5 and A3.6 of Appendix A3 to the HoustonKemp Report on (b) is AME, March 2018. The disclaimers set out at start of the AME Report also apply to that data. The source of the data in tables A3.2 and A3.3 of Appendix A3 to the HoustonKemp Report on (b) is Wood Mackenzie, October 2017. -

Australian Banks Financing Coal and Renewable Energy

Australian banks financing coal and renewable energy A research paper prepared for Greenpeace Australia Pacific Australian banks financing coal and renewable energy A research paper prepared for Greenpeace Australia Final version: 7 September 2010 Jan Willem van Gelder Anna van Ojik Julia Padberg Petra Spaargaren Profundo Radarweg 60 1043 NT Amsterdam The Netherlands Tel: +31-20-8208320 E-mail: [email protected] Website: www.profundo.nl Contents Chapter 1 Methodology ..........................................................................................2 1.1 Objective......................................................................................................2 1.2 Definitions ...................................................................................................2 1.3 Research activities......................................................................................2 Chapter 2 Bank profiles..........................................................................................5 2.1 Australia and New Zealand Banking Group (ANZ)....................................5 2.2 Bendigo Bank..............................................................................................7 2.3 Commonwealth Bank..................................................................................8 2.4 mecu ............................................................................................................9 2.5 National Australia Bank ............................................................................10 2.6 -

BHP Guidance

16 February 2021 To: Australian Securities Exchange New York Stock Exchange RESULTS PRESENTATION FOR HALF YEAR ENDED 31 DECEMBER 2020 Attached are the presentation slides for a presentation by the Chief Executive Officer and Chief Financial Officer. A video of this presentation can be accessed at: https://edge.media-server.com/mmc/p/wok57pbf Further information on BHP can be found at bhp.com. Authorised for lodgement by: Geof Stapledon Acting Group Company Secretary +44 (0)20 7802 4000 BHP Group Limited ABN 49 004 028 077 BHP Group Plc Registration number 3196209 LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768 Registered in Australia Registered in England and Wales Registered Office: Level 18, 171 Collins Street Registered Office: Nova South, 160 Victoria Street, Melbourne Victoria 3000 London SW1E 5LB United Kingdom Tel +61 1300 55 4757 Fax +61 3 9609 3015 Tel +44 20 7802 4000 Fax +44 20 7802 4111 The BHP Group is headquartered in Australia Financial results Half year ended 31 December 2020 Spence Growth Option Disclaimer The information in this presentation is current as at 16 February 2021. It is in summary form and is not necessarily complete. It should be read together with the BHP Results for the half year ended 31 December 2020. Forward-looking statements This presentation contains forward-looking statements, including statements regarding: trends in commodity prices and currency exchange rates; demand for commodities; production forecasts; plans, strategies and objectives of management; closure or divestment of certain assets, operations or facilities (including associated costs); anticipated production or construction commencement dates; capital costs and scheduling; operating costs and shortages of materials and skilled employees; anticipated productive lives of projects, mines and facilities; provisions and contingent liabilities; and tax and regulatory developments. -

For Personal Use Only Use Personal for Our Charter

Economic Contribution Report 2019 For personal use only Our Charter We are BHP, a leading global resources company. Our Purpose Our Values To bring people and resources Sustainability together to build a better world. Putting health and safety first, being environmentally responsible and supporting our communities. Our Strategy Our strategy is to have the best Integrity capabilities, best commodities Doing what is right and doing what we say we will do. and best assets, to create long-term value and high returns. Respect Embracing openness, trust, teamwork, diversity and relationships that are mutually beneficial. Performance Achieving superior business results by stretching our capabilities. Simplicity Focusing our efforts on the things that matter most. Accountability Defining and accepting responsibility and delivering on our commitments. We are successful when: Our people start each day with a sense of purpose and end the day with a sense of accomplishment. Our teams are inclusive and diverse. Our communities, customers and suppliers value their relationships with us. Our asset portfolio is world-class and sustainably developed. Our operational discipline and financial strength enables our future growth. Our shareholders receive a superior return on their investment. Andrew Mackenzie Chief Executive Officer May 2019 BHPFor personal use only Group Limited. ABN 49 004 028 077. Registered in Australia. Registered The headquarters of BHP Group Limited and the global headquarters of the office: 171 Collins Street, Melbourne, Victoria 3000, Australia. BHP Group Plc. combined Group are located in Melbourne, Australia. The headquarters of Registration number 3196209. Registered in England and Wales. Registered BHP Group Plc are located in London, United Kingdom. -

Bowen Basin Coal Growth Project— Caval Ridge Mine

Bowen Basin Coal Growth Project— Caval Ridge Mine: Coordinator-General’s change report no. 9— housing and accommodation condition changes September 2013 © State of Queensland, Department State Development, Infrastructure and Planning, September 2013 , 100 George Street, Brisbane Qld 4000. (Australia) Licence: This work is licensed under the Creative Commons CC BY 3.0 Australia licence. To view a copy of this licence, visit www.creativecommons.org/licenses/by/3.0/au/deed.en . Enquiries about this licence or any copyright issues can be directed to the Senior Advisor, Governance on telephone (07) 3224 2085 or in writing to PO Box 15009, City East, Queensland 4002 Attribution: The State of Queensland, Department of State Development, Infrastructure and Planning. The Queensland Government supports and encourages the dissemination and exchange of information. However, copyright protects this publication. The State of Queensland has no objection to this material being reproduced, made available online or electronically but only if it is recognised as the owner of the copyright and this material remains unaltered. The Queensland Government is committed to providing accessible services to Queenslanders of all cultural and linguistic backgrounds. If you have difficulty understanding this publication and need a translator, please call the Translating and Interpreting Service (TIS National) on telephone 131 450 and ask them to telephone the Queensland Department of State Development, Infrastructure and Planning on telephone (07) 3227 8548. Disclaimer: This report contains factual data, analysis, opinion and references to legislation. The Coordinator-General and the State of Queensland make no representations and give no warranties regarding the accuracy, completeness or suitability for any particular purpose of such data, analysis, opinion or references. -

Supporting Queensland Through Local Buying

Supporting Queensland Through Local Buying www.localbuying.com.au OUR COMMITMENT BHP is the world’s largest exporter of seaborne metallurgical coal and a In 2016 the program was also expanded into New South Wales, with global producer of export and domestic thermal coal. small-medium businesses in the Muswellbrook, Singleton and Upper Our Coal business has a proud history of economic contribution and Hunter shires invited to register to trade through the program with our Mt investment in the communities and local businesses where we operate in Arthur open cut coal mine. Central Queensland and New South Wales. In 2017 the program’s reach was further expanded to support local In 2012, the BHP Mitsubishi Alliance (BMA) Local Buying Program was businesses in the Pilbara region in Western Australia and the Upper created in partnership with C-Res to assist small-to-medium businesses Spencer Gulf and Far North regions in South Australia. in selected host communities in the Bowen Basin (Blackwater, Capella, It is with great pride that we deliver the Local Buying Program with a well- Dysart, Emerald, Moranbah, Nebo) to competitively supply goods and respected organisation such as C-Res (Community Resourcing for the services to BMA operations. Future). This partnership ensures the program continues to remain true to In 2013 the program was expanded to also include BHP Mitsui Coal its values and principles and delivers genuine outcomes for the regions. (BMC) operations, and in 2014 the BMA Hay Point Coal Terminal near Mackay. Following early success, and in response to feedback from our vendors, the program’s eligibility criteria was expanded in 2015 to encourage small-to-medium business owners based across the wider Bowen Basin James Palmer Elsabe Muller and Mackay regions to trade with all of our BMA and BMC operations.